Middle East And Africa Health Screening Market

Market Size in USD Billion

CAGR :

%

USD

7.25 Billion

USD

14.23 Billion

2025

2033

USD

7.25 Billion

USD

14.23 Billion

2025

2033

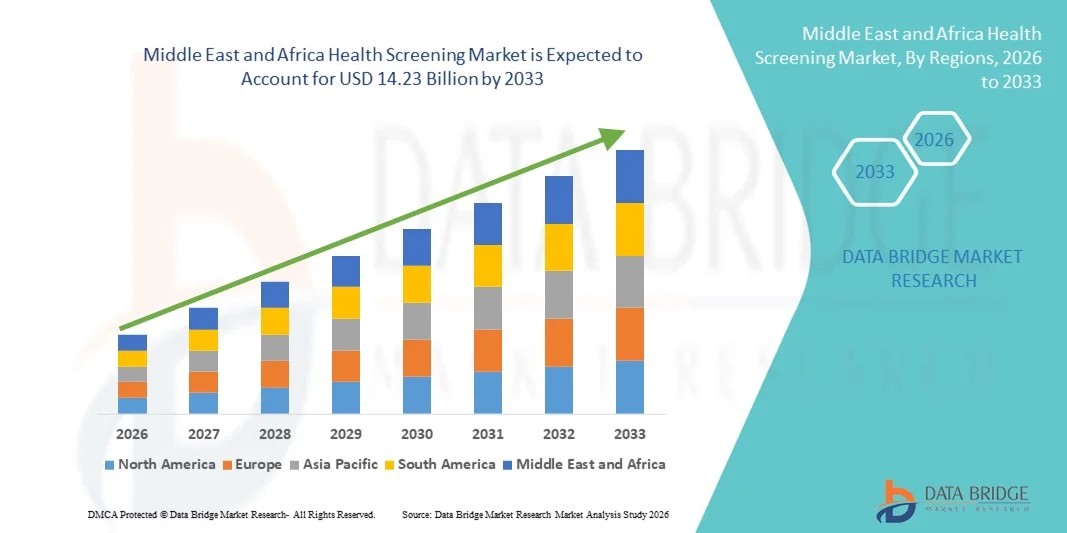

| 2026 –2033 | |

| USD 7.25 Billion | |

| USD 14.23 Billion | |

|

|

|

|

Middle East and Africa Health Screening Market Size

- The Middle East and Africa health screening market size was valued at USD 7.25 billion in 2025 and is expected to reach USD 14.23 billion by 2033, at a CAGR of 8.8% during the forecast period

- The market growth is largely fueled by increased adoption of preventive healthcare practices, expanding diagnostic infrastructure, and enhanced government initiatives to promote early disease screening in both public and private healthcare settings

- Furthermore, rising consumer demand for accessible, effective, and early disease detection solutions particularly for conditions such as cancer, diabetes, hypertension, and cardiovascular diseases is establishing health screening as a critical component of preventive medicine across the region. These converging factors are accelerating the uptake of health screening services, thereby significantly boosting overall industry growth

Middle East and Africa Health Screening Market Analysis

- Health screening services, offering early detection and preventive assessment for a range of chronic and lifestyle-related diseases, are increasingly vital components of modern healthcare systems in both public and private sectors due to their ability to reduce disease burden, improve patient outcomes, and integrate with digital health platforms

- The escalating demand for health screening is primarily fueled by rising prevalence of chronic diseases, growing health awareness among consumers, and an increasing preference for accessible, preventive healthcare solutions

- The United Arab Emirates dominated the Middle East and Africa health screening market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, government initiatives promoting preventive medicine, and high healthcare spending

- Nigeria is expected to be the fastest-growing country in the health screening market during the forecast period due to increasing healthcare access, rising urbanization, and growing adoption of mobile and community-based screening programs

- Cancer screening dominated the Middle East and Africa health screening market with a market share of 40.2% in 2025, driven by rising incidence of cancer, government awareness campaigns, and integration of advanced diagnostic technologies such as imaging and molecular tests into routine screening programs

Report Scope and Middle East and Africa Health Screening Market Segmentation

|

Attributes |

Middle East and Africa Health Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Health Screening Market Trends

