Middle East And Africa Food Container And Kitchen Appliances Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

2.59 Billion

2025

2033

USD

1.75 Billion

USD

2.59 Billion

2025

2033

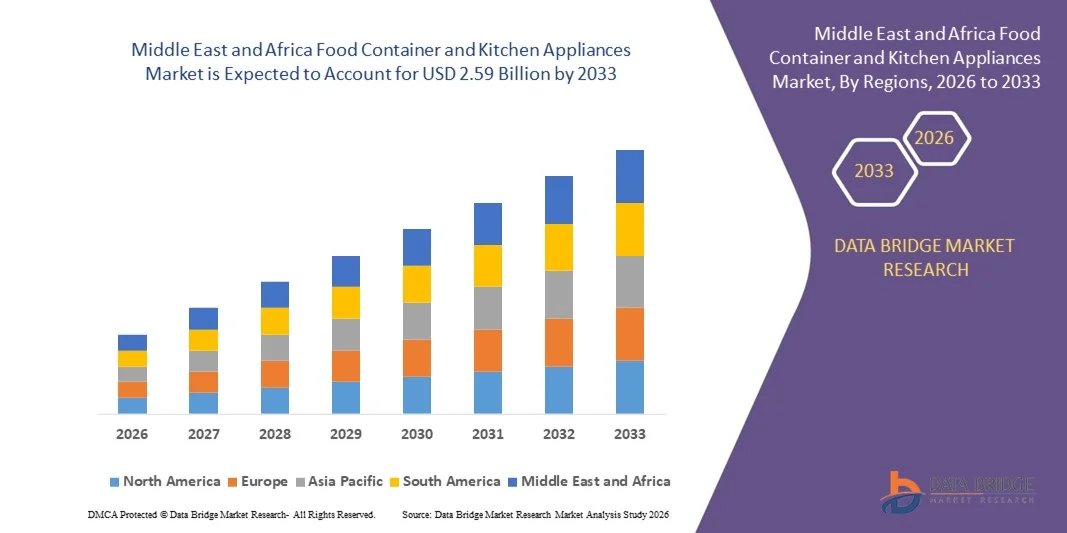

| 2026 –2033 | |

| USD 1.75 Billion | |

| USD 2.59 Billion | |

|

|

|

|

Middle East and Africa Food Container and Kitchen Appliances Market Size

- The Middle East and Africa food container and kitchen appliances market size was valued at USD 1.75 billion in 2025 and is expected to reach USD 2.59 billion by 2033, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by rising consumer demand for convenient, durable, and multifunctional kitchen solutions, which is driving the adoption of innovative food containers and modern kitchen appliances in both residential and commercial settings

- Furthermore, increasing awareness of sustainable and reusable storage solutions, combined with a focus on health-conscious and efficient cooking practices, is establishing advanced food containers and smart kitchen appliances as essential household and professional tools. These converging factors are accelerating product adoption, thereby significantly boosting the industry’s growth

Middle East and Africa Food Container and Kitchen Appliances Market Analysis

- Food containers and kitchen appliances, offering practical, hygienic, and technologically advanced solutions for storage and cooking, are becoming increasingly vital in modern homes and commercial kitchens due to their versatility, ease of use, and integration with contemporary lifestyles

- The escalating demand for these products is primarily fueled by growing urbanization, rising disposable incomes, evolving consumer preferences for energy-efficient and time-saving appliances, and the increasing penetration of e-commerce platforms that facilitate accessibility and variety

- South Africa dominated food container and kitchen appliances market in 2025, due to the expansion of organized retail, growing adoption of modern kitchen appliances, and increasing demand for high-quality, durable, and multifunctional food storage solutions across households and commercial kitchens

- Saudi Arabia is expected to be the fastest growing country in the food container and kitchen appliances market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing adoption of modern kitchen solutions in households and commercial kitchens

- Food containers segment dominated the market with a market share of 34.8% in 2025, due to rising consumer demand for sustainable, reusable, and microwave-safe storage solutions, increasing adoption of meal prepping, and growing awareness of food preservation and hygiene. Consumers are prioritizing airtight, modular, and durable containers that enhance convenience for home and commercial use, supporting consistent demand across regions

