Middle East And Africa Indoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

6.30 Billion

USD

8.65 Billion

2024

2032

USD

6.30 Billion

USD

8.65 Billion

2024

2032

| 2025 –2032 | |

| USD 6.30 Billion | |

| USD 8.65 Billion | |

|

|

|

|

Indoor LED Lighting Market Size

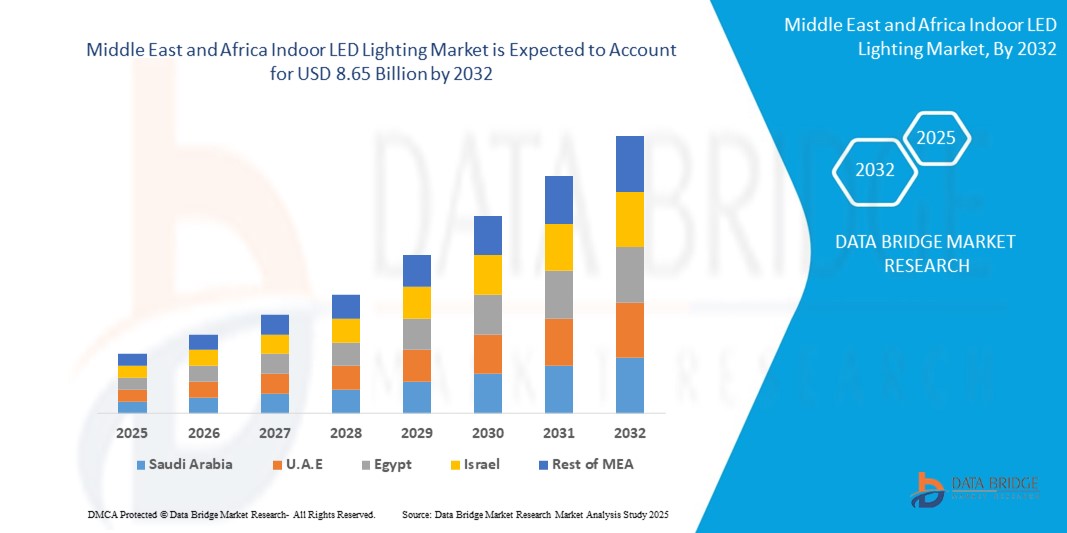

- The Middle East and Africa Indoor LED Lighting Market was valued at USD 6.3 billion in 2025 and is projected to reach USD 8.65 billion by 2032, growing at a CAGR of 4.63% during the forecast period.

- This market growth is driven by increasing government mandates for energy efficiency, growing investments in smart infrastructure, and rising consumer awareness about long-term cost savings. Technological advancements in smart lighting, automation compatibility, and IoT-enabled LED systems are accelerating adoption across residential, commercial, and industrial segments in the region.

Indoor LED Lighting Market Analysis

- Indoor LED lighting systems are energy-efficient lighting technologies that offer long lifespan, reduced maintenance, and superior brightness compared to traditional incandescent and fluorescent lighting. These systems play a critical role in lowering energy consumption, supporting sustainability goals, and enabling smart building operations across residential, commercial, and industrial sectors.

- The growing demand for energy-efficient solutions, rising electricity costs, and government initiatives promoting green building standards are significantly accelerating the adoption of indoor LED lighting across the Middle East and Africa. Commercial buildings, including offices, malls, and educational institutions, are increasingly retrofitting with LED systems to comply with environmental policies and reduce operational costs.

- The Gulf Cooperation Council (GCC) countries lead the indoor LED lighting market in the region, with Saudi Arabia and the UAE at the forefront due to ambitious smart city initiatives, building energy codes, and government-led sustainability programs like Saudi Vision 2030 and the UAE Energy Strategy 2050.

- South Africa holds a major share of the African indoor LED lighting market in 2025, driven by its urban infrastructure development, energy-efficiency campaigns, and increasing commercial real estate activity. Additionally, ongoing challenges with electricity reliability are encouraging businesses and institutions to shift to low-energy lighting alternatives like LEDs.

- The Downlights and LED Tubes & Bulbs segments are expected to dominate the market with a combined share exceeding 40% in 2025, due to their widespread usage in homes, offices, and commercial facilities. Their ease of installation, compatibility with smart controls, and affordability make them key contributors to indoor lighting upgrades.

