Middle East And Africa Industrial Controller Market

Market Size in USD Billion

CAGR :

%

USD

10.25 Billion

USD

16.64 Billion

2024

2032

USD

10.25 Billion

USD

16.64 Billion

2024

2032

| 2025 –2032 | |

| USD 10.25 Billion | |

| USD 16.64 Billion | |

|

|

|

|

Middle East and Africa Industrial Controller Market Analysis

The Middle East and Africa industrial controller market is witnessing significant growth, driven by advancements in automation, IoT integration, and Industry 4.0 adoption. These controllers play a crucial role in optimizing manufacturing processes across industries such as automotive, energy, food & beverage, and pharmaceuticals, ensuring precision, efficiency, and real-time monitoring. The increasing demand for smart factories, coupled with the need for cost reduction, operational safety, and predictive maintenance, is fueling market expansion. In addition, the rise of AI-driven automation, edge computing, and cybersecurity solutions is shaping the future of industrial controllers, enabling seamless data processing and connectivity. As industries continue to embrace digital transformation, the market is poised for sustained growth, with a strong focus on scalability, interoperability, and sustainability.

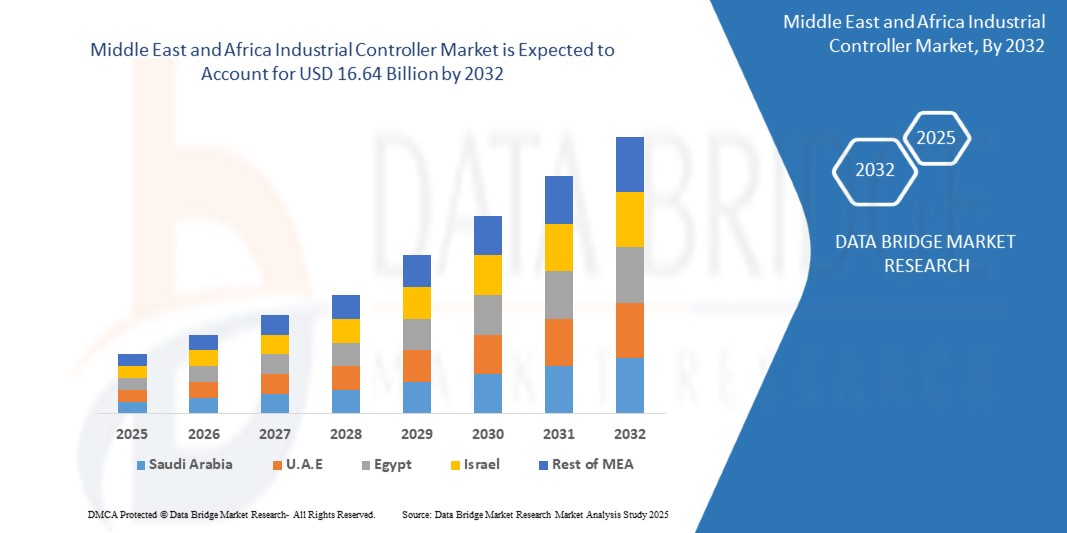

Middle East and Africa Industrial Controller Market Size

Data Bridge Market Research analyses that the Middle East and Africa industrial controller market is expected to reach USD 16.64 billion by 2032 from USD 10.25 billion in 2024, growing with a CAGR of 6.4% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Middle East and Africa Industrial Controller Market Trends

“Edge Computing Enhances Industrial Controller Data Processing Speed”

Edge computing revolutionizes industrial controller data processing by shifting computation from centralized cloud servers to the network's edge, near data generation points. This proximity dramatically reduces latency, enabling real-time analysis crucial for time-sensitive industrial operations. Localized processing empowers swift decision-making, optimizing operational efficiency and minimizing costly downtime. By processing data on-site, edge computing alleviates network congestion and strengthens cybersecurity by reducing data transmission to external systems. This localized approach supports advanced predictive maintenance, allowing for proactive identification and resolution of potential equipment failures. As industries embrace automation and IoT, edge computing becomes vital for optimizing performance, ensuring responsiveness, and enhancing overall system reliability.

