Middle East And Africa Industrial Pc Market

Market Size in

CAGR :

%

8.21

12.50

2024

2032

8.21

12.50

2024

2032

| 2025 –2032 | |

| USD 8.21 | |

| USD 12.50 | |

|

|

|

|

Industrial Personal Computer (PC) Market Size

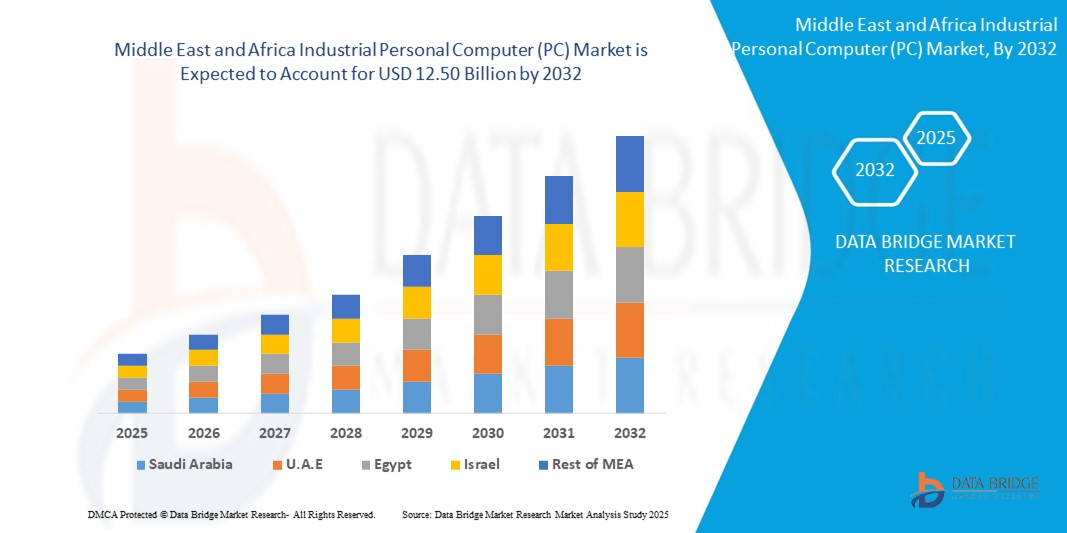

- The Middle East And Africa Industrial Personal Computer (PC) Market size was valued at USD 8.21 billion in 2024 and is expected to reach USD 12.50 billion by 2032, at a CAGR of 6.2% during the forecast period

- This growth is driven by factors such as the increasing industrial automation, smart manufacturing adoption, and rising demand for rugged computing solutions in oil & gas, energy, and transportation sectors

Industrial Personal Computer (PC) Market Analysis

- Industrial Personal Computer (PC) are the computers specifically designed for use in industries and are highly reliable and efficient, they helps in providing the platform to run automation software for monitoring and controlling the processes, applications and also real time assistance.

- They are designed to operate in harsh environmental conditions like high humidity, high shock, extreme temperatures, and vibration, among other conditions It basically requires display and operator units for automation devices in production.

- Saudi Arabia is expected to dominate the Industrial Personal Computer (PC)s market due to its heavy investments in industrial automation, smart infrastructure projects, and the Vision 2030 initiative

- U.A.E. is expected to be the fastest growing region in the Industrial Personal Computer (PC) Market during the forecast period due to rapid digital transformation, smart city initiatives, and expansion of industrial sectors

- Industrial Panel PC segment is expected to dominate the market with a market share of 53.89% due to its user-friendly interface, rugged design, and widespread use in automation and control applications.

Report Scope and Industrial Personal Computer (PC) Market Segmentation

|

Attributes |

Industrial Personal Computer (PC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Personal Computer (PC) Market Trends

“Increasing Adoption of Edge Computing in Industrial Environments”

- One of the key trends in the Middle East and Africa (MEA) Industrial Personal Computer (PC) market is the increasing adoption of edge computing. As industries such as oil and gas, manufacturing, and utilities strive to improve operational efficiency, there is a growing need to process data closer to the source instead of relying on centralized data centers. Industrial PCs are at the heart of edge computing, as they enable real-time data processing, analysis, and decision-making in critical applications.

