Middle East And Africa Ice Cream Freezers Market

Market Size in USD Million

CAGR :

%

USD

313.70 Million

USD

519.18 Million

2025

2033

USD

313.70 Million

USD

519.18 Million

2025

2033

| 2026 –2033 | |

| USD 313.70 Million | |

| USD 519.18 Million | |

|

|

|

|

Middle East and Africa Ice Cream Freezer Market Size

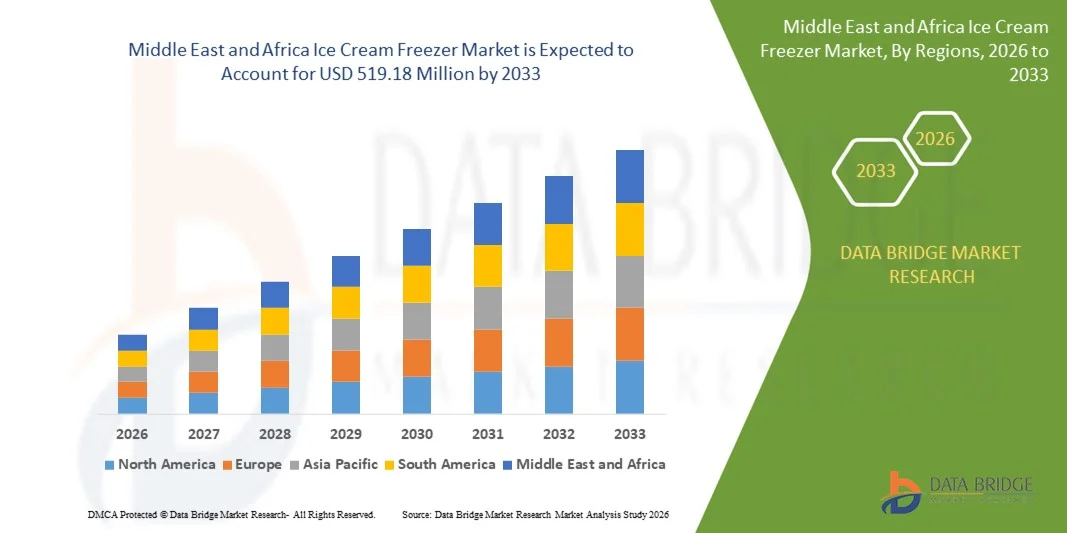

- The Middle East and Africa ice cream freezer market size was valued at USD 313.70 million in 2025 and is expected to reach USD 519.18 million by 2033, at a CAGR of 6.5% during the forecast period

- The market growth is largely driven by the rising demand for reliable, energy-efficient, and high-performance freezing solutions across both residential and commercial environments, supported by rapid expansion of ice cream parlors, QSR chains, and modern retail formats

- Furthermore, increasing adoption of advanced freezer technologies such as improved insulation systems, optimized compressors, and eco-friendly refrigerants is strengthening market expansion as end users prioritize consistent temperature control and reduced operating costs, ultimately accelerating the uptake of ice cream freezers across global markets

Middle East and Africa Ice Cream Freezer Market Analysis

- Ice cream freezers, designed to maintain ultra-low and stable temperatures essential for preserving ice cream texture and quality, have become a critical component for retail, foodservice, and cold-chain operators due to their ability to ensure product freshness, long-duration storage, and dependable performance across varying demand conditions

- The growing need for efficient freezing systems is being reinforced by rising consumption of ice cream and frozen desserts, expansion of organized retail, and increasing preference for energy-efficient appliances that reduce operational expenses for commercial businesses while offering dependable freezing capabilities for residential users

- Saudi Arabia dominated the ice cream freezer market in 2025, due to the rapid expansion of modern retail formats, quick-service restaurant chains, and specialty dessert outlets that require reliable, energy-efficient freezing equipment for large-volume storage and display

- U.A.E. is expected to be the fastest growing country in the ice cream freezer market during the forecast period due to the country’s expanding hospitality sector, flourishing café culture, and rising number of premium ice cream and gelato brands

