Middle East And Africa Heartstring Device And Enclosure Device Market

Market Size in USD Million

CAGR :

%

USD

5.33 Million

USD

9.52 Million

2024

2032

USD

5.33 Million

USD

9.52 Million

2024

2032

| 2025 –2032 | |

| USD 5.33 Million | |

| USD 9.52 Million | |

|

|

|

|

Middle East and Africa Heartstring Device and Enclosure Device Market Size

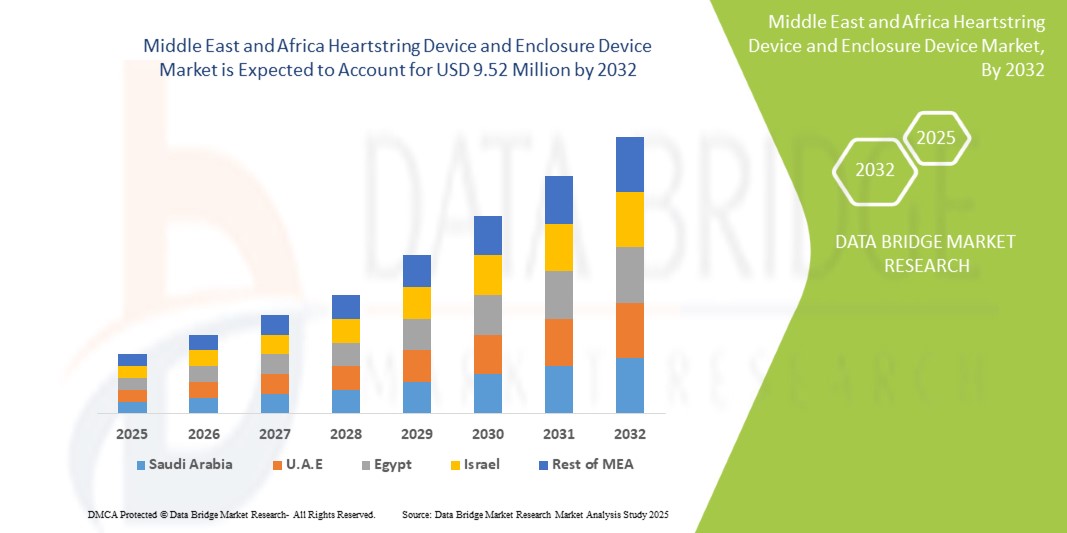

- The Middle East and Africa Heartstring Device and Enclosure Device Market size was valued at USD 5.33 million in 2024 and is expected to reach USD 9.52 million by 2032, at a CAGR of 7.6% during the forecast period

- The expansion of the Heartstring and Enclosure Device market is directly propelled by the increasing integration of smart home ecosystems and the widespread digitalization of commercial properties. This evolution is fueling strong demand for sophisticated, interconnected access control solutions.

- Additionally, shifting consumer expectations toward highly secure, intuitive, and seamless technologies are establishing heartstring and enclosure devices as the benchmark for modern access systems, thereby accelerating market-wide adoption and growth.

Middle East and Africa Heartstring Device and Enclosure Device Market Analysis

- Heartstring device and enclosure device refer to specialized components used across medical and technological applications to enhance safety, precision, and system integrity. The Heartstring device is primarily utilized in cardiovascular surgeries to temporarily seal blood vessels during procedures like coronary artery bypass grafting, minimizing the risk of complications such as embolism.

- Enclosure devices function as critical protective housings, safeguarding sensitive components within medical and smart technology systems from environmental hazards and unauthorized access. The synergy between Heartstring and enclosure devices is therefore fundamental to ensuring procedural safety, optimizing device performance, and bolstering operational reliability across the healthcare and smart infrastructure sectors.

- Saudi Arabia dominates and expected to dominate the Middle East and Africa Heartstring Device and Enclosure Device Market with the largest revenue share of 22.42% in 2025, primarily due to the presence of advanced healthcare infrastructure, high adoption of innovative surgical technologies, and increased investment in cardiac care solutions. Additionally, the region benefits from the presence of key market players, favorable reimbursement policies, and rising prevalence of cardiovascular diseases, all contributing to sustained market growth.

