Middle East And Africa Horticulture Lighting Market

Market Size in USD Million

CAGR :

%

USD

601.10 Million

USD

1,864.52 Million

2024

2032

USD

601.10 Million

USD

1,864.52 Million

2024

2032

| 2025 –2032 | |

| USD 601.10 Million | |

| USD 1,864.52 Million | |

|

|

|

|

Horticulture Lighting Market Size

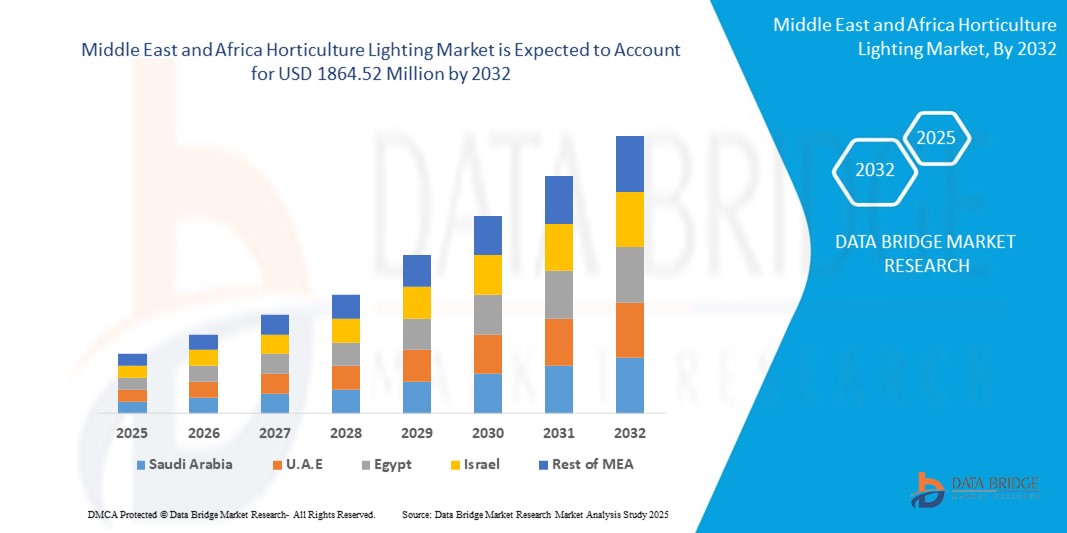

- The Middle East and Africa horticulture lighting market size was valued at USD 601.10 million in 2024 and is expected to reach USD 1864.52 million by 2032, at a CAGR of 15.2% during the forecast period

- The market growth is primarily driven by the increasing adoption of controlled environment agriculture (CEA) and advancements in energy-efficient lighting technologies, particularly LED lights, which support sustainable farming practices

- Rising demand for year-round crop production, driven by food security concerns and urbanization, is positioning horticulture lighting as a critical solution for modern agriculture in the region

Horticulture Lighting Market Analysis

- Horticulture lighting systems, designed to provide artificial light for plant growth, are becoming essential in modern agriculture due to their ability to optimize crop yield, quality, and growth cycles in controlled environments

- The growing demand for horticulture lighting is fueled by the expansion of greenhouse farming, vertical farming, and indoor farming, alongside increasing awareness of sustainable agricultural practices and the need for local food production

- Saudi Arabia dominated the horticulture lighting market with the largest revenue share of 38.5% in 2024, driven by government initiatives which promote sustainable agriculture, high investments in greenhouse projects, and a strong focus on food self-sufficiency

- The U.A.E. is expected to be the fastest-growing country in the horticulture lighting market during the forecast period, attributed to rapid urbanization, government support for vertical farming, and increasing investments in smart agriculture technologies

- The hardware segment dominated the largest market revenue share of 75% in 2024, driven by the high demand for energy-efficient LED lighting systems and their widespread adoption in greenhouses and vertical farms

