Middle East And Africa Healthcare 3d Printing Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

5.01 Billion

2025

2033

USD

1.53 Billion

USD

5.01 Billion

2025

2033

| 2026 –2033 | |

| USD 1.53 Billion | |

| USD 5.01 Billion | |

|

|

|

|

Middle East and Africa Healthcare 3D Printing Market Size

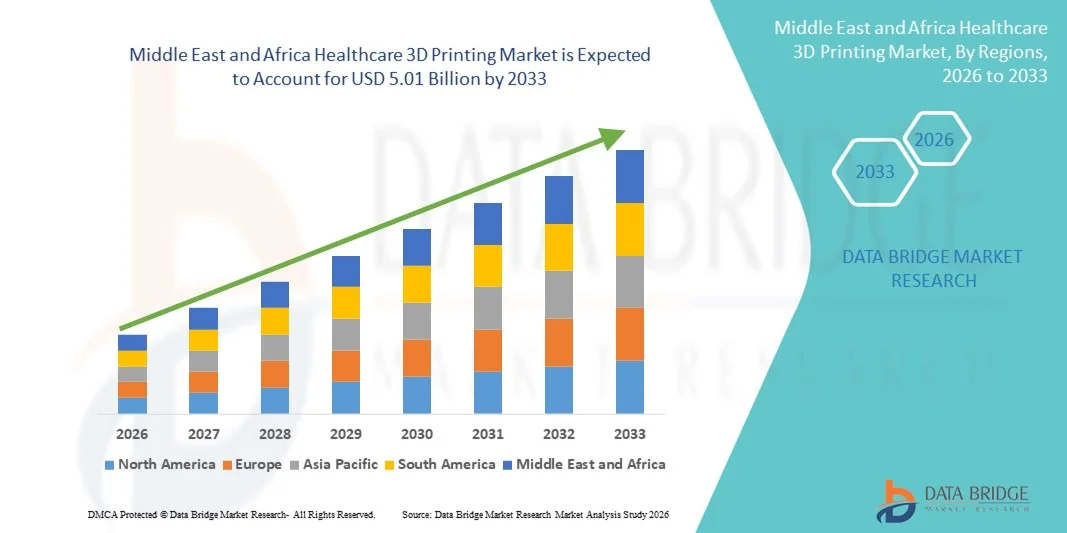

- The Middle East and Africa healthcare 3D printing market size was valued at USD 1.53 billion in 2025 and is expected to reach USD 5.01 billion by 2033, at a CAGR of 16.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced additive manufacturing technologies in healthcare, enabling the production of patient-specific implants, prosthetics, surgical guides, and anatomical models. Rapid technological progress in 3D printing materials, software, and printing techniques is driving greater precision, customization, and efficiency across clinical and research applications

- Furthermore, rising demand from healthcare providers for cost-effective, time-efficient, and personalized medical solutions is establishing healthcare 3D printing as a transformative approach in modern medical practice. These converging factors are accelerating the uptake of Healthcare 3D Printing solutions, thereby significantly boosting overall market growth

Middle East and Africa Healthcare 3D Printing Market Analysis

- Healthcare 3D Printing, which enables the fabrication of patient-specific implants, prosthetics, surgical guides, and anatomical models, is becoming an integral part of modern healthcare delivery due to its ability to enhance treatment precision, reduce procedure time, and improve patient outcomes. Its growing application across hospitals, research institutions, and medical device manufacturing is significantly transforming clinical workflows

- The rising demand for personalized medicine, increasing adoption of advanced additive manufacturing technologies, and continuous innovations in biocompatible materials are the primary factors driving the Healthcare 3D Printing market. These advancements support cost efficiency, faster production cycles, and improved clinical accuracy, thereby accelerating market adoption

- Saudi Arabia dominated the healthcare 3D printing market with the largest revenue share of 34.7% in 2025. This dominance is supported by significant government investments under Vision 2030, rapid modernization of healthcare infrastructure, growing adoption of advanced medical technologies, and increasing use of 3D printing for implants, prosthetics, and surgical planning in major hospitals and research centers

- The U.A.E. is expected to be the fastest-growing region in the healthcare 3D printing market during the forecast period, with a projected CAGR of 22.4%. Growth is driven by strong healthcare spending, government-backed innovation initiatives, expanding medical tourism, rising adoption of precision medicine, and increasing collaboration between hospitals, research institutes, and technology providers