- Chest freezers/deep freezers segment dominated the market with a market share of 38.9% in 2025, due to its strong insulation efficiency and ability to maintain consistent temperatures essential for ice cream preservation. These freezers support bulk storage and long-duration cooling, making them suitable for parlors, retail shops, and distribution points. Their low maintenance needs and energy-efficient design help reduce operational costs for small and mid-sized businesses. The versatility of chest freezers allows them to store multiple SKUs without frequent defrosting. The widespread adoption across both developed and emerging regions reinforces their leading position

Report Scope and Ice Cream Freezer Market Segmentation

|

Attributes |

Ice Cream Freezer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Ice Cream Freezer Market Trends

Rising Demand for Energy-Efficient Freezers

- A major trend in the ice cream freezer market is the rising demand for energy-efficient freezing systems driven by the need to lower operational expenses and meet sustainability expectations across retail and commercial environments. This shift is strengthening the adoption of freezers designed with improved insulation, optimized compressors, and eco-friendly refrigerants that help maintain consistent low temperatures while reducing electricity usage

- For instance, Blue Star and Haier continue expanding their portfolios of energy-efficient deep freezers that help retailers and foodservice operators maintain ice cream quality under stable temperature conditions. Such solutions support long-term cost savings and enhance storage reliability in high-demand locations

- The demand for energy-focused freezers is accelerating due to the growing number of modern retail outlets, ice cream parlors, and QSR chains that require continuous, stable, and economical cold storage. This is pushing manufacturers to develop freezers that combine high performance with lower environmental impact

- Energy-efficient systems are increasingly preferred due to government pushes toward reduced carbon emissions and rising electricity prices. This trend is influencing procurement decisions across emerging and established markets

- Manufacturers are integrating advanced cooling technologies to ensure better product consistency and reduce temperature fluctuations. This strengthens the market for innovative freezers that support smooth product handling throughout storage cycles

- The market is witnessing steady growth as energy-efficient freezer adoption supports long-term sustainability and operational reliability. This rising preference is shaping future product designs and reinforcing the transition toward more efficient cold-storage infrastructure across the industry

Middle East and Africa Ice Cream Freezer Market Dynamics

Driver

Growing Consumption of Ice Cream and Frozen Desserts

- The increasing consumption of ice cream and frozen desserts is a key driver supporting the installation of advanced ice cream freezers across retail and commercial settings. This rising demand is encouraging outlets to expand storage capacity and invest in reliable deep freezers that preserve product quality and texture

- For instance, brands operating in large retail chains and specialty dessert shops rely on high-capacity freezers supplied by companies such as AHT and Whirlpool to manage higher sales volumes and ensure uninterrupted cold storage. These freezers help retailers maintain product integrity during peak demand periods

- The popularity of premium, artisanal, and impulse ice cream varieties is amplifying the need for specialized freezers that can handle low-temperature stability. This growing product diversification is strengthening freezer demand across multiple distribution formats

- Rising consumer preference for frozen desserts as convenient and indulgent snacks is driving retailers to widen stock availability, leading to higher procurement of commercial freezers. This trend directly reinforces equipment demand across retail and foodservice channels

- The steady expansion in frozen dessert consumption is expected to continue strengthening market growth as operators invest in advanced freezing solutions to maintain consistent quality and support inventory requirements

Restraint/Challenge

High Energy and Maintenance Costs

- A major challenge for the ice cream freezer market is the high energy consumption and ongoing maintenance requirements associated with commercial freezing systems. These systems operate continuously to maintain strict temperature standards, leading to significant power expenses for retailers and foodservice operators

- For instance, large-format freezers used by supermarkets and hypermarkets require regular servicing, part replacements, and technical checks to ensure efficient cooling performance. This maintenance expenditure adds pressure to operational budgets, especially for businesses with large freezer fleets

- Maintaining stable freezing temperatures demands continuous compressor usage, which increases electricity costs and limits affordability for small businesses. This challenge is particularly evident in regions with high utility rates

- Commercial freezers often require specialized technicians for repairs and system calibration. These service needs extend downtime and raise operational complexity for businesses reliant on uninterrupted cold storage

- These combined energy and maintenance demands act as a restraint on market expansion, prompting manufacturers to innovate but simultaneously creating cost-related barriers for end users considering new installations

Middle East and Africa Ice Cream Freezer Market Scope

The market is segmented on the basis of type, components, capacity, technology, distribution channel, and end user.

