Middle East And Africa High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Market Size in USD Billion

CAGR :

%

USD

4.35 Billion

USD

6.48 Billion

2025

2033

USD

4.35 Billion

USD

6.48 Billion

2025

2033

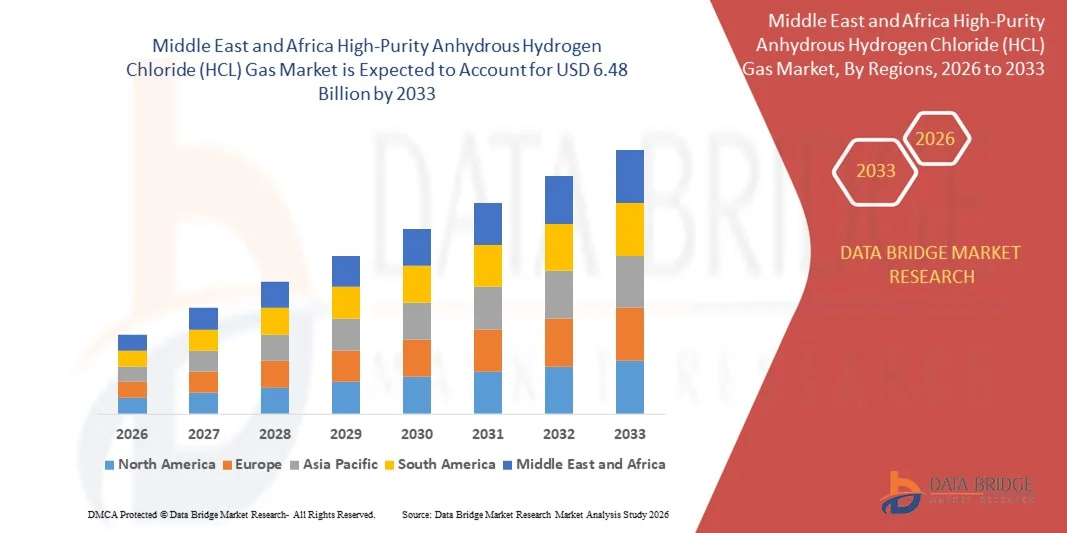

| 2026 –2033 | |

| USD 4.35 Billion | |

| USD 6.48 Billion | |

|

|

|

|

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Size

- The Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market size was valued at USD 4.35 billion in 2025 and is projected to reach USD 6.48 billion by 2033, growing at a CAGR of 5.12% during the forecast period.

- The market expansion is primarily driven by the increasing industrial demand for high-purity chemicals in sectors such as pharmaceuticals, electronics, and chemical processing, coupled with advancements in HCL production technologies.

- Additionally, stringent regulations for maintaining high-quality chemical standards and the rising need for efficient and reliable chemical processing solutions are encouraging adoption across various end-use industries, further propelling the market growth.

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Analysis

- High-Purity Anhydrous Hydrogen Chloride (HCL) Gas, widely used in chemical processing, electronics manufacturing, and pharmaceutical industries, is becoming increasingly essential in the Middle East and Africa due to its role in producing high-quality chemicals and maintaining stringent industrial standards.

- The growing demand for high-purity HCL gas is primarily driven by rapid industrialization, expansion of the electronics and pharmaceutical sectors, and increasing regulatory focus on chemical quality and safety across the region.

- U.A.E. dominated the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 33.1% in 2025, supported by robust industrial infrastructure, high investments in chemical manufacturing, and a strong presence of key chemical producers, with countries like Saudi Arabia and the UAE witnessing significant capacity expansions and technological upgrades in HCL production.

- Saudi Arabia is expected to dominate the market, fueled by its large industrial base, strong government support for chemical manufacturing, and increasing investments in high-purity chemical production for domestic consumption and exports.is expected to be the fastest-growing region in the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market during the forecast period, driven by increasing industrial projects, growing demand for pharmaceuticals and agrochemicals, and rising foreign investments in chemical manufacturing facilities.