- The standalone segment dominated the market with the largest revenue share of 55.4% in 2024, driven by its high flexibility, ease of deployment, and compatibility with various hospital workflows. Standalone systems are preferred by medical facilities due to their lower cost of ownership, minimal setup requirements, and ability to be used across multiple departments

Report Scope and Healthcare 3D Printing Market Segmentation

|

Attributes |

Healthcare 3D Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Healthcare 3D Printing Market Trends

Accelerated Adoption of Patient-Specific and Point-of-Care 3D Printing Solutions

- A significant and accelerating trend in the Middle East and Africa Healthcare 3D Printing market is the growing adoption of patient-specific, customized medical devices and point-of-care 3D printing within hospitals and academic medical centers. Healthcare providers across the region are increasingly leveraging 3D printing to produce anatomical models, surgical guides, prosthetics, and implants tailored to individual patient anatomy, improving surgical precision and clinical outcomes

- For instance, in June 2023, King Faisal Specialist Hospital & Research Centre (Saudi Arabia) expanded its in-house medical 3D printing laboratory to support personalized surgical planning and implant prototyping, enabling surgeons to practice complex procedures using patient-specific anatomical models prior to surgery. Similar initiatives have been observed in the UAE, where academic hospitals have incorporated 3D-printed anatomical models for orthopedic and cardiovascular interventions

- The increasing availability of advanced biocompatible materials and medical-grade polymers is further strengthening this trend, allowing healthcare facilities to move beyond prototyping toward functional applications such as customized implants, dental restorations, and hearing aids. These innovations are particularly valuable in regions facing high trauma incidence and congenital disorders, where customized solutions can significantly improve patient outcomes

- In addition, collaborations between hospitals, universities, and technology providers are supporting the localization of medical 3D printing capabilities. Training programs and innovation hubs are being established to build regional expertise, reducing reliance on imported medical devices and shortening lead times for critical surgical components

- This shift toward decentralized, hospital-based 3D printing is transforming healthcare delivery in the region by enabling faster treatment decisions, reducing surgical risks, and supporting personalized medicine approaches. As a result, healthcare providers across the Middle East and Africa are increasingly viewing 3D printing as a strategic clinical tool rather than a purely experimental technology

- The growing emphasis on customized care, surgical accuracy, and cost-effective production of medical components is expected to further accelerate the adoption of healthcare 3D printing solutions across both public and private healthcare institutions in the region

Middle East and Africa Healthcare 3D Printing Market Dynamics

Driver

Rising Burden of Chronic Diseases, Trauma Cases, and Surgical Demand

- The rising prevalence of chronic diseases, road traffic accidents, and complex surgical cases across the Middle East and Africa is a major driver for the adoption of healthcare 3D printing solutions. Increasing incidences of cardiovascular diseases, orthopedic conditions, and dental disorders are driving demand for customized implants, prosthetics, and surgical planning tools that can improve treatment accuracy and patient recover

- For instance, in September 2022, Dubai Health Authority reported the expanded use of 3D-printed anatomical models in complex orthopedic and spinal surgeries within government hospitals, supporting surgeons in preoperative planning and reducing intraoperative risks. Such initiatives highlight how healthcare systems are integrating 3D printing to manage rising surgical volumes more efficiently

- Healthcare providers are increasingly recognizing the value of 3D printing in reducing operating room time, minimizing surgical errors, and improving procedural outcomes. Customized surgical guides and patient-specific implants help clinicians achieve better alignment and fit, which is particularly important in trauma and reconstructive surgeries

- Furthermore, growing investments in healthcare infrastructure and modernization initiatives across Gulf Cooperation Council (GCC) countries are encouraging the adoption of advanced manufacturing technologies, including medical 3D printing. Government-backed healthcare transformation programs are supporting innovation and digitalization in clinical workflows

- The ability of 3D printing to reduce dependency on imported medical devices, lower long-term costs, and support rapid prototyping is further strengthening its appeal among hospitals and specialty clinics. As surgical demand continues to rise, healthcare 3D printing is becoming a key enabler of efficient and high-quality patient care

- These factors collectively position healthcare 3D printing as a critical solution to address growing clinical demands, thereby driving sustained market growth across the Middle East and Africa

Restraint/Challenge

High Capital Investment, Regulatory Complexity, and Limited Skilled Workforce

- High initial capital investment associated with medical-grade 3D printers, certified materials, and post-processing equipment remains a significant challenge to widespread adoption, particularly in resource-constrained healthcare systems across parts of Africa. Smaller hospitals and clinics often face budget limitations that restrict investment in advanced 3D printing infrastructure

