Middle East And Africa Gait Trainer Market

Market Size in USD Million

CAGR :

%

USD

13.78 Million

USD

19.70 Million

2024

2032

USD

13.78 Million

USD

19.70 Million

2024

2032

| 2025 –2032 | |

| USD 13.78 Million | |

| USD 19.70 Million | |

|

|

|

Middle East and Africa Gait Trainer Market Analysis

The growing prevalence of mobility disorders is a significant driver for the Middle East and Africa gait trainer market. Neurological conditions such as stroke, cerebral palsy, and Parkinson’s disease, along with a surge in musculoskeletal disorders like arthritis and spinal cord injuries, are leading to an increasing demand for effective rehabilitation solutions. As these conditions become more widespread, the healthcare system faces mounting pressure to provide effective and accessible treatments for patients suffering from limited mobility. Gait trainers, which offer specialized assistance in re-establishing motor control, enhancing posture, and improving walking patterns, have proven to be essential tools in rehabilitation settings. The rising incidence of these health conditions, combined with the growing need for advanced rehabilitation technologies, positions gait trainers as a key solution in improving the quality of life for affected individuals. This increased demand for gait training devices driven by the prevalence of mobility disorders directly fuels the growth and expansion of the Middle East and Africa gait trainer market.

Middle East and Africa Gait Trainer Market Size

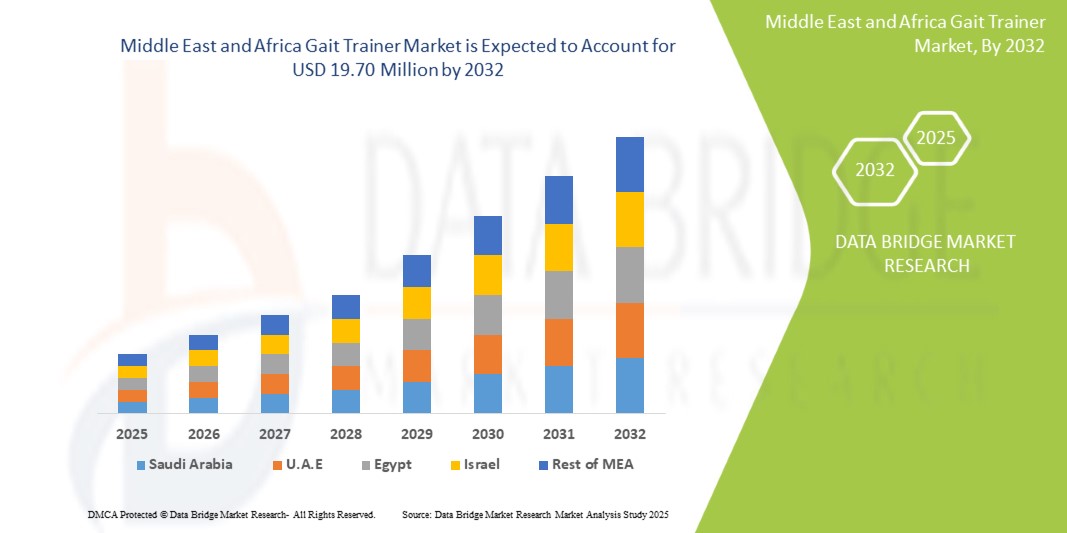

Middle East and Africa gait trainer market size was valued at USD 13.78 million 2024 and is projected to reach USD 19.70 million by 2032, with a CAGR of 4.6% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Middle East and Africa Gait Trainer Market Trends

“Increasing Integration Of Advanced Technologies Such As Robotics And Artificial Intelligence (Ai) In Rehabilitation Devices”

One prominent trend in the Middle East and Africa gait trainer market is the increasing integration of advanced technologies such as robotics and artificial intelligence (AI) in rehabilitation devices. These innovations aim to enhance the effectiveness of gait training by providing personalized feedback and adaptive training regimens that cater to individual needs and progress. This trend is particularly significant as healthcare providers seek to improve patient outcomes for individuals recovering from injuries, neurological conditions, or age-related mobility challenges. The adoption of smart gait trainers equipped with real-time monitoring systems is helping clinicians create more effective rehabilitation plans while enabling patients to engage more actively in their recovery process.