- The electronics grade segment dominated the market with a revenue share of 56.4% in 2025, driven by the growing demand for ultra-high purity chemicals in semiconductor manufacturing, LED production, and other precision electronics applications.

Report Scope and Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Segmentation

|

Attributes |

High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

• SABIC (Saudi Arabia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Trends

Enhanced Efficiency Through Advanced Production Technologies

- A significant and accelerating trend in the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is the adoption of advanced production technologies, including continuous production processes, membrane cell electrolysis, and high-purity distillation systems. These technological advancements are significantly improving product quality, consistency, and operational efficiency.

- For instance, SABIC and Linde have implemented state-of-the-art continuous production systems that enable precise control over gas purity levels, ensuring compliance with stringent industrial standards and reducing production downtime. Similarly, Air Products and Chemicals utilizes advanced distillation techniques to achieve ultra-high purity HCL for sensitive applications in pharmaceuticals and electronics manufacturing.

- Technological integration in HCL production allows features such as automated monitoring of impurities, real-time quality adjustments, and predictive maintenance of production equipment. For example, some plants employ AI-driven process controls that optimize reaction conditions and minimize waste, while predictive analytics can detect potential equipment failures before they occur, ensuring uninterrupted supply.

- The seamless integration of HCL production systems with digital monitoring platforms enables centralized control over chemical output, safety systems, and operational efficiency. Through a single interface, operators can manage multiple production units, track purity levels, and ensure adherence to regulatory standards, creating a highly reliable and automated manufacturing environment.

- This trend towards more intelligent, efficient, and interconnected production systems is fundamentally reshaping expectations in the chemical industry. Consequently, companies such as National Petrochemical Company and Sasol are investing in AI-enabled process optimization and fully automated HCL production lines to enhance output quality and reduce operational costs.

- The demand for high-purity HCL produced through advanced, automated, and technologically integrated methods is growing rapidly across the chemical, pharmaceutical, and electronics sectors, as industries increasingly prioritize reliability, precision, and operational efficiency.

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Dynamics

Driver

Growing Demand Driven by Expanding Industrial Applications and Chemical Standards

- The increasing industrialization across the Middle East and Africa, coupled with the rising demand for high-quality chemicals in pharmaceuticals, electronics, and chemical processing industries, is a significant driver for the heightened demand for high-purity anhydrous Hydrogen Chloride (HCL) gas.

- For instance, in early 2025, SABIC announced the expansion of its high-purity HCL production capacity in Saudi Arabia to meet the growing requirements of the electronics and pharmaceutical sectors. Such strategic initiatives by key market players are expected to drive the HCL gas market growth during the forecast period.

- As industries adopt stricter quality standards and regulatory compliance requirements, high-purity HCL gas is increasingly sought after for its reliability, consistency, and low impurity levels, offering a critical upgrade over lower-grade alternatives.

- Furthermore, the rising adoption of advanced manufacturing processes, including semiconductor fabrication, chemical synthesis, and pharmaceutical production, is making high-purity HCL an indispensable component of these operations, ensuring process efficiency and product quality.

- The growing need for high-purity chemicals, coupled with expanding industrial projects in countries like Saudi Arabia, UAE, and South Africa, is a key factor propelling the adoption of HCL gas across multiple sectors. Investments in automated production systems and supply chain expansions further contribute to market growth.

Restraint/Challenge

Concerns Regarding Supply Chain Stability and Production Costs

- Concerns surrounding the stability of raw material supply, energy costs, and production expenses pose significant challenges to broader market growth. High-purity HCL production requires stringent quality control and specialized equipment, making it sensitive to supply chain disruptions and fluctuations in energy prices.

- For instance, geopolitical tensions or disruptions in chlorine or hydrochloric acid supply can impact production continuity, leading to temporary shortages or price volatility in the HCL market.

- Addressing these challenges through diversified sourcing strategies, investments in energy-efficient production technologies, and robust inventory management is crucial for ensuring consistent supply and maintaining customer confidence.

