Middle East And Africa Health Insurance Market

Market Size in USD Billion

CAGR :

%

USD

155.16 Billion

USD

207.49 Billion

2024

2032

USD

155.16 Billion

USD

207.49 Billion

2024

2032

| 2025 –2032 | |

| USD 155.16 Billion | |

| USD 207.49 Billion | |

|

|

|

|

Middle East and Africa Health Insurance Market Size

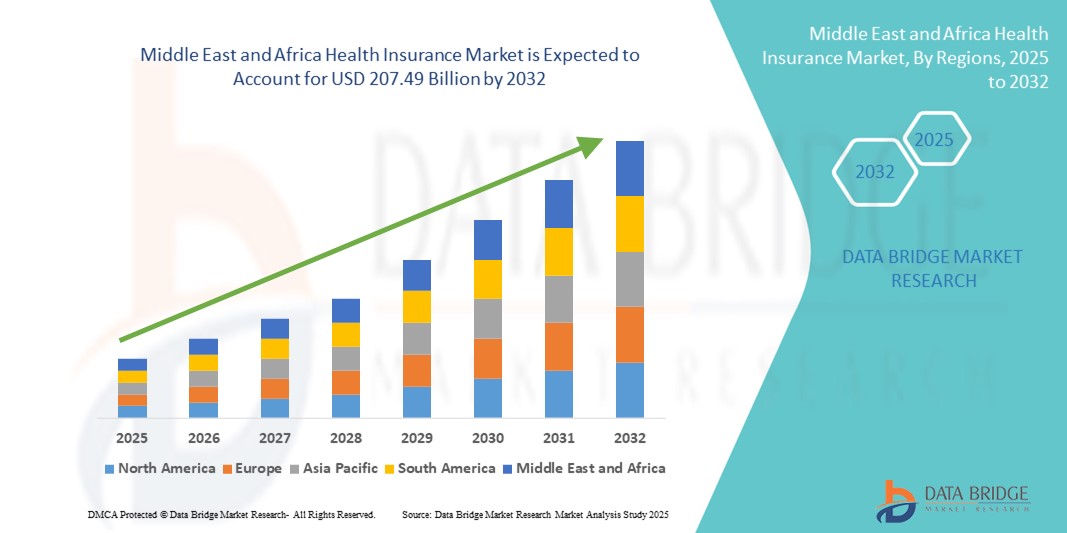

- The Middle East and Africa health insurance market size was valued at USD 155.16 billion in 2024 and is expected to reach USD 207.49 billion by 2032, at a CAGR of 3.70% during the forecast period

- The Middle East and Africa health insurance market is witnessing strong growth, driven by increasing awareness of the importance of health coverage, especially in light of rising chronic disease rates, high out-of-pocket healthcare expenses, and expanding middle-class populations across the region

- Government-led healthcare reforms, the introduction of mandatory health insurance policies in countries such as the U.A.E. and Saudi Arabia, and increased investments in digital health infrastructure are further propelling the adoption of health insurance among individuals, families, and corporates

Middle East and Africa Health Insurance Market Analysis

- The Middle East and Africa Health Insurance market is witnessing significant growth due to rising demand for accessible and affordable healthcare services, increasing prevalence of chronic diseases, and expanding government and private sector initiatives to improve health coverage across the region

- Market growth is driven by growing awareness about health insurance benefits, increasing healthcare expenditures, favorable regulatory reforms, and the rising need for financial protection against medical emergencies and high treatment costs

- Saudi Arabia dominated the Middle East and Africa health insurance market with a 34.7% revenue share in 2024, driven by robust government-led health insurance schemes, expanding private insurance sector, and mandatory insurance requirements for expatriates and private sector employees

- U.A.E. is projected to be the fastest-growing country in the Middle East and Africa health insurance market, expected to register a CAGR of 11.6% during 2025–2032, fueled by rising medical tourism, enhanced digital insurance platforms, and the government’s push for universal health coverage