Report Scope and Middle East and Africa Gait Trainer Market Segmentation

|

Attributes |

Middle East and Africa Gait Trainer Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium, Sweden, Denmark, Finland, Norway, Poland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Philippines, Taiwan, New Zealand, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E, Egypt, Kuwait, Israel, Qatar, Oman, Bahrain, and Rest of Middle East & Africa |

|

Key Market Players |

Ottobock (Germany), EKSO BIONICS (U.S.), ALTERG, INC (U.S.), BIODEX (U.S.), CYBERDYNE INC. (Japan), HOCOMA (Switzerland), Rex Bionics Ltd (New Zealand), Reha-Stim Medtec (Germany), Sole Fitness (U.S.), Raincastle Communications (U.S.), Rifton Equipment (U.S.), Horizon Fitness (U.S.), BIONIK (Canada), NordicTrack (U.S.), P&S Mechanics Co., Ltd. (Taiwan), Helius Medical Technologies, Inc. (U.S.), and Spirit Fitness (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Gait Trainer Market Definition

A gait trainer is an assistive device designed to help individuals with mobility impairments improve their ability to walk by providing support, stability, and assistance. These devices are commonly used by people with conditions such as cerebral palsy, stroke, spinal cord injuries, or neurological disorders that affect their ability to walk independently. Gait trainers help users maintain a more upright posture, improve balance, and develop better coordination by offering adjustable features such as support for the trunk, pelvis, and legs, as well as the ability to adjust height, width, and the level of assistance provided. Many gait trainers are equipped with wheels for easy movement and some have motorized features to assist with partial weight-bearing or robotic-assisted walking, allowing for gradual improvement in walking ability. These devices are frequently used in rehabilitation settings like physical therapy centers or hospitals, and can also be used at home to promote independence and improve mobility over time.

Middle East and Africa Gait Trainer Market Dynamics

Drivers

- Rising Prevalence of Mobility Disorders

The growing prevalence of mobility disorders is a significant driver for the Middle East and Africa gait trainer market. Neurological conditions such as stroke, cerebral palsy, and Parkinson’s disease, along with a surge in musculoskeletal disorders like arthritis and spinal cord injuries, are leading to an increasing demand for effective rehabilitation solutions. As these conditions become more widespread, the healthcare system faces mounting pressure to provide effective and accessible treatments for patients suffering from limited mobility. Gait trainers, which offer specialized assistance in re-establishing motor control, enhancing posture, and improving walking patterns, have proven to be essential tools in rehabilitation settings. The rising incidence of these health conditions, combined with the growing need for advanced rehabilitation technologies, positions gait trainers as a key solution in improving the quality of life for affected individuals. This increased demand for gait training devices driven by the prevalence of mobility disorders directly fuels the growth and expansion of the Middle East and Africa gait trainer market.

For instance,

- In March 2024, according to an article published by the World Health Organization, Neurological conditions are now the leading cause of ill health and disability Middle East and Africaly, with disability-adjusted life years (DALYs) increasing by 18% since 1990. This surge in neurological disorders, which often impair mobility, has amplified the demand for rehabilitation solutions. As a result, the growing prevalence of these conditions acts as a key driver for the Middle East and Africa gait trainer market, fueling demand for effective mobility aids.

- In August 2023, according to the article published by NCBI, Parkinson’s Disease (PD) affects 1 to 2 per 1,000 people, with prevalence rising to 1% in those over 60 years. Around 5% to 10% of cases have a genetic link, and PD is more common in men. As the Middle East and Africa population ages, the growing incidence of PD is driving the demand for gait trainers, boosting the market for mobility assistance devices.

Technological Advancements in Gait Trainers

Technological advancements, particularly in Artificial Intelligence (AI) and robotics, have significantly enhanced the functionality and effectiveness of gait trainers. The integration of AI allows for real-time data analysis, enabling personalized rehabilitation programs that adjust to the patient’s progress and specific needs. Robotics further elevates the capabilities of gait trainers by providing precise, controlled movements that replicate natural walking patterns, improving both the quality of training and patient outcomes. These innovations not only make gait trainers more efficient in restoring mobility but also increase their appeal to healthcare providers seeking advanced, evidence-based solutions for patient rehabilitation. With healthcare systems increasingly prioritizing technology-driven treatments, the incorporation of AI and robotics in gait trainers has become a key factor in the market’s growth. As these technological advancements continue to improve the effectiveness and appeal of gait trainers, they act as a major driver for the Middle East and Africa gait trainer market, attracting greater investment and widespread adoption across rehabilitation centers and clinics.

For instance,

- In January 2025, according to the article published by ETHealthworld, the pediatric gait trainer, powered by Genrobotics' GPLOT Exoskeleton Technology, offers advanced robotic gait therapy to help children with gait disabilities develop natural walking patterns. With features like Intelligent Therapy Mode for improving motor coordination and muscle strength, this child-friendly device ensures comfort and effectiveness. Such technological innovations drive the demand for more sophisticated gait trainers, fueling the Middle East and Africa market's growth.

- In September 2024, according to the article published by BMC, Robotic-Assisted Gait Training (RAGT) improves lower extremity function, balance, walking ability, and endurance more effectively than conventional gait training (CGT). The proven superiority of RAGT in enhancing rehabilitation outcomes highlights the growing role of advanced technologies in gait therapy. Such evidence propels the demand for cutting-edge gait trainers, driving growth in the Middle East and Africa market.

Advancements in AI and robotics have greatly improved gait trainers, making them more effective in rehabilitation. AI enables real-time, personalized programs that adapt to patient progress, while robotics ensure precise, natural movements, enhancing training quality and outcomes. These innovations make gait trainers more efficient and attractive to healthcare providers, driving market growth as technology-driven solutions gain priority in patient care.