- Enclose device segment is expected to dominate the Middle East and Africa Heartstring Device and Enclosure Device Market with a market share of 67.74% in 2025, due to its critical role in facilitating safe, the enclosure device segment minimally invasive cardiac procedures. Its ability to ensure controlled vascular access and reduce procedural complications is driving widespread clinical adoption

Report Scope and Middle East and Africa Heartstring Device and Enclosure Device Market Segmentation

|

Attributes |

Middle East and Africa Heartstring Device and Enclosure Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Heartstring Device and Enclosure Device Market Trends

Growth Potential in Emerging Healthcare Regions

- Progress is accelerating through the expansion of healthcare infrastructure and the rising prevalence of cardiovascular disease in emerging regions.

- Device manufacturers are increasingly collaborating with local hospitals and healthcare providers to introduce heartstring and enclosure systems tailored to the specific needs and resource constraints of these markets.

- These partnerships focus on training healthcare professionals, improving procedural workflows, and facilitating access to advanced cardiac surgical technologies.

For instance,

- In June 2024, a study published in Asian Cardiovascular & Thoracic Annals highlighted the significant strides made by the Cardiac Surgery Intersociety Alliance (CSIA) over five years in enhancing cardiac surgical care across emerging regions, including Asia and Africa. The study emphasized the importance of collaborative efforts in training, resource sharing, and capacity building to address the rising burden of cardiovascular diseases in these regions. By focusing on skill development and infrastructure improvement, the CSIA has played a pivotal role in expanding access to advanced cardiac surgical procedures, thereby tapping into the vast growth potential of these emerging healthcare markets

- In March 2022, a study published in the International Journal of Environmental Research and Public Health examined the implementation of telecardiology in rural areas across various countries. The research highlighted that telecardiology platforms, including remote monitoring and virtual consultations, have significantly improved access to cardiovascular care in underserved regions. Hospitals in these areas have partnered with telemedicine providers to train healthcare professionals, integrate digital health tools, and enhance patient outcomes. This collaboration has been crucial in addressing the rising demand for cardiac services in emerging healthcare regions

Emerging healthcare regions are rapidly upgrading their cardiac care capabilities through investments in infrastructure, training of their workforce, and strategic collaborations. These developments are opening significant opportunities for the adoption of advanced surgical tools like heartstring and enclosure devices.

Middle East and Africa Heartstring Device and Enclosure Device Market Dynamics

Driver

Rising Prevalence of Chronic Venous Disorders (CVDS) globally

- Chronic Venous Disorders (CVDs) — including varicose veins, chronic venous insufficiency, edema, and venous leg ulcers — are costly, debilitating, and typically progressive. Middle East and Africa risk factors like aging, obesity, sedentary behavior, and hereditary predisposition combine to increase this burden.

- Compression therapy is the frontline non-surgical treatment recommended by vascular health experts. Because CVDs often require lifelong management, demand for compression garments and devices continues to grow sustainably. This escalating demand underscores the need for ongoing innovation in compression technologies, providing more comfortable and effective solutions.

- For instance- In May 2023, according to the National Center for Biotechnology Information, a scoping review was conducted to assess the prevalence of chronic venous disease (CVD) among healthcare workers. This review, adhering to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses guidelines, analyzed 15 publications. The findings revealed a mean CVD prevalence of 58.5% and a mean varicose vein prevalence of 22.1% among healthcare workers. These figures suggest an elevated prevalence of CVD in this group compared to the general population, highlighting the need for early diagnosis and preventative measures

- Furthermore, increased awareness and early diagnosis are crucial for slowing disease progression and improving patient quality of life. The economic impact of CVDs also underscores the importance of preventative measures and accessible, long-term management strategies.

- Ultimately, a multi-pronged approach involving lifestyle modifications, early intervention, and advanced compression therapies is essential to mitigate the rising Middle East and Africa burden of CVDs.

Opportunity

Advancements in Heart String Device Technology and Usability

- Continuous innovation in off-pump CABG (Coronary Artery Bypass Grafting) systems, often exemplified by advancements like the Heartstring device, is significantly enhancing surgical accessibility and outcomes.