Report Scope and Horticulture Lighting Market Segmentation

|

Attributes |

Horticulture Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Horticulture Lighting Market Trends

“Increasing Adoption of Smart and IoT-Integrated Lighting Solutions”

- The Middle East and Africa (MEA) horticulture lighting market is experiencing a significant trend toward the integration of smart technologies and Internet of Things (IoT) platforms in lighting system

- These technologies enable precise control over light spectra, intensity, and photoperiods, optimizing plant growth for specific crops and growth stages

- Smart lighting systems, often paired with sensors and software, allow real-time monitoring and adjustments based on environmental conditions, enhancing energy efficiency and crop yields

- For instance, companies such as Signify Holding are deploying IoT-enabled LED systems, such as the Philips GreenPower LED, which allow growers in the MEA region to customize lighting for greenhouses and vertical farms

- This trend is particularly appealing in Saudi Arabia, the dominating country, and the U.A.E., the fastest-growing country, where investments in advanced agricultural technologies are rising to support food security initiatives

- IoT integration also facilitates data analytics for crop performance, enabling predictive adjustments to lighting conditions to maximize productivity and reduce operational costs.

Horticulture Lighting Market Dynamics

Driver

“Growing Demand for Food Security and Year-Round Crop Production”

- Increasing consumer and governmental focus on food security, driven by the region's arid climate and reliance on imported produce, is a major driver for the MEA horticulture lighting market

- Horticulture lighting enables year-round cultivation in controlled environments such as greenhouses, vertical farms, and indoor farms, supporting local production of fruits, vegetables, and floriculture

- Government initiatives in Saudi Arabia and the U.A.E., such as Vision 2030 and the UAE Food Security Strategy, are promoting controlled environment agriculture (CEA) through subsidies and investments in advanced lighting technologies

- The adoption of 5G and IoT technologies is enhancing the capabilities of horticulture lighting systems, enabling faster data processing and real-time control for improved crop quality and yield

- Major companies such as Signify Holding, OSRAM GmbH, and Cree, Inc. are offering advanced LED lighting solutions tailored to the MEA region's needs, further driving market growth

Restraint/Challenge

“High Initial Costs and Infrastructure Limitations”

- The high upfront costs of hardware, software, and services for horticulture lighting systems, particularly LED and IoT-integrated solutions, pose a significant barrier to adoption in the MEA region, especially for small-scale growers

- Retrofitting existing facilities with modern lighting systems, such as transitioning from HID to LED, can be complex and expensive, requiring significant infrastructure upgrades

- Limited agricultural infrastructure and technical expertise in some MEA countries, outside of leading markets such as Saudi Arabia and the U.A.E., hinder widespread adoption

- Data security concerns related to IoT-enabled lighting systems, which collect and transmit sensitive agricultural data, raise challenges regarding compliance with regional data protection regulations and potential cyber risks

- These factors may slow market growth in less developed areas of the MEA region, where cost sensitivity and infrastructural constraints are more pronounced

Horticulture Lighting market Scope

The market is segmented on the basis of offering, deployment, technology, lighting type, cultivation, and application.

- By Offering

On the basis of offering, the market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of 75% in 2024, driven by the high demand for energy-efficient LED lighting systems and their widespread adoption in greenhouses and vertical farms. Hardware, including fixtures and control units, is critical for delivering tailored light spectra to optimize plant growth.

The software and services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of smart lighting solutions. These include data analytics platforms and crop monitoring software that provide growers with actionable insights to enhance yield and efficiency. The integration of IoT and AI-driven interfaces further accelerates the adoption of these solutions.

- By Deployment

On the basis of deployment, the market is segmented into turnkey and retrofit. The turnkey segment dominated the largest market revenue share of 60% in 2024, driven by the increasing number of new greenhouse and vertical farming projects in the MEA region. Turnkey solutions offer seamless integration of lighting systems during facility setup, ensuring optimal performance and scalability.