- Growing Awareness of Rehabilitation

There has been a significant shift in the healthcare industry toward rehabilitation-based approaches, with a growing emphasis on non-invasive treatments over purely surgical solutions. This change has led to an increased focus on rehabilitation technologies, such as gait trainers, that help patients recover mobility and function through therapeutic interventions. Healthcare providers are increasingly recognizing the importance of rehabilitation in improving long-term outcomes for patients with mobility impairments caused by neurological conditions, musculoskeletal disorders, and aging-related issues. Gait trainers, which assist in the gradual restoration of walking ability and balance, are now an integral part of physical therapy and rehabilitation programs in hospitals, outpatient clinics, and specialized centers. As the healthcare landscape continues to prioritize rehabilitation and patient-centered care, the adoption of gait trainers is rising, driving demand for these devices. The shift towards rehabilitation-based approaches acts as a key driver for the Middle East and Africa gait trainer market, fostering growth and innovation within this sector.

For instance,

- In January 2022, according to the article published by Science Direct, Nonoperative care, including rehabilitation, is increasingly emphasized before elective orthopedic surgeries to achieve optimal patient outcomes. Improved collaboration between surgeons and rehabilitation professionals ensures better recovery for those with musculoskeletal disorders. This growing recognition of rehabilitation as a key element in recovery drives the adoption of gait trainers, fueling demand in the Middle East and Africa gait trainer market as a vital tool in rehabilitation.

- In August 2022, according to the article published by Science Direct, High-quality trials, like the Swedish KANON trial, emphasize rehabilitation as the first line of treatment for acute ACL injuries, suggesting that a period of rehab can reduce the need for surgery by up to 50%. This growing focus on rehabilitation over surgical intervention boosts the demand for advanced gait trainers, driving growth in the Middle East and Africa gait trainer market for better recovery outcomes.

The healthcare industry is increasingly prioritizing rehabilitation over surgery, leading to a rise in demand for non-invasive therapies like gait trainers. These devices, essential for restoring mobility and balance, are now integral to physical therapy programs for patients with neurological, musculoskeletal, and age-related conditions. As the focus shifts toward patient-centered care, the growing adoption of gait trainers drives market expansion and innovation.

Opportunities

- Rising Impact of the Aging Population on the Growth of the Gait Trainer

The aging population is one of the most significant opportunity in the gait trainer market. As people live longer, there is an increasing prevalence of age-related health issues that impact mobility, such as arthritis, osteoporosis, stroke, and Parkinson’s disease. These conditions can severely affect a person’s ability to walk or maintain balance, leading to a higher demand for rehabilitation devices that support mobility. Gait trainers, which help individuals regain walking ability or improve their gait, are increasingly being recognized as essential tools in rehabilitation programs for older adults. These devices aid in providing the necessary support to individuals as they recover from injury surgery or manage chronic conditions that impair their ability to move freely.

As the aging population continues to grow, healthcare systems face significant challenges in providing adequate care and rehabilitation services. Gait trainers offer a solution to this challenge by allowing for both in-clinic and home-based rehabilitation, enabling patients to receive effective therapy without the need for constant visits to healthcare facilities. The convenience of using gait trainers in home settings appeals to older adults who may prefer the comfort and privacy of home-based care. This growing trend toward homecare, alongside the need for rehabilitation in an aging population, positions the gait trainer market for considerable expansion.

- Expansion of the Homecare Market and the Growing Role of Gait Trainers

The homecare market has been rapidly expanding in recent years, fueled by a combination of factors such as rising healthcare costs, advancements in telemedicine, and a growing preference for receiving care in the comfort of one’s home. For patients with mobility impairments, rehabilitation and therapy are essential for improving their quality of life, and gait trainers have become a crucial tool in this process. These devices, which assist individuals in regaining or enhancing their walking ability, are increasingly being incorporated into homecare settings to provide patients with more flexible and accessible rehabilitation options.

The shift toward homecare is particularly relevant for aging populations, individuals recovering from surgery, and people with chronic conditions that affect their mobility. Many patients prefer to receive therapy at home as it offers a more personalized, convenient, and cost-effective alternative to frequent visits to healthcare facilities or rehabilitation centers. Gait trainers, especially those designed for home use, cater to this need by providing patients with the necessary support to practice walking exercises, balance, and coordination in a familiar environment. Moreover, these devices are designed to be user-friendly, enabling caregivers or family members to assist in the rehabilitation process without the need for specialized medical training.