Report Scope and Indoor LED Lighting Market Segmentation

|

Attributes |

Indoor LED Lighting Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

The rising adoption of smart homes, commercial automation, and energy management systems is significantly boosting the demand for connected LED lighting solutions in the Middle East and Africa. Features such as motion sensing, daylight harvesting, wireless dimming, and remote control are creating strong opportunities for lighting manufacturers to offer intelligent, value-added products that enhance energy efficiency and user comfort.

Governments across the region are implementing energy efficiency policies, green building codes, and public sector retrofit programs that promote the replacement of conventional lighting with LEDs. Certifications such as LEED and Estidama are gaining traction in new construction and renovation projects, presenting lighting firms with substantial growth prospects in both the public and private sectors. |

|

Value Added Data Infosets |

In addition to insights on market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated for the Middle East and Africa Indoor LED Lighting Market also include import-export analysis, lighting energy savings potential, installation cost benchmarking, price trend analysis, regional government subsidy mapping, supply chain and distribution network evaluation, raw material and component sourcing overview, vendor selection and performance benchmarking, as well as in-depth strategic tools such as PESTLE Analysis, Porter's Five Forces Analysis, and regional regulatory frameworks related to energy efficiency, green building standards, and indoor lighting codes.. |

Indoor LED Lighting Market Trends

“Proliferation of Smart, Sensor-Integrated, and IoT-Enabled Lighting Solutions”

- A key accelerating trend in the Middle East and Africa indoor LED lighting market is the integration of IoT technologies, motion sensors, and wireless connectivity into LED lighting systems, enabling real-time energy optimization, remote management, and intelligent automation in both residential and commercial buildings.

- For example, smart lighting platforms now combine occupancy sensors, daylight harvesting, and centralized controls to reduce energy consumption and enhance comfort. Companies like Signify and Acuity Brands are leading the development of connected lighting ecosystems tailored for smart homes and commercial facilities.

- These advanced systems can adjust brightness and color temperature automatically based on user behavior or ambient conditions, offering personalized lighting environments and energy savings.

- The integration of cloud-based platforms allows facility managers to monitor and control lighting systems remotely, optimize maintenance schedules, and access energy usage analytics in real time.

- The ongoing trend toward miniaturized, modular LED components supports flexible installation and seamless integration into architectural spaces, catering to modern interior design and retrofit demands.

- Major lighting manufacturers are investing in AI-enabled lighting controls and open-protocol smart lighting systems that can interface with building management systems (BMS) and other IoT devices.

- The rising demand for adaptive, connected, and intelligent lighting is reshaping indoor environments, making smart LED systems a cornerstone of sustainable, tech-driven infrastructure in the Middle East and Africa.

Indoor LED Lighting Market Dynamics

Driver

“Increasing Demand Driven by Energy Efficiency Mandates and Infrastructure Expansion”

- The growing implementation of government policies focused on energy efficiency, climate change mitigation, and sustainable urban development is a major driver accelerating demand for indoor LED lighting solutions across the Middle East and Africa. Regulatory frameworks are promoting the transition from incandescent and fluorescent lighting to energy-saving LED systems in both new construction and retrofit projects.

- For example, the UAE has mandated the use of energy-efficient lighting in all public buildings, while Saudi Arabia’s SASO standards restrict inefficient lighting imports, reinforcing the market shift.

- As energy costs rise and electricity grid reliability becomes a challenge in parts of Africa, commercial and residential users are increasingly adopting LED lighting to reduce utility bills and maintenance burdens.

- Urbanization and large-scale infrastructure investments in offices, educational institutions, hospitals, and government buildings are further contributing to the widespread deployment of LED systems.

- Additionally, the push for smart city development and green building certifications (e.g., LEED, Estidama) is creating strong demand for intelligent, sensor-based lighting systems that integrate with broader building management and energy monitoring platforms.

- The scalability, long service life, and low energy footprint of LEDs are making them essential components in energy conservation strategies, positioning the technology as a foundational element of sustainable urban growth in the region.

Restraint/Challenge

“High Upfront Costs and Limited Awareness in Rural and Emerging Areas”`

- While indoor LED lighting delivers substantial long-term savings, the initial investment cost for quality fixtures, smart lighting controls, and installation remains a barrier to entry in price-sensitive and rural segments of the Middle East and Africa.

