Middle East And Africa Inflation Device Market

Market Size in USD Million

CAGR :

%

USD

34.70 Million

USD

42.94 Million

2025

2033

USD

34.70 Million

USD

42.94 Million

2025

2033

| 2026 –2033 | |

| USD 34.70 Million | |

| USD 42.94 Million | |

|

|

|

|

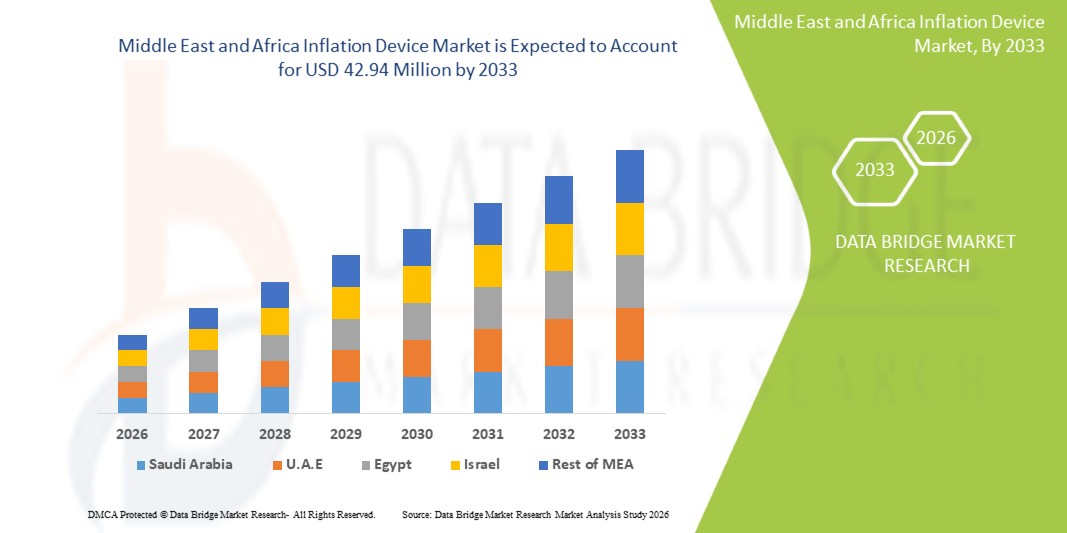

Middle East and Africa Inflation Device Market Size

- The Middle East and Africa Inflation Device market size was valued at USD 34.70 million in 2025 and is expected to reach USD 42.94 million by 2033, at a CAGR of 2.70% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cardiovascular and peripheral vascular diseases in the region, along with rising investments in advanced medical infrastructure and interventional procedures

- In addition, growing adoption of minimally invasive treatments and technological advancements in inflation devices are supporting healthcare providers in improving procedural efficiency and patient outcomes. These factors, combined with heightened awareness of advanced medical solutions, are fueling the demand for inflation devices across hospitals and specialized clinics, thereby propelling the market expansion

Middle East and Africa Inflation Device Market Analysis

- Inflation devices, which provide controlled pressure during balloon angioplasty and other interventional procedures, are becoming essential components of modern cardiovascular, peripheral vascular, and urological interventions due to their precision, safety features, and ease of operation

- The increasing demand for inflation devices is primarily driven by the rising prevalence of cardiovascular diseases, growing awareness of minimally invasive procedures, and ongoing investments in advanced healthcare infrastructure across the region

- Saudi Arabia dominated the Middle East and Africa inflation device market with the largest revenue share of 38.1% in 2025, supported by high healthcare expenditure, government initiatives to enhance interventional cardiology services, and the presence of key distributors and regional medical device companies, with significant adoption in both private and public hospitals

- The United Arab Emirates is expected to be the fastest growing country in the inflation device market during the forecast period due to increasing healthcare access, rising numbers of specialized cardiac and interventional radiology centers, and collaborations with international device manufacturers to improve procedural capabilities

- Digital inflation devices dominated the market with a share of 55.2% in 2025, driven by their precise pressure control, real-time monitoring capabilities, integration with advanced catheter systems, and increasing preference among hospitals and interventional laboratories for technologically advanced solutions

Report Scope and Middle East and Africa Inflation Device Market Segmentation

|

Attributes |

Middle East and Africa Inflation Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Inflation Device Market Trends