The retrofit segment is anticipated to experience the fastest growth rate of approximately 16.5% from 2025 to 2032. Retrofitting existing agricultural facilities with energy-efficient LED systems is gaining traction due to cost savings, improved plant quality, and reduced maintenance costs, particularly in regions aiming to modernize agricultural practices.

- By Technology

On the basis of technology, the market is segmented into fluorescent lamps, HID lights, LED lights, and others. The LED lights segment dominated the largest market revenue share of 65% in 2024, owing to their energy efficiency, long lifespan, and customizable spectral outputs. LEDs are widely adopted in the MEA region for their ability to reduce energy consumption and support sustainable farming.

The fluorescent lamps segment is anticipated to witness significant growth from 2025 to 2032, driven by their affordability and versatility. Fluorescent lights remain a cost-effective option for small-scale and hobbyist growers, contributing to their sustained relevance in the market.

- By Lighting Type

On the basis of lighting type, the market is segmented into toplighting and interlighting. The toplighting segment dominated the market with a revenue share of 70% in 2024, driven by its critical role in providing high-intensity light for plant growth in greenhouses and vertical farms. Toplighting systems ensure maximum yields and efficient use of space and resources, particularly in countries such as Saudi Arabia and the U.A.E.

The interlighting segment is expected to grow at the fastest rate from 2025 to 2032, driven by its increasing use in high-density cultivation, such as tomatoes and cucumbers, in controlled environments. Interlighting enhances light exposure to lower plant canopies, improving photosynthesis and yield efficiency.

- By Cultivation

On the basis of cultivation, the market is segmented into fruits and vegetables and floriculture. The fruits and vegetables segment dominated the largest market revenue share of 68% in 2024, driven by the rising demand for fresh, locally grown produce in the MEA region. Adverse environmental conditions, such as extreme heat and water scarcity, have increased reliance on controlled environment agriculture (CEA) and LED lighting to ensure consistent production.

The floriculture segment is anticipated to witness robust growth from 2025 to 2032, fueled by increasing consumer demand for ornamental plants and flowers. The use of advanced lighting solutions to reduce flowering time and enhance flower quality is driving adoption in this segment.

-

By Application

On the basis of application, the market is segmented into greenhouses, vertical farming, indoor farming, and others. The greenhouses segment dominated the market with a revenue share of 60% in 2024, driven by the widespread adoption of greenhouse farming in countries such as Saudi Arabia and the U.A.E. to address food security and reduce reliance on imports.

The vertical farming segment is expected to witness the fastest growth rate of 18% from 2025 to 2032, driven by the increasing adoption of space-efficient farming techniques in urban areas. Vertical farming’s reliance on advanced lighting systems to support year-round crop production is a key growth driver, particularly in the U.A.E., where urban agriculture is rapidly expanding.

Horticulture Lighting Market Regional Analysis

- Saudi Arabia dominated the horticulture lighting market with the largest revenue share of 38.5% in 2024, driven by government initiatives such as Vision 2030, which promote sustainable agriculture, high investments in greenhouse projects, and a strong focus on food self-sufficiency

- Consumers and growers prioritize horticulture lighting for enhancing crop yield, enabling year-round cultivation, and improving energy efficiency, particularly in regions with harsh climatic condition

- Market expansion is supported by advancements in lighting technology, such as energy-efficient LED lights and smart control systems, alongside rising adoption in both turnkey and retrofit deployments

Saudi Arabia Horticulture Lighting Market Insight

Saudi Arabia dominated the MEA horticulture lighting market with the highest revenue share in 2024, fueled by significant government investments in agricultural technology and a strong focus on food security. The adoption of advanced LED lighting systems in greenhouses and vertical farms is driven by the need to reduce reliance on imported produce. The trend towards sustainable farming practices and increasing regulations promoting energy-efficient solutions further boost market growth.

