Middle East And Africa Image Guided Surgery Equipment And Robot Assisted Surgical Equipment Market

Market Size in USD Million

CAGR :

%

USD

289.34 Million

USD

535.56 Million

2024

2032

USD

289.34 Million

USD

535.56 Million

2024

2032

| 2025 –2032 | |

| USD 289.34 Million | |

| USD 535.56 Million | |

|

|

|

|

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Size

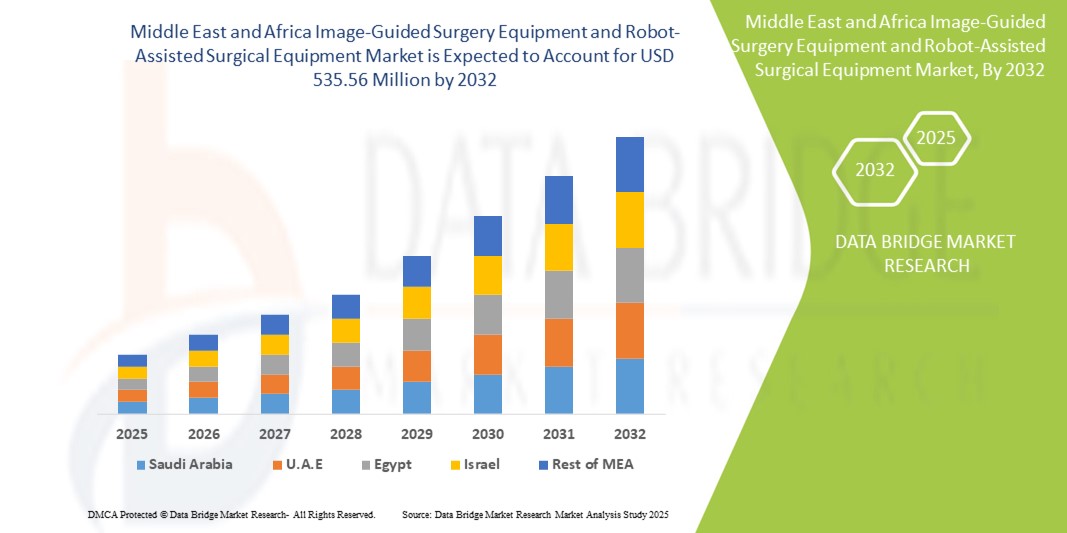

- The Middle East and Africa Image-guided surgery equipment and robot-assisted surgical equipment market size was valued at USD 289.34 Million in 2024 and is expected to reach USD 535.56 Million by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within advanced surgical navigation systems, robotic platforms, and imaging technologies, leading to increased digitalization and precision in both preoperative planning and intraoperative procedures

- Furthermore, rising demand for accurate, user-friendly, and integrated surgical solutions across hospitals and specialty centers is establishing image-guided surgery equipment and robot-assisted surgical systems as the preferred choice for complex interventions. These converging factors are accelerating the uptake of Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment solutions, thereby significantly boosting the industry's growth

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Analysis

- Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment, offering advanced visualization, precision, and minimally invasive capabilities, are increasingly vital components of modern healthcare systems in the Middle East and Africa due to their role in improving surgical outcomes and reducing recovery times

- The escalating demand for these technologies is primarily fueled by rising investments in healthcare infrastructure, growing prevalence of chronic and complex diseases, and increasing adoption of advanced surgical techniques across the region

- Saudi Arabia dominated the image-guided surgery equipment and robot-assisted surgical equipment market in the Middle East & Africa with the largest revenue share of 38.1% in 2024, driven by significant government healthcare investments under Vision 2030, the establishment of advanced surgical centers, and collaborations with global medtech companies

- The United Arab Emirates is expected to be the fastest growing country in the image-guided surgery equipment and robot-assisted surgical equipment market during the forecast period, supported by rising healthcare expenditure, the rapid expansion of specialty clinics, and the integration of robotic and navigation-assisted systems in leading hospitals

- The Minimally Invasive segment dominated with a image-guided surgery equipment and robot-assisted surgical equipment market share of 45.2% in 2024, driven by its ability to significantly reduce patient recovery times, minimize surgical scarring, and lower the risk of intraoperative complications

Report Scope and Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Segmentation

|

Attributes |

Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Trends

Enhanced Precision and Improved Surgical Outcomes

- A significant and accelerating trend in the Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment market is the increasing adoption of advanced surgical navigation and robotic systems, designed to improve precision, reduce complications, and shorten recovery times