“Adoption of Digital and Connected Inflation Devices”

- A significant and accelerating trend in the Middle East and Africa inflation device market is the growing shift from analog to digital inflation devices with advanced pressure monitoring and connectivity features, enhancing procedural precision and safety

- For instance, Merit Medical’s digital inflation systems allow clinicians to monitor and control balloon inflation remotely, improving procedural efficiency and reducing risks during interventional procedures

- Digital inflation devices increasingly feature data logging and integration with hospital information systems, enabling real-time recording of procedural parameters and facilitating post-procedure analysis

- The adoption of connected devices also supports predictive maintenance and remote troubleshooting, reducing device downtime and operational disruptions in hospitals and interventional laboratories

- Increasing compatibility with multi-procedure platforms is another trend, allowing a single device to be used across interventional cardiology, peripheral vascular, and urological procedures, improving operational flexibility

- Manufacturers are also focusing on ergonomic designs and ease-of-use enhancements to reduce clinician fatigue and procedural errors during long or complex interventions

- This trend toward intelligent, connected, and digitally monitored inflation devices is reshaping user expectations in interventional cardiology and other minimally invasive procedures

- The demand for digital and smart inflation devices is growing rapidly across both hospitals and specialized clinics, as healthcare providers prioritize patient safety, operational efficiency, and data-driven procedural insights

Middle East and Africa Inflation Device Market Dynamics

Driver

“Increasing Cardiovascular Disease Prevalence and Healthcare Investments”

- The rising prevalence of cardiovascular and peripheral vascular diseases, coupled with expanding investments in advanced healthcare infrastructure, is a key driver for the demand for inflation devices in the region

- For instance, in March 2025, Boston Scientific expanded its presence in Saudi Arabia with advanced interventional cardiology solutions, strengthening access to cutting-edge inflation devices for hospitals and cardiac centers

- As more patients undergo minimally invasive procedures, hospitals increasingly require reliable inflation devices offering precise pressure control, monitoring, and safety features

- Furthermore, government initiatives in countries such as UAE and Saudi Arabia to improve cardiac care and interventional facilities are boosting the adoption of technologically advanced devices

- The demand for user-friendly, accurate, and safe inflation devices is also supported by growing awareness among clinicians about reducing procedural complications and enhancing patient outcomes

- Rising collaborations between hospitals and global device manufacturers further facilitate access to advanced inflation systems, driving market growth across both public and private healthcare sectors

- Increasing training programs and workshops by device manufacturers for healthcare professionals are promoting confidence in using advanced inflation devices, further encouraging adoption

- Growing interest in minimally invasive procedures in secondary cities and emerging healthcare hubs is expanding the addressable market beyond major metropolitan hospitals

Restraint/Challenge

“High Costs and Regulatory Compliance Requirements”

- The relatively high cost of advanced digital inflation devices and stringent regulatory compliance requirements pose significant challenges to broader adoption in the Middle East and Africa

- For instance, smaller hospitals and clinics in some regions may hesitate to invest in premium inflation devices due to budget constraints, limiting market penetration

- Compliance with local medical device regulations and the need for device certifications from health authorities can delay product launches and increase operational costs for manufacturers and distributors

- In addition, training requirements for clinicians to properly operate advanced inflation devices can be a barrier in hospitals with limited staff or expertise in interventional procedures

- While prices of some basic analog inflation devices are lower, the premium for digital or connected systems remains a hurdle, particularly for emerging markets within the region

- Overcoming these challenges through cost optimization, regulatory support, and clinician training programs will be essential for sustained adoption and growth of inflation devices in the region

- Limited local manufacturing capacity and reliance on imports can increase lead times and procurement costs for hospitals, affecting timely access to devices

- Variability in infrastructure and procedural readiness across countries may hinder uniform adoption, as some hospitals may lack supporting equipment or trained personnel to fully utilize advanced inflation devices

Middle East and Africa Inflation Device Market Scope

The market is segmented on the basis of type, capacity, application, pressure, function, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into analog inflation devices and digital inflation devices. The digital inflation device segment dominated the market with the largest revenue share of 55.2% in 2025, driven by its precise pressure control, real-time monitoring capabilities, and integration with advanced catheter systems. Hospitals and interventional laboratories prefer digital devices for their enhanced procedural safety, accurate pressure recording, and ability to store and transfer procedural data for post-operative analysis. Digital devices reduce human error during complex interventions, making them a preferred choice in high-volume cardiac and radiology centers. Growing awareness of minimally invasive procedures and preference for technologically advanced solutions is supporting adoption. Manufacturers are also focusing on software-enabled monitoring and predictive maintenance to improve operational efficiency.