- The ability to quickly analyze data on-site without the latency of cloud-based systems offers businesses a competitive edge. With the rise of the Internet of Things (IoT) and smart sensors, industrial PCs are essential in gathering and processing data locally, thus improving productivity and reducing response time. As industries in the MEA region focus on enhancing their digital capabilities and achieving higher operational standards, the demand for edge computing solutions is expected to continue growing. This trend will drive the market for industrial PCs that offer robust, high-performance capabilities.

- For instance, In May 2024, a mining company in South Africa deployed industrial PCs equipped with edge computing capabilities to monitor equipment performance and predict maintenance needs. By processing data on-site, the company reduced equipment downtime by 20% and improved operational efficiency. This implementation demonstrates how edge computing, powered by industrial PCs, is revolutionizing sectors like mining by enabling real-time monitoring and decision-making.

Industrial Personal Computer (PC) Market Dynamics

Driver

“Rapid Growth of Industrial Automation in the MEA Region”

- The Middle East and Africa (MEA) region is witnessing significant growth in industrial automation, driven by the need for enhanced operational efficiency, cost reduction, and increased productivity. Industries such as manufacturing, oil and gas, automotive, and mining are increasingly adopting automation solutions to optimize their operations.

- Industrial Personal Computers (PCs) are a key enabler of this transition, offering robust computing power for real-time data processing and seamless integration with industrial control systems. As industries move towards automated production lines and smart factories, industrial PCs are essential in managing complex processes, controlling machinery, and ensuring reliability in mission-critical operations. This growing emphasis on automation is pushing the demand for high-performance industrial PCs that can withstand harsh environments and provide real-time data analytics. The rapid development of industrial automation in the MEA region is thus a major driver for the growth of the industrial PC market.

For instance,

- In March 2024, a manufacturing plant in Egypt upgraded its production line with automated machinery controlled by industrial PCs. The plant saw a 25% increase in production efficiency within the first quarter, thanks to real-time data processing and automated system management. This showcases how industrial PCs play a pivotal role in the region's drive toward automation, transforming industries with smart, connected solutions

Opportunity

“Growth in Smart Manufacturing and Industrial Automation”

- The Middle East and Africa (MEA) Industrial Personal Computer (PC) market stands to benefit from the rapid adoption of smart manufacturing and industrial automation. With industries like oil and gas, manufacturing, and logistics undergoing significant digital transformation, there’s a rising demand for robust, high-performance computing solutions. Industrial PCs are integral to automation systems, controlling operations, and monitoring real-time data.

- As companies focus on improving efficiency and reducing downtime through automation, the need for advanced industrial PCs grows. The integration of AI, IoT, and cloud technologies further boosts this demand, requiring highly reliable and versatile computing devices.

- As factories move towards Industry 4.0, MEA countries, particularly Saudi Arabia and the UAE, are increasingly investing in technologies that support these advancements. This presents a clear opportunity for manufacturers to deliver customized industrial PCs that meet the needs of various sectors, ensuring productivity, reliability, and safety in industrial environments.

For instance,

- In June 2024, a large automotive manufacturing plant in Dubai adopted industrial panel PCs to streamline its assembly line operations. The new PCs integrated with the factory’s automation systems, enabling real-time data monitoring and analysis. As a result, production efficiency increased by 15%, and downtime was reduced by 10%. This example highlights how the growing adoption of automation and smart manufacturing in the UAE is driving the demand for industrial PCs. It also demonstrates the significant role that these devices play in boosting industrial performance

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- One of the key restraints for the growth of the Industrial Personal Computer (PC) market in the Middle East and Africa (MEA) region is the high initial investment and maintenance costs. Industrial PCs are designed for harsh environments and offer advanced features such as rugged construction, long-term durability, and high-performance capabilities. However, these features come at a premium price compared to consumer-grade PCs.