- These innovations focus on several key areas that directly benefit both the surgical team and the patient. Improvements in stabilizers enable a more precise and steadier surgical field on the beating heart, which is crucial for delicate anastomoses. Integrated imaging provides surgeons with enhanced visualization, improving accuracy and reducing complications

For instance,

- In October 2024, the National Center for Biotechnology Information highlighted that wearable device are revolutionizing the management and diagnosis of Cardio vascular Disease (CVD). These cost-effective tools offer continuous, real-time monitoring of vital parameters, addressing limitations of traditional methods. The review discusses advancements in wearable technologies, categorized by galvanic contact, Photoplethysmography (PPG), and Radio Frequency (RF) waves, also emphasizing the role of AI in CVD diagnostics and future device perspectives

- Technological advancements are lowering technical barriers and enhancing the reproducibility of off-pump CABG procedures. These innovations support wider adoption by reducing surgeon training time, procedural risks, and hospital stays—aligning well with healthcare efficiency objectives.

- By investing in R&D that improves usability and reliability, device makers can justify premium pricing and drive wider procurement by healthcare systems

Restraint/Challenge

Growing Preference for Minimally Invasive Cardiac Procedures

- Minimally invasive cardiac interventions are becoming the preferred approach over traditional open-heart surgery due to their alignment with critical clinical goals.

- Procedures like Off-Pump Coronary Artery Bypass (OPCAB), transcatheter closure of congenital defects, and percutaneous valve repair offer substantial benefits to both patients and healthcare systems.

- For instance- In December 2024, according to the National Center for Biotechnology Information, a comprehensive review was conducted to evaluate the utilization and outcomes of off-pump coronary artery bypass grafting (OPCAB). The study highlighted several concerns regarding the overuse of OPCAB, particularly in settings where surgeon experience and institutional volume are limited. It was noted that OPCAB is associated with higher rates of incomplete revascularization and inferior graft patency compared to on-pump CABG.

- These advanced techniques aim to significantly reduce patient trauma by utilizing smaller incisions or catheter-based methods, bypassing the need for a large chest incision. This less invasive approach results in shorter recovery periods, enabling patients to return to their daily lives more quickly with reduced pain and fewer complications.

- Ultimately, the adoption of these minimally invasive procedures also optimizes health system efficiency by potentially reducing hospital stays, lowering the risk of readmissions, and freeing up resources, demonstrating a clear advantage in modern cardiac care

Middle East and Africa Heartstring Device and Enclosure Device Market Scope

The market is segmented into five notable segments which are based on product type, application, technology type, end-user, and distribution channel.

- By Product Type

On the basis of product type, Middle East and Africa Heartstring Device and Enclosure Device Market is segmented into enclose device, and heartstring device. In 2025, the enclosure device segment is expected to dominate with 67.74% market share due to its critical role in facilitating safe, the enclosure device segment minimally invasive cardiac procedures. Its ability to ensure controlled vascular access and reduce procedural complications is driving widespread clinical adoption.

The enclose device segment is projected to grow at the highest CAGR of 7.8% during the forecast period. This rapid growth is fueled by the increasing adoption of these devices in complex, off-pump cardiac surgeries to improve patient outcomes. Continuous innovation in heartstring technology, leading to enhanced ease of use and greater reliability in creating secure anastomoses, is directly driving its expanding preference among cardiac surgeons.

- By Application

On the basis of application, the Middle East and Africa Heartstring Device and Enclosure Device Market is segmented into Coronary Artery Bypass Grafting (CABG), Aortic Anastomosis, Valve Surgery, and Other. Coronary Artery Bypass Grafting (CABG) is further segmented into Coronary Artery Bypass Grafting (CABG), aortic anastomosis, valve surgery, and other. In 2025, the Coronary Artery Bypass Grafting (CABG) segment is expected to dominate with 75.93% market share due to the growing burden of coronary artery disease and the increasing preference for off-pump surgical techniques. CABG procedures benefit significantly from heartstring and enclosure devices that enhance safety and reduce operative risks.

The Coronary Artery Bypass Grafting (CABG) segment is anticipated to exhibit the fastest growth, this growth is driven by the rising incidence of coronary artery in aging populations and the development of less invasive valve repair and replacement techniques. These advanced procedures demand precise and reliable tools like heartstring devices to ensure secure and effective outcomes, thereby accelerating adoption in this application.

