Middle East And Africa Industrial Filter Cartridge Market

Market Size in USD Million

CAGR :

%

USD

360.88 Million

USD

541.36 Million

2024

2032

USD

360.88 Million

USD

541.36 Million

2024

2032

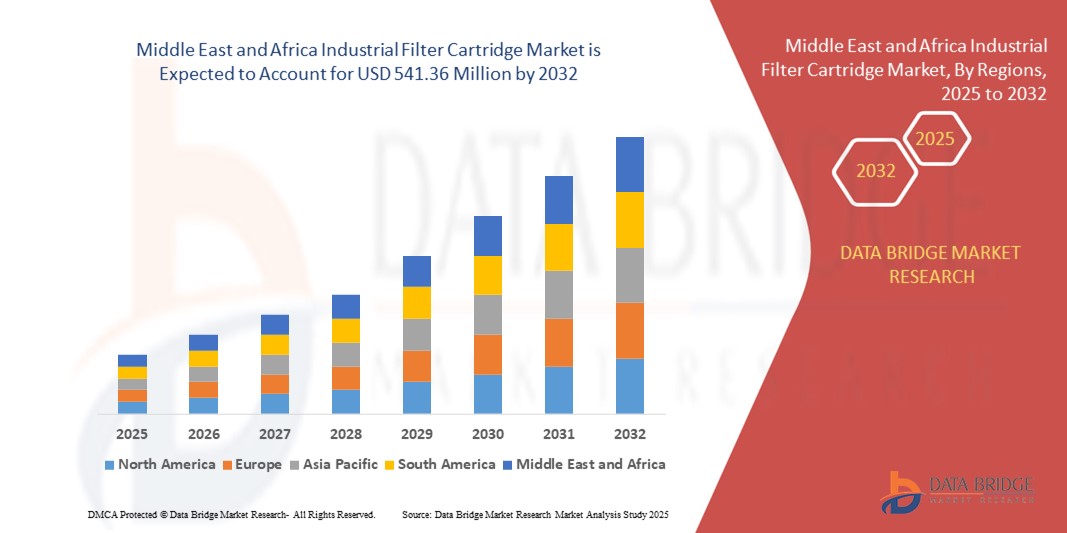

| 2025 –2032 | |

| USD 360.88 Million | |

| USD 541.36 Million | |

|

|

|

|

Middle East and Africa Industrial Filter Cartridge Market Size

- The Middle East and Africa industrial filter cartridge market size was valued at USD 360.88 million in 2024 and is expected to reach USD 541.36 million by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by increased industrialization, expanding manufacturing activities, and growing awareness regarding environmental regulations, particularly in water treatment and chemical processing sectors

- Furthermore, rising demand for efficient, cost-effective filtration solutions across oil & gas, food & beverage, and pharmaceutical industries is positioning filter cartridges as an essential component in industrial operations. These factors are driving strong adoption and contributing to the sustained expansion of the regional market

Middle East and Africa Industrial Filter Cartridge Market Analysis

- Industrial filter cartridges, used for removing contaminants from liquids and gases, are becoming increasingly essential in industrial operations across sectors such as oil & gas, water treatment, and chemicals, due to their high efficiency, cost-effectiveness, and ease of maintenance

- The accelerating demand for industrial filter cartridges is primarily driven by stricter environmental regulations, growing industrialization, and rising water treatment needs across countries facing water scarcity and infrastructure expansion

- Saudi Arabia dominated the industrial filter cartridge market with the largest revenue share of 29.1% in 2024, supported by its massive oil & gas industry, government-backed sustainability goals, and increasing investment in wastewater treatment and industrial filtration systems

- United Arab Emirates (UAE) is expected to be the fastest-growing country in the industrial filter cartridge market during the forecast period due to rapid urbanization, technological upgrades in manufacturing, and increased focus on green industrial practices and water reuse

- The pleated filter cartridges segment dominated the industrial filter cartridge market with a market share of 32.9% in 2024, owing to their high dirt-holding capacity, long operational life, and versatility across various industrial filtration applications