- For instance, in February 2024, King Faisal Specialist Hospital in Saudi Arabia introduced new robotic-assisted surgery platforms for neurology and cardiology, enhancing accuracy in complex procedures and setting a benchmark for technological advancement in the region

- Integration of image-guided systems in surgical workflows enables real-time visualization, improved preoperative planning, and intraoperative guidance, which together contribute to higher success rates and better patient outcomes. Hospitals and specialty clinics are increasingly relying on these solutions for critical surgeries, including spine, oncology, and orthopedics

- The use of robot-assisted surgical equipment provides surgeons with enhanced dexterity, minimally invasive access, and superior ergonomics, allowing for complex surgeries to be performed with smaller incisions, less pain, and quicker recovery times for patients

- The seamless integration of these systems with diagnostic imaging modalities such as MRI, CT, and ultrasound facilitates accurate localization of surgical sites, reducing errors and improving confidence among surgeons. This interconnected approach is creating a more efficient and patient-centric surgical ecosystem

- This trend towards precision-driven, minimally invasive, and technologically advanced surgical solutions is fundamentally reshaping expectations in healthcare across the Middle East and Africa. Consequently, companies and hospitals in the region are increasingly investing in state-of-the-art robotic platforms and navigation-assisted equipment to address the growing demand for advanced surgical care

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Dynamics

Driver

Growing Demand Due to Rising Surgical Needs and Healthcare Modernization

- The increasing prevalence of complex surgical cases, coupled with the modernization of healthcare infrastructure in the Middle East and Africa, is driving the growing adoption of Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment

- For instance, in March 2024, King Faisal Specialist Hospital in Saudi Arabia expanded its robotic-assisted surgery suite for neurology and cardiology procedures, highlighting the commitment of regional hospitals to advanced surgical technologies. Such initiatives are expected to propel the market growth over the forecast period

- Surgeons are increasingly adopting navigation-assisted systems and robotic platforms to improve precision, reduce intraoperative errors, and enhance patient outcomes, making these solutions integral to modern surgical practices

- Moreover, government support for advanced healthcare solutions, investments in specialized surgical centers, and collaborations with international medical technology providers are further boosting market adoption in the region

- The convenience of real-time imaging, improved preoperative planning, and minimally invasive surgery capabilities are key factors encouraging hospitals and specialty clinics to implement these technologies across various surgical disciplines

Restraint/Challenge

High Capital Investment and Maintenance Requirements

- High acquisition costs and ongoing maintenance expenses of Image-Guided Surgery and Robot-Assisted systems pose a significant barrier to widespread adoption, particularly for smaller hospitals and clinics in developing regions

- In addition, the need for specialized surgical training and the integration of advanced equipment into existing workflows can slow down implementation

- Addressing these challenges through regional training programs, leasing options, and service agreements with equipment manufacturers is crucial for expanding market penetration

- While costs are gradually being offset by the efficiency gains, improved patient outcomes, and reduced post-operative complications, the initial financial burden can still limit rapid adoption

- Ensuring affordability, improving service networks, and providing adequate clinical support will be vital for sustained growth of the Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment market in the Middle East and Africa

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Scope

The market is segmented on the basis of type, application, procedure type, end user, and distribution channel.

- By Type

On the basis of type, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into Robotic Systems, Instruments and Accessories, and Interventional Imaging Systems and Services. The Robotic Systems segment dominated the market with the largest revenue share of 41.5% in 2024, driven by their superior precision, enhanced dexterity, and ability to perform complex procedures with minimal invasiveness. Hospitals and specialty surgical centers across Saudi Arabia are increasingly investing in robotic platforms to improve surgical outcomes and reduce intraoperative complications. The adoption is supported by partnerships with leading global technology providers and government initiatives to modernize healthcare infrastructure. These systems are widely preferred for minimally invasive surgeries due to reduced patient recovery times and lower infection risks. Continuous training programs for surgeons and expanding technical support further strengthen market penetration. The reliability, reproducibility, and ability to integrate with advanced imaging systems make robotic systems indispensable in modern operating rooms.

The Interventional Imaging Systems and Services segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, driven by the rising need for real-time visualization during procedures and increasing deployment in specialized surgical centers. Hospitals are implementing advanced imaging solutions to enhance surgical accuracy, optimize intervention planning, and monitor patient outcomes. Growth is supported by increasing healthcare investments, rising awareness of advanced diagnostic tools, and improved availability of trained technicians. Integration of imaging systems with robotic platforms also boosts efficiency in minimally invasive procedures, further driving adoption.