Integration of Digital Health and AI-Driven Screening

- A significant and accelerating trend in the Middle East and Africa health screening market is the growing integration of artificial intelligence (AI) and digital health platforms into screening programs, enhancing accuracy, personalization, and efficiency of preventive care

- For instance, AI-enabled mammography solutions in the UAE and Saudi Arabia allow automated detection of early-stage tumors, reducing diagnostic errors and enabling faster reporting to healthcare providers. Similarly, AI-powered mobile screening apps in Nigeria and Kenya facilitate community-level outreach, helping identify high-risk individuals

- AI integration enables predictive risk assessments, pattern recognition, and tailored health recommendations, supporting early intervention. For instance, some AI-driven platforms in Qatar use patient history and lifestyle data to flag high-risk individuals for cardiovascular or cancer screenings. Furthermore, mobile and wearable health technologies provide real-time monitoring and personalized health insights to patients

- The seamless integration of digital tools with health screening programs allows centralized data management, enabling healthcare providers to monitor patient populations, track follow-ups, and optimize screening schedules efficiently across multiple facilities

- This trend towards smarter, data-driven, and interconnected screening services is reshaping patient expectations and preventive healthcare delivery. Consequently, companies and hospitals in the UAE, Saudi Arabia, and South Africa are deploying AI-assisted health screening solutions that combine imaging, molecular diagnostics, and telehealth capabilities

- The demand for health screening services that leverage AI and digital integration is rapidly growing across both urban and rural populations, as healthcare providers and governments aim to improve early detection rates and reduce disease burden

- Furthermore, partnerships between diagnostic companies and insurance providers in Saudi Arabia are enabling incentivized preventive screening programs, encouraging more individuals to participate in routine health checks

Middle East and Africa Health Screening Market Dynamics

Driver

Rising Chronic Disease Burden and Preventive Health Awareness

- The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, coupled with growing awareness of preventive healthcare, is a significant driver for the heightened demand for health screening services

- For instance, in April 2025, a private hospital chain in the UAE announced the launch of a comprehensive AI-enabled cancer and cardiovascular screening program targeting high-risk adults, integrating imaging, lab diagnostics, and mobile follow-ups. Such initiatives by key players are expected to drive the health screening market growth during the forecast period

- As patients become more aware of the benefits of early disease detection, health screening services offer advanced features such as personalized risk assessments, predictive analytics, and telehealth consultations, providing a compelling alternative to reactive healthcare

- Furthermore, government initiatives and public health campaigns promoting early detection of non-communicable diseases are increasing participation rates in routine screening programs across Middle East and African countries

- The convenience of multi-disease screening packages, mobile screening units, and digital appointment management systems are key factors propelling adoption in both urban and rural settings. The expansion of private diagnostic centers and government-supported screening programs further contributes to market growth

- For instance, corporate wellness programs in Saudi Arabia and the UAE are increasingly incorporating routine health screening, driving demand among working adults for early detection of lifestyle-related diseases

- In addition, the growing penetration of smartphones and telemedicine platforms across the region facilitates remote consultations and booking of health screenings, increasing accessibility and uptake

Restraint/Challenge

High Cost and Limited Accessibility in Rural Areas

- Concerns surrounding the high cost of advanced diagnostic and screening services, particularly for AI-driven or multi-disease packages, pose a significant challenge to broader market penetration. Patients in rural areas may have limited access to specialized facilities, restricting adoption

- For instance, limited infrastructure in rural Nigeria and Kenya reduces accessibility to comprehensive cancer and cardiovascular screening programs, delaying early detection and treatment

- Addressing these challenges through mobile health units, telemedicine integration, and government subsidies is crucial for increasing adoption. Hospitals in the UAE and South Africa are investing in cost-effective mobile diagnostic units and community outreach programs to expand coverage. In addition, some AI-powered platforms are being developed for low-cost implementation in resource-limited settings

- While affordability is gradually improving, the perceived premium for advanced screening technologies can still hinder widespread adoption, particularly among low-income populations in African countries

- Overcoming these challenges through cost optimization, increased rural healthcare infrastructure, and patient education on preventive care will be vital for sustained market growth in the region

- For instance, inconsistent regulatory policies across different countries in the region can delay the approval and deployment of advanced screening technologies, limiting availability

- Furthermore, limited trained personnel for operating high-tech diagnostic equipment in some countries restricts the scale of screening programs, particularly in rural and semi-urban areas

Middle East and Africa Health Screening Market Scope

The market is segmented on the basis of test type, package type, panel type, sample type, technology, condition, sample collection sites, and distribution channel.