Report Scope and Middle East and Africa Industrial Filter Cartridge Market Segmentation

|

Attributes |

Middle East and Africa Industrial Filter Cartridge Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Industrial Filter Cartridge Market Trends

Rising Demand for High-Performance Filtration in Water-Stressed Industries

- A major and accelerating trend in the Middle East and Africa industrial filter cartridge market is the increasing reliance on high-performance filtration systems across water-intensive industries such as oil & gas, power generation, and food & beverage. The region’s growing water scarcity has prompted industries to implement advanced filtration solutions to maximize water reuse and ensure process reliability

- For instance, industrial facilities in Saudi Arabia and the UAE are incorporating pleated and high-flow filter cartridges into closed-loop systems to reduce water consumption while maintaining regulatory compliance. In addition, filtration technologies are increasingly being integrated with real-time monitoring systems to ensure consistent output quality and predictive maintenance

- These advanced filtration systems enable industries to reduce downtime, increase operational efficiency, and meet stricter environmental regulations. Manufacturers are innovating with materials such as polypropylene and PTFE to enhance chemical resistance and durability, particularly in harsh process environments

- As a result, companies such as Parker Hannifin and Eaton Corporation are expanding their presence in the region by offering customized cartridge solutions tailored to specific industrial applications

- This trend toward advanced and adaptive filtration technologies is transforming industry standards and driving demand for durable, efficient, and scalable filter cartridge solutions in sectors under pressure to conserve water and meet environmental goals

- The market is witnessing growing interest in solutions that not only offer filtration performance but also align with corporate sustainability initiatives, especially in regions investing heavily in desalination and wastewater reuse infrastructure

Middle East and Africa Industrial Filter Cartridge Market Dynamics

Driver

Industrial Growth and Water Scarcity Driving Adoption

- The accelerating industrial development across key countries in the region, combined with acute water scarcity, is a major driver of the growing demand for industrial filter cartridges

- For instance, Saudi Arabia’s Vision 2030 includes major investments in wastewater treatment, driving demand for high-efficiency liquid filter cartridges in sectors such as petrochemicals and desalination

- As industries across the UAE, Egypt, and South Africa strive to increase water reuse and meet environmental standards, filter cartridges are increasingly being used in filtration units for process water, effluent treatment, and raw material purification

- The need for operational efficiency, minimal downtime, and clean resource cycles is compelling industries to invest in reliable filtration solutions that improve system performance

- The wide applicability of filter cartridges across various industries—ranging from metals and mining to food & beverage and pharmaceuticals—continues to expand their role as a critical component in industrial processes

Restraint/Challenge

Import Dependency and Cost Sensitivity in Developing Nations

- One of the key challenges facing the market is the high dependency on imported filter cartridges and components, which leads to increased procurement costs and longer lead times, particularly in developing nations with limited local manufacturing capabilities

- Countries such as Kenya and Nigeria often face logistical hurdles and currency fluctuations, which can raise the total cost of industrial filtration solutions and deter smaller industries from adopting advanced systems

- For instance, in 2023, several Nigerian water treatment facilities experienced delays and cost overruns due to disruptions in cartridge imports caused by foreign exchange restrictions and port congestion impacting their filtration system upgrades

- In addition, cost-sensitive end users may opt for lower-quality or locally fabricated alternatives, potentially compromising performance and lifespan

- Addressing these issues requires developing localized manufacturing capabilities, forming regional distribution networks, and offering competitively priced yet durable filter options. Market players are increasingly focused on partnerships and joint ventures to establish a regional presence and mitigate supply chain challenges, which will be essential for long-term growth and resilience in this fragmented market

Middle East and Africa Industrial Filter Cartridge Market Scope

The market is segmented on the basis of types of filters, material, media type, end-use, and distribution channel.

- By Types of Filters

On the basis of filter type, the industrial filter cartridge market in the Middle East and Africa is segmented into pleated depth filters, melt-blown depth filter cartridges, high-flow filter cartridges, pleated filter cartridges, and string-wound cartridge filters. The pleated filter cartridges segment dominated the market with the largest revenue share of 32.9% in 2024, driven by their high surface area, long service life, and compatibility with a wide range of industrial applications, especially in water & waste treatment and chemical processing. Their versatility and efficient particle retention make them a preferred choice for facilities seeking low maintenance and high-performance solutions.