Report Scope and Middle East and Africa Industrial Controller Market Segmentation

|

Report Metric |

Middle East and Africa Industrial Controller Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

ABB (Switzerland), Siemens (Germany), Hitachi Industrial Equipment Systems Co., Ltd (Japan), Honeywell International Inc. (U.S.), Schneider Electric (France), Mitsubishi Electric Corporation (Japan), GE Grid Solutions, LLC (U.S.), Emerson Electric Co. (US), OMRON Corporation (Japan), Kawasaki Heavy Industries, Ltd (Japan), JTEKT Electronics India Pvt. Ltd. (Tokyo), Rockwell Automation (U.S.), YOKOGAWA ELECTRIC CORPORATION (Japan), DELTA ELECTRONICS, INC (Taiwan), AUDUBONCOMPANIES (U.S.), ASROCK INDUSTRIAL (Taiwan), IDEC Corporation (Japan), Red Lion (U.S.), Ascon Tecnologic (Italy), WEINTEK USA. (U.S.), ANAHEIM AUTOMATION, INC. (U.S.), South Shore Controls, Inc (U.S.), NATIONAL INSTRUMENTS CORP. (U.S.), META THERM FURNACE PVT LTD (India) among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Middle East and Africa Industrial Controller Market Definition

An industrial controller is a specialized automation device used to monitor, control, and optimize industrial processes and machinery in manufacturing, energy, transportation, and other industries. It ensures precision, efficiency, and reliability by processing real-time data and executing programmed instructions. Industrial controllers include Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems, each designed for specific automation tasks. These controllers integrate with sensors, actuators, and communication networks to enable seamless industrial operations, improve safety, reduce downtime, and support digital transformation through IoT and Industry 4.0 technologies

Middle East and Africa Industrial Controller Market Dynamics

Drivers

- Rapid Urbanization and Infrastructure Development

The growing expansion of manufacturing facilities worldwide is driving demand for industrial controller systems to enhance automation, efficiency, and process control. As industries adopt smart manufacturing and Industry 4.0 technologies, the need for Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems is increasing. These controllers optimize operations, reduce downtime, and improve productivity, making them essential for modern manufacturing environments. In addition, the rise of IoT-enabled automation and real-time monitoring further accelerates market growth, as industries seek advanced control solutions to streamline production and ensure operational reliability.

For Instance,

- In September 2024, according to a blog published by Fictiv, the number of enterprises in the manufacturing market is projected to grow to 6.14 million by 2029, reflecting a 2.15% CAGR. Between 2024 and 2029, material products and medical devices are expected to see the highest growth (16.7% increase each), followed by consumer goods and industrial products (10.8% each), while automotive products will grow by 7.1%. The 11.2% overall growth from 2024 to 2029 is more than double the 5.1% increase from 2018 to 2024, highlighting the rapid expansion of manufacturing. This surge in enterprises will drive higher demand for industrial controller systems, as manufacturers seek to enhance automation, efficiency, and process control to support the growing industry.

Growing Need for Real-Time Monitoring Boosts Smart Control System Adoption

The increasing demand for real-time monitoring in industrial operations is driving the adoption of smart control systems, enhancing efficiency, predictive maintenance, and process optimization. Manufacturing is integrating PLCs, DCS, and SCADA systems with IoT and AI to enable instant data analysis, remote monitoring, and automated decision-making. This shift reduces downtime, improves safety, and ensures compliance with stringent operational standards. As manufacturing and infrastructure sectors prioritize data-driven control solutions, the Middle East and Africa industrial controller market is witnessing significant growth, fueled by advancements in connectivity, edge computing, and smart automation technologies.

For instance,

- In February 2024, according to the blog published by Endeavor Business Media, LLC, the integration of PLCs and camera systems is enhancing automation in quality control, driven by the need for real-time monitoring in industrial environments. Advanced image comparison algorithms, pattern recognition techniques, and barcode or QR-code readers are being embedded into PLC programming, ensuring faster and more accurate inspections. Bosch Rexroth’s ctrlX OS further supports this shift by providing an app-based approach to industrial automation, enabling seamless integration of motion control, PLCs, IoT applications, and AI-driven vision systems

Opportunities

- Cloud-Based Analytics Optimize Real-Time Industrial Controller Insights

By leveraging cloud computing, businesses can process vast amounts of data from industrial controllers, gaining actionable insights with minimal latency. This facilitates improved decision-making, reduces downtime, and supports scalable operations. As industries increasingly adopt IoT and AI-driven automation, cloud-based analytics provide a competitive edge by ensuring seamless data integration, remote monitoring, and adaptive control strategies, driving innovation and operational excellence.

