Middle East And Africa Insight Engines Market

Market Size in USD Million

CAGR :

%

USD

156.90 Million

USD

490.20 Million

2024

2032

USD

156.90 Million

USD

490.20 Million

2024

2032

| 2025 –2032 | |

| USD 156.90 Million | |

| USD 490.20 Million | |

|

|

|

|

Middle East and Africa Insight Engines Market Size

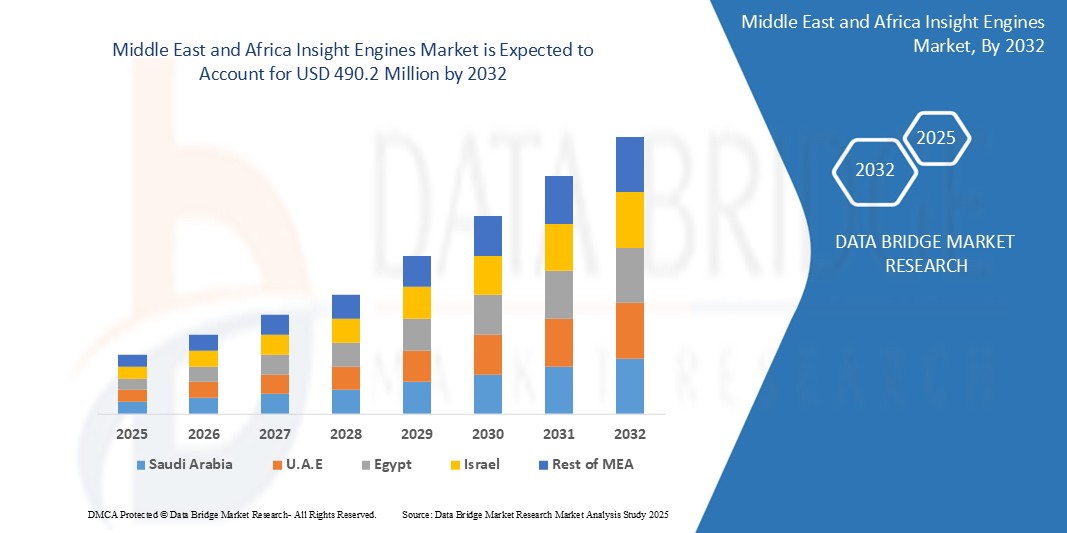

- The Middle East and Africa Insight Engines Market size was valued at USD 156.9 million in 2024 and is expected to reach USD 490.2 million by 2032, at a CAGR of 17.7% during the forecast period.

- This growth is driven by Gulf countries like the UAE and Saudi Arabia are heavily investing in AI and data analytics as part of Vision 2030. In 2023, Saudi Aramco partnered with IBM to integrate AI-driven insight engines for real-time data intelligence in energy operations.

Middle East and Africa Insight Engines Market Analysis

- Organizations across retail and banking, such as ING and Zalando, adopted insight engines to improve search relevance and deliver personalized user interactions through conversational AI.

- The growing volume of data generated across sectors—healthcare, legal, and finance—is driving the need for semantic search solutions. Amadeus IT Group began leveraging AI-driven search in 2023 to optimize travel-related data analysis.

- South Africa holds a significant market share due to Technological Advancements.

- South Africa is expected to register the fastest growth, fuelled by Growth in Big Data Analytics.

- The Prescriptive Insights segment is projected to account for a significant market share of approximately 41.3% in 2025, driven by Cloud Migration Across Sectors.

Report Scope and Middle East and Africa Insight Engines Market Segmentation

|

Attributes |

Middle East and Africa Insight Engines Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Insight Engines Market Trends

“Cloud-Based Solutions”

- The shift towards cloud deployment offers enhanced scalability, flexibility, and cost-efficiency. Cloud-based Insight Engine solutions allow organizations to rapidly adjust resources in response to changing demands, ensuring optimal performance and reliability. This trend is particularly beneficial for industries undergoing rapid digital transformation, such as telecommunications, where cloud-based Insight Engines facilitate logical business process integration across various independent application systems.

- The convergence of Artificial Intelligence (AI) and the Internet of Things (IoT) within Insight Engines is revolutionizing decision-making capabilities. AI algorithms analyze data from IoT devices to provide real-time insights, enabling organizations to automate complex processes such as predictive maintenance in manufacturing and personalized customer experiences in retail.

- In October 2023, Major smart city initiatives like NEOM in Saudi Arabia and Smart Dubai are fueling demand for cognitive search and contextual data platforms. In 2024, Microsoft launched Azure AI solutions in the UAE, enabling real-time multilingual search analytics.

- The continued shift toward cloud computing has enabled scalable deployments of insight engines, with Microsoft Azure Cognitive Search gaining ground in sectors like healthcare and public services in the UK and Nordics.