- The upfront costs associated with purchasing these specialized systems can be a significant barrier for small and medium-sized enterprises (SMEs) and industries with limited budgets. Additionally, the maintenance and repair costs can also be higher, given the complex hardware and the need for specialized technical support. In regions where cost efficiency is a priority, these financial challenges can deter businesses from investing in industrial PCs, limiting market growth.

For instance,

- In September 2024, a logistics company in South Africa decided against upgrading to industrial PCs due to the high costs associated with the purchase and ongoing maintenance. Instead, the company opted for regular commercial computers, which, while less durable, were more affordable and easier to replace. This decision highlights how high initial costs can be a significant barrier for businesses in the region, especially in industries with tight budgets

Industrial Personal Computer (PC) Market Scope

The market is segmented on the basis by type, industry, data storage medium, sales channel, touchscreen technology and ram capacity.

|

Segmentation |

Sub-Segmentation |

|

By type |

|

|

Industry |

|

|

Data storage medium |

|

|

Sales channel |

|

|

Touchscreen technology |

|

|

Ram capacity |

|

In 2025, the Industrial Panel PC is projected to dominate the market with a largest share in segment

In 2025, the Industrial Panel PC segment is expected to dominate the Middle East and Africa Industrial Personal Computer (PC) market, holding a market share of 53.89%. This growth is driven by the increasing demand for space-efficient, all-in-one solutions that combine the functions of a computer and display. Industrial Panel PCs are widely used in manufacturing, automation, and other sectors for their rugged design and touchscreen capabilities. Their ability to withstand harsh environments while providing real-time data processing is a key factor contributing to their market dominance. As industries continue to seek more streamlined, efficient computing solutions, Industrial Panel PCs are poised to lead the market

The Box IPC is expected to account for the largest share during the forecast period in market

The Box IPC (Industrial Personal Computer) is expected to account for the largest share of 49.56% in the Middle East and Africa Industrial Personal Computer (PC) market during the forecast period. This segment's growth is driven by the rising demand for rugged, durable, and versatile computing solutions in industries such as manufacturing, logistics, and energy. Box IPCs are designed to withstand extreme conditions like high temperatures, dust, and vibrations, making them ideal for use in industrial environments. Their compact design and ability to support various industrial applications also contribute to their widespread adoption. As industrial automation continues to expand, Box IPCs are expected to remain a critical component in operational efficiency and data processing.

Industrial Personal Computer (PC) Market Regional Analysis

“Saudi Arabia Holds the Largest Share in the Industrial Personal Computer (PC) Market”

- Saudi Arabia holds the largest share in the Middle East and Africa Industrial Personal Computer (PC) market due to its growing industrial sector and significant investments in infrastructure development. The country’s increasing focus on digital transformation across industries such as oil and gas, manufacturing, and logistics is driving demand for rugged and high-performance industrial PCs.

- Saudi Arabia’s Vision 2030, which emphasizes modernization and diversification of the economy, has further bolstered the adoption of advanced technologies, including industrial computing solutions. With major industrial hubs and a large number of construction and infrastructure projects, the need for reliable and durable industrial PCs continues to rise.

- Moreover, Saudi Arabia's strategic location in the region makes it a key player for businesses looking to expand into the broader Middle East and Africa markets. As a result, Saudi Arabia is set to maintain its leadership in the market throughout the forecast period.

“U.A.E. is Projected to Register the Highest CAGR in the Industrial Personal Computer (PC) Market”

- The UAE is projected to register the highest CAGR in the Industrial Personal Computer (PC) market due to its rapid technological advancements and robust industrial growth. As the UAE diversifies its economy away from oil dependency, sectors like manufacturing, logistics, and smart cities are increasingly relying on industrial PCs for automation and digital integration.

- The country’s focus on becoming a Middle_East & Africa hub for innovation and technology through initiatives like "Smart Dubai" and "Industry 4.0" is driving the demand for high-performance computing solutions. Additionally, the UAE's investment in sectors such as logistics, retail, and construction provides further opportunities for the adoption of industrial PCs.