- In many areas, consumers and small businesses still rely on cheaper, less efficient lighting due to budget constraints or lack of access to financing or subsidy programs.

- Awareness about the total cost of ownership (TCO), environmental benefits, and government incentives for LED adoption is often limited outside urban centers, hindering market penetration in remote and underserved regions.

- In addition, the availability of counterfeit or low-quality LED products in informal markets can damage consumer trust and result in poor lighting performance, further discouraging adoption.

- Addressing these challenges will require greater outreach through awareness campaigns, subsidies or tax incentives, and stronger enforcement of quality and import standards.

- As costs continue to decline and smart lighting gains traction, greater market education and infrastructure development will be critical to unlocking widespread adoption across all socioeconomic segments.

Indoor LED Lighting Market Scope

The market is segmented on the basis of product type, application, and distribution channel.

- By Product Type

The indoor LED lighting market is segmented into recessed lighting, LED tubes & bulbs, downlights, troffers, and others. The LED tubes & bulbs segment is expected to hold the largest market share in 2025, due to their ease of replacement, wide availability, and cost-effectiveness. These products are extensively used in both residential and commercial spaces for general illumination. Meanwhile, smart recessed lighting and downlights are projected to witness the fastest growth through 2032, driven by increased deployment in modern homes, offices, and smart buildings requiring integrated design and control flexibility.

- By Application

Applications include residential, commercial, industrial, and others. The commercial segment dominates the market in terms of revenue share in 2025, owing to growing LED adoption in retail outlets, office buildings, educational institutions, and hospitality spaces for both aesthetic appeal and operational cost reduction. The residential segment is also growing steadily due to rising consumer awareness of energy savings and increasing government programs encouraging LED use in homes across urban and rural areas.

- By Distribution Channel

The market is segmented into online and offline channels. The offline segment (including electrical distributors, specialty lighting retailers, and hardware stores) currently holds the largest share, benefiting from established distribution networks and bulk procurement by commercial buyers. However, the online channel is expected to grow rapidly from 2025 to 2032, driven by rising e-commerce penetration, availability of smart lighting products online, and consumer preference for convenience, reviews, and competitive pricing.

Indoor LED Lighting Market Regional Analysis

- The Middle East and Africa region is rapidly emerging as a key growth market for indoor LED lighting, driven by energy efficiency mandates, infrastructure modernization, and widespread efforts to reduce electricity consumption across residential and commercial sectors. The region is projected to hold a significant share of the global indoor LED lighting market by 2025, with notable government-led initiatives in sustainability and smart infrastructure development.

- Countries such as Saudi Arabia and the UAE are leading the market, backed by strong regulatory support, smart city programs (e.g., NEOM, Masdar), and mandates for high-efficiency lighting systems in new construction and public sector buildings. These markets benefit from high investment in commercial real estate and energy-conscious retrofitting.

- In Africa, South Africa holds a dominant position, supported by national energy efficiency strategies, growing commercial adoption, and increasing pressure to reduce load on the grid. Rising electricity tariffs and ongoing power shortages are prompting a rapid shift toward low-energy lighting alternatives like LEDs across both public and private sectors.

- The broader regional growth is supported by international funding for energy efficiency projects, rapid urbanization, and increasing public awareness about LED benefits. As governments continue to push for sustainable development and modernization of lighting infrastructure, the Middle East and Africa are becoming central to global LED adoption trends and market expansion.

Saudi Arabia Indoor LED Lighting Market Insight

The Saudi Arabian indoor LED lighting market is poised for strong growth, driven by the country's Vision 2030 initiative, which emphasizes energy efficiency, smart city infrastructure, and green building development. The government has implemented stringent lighting efficiency regulations through SASO (Saudi Standards, Metrology and Quality Organization), which mandate LED use in new construction and public buildings.

Large-scale projects like NEOM, The Line, and Qiddiya are integrating smart LED lighting systems into their infrastructure blueprints, fueling demand across residential, commercial, and industrial applications. The retrofit market is also gaining traction, with older buildings being upgraded to meet sustainability goals.

United Arab Emirates (UAE) Indoor LED Lighting Market Insight

The UAE has established itself as a regional leader in smart infrastructure and energy conservation, with Dubai and Abu Dhabi actively promoting the use of indoor LED lighting in both government and private sectors. The Dubai Municipality mandates LED lighting in public buildings, and the UAE Energy Strategy 2050 sets clear targets for reducing energy consumption per capita.