The analog inflation device segment is expected to witness the fastest growth during the forecast period due to its lower cost, simpler design, and ease of maintenance. Smaller hospitals and clinics in Africa and emerging Middle Eastern markets are adopting analog devices as cost-effective solutions while gradually transitioning to digital systems. Analog devices offer reliability for routine interventional procedures and require minimal training for clinicians. Limited budgets and lower infrastructure requirements make analog devices appealing in secondary cities and smaller healthcare facilities. Ease of repair and minimal dependency on technical support further drive adoption. Their compatibility with existing balloon catheters ensures continued demand in resource-constrained environments.

- By Capacity

On the basis of capacity, the market is segmented into 20 ml, 25 ml, 30 ml, and 60 ml inflation devices. The 30 ml segment dominated the market with a share of 40% in 2025, owing to its versatility across interventional cardiology, peripheral vascular, and urological procedures. Clinicians prefer this capacity for its compatibility with commonly used balloon catheters and ease of handling during both diagnostic and therapeutic procedures. The balance between volume and control makes it suitable for high-frequency use in hospitals and interventional laboratories. It is widely used in both private and public healthcare facilities in Saudi Arabia and UAE. Hospitals favor this capacity for reducing procedural complications and achieving precise inflation. High demand in cardiac and vascular centers further strengthens its market dominance.

The 60 ml segment is expected to witness the fastest growth during the forecast period due to increasing complex interventions requiring larger inflation volumes, such as stent deployment in peripheral vascular procedures. Expansion of cardiac care facilities in UAE, Saudi Arabia, and select African markets supports the adoption of higher-capacity devices. Growing awareness of minimally invasive procedures and the need for procedural efficiency drives demand. Technological advancements in large-volume devices, including enhanced pressure monitoring, also boost adoption. Increased procedural complexity in tertiary care centers fuels growth in this segment.

- By Application

On the basis of application, the market is segmented into interventional cardiology, peripheral vascular procedures, interventional radiology, urological procedures, gastroenterological procedures, and others. The interventional cardiology segment dominated the market with a share of 50% in 2025 due to the high prevalence of cardiovascular diseases in the region. Hospitals prioritize devices with precise pressure control for balloon angioplasty and stent placement, ensuring patient safety. Government initiatives to improve cardiac care and increased healthcare investments in Saudi Arabia and UAE further drive adoption. Hospitals benefit from digital devices enabling data recording, procedural monitoring, and reduced risk of complications. Clinician preference for reliable devices in high-volume cardiac centers reinforces market dominance. Widespread use in both private and public hospitals strengthens the segment’s leading position.

The peripheral vascular procedures segment is expected to witness the fastest growth during the forecast period due to the rising adoption of minimally invasive techniques and increased awareness of peripheral arterial disease management. Advanced inflation devices supporting these procedures are gaining traction in specialized hospitals and clinics. Growing demand for accurate stent deployment and balloon angioplasty in peripheral arteries boosts growth. Expansion of vascular care centers in urban and secondary cities contributes to rapid adoption. Awareness campaigns and government support for advanced interventions also support market expansion.

- By Pressure

On the basis of pressure, the market is segmented into 30 atm, 40 atm, 55 atm, and others. The 40 atm segment dominated the market with the largest revenue share in 2025, as most routine interventional procedures require this pressure range for safe and effective balloon inflation. Devices in this category provide optimal control and safety margins for clinicians, making them standard in hospitals and interventional labs. Adoption is strongest in Saudi Arabia and UAE due to advanced cardiac and radiology facilities. The 40 atm devices balance safety and procedural efficiency for both high-volume and complex interventions. Their compatibility with common balloon catheters ensures widespread use. Clinicians prefer these devices for predictable and reliable performance during interventions.