- By Technology Type

On the basis of technology type, the Middle East and Africa Heartstring Device and Enclosure Device Market is segmented into manual, automated or semi-automated, and others. In 2025, the manual segment is expected to dominate with 67.77% market share due to its widespread clinical acceptance, cost-effectiveness, and ease of use in diverse surgical settings. Stapling systems and clip-based closure devices offer reliable performance with minimal training requirements, driving their continued preference.

The manual segment is poised to register the highest CAGR. This growth is propelled by the increasing demand for enhanced surgical precision, reduced procedural times, and superior safety outcomes. The integration of automated technologies with robotic-assisted surgical platforms and the drive to minimize human error in complex cardiac procedures are key factors fueling its rapid market expansion

- By End User

On the basis of end user, the Middle East and Africa Heartstring Device and Enclosure Device Market is segmented into hospitals, cardiac surgery centers, academic & research institutes, and others. In 2025, hospitals segment is expected to dominate with 66.08% market share due to the high volume of cardiac surgeries performed in Tier 1 and Tier 2 facilities and their access to advanced surgical infrastructure. These institutions also benefit from greater funding, skilled personnel, and integration of cutting-edge cardiovascular technologies.

Meanwhile, hospitals are projected to be the fastest-growing segment, with a CAGR of 8.8%. Their growth is attributed to a rising trend of procedural specialization, which allows these centers to achieve higher efficiency, superior patient outcomes, and quicker adoption of niche technologies. As healthcare shifts towards value-based models, these specialized centers are becoming increasingly preferred for complex cardiovascular interventions.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa Heartstring Device and Enclosure Device Market is segmented into direct tenders, distributors & dealers, online procurement platforms, and others. In 2025, the direct tenders segment is expected to dominate the market with 51.93% market share due to bulk purchasing by government-sponsored hospitals and large private hospital networks. This channel ensures cost efficiency, streamlined procurement, and faster access to advanced surgical devices.

The direct tenders segment is expected to record the highest CAGR over the forecast period. This trend is a direct result of the increasing digitalization of healthcare supply chains. These platforms offer greater price transparency, enhanced accessibility for a wider range of buyers (including smaller clinics and research institutes), and simplified logistics, making them an increasingly attractive channel for sourcing medical devices.

Middle East and Africa Heartstring Device and Enclosure Device Market Regional Analysis

- Middle East and Africa is expected to hold the market share of 4.90% in 2025, primarily due to the presence of advanced healthcare infrastructure, high adoption of innovative surgical technologies, and increased investment in cardiac care solutions.

- Additionally, the region benefits from the presence of key market players, favorable reimbursement policies, and rising prevalence of cardiovascular diseases, all contributing to sustained market growth

Saudi Arabia Middle East and Africa Heartstring Device and Enclosure Device Market Insight

The Saudi Arabia Middle East and Africa Heartstring Device and Enclosure Device Market captured the largest revenue share of 22.42% within Middle East and Africa in 2025, fueled by advanced healthcare infrastructure, high adoption of minimally invasive cardiac procedures, favorable reimbursement policies, and a strong presence of key medical device manufacturers.

Middle East and Africa Heartstring Device and Enclosure Device Market Share

The heartstring device and enclosure device industry is primarily led by well-established companies, including:

- Peters Surgical (France)

- Getinge (Sweden)

- KARL STORZ (Germany)

Latest Developments in Middle East and Africa Heartstring Device and Enclosure Device Market

- In July 2025, Getinge entered a strategic partnership with Zimmer Biomet to expand their offerings in the Ambulatory Surgical Center (ASC) sector. This collaboration combines Getinge’s OR infrastructure and sterilization solutions with Zimmer Biomet’s surgical technologies, enabling integrated, turnkey solutions for outpatient centers. The partnership enhances Getinge’s market reach, strengthens its ASC positioning, and supports growth in minimally invasive surgical care.

- In July 2024, Getinge announced the opening of its new Experience Center in India as part of its expansion strategy in Asia. This facility offers hands-on demonstrations of advanced surgical, intensive care, and sterile reprocessing solutions. The development enhances Getinge’s customer engagement, training capabilities, and strengthens its presence in a rapidly growing healthcare market.