- The UAE's modern infrastructure and strong economic stability also contribute to the increased uptake of advanced industrial technologies. These factors, combined with a growing emphasis on automation and IoT, are expected to fuel the UAE's strong growth in the industrial PC market during the forecast period.

Industrial Personal Computer (PC) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle_East & Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Advantech CO., Ltd.,

- Beckhoff Automation,

- Kontron,

- Siemens,

- General Electric,

- Mitsubishi Electric Corporation,

- Omron Corporation,

- Rockwell Automation, Inc.,

- Schneider Electric,

- Industrial Personal Computer (PC) Inc,

- B&R,

- The Contec Group,

- PRO TECH.,

- Acnodes,

- Phoenix Contact,

- DFI,

- Vartech Systems Inc,

- Crystal Group Inc.,

- Four-Faith,

- OnLogic

Latest Developments in Middle_East & Africa Industrial Personal Computer (PC) Market

- In December 2024, Advantech shared its vision for 2025, focusing on becoming a Middle_East & Africa leader in edge computing and artificial intelligence (AI) at the edge. The company plans to showcase its latest innovations at prominent international events, such as Computex, and work closely with partners to deliver tailored solutions for various industries. Advantech aims to help businesses around the world leverage edge computing to create smarter, more efficient operations

- In March 2025, Beckhoff Automation presented its latest advancements at the Embedded World conference. The company unveiled its new integrated automation systems, powered by the latest Intel processors with hybrid architecture. Beckhoff also introduced the MX-System, a cabinet-free automation solution, and demonstrated its TwinCAT ML and Machine Learning Creator tools, enabling AI applications for image processing. These innovations reflect Beckhoff’s commitment to pushing the boundaries of PC-based automation systems.

- In February 2025, At Embedded World, Kontron showcased its new high-performance industrial PC, the KBox A-251-AML/ADN. This compact device is designed for edge computing and gateway applications, featuring energy-efficient processors. In addition, Kontron introduced an AI-based Intrusion Detection System (IDS) and firewall solution to protect industrial networks in real-time, enhancing cybersecurity for IoT and edge infrastructures across various industries.

- In October 2024, Schneider Electric opened a new manufacturing facility in Sharjah, UAE, dedicated to producing AI-ready, prefabricated modular data centers. This move aligns with the UAE’s “Make it in the Emirates” initiative and is aimed at meeting the growing need for scalable, energy-efficient digital infrastructure in the region. The facility is expected to drive local economic growth and help enhance the UAE’s position as a hub for technological innovation.

- At CES 2025, Siemens introduced groundbreaking innovations in industrial AI and digital twin technology. The company launched the Siemens Industrial Copilot for Operations, a tool designed to enable AI-powered tasks near the machines, allowing for faster and more accurate decision-making in real-time. This solution aims to boost productivity, improve operational efficiency, and reduce downtime across industries by making automation more intelligent and responsive.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 PRICING ANALYSIS