Middle East and Africa Insight Engines Market Dynamics

Driver

“Reduced Dependency on IT Teams”

- Modern Insight Engine platforms enable business users to define and manage rules without extensive IT involvement, accelerating the deployment of business rules and reducing time-to-market. This democratization of rule management empowers organizations to respond swiftly to changing business environments.

- With the increasing complexity of regulatory environments, Insight Engine solutions provide a framework for automated compliance monitoring, ensuring that business rules adhere to current regulations. This capability is crucial for industries such as finance and healthcare, where compliance with laws like GDPR and HIPAA is mandatory.

- For instance, In April 2024, Enterprises in sectors like telecom and banking (e.g., MTN Group, First Abu Dhabi Bank) are adopting cloud-based insight engines for enhanced data visibility and customer service.

- As hybrid cloud environments become common, the need for insight engines that unify data from multiple sources is growing. Elastic NV is expanding capabilities in federated AI search for Asia Pacific financial institutions.

Opportunity

“Expansion in Emerging Markets”

- Nations like the UAE (e.g., Smart Dubai), Saudi Arabia (Vision 2030, NEOM), and South Africa are investing in digital infrastructure, increasing the demand for technologies that make use of unstructured data—an area where insight engines are highly effective.

- The incorporation of [ND3] analytics capabilities such as predictive analytics and data mining into Insight Engine platforms enables organizations to derive actionable insights from vast datasets. This integration supports data-driven decision-making, allowing businesses to adapt their rules and policies proactively.

- For instance, As of September 2024, Governments in the Gulf region are investing in e-governance, using insight engines to power AI chatbots and digital citizen services. In 2024, Dubai Municipality introduced AI-driven search to streamline city services.

- Insight engine startups and niche providers are becoming acquisition targets for larger cloud and enterprise platforms. In 2024, ServiceNow acquired a Middle East and Africa AI search startup to enhance its knowledge management offerings.

Restraint/Challenge

“Shortage of Skilled AI and NLP Talent”

- Many organizations struggle to find local expertise in NLP, machine learning, and cognitive search. This has slowed large-scale deployment, particularly in southern and central Asia Pacific.

- Deploying enterprise-grade insight engines remains costly due to custom integration, licensing, and AI training. In 2023, smaller firms in Eastern Middle East and Africa delayed adoption due to budget constraints.

- For instance, in 2023, AI-powered insight engines require significant investment in software, customization, and cloud infrastructure. SMEs in the region face affordability issues, as noted by Oracle MEA during a 2023 enterprise cloud migration survey.

- Many organizations struggle to find local expertise in NLP, machine learning, and cognitive search. This has slowed large-scale deployment, particularly in southern and central Asia Pacific.

Middle East and Africa Insight Engines Market Scope

The market is segmented based on Component, Technology, and Road Type

|

Segmentation |

Sub-Segmentation |

|

By Insight Type |

|

|

By Deployment Type |

|

|

By Component |

|

|

By Application |

|

|

By Organization Size |

|

|

By Industry Vertical |

|

In 2025, Tools segment is projected to dominate the component segment

The Tools segment is expected to hold a market share of approximately 59.3% in 2025, driven by Industry-Specific Solutions.

The Cloud segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Cloud segment is projected to account for a market share of 69.8%, driven by Regulatory Push for Data Transparency.

“South Africa Holds the Largest Share in the Middle East and Africa Insight Engines Market”

- South Africa dominates the market due to Rapid urbanization and increasing vehicle ownership in emerging markets present significant opportunities for road safety solution providers to expand their footprint and address the growing demand for traffic management systems.

- The South Africa holds a significant share, driven by Smart City and IoT Initiatives.

- In April 2024, FLIR introduced the Trafibot AI camera to enhance interurban traffic flow and road safety through advanced detection performance.

“South Africa is Projected to Register the Highest CAGR in the Middle East and Africa Insight Engines Market”

- South Africa growth is driven by With Asia Pacific’s linguistic diversity, companies like Sinequa and Yext are offering robust multilingual NLP engines, creating a competitive edge in EU-wide deployments.

- South Africa is projected to exhibit the highest CAGR due to Rising Demand for Federated Search.

- As hybrid cloud environments become common, the need for insight engines that unify data from multiple sources is growing. Elastic NV is expanding capabilities in federated AI search for Asia Pacific financial institutions.

Middle East and Africa Insight Engines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM,

- Microsoft,

- Oracle,

- Attivio,

- Sinequa,

- Coveo Solutions Inc.,

- Celonis,

- IntraFind Software AG.,

- Lucidworks,

- Insight engines,

- Mindbreeze GmbH,

- Squirro Americas Inc.,

- Hewlett Packard Enterprise Development LP,

- Veritone, Inc.,

- Smartlogic Semaphore Ltd,

- BA Insight,

- ForwardLane, CognitiveScale,

- Comintelli,

- ActiveViam.,

- Prevedere, Inc.