For instance,

- In February 2023, according to the article published in the National Library of Medicine, the expansion of homecare services, including home-based rehabilitation and telerehabilitation, presents a valuable opportunity for robotic-assisted gait trainers. As patients prefer convenient, in-home rehabilitation, gait trainers can enhance mobility recovery. Integrating them into telerehabilitation programs can address healthcare access gaps, offering cost-effective, personalized solutions. This growing demand for homecare solutions creates significant market potential for advanced gait training technologies

The homecare market's expansion represents a significant opportunity for the gait trainer market. As more individuals seek rehabilitation options that allow them to stay at home, the demand for gait trainers that provide mobility support and facilitate recovery will continue to rise. The increasing focus on patient-centered care, combined with innovations in remote monitoring and technology integration, ensures that gait trainers will play a pivotal role in the future of homecare, driving the market’s growth and offering more effective and accessible rehabilitation solutions.

- Integration of Gait Trainers with Wearable Health Devices

The integration of gait trainers with wearable health devices represents a groundbreaking opportunity for enhancing rehabilitation outcomes in the Middle East and Africa gait trainer market. Wearable health devices, such as fitness trackers, smartwatches, and biometric sensors, have gained widespread popularity due to their ability to monitor various aspects of health, including heart rate, steps taken, calories burned, and sleep patterns. By integrating gait trainers with these devices, users and healthcare providers can track real-time progress, gather detailed data, and adjust rehabilitation protocols based on accurate and continuous feedback. This integration enables a more holistic approach to mobility therapy, making rehabilitation more effective, personalized, and data-driven.

For individuals using gait trainers, wearable health devices offer several benefits. First, they allow for the continuous tracking of mobility metrics such as walking speed, step length, balance, and gait symmetry. This real-time data can help users assess their progress more clearly and stay motivated throughout their rehabilitation journey. Healthcare providers also benefit from this integration as they can remotely monitor patients' recovery and make timely adjustments to treatment plans without requiring frequent in-person visits. The integration can even trigger alerts for caregivers or clinicians if there are signs of potential issues, such as a decrease in mobility or gait stability, allowing for quicker intervention and reducing the risk of complications.

For instance-

- In September 2022, according to the article published by NCBI, The integration of gait trainers with wearable health devices, such as Stride Management Assist (SMA) exoskeletons, presents a significant opportunity in the Middle East and Africa gait trainer market. Studies show that home-based SMA gait training can enhance exercise endurance in individuals with Parkinson's disease. This trend offers the potential to expand the market by improving accessibility, personalization, and patient outcomes, fostering growth in homecare and tele-rehabilitation solutions

- In November 2024, article published by MDPI, the integration of gait trainers with wearable health devices, such as sensors for monitoring motion and gait patterns, presents a valuable opportunity in the Middle East and Africa gait trainer market. Continuous gait analysis using technologies like vision recognition and IMU sensors allows for personalized treatments and better rehabilitation outcomes. This integration enhances early diagnosis, improves recovery, and supports athletes in preventing injuries, thus driving market growth in clinical and homecare settings

The integration of gait trainers with wearable health devices represents a transformative opportunity for the gait trainer market. By enabling continuous, data-driven tracking and providing personalized insights, this integration not only enhances the rehabilitation process but also fosters greater patient engagement and more efficient care. As wearable technologies continue to evolve, their role in supporting mobility rehabilitation and optimizing gait training will become increasingly important, contributing to the growth and advancement of the Middle East and Africa gait trainer market.

Middle East and Africa Gait Trainer Market Scope

Middle East and Africa gait trainer market is segmented into six notable segments based on product, type, disorder, age-group, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Manual Walker

- By Type Wheel

- Medium

- Large

- Small

- Mini

- By Upper Frame

- Standard Upper Frame

- Dynamic Upper Frame

- By Base

- Standard Base

- Utility Base

- By Base

- Without Odometer

- With Odometer

- By Arm Support

- Large Arm Prompts

- Small Arm Prompts

- By Hip Positioner

- Large

- Small

- By Pelvic Support

- Medium

- Large

- Small

- By Thigh Strap

- Wide

- Narrow

- By Chest Prompts

- Medium

- Large

- Small

- By Handle Bars

- Large

- Small

- By Type Wheel

- Treadmill

- Standard Treadmill

- Robot-Assisted Treadmill System

- Active

- Passive

- Exoskeleton

- Consumable Products

- Gait Trainer Pads

- Handles And Grips

- Harnesses And Belts

- Battery Packs (For Electronic Trainers)

- Gait Trainer Pads

- Cushions And Seat Covers

- Others

- Electric Walker

- By Type Wheel

- Medium

- Large

- Small

- Mini

- By Upper Frame

- Standard Upper Frame

- Dynamic Upper Frame

- By Base

- Standard Base

- Utility Base

- By Base

- Without Odometer

- With Odometer

- By Base

- Without Odometer

- With Odometer

- By Arm Support

- Large Arm Prompts

- Small Arm Prompts

- By Hip Positioner

- Large

- Small

- By Pelvic Support

- Medium

- Large

- Small

- By Thigh Strap

- Wide

- Narrow

- By Chest Prompts

- Medium

- Large

- Small

- By Handle Bars

- Large

- Small

- By Type Wheel

Type

- Conventional/Standard Gait Trainer

- Robot-Assisted Gait Trainer

- Robotic Neuro Rehabilitation

- Exoskeleton

- Others

- Others

Disorder

- Orthopaedic Disorders

- Neurological Disorders

- Parkinson’s Disease/Parkinsonism

- Cerebral Palsy

- Multiple Sclerosis

- Spinal Cord Injury (Sci)

