Middle East And Africa Foundry Chemicals Market

Market Size in USD Million

CAGR :

%

USD

218.69 Million

USD

285.76 Million

2025

2033

USD

218.69 Million

USD

285.76 Million

2025

2033

| 2026 –2033 | |

| USD 218.69 Million | |

| USD 285.76 Million | |

|

|

|

|

What is the Middle East and Africa Foundry Chemicals Market Size and Growth Rate?

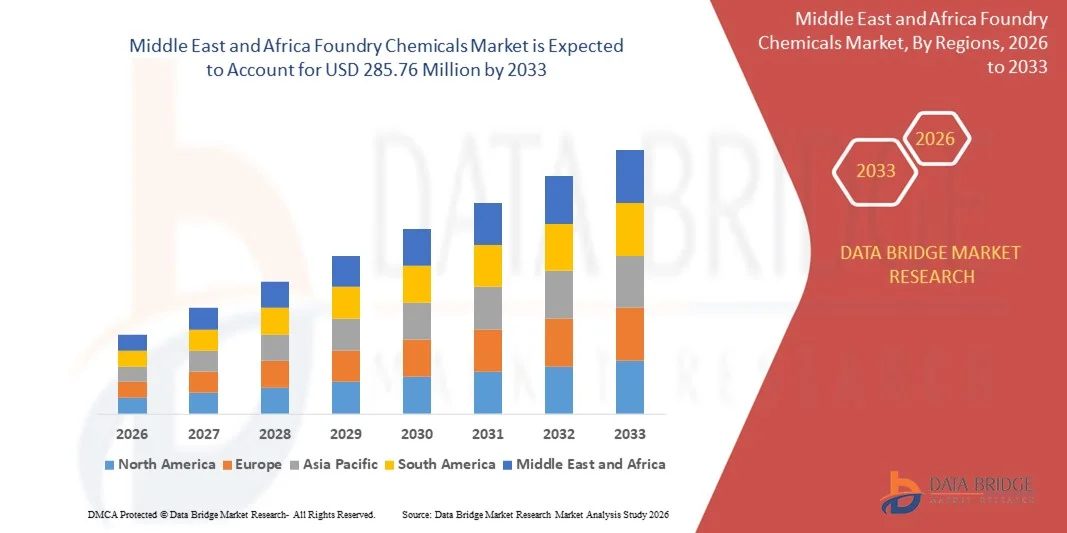

- The Middle East and Africa foundry chemicals market size was valued at USD 218.69 million in 2025 and is expected to reach USD 285.76 million by 2033, at a CAGR of 3.4% during the forecast period

- The growing demand for metal casting in the manufacturing of heavy machinery is boosting the foundry chemicals market growth

- Corrodibility of ferrous metals under environmental conditions is hampering the demand for the foundry chemicals market

What are the Major Takeaways of Foundry Chemicals Market?

- Increasing demand for steel in the market is acting as an opportunity for the foundry chemicals market. The stringent environmental regulation regarding chemicals released from foundries is acting as a challenge for hampering the demand of the foundry chemicals market

- Saudi Arabia dominated the Middle East and Africa foundry chemicals market with an estimated 39.7% revenue share in 2025, driven by large-scale industrial projects, automotive and machinery manufacturing, and high adoption in construction, renewable energy, and heavy equipment sectors

- South Africa is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rising use in automotive, mining, and industrial machinery applications

- The Formaldehyde segment dominated the market with an estimated 41.2% share in 2025, driven by its high reactivity, excellent binding properties, and wide application across ferrous and non-ferrous casting industries

Report Scope and Foundry Chemicals Market Segmentation

|

Attributes |

Foundry Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Foundry Chemicals Market?

Rising Adoption of Advanced, Lightweight, and High-Durability Foundry Chemicals

- The foundry chemicals market is experiencing growing demand for lightweight, corrosion-resistant, and high-performance materials used in automotive, aerospace, industrial machinery, and renewable energy sectors

- Manufacturers are increasingly introducing polymer composites, PTFE-coated alloys, and fiber-reinforced metal-ceramic solutions to improve wear resistance, load capacity, and operational reliability

- Emphasis on energy efficiency, reduced maintenance, and longer lifecycle performance is driving adoption in high-stress and continuous operation environments

- For instance, companies such as SKF, Schaeffler, Trelleborg, GGB, and RBC Bearings are expanding their portfolio of advanced composite bearings and friction-reducing coatings for EVs, wind turbines, industrial automation, and heavy equipment

- High uptake of Foundry Chemicals in electric vehicles, industrial robotics, fluid-handling, and aerospace components is sustaining market expansion

- As industries focus on durability, weight optimization, and lifecycle cost reduction, foundry chemicals are expected to remain critical in next-generation mechanical and industrial systems

What are the Key Drivers of Foundry Chemicals Market?