- In October 2023, Getinge acquired Healthmark Industries Co. Inc. for approximately USD 320 million. Healthmark is a key provider of instrument care and infection control consumables. This acquisition strengthens Getinge’s position in sterile reprocessing, particularly in the U.S., while supporting Middle East and Africa expansion of Healthmark’s product offerings.

- In December 2024, Artivion, Inc. received FDA Humanitarian Device Exemption (HDE) approval for its AMDS Hybrid Prosthesis, marking a key regulatory milestone. This allows the early U.S. commercialization of AMDS for treating acute DeBakey Type I aortic dissections with malperfusion—representing roughly 40% of such cases. The device also holds Breakthrough and Humanitarian Use Designation due to its life-saving potential in a rare, high-risk condition. This development strengthens Artivion’s leadership in the structural heart and aortic surgery market, expands its clinical footprint, and paves the way for broader Premarket Approval (PMA) coverage in the future.

- In November 2023, Artivion announced the completion of patient enrollment in its PERSEVERE clinical trial for the AMDS Hybrid Prosthesis, intended for treating acute DeBakey Type I aortic dissections. The 93-patient, U.S.-based study will support a PMA (Premarket Approval) application to the FDA by 2025. This milestone strengthens Artivion’s position in the aortic and structural heart device market, targeting reduced mortality and complications in high-risk aortic surgery cases.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 BRAND OUTLOOK

4.5.1 BRAND POSITIONING AND CLINICAL TRUST

4.5.2 COMPETITIVE DIFFERENTIATION IN A TECHNOLOGICALLY EVOLVING MARKET

4.5.3 PHYSICIAN-CENTRIC APPROACH AND BRAND ADAPTABILITY

4.5.4 INSTITUTIONAL PROCUREMENT, BRAND EQUITY, AND FINANCIAL STRENGTH

4.5.5 DIGITAL INTEGRATION AND MIDDLE EAST AND AFRICA BRAND VISIBILITY

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 CONSUMER BUYING BEHAVIOUR FOR HEARTSTRING DEVICE

4.7.1 CLINICAL EFFECTIVENESS AND SAFETY

4.7.2 COST AND VALUE-BASED PURCHASING

4.7.3 SURGEON PREFERENCES AND TRAINING SUPPORT

4.7.4 REGULATORY APPROVALS AND COMPLIANCE

4.7.5 BRAND REPUTATION AND VENDOR RELATIONSHIPS

4.8 CONSUMER BUYING BEHAVIOR FOR ENCLOSURE DEVICE

4.8.1 INNOVATION AND CLINICAL NEED

4.8.2 COST CONSIDERATIONS AND BUDGET IMPACT

4.8.3 TRUST IN MATERIAL SAFETY AND BIOCOMPATIBILITY

4.8.4 SURGEON EXPERTISE AND TRAINING REQUIREMENTS

4.8.5 REGULATORY ACCEPTANCE AND MARKET ADOPTION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT AND SUPPLIER LANDSCAPE