- Hemiplegia

- Spinal Stenosis

- Traumatic Brain Injury

- Others

- Stroke

- Amputation

- Others

Age Group

- Adults

- Pediatric

End User

- Hospitals

- Public

- Private

- Rehabilitation Centers

- Public

- Private

- Home Care Settings

- Sports Centers

- Public

- Private

- Trauma Centers

- Others

Distribution Channel

- Retail Sales

- Offline

- Online

- Direct Tenders

- Others

Middle East and Africa Gait Trainer Market Regional Analysis

The market is analyzed and market size insights and trends are provided based on country, product, type, disorder, age-group, end user, and distribution channel as referenced above.

The countries covered in the market are Saudi Arabia, U.A.E., South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia is expected to dominate the Middle East and Africa Gait Trainer Market due to due to its advanced healthcare infrastructure, increasing prevalence of mobility disorders, and strong presence of key manufacturers and innovative technologies in rehabilitation.

South Africa is expected to dominate the Middle East and Africa Gait Trainer Market in the forecast period due to a growing aging population, rising awareness of rehabilitation technology, and increasing investment in healthcare infrastructure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Gait Trainer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Gait Trainer Market Leaders Operating in the Market Are:

- Ottobock (Germany)

- EKSO BIONICS (U.S.)

- ALTERG, INC (U.S.)

- BIODEX (U.S.)

- CYBERDYNE INC. (Japan)

- HOCOMA (Switzerland)

- Rex Bionics Ltd (New Zealand)

- Reha-Stim Medtec (Germany)

- Sole Fitness (U.S.)

- Raincastle Communications (U.S.)

- Rifton Equipment (U.S.)

- Horizon Fitness (U.S.)

- BIONIK (Canada)

- NordicTrack (U.S.)

- P&S Mechanics Co., Ltd. (Taiwan)

- Helius Medical Technologies, Inc. (U.S.)

- Spirit Fitness (U.S.)

Latest Developments Middle East and Africa Gait Trainer Market

- In March 2023, Ottobock acquired Brillinger, a leading medical supply chain in Baden-Württemberg, expanding its care network in southern Germany. The takeover enhanced Ottobock’s growth strategy, allowing for improved patient care and rehabilitation services across multiple locations in the region

- In July 2024, Ottobock acquired Sahva A/S, a top orthopedic technology provider in Denmark, to boost its presence in the Scandinavian market. In 2024, Ottobock achieved a 7% revenue growth and a 17% increase in earnings, driving sustainable and profitable expansion

- In May 2024, Ottobock launched the Evanto Prosthetic Foot, a groundbreaking mechanical foot offering improved mobility. Designed for activity levels 2 to 4, it combines stability, flexibility, and energy return, enhancing comfort and adaptability across different terrains, while supporting users’ increased mobility and quality of life.

- In August 2023, AlterG acquired by ReWalk Robotics, aiming to expand commercial scale and accelerate its path to profitability. The acquisition strengthens ReWalk's position in the rehabilitation technology market, enhancing its ability to deliver innovative solutions and drive future growth

- In December 2024, Cyberdyne Inc. received conformity certification under the EU Medical Device Regulation for its small model of the HAL for Medical Use Lower Limb Type. Prior to this certification, only patients over 150 cm in height were eligible for Cybernics Treatment. With the new certification, EU patients ranging from approximately 100 cm to 150 cm can now undergo Cybernics Treatment

- In December 2024, Cyberdyne Inc. received conformity certification under the EU Medical Device Regulation for its small model of the HAL for Medical Use Lower Limb Type. Prior to this certification, only patients over 150 cm in height were eligible for Cybernics Treatment. With the new certification, EU patients ranging from approximately 100 cm to 150 cm can now undergo Cybernics Treatment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA GAIT TRAINER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: REGULATIONS