- For instance, in November 2021, several public hospitals in Sub-Saharan Africa highlighted budgetary constraints and regulatory uncertainties as barriers to adopting in-house medical 3D printing, despite recognizing its clinical benefits, reflecting the uneven pace of adoption across the region

- In addition to cost barriers, the lack of harmonized regulatory frameworks for 3D-printed medical devices poses challenges for commercialization and clinical use. Regulatory approval processes for patient-specific implants and surgical guides can be complex and time-consuming, discouraging rapid adoption by healthcare providers

- The limited availability of skilled professionals trained in medical design software, additive manufacturing processes, and clinical validation further restricts market growth. Many healthcare facilities rely on external service providers due to the shortage of in-house expertise, which can increase operational costs and turnaround times

- Concerns related to quality assurance, material standardization, and long-term performance of 3D-printed medical products also contribute to cautious adoption among clinicians and hospital administrators. Ensuring consistent product quality and compliance with international medical standards remains a critical requirement

- Addressing these challenges through targeted investments, workforce training programs, clearer regulatory guidelines, and cost-effective technology solutions will be essential for unlocking the full potential of healthcare 3D printing across the Middle East and Africa

Middle East and Africa Healthcare 3D Printing Market Scope

The market is segmented on the basis of modality, components, technology, application, medical specialty, and end user.

- By Modality

On the basis of modality, the Healthcare 3D Printing market is segmented into standalone and integrated. The standalone segment dominated the market with the largest revenue share of 55.4% in 2024, driven by its high flexibility, ease of deployment, and compatibility with various hospital workflows. Standalone systems are preferred by medical facilities due to their lower cost of ownership, minimal setup requirements, and ability to be used across multiple departments. The segment also benefits from rising adoption in small and medium-sized hospitals and dental clinics that prefer dedicated 3D printers for specific applications such as prosthetics and dental models. In addition, standalone systems often provide better customization options for specific medical specialties, making them ideal for orthopedic and dental applications. Strong demand for rapid prototyping and patient-specific solutions further supports the dominance of standalone systems in the market.

The integrated segment is expected to register the fastest CAGR of 18.2% from 2025 to 2032, owing to growing demand for end-to-end printing solutions that combine hardware, software, and workflow integration. Integrated systems provide enhanced automation, reduced manual intervention, and improved accuracy, making them suitable for high-volume hospital environments. The increasing adoption of integrated systems is also driven by the need for standardized workflows, regulatory compliance, and improved traceability in medical device manufacturing. As healthcare providers move toward digitalization, integrated solutions are gaining traction for streamlined operations and reduced time-to-treatment. Rising investments in hospital infrastructure and digital transformation initiatives are expected to accelerate growth in this segment during the forecast period.

- By Components

On the basis of components, the Healthcare 3D Printing market is segmented into material, hardware, software, and services. The material segment dominated the market with the largest revenue share of 39.7% in 2024, driven by increasing demand for biocompatible materials and customized medical-grade polymers. Materials such as medical-grade resins, metals, and ceramics are widely used for implants, prosthetics, surgical guides, and dental applications. Rising R&D activities in material science and increasing approval of new biomaterials by regulatory authorities further strengthen this segment. Additionally, the need for patient-specific implants and personalized medicine is driving material consumption across healthcare settings. Growing demand for high-performance materials that ensure safety, durability, and precision is also supporting market dominance.

The services segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, driven by increasing outsourcing of 3D printing services by hospitals and clinics. Service providers offer end-to-end solutions including design, printing, post-processing, and quality validation. Many healthcare providers prefer outsourcing due to high capital investment and technical expertise required for in-house printing. Rising demand for rapid prototyping, patient-specific implants, and surgical planning models is fueling growth in service-based offerings. In addition, the growing adoption of centralized printing hubs and shared services models is expected to boost the services segment during the forecast period.

- By Technology

On the basis of technology, the Healthcare 3D Printing market is segmented into bioprinting, droplet deposition/extrusion-based technologies, photopolymerization, laser beam melting, electron beam melting (EBM), 3DP/adhesion bonding/binder jetting, and others. The droplet deposition/extrusion-based technology segment dominated the market with the largest revenue share of 31.8% in 2024, driven by its wide use in creating surgical models, dental prosthetics, and orthopedic implants. This technology offers high accuracy, cost-efficiency, and compatibility with a wide range of biomaterials, which supports its adoption across hospitals and dental clinics. The segment also benefits from continuous innovation and development of multi-material printing capabilities.