- By Test Type

On the basis of test type, the health screening market is segmented into cholesterol tests, diabetes tests, cancer screening, general check-up tests, STDs, blood pressure tests, and others. The Cancer Screening segment dominated the market with the largest revenue share of 40.2% in 2025, driven by the rising incidence of cancers such as breast, colorectal, and prostate cancer across the Middle East and Africa. Cancer screening programs are heavily promoted by governments in the UAE, Saudi Arabia, and South Africa through national health initiatives and awareness campaigns. Hospitals and diagnostic laboratories increasingly deploy advanced imaging and molecular testing for early detection, contributing to higher adoption. Consumers prefer cancer screening due to the life-saving potential of early diagnosis and the availability of multi-disease screening packages. The segment’s dominance is also fueled by the growing integration of AI and digital platforms for precise, automated reporting. In addition, public-private partnerships are expanding outreach programs, particularly for high-risk populations, enhancing market penetration.

The Diabetes Test segment is expected to witness the fastest growth rate of 12.5% CAGR from 2026 to 2033, due to rising prevalence of diabetes in countries such as Egypt, Saudi Arabia, and Nigeria. Increased awareness of lifestyle diseases, coupled with government-funded diabetes screening initiatives, is driving demand. The adoption of home-based glucose monitoring kits and mobile health solutions enables wider coverage. Corporates and insurance providers are incentivizing regular screening, further accelerating uptake. Technological improvements in rapid testing and continuous glucose monitoring also contribute to growth. The urban population’s increasing focus on preventive care is a key factor behind the segment’s strong expansion.

- By Package Type

On the basis of package type, the market is segmented into basic health screening, senior citizen profile, women health check, men health check, heart check, diabetes check, and others. The Women Health Check segment dominated the market with a share of 29.8% in 2025, driven by rising awareness of gender-specific health issues such as breast and cervical cancer. Hospitals and diagnostic chains in the UAE, Qatar, and South Africa are offering comprehensive women-focused screening packages. These packages often include multiple tests such as mammography, hormonal assessment, and general health check-ups. The dominance is further supported by government initiatives encouraging routine women’s health screenings. Private healthcare providers leverage AI and imaging technologies to provide accurate diagnostics efficiently. Regular preventive screening among working women and urban populations reinforces the segment’s strong market presence.

The Senior Citizen Profile segment is expected to witness the fastest CAGR of 13% from 2026 to 2033, fueled by the rapidly aging population in Saudi Arabia, UAE, and Egypt. Packages targeting the elderly combine cardiovascular, diabetes, cancer, and metabolic disorder screening in a single offering. The rising prevalence of chronic diseases among seniors creates demand for multi-test packages. Healthcare providers are deploying mobile screening units and home visits to improve accessibility. Insurance providers are also promoting senior wellness packages, enhancing adoption. Digital health tools and AI-assisted risk profiling make these packages highly efficient and scalable.

- By Panel Type

On the basis of panel type, the market is segmented into multi-test panels and single-test panels. The Multi-Test Panels segment dominated the market with the largest share of 57% in 2025, driven by the demand for comprehensive diagnostic solutions that allow simultaneous testing for multiple conditions. Hospitals, corporate wellness programs, and government initiatives prefer multi-test panels for efficient screening of high-risk populations. These panels provide cost-effectiveness, faster reporting, and improved patient convenience. The growing adoption of AI-based interpretation tools enhances accuracy and reduces manual effort. Multi-test panels also appeal to urban populations seeking preventive healthcare convenience. Public-private collaborations and mobile screening initiatives further strengthen adoption across Middle East and African countries.

The Single-Test Panels segment is expected to witness the fastest growth at a CAGR of 11% from 2026 to 2033, as rising demand for targeted diagnostics and home-based testing grows. Single-test panels are easier to administer in rural or resource-limited settings. Patients prefer them for specific conditions such as diabetes or cholesterol monitoring. Technological advancements in rapid testing kits improve accuracy and reliability. Insurance coverage for single-condition tests also boosts uptake. Increasing awareness about early detection of high-risk diseases contributes to strong adoption.