The melt-blown depth filter cartridges segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by rising demand in pre-filtration stages and their cost-effectiveness in large-scale operations. Their ability to capture fine particles and compatibility with aggressive fluids supports their growing use in oil & gas and pharmaceutical applications.

- By Material

On the basis of material, the industrial filter cartridge market is segmented into polypropylene, polyamide, FRP (fiber-reinforced plastic), cotton, and others (including PTFE). The polypropylene segment held the largest revenue share of 38.7% in 2024, owing to its chemical resistance, thermal stability, and affordability. It is widely used in liquid filtration applications across the water treatment, food & beverage, and pharmaceutical industries.

The PTFE segment is projected to grow at the fastest CAGR during forecast period, supported by its excellent resistance to high temperatures and aggressive chemicals, making it suitable for specialized applications in chemical and metal processing industries.

- By Media Type

On the basis of media type, the industrial filter cartridge market is segmented into thick media, sintered media, and thin media. The thick media segment dominated the market with a share of 41.5% in 2024, as it offers superior dirt-holding capacity and longevity, especially valuable in water-intensive industries and heavy-duty filtration systems.

The sintered media segment is expected to grow the fastest during forecast period, due to its use in high-temperature, high-pressure applications where mechanical strength and backwash capabilities are critical, such as in petrochemical and power generation facilities.

- By End-Use

On the basis of end-use, the industrial filter cartridge market is segmented into oil & gas (water application), water & waste treatment, chemical, metals, food & beverages, pharmaceutical, and others (including paper & pulp, paint, and coating). The water & waste treatment segment led the market with a share of 29.8% in 2024, driven by increasing government and private investments in desalination, water reuse, and industrial wastewater treatment facilities across Saudi Arabia and the UAE.

The pharmaceutical segment is projected to witness the fastest growth during forecast period, due to the increasing need for sterile and high-purity processing environments, along with regulatory pressure to maintain contamination-free operations in drug manufacturing.

- By Distribution Channel

On the basis of distribution channel, the industrial filter cartridge market is segmented into indirect and direct sales. The indirect distribution segment (including OEMs, system integrators, and industrial suppliers) held the largest share of 56.3% in 2024, as it provides extensive reach across the region and serves clients through well-established vendor networks.

The direct distribution segment is growing steadily during forecast period, particularly among large-scale industrial clients seeking customized solutions and long-term service contracts with manufacturers.

Middle East and Africa Industrial Filter Cartridge Market Regional Analysis

- Saudi Arabia dominated the industrial filter cartridge market with the largest revenue share of 29.1% in 2024, supported by its massive oil & gas industry, government-backed sustainability goals, and increasing investment in wastewater treatment and industrial filtration systems

- Industries in the country prioritize high-performance filtration systems to ensure operational efficiency, regulatory compliance, and sustainable resource management—especially in desalination and wastewater reuse projects

- This widespread adoption is further supported by robust industrial growth, government-led environmental initiatives, and the rising importance of water conservation technologies, positioning industrial filter cartridges as critical components in maintaining clean and efficient processing systems across key sectors

The Saudi Arabia Industrial Filter Cartridge Market Insight

The Saudi Arabia industrial filter cartridge market captured the largest revenue share of 29.1% in the Middle East and Africa industrial filter cartridge market in 2024, driven by large-scale investments in oil & gas, desalination plants, and wastewater reuse initiatives under Vision 2030. The Kingdom’s industrial sectors are integrating advanced filtration systems to improve process reliability and ensure regulatory compliance. Demand is particularly strong for pleated and melt-blown cartridges used in refining and utility operations. Government-backed environmental policies and public-private partnerships are further strengthening the filtration equipment landscape in the country.