- Additionally, the relatively high production costs of ultra-high-purity HCL compared to standard-grade variants can be a barrier for smaller industrial consumers or cost-sensitive manufacturers. While large-scale producers can absorb these costs, smaller enterprises may face adoption constraints.

- Overcoming these challenges through technological innovation, cost optimization in production, and stronger supply chain resilience will be vital for sustained market growth in the Middle East and Africa HCL gas sector.

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The ultra-high-purity anhydrous hydrogen chloride (HCL) gas market is segmented on the basis of product and application.

- By Product

On the basis of product, the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics grade and chemical grade. The electronics grade segment dominated the market with a revenue share of 56.4% in 2025, driven by the growing demand for ultra-high purity chemicals in semiconductor manufacturing, LED production, and other precision electronics applications. Electronics-grade HCL is critical for processes such as etching, wafer cleaning, and chemical vapor deposition, where even trace impurities can impact product quality and yield. Its adoption is further accelerated by increasing electronics manufacturing facilities in the UAE, Saudi Arabia, and South Africa, focusing on high-tech production.

The chemical grade segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by rising industrial applications in chemical synthesis, metal processing, and water treatment. Chemical-grade HCL is widely used in bulk industrial processes where high purity is beneficial but not as critical as in electronics.

- By Application

On the basis of application, the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment dominated the market with a revenue share of 53.7% in 2025, driven by the growing semiconductor, LED, and solar panel industries in the region. High-purity HCL is crucial for maintaining stringent quality standards and achieving high precision in etching and chemical processing steps, making it indispensable for electronics production.

The pharmaceuticals segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by increasing pharmaceutical manufacturing and research activities that require high-purity chemicals for API synthesis, pH control, and formulation processes. Rising regulatory standards, coupled with the expansion of pharmaceutical hubs in the UAE, South Africa, and Egypt, are contributing to higher adoption of HCL in this sector.

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

- U.A.E. dominated the Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 33.1% in 2025, driven by the region’s expanding industrial base, increasing investments in chemical manufacturing, and the growing demand for high-purity chemicals across electronics, pharmaceutical, and chemical processing sectors.

- Key markets such as Saudi Arabia and the UAE are investing heavily in modern production facilities and technological upgrades to ensure consistent supply of high-purity HCL, supporting industrial efficiency and compliance with stringent quality standards.

- The region’s market growth is further reinforced by strong government support for industrialization, the presence of established chemical manufacturers, and rising adoption of advanced production technologies. These factors collectively position high-purity HCL as a critical input for industrial processes, driving both domestic consumption and export opportunities across the Middle East and Africa.

Saudi Arabia High-Purity HCL Gas Market Insight

The Saudi Arabia high-purity anhydrous HCL gas market captured the largest revenue share of 32% in 2025 within the Middle East, driven by rapid industrialization and the expansion of chemical, pharmaceutical, and electronics manufacturing facilities. The government’s strong focus on industrial diversification and Vision 2030 initiatives has led to significant investments in modern chemical production plants. Additionally, the adoption of advanced technologies for ultra-high purity chemical production is fueling demand across multiple end-use industries, including semiconductor fabrication and pharmaceutical manufacturing. The country’s well-developed industrial infrastructure, availability of raw materials, and presence of key global chemical players further contribute to market growth.

U.A.E. High-Purity HCL Gas Market Insight

The U.A.E. high-purity anhydrous HCL gas market is anticipated to grow at a substantial CAGR during the forecast period, driven by the country’s increasing chemical production capacities and rising demand from pharmaceuticals, electronics, and water treatment sectors. Dubai and Abu Dhabi are emerging as industrial hubs with significant investments in high-purity chemical manufacturing and export-oriented facilities. The adoption of automation, continuous production systems, and advanced quality control measures ensures consistent supply and high reliability, supporting the market expansion in both domestic and regional applications.

