Middle East And Africa Fuel Tank Market

Market Size in USD Million

CAGR :

%

USD

4,255.85 Million

USD

6,192.66 Million

2022

2030

USD

4,255.85 Million

USD

6,192.66 Million

2022

2030

| 2023 –2030 | |

| USD 4,255.85 Million | |

| USD 6,192.66 Million | |

|

|

|

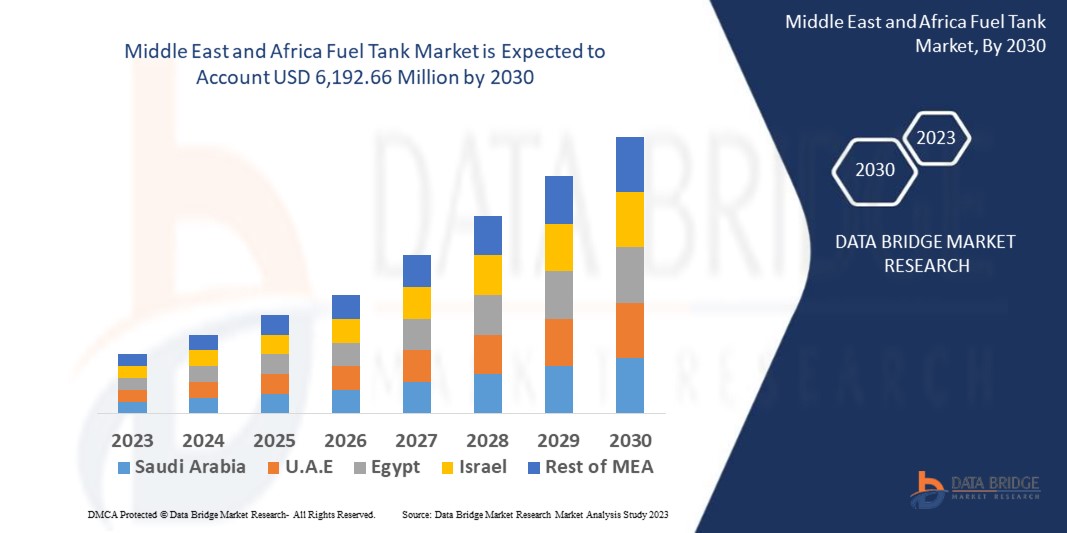

Middle East and Africa Fuel Tank Market Analysis and Size

The increasing demand and sales of vehicles are demanding more fuel tanks for storage fuels with better safety features. The government regulations for reducing the vehicle's weight and a minimum cost of fuel tank maintenance enhance the market growth. Manufacturers in this region are substituting metal fuel tanks with plastic fuel tanks to reduce the vehicle's overall weight. Plastic fuel tanks have numerous advantages over metal fuel tanks, which is growing their popularity in the fuel tank market.

Data Bridge Market Research analyses that the fuel tank market is expected to reach USD 6,192.66 million by 2030, which was USD 4,255.85 million in 2022, at a CAGR of 4.80% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Middle East and Africa Fuel Tank Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Tank Capacity (Less Than 45 L, 45L -70L, and More Than 70L), CNG Tank Type (Type 1, Type 2, Type 3, Type 4), Material Type (Plastic, Aluminum, Steel, Others), Weight (Less Than 7KG, 7KG to 10 KG, More Than 70KG), Fuel Type (LPG/CNG, Diesel, Gasoline), Propulsion Type (Natural Gas, Hydrogen, Internal Combustion Engine (ICE), Hybrid), Sales Channel (OEM, Aftermarket), Vehicle Type (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle, Hybrid Vehicle) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

TI Fluid Systems (U.K.), Yachiyo Industry Co., Ltd. (Japan), Magna International Inc. (Canada), Plastic Omnium (France), Unipres Corporation (U.S.), Kautex (Germany), ContiTech AG (Germany), SMA Serbatoi SpA (Italy), FTS CO.,LTD. (Japan), Crefact Corporation (U.S.), Boyd Welding LLC (U.S.), Elkamet Kunststofftechnik GmbH (Germany), Salzburger Aluminium Group (Austria), Central Precision Limited (U.K.), Arrow Radiators (Melksham) Ltd (U.K.), A. KAYSER AUTOMOTIVE SYSTEMS GmbH (Germany), PIOLAX, Inc (Japan) |

|

Market Opportunities |

|

Market Definition

A fuel tank is a safe storage solution for hazardous and flammable liquids such as petrol, diesel, gasoline, and more. Some are highly transportable and portable, so they are designed to dispense and transport fuel to job sites when required. They can also store fuel in large quantities in suitable conditions for optimal performance and preservation.

Middle East and Africa Fuel Tank Market Dynamics

Drivers

- Increasing demand for fuel tanks to reduce contamination risk

The growing demand for fuel tanks to reduce contamination risk will likely boost the market's growth during the forecast period. A fuel tank can help to lessen the risk of fuel contamination by controlling the handling and storage of fuel. An added benefit is that it gives the peace of mind of knowing that the customers have enough fuel and will not be easily contaminated. Asa a result of this, it boosts the market growth.