- Rising demand for maintenance-free, lubrication-free, and high-load capable bearings is significantly boosting foundry chemicals adoption across automotive, aerospace, and industrial sectors

- For instance, during 2024–2025, SKF, Schaeffler, and Trelleborg launched advanced composite and polymer-based solutions designed for extreme temperatures, heavy loads, and extended operating life

- Growing deployment of EVs, wind energy systems, automated machinery, and industrial robots is increasing need for lightweight, durable, and energy-efficient bearings

- Advances in polymer engineering, material composites, and precision manufacturing are enhancing friction resistance, wear performance, and load-bearing capabilities

- Increasing focus on sustainability and energy savings is promoting replacement of conventional metal bearings with composite or polymer alternatives

- Supported by industrial automation, renewable energy expansion, and infrastructure growth, the foundry chemicals market is poised for steady long-term growth

Which Factor is Challenging the Growth of the Foundry Chemicals Market?

- Higher costs of advanced polymers, fibers, and precision-fabricated materials limit adoption in price-sensitive applications

- Volatility in raw material prices and supply-chain disruptions during 2024–2025 increased operational costs for key manufacturers

- Performance constraints under extreme shock loads or misalignment conditions may restrict application in certain heavy-duty industrial systems

- Limited awareness among small-scale manufacturers about lifecycle benefits and long-term cost efficiency slows market penetration

- Competition from traditional metal bearings and low-cost substitutes exerts pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on cost-efficient designs, targeted applications, and customer education to drive broader adoption of Foundry Chemicals

How is the Foundry Chemicals Market Segmented?

The market is segmented on the basis of type, product type, foundry type, foundry tool type, foundry process type, foundry system type, distribution channel, and application.

- By Type

The Foundry Chemicals market is segmented into Benzene, Formaldehyde, Naphthalene, Phenol, Xylene, and Others. The Formaldehyde segment dominated the market with an estimated 41.2% share in 2025, driven by its high reactivity, excellent binding properties, and wide application across ferrous and non-ferrous casting industries. Formaldehyde-based chemicals are extensively used in resin formulations, coatings, and core binders, providing strength and durability in high-temperature operations.

The Phenol segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for phenolic resins in advanced casting processes, aerospace, and automotive applications. Its superior heat resistance, chemical stability, and ability to produce low-emission cores are accelerating adoption. Increasing focus on sustainable production and improved casting quality further reinforces growth opportunities for phenol-based Foundry Chemicals globally.

- By Product Type

On the basis of product type, the market is segmented into Binders, Additive Agents, Coatings, Fluxes, and Others. The Binders segment dominated with 38.5% share in 2025, supported by strong demand in sand casting, core making, and chemically bonded sand systems. Binders enhance mold strength, reduce defects, and improve surface finish across automotive, construction, and industrial applications.

The Coatings segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing adoption of heat-resistant and protective coatings in high-precision castings, aerospace, and industrial machinery. Technological advancements in coating formulations that improve thermal insulation, wear resistance, and defect reduction are further strengthening market expansion globally.

- By Foundry Type

Based on foundry type, the market is segmented into Ferrous and Non-Ferrous. The Ferrous segment dominated the market with a 56.7% share in 2025, attributed to its extensive use in steel, iron, and alloy castings for automotive, construction, and heavy machinery sectors. Ferrous foundries require robust chemical solutions for high-temperature molding, binder performance, and surface finish quality.

The Non-Ferrous segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising aluminum, copper, and specialty alloy casting in electronics, aerospace, and lightweight automotive applications. Growing industrialization and demand for precision, lightweight components further support non-ferrous Foundry Chemicals adoption.

- By Foundry Tool Type

On the basis of tool type, the market is segmented into Shovel, Trowels, Lifter, Hand Riddle, Vent Wire, Rammers, Swab, Sprue Pins & Cutters, and Others. The Rammers segment dominated with 33.4% share in 2025, widely used for compacting molds and cores in high-quality casting operations. Rammers ensure uniform density, reduced defects, and better mold strength, particularly in heavy-duty industrial and automotive foundries.

The Swab segment is projected to grow at the fastest CAGR from 2026 to 2033 due to rising use in core coating, precision cleaning, and defect-free mold preparation in ferrous and non-ferrous casting. Increasing automation and demand for high-quality castings accelerate swab adoption.

- By Foundry Process Type

On the basis of process type, the market is segmented into Thermal Galvanization and Electro Less Nickel Plating. The Thermal Galvanization segment dominated with a 59.1% share in 2025, driven by strong application in corrosion protection, surface hardening, and high-temperature resistance for industrial components.

The Electro Less Nickel Plating segment is expected to grow at the fastest CAGR from 2026 to 2033, due to its uniform deposition, enhanced wear resistance, and wide adoption in aerospace, automotive, and precision engineering castings. Regulatory emphasis on sustainability and improved coating technologies further supports growth.

- By Foundry System Type

The market is segmented into Sand Cast Systems and Chemically Bonded Sand Cast Systems. The Sand Cast Systems segment dominated with 52.6% share in 2025, owing to its widespread use in ferrous and non-ferrous metal casting, cost-effectiveness, and compatibility with traditional foundries.