For instance,

- In May 2024, according to an article published by Endeavor Business Media, LLC, the OPC Foundation launched an IT/cloud initiative to enhance interoperability across IT and cloud platforms using OPC UA, enabling advanced data analytics, digital twins, and AI applications. Supported by major cloud providers such as AWS and Microsoft, this initiative optimizes OPC UA for cloud-based applications, reducing costs and improving usability. This presents a key market opportunity, as cloud-based analytics enhance real-time industrial controller insights by ensuring seamless data integration, AI-driven analytics, and secure, standardized communication, enabling predictive maintenance, improved efficiency, and smarter industrial automation

Growing Adoption of Modular and Scalable Controllers

The growing adoption of modular and scalable controllers presents a significant market opportunity by enabling flexible, cost-effective, and future-proof automation solutions. Industries can easily upgrade and expand their control systems without extensive overhauls, improving operational efficiency and reducing downtime. With the increasing demand for adaptable automation in manufacturing, energy, and industrial sectors, companies investing in modular controllers can offer enhanced customization, seamless integration with cloud-based analytics, and better performance optimization, positioning themselves for long-term growth in the evolving digital landscape.

For instance,

- In September 2024, according to the blog published by WTWH Media LLC, Applied Motion Products (AMP) introduced the CPBD-A-C remote control module, enhancing the flexibility and usability of its CSM34 Conveyor Smart Motor. This module enables remote configuration of motion profiles, real-time system monitoring, and manual conveyor adjustments, eliminating the need for operators to be physically near the motor. With integrated controls, a status display, and push-button functionality, it streamlines conveyor operations while reducing wiring complexity. This aligns with the growing adoption of modular and scalable controllers in the market, presenting significant opportunities by allowing industries to optimize automation processes with adaptable, easily upgradable, and cost-efficient solutions

Restraints/Challenges

- Cyber Threats Increase Industrial Controller System Vulnerabilities

As industrial systems become more interconnected through IoT and cloud-based control solutions, they become prime targets for cyberattacks, including ransomware, data breaches, and system disruptions. These vulnerabilities can lead to severe financial losses, production halts, and compromised safety in critical industries such as oil and gas, manufacturing, and power generation. Additionally, the high costs associated with implementing robust cybersecurity measures and compliance with evolving regulations create further challenges for market growth. The increasing sophistication of cyber threats continues to erode confidence in industrial automation, deterring businesses from fully embracing advanced control technologies.

For instance,

- In July 2024, according to an article published by TechTarget, Inc., Dragos researchers identified a new industrial control system-specific malware, FrostyGoop, which exploits the Modbus transmission control protocol to attack operational technology environments. The malware, linked to a January attack on a Ukrainian energy provider, disrupted heating for over 600 buildings by manipulating Enco controllers through Modbus commands. With over 46,000 systems worldwide using the Modbus protocol, FrostyGoop presents a significant cybersecurity threat, as it remains undetectable by antivirus software and does not require prior system compromise

Semiconductor Shortages Delay Controller Manufacturing And Supply Chains

The ongoing semiconductor shortages have significantly impacted controller manufacturing and disrupted supply chains, posing a major challenge to the market. With critical components in short supply, production delays have increased, leading to extended lead times and higher costs for manufacturers and end-users. This bottleneck affects various industries relying on advanced controllers for automation, limiting their ability to scale operations efficiently. As demand for controllers continues to rise, companies must navigate supply chain constraints, explore alternative sourcing strategies, and invest in long-term solutions to mitigate the risks associated with semiconductor shortages.

For instance,

- In April 2024, according to an article published by The Indian Express [P] Ltd., a powerful 7.4 magnitude earthquake in Taiwan raised fresh concerns about semiconductor shortages, potentially impacting controller manufacturing and Middle East and Africa supply chains. Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker, temporarily halted production at some of its plants but managed to resume over 70% of operations within the same day. This highlights the persistent vulnerability of Middle East and Africa supply chains to natural disasters, reinforcing the need for diversified sourcing strategies and resilient manufacturing ecosystems to mitigate such challenges

In an increasingly interconnected Middle East and Africa market, semiconductor shortages continue to pose significant challenges to controller manufacturing and supply chains. Disruptions in mature process node production, rising demand across industries, and geopolitical factors have created supply constraints that impact industrial automation, automotive, and other critical sectors. Delays in chip availability can lead to production slowdowns, increased costs, and reduced scalability for manufacturers relying on these components. As demand surges and supply remains uncertain, businesses must adopt proactive strategies, including supply chain diversification, strategic partnerships, and investment in alternative technologies, to mitigate risks and ensure long-term stability.