Report Scope and Food Container and Kitchen Appliances Market Segmentation

|

Attributes |

Food Container and Kitchen Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Food Container and Kitchen Appliances Market Trends

Growth of Smart and Multi-Functional Kitchen Appliances

- A significant trend in the food container and kitchen appliances market is the growing adoption of smart and multi-functional appliances that combine convenience, efficiency, and energy-saving features for residential and commercial kitchens. These appliances are transforming cooking and storage practices, enabling users to prepare meals faster, maintain food freshness, and manage kitchen workflows more effectively

- For instance, companies such as Philips and LG Electronics are offering smart air fryers, induction cooktops, and connected coffee machines that allow remote control via mobile apps and integrate with smart home ecosystems. These products enhance user convenience, optimize cooking times, and support healthier cooking methods

- The demand for multi-functional appliances is expanding as consumers seek devices that combine several functions, such as blenders with heating capabilities or ovens with steaming and baking modes. This is positioning kitchen appliances as essential tools that reduce the need for multiple single-use devices and save kitchen space

- Urbanization and the rise of nuclear families are driving the need for compact, versatile appliances suitable for small kitchens, while the increase in single-person households boosts the preference for appliances that enable quick meal preparation

- The trend is further reinforced by the rise of cloud-connected kitchen appliances that provide recipe guidance, automated cooking cycles, and energy usage tracking, which are increasingly attractive to tech-savvy and health-conscious consumers

- Retailers and e-commerce platforms are actively promoting smart appliances through bundled offers, demonstrations, and online reviews, which is accelerating adoption and establishing these products as key components of modern kitchens

Middle East and Africa Food Container and Kitchen Appliances Market Dynamics

Driver

Rising Demand for Sustainable and Reusable Food Storage Solutions

- The market growth is primarily driven by increasing consumer focus on sustainability, reducing food waste, and adopting reusable storage solutions that are safe, durable, and versatile for both home and commercial use

- For instance, Tupperware and Lock & Lock are expanding their offerings of BPA-free, stackable, airtight containers that promote longer food shelf life and support meal prepping practices. These containers are designed to be reusable, microwave-safe, and dishwasher-friendly, enhancing convenience and environmental responsibility

- Growing awareness of hygiene, food safety, and organized kitchen storage is motivating households and foodservice operators to invest in high-quality containers and storage sets. This has created steady demand for premium glass, metal, and high-grade plastic containers that meet consumer expectations

- Rising online availability and direct-to-consumer sales models are further boosting access to a wide range of sustainable containers, increasing market penetration in urban and semi-urban areas

- The demand for modular, airtight, and temperature-resistant containers is also driving innovation in materials and design, reinforcing the market’s expansion in both residential and commercial segments

Restraint/Challenge

High Initial Cost of Advanced Kitchen Appliances

- The market faces challenges due to the high purchase cost of technologically advanced kitchen appliances, which may limit adoption among price-sensitive consumers and small-scale commercial users

- For instance, smart ovens, induction cooktops, and multifunctional appliances from brands such as Whirlpool and Samsung often come at premium price points, making them less accessible in emerging markets and smaller households

- The integration of smart features, sensors, and app connectivity increases manufacturing complexity and production costs, which are subsequently reflected in retail pricing

- Consumers may also face higher maintenance and repair costs for advanced appliances compared to conventional devices, affecting repeat purchases and replacement cycles

- While these appliances offer long-term energy efficiency and convenience, the upfront investment remains a significant barrier, slowing adoption among budget-conscious buyers and impacting market growth in cost-sensitive regions

Middle East and Africa Food Container and Kitchen Appliances Market Scope

The market is segmented on the basis of product type, material, and distribution channel.

- By Product Type

On the basis of product type, the food container and kitchen appliances market is segmented into cookware, kitchen appliances, food containers, serveware, and baby/kids products. The food containers segment dominated the market with the largest revenue share of 34.8% in 2025, driven by rising consumer demand for sustainable, reusable, and microwave-safe storage solutions, increasing adoption of meal prepping, and growing awareness of food preservation and hygiene. Consumers are prioritizing airtight, modular, and durable containers that enhance convenience for home and commercial use, supporting consistent demand across regions.