- By Type

On the basis of type, the ice cream freezer market is segmented into chest freezers/deep freezers, upright freezers, drawer freezers, portable freezers, display freezers, frost free freezers, continuous freezers, and batch freezers. The chest freezers/deep freezers segment dominated the market with the largest share of 38.9% in 2025 due to its strong insulation efficiency and ability to maintain consistent temperatures essential for ice cream preservation. These freezers support bulk storage and long-duration cooling, making them suitable for parlors, retail shops, and distribution points. Their low maintenance needs and energy-efficient design help reduce operational costs for small and mid-sized businesses. The versatility of chest freezers allows them to store multiple SKUs without frequent defrosting. The widespread adoption across both developed and emerging regions reinforces their leading position.

The display freezers segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing installation in supermarkets, hypermarkets, and specialty ice cream outlets. These freezers enhance product visibility with transparent panels and LED illumination, which improves impulse buying and brand promotion. For instance, brands such as Haier offer advanced display freezers designed to achieve uniform cooling and attractive presentation for premium frozen desserts. Retailers prefer these units for their ability to attract customers and maintain consistent temperatures while showcasing diverse offerings. The expansion of modern retail formats supports the rising deployment of display freezers. Their design flexibility and promotional advantage contribute to rapid market expansion.

- By Components

On the basis of components, the ice cream freezer market is segmented into compressor, condenser, filter/dryer, expansion valve, evaporator, accumulator, fan motor, and others. The compressor segment dominated in 2025 due to its crucial role in ensuring cooling reliability and stable operation. High-efficiency compressors maintain precise low temperatures required to preserve ice cream texture and consistency. Manufacturers increasingly focus on durable and energy-efficient compressors that reduce electricity consumption for both commercial and residential users. These components support rapid cooling capability and improved equipment lifespan. Their essential function across all freezer types drives strong preference among retailers and commercial operators. The consistency and durability provided by compressors ensure continued dominance.

The evaporator segment is projected to grow the fastest from 2026 to 2033, supported by its importance in heat exchange and temperature uniformity. Improved evaporator designs enhance cooling distribution and reduce frost build-up, which helps maintain product quality. For instance, companies such as Carrier have introduced upgraded evaporator coils that support faster freeze times and consistent temperature cycles. Rising demand for frost-free and energy-optimized freezer designs accelerates adoption of advanced evaporators. Their contribution to efficient cooling performance strengthens the effectiveness of overall refrigeration systems. The shift toward modern commercial cold storage solutions contributes to strong segment growth.

- By Capacity

On the basis of capacity, the ice cream freezer market is segmented into less than 70 litres, 70–150 litres, 150–300 litres, 300–500 litres, 500–700 litres, and more than 700 litres. The 150–300 litres segment dominated in 2025 because it provides an ideal balance between storage volume and space utilization. Retailers and small commercial outlets prefer this range for its ability to store multiple ice cream varieties efficiently. These freezers support high turnover environments without occupying excessive floor space. Their energy-efficient cooling systems provide stable performance for various product loads. Manufacturers prioritize this capacity range due to strong replacement demand in developing markets. Its adaptability across commercial and residential users reinforces dominance.

The more than 700 litres segment is anticipated to grow the fastest from 2026 to 2033 due to rising investment in large-scale storage for ice cream production and distribution. These freezers support bulk operations required by cold-chain networks, QSR chains, and large retail warehouses. For instance, Blue Star offers high-capacity commercial freezers with improved insulation that supports long-duration temperature stability. Large-volume storage helps businesses maintain supply consistency and reduce logistical costs. Growing expansion of ice cream brands into new markets increases the need for industrial-scale freezing solutions. The segment benefits from growth in centralized cold storage operations.

- By Technology

On the basis of technology, the ice cream freezer market is segmented into manual, semi-automated, and fully automated. The manual segment dominated the market in 2025 due to its affordability, long-term reliability, and ease of use in price-sensitive regions. Small shops and independent ice cream vendors depend on manual freezers for their low maintenance requirements and durability under varying power conditions. These units have simple mechanical controls that ensure operational stability in remote or underserved regions. Their extended lifecycle makes them suitable for cost-conscious buyers prioritizing functional performance. The broad accessibility and low upfront investment reinforce their leading share.