Middle East and Africa Industrial Controller Market Scope

The Middle East and Africa industrial controller market is segmented into six notable segments based on the type, components, control, network type, enterprise size, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

Components

- Human Machine Interface (HMI)

- Remote Terminal Unit (RTU)

- IT And OT

- By Type

- Hardware Systems

- Software Systems

- By Type

- Programmable Automation Controller

- Control Loop

- Others

Control

- Closed-Loop Control

- Open-Loop Control

- On-Off Control

- Feed-Forward Control

Network Type

- Ethernet For Control Automation Technology (ETHERCAT)

- Modbus

- Common Industrial Protocol (CIP)

- Process Filed Bus (Profibus)

- By Type

- RTU To MTU

- MTU To MTU

- RTU To RTU

- By Type

- Open Platform Communication (OPC)

- By Operating System

- DCOM

- Com

- Ole

- By Operating System

- Distributed Network Protocol (Dnp3)

- Building Automation And Control Networks (BACNET)

Enterprise Size

- Large Enterprises

- Medium-Sized Enterprises

- Small Enterprises

Application

- Manufacturing

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Oil And Gas

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By End-User Process

- Refining And Processing

- Production And Extraction

- Transportation And Storage

- Drilling And Exploration

- By Deployment Type

- On-Shore Deployment

- Off-Shore Deployment

- By Function

- Process Automation And Control

- Real-Time Monitoring And Data Acquisition

- Operational Efficiency And Optimization

- Safety And Risk Management

- By Type

- Energy And Utilities

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Automotive

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Food Processing And Beverages

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Water And Wastewater

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Aerospace And Aviation

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Others

Middle East and Africa Industrial Controller Market Regional Analysis

The Middle East and Africa industrial controller market is segmented into six notable segments based on the type, components, control, network type, enterprise size, and application

The countries covered in the market report as South Africa, Saudi Arabia, Egypt, U.A.E., Israel, Kuwait, Qatar, Oman, Bahrain and Rest of Middle East and Africa

South Africa is expected to dominate the industrial controller market due to its rapid industrialization, strong manufacturing base, and significant investments in automation and smart factories. The region's expanding consumer electronics, automotive, and semiconductor industries further fuel demand for advanced industrial controllers.

The South Africa country is poised to fastest growing region due to its rapid industrialization, robust manufacturing base, and substantial investments in automation and smart factories, fueled by strong government initiatives supporting Industry 4.0 adoption. The country expanding consumer electronics, automotive, and semiconductor industries, coupled with the increased adoption of IIoT and Industry 4.0 technologies, drive the demand for advanced industrial controllers,

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Industrial Controller Market Share

Industrial controller market competitive landscape provides details of the competitor. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa Free Space Optical Communication Market.

Middle East and Africa Industrial Controller Market Leaders Operating in the Market are:

- ABB (Switzerland)

- Siemens (Germany)

- Hitachi Industrial Equipment Systems Co., Ltd (Japan)

- Honeywell International Inc. (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- GE Grid Solutions, LLC (U.S.)

- Emerson Electric Co. (US)

- OMRON Corporation (Japan)

- Kawasaki Heavy Industries, Ltd (Japan)

- JTEKT Electronics India Pvt. Ltd. (Tokyo)

- Rockwell Automation (U.S.)

- YOKOGAWA ELECTRIC CORPORATION (Japan)

- DELTA ELECTRONICS, INC (Taiwan)

- AUDUBONCOMPANIES (U.S.)

- ASROCK INDUSTRIAL (Taiwan)

- IDEC Corporation (Japan)

- Red Lion (U.S.)

- Ascon Tecnologic (Italy)

- WEINTEK USA. (U.S.)

- ANAHEIM AUTOMATION, INC. (U.S.)