Latest Developments in Middle East and Africa Insight Engines Market

- In March 2023, Insight engines are being used for real-time data governance and compliance monitoring, especially in regulated industries like finance and healthcare. Deloitte Middle East integrated AI search capabilities into its risk advisory practice in 2023.

- In January 2024, With multiple official languages across MEA, companies like Sinequa and Elastic are rolling out Arabic-optimized NLP engines to meet regional needs.

- In November 2023, Google Cloud and Microsoft Azure have partnered with regional enterprises in Japan, India, and Australia for deploying scalable insight engines.

- As of February 2024, SAP reported that lack of skilled data engineers and AI specialists is a barrier to scaling insight engine deployments across industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PENETRATION AND GROWTH POSPECT MAPPING

5.2 COMPETITOR KEY PRICING STRATEGIES

5.3 TECHNOLOGY ANALYSIS

5.3.1 KEY TECHNOLOGIES

5.3.2 COMPLEMENTARY TECHNOLOGIES

5.3.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.4 COMPANY COMPETITIVE ANALYSIS

5.4.1 STRATEGIC DEVELOPMENT

5.4.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.4.2.1. CHALLENGES

5.4.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.4.3 TECHNOLOGY SPEND OF COMPANY

5.4.4 CUSTOMER BASE

5.4.5 SERVICE POSITIONING

5.4.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.4.7 APPLICATION REACH

5.4.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.5 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.6 USED CASES & ITS ANALYSIS

6 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY OFFERING

6.1 OVERVIEW

6.2 TOOLS

6.3 SERVICES

6.3.1 IMPLEMENTATION & INTEGRATION

6.3.2 TRAINING AND CONSULTING

6.3.3 SUPPORT & MAINTENANCE

7 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 CUSTOMER EXPERIENCE MANAGEMENT

7.3 OPERATIONS MANAGEMENT

7.4 RISK AND COMPLIANCE MANAGEMENT

7.5 SALES AND MARKETING MANAGEMENT

7.6 WORKFORCE MANAGEMENT

7.7 KNOWLEDGE MANAGEMENT

7.8 DATA ANALYTICS

7.9 OPERATIONAL INTELLIGENCE

7.1 FRAUD DETECTION AND RISK MANAGEMENT

7.11 CONTENT PERSONALIZATION

7.12 OTHERS

8 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY INSIGHT TYPE

8.1 OVERVIEW

8.2 PREDICITVE INSIGHTS

8.3 PRESCRIPTIVE INISGHTS

8.4 DESCRIPTIVE INSIGHTS

9 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY DEPLOYMENT

9.1 OVERVIEW

9.2 CLOUD

9.2.1 PUBLIC

9.2.2 PRIVATE

9.2.3 HYBRID

9.3 ON-PREMISE

10 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES

11 MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERPRISE SEARCH

11.3 CUSTOMER EXPERIENCE MANAGEMENT

11.4 KNOWLEDGE MANAGEMENT

11.5 DATA ANALYTICS

11.6 OPERATIONAL INTELLIGENCE

11.7 FRAUD DETECTION AND RISK MANAGEMENT

11.8 CONTENT PERSONALIZATION

11.9 OTHERS

12 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY END USE

12.1 OVERVIEW

12.2 BFSI

12.3 IT & TELECOM

12.4 RETAIL & ECOMMERCE

12.5 HEALTHCARE

12.6 MANUFACTURING

12.7 GOVERNMENT

12.8 MEDIA & ENTERTAINMENT

12.9 OTHERS

13 MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, BY REGION

MIDDLE EAST AND AFRICA INSIGHT ENGINES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 EGYPT

13.1.3 SAUDI ARABIA

13.1.4 U.A.E

13.1.5 ISRAEL

13.1.6 KUWAIT

13.1.7 JORDAN

13.1.8 KENYA

13.1.9 UGANDA

13.1.10 IRAN

13.1.11 IRAQ

13.1.12 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14.2 MERGERS & ACQUISITIONS

14.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.4 EXPANSIONS

14.5 REGULATORY CHANGES

14.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET, SWOT AND DBMR ANALYSIS

16 MIDDLE EAST AND AFRICA INSIGHT ENGINE MARKET, COMPANY PROFILE

16.1 LUCIDYA COMPANY LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 MICROSOFT CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 GOOGLE LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 GROUP 42 HOLDING LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 LIGHTON SAS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 DXC TECHNOLOGY COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 AUSPEX INTERNATIONAL LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 IMRB INTERNATIONAL PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 EDGE GROUP PJSC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 BILFINGER MIDDLE EAST FZCO

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ORIENT RESEARCH CENTRE FZ LLC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 ASTRA TECH LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 SAKHR SOFTWARE COMPANY K.S.C.C.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 YEMENSOFT LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 MIDDLE EAST ECONOMIC DIGEST (MEED MEDIA FZ LLC)

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.