U.A.E. Horticulture Lighting Market Insight

The U.A.E. market for horticulture lighting is expected to witness the fastest growth rate in the forecast pweriod, driven by rapid urbanization and increasing demand for locally grown fruits, vegetables, and floriculture. The integration of advanced technologies such as LED toplighting and smart software systems in vertical farms supports market expansion. Growing awareness of sustainability and government initiatives promoting CEA in urban settings enhance adoption.

South Africa Horticulture Lighting Market Insight

South Africa is expected to witness significant growth in the horticulture lighting market, attributed to its expanding agricultural sector and focus on improving crop quality and yield. Consumers and growers prefer LED lighting solutions for their energy efficiency and ability to support year-round cultivation. The integration of retrofit lighting systems in existing greenhouses and rising interest in indoor farming contribute to sustained market growth.

Horticulture Lighting Market Share

The horticulture lighting industry is primarily led by well-established companies, including:

- Nexsel Tech (U.A.E.)

- FENA Lighting (U.A.E.)

- HORTIV by Megalight (Israel)

- Signify Holding (U.A.E)

- OSRAM GmbH (U.A.E)

- SAMSUNG (U.A.E.)

- Cree, Inc. (U.A.E)

- GE Lighting (South Africa)

- Heliospectra AB (South Africa)

- Hortilux Schréder B.V. (South Africa)

- Lumileds Holding B.V. (South Africa

- Gavita International B.V. (South Africa)

- Illumitex Inc. (South Africa)

- PARsource (South Africa)

- Valoya Oy (South Africa)

What are the Recent Developments in Middle East and Africa Horticulture Lighting Market?

- In May 2025, GlobeNewswire reported that the Horticulture Lighting Market is set for significant growth, fueled by rising demand for Controlled-Environment Agriculture (CEA) and advancements in LED and smart lighting technologies. This trend is particularly strong in the Middle East and Africa, where sustainable agriculture and food security are becoming key priorities. The market is expected to expand as growers adopt energy-efficient lighting solutions to enhance crop yields and optimize indoor farming

- In May 2022, OSRAM GmbH introduced the OSLON Optimal Family of LEDs, designed for high-efficiency horticulture lighting. These LEDs provide precise light composition tailored for various plant growth stages, ensuring cost-effective solutions for growers. The Hyper Red (660 nm) and Far Red (730 nm) variants optimize photosynthesis, while upcoming Deep Blue and Horti White versions expand spectral flexibility. This innovation supports energy-efficient agriculture, benefiting the MEA region by enhancing crop yields and sustainability

- In December 2021, Signify announced a definitive agreement to acquire Fluence, a Texas-based horticultural lighting company, from ams OSRAM for USD 272 million. This strategic acquisition aimed to strengthen Signify’s global agricultural lighting platform, expanding its presence in the North American horticultural market while reinforcing its expertise in energy-efficient LED solutions. The move aligns with Signify’s commitment to sustainable food production, with potential ripple effects in MEA as global players extend their reach

- In May 2021, Abu Dhabi Municipality initiated a campaign to promote the environmental benefits of energy-efficient LED streetlights. The project aimed to replace conventional lighting with smart LED technology, reducing electricity consumption and enhancing sustainability. By integrating smart lighting control systems, the initiative sought to improve urban lighting efficiency while lowering carbon emissions. Although focused on street lighting, such government-led efforts contribute to a broader favorable environment for horticulture lighting solutions in the MEA region, supporting sustainable agriculture and energy-efficient practices

- In May 2021, Signify Holding (formerly Philips Lighting) partnered with Ljusgarda, a Swedish vertical farming pioneer, to enhance productivity using high-tech solutions. The collaboration involved deploying Philips GreenPower LED production modules and the GrowWise Control System, optimizing light spectrum and levels for improved crop yield and quality. While this initiative primarily focused on Sweden, such global partnerships highlight a broader trend influencing advanced horticulture lighting adoption in emerging markets, including MEA

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Horticulture Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Horticulture Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Horticulture Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.