- South Shore Controls, Inc (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- META THERM FURNACE PVT LTD (India)

Latest Developments in Middle East and Africa Industrial Controller Market

- In May 2024, Siemens introduced the Simatic Automation Workstation at Automate 2024, a software-defined solution replacing PLCs, HMIs, and edge devices with a centralized system. Ford Motor Company will be the first to deploy it. This innovation strengthens Siemens' Industrial Controller portfolio by enhancing IT-OT integration, security, and scalability, offering manufacturers greater flexibility and efficiency in automation

- In October 2024, Emerson has finalized its USD 8.2 billion acquisition of National Instruments (NI), incorporating NI into its new Test & Measurement segment and further solidifying its leadership in Middle East and Africa automation. This move benefits NI by expanding the market reach of its industrial controller offerings through enhanced product synergies with Emerson’s automation portfolio and improved access to high-growth industrial software and control solutions

- In April 2024, Siemens unveiled the Simatic S7-1200 G2 controller at Hannover Messe 2024, its first new generation in a decade. Launching in winter 2024, it offers enhanced motion control, flexible safety, and improved performance, integrating with Siemens Xcelerator. This strengthens Siemens' Industrial Controller lineup by bridging OT and IT, boosting efficiency, and enabling smarter automation

- In October 2023, Emerson has finalized its USD 8.2 billion acquisition of National Instruments (NI), incorporating NI into its new Test & Measurement segment and further solidifying its leadership in Middle East and Africa automation. This move benefits NI by expanding the market reach of its industrial controller offerings through enhanced product synergies with Emerson’s automation portfolio and improved access to high-growth industrial software and control solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL

4.2.2 ECONOMIC

4.2.3 SOCIAL

4.2.4 TECHNOLOGICAL

4.2.5 ENVIRONMENTAL

4.2.6 LEGAL

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: IMPORT-EXPORT SCENARIO

4.5.1 IMPORT TRENDS: KEY PLAYERS AND MARKET DYNAMICS

4.5.2 EXPORT SCENARIO: MIDDLE EAST AND AFRICA SUPPLY CHAIN AND TRADE FLOW

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 MIDDLE EAST AND AFRICA MARKET FEEDBACK TO THE O-PAS STRUCTURE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 MANUFACTURING EXPANSION INCREASES CONTROLLER SYSTEM DEMAND