The 55 atm segment is expected to witness the fastest growth during the forecast period, driven by increasing complex interventions requiring higher inflation pressures, particularly in stent deployment and peripheral vascular procedures. Rising prevalence of advanced cardiovascular conditions supports demand. Hospitals performing intricate interventions prefer high-pressure devices for precision. Technological enhancements in 55 atm devices, including digital monitoring, improve procedural safety. Adoption is increasing in specialized cardiac and vascular centers across Middle Eastern and African markets.

- By Function

On the basis of function, the market is segmented into stent deployment and fluid delivery. The stent deployment segment dominated the market with a share of 52% in 2025, driven by rising cardiovascular interventions and the critical requirement for precision in stent placement. Hospitals and specialized cardiac centers prefer digital devices offering controlled deployment and real-time monitoring. Growing procedural volume in interventional cardiology further supports adoption. Digital stent deployment devices reduce risk and improve patient outcomes. Compatibility with advanced catheter systems strengthens market leadership. Widespread clinician familiarity with stent deployment devices ensures steady demand.

The fluid delivery segment is expected to witness the fastest growth during the forecast period due to increasing use in urological and gastroenterological procedures requiring precise fluid administration and controlled pressure delivery. Hospitals and clinics are adopting devices enabling accurate fluid management. Rising minimally invasive procedures in peripheral vascular and urological care drive demand. Integration with digital monitoring improves safety and procedural efficiency. Growth is supported by expanding secondary hospitals and specialty clinics. Increasing focus on patient safety and procedural precision reinforces adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, interventional laboratories, and clinics. The hospitals segment dominated the market with a share of 60% in 2025, driven by high patient volumes, advanced infrastructure, and demand for reliable, high-performance inflation devices. Hospitals require devices for interventional cardiology, radiology, and urology procedures with precise pressure control. Advanced hospitals in Saudi Arabia and UAE prioritize digital devices for operational efficiency. Large-scale adoption in public and private hospitals reinforces market dominance. Integration with hospital information systems enhances data recording and procedural tracking. Preference for devices offering reliability and safety strengthens hospital adoption.

The interventional laboratories segment is expected to witness the fastest growth during the forecast period due to the expansion of specialized labs across UAE and Saudi Arabia to meet the demand for minimally invasive procedures with advanced monitoring requirements. Growth is supported by increased investment in cardiac and vascular labs. Adoption of digital devices for precise pressure control drives growth. Rising awareness among clinicians for safety and procedural accuracy supports expansion. Emerging interventional labs in secondary cities contribute to the segment’s rapid growth. Focus on enhancing operational efficiency reinforces adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and third-party distributors. The direct tender segment dominated the market with a share of 50% in 2025, driven by hospital procurement strategies and government healthcare tenders ensuring access to high-quality inflation devices. Hospitals prefer direct procurement for guaranteed support, service, and maintenance. Large-scale tenders in Saudi Arabia and UAE strengthen the segment’s dominance. Devices procured through direct tender are often digital, ensuring advanced features and safety. Government initiatives for cardiac and interventional facilities drive adoption. Direct tender ensures compliance with regulatory standards and quality assurance.

The third-party distributors segment is expected to witness the fastest growth during the forecast period, due to increasing penetration in smaller clinics and hospitals in emerging African healthcare markets. Third-party distributors provide access to both analog and digital inflation devices with localized support. Growing healthcare infrastructure in secondary cities drives adoption. Distributors offer flexibility in procurement and maintenance, making them attractive to smaller facilities. Expansion of regional distribution networks strengthens market growth. Rising demand for minimally invasive procedures in clinics and smaller hospitals further supports growth.

Middle East and Africa Inflation Device Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa inflation device market with the largest revenue share of 38.1% in 2025, supported by high healthcare expenditure, government initiatives to enhance interventional cardiology services, and the presence of key distributors and regional medical device companies, with significant adoption in both private and public hospitals

- Hospitals and interventional laboratories in the region highly value the precision, real-time monitoring, and safety features offered by digital inflation devices, which enhance procedural efficiency and patient outcomes

- This widespread adoption is further supported by government initiatives to improve cardiac care, strong presence of key distributors and regional medical device companies, and increasing awareness among clinicians regarding the benefits of advanced inflation devices, establishing them as the preferred choice for both hospitals and specialized clinics

The Saudi Arabia Inflation Device Market Insight

The Saudi Arabia inflation device market captured the largest revenue share of 38.1% in 2025 within the Middle East and Africa, driven by the rising prevalence of cardiovascular and peripheral vascular diseases and increasing investments in advanced healthcare infrastructure. Hospitals and interventional laboratories are prioritizing digital inflation devices for their precision, real-time monitoring, and safety features, which enhance procedural efficiency and patient outcomes. The government’s initiatives to improve cardiac care and the growing adoption of minimally invasive procedures are further fueling market growth. In addition, the presence of key distributors and regional medical device companies ensures wide availability and after-sales support, strengthening the market’s expansion.