4.9.2 MANUFACTURING AND ASSEMBLY OPERATIONS

4.9.3 REGULATORY COMPLIANCE AND QUALITY ASSURANCE

4.9.4 DISTRIBUTION, LOGISTICS, AND INVENTORY MANAGEMENT

4.9.5 AFTER-SALES SERVICES, TRAINING, AND LIFECYCLE MANAGEMENT

4.9.6 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 MANUFACTURING, ASSEMBLY, AND QUALITY CONTROL

4.10.2 R&D AND REGULATORY COMPLIANCE COSTS

4.10.3 PACKAGING, STERILIZATION, AND LOGISTICS

4.10.4 MARKETING, DISTRIBUTION, AND AFTER-SALES SUPPORT

4.10.5 CONCLUSION

4.11 INDUSTRY ECOSYSTEM ANALYSIS

4.11.1 PROMINENT COMPANIES

4.11.2 SMALL & MEDIUM SIZED COMPANIES

4.11.3 END USERS

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.12.1 JOINT VENTURES

4.12.2 MERGERS AND ACQUISITIONS (M&A)

4.12.3 LICENSING AND PARTNERSHIPS

4.12.4 TECHNOLOGY COLLABORATIONS

4.12.5 COMPANY’S OVERVIEW

4.12.6 CONCLUSION

4.13 PRICING ANALYSIS – MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

4.13.1 PREMIUM PRICING STRATEGY FOR SPECIALIZED CARDIAC DEVICES

4.13.2 PRICING BASED ON DEVICE TYPE AND APPLICATION

4.13.3 MANUFACTURER INFLUENCE ON PRICE POSITIONING

4.13.4 REGULATORY AND QUALITY COMPLIANCE COSTS

4.13.5 MARKET-SPECIFIC PRICING STRATEGIES

4.13.6 PROCUREMENT MODELS AND TENDERING SYSTEMS

4.13.7 INNOVATION AND ADDED FEATURES IMPACT ON PRICING

4.13.8 CONCLUSION

4.14 PROFIT MARGIN SCENARIO

4.14.1 GROSS PROFIT MARGIN

4.14.2 OPERATING PROFIT MARGIN ASSESSMENT

4.14.3 NET PROFIT MARGIN ANALYSIS

4.14.4 SCENARIO MODELING: BEST, BASE, AND WORST CASES

4.14.5 STRATEGIES TO OPTIMIZE PROFIT MARGINS

4.15 RAW MATERIAL COVERAGE

4.15.1 SILICONE ELASTOMER (HEARTSTRING DEVICE)

4.15.2 RADIOPAQUE POLYESTER (HEARTSTRING DEVICE)

4.15.3 STAINLESS STEEL (ENCLOSURE DEVICES)

4.15.4 NITINOL (ENCLOSURE DEVICES)

4.15.5 ULTRA-HIGH-MOLECULAR-WEIGHT POLYETHYLENE (UHMWPE) (ENCLOSURE DEVICES)

4.16 TECHNOLOGICAL ADVANCEMENTS

4.16.1 ADVANCED ATRAUMATIC SEALING MECHANISMS

4.16.2 COMPACT, ERGONOMIC, AND USER-FRIENDLY DESIGNS

4.16.3 RAPID-DEPLOYMENT DELIVERY SYSTEMS

4.16.4 HYBRID BIOCOMPATIBLE MATERIALS FOR IMPROVED OUTCOMES

4.16.5 ENHANCED VISUALIZATION THROUGH IMAGING INTEGRATION

4.16.6 INTEGRATION WITH ROBOTIC AND MINIMALLY INVASIVE PLATFORMS

4.16.7 DATA-DRIVEN FEEDBACK AND DIGITAL INTEGRATION

4.17 VALUE CHAIN ANALYSIS

4.17.1 RAW MATERIAL PROCUREMENT

4.17.2 RESEARCH & DEVELOPMENT (R&D)

4.17.3 PRODUCT DESIGN AND PROTOTYPING

4.17.4 MANUFACTURING AND ASSEMBLY

4.17.5 REGULATORY APPROVALS AND QUALITY ASSURANCE

4.17.6 DISTRIBUTION AND LOGISTICS

4.17.7 MARKETING AND SALES

4.17.8 TRAINING AND TECHNICAL SUPPORT

4.17.9 AFTER-SALES SERVICE AND FEEDBACK INTEGRATION

4.18 VENDOR SELECTION CRITERIA

4.18.1 TECHNOLOGICAL CAPABILITIES AND INNOVATION PIPELINE

4.18.2 REGULATORY COMPLIANCE AND QUALITY CERTIFICATIONS

4.18.3 MANUFACTURING INFRASTRUCTURE AND SUPPLY CHAIN STRENGTH

4.18.4 CLINICAL SUPPORT, CUSTOMIZATION, AND AFTER-SALES SERVICE

4.18.5 MARKET REPUTATION, CUSTOMER BASE, AND FINANCIAL STABILITY

4.19 TARIFFS AND THEIR IMPACT ON MARKET

4.19.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.19.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.19.3 VENDOR SELECTION CRITERIA DYNAMICS

4.19.4 IMPACT ON SUPPLY CHAIN

4.19.4.1 COMPONENT PROCUREMENT

4.19.4.2 MANUFACTURING AND PRODUCTION

4.19.4.3 LOGISTICS AND DISTRIBUTION

4.19.4.4 PRICE PITCHING AND POSITION OF MARKET

4.19.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.19.5.1 SUPPLY CHAIN OPTIMIZATION

