Middle East And Africa Food Processing And Food Material Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

9.86 Billion

USD

15.60 Billion

2024

2032

USD

9.86 Billion

USD

15.60 Billion

2024

2032

| 2025 –2032 | |

| USD 9.86 Billion | |

| USD 15.60 Billion | |

|

|

|

|

Food Processing and Food Material Handling Equipment Market Size

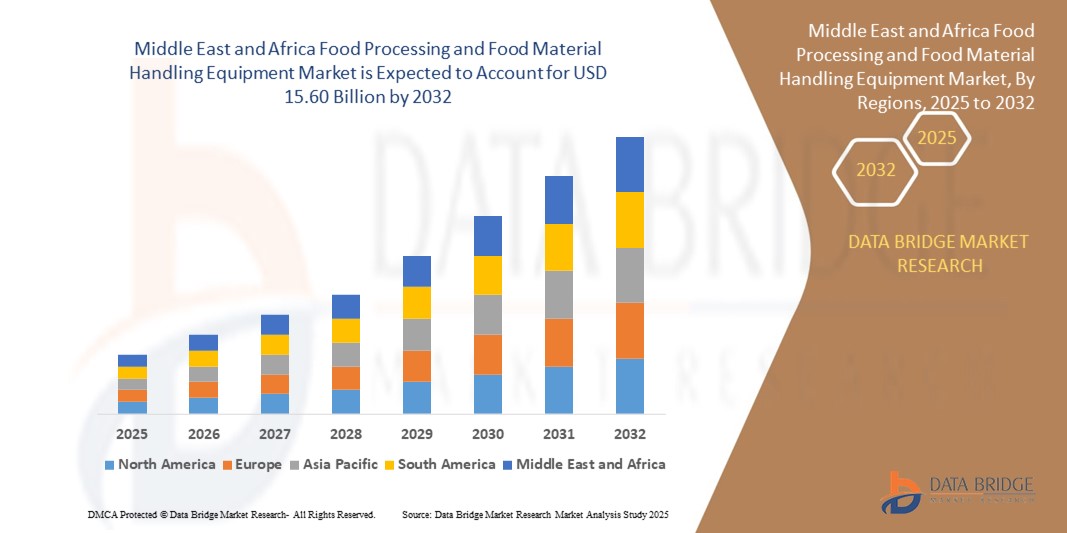

- The Middle East and Africa food processing and food material handling equipment market size was valued at USD 9.86 billion in 2024 and is expected to reach USD 15.60 billion by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is primarily driven by increasing demand for processed and packaged foods, advancements in automation technologies, and the rising adoption of efficient material handling systems in the food and beverage industry

- Growing consumer preference for safe, hygienic, and sustainable food processing solutions, coupled with rapid urbanization and changing dietary habits, is further propelling the market's expansion across the region

Food Processing and Food Material Handling Equipment Market Analysis

- Food processing and material handling equipment are critical components of the food and beverage industry, enabling efficient production, packaging, and distribution while maintaining hygiene and safety standards

- The rising demand for these solutions is fueled by growing food safety regulations, increasing consumer awareness of quality standards, and the need for cost-effective and automated processing systems

- South Africa dominated the market with the largest revenue share of 38.5% in 2024, driven by a well-established food and beverage industry, advanced infrastructure, and significant investments in automation technologies

- The U.A.E. is expected to be the fastest-growing country in the region during the forecast period, attributed to rapid urbanization, increasing disposable incomes, and a growing focus on food security and modernized food processing facilities

- The non-wood segment dominated the largest market revenue share of 68.2% in 2024, driven by the increasing adoption of sustainable, non-wood materials such as biodegradable plastics and composites in food processing equipment

Report Scope and Food Processing and Food Material Handling Equipment Market Segmentation

|

Attributes |

Food Processing and Food Material Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Processing and Food Material Handling Equipment Market Trends

“Increasing Adoption of Automation and IoT Technologies”

- The Middle East and Africa food processing and food material handling equipment market is experiencing a notable trend toward the integration of automation and Internet of Things (IoT) technologies

- These technologies enable real-time monitoring, enhanced process control, and improved operational efficiency in food processing and handling operations

- Automation solutions, such as robotic sorting and packaging systems, reduce labor costs and improve precision in tasks such as cutting, sorting, and packaging

- For instance, companies are deploying IoT-enabled equipment to monitor production lines, track equipment performance, and optimize supply chain logistics in real time

- This trend is particularly appealing in the food and beverage sector, where efficiency and compliance with stringent quality standards are critical

- IoT systems can analyze data from various processes, such as temperature control in preservation or material flow in packaging, to ensure product quality and minimize waste

Food Processing and Food Material Handling Equipment Market Dynamics

Driver

“Growing Demand for Processed and Convenience Foods”

- The rising consumer preference for processed and convenience foods, driven by urbanization and changing lifestyles, is a key driver for the Middle East and Africa food processing and food material handling equipment market