- By Sample Type

On the basis of sample type, the market is segmented into blood, urine, serum, saliva, and others. The Blood segment dominated the market with the largest share of 62% in 2025, driven by its applicability across nearly all diagnostic and preventive tests including cancer markers, cholesterol, and diabetes. Hospitals and diagnostic labs in Saudi Arabia, UAE, and South Africa rely on blood samples for high-accuracy results. The dominance is also supported by advancements in automated blood analyzers and AI-assisted diagnostics. Blood-based testing allows multi-test panels to be conducted efficiently, increasing throughput. Urban hospitals and private diagnostic chains increasingly standardize blood collection for routine health checks. Blood sample-based testing is preferred due to its reliability, widespread availability, and compatibility with advanced diagnostic technologies.

The Urine segment is expected to witness the fastest growth rate of 12% CAGR from 2026 to 2033, driven by the rise in diabetes monitoring, kidney function tests, and STDs screening. Home-based urine test kits and mobile diagnostics facilitate remote sample collection. Adoption is increasing in African countries with limited healthcare infrastructure. Rapid point-of-care testing technologies reduce turnaround time, making urine testing popular in rural and semi-urban areas. Awareness campaigns highlighting non-invasive testing benefits further drive growth. Insurance incentives for routine kidney and metabolic screenings also boost adoption.

- By Technology

On the basis of technology, the market is segmented into Immunoassays, Medical Imaging, QPCR (Quantitative Polymerase Chain Reaction), Q-FISH (Quantitative Fluorescence in Situ Hybridization), TRF (Terminal Restriction Fragment), STELA (Single Telomere Length Analysis), and Others. The Medical Imaging segment dominated the market with the largest share of 38% in 2025, driven by widespread use in cancer, cardiovascular, and neurological screening programs. Hospitals in the UAE, Saudi Arabia, and South Africa rely on imaging technologies such as MRI, CT scans, and mammography for accurate early detection. Medical imaging allows visualization of internal structures, making it critical for high-risk patients and multi-disease panels. Advanced imaging combined with AI-assisted diagnostics improves accuracy and reduces manual interpretation errors. Government-backed national cancer screening programs further enhance adoption. Patients increasingly prefer imaging-based tests due to non-invasive procedures and rapid results.

The QPCR segment is expected to witness the fastest growth at a CAGR of 14% from 2026 to 2033, fueled by the rising need for molecular-level disease detection and viral screening such as COVID-19, Hepatitis-C, and genetic disorders. Laboratories in South Africa, Nigeria, and UAE are rapidly adopting QPCR due to its high sensitivity and rapid results. Home-collection kits combined with QPCR-based testing facilitate wider accessibility. AI-based automation in QPCR testing improves throughput and reliability. Rising demand for early detection and personalized medicine drives adoption. Insurance and government programs incentivizing molecular diagnostics further contribute to growth.

- By Condition

On the basis of condition, the market is segmented into cardiovascular disease, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, hepatitis-c complications, immunology-related conditions, and others. The Cancer segment dominated the market with a revenue share of 40.2% in 2025, driven by rising cancer incidence in UAE, Saudi Arabia, South Africa, and Egypt. Early detection programs and multi-test screening packages are widely promoted through public health campaigns. Hospitals and private diagnostic chains leverage advanced imaging and molecular testing for precise diagnosis. Patients prioritize cancer screening due to the high survival benefit associated with early detection. Government partnerships with private providers expand outreach to urban and high-risk rural populations. AI-assisted diagnostics improve efficiency, reduce errors, and enhance reporting speed, reinforcing dominance.

The Cardiovascular Disease segment is expected to witness the fastest growth at a CAGR of 13% from 2026 to 2033, fueled by the rising prevalence of hypertension, heart attacks, and stroke across the region. Multi-test panels targeting cardiac risk factors, including cholesterol, blood pressure, and ECG, are increasingly adopted. Awareness campaigns and workplace health programs encourage routine cardiovascular checks. Advanced diagnostics such as imaging and biomarkers improve early detection. Mobile health screening units expand coverage in remote areas. Insurance-backed preventive packages further accelerate adoption among high-risk populations.