The fully automated segment is projected to record the fastest growth from 2026 to 2033 driven by rising demand for precision cooling and improved operational efficiency. Automated freezers feature digital temperature regulation, smart defrosting, and energy-optimized controls. For instance, Panasonic offers IoT-enabled freezer systems that allow real-time performance monitoring for commercial users. Large retail chains and QSR brands prefer these units for accurate temperature control and reduced manual supervision. Enhanced energy savings support long-term cost reduction for high-volume storage operations. The transition toward technologically advanced retail infrastructure strengthens rapid segment expansion.

- By Distribution Channel

On the basis of distribution channel, the ice cream freezer market is segmented into online, specialty stores, retail outlets, distributors/dealers, electronic stores, supermarket/hypermarket, and others. The supermarket/hypermarket segment dominated in 2025 due to strong consumer footfall and the ability to install multiple display and storage freezers. These outlets depend on large-capacity freezers to ensure uninterrupted product availability across diverse SKUs. Retail chains prefer energy-efficient models to optimize electricity expenses while maintaining high-volume storage. Their structured layout supports effective product placement and visibility for frozen desserts. The rapid expansion of organized retail networks strengthens the dominance of this segment. High product rotation rates improve freezer utilization.

The online segment is expected to grow the fastest from 2026 to 2033, supported by the convenience of doorstep appliance delivery and availability of detailed product specifications. Customers increasingly prefer online channels for transparent pricing, wide product comparisons, and financing options. For instance, Amazon offers extensive ice cream freezer listings with installation support and verified customer reviews, encouraging digital adoption. Manufacturers are expanding direct-to-consumer online strategies to reach a broader audience. Growing internet penetration in emerging markets strengthens e-commerce as a preferred buying method. The ease of warranty registration and digital customer service accelerates growth.

- By End User

On the basis of end user, the ice cream freezer market is segmented into residential and commercial. The commercial segment dominated in 2025 due to heavy demand from ice cream parlors, cafes, restaurants, convenience stores, and cold-chain operators. Commercial establishments require high-performance freezers that maintain consistent low temperatures during extended operating hours. These units support rapid freeze cycles essential for product quality in high-volume environments. Businesses prioritize models with durable construction and energy-optimized mechanisms to reduce long-term operating costs. Expansion of specialty dessert outlets and QSR chains strengthens commercial usage. Their need for reliable, continuous cooling ensures strong dominance.

The residential segment is projected to grow the fastest from 2026 to 2033 due to increasing household consumption of frozen desserts and rising adoption of compact freezers. Urban consumers prefer dedicated freezer units to store premium, artisanal, and bulk ice cream products. For instance, LG offers compact frost-free freezers tailored for modern kitchen spaces, supporting rising lifestyle shifts. Growing awareness regarding energy-efficient home appliances increases adoption among urban families. These units provide convenience for stocking a wider range of frozen snacks and desserts. The expansion of premium frozen food culture accelerates residential market growth.

Middle East and Africa Ice Cream Freezer Market Regional Analysis

- Saudi Arabia dominated the ice cream freezer market with the largest revenue share in 2025, driven by the rapid expansion of modern retail formats, quick-service restaurant chains, and specialty dessert outlets that require reliable, energy-efficient freezing equipment for large-volume storage and display

- Strong growth in the country’s cold-chain infrastructure and increasing consumer preference for premium frozen desserts continue to elevate demand for commercial freezers across supermarkets, hypermarkets, and food-service establishments. Strategic government initiatives supporting retail modernization and hospitality expansion under Vision 2030 are accelerating freezer installations in both urban and developing regions

- The presence of international and regional refrigeration manufacturers, combined with rising adoption of advanced, eco-friendly cooling technologies, reinforces Saudi Arabia’s dominant position in the regional market while strengthening its leadership across commercial frozen food storage

U.A.E. Ice Cream Freezer Market Insight

The U.A.E. is projected to record the fastest CAGR in the Middle East and Africa ice cream freezer market from 2026 to 2033, supported by the country’s expanding hospitality sector, flourishing café culture, and rising number of premium ice cream and gelato brands. For instance, collaborations between global freezer manufacturers and U.A.E.-based distributors to supply energy-efficient, aesthetically designed display freezers are enhancing product presence in malls, resorts, and high-footfall retail locations. Growing demand for grab-and-go dessert formats, strong investment in modern retail infrastructure, and adoption of low-GWP, energy-saving refrigeration systems are accelerating market penetration. Smart city initiatives, tourism-driven food retail expansion, and increasing preference for high-performance freezers with advanced temperature control further position the U.A.E. as the fastest-growing market in the region.