5.1 REGULATORY BODIES FOR GAIT TRAINER MARKET IN NORTH AMERICA

5.2 REGULATORY BODIES FOR GAIT TRAINER MARKET IN SOUTH AMERICA

5.3 REGULATORY BODIES FOR GAIT TRAINER MARKET IN EUROPE

5.4 REGULATORY BODIES FOR GAIT TRAINER MARKET IN THE ASIA-PACIFIC (APAC) REGION

5.5 REGULATORY BODIES FOR GAIT TRAINER MARKET IN MIDDLE EAST AND AFRICA (MEA)

6 INDUSTRY INSIGHTS

6.1 PENETRATION AND GROWTH PROSPECT MAPPING

6.1.1 MARKET PENETRATION:

6.2 CHALLENGES TO OVERCOME:

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.4.1 OTTOBOCK

6.4.2 EKSO BIONIC

6.4.3 REX BIONICS

6.4.4 RAINCASTLE

6.4.5 HOCOMA

6.5 ANALYSIS AND RECOMMENDATION

6.6 MICROECONOMIC FACTORS

6.7 COST ANALYSIS

6.8 OPPORTUNITY MAP ANALYSIS FOR THE MIDDLE EAST AND AFRICA GAIT TRAINER MARKET

6.9 TECHNOLOGY ROAD MAP

6.1 SURGERY PROCEDURES

6.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

6.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

6.11.1.1 JOINT VENTURES

6.11.1.2 MERGERS AND ACQUISITIONS

6.11.1.3 LICENSING AND PARTNERSHIP

6.11.1.4 TECHNOLOGY COLLABORATIONS

6.11.1.5 STRATEGIC DIVESTMENTS

6.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

6.11.3 STAGE OF DEVELOPMENT

6.11.4 TIMELINES AND MILESTONES

6.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

6.11.6 RISK ASSESSMENT AND MITIGATION

6.11.7 FUTURE OUTLOOK

6.12 INSTALLED BASE DATA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF MOBILITY DISORDERS

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN GAIT TRAINERS

7.1.3 GROWING AWARENESS OF REHABILITATION

7.1.4 PERSONALIZED GAIT TRAINING

7.2 RESTRAINTS

7.2.1 RISK OF INJURY AND DISCOMFORT IN STATIONARY GAIT TRAINERS

7.2.2 HIGH COST OF GAIT TRAINERS

7.3 OPPORTUNITIES

7.3.1 RISING IMPACT OF THE AGING POPULATION ON THE GROWTH OF THE GAIT TRAINER

7.3.2 EXPANSION OF THE HOMECARE MARKET AND THE GROWING ROLE OF GAIT TRAINERS

7.3.3 INTEGRATION OF GAIT TARINER WITH WEARABLE HEALTH DEVICES

7.4 CHALLENGES

7.4.1 BARRIERS TO AWARENESS AND ADOPTION OF GAIT TRAINERS

7.4.2 RESISTANCE TO NEW TECHNOLOGY

8 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MANUAL WALKER

8.2.1 BY TYPE

8.2.1.1 MEDIUM

8.2.1.2 LARGE

8.2.1.3 SMALL

8.2.1.4 MINI

8.2.2 BY UPPER FRAME

8.2.2.1 STANDARD UPPER FRAME

8.2.2.2 DYNAMIC UPPER FRAME

8.2.3 BY BASE

8.2.3.1 STANDARD BASE

8.2.3.1.1 THE STANDARD BASE BY BASE

8.2.3.1.1.1 WITHOUT ODOMETER

8.2.3.1.1.2 WITH ODOMETER

8.2.3.2 UTILITY BASE

8.2.3.2.1 BASE BY BASE

8.2.3.2.1.1 WITHOUT ODOMETER

8.2.3.2.1.2 WITH ODOMETER

8.2.4 BY ARM SUPPORT

8.2.4.1 LARGE ARM PROMPTS

8.2.4.2 SMALL ARM PROMPTS

8.2.5 BY HIP POSITIONER

8.2.5.1 LARGE

8.2.5.2 SMALL

8.2.6 BY PELVIC SUPPORT

8.2.6.1 MEDIUM

8.2.6.2 LARGE

8.2.6.3 SMALL

8.2.7 BY THIGH STRAPS

8.2.7.1 WIDE

8.2.7.2 NARROW

8.2.8 BY CHEST PROMPT

8.2.8.1 MEDIUM

8.2.8.2 LARGE

8.2.8.3 SMALL

8.2.9 BY CHEST PROMPT

8.2.9.1 LARGE

8.2.9.2 SMALL

8.3 TREADMILL

8.3.1 STANDARD TREADMILL

8.3.2 ROBOT-ASSISTED TREADMILL SYSTEM

8.3.2.1 ACTIVE

8.3.2.2 PASSIVE

8.3.3 EXOSKELETON

8.3.4 CONSUMABLE PRODUCTS

8.3.4.1 GAIT TRAINER PADS

8.3.4.2 HANDLES AND GRIPS

8.3.4.3 HARNESSES AND BELTS

8.3.4.4 BATTERY PACKS (FOR ELECTRONIC TRAINERS)

8.3.4.5 GAIT TRAINER PADS

8.3.4.6 CUSHIONS AND SEAT COVERS

8.3.4.7 OTHERS

8.4 ELECTRIC WALKER

8.4.1 BY TYPE

8.4.1.1 MEDIUM

8.4.1.2 LARGE

8.4.1.3 SMALL

8.4.1.4 MINI