- Equipment such as food mechanical processing units and packaging systems supports the production of ready-to-eat meals, snacks, and beverages, meeting the demand for quick and hygienic food options

- Government initiatives in countries such as South Africa and the U.A.E. to enhance food security and promote local food production are boosting investments in advanced processing technologies

- The expansion of 5G and IoT infrastructure in the region, particularly in the U.A.E., supports faster data transmission and enables sophisticated automation in food processing and material handling

- Manufacturers are increasingly incorporating advanced equipment, such as thermoforming and transfer systems, as standard features to meet consumer expectations for high-quality, safe, and sustainable food products

Restraint/Challenge

“High Initial Investment Costs and Regulatory Compliance Issues”

- The high upfront costs associated with acquiring, installing, and maintaining advanced food processing and material handling equipment, such as automated thermoforming or thick wall processing systems, pose a significant barrier, particularly for small and medium-sized enterprises in the region

- Integrating these systems into existing production facilities can be complex and expensive, especially in less developed markets within Africa

- In addition, stringent food safety and quality regulations across the Middle East and Africa, coupled with varying standards across countries, create challenges for manufacturers and equipment providers in ensuring compliance

- Concerns over environmental sustainability, particularly with non-wood-based materials used in products such as plates, trays, and clamshells, add complexity due to regulatory pressures and consumer demand for eco-friendly solutions

- These factors can limit market growth, especially in regions with lower disposable incomes or where regulatory frameworks are highly fragmented

Food Processing and Food Material Handling Equipment market Scope

The market is segmented on the basis of source, process, product, application, type, and form.

- By Source

On the basis of source, the Middle East and Africa food processing and food material handling equipment market is segmented into wood and non-wood sources. The non-wood segment dominated the largest market revenue share of 68.2% in 2024, driven by the increasing adoption of sustainable, non-wood materials such as biodegradable plastics and composites in food processing equipment. These materials align with environmental regulations and consumer preferences for eco-friendly solutions.

The wood segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, propelled by its cost-effectiveness and traditional use in specific applications such as packaging and material handling in smaller-scale operations, particularly in emerging markets such as the U.A.E.

- By Process

On the basis of process, the Middle East and Africa food processing and food material handling equipment market is segmented into thermoforming, thick wall, transfer, and others. The thermoforming segment dominated with a market revenue share of 40.3% in 2024, attributed to its widespread use in producing lightweight, durable packaging solutions such as trays and containers for food and beverage applications. Its efficiency and versatility drive its adoption across South Africa’s robust food processing sector.

The transfer process segment is anticipated to experience the fastest growth rate of 7.2% from 2025 to 2032, fueled by advancements in automation and precision molding, which enhance production efficiency and meet rising demand for customized packaging solutions in the U.A.E.

- By Product

On the basis of product, the Middle East and Africa food processing and food material handling equipment market is segmented into plates, trays, cups, clamshells, bowls, and others. The trays segment held the largest market revenue share of 34.7% in 2024, driven by their extensive use in food and beverage packaging, particularly in South Africa’s growing processed food industry. Trays are favored for their versatility in handling solid and semi-solid food products.

The cups segment is expected to witness the fastest growth rate of 6.9% from 2025 to 2032, spurred by increasing demand for convenient, single-serve beverage packaging in urbanized regions such as the U.A.E., where the hospitality and quick-service restaurant sectors are expanding rapidly.

- By Application

On the basis of application, the Middle East and Africa food processing and food material handling equipment market is segmented into food and beverages, industrial, cosmetics, logistics, electrical and electronics, pharmaceuticals, and others. The food and beverages segment dominated with a market revenue share of 72.5% in 2024, driven by the surging demand for processed and packaged foods in South Africa, supported by urbanization and a growing middle-class population.

The pharmaceuticals segment is projected to experience the fastest growth rate of 7.5% from 2025 to 2032, fueled by increasing investments in hygienic and automated processing equipment in the U.A.E., where stringent quality standards are driving demand for specialized packaging solutions.

- By Type

On the basis of type, the Middle East and Africa food processing and food material handling equipment market is segmented into food mechanical processing, equipment, food service, preservation, and food packaging. The food packaging segment held the largest market revenue share of 38.4% in 2024, driven by the critical role of packaging equipment in ensuring food safety, shelf life, and compliance with regulations in South Africa’s advanced food processing industry.

The preservation segment is expected to witness the fastest growth rate of 6.7% from 2025 to 2032, propelled by the adoption of advanced preservation technologies such as refrigeration and vacuum sealing in the U.A.E., where demand for high-quality, long-shelf-life products is rising.

- By Form

On the basis of form, the Middle East and Africa food processing and food material handling equipment market is segmented into solid, semi-solid, and liquid forms. The solid form segment dominated with a market revenue share of 55.6% in 2024, driven by the high demand for equipment to process solid food products such as baked goods and meat, particularly in South Africa’s established food processing sector.