South Africa Ice Cream Freezer Market Insight

South Africa is expected to experience steady growth between 2026 and 2033, driven by the expansion of its organized retail sector, rising popularity of frozen desserts, and increased adoption of commercial freezers across bakeries, convenience stores, and food-service outlets. Modernization of small and mid-sized retail formats and growing consumer preference for packaged ice cream products are boosting demand for reliable, durable, and cost-efficient freezer units. Partnerships between global refrigeration brands and local distributors, along with wider availability of energy-efficient and inverter-based freezers, are improving market coverage across urban and semi-urban areas. Government support for enhancing cold-chain capacity, combined with rising focus on sustainable, low-emission cooling technologies, contributes to consistent long-term growth in South Africa’s ice cream freezer market.

Middle East and Africa Ice Cream Freezer Market Share

The ice cream freezer industry is primarily led by well-established companies, including:

- AHT Cooling Systems GmbH (Austria)

- Panasonic Corporation (Japan)

- Haier Group (China)

- Whirlpool Corporation (U.S.)

- Robert Bosch GmbH (Germany)

- Scandomestic A/S (Denmark)

- Midea Group (China)

- Siemens (Germany)

- Miele (Germany)

- Electrolux (Sweden)

- Metalfrio Solutions (Brazil)

- AHT (Austria)

- Liebherr-International Deutschland GmbH (Germany)

- Vestfrost Solutions (Denmark)

- Ugur Sogutuma AS (Turkey)

- Qingdao Hiron Commercial Cold Chain Co., Ltd. (China)

- Viessmann (Germany)

Latest Developments in Middle East and Africa Ice Cream Freezer Market

- In November 2025, Elanpro expanded its glass-top freezer range for the ice cream and frozen dessert segment, strengthening the market by increasing the availability of high-visibility, energy-efficient retail freezers. This expansion supports modern merchandising needs and enables retailers to adopt upgraded display solutions that enhance product appeal and improve customer engagement. The broader product portfolio also helps the company capture a larger share in the commercial freezer category as branded outlets and convenience stores continue to grow

- In March 2024, Blue Star Ltd introduced a new portfolio of energy-efficient deep freezers ranging from 60 to 600 litres, reinforcing the industry’s shift toward power-optimized refrigeration systems. This launch improves accessibility for both small and large businesses seeking cost-effective freezing solutions while reducing operational costs. The addition of multiple capacity options enhances penetration across retail, foodservice, and cold-chain operators, contributing to greater market competitiveness

- In May 2022, Unilever initiated two pilot programs to test warmer ice cream freezer cabinets aimed at lowering energy consumption and greenhouse-gas emissions by an estimated 20–30% per unit, supporting the market’s transition toward sustainable refrigeration. This initiative encourages freezer manufacturers to innovate around temperature-efficient designs while maintaining product quality standards. It also pushes retailers to consider greener equipment options, accelerating adoption of eco-friendly freezers across global markets

- In February 2022, True Manufacturing upgraded its commercial ice cream freezer line with high-efficiency refrigeration systems designed to lower energy usage and enhance temperature recovery speed, strengthening demand for next-generation freezers. This upgrade supports foodservice operators in maintaining consistent product texture during frequent door openings, a critical factor in busy retail environments. The improved systems also reduce overall operational expenses, promoting wider transition to energy-optimized commercial units

- In October 2021, Haier expanded its presence in the ice cream freezer market by introducing new display freezer models equipped with advanced LED illumination and uniform cooling technology, improving product merchandising for retailers. These upgrades help stores increase impulse purchases by improving visibility and presentation of frozen desserts. The focus on retail-friendly design also boosts demand for modern display freezers across supermarkets, hypermarkets, and specialty outlets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Ice Cream Freezers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Ice Cream Freezers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Ice Cream Freezers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.