South Africa High-Purity HCL Gas Market Insight

The South Africa high-purity anhydrous HCL gas market is expected to witness notable growth, fueled by increasing industrialization, mining, and chemical processing activities. High-purity HCL is in growing demand for use in metal processing, water treatment, and chemical synthesis. The country’s industrial base, supported by local chemical manufacturers and international partnerships, provides a steady supply of high-quality HCL to meet domestic and regional needs. Furthermore, rising regulatory standards and quality requirements across end-use industries are driving adoption of ultra-high purity HCL.

Egypt High-Purity HCL Gas Market Insight

The Egypt high-purity anhydrous HCL gas market is poised to expand at a significant CAGR during the forecast period, driven by the country’s growing pharmaceutical, chemical, and electronics manufacturing sectors. Increasing government support for industrial growth, coupled with the development of industrial zones and export-oriented facilities, is enhancing the demand for high-purity chemicals. The market benefits from investments in modern production technologies and quality control processes, ensuring reliability for critical applications in both domestic and regional markets. Rising awareness about industrial standards and the need for high-quality chemical inputs further supports growth.

Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Share

The High-Purity Anhydrous Hydrogen Chloride (HCL) Gas industry is primarily led by well-established companies, including:

• SABIC (Saudi Arabia)

• Qatar Chemical Company (Qatar)

• National Petrochemical Company (U.A.E.)

• Sasol (South Africa)

• Linde plc (Germany)

• Air Products and Chemicals (U.S.)

• Praxair (U.S.)

• BASF SE (Germany)

• Sumitomo Chemical (Japan)

• Huntsman Corporation (U.S.)

• Chemanol (Saudi Arabia)

• Chevron Phillips Chemical (U.S.)

• Lonza Group (Switzerland)

• Tosoh Corporation (Japan)

• OCI N.V. (Netherlands)

• Arkema (France)

• Covestro (Germany)

• Deepak Nitrite (India)

• Sherwin-Williams Chemicals (U.S.)

• Mitsui Chemicals (Japan)

What are the Recent Developments in Middle East and Africa High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market?

- In April 2024, SABIC, a global leader in chemicals and high-purity gas production, announced the expansion of its high-purity HCL production facility in Saudi Arabia. The project aims to meet rising demand from the electronics, pharmaceutical, and chemical processing industries. This initiative highlights SABIC’s commitment to delivering high-quality chemical solutions and reinforcing its leadership in the Middle East and Africa HCL gas market through advanced production technologies and stringent quality standards.

- In March 2024, Linde plc commissioned a state-of-the-art high-purity HCL plant in the UAE, designed to supply ultra-high purity gas for semiconductor fabrication and specialty chemical manufacturing. The facility incorporates continuous production systems and automated quality control, demonstrating Linde’s dedication to technological innovation and reliable supply for critical industrial applications.

- In March 2024, Air Products and Chemicals expanded its HCL distribution network across South Africa, ensuring a steady supply of high-purity chemicals for local pharmaceutical, water treatment, and metal processing sectors. This strategic move emphasizes Air Products’ focus on operational excellence, safety, and responsiveness to regional industrial needs, supporting market growth in Sub-Saharan Africa.

- In February 2024, National Petrochemical Company (NPC, UAE) entered into a strategic partnership with regional electronics manufacturers to provide customized high-purity HCL solutions tailored for precision applications in semiconductor and LED production. This collaboration underscores NPC’s commitment to innovation, customer-focused solutions, and strengthening its position in the growing Middle East HCL gas market.

- In January 2024, Sasol launched an upgraded high-purity HCL line at its South African chemical production facility, featuring advanced distillation and purification technologies. The initiative aims to enhance chemical quality, reduce impurities, and support expanding industrial and pharmaceutical applications, reflecting Sasol’s focus on reliability, efficiency, and sustained market leadership in the region.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa High Purity Anhydrous Hydrogen Chloride Hcl Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa High Purity Anhydrous Hydrogen Chloride Hcl Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa High Purity Anhydrous Hydrogen Chloride Hcl Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.