The kitchen appliances segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of time-saving, energy-efficient, and multifunctional appliances such as air fryers, blenders, and smart cooking devices. For instance, companies such as Philips and Instant Brands are expanding their smart appliance portfolios, integrating connectivity and automation features to meet evolving consumer needs. Rising interest in healthy cooking practices, smart kitchen integration, and compact appliance designs for modern homes further drive the segment’s growth.

- By Material

On the basis of material, the market is segmented into rigid packaging, flexible packaging, paperboard, metal, glass, and others. The glass segment held the largest market revenue share in 2025, driven by its non-reactive properties, durability, and premium appeal for food storage and kitchen use. Glass containers are favored for their transparency, allowing easy identification of contents, and their compatibility with microwave and dishwasher use increases convenience for consumers. Rising adoption in both residential and commercial kitchens supports consistent demand, particularly for premium and reusable storage solutions.

The metal segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its long-lasting nature and suitability for thermal insulation and durability in storage containers. For instance, companies such as Lock & Lock are promoting stainless steel containers and lunch boxes that maintain food temperature and provide leak-proof solutions. Increasing consumer awareness of sustainable alternatives to plastic further drives growth, while innovations in lightweight and corrosion-resistant designs expand usability across households and commercial food services.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based retailers and e-commerce. The store-based retailers segment dominated the market with the largest revenue share in 2025, supported by the presence of well-established kitchenware and home appliance chains that allow consumers to physically evaluate products before purchase. Shoppers often prefer in-store experiences to assess material quality, size, and ergonomics, which is particularly important for cookware and premium kitchen appliances. Retailers also benefit from bundling offers and loyalty programs that boost repeat purchases and customer engagement.

The e-commerce segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing online penetration, convenience, and competitive pricing. For instance, platforms such as Amazon and Flipkart are expanding their kitchenware and food container selections, offering doorstep delivery and customer reviews that simplify purchase decisions. Growth is further supported by targeted promotions, subscription services, and the rising popularity of direct-to-consumer brand models that enhance accessibility across urban and semi-urban markets.

Middle East and Africa Food Container and Kitchen Appliances Market Regional Analysis

- South Africa dominated the food container and kitchen appliances market with the largest revenue share in 2025, driven by the expansion of organized retail, growing adoption of modern kitchen appliances, and increasing demand for high-quality, durable, and multifunctional food storage solutions across households and commercial kitchens

- Strong growth in the country’s foodservice sector, along with rising consumer preference for sustainable, reusable, and space-efficient containers, continues to boost adoption of advanced kitchen appliances and storage products across restaurants, catering services, and retail households

- Strategic government initiatives supporting household appliance modernization and investment in commercial kitchen infrastructure are accelerating the use of smart and multi-functional appliances. The presence of regional and international suppliers, including Tupperware and Lock & Lock, combined with increasing availability of energy-efficient and technologically advanced appliances, reinforces South Africa’s dominant position in the regional market while strengthening its leadership across both residential and commercial segments

Saudi Arabia Food Container and Kitchen Appliances Market Insight

Saudi Arabia is projected to record the fastest CAGR in the Middle East and Africa food container and kitchen appliances market from 2026 to 2033, supported by rapid urbanization, rising disposable incomes, and increasing adoption of modern kitchen solutions in households and commercial kitchens. For instance, companies such as Philips and LG Electronics are expanding their smart kitchen appliance portfolios and premium food storage solutions in the country, offering multifunctional devices and durable containers that meet evolving consumer needs. Growing demand for energy-efficient, space-saving, and user-friendly appliances, coupled with investments in retail modernization and e-commerce penetration, is accelerating market adoption. Rising awareness of sustainable storage practices, meal prepping trends, and increasing use of smart and connected kitchen solutions in urban households further position Saudi Arabia as one of the fastest-growing markets in the region.