- By Sample Collection Sites

On the basis of sample collection sites, the market is segmented into hospital, homes, diagnostic laboratories, offices, and others. The Hospital segment dominated the market with a share of 52% in 2025, driven by the availability of advanced diagnostic equipment, trained staff, and multi-test capabilities in healthcare facilities across UAE, Saudi Arabia, and South Africa. Hospitals are preferred for comprehensive screening packages covering cancer, cardiovascular, and metabolic disorders. Public-private partnerships often centralize sample collection in hospitals for efficiency. AI-assisted diagnostics and digital platforms allow quick result processing and follow-up scheduling. Patients perceive hospital-based screening as more reliable and trustworthy. Government and corporate health programs further strengthen hospital-based testing dominance.

The Homes segment is expected to witness the fastest growth at a CAGR of 15% from 2026 to 2033, fueled by the rise of home-based sample collection kits for diabetes, cholesterol, and STDs. Telemedicine platforms facilitate online booking, delivery of kits, and remote consultations. Home-based testing improves accessibility in rural and semi-urban areas. AI-enabled reporting and mobile health apps enhance convenience and compliance. Growing awareness of preventive care and avoidance of hospital visits post-COVID-19 pandemic increases adoption. Insurance and corporate wellness initiatives supporting home testing further drive growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. The Direct Tenders segment dominated the market with the largest revenue share of 48% in 2025, driven by government procurement for national health screening programs and corporate wellness initiatives. Governments in UAE, Saudi Arabia, and South Africa often use tenders to supply hospitals and diagnostic chains with multi-test kits and advanced screening equipment. Direct tender agreements ensure standardized quality and bulk distribution efficiency. Public health initiatives for cancer, diabetes, and cardiovascular diseases rely heavily on tender-based procurement. Hospitals and diagnostic laboratories prefer this channel for reliable sourcing. Strategic partnerships with suppliers further strengthen market penetration.

The Retail Sales segment is expected to witness the fastest growth at a CAGR of 14% from 2026 to 2033, fueled by rising demand for home-based testing kits and over-the-counter diagnostic tools. Pharmacies, e-commerce platforms, and health tech startups are expanding access to cholesterol, diabetes, and STDs test kits. Consumer preference for convenience, privacy, and self-monitoring drives retail adoption. Rapid advancements in portable testing technologies enhance reliability and ease of use. Corporate wellness programs and insurance partnerships supporting retail-based testing further accelerate growth.

Middle East and Africa Health Screening Market Regional Analysis

- The United Arab Emirates dominated the Middle East and Africa health screening market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, government initiatives promoting preventive medicine, and high healthcare spending

- Consumers in the UAE and Saudi Arabia highly value the convenience, accuracy, and comprehensive coverage offered by health screening programs, including multi-disease packages, AI-assisted diagnostics, and cancer screening, which enable early detection and timely treatment

- This widespread adoption is further supported by rising health awareness, growing prevalence of chronic diseases, expanding private diagnostic networks, and government-backed national health programs, establishing health screening as a preferred solution for both urban and high-risk populations across the region

The UAE Health Screening Market Insight

The UAE health screening market captured the largest revenue share of 28.5% in 2025, fueled by the government’s proactive preventive healthcare initiatives and the widespread availability of advanced diagnostic infrastructure. Consumers are increasingly prioritizing early detection of chronic and lifestyle-related diseases such as cancer, diabetes, and cardiovascular conditions. The growing preference for multi-disease packages, AI-assisted diagnostics, and home-visit screening services further propels the market. Moreover, the integration of digital health platforms and telemedicine is significantly contributing to market expansion, enhancing accessibility and efficiency across both urban and high-risk populations.

Saudi Arabia Health Screening Market Insight

The Saudi Arabia health screening market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of non-communicable diseases and government-backed national screening programs. The increase in urbanization, coupled with the demand for early detection services, is fostering the adoption of routine and specialized screening tests. Consumers are also drawn to the convenience and comprehensiveness offered by private diagnostic chains. The region is experiencing significant growth across hospital, clinic, and corporate wellness applications, with health screening services being incorporated into both public initiatives and private healthcare offerings.