- Growing demand for fuel tanks due to their environment-friendly nature

The demand for fuel tanks increases due to their environment-friendly nature, which will likely propel the market growth. For instance, gasoline comprises harmful chemicals that pollute water and air, but with a fuel tank, the customer can easily reduce the emission of these toxic chemicals into the environment. Fuel storage in fuel tanks also decreases the carbon footprint. The result of these factors boosts market growth.

Opportunities

- Growth and expansion of the e-commerce sector

Increasing demand for commercial vehicles because of the growth of the e-commerce sector contributes to the growth of the fuel tank market during the forecast period. The construction and logistics sectors need increased infrastructure and transportation development which will result in the growth of the fuel tank market. Therefore, the growth and expansion of the e-commerce sector will likely create lucrative market growth opportunities.

- Rising focus of manufacturers to improve vehicle efficiency

Recent automobiles need advanced materials for fuel tank production to improve fuel economy while retaining performance and safety. Lightweight materials have lot of potential for enhancing vehicle efficiency because they need minimum energy to accelerate a lighter product than a heavy one. As a result of all these factors, manufacturers in the fuel tank market are highly focusing on using lightweight materials to improve vehicle efficiency, which will likely create lucrative opportunities for market growth.

Restraints/ Challenges

- High cost associated with composite fuel tanks

The high cost of composite fuel tanks, such as carbon fiber composite-based fuel tanks, will likely hamper the market's growth. Carbon fiber composite-based fuel tanks are relatively more expensive than other fuel tanks because of the cost of carbon fiber, which accounts for about 40 percent of the overall tank cost.

- Growing usage of an advanced technological system

The growing penetration of electric vehicles day-by-day in the market is a major factor restraining the fuel tank market growth. The sales of electric vehicles are also likely to increase in upcoming years because of the growing demand for zero-emission vehicles. As a result, this reduces the demand for the fuel tank factor and hampers the growth of the fuel tank market in the forecast period.

This fuel tank market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the fuel tank market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2021, TI Fluid Systems, the supplier of automotive fluid systems technology, introduced fluid handling products for fuel systems in Hyundai Santa FE SUV hybrid electric vehicle. This Hyundai HEV application demonstrates the ability of the company to improve systems with lightweight solutions for enhanced electric vehicle mode efficiency.

- In 2021, TI Fluid Systems declared to launch a new generation of plastic fuel tanks capable of managing high-pressure demand in hybrid electric vehicles. This plastic fuel tank launched in volume production on Magotan and Passat plug-in hybrid electric vehicle models, with a planned adoption across a wide range of global platforms.

Fuel Tank Market Scope

The fuel tank market is segmented on the basis of tank capacity, CNG tank type, material type, weight, fuel type, propulsion type, sales channel and vehicle type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Tank Capacity

- Less Than 45 L

- 45L -70L

- More Than 70L

CNG Tank Type

- Type 1

- Type 2

- Type 3

- Type 4

Material Type

- Plastic

- Aluminum

- Steel

- Others

Weight

- Less Than 7KG

- 7KG to 10 KG

- More Than 70 KG

Fuel Type

- LPG/CNG

- Diesel

- Gasoline

Propulsion Type

- Natural Gas

- Hydrogen

- Internal Combustion Engine (ICE)

- Hybrid

Sales Channel

- OEM

- Aftermarket

Vehicle Type

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Hybrid Vehicle

Fuel Tank Market Regional Analysis/Insights

The fuel tank market is analysed and market size insights and trends are provided by country, tank capacity, CNG tank type, material type, weight, fuel type, propulsion type, sales channel and vehicle type as referenced above.

The countries covered in the fuel tank market report Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa dominates the Middle East and Africa fuel tank market because of increasing disposable income. Furthermore, increasing demand for passenger cars has surged the fuel tank demand, which will further increase the market's growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Fuel Tank Market Share Analysis

The fuel tank market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to fuel tank market.

Some of the major players operating in the fuel tank market are:

- TI Fluid Systems (U.K.)

- Yachiyo Industry Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- Plastic Omnium (France)

- Unipres Corporation (U.S.)

- Kautex (Germany)

- ContiTech AG (Germany)

- SMA Serbatoi SpA (Italy)

- FTS CO., LTD. (Japan)

- Crefact Corporation (U.S.)

- Boyd Welding LLC (U.S.)

- Elkamet Kunststofftechnik GmbH (Germany)

- Salzburger Aluminium Group (Austria)

- Central Precision Limited (U.K.)

- Arrow Radiators (Melksham) Ltd (U.K.)

- KAYSER AUTOMOTIVE SYSTEMS GmbH (Germany)

- PIOLAX, Inc (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.