U.A.E. Food Container and Kitchen Appliances Market Insight

The U.A.E. is also witnessing rapid growth in the food container and kitchen appliances market, supported by a thriving hospitality industry, high consumer spending power, and increasing penetration of premium and smart kitchen appliances. For instance, companies such as Kenwood and Moulinex are actively promoting connected appliances, multifunctional cooking devices, and durable food containers that cater to the needs of both households and commercial kitchens. Rising demand for energy-efficient appliances, reusable and sustainable storage solutions, and modern kitchen setups in urban households is driving market expansion. Investments in e-commerce platforms, smart home integration, and retail modernization further enhance product accessibility, positioning the U.A.E. as a key emerging market alongside Saudi Arabia.

Middle East and Africa Food Container and Kitchen Appliances Market Share

The food container and kitchen appliances industry is primarily led by well-established companies, including:

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- AB Electrolux (Sweden)

- Whirlpool (U.S.)

- BALL CORPORATION (U.S.)

- Greif (U.S.)

- Evergreen Packaging LLC (U.S.)

- Crown (U.S.)

- Havells India Ltd. (India)

- Pactiv LLC (U.S.)

- Berry Global Inc. (U.S.)

- Amcor plc (Switzerland)

- PLASTIPAK HOLDINGS, INC. (U.S.)

- Plus Pack AS (Denmark)

- Lacerta Group, Inc. (U.S.)

- Ampak Inc. (Canada)

- Novolex (U.S.)

- O-I Glass, Inc. (U.S.)

Latest Developments in Middle East and Africa Food Container and Kitchen Appliances Market

- In July 2025, Huhtamaki, a global leader in sustainable food packaging, launched a new line of compostable ice cream cups designed for both home and industrial composting, as well as recyclability. Made from certified paperboard with a bio-based barrier coating, the cups contain less than 10% plastic and mark a shift from fossil-based to bio-based materials. This innovation reflects Huhtamaki’s commitment to reducing environmental impact while maintaining product quality and performance. The launch expands its ice cream packaging portfolio and aligns with growing consumer and industry demand for eco-friendly food containers

- In March 2025, Samsung Electronics Co., Ltd. revealed plans to debut its first Air to Water Heat Pump lineup for North American homes at CES 2025. The system includes Slim Fit EHS ClimateHub indoor units—available in Mono and Hydro variants—and the EHS Mono R32 HT Quiet outdoor unit, engineered for ultra-low noise and high efficiency. Featuring AI Home integration, these units offer intuitive control, energy monitoring, and compatibility with SmartThings-connected devices. This launch marks Samsung’s strategic entry into the North American heating market, delivering compact, high-performance solutions tailored for modern households

- In July 2024, BSH Hausgeräte GmbH, Europe’s leading home appliance manufacturer, inaugurated its first refrigeration factory in Monterrey, Mexico, marking a strategic milestone in its North American expansion. The facility, located in Nuevo León, produces French Door Bottom Mount refrigerators under the Bosch and Thermador brands, tailored to meet the preferences of U.S. and Canadian consumers. Designed for scalability, the plant features state-of-the-art production technologies, carbon-neutral operations, and photovoltaic energy systems. With an investment of €220 million, BSH aims to create 1,500 skilled jobs, reinforcing its commitment to innovation and sustainability in the premium appliance segment

- In May 2024, Thermomix® introduced the Thermomix® Sensor, a smart thermometer designed to elevate precision cooking beyond the TM6 mixing bowl. Equipped with dual sensors, it measures both core food temperature (up to 212°F) and ambient oven temperature (up to 527°F), making it ideal for baking, grilling, and roasting. The Sensor connects via Bluetooth® to the TM6 and the Cooking Center mobile app, enabling real-time monitoring and guided cooking. This innovation ensures perfect doneness for cakes, bread, meat, and fish—turning guesswork into guaranteed results for home chefs

- In February 2023, Electrolux expanded its footprint in India by launching a premium range of built-in kitchen appliances, including microwaves, ovens, hobs, cooker hoods, dishwashers, and a fully automatic coffee machine. The lineup features the UltimateTaste and UltimateCare series, designed with Scandinavian aesthetics and smart functionality. Key highlights include Eco programs for water and energy conservation, pre-set meal settings, and steam-cooking modes that preserve nutrients and flavor. With options such as Airfry, SenseFry, and Hob2Hood automation, Electrolux aims to simplify sustainable cooking and elevate the home chef experience in modern Indian kitchens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.