4.19.5.2 REGIONAL MANUFACTURING AND NEARSHORING

4.19.6 IMPACT ON PRICES

4.19.7 REGULATORY INCLINATION

4.19.7.1 INDUSTRY LOBBYING FOR EXEMPTIONS

4.19.7.2 LONG-TERM POLICY RESPONSE

4.19.7.3 TRADE AGREEMENTS & REGIONAL ALIGNMENT

4.19.8 CONCLUSION

5 REGULATORY FRAMEWORK

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

5.4 PRODUCT CODES

5.5 CERTIFIED STANDARDS

5.6 SAFETY STANDARDS

5.6.1 MATERIAL HANDLING & STORAGE

5.6.2 HAZARD IDENTIFICATION

5.7 PRODUCT CODES (ASIA PACIFIC CLASSIFICATION)

5.8 CERTIFIED STANDARDS

5.9 SAFETY STANDARDS

5.9.1 MATERIAL HANDLING & STORAGE

5.9.2 TRANSPORT & PRECAUTIONS

5.9.3 HAZARD IDENTIFICATION

5.1 PRODUCT CODES (DEVICE CLASSIFICATION)

5.11 CERTIFIED STANDARDS

5.12 SAFETY STANDARDS

5.12.1 MATERIAL HANDLING & STORAGE

5.12.2 TRANSPORT & PRECAUTIONS

5.12.3 HAZARD IDENTIFICATION

5.13 PRODUCT CODES

5.14 CERTIFIED STANDARDS

5.15 SAFETY STANDARDS

5.15.1 MATERIAL HANDLING & STORAGE

5.15.2 TRANSPORT & PRECAUTIONS

5.15.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC VENOUS DISORDERS (CVDS) GLOBALLY

6.1.2 RISING PREVALENCE OF CARDIOVASCULAR DISEASES (CVDS) GLOBALLY

6.1.3 INCREASING ADOPTION OF OFF-PUMP CABG (“HEART STRING”) TECHNIQUES

6.1.4 ADVANCEMENTS IN HEART STRING DEVICE TECHNOLOGY AND USABILITY

6.2 RESTRAINTS

6.2.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE CARDIAC PROCEDURES

6.2.2 HIGH COST OF DEVICES & LIMITED REIMBURSEMENT IN DEVELOPING MARKETS

6.3 OPPORTUNITIES

6.3.1 GROWTH POTENTIAL IN EMERGING HEALTHCARE REGIONS

6.3.2 INTEGRATION OF AI FOR SURGICAL PRECISION IMPROVEMENT

6.3.3 GROWTH OF TELECARDIOLOGY AND REMOTE PROCEDURE PLANNING

6.4 CHALLENGES

6.4.1 INCONSISTENT ADOPTION ACROSS FACILITIES

6.4.2 RISK OF COMPLICATIONS WITH IMPROPER DEVICE USAGE

7 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ENCLOSE DEVICE

7.3 HEARTSTRING DEVICE

8 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MANUAL

8.3 AUTOMATED OR SEMI-AUTOMATED

8.4 OTHERS

9 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CORONARY ARTERY BYPASS GRAFTING (CABG)

9.3 AORTIC ANASTOMOSIS

9.4 VALVE SURGERY

9.5 OTHER

10 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 CARDIAC SURGERY CENTERS

10.4 ACADEMIC & RESEARCH INSTITUTES

10.5 OTHERS

11 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDERS

11.3 DISTRIBUTORS & DEALERS

11.4 ONLINE PROCUREMENT PLATFORMS

11.5 OTHERS

12 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 UNITED ARAB EMIRATES

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 QATAR

12.1.7 KUWAIT

12.1.8 OMAN

12.1.9 BAHRAIN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GETINGE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS/NEWS

15.2 PETERS SURGICAL

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 KARL STORZ

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 ARTIVION, INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CARDINAL HEALTH

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FUMEDICA MEDIZINTECHNIK GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 HENRY SCHEIN, INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 JOHNSON & JOHNSON