The bioprinting segment is expected to register the fastest CAGR of 21.1% from 2025 to 2032, driven by growing R&D in tissue engineering, regenerative medicine, and organ-on-chip applications. Bioprinting enables the fabrication of complex tissues and organs using living cells and biomaterials, making it a key technology for future medical breakthroughs. Increasing funding for bioprinting research, rising collaborations between academic institutions and biotech companies, and growing demand for personalized medicine are accelerating market growth.

- By Application

On the basis of application, the Healthcare 3D Printing market is segmented into medical, surgical, pharmaceutical, and others. The medical segment dominated the market with the largest revenue share of 42.5% in 2024, supported by high demand for patient-specific implants, anatomical models, and prosthetics. 3D printing is widely used in orthopedics and dentistry to produce customized implants and surgical guides. Rising prevalence of chronic diseases and increasing need for personalized healthcare solutions further drive adoption. The segment also benefits from regulatory approvals for medical-grade printing materials and devices. Continuous innovation in biocompatible materials and improved printing accuracy further strengthen its leadership. Medical applications also receive strong investments from hospitals and healthcare systems to improve patient outcomes. The growing demand for rapid prototyping in medical research is also boosting this segment. As healthcare providers increasingly focus on precision medicine, the medical segment is expected to retain dominance in the near future.

The surgical segment is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, driven by rising use of 3D printed surgical guides, pre-operative planning models, and custom implants. Surgeons increasingly rely on 3D printed models to improve surgical accuracy, reduce operation time, and enhance patient outcomes. Growing adoption in complex surgeries such as spinal, craniofacial, and orthopedic procedures is supporting this growth. The segment benefits from advancements in multi-material printing and better imaging-to-print workflows. Increasing use of patient-specific implants and surgical planning tools further accelerates adoption. Collaboration between hospitals and 3D printing solution providers is strengthening market expansion. Rising investments in healthcare infrastructure in emerging markets also contribute to faster growth. The growing trend of minimally invasive surgeries is also boosting the need for 3D printed surgical models.

- By Medical Specialty

On the basis of medical specialty, the Healthcare 3D Printing market is segmented into orthopedics, dental, cardiovascular, craniomaxillofacial (CMF), neurosurgery, oncology, and others. The dental segment dominated the market with the largest revenue share of 37.9% in 2024, driven by widespread use of 3D printing in dental implants, aligners, crowns, and bridges. Dental clinics and labs are adopting 3D printing due to its precision, cost-efficiency, and fast turnaround time. The availability of advanced dental materials and increasing demand for customized dental solutions further support market dominance. The segment also benefits from increasing patient awareness and rising demand for cosmetic dentistry. Rapidly evolving dental CAD/CAM systems and scanners are further boosting adoption. Dental 3D printing reduces production time and improves treatment accuracy, making it a preferred choice for dentists.

The orthopedics segment is expected to register the fastest CAGR of 18.9% from 2025 to 2032, driven by increasing use of 3D printed implants, prosthetics, and surgical models. Orthopedic applications require highly customized and patient-specific devices, which is driving adoption of 3D printing technology. Growing incidence of bone disorders and trauma cases, along with rising demand for personalized implants, is expected to boost segment growth. Innovations in metal 3D printing and biocompatible polymers are also supporting this trend. Rising geriatric population and increased orthopedic surgeries are further increasing demand. Hospitals are investing heavily in 3D printed surgical models for better treatment outcomes. The growing adoption of 3D printed joint implants is also strengthening the segment’s growth.

- By End User

On the basis of end user, the Healthcare 3D Printing market is segmented into medical & surgical centers, research centers and academic institutions, pharmaceutical & biotechnology companies, and others. The medical & surgical centers segment dominated the market with the largest revenue share of 45.2% in 2024, driven by high adoption of 3D printing for surgical planning, patient-specific implants, and prosthetics. Hospitals and surgical centers increasingly use 3D printing to reduce operation time, improve patient outcomes, and enhance preoperative planning. The presence of advanced healthcare infrastructure and increasing investments in digital health are further supporting this segment. Increasing number of hospital-based 3D printing labs and partnerships with technology providers is strengthening market dominance.

The research centers and academic institutions segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by growing research in bioprinting, regenerative medicine, and medical device innovation. Academic institutions and research labs are investing in 3D printing technologies for experimental studies, prototyping, and tissue engineering. Increasing collaborations between universities and biotech companies are accelerating innovation and driving market growth. The segment also benefits from government grants and funding for advanced research. Rising interest in personalized medicine and tissue engineering is further boosting adoption. Research centers are focusing on developing new biomaterials and printing methods to improve clinical applications.