- The Individual Health Insurance segment dominated the Middle East and Africa Health insurance market with a revenue share of 53.1% in 2024, attributed to increasing enrollment among self-employed individuals, freelancers, and employees in the informal sector seeking comprehensive and personalized health coverage

Report Scope and Middle East and Africa Health Insurance Market Segmentation

|

Attributes |

Middle East and Africa Health Insurance Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Health Insurance Market Trends

Government Reforms and Digital Transformation Driving the Middle East and Africa Health Insurance Market

- A significant trend shaping the Middle East and Africa health insurance market is the rapid digitization of insurance services, with insurers integrating AI-powered platforms, telemedicine solutions, and mobile health applications to improve customer access and operational efficiency

- Governments in countries such as Saudi Arabia and the U.A.E. are introducing mandatory health insurance regulations for expatriates and private sector employees, significantly expanding the insured population and improving healthcare access

- Insurtech startups and traditional insurers are leveraging blockchain technology and cloud-based systems to enhance claims transparency, prevent fraud, and streamline the policy management process, attracting younger, tech-savvy consumers

- There is growing investment in public-private partnerships to expand healthcare infrastructure and insurance coverage in underserved rural regions of South Africa, Nigeria, and Kenya, supporting inclusive health financing initiatives

- Post-pandemic awareness around financial protection from unexpected medical costs has significantly increased demand for individual and family-based health insurance plans, especially among self-employed and informal sector workers

- Countries such as Egypt and Morocco are rolling out universal health coverage (UHC) frameworks, integrating both public and private insurers to reduce out-of-pocket expenses and enhance access to essential medical services

- This wave of regulatory reforms, coupled with technological innovation and a shift toward preventive care, is expected to transform the Middle East and Africa Health Insurance market landscape, fostering higher insurance penetration and sustained growth through 2032

Middle East and Africa Health Insurance Market Dynamics

Driver

Growing Demand Driven by Regulatory Reforms, Digital Expansion, and Private Sector Participation

- The Middle East and Africa health insurance market is witnessing robust growth, fueled by ongoing regulatory reforms, digital health ecosystem expansion, and increasing private sector involvement to bridge healthcare access gaps across both urban and rural populations

- In April 2024, the Saudi Central Bank (SAMA) launched a digital health insurance sandbox program to enable InsurTech firms to pilot AI-powered health coverage platforms under regulatory oversight, reflecting the region’s shift toward technology-led insurance models

- Countries such as Egypt, Kenya, and Morocco are scaling up universal health coverage (UHC) programs, integrating private insurance schemes to reduce out-of-pocket expenses and enhance accessibility to essential healthcare services for low-income populations

- Increasing penetration of mobile-based insurance platforms in Sub-Saharan Africa—driven by smartphone adoption and mobile money infrastructure—is enabling on-demand micro health insurance plans tailored for informal sector workers and gig economy participants

- U.A.E.-based insurers are partnering with digital health startups to provide teleconsultation, e-pharmacy, and chronic disease management services bundled within their health insurance plans, improving patient engagement and preventive care outcomes

- Governments in the GCC region are mandating employer-based health insurance coverage for expatriates and private sector workers, contributing to a broader risk pool and improved healthcare system sustainability

- The expansion of international insurance providers and reinsurance firms into markets such as Nigeria, South Africa, and Ghana is introducing advanced underwriting models, customizable policy options, and global best practices into local ecosystems

- Health insurance literacy campaigns, supported by public-private partnerships in countries such as Rwanda and Tanzania, are helping citizens understand coverage benefits, claims procedures, and rights under national health insurance programs

- Through 2032, the convergence of digital health innovation, supportive policy environments, and growing demand for accessible, affordable care will continue to accelerate the formalization and growth of the health insurance market in the Middle East and Africa