The liquid form segment is anticipated to experience the fastest growth rate of 7.0% from 2025 to 2032, fueled by the increasing consumption of processed beverages such as soft drinks and juices in the U.A.E., supported by technological advancements in liquid processing equipment.

Food Processing and Food Material Handling Equipment Market Regional Analysis

- South Africa dominated the market with the largest revenue share of 38.5% in 2024, driven by a well-established food and beverage industry, advanced infrastructure, and significant investments in automation technologies

- Strong demand for convenience foods, coupled with the presence of major equipment manufacturers, fuels market growth. The adoption of advanced technologies, such as automated processing and packaging systems, further strengthens South Africa’s position as a market leader

U.A.E. Food Processing and Food Material Handling Equipment Market Insight

The U.A.E. is expected to witness the fastest growth rate in the Middle East and Africa food processing and food material handling equipment market, propelled by rapid urbanization, a growing hospitality industry, and increasing investments in food processing infrastructure. Consumer demand for high-quality, hygienic, and efficient equipment, particularly for food and beverage applications, drives market expansion. Supportive government policies and a focus on reducing reliance on food imports further accelerate adoption.

Food Processing and Food Material Handling Equipment Market Share

The food processing and food material handling equipment industry is primarily led by well-established companies, including:

- ALFA LAVAL (Sweden)

- FENCO Food Machinery s.r.l. (Italy)

- JBT (U.S.)

- SPX FLOW (U.S.)

- TNA Australia Pty Limited (Australia)

- Krones AG (Germany)

- Schaaf Technologie GmbH (India)

- BAADER (Germany)

- Marel (Iceland)

- Bühler Group (Switzeland)

- The Middleby Corporation (U.S.)

- Lehui (China)

- GEA Group Aktiengesellschaft (Germany)

- SPX Flow (U.S.)

- Dover Corporation (U.S.)

- IMA Group (Italy)

- Tetra Pak (Switzerland)

What are the Recent Developments in Middle East and Africa Food Processing and Food Material Handling Equipment Market?

- In April 2025, FPS Food Process Solutions announced a strategic partnership with Almarai Co. Ltd., one of the Middle East’s largest food producers. As part of the collaboration, FPS will supply and install a state-of-the-art Carton Continuous Flow Freezer designed for boxed whole fresh poultry. This initiative supports Almarai’s efforts to enhance its poultry processing capabilities and meet growing demand across Saudi Arabia, the UAE, and Kuwait. The partnership also strengthens FPS’s presence in the region and reflects ongoing investment in advanced food processing technologies tailored for high-efficiency and hygiene standards

- In March 2025, Tetra Pak and Al Rabie launched a strategic three-year partnership to modernize and digitize Al Rabie’s production facilities in Saudi Arabia. The initiative leverages Tetra Pak’s cutting-edge technologies and sustainability practices to transform the plant into a “Next Generation Factory.” It includes upgrading equipment, integrating Industry 4.0 solutions, and optimizing resource efficiency in line with Saudi Vision 2030. The project is expected to save up to 36 million liters of water annually and reduce energy consumption, while boosting production capacity and environmental performance

- In December 2024, Saudi Modon inaugurated the Jeddah Food Cluster, officially recognized by Guinness World Records as the largest food industrial complex globally. Spanning 11 million square meters, this mega-project is designed to strengthen Saudi Arabia’s food security, reduce reliance on imports, and boost national exports. The cluster is expected to attract SAR 20 billion in investments and create 43,000 jobs by 2035. It features advanced infrastructure, shared services, and integrated supply chains to support food production, processing, and logistics—aligning with Saudi Vision 2030’s goals for economic diversification and sustainability

- In November 2024, Americana Holding for Food Ltd., through its subsidiary The Agricultural Growth and Processing Company, announced investment to build a Greenfield Frozen French Fries manufacturing facility in Riyadh’s Sudair Industrial and Business City. This strategic move deepens its long-standing partnership with Farm Frites and marks their second joint venture in the MENA region. The plant, set to open in early 2026, will span over 100,000 square meters and produce 70,000 metric tons annually. The initiative supports Saudi Vision 2030 by boosting local food production and creating jobs

- In September 2021, Middleby Corporation acquired Imperial Commercial Cooking Equipment, a well-established manufacturer of ranges, fryers, ovens, and countertop cooking products. Although the acquisition predates the 2023–2025 window, it’s frequently cited in market reports as a pivotal move that expanded Middleby’s core cooking portfolio and enhanced its presence in the commercial foodservice sector. Imperial’s strong footprint in the fast-casual restaurant segment and its manufacturing capabilities also offered Middleby greater operational flexibility and access to new customer bases, particularly across the U.S. West Coast

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Food Processing And Food Material Handling Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Food Processing And Food Material Handling Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Food Processing And Food Material Handling Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.