5.1.2 GROWING NEED FOR REAL-TIME MONITORING BOOSTS SMART CONTROL SYSTEM ADOPTION

5.1.3 INDUSTRIAL ROBOTS RELY ON SOPHISTICATED AUTOMATION CONTROLLERS FOR OPTIMAL PERFORMANCE

5.1.4 IOT-ENABLED CONTROLLERS IMPROVE REAL-TIME PROCESS MONITORING

5.2 RESTRAINTS

5.2.1 CYBER THREATS INCREASE INDUSTRIAL CONTROLLER SYSTEM VULNERABILITIES

5.2.2 FREQUENT SOFTWARE UPDATES CAUSE OPERATIONAL DISRUPTIONS

5.3 OPPORTUNITIES

5.3.1 EDGE COMPUTING ENHANCES INDUSTRIAL CONTROLLER DATA PROCESSING SPEED

5.3.2 CLOUD-BASED ANALYTICS OPTIMIZE REAL-TIME INDUSTRIAL CONTROLLER INSIGHTS

5.3.3 GROWING ADOPTION OF MODULAR AND SCALABLE CONTROLLERS

5.4 CHALLENGES

5.4.1 SEMICONDUCTOR SHORTAGES DELAY CONTROLLER MANUFACTURING AND SUPPLY CHAINS

5.4.2 HUMAN-MACHINE COLLABORATION RISKS INCREASE WORKPLACE SAFETY CONCERNS

6 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE

6.1 OVERVIEW

6.2 DISTRIBUTED CONTROL SYSTEM (DCS)

6.3 PROGRAMMABLE LOGIC CONTROLLER (PLC)

6.4 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

6.5 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

7 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS

7.1 OVERVIEW

7.2 HUMAN MACHINE INTERFACE (HMI)

7.3 REMOTE TERMINAL UNIT (RTU)

7.4 IT AND OT

7.4.1 IT AND OT, BY TYPE

7.4.1.1 HARDWARE SYSTEMS

7.4.1.2 SOFTWARE SYSTEMS

7.5 PROGRAMMABLE AUTOMATION CONTROLLER

7.6 CONTROL LOOP

7.7 OTHERS

8 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY CONTROL

8.1 OVERVIEW

8.2 CLOSED-LOOP CONTROL

8.3 OPEN-LOOP CONTROL

8.4 ON-OFF CONTROL

8.5 FEED-FORWARD CONTROL

9 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE

9.1 OVERVIEW

9.2 ETHERNET FOR CONTROL AUTOMATION TECHNOLOGY (ETHERCAT)

9.3 MODBUS

9.4 COMMON INDUSTRIAL PROTOCOL (CIP)

9.5 PROCESS FILED BUS (PROFIBUS)

9.5.1 PROCESS FILED BUS (PROFIBUS), BY TYPE

9.5.1.1 RTU to MTU

9.5.1.2 MTU to MTU

9.5.1.3 RTU to RTU

9.6 OPEN PLATFORM COMMUNICATION (OPC)

9.6.1 OPEN PLATFORM COMMUNICATION (OPC), BY OPERATING SYSTEM

9.6.1.1 DCOM

9.6.1.2 COM

9.6.1.3 OLE

9.7 DISTRUBUTED NETWORK PROTOCOL (DNP3)

9.8 BUILDING AUTOMATION AND CONTROL NETWORKS (BACNET)

10 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 MEDIUM-SIZED ENTERPRISES

10.4 SMALL ENTERPRISES

11 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MANUFACTURING

11.2.1 MANUFACTURING, BY TYPE

11.2.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.2.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.2.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.2.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.3 OIL AND GAS

11.3.1 OIL AND GAS, BY TYPE

11.3.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.3.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.3.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.3.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.3.2 OIL AND GAS, BY END-USER PROCESS

11.3.2.1 REFINING AND PROCESSING

11.3.2.2 PRODUCTION AND EXTRACTION

11.3.2.3 TRANSPORTATION AND STORAGE

11.3.2.4 DRILLING AND EXPLORATION

11.3.3 OIL AND GAS, BY DEPLOYMENT TYPE

11.3.3.1 ON-SHORE DEPLOYMENT

11.3.3.2 OFF-SHORE DEPLOYMENT

11.3.4 OIL AND GAS, BY FUNCTION

11.3.4.1 PROCESS AUTOMATION AND CONTROL

11.3.4.2 REAL-TIME MONITORING AND DATA ACQUISITION

11.3.4.3 OPERATIONAL EFFICIENCY AND OPTIMIZATION

11.3.4.4 SAFETY AND RISK MANAGEMENT

11.4 ENERGY AND UTILITIES

11.4.1 ENERGY AND UTILITIES, BY TYPE

11.4.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.4.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.4.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.4.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.5 AUTOMOTIVE

11.5.1 AUTOMOTIVE, BY TYPE

11.5.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.5.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.5.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.5.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.6 FOOD PROCESSING AND BEVERAGES

11.6.1 FOOD PROCESSING AND BEVERAGES, BY TYPE

11.6.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.6.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.6.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.6.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.7 WATER AND WASTEWATER

11.7.1 WATER AND WASTEWATER, BY TYPE

11.7.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.7.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.7.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.7.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.8 AEROSPACE AND AVIATION

11.8.1 AEROSPACE AND AVIATION, BY TYPE

11.8.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.8.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.8.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.8.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.9 OTHERS

12 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ABB

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 SIEMENS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HONEYWELL INTERNATIONAL INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SCHNEIDER ELECTRIC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ANAHEIM AUTOMATION, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ASCON TECNOLOGIC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ASROCK INDUSTRIAL.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 AUDUBON COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DELTA ELECTRONICS, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 EMERSON ELECTRIC CO.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 GE VERNOVA (AS A PART OF GENERAL ELECTRIC COMPANY)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 BUSINESS PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 IDEC CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 BRAND PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 JTEKT ELECTRONICS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 KAWASAKI HEAVY INDUSTRIES, LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 META THERM FURNACE PVT LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MITSUBISHI ELECTRIC CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 NATIONAL INSTRUMENTS CORP.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 OMRON CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 RED LION

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ROCKWELL AUTOMATION

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 SOUTH SHORE CONTROLS, INC

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 WEINTEK USA

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 YOKOGAWA ELECTRIC CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COMPARISON TABLE