6 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY TYPE

6.1 OVERVIEW

6.2 RACK MOUNT IPC

6.3 PANEL IPC

6.4 BOX IPC

6.5 DIN RAIL IPC

6.6 EMBEDDED IPC

6.7 OTHERS

7 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY SPECIFICATIONS

7.1 OVERVIEW

7.2 TOUCHSCREEN TECHNOLOGY

7.2.1 CAPACITIVE TOUCHSCREEN

7.2.2 RESISTIVE TOUCHSCREEN

7.3 DATA STORAGE SYSTEM

7.3.1 SSD

7.3.2 HDD

7.4 MAXIMUM RAM CAPACITY

7.4.1 512 KB TO 512 MB

7.4.2 512 MB TO 3 GB

7.4.3 3 GB TO 8 GB

7.4.4 8 GB TO 64 GB

7.4.5 MORE THAN 64 GB

8 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY TEMPERATURE

8.1 OVERVIEW

8.2 -45 C TO 0 C

8.3 0 C TO 100 C

9 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 DIRECT SALES CHANNEL

9.3 INDIRECT SALES CHANNEL

10 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY END USER

10.1 OVERVIEW

10.2 OIL & GAS

10.2.1 BY TYPE

10.2.1.1. RACK MOUNT IPC

10.2.1.2. PANEL IPC

10.2.1.3. BOX IPC

10.2.1.4. DIN RAIL IPC

10.2.1.5. EMBEDDED IPC

10.2.1.6. OTHERS

10.3 ENERGY & POWER

10.3.1 BY TYPE

10.3.1.1. RACK MOUNT IPC

10.3.1.2. PANEL IPC

10.3.1.3. BOX IPC

10.3.1.4. DIN RAIL IPC

10.3.1.5. EMBEDDED IPC

10.3.1.6. OTHERS

10.4 CHEMICALS

10.4.1 BY TYPE

10.4.1.1. RACK MOUNT IPC

10.4.1.2. PANEL IPC

10.4.1.3. BOX IPC

10.4.1.4. DIN RAIL IPC

10.4.1.5. EMBEDDED IPC

10.4.1.6. OTHERS

10.5 PHARMACEUTICALS

10.5.1 BY TYPE

10.5.1.1. RACK MOUNT IPC

10.5.1.2. PANEL IPC

10.5.1.3. BOX IPC

10.5.1.4. DIN RAIL IPC

10.5.1.5. EMBEDDED IPC

10.5.1.6. OTHERS

10.6 SEMICONDUCTOR & ELECTRONICS

10.6.1 BY TYPE

10.6.1.1. RACK MOUNT IPC

10.6.1.2. PANEL IPC

10.6.1.3. BOX IPC

10.6.1.4. DIN RAIL IPC

10.6.1.5. EMBEDDED IPC

10.6.1.6. OTHERS

10.7 AEROSPACE & DEFENSE

10.7.1 BY TYPE

10.7.1.1. RACK MOUNT IPC

10.7.1.2. PANEL IPC

10.7.1.3. BOX IPC

10.7.1.4. DIN RAIL IPC

10.7.1.5. EMBEDDED IPC

10.7.1.6. OTHERS

10.8 MEDICAL DEVICES

10.8.1 BY TYPE

10.8.1.1. RACK MOUNT IPC

10.8.1.2. PANEL IPC

10.8.1.3. BOX IPC

10.8.1.4. DIN RAIL IPC

10.8.1.5. EMBEDDED IPC

10.8.1.6. OTHERS

10.9 OTHERS

10.9.1 BY TYPE

10.9.1.1. RACK MOUNT IPC

10.9.1.2. PANEL IPC

10.9.1.3. BOX IPC

10.9.1.4. DIN RAIL IPC

10.9.1.5. EMBEDDED IPC

10.9.1.6. OTHERS

11 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, BY REGION

MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 EGYPT

11.1.3 SAUDI ARABIA

11.1.4 U.A.E

11.1.5 OMAN

11.1.6 BAHRAIN

11.1.7 ISRAEL

11.1.8 KUWAIT

11.1.9 QATAR

11.1.10 REST OF MIDDLE EAST AND AFRICA

11.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12.2 MERGERS & ACQUISITIONS

12.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.4 EXPANSIONS

12.5 REGULATORY CHANGES

12.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, SWOT & DBMR ANALYSIS

14 MIDDLE EAST AND AFRICA INDUSTRIAL PERSONAL COMPUTER (PC) MARKET, COMPANY PROFILE

14.1 SIEMENS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ADVANTECH CO, LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 B&R AUTOMATION ( A MEMBER OF THE ABB GROUP)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BECKHOFF AUTOMATION GMBH & CO.KG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 EMERSON ELECTRIC CO

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 MITSUBISHI ELECTRIC CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 SCHNEIDER ELECTRIC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 ROCKWELL AUTOMATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 AMPLICON LIVELINE

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.1 AXIOMTEK CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 CYBERNET MANUFACTURING, INC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENT

14.12 IPC2U GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 IRONTECH GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 OMRON CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENT

14.15 TR ELECTRONIC GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENT

14.16 WEIDMÜLLER

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENT

14.17 PLC TECHNOLOGIES

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Industrial Pc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Industrial Pc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Industrial Pc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.