The Chemically Bonded Sand Cast Systems segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for high-precision, low-defect castings in automotive, aerospace, and industrial machinery. Advanced binder technologies and high-performance chemicals are accelerating adoption.

- By Application

Based on application, the market is segmented into Cast Iron, Steel, Aluminium, and Others. The Cast Iron segment dominated with a 44.3% share in 2025, driven by extensive use in automotive engines, industrial machinery, and heavy equipment. Cast iron foundries require high-performance binders, coatings, and fluxes for precision, thermal stability, and defect-free output.

The Aluminium segment is expected to grow at the fastest CAGR from 2026 to 2033 due to increasing lightweight automotive and aerospace components, rising industrial automation, and demand for sustainable, high-precision castings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Specialty Stores, B2B/Third Party Distributors, and Others. The B2B/Third Party Distributors segment dominated with 61.8% share in 2025, owing to strong supplier relationships, bulk procurement by industrial users, and customized solutions for high-volume foundries.

The E-Commerce segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing digitalization, online access to standard and specialty chemicals, and adoption by small and medium-scale foundries. Faster delivery, competitive pricing, and wider product availability support market expansion globally.

Which Region Holds the Largest Share of the Foundry Chemicals Market?

- Saudi Arabia dominated the Middle East and Africa foundry chemicals market with an estimated 39.7% revenue share in 2025, driven by large-scale industrial projects, automotive and machinery manufacturing, and high adoption in construction, renewable energy, and heavy equipment sectors

- Rising demand for high-performance, durable, and low-maintenance foundry chemicals reinforces Saudi Arabia’s market leadership. Strong OEM collaborations, advanced manufacturing capabilities, and continuous R&D investments further strengthen long-term growth prospects

UAE Foundry Chemicals Market Insight

In the U.A.E., market growth is fueled by construction, oil & gas, and renewable energy projects. Foundry Chemicals are increasingly used in heavy machinery, precision casting, and industrial equipment due to low friction, high wear resistance, and maintenance-free performance. Focus on energy efficiency, sustainable manufacturing, and strong partnerships with OEMs supports steady adoption and ensures long-term market expansion in key industrial sectors.

South Africa Foundry Chemicals Market Insight

South Africa is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rising use in automotive, mining, and industrial machinery applications. Increasing adoption of energy-efficient production methods, renewable energy initiatives, and advanced industrial automation accelerates demand for fiber and metal matrix foundry chemicals. Expansion of domestic manufacturing hubs and export-oriented industrial growth further supports long-term market development.

Egypt Foundry Chemicals Market Insight

In Egypt, growth is supported by investments in automotive, construction, and industrial sectors, where foundry chemicals are preferred for high-load, wear-resistant, and low-maintenance applications. Adoption in renewable energy installations, infrastructure projects, and heavy machinery manufacturing is rising due to modernization programs and government incentives. Collaborations between local manufacturers, OEMs, and research institutions enhance innovation and competitiveness in the regional market.

Morocco Foundry Chemicals Market Insight

Morocco shows steady growth driven by construction, automotive, and industrial equipment projects. Foundry Chemicals are increasingly used in heavy machinery, casting, and renewable energy applications to improve durability, operational efficiency, and service life. Government-supported industrial upgrades, energy-efficient initiatives, and expansion of local manufacturing capabilities encourage adoption. Growth in exports and regional industrial collaborations further strengthens long-term market development.

Which are the Top Companies in Foundry Chemicals Market?

The foundry chemicals industry is primarily led by well-established companies, including:

- Vesuvius (U.K.)

- Imerys (France)

- Saint Gobain Performance Ceramics & Refractories (France)

- Georgia Pacific Chemicals (U.S.)

- DuPont (U.S.)

- ASK Chemicals (U.S.)

- Shandong Crownchem Industries Co., Ltd (China)

- Compax Industrial Systems Pvt. Ltd (India)

- CS ADDITIVE GMBH (Germany)

- CAGroup (U.A.E.)

- Ultraseal India Pvt. Ltd. (India)

- Hüttenes Albertus (Germany)

- CERAFLUX INDIA PVT.LTD. (India)

- Forace Polymers (P) Ltd. (India)

- Scottish Chemical (U.K.)

What are the Recent Developments in Global Foundry Chemicals Market?

- In August 2025, Vesuvius acquired Morgan Advanced’s Molten Metal Systems to strengthen its non-ferrous revenue to 27%, focusing on expansion in India with cost synergies expected to deliver over 50% EBITDA uplift, reinforcing the company’s global market position

- In March 2025, ASK Chemicals launched a new range of low-emission cold-box binders, reducing VOC outputs by 30% to promote sustainable foundry operations in automotive applications, supporting environmentally responsible production practices

- In January 2024, Hüttenes-Albertus International developed bio-based release agents in alignment with EU green directives, targeting growth in the construction sector, further enhancing the company’s commitment to sustainable and eco-friendly solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Foundry Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Foundry Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Foundry Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.