8.4.2 BY UPPER FRAME

8.4.2.1 STANDARD UPPER FRAME

8.4.2.2 DYNAMIC UPPER FRAME

8.4.3 BY BASE

8.4.3.1 STANDARD BASE

8.4.3.1.1 BY BASE

8.4.3.1.1.1 WITHOUT ODOMETER

8.4.3.1.1.2 WITH ODOMETER

8.4.3.1 UTILITY BASE

8.4.3.1.1 BY BASE IS

8.4.3.1.1.1 WITHOUT ODOMETER

8.4.3.1.1.2 WITH ODOMETER

8.4.4 BY ARM

8.4.4.1 LARGE ARM PROMPTS

8.4.4.2 SMALL ARM PROMPTS

8.4.5 BY HIP

8.4.5.1 LARGE

8.4.5.2 SMALL

8.4.6 BY PELVIC SUPPORT

8.4.6.1 MEDIUM

8.4.6.2 LARGE

8.4.6.3 SMALL

8.4.7 BY THIGH STRAPS

8.4.7.1 WIDE

8.4.7.2 NARROW

8.4.8 BY CHEST PROMPT

8.4.8.1 MEDIUM

8.4.8.2 LARGE

8.4.8.3 SMALL

8.4.9 HANDLE BARS

8.4.9.1 LARGE

8.4.9.2 SMALL

9 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISORDER

9.1 OVERVIEW

9.2 ORTHOPAEDIC DISORDERS

9.3 NEUROLOGICAL DISORDERS

9.3.1 PARKINSON’S DISEASE/PARKINSONISM

9.3.2 CEREBRAL PALSY

9.3.3 MULTIPLE SCLEROSIS

9.3.4 SPINAL CORD INJURY (SCI)

9.3.5 HEMIPLEGIA

9.3.6 SPINAL STENOSIS

9.3.7 TRAUMATIC BRAIN INJURY

9.3.8 OTHERS

9.4 STROKE

9.5 AMPUTATION

9.6 OTHERS

10 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULTS

10.3 PEDIATRIC

11 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY TYPE

11.1 OVERVIEW

11.2 CONVENTIONAL/STANDARD GAIT TRAINER

11.3 ROBOT-ASSISTED GAIT TRAINER

11.3.1 ROBOTIC NEURO REHABILITATION

11.3.2 EXOSKELETON

11.3.3 OTHERS

11.4 OTHERS

12 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC

12.2.2 PRIVATE

12.3 REHABILITATION CENTERS

12.3.1 PUBLIC

12.3.2 PRIVATE

12.4 HOME CARE SETTINGS

12.5 SPORTS CENTERS

12.5.1 PUBLIC

12.5.2 PRIVATE

12.6 TRAUMA CENTERS

12.7 OTHERS

13 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 OTHERS

14 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 U.A.E

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 OTTOBOCK

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 EKSO BIONICS

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ALTERG, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 BIODEX

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 CYBERDYNE INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 BIONIK

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ECHLON FIT US

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 GENROBOTICS MEDICAL AND MOBILITY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 HELIUS MEDICAL TECHNOLOGIES, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HOCOMA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HORIZON FITNESS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 IFIT INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 JOHNSON HEALTH TECH.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MADE FOR MOVEMENT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MATRIX FITNESS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 MEDITOUCH USA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PELOTON INTERACTIVE, INC

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 P&S MECHANICS CO., LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 REHA-STIM MEDTEC AG

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 REX BIONICS LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 RIFTON EQUIPMENT

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SOLE FITNESS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 SPIRIT FITNESS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 VOYAR