Restraint/Challenge

Affordability Barriers, Regulatory Fragmentation, and Infrastructure Gaps

- Despite market growth, the Middle East and Africa Health Insurance market faces challenges related to affordability, limited regulatory standardization, and underdeveloped healthcare infrastructure in low-income and rural regions

- For instance, in several Sub-Saharan African countries, over 60% of the population remains uninsured due to high premium costs and lack of employer-sponsored insurance models, limiting the scale of formal insurance adoption

- Fragmented regulatory frameworks across countries—such as differences in coverage mandates, claims handling protocols, and solvency requirements—create operational complexities for regional and multinational insurers

- In regions such as Sudan, Somalia, and parts of Central Africa, persistent political instability, weak institutional capacity, and underfunded public healthcare systems severely restrict the reach of both public and private health insurance providers

- Cultural skepticism toward insurance and a general lack of awareness about policy benefits lead to low uptake, particularly in rural communities where traditional care practices often prevail over formal healthcare systems

- Data privacy concerns, inadequate digital literacy, and poor access to reliable health records continue to hinder the implementation of digital-first insurance models, especially among older populations

- To overcome these obstacles, efforts must focus on premium subsidies for low-income groups, regulatory harmonization across regions, public-private infrastructure partnerships, and aggressive awareness campaigns to improve health insurance penetration through 2032

Middle East and Africa Health Insurance Market Scope

The market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographic, coverage type, end user, and distribution channel

- By Type

On the basis of type, the Middle East and Africa health insurance market is segmented into products and solutions. The products segment held the largest market share of 62.4% in 2024, owing to the widespread adoption of standardized insurance policy offerings such as basic health coverage, critical illness plans, and employer-based health benefits. These products are popular due to their structured benefits, ease of comparison, and regulatory compliance.

The solutions segment is expected to register the fastest CAGR of 9.8% from 2025 to 2032, driven by rising demand for customized, tech-enabled insurance services such as digital policy management, telehealth integration, AI-powered underwriting, and fraud detection platforms. These innovations are revolutionizing user experience and operational efficiency across the health insurance ecosystem.

- By Services

On the basis of services, the Middle East and Africa health insurance market is segmented into inpatient treatment, outpatient treatment, medical assistance, and others. The inpatient treatment segment led the market with the highest revenue share of 41.9% in 2024, primarily due to the increasing burden of chronic diseases and high treatment costs associated with surgeries, prolonged hospital stays, and intensive care. Health insurance plays a critical role in reducing financial strain for patients undergoing hospitalization.

The medical assistance segment is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, fueled by the growing need for 24/7 emergency response services, ambulance support, second medical opinions, and virtual health consultations, especially in remote and underserved areas.

- By Level of Coverage

On the basis of level of coverage, the Middle East and Africa health insurance market is segmented into bronze, silver, gold, and platinum. The silver segment dominated the market with a revenue share of 36.8% in 2024, as it offers a balanced combination of affordable premiums and moderate out-of-pocket expenses. It is particularly favored by middle-income families seeking adequate protection without premium overload.

The platinum segment is anticipated to grow at the fastest CAGR of 11.1% from 2025 to 2032, driven by increasing demand for premium, comprehensive plans that cover a wide range of services with minimal cost-sharing, especially among high-net-worth individuals and patients with complex medical needs.

- By Service Providers

On the basis of service providers, the Middle East and Africa health insurance market is segmented into public health insurance providers and private health insurance providers. The private health insurance providers segment held the largest market share of 69.1% in 2024, attributed to their ability to offer faster claims processing, broader hospital networks, and more tailored coverage options. Many employers and individuals prefer private insurers for their efficiency and customer-centric services.

The public health insurance providers segment is expected to grow at the fastest CAGR of 8.9% from 2025 to 2032, supported by increased government investment in national health programs, social insurance schemes, and policies aimed at expanding healthcare access to low-income and rural populations.