Middle East and Africa Healthcare 3D Printing Market Regional Analysis

- The Europe healthcare 3D printing market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing demand for personalized medical devices and rising adoption of advanced healthcare technologies. The region benefits from strong healthcare infrastructure, high R&D spending, and supportive regulatory frameworks for medical device innovation. European hospitals and clinics are increasingly adopting 3D printing for implants, surgical planning models, and prosthetics

- Rising geriatric population and chronic disease prevalence are further supporting demand for customized healthcare solutions. Continuous advancements in biocompatible materials and printing technologies also contribute to market growth

- Key European countries such as Germany, the U.K., France, and Italy are investing heavily in 3D printing research and clinical applications. Collaboration between healthcare providers and technology companies is accelerating product development and commercialization. The presence of leading medical device manufacturers in Europe further strengthens market expansion

U.K. Healthcare 3D Printing Market Insight

The U.K. healthcare 3D printing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of 3D printing in clinical and surgical applications. The U.K. has strong medical research capabilities and a well-established healthcare system, supporting innovation in 3D printing for implants, prosthetics, and surgical models. Rising demand for patient-specific solutions and growing investments in healthcare digitalization further accelerate growth. The U.K. also benefits from strong collaboration between academic institutions, hospitals, and technology providers. Increasing focus on reducing surgical time and improving patient outcomes is encouraging the use of 3D printed models for preoperative planning.

Germany Healthcare 3D Printing Market Insight

The Germany healthcare 3D printing market is expected to expand at a considerable CAGR during the forecast period, driven by rising demand for advanced medical devices and increasing adoption of 3D printing in hospitals and research centers. Germany’s well-developed healthcare infrastructure, strong manufacturing base, and high investment in medical technology support market growth. The country is witnessing rising use of 3D printing in orthopedic implants, dental applications, and surgical models. The emphasis on innovation and quality standards also encourages adoption of medical-grade 3D printing materials. Increasing healthcare spending and the growing need for customized healthcare solutions further drive demand. Germany’s strong focus on sustainability and precision manufacturing also supports the use of 3D printing technology.

Middle East and Africa Healthcare 3D Printing Market Share

The Healthcare 3D Printing industry is primarily led by well-established companies, including:

• GE HealthCare (U.S.)

• Renishaw (U.K.)

• EnvisionTEC (Germany)

• EOS GmbH (Germany)

• Stryker (U.S.)

• Zimmer Biomet (U.S.)

• Johnson & Johnson (U.S.)

• HP Inc. (U.S.)

• Carbon, Inc. (U.S.)

• Formlabs (U.S.)

• CELLINK (Sweden)

• Organovo (U.S.)

• Bio3D Technologies (Japan)

• Aspect Biosystems (Canada)

• Nano Dimension (Israel)

• Prodways Group (France)

• Ultimaker (Netherlands)

Latest Developments in Middle East and Africa Healthcare 3D Printing Market

- In March 2021, Stratasys Ltd. partnered with Canwell Medical to introduce the J5 DentaJet 3D PolyJet printer for dental laboratories, enabling high-precision, multi-material 3D printing of dental parts such as crowns, bridges, and surgical guides. This development helped accelerate the use of 3D printing technology for customized dental and minor surgical applications, supporting broader adoption of 3D printing in clinical workflows

- In June 2024, Stratasys announced the launch of the J5 Digital Anatomy 3D printer at the RAPID + TCT conference, designed to produce highly accurate anatomical models for surgical planning and clinical education, thereby improving preoperative visualization and enhancing clinician decision-making

- In June 2025, 3D Systems and French MedTech partner TISSIUM received FDA De Novo authorization for COAPTIUM CONNECT with TISSIUM Light, a first-of-its-kind 3D-printed bioabsorbable solution for peripheral nerve repair. This regulatory milestone underscores the potential of additive manufacturing for advanced regenerative medical applications and personalized implants

- In April 2025, 3D Systems collaborated with University Hospital Basel to produce the first MDR-compliant 3D-printed PEEK facial implant at the point of care using its EXT 220 MED system, enabling on-site manufacturing of customized maxillofacial implants that meet stringent European medical device regulations

- In February 2025, Stratasys Direct’s Tucson, Arizona facility received ISO 13485 certification, a key quality management standard for medical device manufacturing that supports broader clinical adoption and scalable production of 3D-printed components and implants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.