TABLE 2 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA DISTRIBUTED CONTROL SYSTEM (DCS) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA PROGRAMMABLE LOGIC CONTROLLER (PLC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA PROGRAMMABLE AUTOMATION CONTROLLER (PAC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA HUMAN MACHINE INTERFACE (HMI) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA REMOTE TERMINAL UNIT (RTU) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PROGRAMMABLE AUTOMATION CONTROLLER IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CONTROL LOOP IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CLOSED-LOOP CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA OPEN-LOOP CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ON-OFF CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FEED-FORWARD CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA ETHERNET FOR CONTROL AUTOMATION TECHNOLOGY (ETHERCAT) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA MODBUS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA COMMON INDUSTRIAL PROTOCOL (CIP) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA DISTRIBUTED NETWORK PROTOCOL (DNP3) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BUILDING AUTOMATION AND CONTROL NETWORKS (BACNET) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA LARGE ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MEDIUM-SIZED ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA SMALL ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH AFRICA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH AFRICA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 SOUTH AFRICA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SOUTH AFRICA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SAUDI ARABIA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SAUDI ARABIA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 99 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 100 SAUDI ARABIA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 SAUDI ARABIA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SAUDI ARABIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SAUDI ARABIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 104 SAUDI ARABIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SAUDI ARABIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SAUDI ARABIA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 125 EGYPT ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 EGYPT AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 EGYPT FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 EGYPT WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 EGYPT AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 132 U.A.E. IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 134 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.A.E. PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.A.E. OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 137 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 138 U.A.E. INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 U.A.E. MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.A.E. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.A.E. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 142 U.A.E. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.A.E. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 144 U.A.E. ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.A.E. AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.A.E. FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.A.E. WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.A.E. AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 151 ISRAEL IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 153 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ISRAEL PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ISRAEL OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 156 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 157 ISRAEL INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 ISRAEL MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ISRAEL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ISRAEL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 161 ISRAEL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 ISRAEL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 163 ISRAEL ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ISRAEL AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ISRAEL FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ISRAEL WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 ISRAEL AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 170 KUWAIT IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 172 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 KUWAIT PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 KUWAIT OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 175 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 176 KUWAIT INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 177 KUWAIT MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 KUWAIT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 KUWAIT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 180 KUWAIT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 KUWAIT OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 182 KUWAIT ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 KUWAIT AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 KUWAIT FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 KUWAIT WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 KUWAIT AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 QATAR INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 196 QATAR MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 QATAR OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 QATAR OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 199 QATAR OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 QATAR OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 201 QATAR ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 QATAR AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 QATAR FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 QATAR WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 QATAR AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 OMAN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 OMAN INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 218 OMAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 OMAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 220 OMAN ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 OMAN AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 OMAN FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 OMAN WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 OMAN AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 227 BAHRAIN IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 229 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 BAHRAIN PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 BAHRAIN OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 232 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 233 BAHRAIN INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 234 BAHRAIN MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 BAHRAIN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 BAHRAIN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 237 BAHRAIN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 BAHRAIN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 239 BAHRAIN ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 BAHRAIN WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 5 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 6 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: MULTIVARIATE MODELING

FIGURE 7 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: TYPE TIMELINE CURVE

FIGURE 8 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: SEGMENTATION

FIGURE 10 SEMICONDUCTOR: MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET, BY TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 MANUFACTURING EXPANSION INCREASES CONTROLLER SYSTEM DEMAND IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 DISTRIBUTED CONTROL SYSTEM (DCS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET IN 2025 & 2032

FIGURE 15 PRODUCTION ANALYSIS

FIGURE 16 CONSUMPTION ANALYSIS

FIGURE 17 DROC ANALYSIS

FIGURE 18 NUMBER OF ENTERPRISES IN THE MANUFACTURING MARKET (MILLION USD)

FIGURE 19 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY COMPONENTS, 2024

FIGURE 21 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY CONTROL, 2024

FIGURE 22 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY NETWORK TYPE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY ENTERPRISE SIZE, 2024

FIGURE 24 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: SNAPSHOT (2024)

FIGURE 26 MIDDLE EAST AND AFRICA INDUSTRIAL CONTROLLER MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Industrial Controller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Industrial Controller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Industrial Controller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.