- By Health Insurance Plans

On the basis of health insurance plans, the Middle East and Africa health insurance market is segmented into POS, EPOS, indemnity, HSA, QSEHRAs, PPO, HMO, and others. The HMO segment led the market with the highest revenue share of 31.6% in 2024, due to its cost-effectiveness and coordinated care model that requires patients to access services through a primary care physician within a defined network. This model is attractive for both insurers and policyholders due to lower premiums and simplified management.

The HSA segment is projected to grow at the fastest CAGR of 10.9% from 2025 to 2032, as more consumers are opting for high-deductible health plans linked with tax-advantaged savings accounts, providing flexibility and control over healthcare spending.

- By Demographics

On the basis of demographics, the Middle East and Africa health insurance market is segmented into adults, minors, and senior citizens. The adults segment dominated the market with a revenue share of 54.8% in 2024, representing the largest insurable population actively seeking coverage through employers, individual plans, or government schemes. Adults are the primary decision-makers for family health coverage and contribute significantly to the insurance premium pool.

The senior citizens segment is anticipated to grow at the fastest CAGR of 12.3% from 2025 to 2032, propelled by a rising geriatric population, increased prevalence of age-related illnesses, and the need for long-term care and hospitalization benefits.

- By Coverage Type

On the basis of coverage type, the Middle East and Africa health insurance market is segmented into lifetime coverage and term coverage. The term coverage segment held the largest market share of 60.2% in 2024, driven by its affordability and popularity among younger populations and first-time policyholders looking for temporary or short-to-medium term protection.

The lifetime coverage segment is expected to grow at the fastest CAGR of 9.6% from 2025 to 2032, as consumers become increasingly aware of the importance of lifelong financial protection against health risks, especially in light of growing lifestyle-related conditions and medical inflation.

- By End User

On the basis of end user, the Middle East and Africa health insurance market is segmented into corporates, individuals, and others. The individual health insurance segment dominated the market with a revenue share of 53.1% in 2024, attributed to increasing enrollment among self-employed individuals, freelancers, and employees in the informal sector seeking comprehensive and personalized health coverage.

The individuals segment is also projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, as self-employed professionals, gig economy workers, and uninsured populations increasingly turn to personal health insurance plans facilitated by digital onboarding and simplified product offerings.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa health insurance market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others. The direct sales segment dominated the market with a revenue share of 36.5% in 2024, owing to the effectiveness of agent-based distribution networks and face-to-face interactions in building trust, explaining policy benefits, and offering customized recommendations.

The e-commerce segment is expected to grow at the fastest CAGR of 12.6% from 2025 to 2032, backed by increasing internet penetration, mobile accessibility, and the growing adoption of online platforms that allow users to compare, purchase, and manage policies in real-time.

Middle East and Africa Health Insurance Market Regional Analysis

- The Middle East and Africa health insurance market accounted for 8.4% of the global market share in 2024 and is projected to grow at a CAGR of 10.7% from 2025 to 2032, driven by rising public health awareness, increasing healthcare expenditure, and policy initiatives aimed at expanding access to quality care across diverse populations

- Governments in the region are actively implementing regulatory reforms, digitization strategies, and mandatory insurance schemes to address low insurance penetration and high out-of-pocket healthcare costs

- The market is witnessing increased participation from private insurers, InsurTech startups, and international reinsurance firms, introducing innovative digital platforms, personalized plans, and risk-based underwriting models tailored to underserved segments

Saudi Arabia Health Insurance Market Insight

The Saudi Arabia health insurance market dominated the with a 34.7% revenue share in 2024, driven by robust government-led health insurance schemes, the expansion of the private insurance sector, and mandatory coverage requirements for expatriates and private sector employees. The country’s Vision 2030 reforms are propelling large-scale investments in digital health infrastructure and insurance coverage expansion. The Cooperative Health Insurance Council (CCHI) is accelerating the adoption of standardized digital claims systems and integrated care models, while increasing transparency and compliance across providers. Rising demand for supplementary private insurance packages among high-income urban populations is further boosting market growth in cities such as Riyadh, Jeddah, and Dammam.