- By Application

On the basis of application, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into abdominal surgery, urology, otorhinolaryngology, orthopedic trauma surgery, oncology, gynaecology, neurology, spine surgery, cardiology, respiratory, thoracic surgery, and others. The orthopedic trauma surgery segment dominated with a revenue share of 38.7% in 2024, owing to the high incidence of trauma cases in the region and growing adoption of navigation-assisted systems for fracture repair and joint replacement. Hospitals prefer these systems for their ability to reduce surgical errors, enhance precision, and shorten rehabilitation times. Investments by leading orthopedic centers and collaborations with medical technology companies further drive growth. The segment benefits from the availability of specialized training and technical support for surgeons, ensuring successful outcomes. Increased awareness among patients regarding advanced orthopedic interventions also supports adoption.

The neurology segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, fueled by rising prevalence of neurological disorders and increasing demand for minimally invasive brain and spinal procedures. Hospitals and specialty clinics are deploying navigation-assisted systems for precise neurosurgeries, improving safety and outcomes. Government initiatives and public awareness campaigns promoting neurological care further stimulate growth. Integration with imaging systems allows real-time monitoring during procedures, enhancing procedural accuracy. The rising number of specialized neurosurgeons in the region also contributes to adoption.

- By Procedure Type

On the basis of procedure type, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into open surgery and minimally invasive. The Minimally Invasive segment dominated with a market share of 45.2% in 2024, driven by its ability to significantly reduce patient recovery times, minimize surgical scarring, and lower the risk of intraoperative complications. Surgeons increasingly prefer minimally invasive techniques for abdominal, orthopedic, and cardiovascular procedures, as they enhance procedural precision and improve patient satisfaction. Hospitals in Saudi Arabia and other leading Middle East markets are adopting these techniques at a growing pace, supported by advanced training programs and substantial investment in state-of-the-art operating theaters. The segment benefits from integration with navigation-assisted imaging systems and robotic instruments, which improve surgical accuracy and outcomes. In addition, rising patient awareness about faster recovery and less postoperative pain is accelerating adoption.

The Open Surgery segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, as it continues to play a critical role in complex surgical cases where minimally invasive approaches are not feasible. Hospitals rely on open surgery for high-risk oncology, thoracic, and cardiac procedures, where extensive access and direct visualization are essential. Investment in advanced surgical instruments, coupled with specialized training programs, ensures procedural safety and efficiency. Rising case complexity, growing incidence of advanced-stage diseases, and demand for specialized surgical expertise further support the segment’s growth. The segment remains indispensable for scenarios requiring maximal exposure and precision.

- By End User

On the basis of end user, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into hospitals, ambulatory surgical centers, clinics, and others. The Hospitals segment dominated with a revenue share of 52.4% in 2024, owing to larger infrastructure, substantial budgets, and the ability to deploy comprehensive robotic and navigation-assisted surgical systems across multiple departments. Both government and private hospitals in the Middle East, particularly in Saudi Arabia, are leading the adoption due to strategic healthcare modernization initiatives, skilled surgical teams, and availability of technical support. Hospitals leverage these systems to perform a wide range of procedures with higher precision and improved patient outcomes, establishing them as key adopters in the region.

The ambulatory surgical centers segment is expected to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by growing patient preference for outpatient procedures and shorter hospital stays. Increasing investment in smaller surgical centers, adoption of compact robotic and navigation-assisted systems, and emphasis on procedural efficiency are accelerating market growth. These centers benefit from lower operational costs, faster patient throughput, and ability to offer specialized services without requiring extensive infrastructure. Rising awareness of advanced surgical options among patients, coupled with supportive government regulations and reimbursement policies, further bolsters adoption in the region.

- By Distribution Channel

On the basis of distribution channel, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into direct tender and retail sales. The Direct Tender segment dominated with a share of 60.3% in 2024, as large hospitals, government institutions, and multi-specialty centers prefer centralized procurement of advanced robotic and navigation-assisted surgical systems. This approach ensures cost efficiency, standardized maintenance, and technical support, enabling institutions to deploy high-end systems across multiple surgical departments. In addition, strategic partnerships between manufacturers and healthcare authorities in countries like Saudi Arabia facilitate bulk purchases, long-term service agreements, and training programs, reinforcing the dominance of direct tender. The segment also benefits from government-led healthcare modernization initiatives, which encourage large-scale acquisitions of state-of-the-art surgical equipment.