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 COUNTRY ANALYSIS

TABLE 2 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA TREADMILL IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ORTHOPEDIC DISORDERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA STROKE IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA AMPUTATION IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PEDIATRIC IN GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PEDIATRIC IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA CONVENTIONAL/STANDARD GAIT TRAINER IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA HOSPITALS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA HOME CARE SETTINGS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA SPORTS CENTERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA TRAUMA CENTERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA OTHERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA DIRECT TENDERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA RETAIL SALES IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN GAIT TRAINER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH AFRICA MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 116 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH AFRICA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 118 SOUTH AFRICA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 120 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH AFRICA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 125 SOUTH AFRICA GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH AFRICA ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SOUTH AFRICA GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH AFRICA NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH AFRICA GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH AFRICA GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH AFRICA HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH AFRICA REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH AFRICA SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH AFRICA GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH AFRICA RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SAUDI ARABIA ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SAUDI ARABIA GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 165 SAUDI ARABIA NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 166 SAUDI ARABIA GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 167 SAUDI ARABIA GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 168 SAUDI ARABIA HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SAUDI ARABIA REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SAUDI ARABIA SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SAUDI ARABIA GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 SAUDI ARABIA RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 178 EGYPT UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 193 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 194 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 195 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 196 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 197 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 198 EGYPT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 199 EGYPT GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 EGYPT ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 EGYPT GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 202 EGYPT NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 203 EGYPT GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 204 EGYPT GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 205 EGYPT HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 EGYPT REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 EGYPT SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 EGYPT GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 209 EGYPT RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E. GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E. STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E. UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E. MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 222 U.A.E. TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 223 U.A.E. ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 224 U.A.E. CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 226 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 227 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 228 U.A.E. STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 229 U.A.E. UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 230 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 231 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 232 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 233 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 234 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 235 U.A.E. ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 236 U.A.E. GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 U.A.E. ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.A.E. GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 239 U.A.E. NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 240 U.A.E. GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 241 U.A.E. GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 242 U.A.E. HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.A.E. REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.A.E. SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 U.A.E. GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 246 U.A.E. RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 247 ISRAEL GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 248 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 249 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 250 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 251 ISRAEL STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 252 ISRAEL UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 253 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 254 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 255 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 256 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 257 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 258 ISRAEL MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 259 ISRAEL TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 260 ISRAEL ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 261 ISRAEL CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 263 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 264 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 265 ISRAEL STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 266 ISRAEL UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 267 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 268 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 269 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 270 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 271 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 272 ISRAEL ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 273 ISRAEL GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 ISRAEL ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 ISRAEL GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 276 ISRAEL NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 277 ISRAEL GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 278 ISRAEL GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 279 ISRAEL HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 ISRAEL REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 ISRAEL SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 ISRAEL GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 283 ISRAEL RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 284 KUWAIT GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 285 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 286 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 287 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 288 KUWAIT STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 289 KUWAIT UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 290 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 291 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 292 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 293 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 294 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 295 KUWAIT MANUAL WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 296 KUWAIT TREADMILL IN GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 297 KUWAIT ROBOT-ASSISTED TREADMILL SYSTEM IN GAIT TRAINER MARKET, BY ACTIVITY MODE, 2018-2032 (USD THOUSAND)

TABLE 298 KUWAIT CONSUMABLE PRODUCTS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY TYPE WHEEL, 2018-2032 (USD THOUSAND)

TABLE 300 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY UPPER FRAME, 2018-2032 (USD THOUSAND)

TABLE 301 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 302 KUWAIT STANDARD BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 303 KUWAIT UTILITY BASE IN GAIT TRAINER MARKET, BY BASE, 2018-2032 (USD THOUSAND)

TABLE 304 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY ARM SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 305 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HIP POSITIONER, 2018-2032 (USD THOUSAND)

TABLE 306 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY PELVIC SUPPORT, 2018-2032 (USD THOUSAND)

TABLE 307 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY THIGH STRAPS, 2018-2032 (USD THOUSAND)

TABLE 308 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY CHEST PROMPTS, 2018-2032 (USD THOUSAND)

TABLE 309 KUWAIT ELECTRIC WALKER IN GAIT TRAINER MARKET, BY HANDLE BARS, 2018-2032 (USD THOUSAND)

TABLE 310 KUWAIT GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 KUWAIT ROBOT-ASSISTED GAIT TRAINER IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 KUWAIT GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 313 KUWAIT NEUROLOGICAL DISORDERS IN GAIT TRAINER MARKET, BY DISORDER, 2018-2032 (USD THOUSAND)

TABLE 314 KUWAIT GAIT TRAINER MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 315 KUWAIT GAIT TRAINER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 316 KUWAIT HOSPITALS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 KUWAIT REHABILITATION CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 KUWAIT SPORTS CENTERS IN GAIT TRAINER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 KUWAIT GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 320 KUWAIT RETAIL SALES IN GAIT TRAINER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 321 REST OF MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: SEGMENTATION

FIGURE 10 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA GAIT TRAINER MARKET, BY PRODUCT (2024)

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF MOBILITY DISORDERS IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA GAIT TRAINER MARKET FROM 2025 TO 2032

FIGURE 14 MANUAL WALKER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA GAIT TRAINER MARKET IN 2025 AND 2032

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA GAIT TRAINER MARKET

FIGURE 16 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY PRODUCT, 2024

FIGURE 17 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 18 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 19 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISORDER, 2024

FIGURE 21 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISORDER, 2025-2032 (USD THOUSAND)

FIGURE 22 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISORDER, CAGR (2025-2032)

FIGURE 23 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISORDER, LIFELINE CURVE

FIGURE 24 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY AGE GROUP, 2024

FIGURE 25 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 26 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 27 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY TYPE, 2024

FIGURE 29 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 30 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 31 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY TYPE, LIFELINE CURVE

FIGURE 32 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY END USER, 2024

FIGURE 33 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 34 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY END USER, CAGR (2025-2032)

FIGURE 35 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 37 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 38 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 39 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: SNAPSHOT (2024)

FIGURE 41 MIDDLE EAST AND AFRICA GAIT TRAINER MARKET: COMPANY SHARE 2024 (%)

FIGURE 42 NORTH AMERICA GAIT TRAINER MARKET: COMPANY SHARE 2024 (%)

FIGURE 43 EUROPE GAIT TRAINER MARKET: COMPANY SHARE 2024 (%)

FIGURE 44 ASIA-PACIFIC GAIT TRAINER MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available