United Arab Emirates (UAE) Industrial Filter Cartridge Market Insight

The UAE industrial filter cartridge market is projected to grow at the fastest CAGR during the forecast period, propelled by expanding infrastructure projects, technological innovation, and a sharp focus on industrial automation. The country's leadership in sustainability, reflected in initiatives such as the UAE Water Security Strategy 2036, is creating demand for efficient filtration systems in water reuse and desalination. Moreover, the rising deployment of smart factories and clean industrial processes is enhancing the role of filter cartridges in maintaining high product quality and environmental standards.

South Africa Industrial Filter Cartridge Market Insight

The South Africa industrial filter cartridge market is witnessing steady growth in the industrial filter cartridge market, supported by ongoing developments in the mining, power generation, and chemical industries. As industrial sectors modernize, the need for reliable, low-maintenance filtration systems is rising. The country also faces growing environmental pressure to enhance wastewater treatment and pollution control, which is boosting demand for thick media and high-flow filter cartridges. Local industries are increasingly exploring sustainable filtration solutions to meet both domestic and export quality standards.

Nigeria Industrial Filter Cartridge Market Insight

The Nigeria industrial filter cartridge market is emerging, fueled by expanding manufacturing activities, increased investment in water treatment infrastructure, and the need for improved air and liquid filtration in sectors such as cement, food & beverage, and energy. Although the market faces challenges such as import dependency and inconsistent infrastructure, government initiatives aimed at industrial diversification and environmental regulation enforcement are paving the way for steady growth. Local partnerships and affordable filtration options are expected to support broader market penetration in coming years.

Middle East and Africa Industrial Filter Cartridge Market Share

The Middle East and Africa industrial filter cartridge industry is primarily led by well-established companies, including:

- Pall Corporation (U.S.)

- Eaton Corporation plc (Ireland)

- Parker Hannifin Corporation (U.S.)

- MANN+HUMMEL GmbH (Germany)

- Donaldson Company, Inc. (U.S.)

- Pentair plc (U.K.)

- Camfil AB (Sweden)

- Filtration Group Corporation (U.S.)

- 3M (U.S.)

- Lydall, Inc. (U.S.)

- Porvair plc (U.K.)

- Graver Technologies, LLC (U.S.)

- Critical Process Filtration, Inc. (U.S.)

- MAHLE GmbH (Germany)

- Ahlstrom Oyj (Finland)

- Suez SA (France)

- Veolia Environnement SA (France)

- GE Water & Process Technologies (U.S.)

- SPX FLOW, Inc. (U.S.)

- Haycarb PLC (Sri Lanka)

What are the Recent Developments in Middle East and Africa Industrial Filter Cartridge Market?

- In December 2023, Pall Corporation, a global leader in filtration, separation and purification, and Tanajib, [Al-Khobar], a prominent petroleum services company throughout the GCC, today announced the expansion of its Pall Arabia facility to include filter coalescer manufacturing capabilities to support the oil and gas and petrochemical industries in the Kingdom of Saudi Arabia

- In September 2023, Parker Hannifin Corporation launched cost‑effective BHA® replacement dust cartridges for Donaldson’s Downflo Evolution (DFE) collectors, delivering enhanced air-cleaning efficiency, operational cost savings, and robust customer support for MEA industrial filtration users

- In July 2023, Pall Corporation showcased next-generation filtration and purification technologies at SEMICON West, geared to support increasing demands in semiconductor manufacturing driven by 5G, AI, and IoT developments

- In May 2023, 3M announced a USD 146 million investment aimed at expanding its capabilities in biopharmaceutical filtration technology, including facility upgrades, equipment enhancements, and the creation of 60 full-time positions in its European manufacturing facilities. This move strengthens 3M's leadership in delivering advanced filtration solutions for bioprocessing and pharmaceutical manufacturing

- In April 2023, Eaton’s Filtration Division unveiled its new BECO CARBON ACF 03 activated carbon depth filter sheets, designed to meet rigorous pharmaceutical and biopharmaceutical standards, providing effective decolorization and adsorptive separation with built-in biocompatibility validation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Industrial Filter Cartridge Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Industrial Filter Cartridge Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Industrial Filter Cartridge Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.