U.A.E. Health Insurance Market Insight

The U.A.E. health insurance market captured 22.1% of the regional market share in 2024 and is projected to be the fastest-growing country, registering a CAGR of 11.6% during 2025–2032. Growth is fueled by the country’s rising status as a medical tourism hub, widespread adoption of digital health insurance platforms, and the government’s push for universal health coverage through regulatory mandates such as the Dubai Health Insurance Law and Abu Dhabi’s Thiqa Program. The integration of telemedicine, e-pharmacy, and AI-driven health analytics is enhancing the efficiency and accessibility of health insurance services. U.A.E.-based insurers are increasingly collaborating with digital health startups to offer value-added services and personalized coverage, further attracting expatriates and international patients seeking premium care packages.

Middle East and Africa Health Insurance Market Share

The health insurance market industry is primarily led by well-established companies, including:

- Bupa (U.K.)

- Now Health International (China)

- Cigna (U.S.)

- Aetna Inc. (U.S.)

- AXA (France)

- HBF Health Limited (Australia)

- Vitality (U.K.)

- Centene Corporation (U.S.)

- International Medical Group, Inc. (U.S.)

- Anthem Insurance Companies, Inc. (U.S.)

- Broadstone Corporate Benefits Limited (U.K.)

- Allianz Care (France)

- HealthCare International Middle East and Africa Network Ltd (U.K.)

- Assicurazioni Generali S.P.A. (Italy)

- Aviva (U.K.)

- Vhi Group (Ireland)

- UnitedHealth Group (U.S.)

- MAPFRE (Spain)

- AIA Group Limited (China)

Latest Developments in Middle East and Africa Health Insurance Market

- In February 2025, Bupa Arabia launched its CareConnect platform and Bupa Pro service to revolutionize digital health insurance in Saudi Arabia. CareConnect allows users to access digital health cards, track claims, and store medical data, while Bupa Pro eliminates outpatient preapprovals for over 200,000 members through real-time API validation. These innovations aim to reduce patient wait times and improve health service accessibility across the region

- In May 2025, the WHO Foundation signed a strategic partnership with Tawuniya, one of Saudi Arabia’s leading insurers, to boost health system innovation and resilience in the Eastern Mediterranean region. The collaboration focuses on population health management, digital health acceleration, and universal health coverage, marking a milestone in regional healthcare transformation

- In April 2025, Oman’s Financial Services Authority launched Dhamani, a national health insurance digital platform aimed at automating claims, improving transparency, and streamlining insurance workflows. The initiative supports Oman’s vision to digitalize the healthcare ecosystem and expand insurance coverage to more citizens and residents

- In January 2024, AXA Egypt introduced a new product called AXA Health Advantage, offering telemedicine consultations, mental health support, and chronic disease management as part of its individual and corporate health plans. This initiative addresses the growing demand for hybrid healthcare models across the country

- In March 2024, Discovery Health South Africa announced its intention to integrate AI-powered claims processing by 2026, aiming to reduce fraud, automate decisions, and enhance client satisfaction. The initiative is part of Discovery’s broader push toward digital transformation and improved operational efficiency

- In June 2024, Medgulf Insurance in Saudi Arabia partnered with Altibbi, a leading digital health provider, to offer telehealth services bundled with insurance plans. The integration allows policyholders to access 24/7 remote consultations and electronic prescriptions via a mobile app, reflecting a major trend toward tech-enabled insurance services in the region

- In June 2021, Vitality has announced it has partnered with Samsung UK to integrate Samsung Health into the Vitality Programme, providing members with more ways to track their activity and improve their health. The new partnership with Samsung will unlock the full benefits of the Vitality Programme to Android users as members will be able to link their Samsung Health profile to their Vitality Member Zone account to automatically capture daily steps and heart rate activity to earn Vitality activity points

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.