The retail sales segment is expected to witness the fastest CAGR of 12.1% from 2025 to 2032, driven by smaller clinics, specialty centers, and private surgical facilities investing in individual robotic instruments, imaging systems, and navigation-assisted tools. These institutions prioritize operational flexibility, targeted procedural capabilities, and patient throughput optimization. Growth is further supported by increasing awareness of minimally invasive and precision-guided surgeries among patients, prompting smaller facilities to adopt advanced equipment independently. The availability of modular systems, financing options, and vendor support packages enhances accessibility for smaller centers, while rising investments in outpatient and day-care surgical procedures accelerate the adoption of retail sales channels across the Middle East and Africa.

Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Regional Analysis

- Middle East & Africa dominated by Saudi Arabia with the largest revenue share in 2024, driven by significant government healthcare investments under Vision 2030, establishment of advanced tertiary and specialty surgical centers, and collaborations with global medtech companies

- The country is increasingly adopting robot-assisted and navigation-assisted surgical systems, particularly in neurosurgery, orthopedics, and oncology, where precision and minimally invasive procedures are prioritized

- Strong demand is supported by rising healthcare spending, expansion of high-end hospitals, and strategic partnerships facilitating faster deployment of next-generation surgical technologies

Saudi Arabia Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Insight

The Saudi Arabia image-guided surgery equipment and robot-assisted surgical equipment market dominated the Middle East & Africa market with the largest revenue share of 38.1% in 2024, fueled by government investments, state-of-the-art surgical centers, and partnerships with leading medtech companies. Adoption is highest in neurosurgery, orthopedics, and oncology, emphasizing robotic and navigation-assisted precision. Public and private hospitals are rapidly deploying these systems to enhance patient outcomes, and Vision 2030 initiatives continue to support expansion across tertiary and specialty care facilities.

UAE Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Insight

The United Arab Emirates image-guided surgery equipment and robot-assisted surgical equipment market is expected to be the fastest-growing country in the Middle East & Africa market during the forecast period, supported by rising healthcare expenditure, rapid expansion of specialty clinics, and adoption of robotic and navigation-assisted systems in leading hospitals. Growth is driven by strong investments in medical tourism, digital healthcare innovation, and advanced surgical infrastructure, particularly in cardiology, neurology, and oncology. Collaborative initiatives with international providers and patient inflow from neighboring regions further propel market expansion.

Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Share

The Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment industry is primarily led by well-established companies, including:

- Brainlab (Germany)

- Stereotaxis, Inc. (U.S.)

- Titan Medical Inc. (Canada)

- PS-Medtech (Netherlands)

- Renishaw plc. (U.K.)

- Intuitive Surgical (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- Siemens Healthineers AG (Germany)

- Hitachi Ltd. (Japan)

- Smith+ Nephew (U.K.)

- Stryker (U.S.)

- Koninklijke Philips N.V. (Netherlands)

Latest Developments in Middle East and Africa Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market

- In July 2025, Zimmer Biomet announced its acquisition of Monogram Technologies for approximately USD 177 million. This strategic move aims to enhance Zimmer Biomet's robotics portfolio, particularly in surgical robotics. Monogram specializes in semi- and fully autonomous surgical technologies, including a semi-autonomous knee replacement system approved by the FDA in March 2025. The acquisition is expected to contribute to revenue growth beginning in 2027

- In September 2024, Mendaera, a medical-robotics startup based in San Mateo, California, raised USD 73 million in a Series B funding round led by Threshold Ventures. The company has developed a robotic system integrated with ultrasound to enhance precision in needle-based medical procedures. Mendaera aims to extend robotics from high-end surgeries to more common procedures, addressing workforce shortages and patient backlogs exacerbated by the Covid-19 pandemic. The company plans to seek FDA clearance in 2025 and to conduct clinical studies to prove the clinical benefits of their technology

- In August 2023, Siemens Healthineers joined an International Finance Corporation (IFC) facility to boost access to affordable medical equipment in Africa. This collaboration aims to enhance access to medical technologies, including surgical navigation systems, in the region

- In October 2023, Philips launched the Zenition 30 mobile C-arm system during Global Health 2023 in Saudi Arabia. The Zenition 30 offers personalized control and image clarity to enhance the speed and accuracy of decision-making for a range of clinical procedures. This launch aligns with Saudi Arabia's Vision 2030 initiative to improve healthcare infrastructure and access

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.