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 KLS MARTIN GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MEDTRONIC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 OWENS & MINOR, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SANTAIR AE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 SONTEC INSTRUMENTS, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TELEFLEX INCORPORATED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 TERUMO CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 UNIPHAR GROUP PLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 SERVICE PORTFOLIO

15.17.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 STRATEGIC INNOVATION TYPES AND THEIR IMPACT

TABLE 2 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA AUTOMATED OR SEMI-AUTOMATED IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA OTHER IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DISTRIBUTORS & DEALER IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ONLINE PROCUREMENT PLATFORMS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 UNITED ARAB EMIRATES HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 UNITED ARAB EMIRATES ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 UNITED ARAB EMIRATES ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 UNITED ARAB EMIRATES CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 UNITED ARAB EMIRATES AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 UNITED ARAB EMIRATES VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 UNITED ARAB EMIRATES HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 UNITED ARAB EMIRATES MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 UNITED ARAB EMIRATES OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 UNITED ARAB EMIRATES HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 78 UNITED ARAB EMIRATES HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 UNITED ARAB EMIRATES CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 UNITED ARAB EMIRATES ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 UNITED ARAB EMIRATES HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 UNITED ARAB EMIRATES DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 UNITED ARAB EMIRATES DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 SOUTH AFRICA AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SOUTH AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AFRICA OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH AFRICA ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 100 EGYPT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 EGYPT ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 EGYPT ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 EGYPT CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 EGYPT AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 EGYPT VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 EGYPT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 EGYPT MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EGYPT OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EGYPT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 110 EGYPT HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 ISRAEL HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 ISRAEL ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 ISRAEL ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 ISRAEL CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 ISRAEL AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 ISRAEL VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 ISRAEL HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 ISRAEL MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 ISRAEL OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 ISRAEL HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 ISRAEL HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 ISRAEL CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 ISRAEL ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ISRAEL HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 130 ISRAEL DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ISRAEL DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 132 QATAR HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 QATAR ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 QATAR ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 QATAR CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 QATAR AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 QATAR VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 QATAR HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 QATAR MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 QATAR OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 QATAR HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 142 QATAR HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 QATAR CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 QATAR ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 QATAR HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 QATAR DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 QATAR DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 KUWAIT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 KUWAIT ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 KUWAIT ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 KUWAIT CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 KUWAIT AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 KUWAIT VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 KUWAIT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 KUWAIT MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 KUWAIT OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 KUWAIT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 158 KUWAIT HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 KUWAIT CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 KUWAIT ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 KUWAIT HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 KUWAIT DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 KUWAIT DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 164 OMAN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 OMAN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 OMAN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 OMAN CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 OMAN AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 OMAN VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 OMAN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 OMAN MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 OMAN OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 OMAN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 174 OMAN HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 OMAN CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 OMAN ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 OMAN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 OMAN DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 OMAN DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 180 BAHRAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 BAHRAIN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 BAHRAIN ENCLOSE DEVICE IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 BAHRAIN CORONARY ARTERY BYPASS GRAFTING (CABG) IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BAHRAIN AORTIC ANASTOMOSIS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 BAHRAIN VALVE SURGERY IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 BAHRAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TECHNOLOGY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BAHRAIN MANUAL IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 BAHRAIN OTHERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 BAHRAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 190 BAHRAIN HOSPITALS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 BAHRAIN CARDIAC SURGERY CENTERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 BAHRAIN ACADEMIC & RESEARCH INSTITUTES IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN DIRECT TENDERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 BAHRAIN DISTRIBUTORS & DEALERS IN HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 REST OF MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: MIDDLE EAST AND AFRICA VS. REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 RISING PREVALENCE OF CARDIOVASCULAR DISEASES (CVDS) GLOBALLY EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET IN 2025 & 2032

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET

FIGURE 18 DROC ANALYSIS

FIGURE 19 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 22 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, 2024

FIGURE 24 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, CAGR (2025- 2032)

FIGURE 26 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY TECHNOLOGY TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, 2024

FIGURE 28 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 30 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, 2024

FIGURE 32 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 34 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 36 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 38 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: SNAPSHOT (2024)

FIGURE 40 MIDDLE EAST AND AFRICA HEARTSTRING DEVICE AND ENCLOSURE DEVICE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.