United Arab Emirates Inflation Device Market Insight

The United Arab Emirates inflation device market is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare access, rising numbers of specialized cardiac and vascular centers, and growing collaborations with international device manufacturers. Hospitals and clinics in the UAE are rapidly adopting digital inflation devices to improve procedural precision and efficiency. Government initiatives promoting advanced interventional care, coupled with rising awareness among clinicians of minimally invasive procedures, are further supporting adoption. The availability of modern hospital infrastructure and highly trained medical personnel contributes to the market’s dynamic growth.

South Africa Inflation Device Market Insight

The South Africa inflation device market is witnessing steady growth due to increasing healthcare expenditure and the rising prevalence of cardiovascular and peripheral vascular diseases. Hospitals and interventional laboratories are adopting both analog and digital inflation devices to meet procedural requirements efficiently. Expansion of private and public healthcare facilities, coupled with initiatives to improve access to advanced interventional procedures, is supporting market development. The growing awareness of minimally invasive techniques and increasing number of specialized cardiac centers further contribute to market growth.

Egypt Inflation Device Market Insight

The Egypt inflation device market is expected to grow at a notable CAGR during the forecast period, fueled by rising incidence of cardiovascular diseases and expanding interventional healthcare services. Hospitals and clinics are increasingly investing in digital inflation devices for better procedural control and patient safety. Government support for upgrading hospital infrastructure and increasing accessibility to advanced cardiovascular procedures is further propelling demand. Adoption is also supported by training programs and workshops organized by manufacturers to familiarize clinicians with advanced devices. The growing urban population and healthcare modernization projects reinforce the market’s expansion.

Middle East and Africa Inflation Device Market Share

The Middle East and Africa Inflation Device industry is primarily led by well-established companies, including:

- Merit Medical Systems, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Cook (U.S.)

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Teleflex Incorporated (U.S.)

- Abbott (U.S.)

- Cardinal Health (U.S.)

- AngioDynamics, Inc. (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- Lepu Medical Technology Co., Ltd. (China)

- Vygon SA (France)

- ICU Medical, Inc. (U.S.)

- Ortus Medi-Tech (China)

- St. Stone Medical Devices (India)

- Angiomed GmbH (Germany)

- Sinomed Medical (China)

- Zylox-Tonbridge (China/UK listing)

- Hunan VST BioTechnology Co., Ltd. (China)

What are the Recent Developments in Middle East and Africa Inflation Device Market?

- In January 2025, Burjeel Holdings, a major private healthcare provider in the UAE and Oman, announced expansion of its facility network including new specialty centers and increased surgical / interventional capacity signaling rising demand for advanced interventional devices in the region

- In May 2024, Merit Medical Systems launched its basixSKY Inflation Device, a new analog inflation device designed for balloon angioplasty and stent procedures, offering fast inflation, one‑hand preparation, and simplified handling

- In February 2024, Zylox‑Tonbridge received marketing approvals from the United Arab Emirates Ministry of Health and Prevention for five of its interventional vascular products including the ZENFluxion Drug‑coated PTA Balloon Catheter and ZENFlow HP PTA Balloon Catheter marking the company’s first regulatory entry into the Gulf region

- In November 2022, Merit Medical released the BasixAlpha Inflation Device an ergonomic inflation device enabling one‑handed preparation and quick inflation, aimed at improving throughput for angioplasty procedures

- In January 2022, Medtronic acquired Affera, a cardiac-technology firm specialized in mapping, navigation, and ablation systems marking Medtronic’s deeper commitment to expanding cardiovascular interventional offerings, which can stimulate demand for supporting devices including inflation systems across MEA markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.