South Africa Health Screening Market Insight

The South Africa health screening market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of lifestyle-related diseases and growing awareness of preventive care. In addition, concerns regarding chronic conditions such as diabetes and hypertension are encouraging both individuals and organizations to adopt regular health check-ups. South Africa’s advanced diagnostic infrastructure, combined with expanding telehealth and digital platforms, is expected to continue to stimulate market growth.

Nigeria Health Screening Market Insight

The Nigeria health screening market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare access, rising urbanization, and the adoption of mobile and community-based screening programs. Nigeria’s growing private healthcare sector and investments in preventive care promote market adoption, particularly for multi-test panels and rapid diagnostic services. Integration of AI-assisted diagnostics and telemedicine platforms is improving outreach and efficiency. Public awareness campaigns on early detection of cancer, cardiovascular, and metabolic disorders further enhance market growth.

Middle East and Africa Health Screening Market Share

The Middle East and Africa Health Screening industry is primarily led by well-established companies, including:

- IQVIA Inc (U.S.)

- Vezeeta (United Arab Emirates)

- Med‑e‑Screen (South Africa)

- Abbott (U.S.)

- F. Hoffmann‑La Roche Ltd (Switzerland)

- Danaher (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc (U.S.)

- QIAGEN (Germany)

- Bio‑Rad Laboratories, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- BioMérieux (France)

- Ortho Clinical Diagnostics (U.S.)

- Nova Biomedical (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- H.U Group Holdings, Inc. (U.S.)

- LabPLUS Laboratories (South Africa)

- BioReference Laboratories (U.S.)

- Cerba Healthcare (France)

- Trinity Biotech (Ireland)

What are the Recent Developments in Middle East and Africa Health Screening Market?

- In January 2026, UAE federal health authorities announced plans to expand mandatory early cancer screening nationwide by tying preventive tests to health insurance requirements. This initiative aimed at improving early detection of breast, colorectal, cervical, lung cancer, and other chronic diseases is expected to standardize screening participation and enhance disease prevention outcomes across the country. The programme builds on successful regional models such as Abu Dhabi’s ‘Ifhas’ preventive screening scheme

- In October 2025, Fujifilm announced plans to open its first NURA health screening center in Africa, located in Cape Town, South Africa, with a companion center in Dubai. Designed to offer comprehensive cancer screening and lifestyle disease testing using advanced imaging and AI‑based systems, this expansion reflects increasing private sector investment in accessible preventive health services across the Middle East and Africa

- In May 2025, the Abu Dhabi Public Health Centre (ADPHC) and the Authority of Social Contribution Ma’an launched a free health screenings initiative offering early detection for cancer, diabetes, and heart disease for basic health insurance holders. The programme includes screenings for cervical, breast, and colorectal cancers, as well as risk assessments for type 2 diabetes and cardiovascular disease, highlighting strong public‑private collaboration to widen preventive care access

- In March 2025, Qatar’s Primary Health Care Corporation (PHCC) launched a national bowel cancer awareness campaign under its Screen for Life Program to boost early detection participation. The campaign offers free Fecal Immunochemical Tests (FIT) and educational outreach across multiple health centers, reinforcing Qatar’s continued efforts to expand population‑based cancer screening and community health engagement

- In January 2025, Emirates Health Services (EHS) launched an AI-powered breast cancer screening programme in the UAE targeting school teachers, marking one of the first region‑focused implementations of advanced screening technology. The initiative was unveiled at Arab Health 2025 in Dubai, offering portable, highly accurate AI‑assisted mammography to improve early detection and accessibility among women in educational sectors

- https://www.khaleejtimes.com/uae/uae-moves-towards-nationwide-mandatory-early-cancer-screening-says-minister

- https://gulfnews.com/uae/health/arab-health-2025-ai-powered-breast-cancer-screening-launched-for-teachers-in-uae-1.500023476

- https://www.fujifilm.com/py/en/news/hq/12811?u

- https://cairoscene.com/Buzz/Free-Health-Screenings-Initiative-Launched-in-Abu-Dhabi?ut

- https://thepeninsulaqatar.com/article/03/03/2025/phcc-launches-national-bowel-cancer-awareness-campaign-to-encourage-early-detection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.