Major developments in hospitality, retail, and residential sectors—especially in Dubai’s Expo 2020 legacy sites—are boosting demand for connected and sensor-enabled lighting systems. Additionally, the growing prevalence of smart home solutions is accelerating consumer interest in LED automation and app-based controls.

South Africa Indoor LED Lighting Market Insight

South Africa represents the most developed indoor LED lighting market in sub-Saharan Africa, driven by power supply challenges, rising electricity costs, and the need for grid stabilization. The government’s National Energy Efficiency Strategy (NEES), supported by Eskom’s Demand Side Management (DSM) programs, has created a favorable environment for LED adoption, especially in the commercial and public sectors.

The retail and office segments are particularly active in replacing fluorescent and halogen systems with LEDs to reduce operational costs. Urban centers like Johannesburg, Cape Town, and Durban are experiencing increased LED deployment, while educational institutions and hospitals are leading in retrofit initiatives.

Rest of Middle East and Africa Indoor LED Lighting Market Insight

- Emerging economies such as Egypt, Nigeria, Kenya, and Morocco are witnessing rising adoption of indoor LED lighting, supported by urbanization, electrification efforts, donor-funded green energy projects, and regional lighting standards harmonized with international codes.

- In Egypt, the government has partnered with development banks to implement energy-saving LED programs in schools and government buildings.

- Nigeria is experiencing strong growth in residential and commercial lighting, supported by expanding retail construction and rising awareness of LED cost savings.

- Kenya and Morocco are investing in sustainable infrastructure and offering subsidies for energy-efficient technologies, creating new opportunities for lighting manufacturers and suppliers across the region.

Indoor LED Lighting Market Share

The market competitive landscape provides detailed insights by competitor. Details included are company overview, financial performance, revenue generated, market presence in the Middle East and Africa, investment in research and development, strategic partnerships, regional expansion initiatives, local production or distribution capabilities, and product portfolios specific to indoor LED lighting.

The analysis also covers competitive advantages such as technological innovation, price competitiveness, brand reputation, product customization, and energy-efficiency certifications. Key players are evaluated on parameters such as product launch frequency, product width and depth, application focus (e.g., residential, commercial, industrial), and their alignment with regional regulatory standards and smart lighting trends.

The above data points are specifically curated to reflect each company’s competitive positioning and strategic focus within the Middle East and Africa indoor LED lighting market.

The Major Market Leaders Operating in the Market Are:

- Signify Holding (Philips) (Netherlands)

- OSRAM GmbH (Germany)

- Zumtobel Group (Austria)

- Acuity Brands, Inc. (United States)

- Cree Lighting (United States)

- Eaton Corporation (Ireland)

- Havells Sylvania (United Kingdom)

- Fagerhult Group (Sweden)

- NVC Lighting (China)

- Thorn Lighting (United Kingdom)

Latest Developments in Middle East and Africa Indoor LED Lighting Market

- In April 2025, Signify (Philips) launched a new range of IoT-connected LED luminaires specifically designed for smart commercial buildings in the Middle East, featuring integrated motion and daylight sensors. The series supports real-time energy management and is fully compatible with major building management systems (BMS).

- In March 2025, Zumtobel Group partnered with a UAE-based real estate developer to deploy sensor-driven LED lighting systems across multiple mixed-use developments in Abu Dhabi. The collaboration includes human-centric lighting solutions to enhance occupant comfort in office and hospitality environments.

- In February 2025, Acuity Brands expanded its presence in Africa through a joint venture with a South African energy services firm. The initiative focuses on delivering retrofitting solutions for schools, hospitals, and municipal buildings using energy-efficient LED lighting combined with wireless control systems.

- In January 2025, Cree Lighting introduced its next-generation modular LED downlight series in the GCC market. The new products are engineered for quick installation, reduced heat output, and superior color rendering, making them ideal for high-end retail and residential interiors.

- In December 2024, Fagerhult Group secured a government contract in Kenya to supply LED lighting systems for public education facilities, incorporating daylight-responsive dimming and maintenance-free design. This marks the company's expanding footprint in East Africa's energy transformation initiatives.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Indoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Indoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Indoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.