Market Analysis and Insights : Middle East and Africa IVD Regulatory Affairs Outsourcing Market

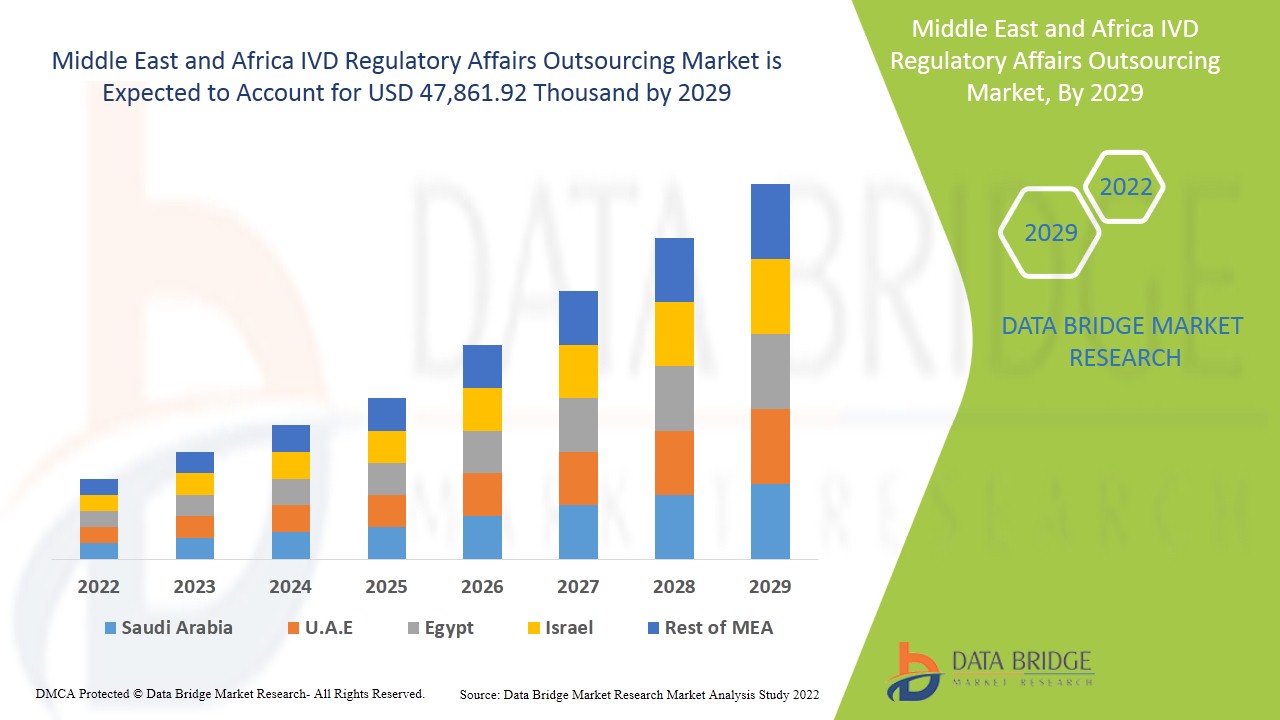

Middle East and Africa IVD regulatory affairs outsourcing market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 11.6% in the forecast period of 2022 to 2029 and expected to reach USD 47,861.92 thousand by 2029.

- In vitro diagnostic products are reagents, devices, and systems used to diagnose disease or other conditions, including determining one's state of health to cure, mitigate, treat, or prevent disease. These products are intended for use in the collecting, preparation, and examination of human body specimens. Regulatory affairs play a crucial part in the in vitro diagnostic device (IVD) and medical device industry. The regulatory affairs outsourcing services entails medical writing and publication of regulatory documentation by professionals who contribute to the production of high-quality documents for clinical research projects. The demand for regulatory services outsourcing is substantially increasing in clinical studies conducted in emerging economies, providing a healthy platform for this industry's growth.

The major factors driving the growth of the IVD regulatory affairs outsourcing market are rise in the prevalence of chronic diseases across the region and technological advancement in various in vitro diagnostic devices. Rise in strategic acquisition & partnership among organization is creating opportunities for the growth of the market. Changing regulations regarding medical devices in different regions is acting as the major restraint for IVD Regulatory Affairs Outsourcing market. Lack of infrastructure in healthcare service is acting as a major challenge for the growth of the market.

This IVD regulatory affairs outsourcing market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa IVD Regulatory Affairs Outsourcing Market Scope and Market Size

Middle East and Africa IVD regulatory affairs outsourcing market is segmented into seven notable segments which are based on the services, indication, deployment mode, organization size, stage, class and end user.

- On the basis of services, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into regulatory writing & submissions, regulatory registration & clinical trial applications, regulatory consulting, legal representation, data management services, chemistry manufacturing and controls (CMC) services, and others. In 2022, regulatory writing & submissions is expected to dominate as it is cost efficient and the solution flexible characteristics of the cloud computing technology in IVD regulatory provides a steady infrastructure with maximum output to the IVD systems dealing organizations.

- On the basis of indication, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into oncology, neurology, cardiology, clinical chemistry and immunoassays, precision medicine, infectious diseases, diabetes, genetic testing, HIV/AIDS, haematology, drug testing/pharmacogenomics, blood transfusion, point of care, and others. In 2022, the oncology segment is expected to dominate as it helps in improving the predictability of the oncology drug development process and become an important tool for the oncologist in relation to the choice of treatment for the patient

- On the basis of deployment mode, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into cloud and on-premises. In 2022, the cloud segment is expected to dominate as it is the solution flexible characteristics of the cloud computing technology is cost efficient in IVD regulatory provides a steady infrastructure with maximum output to the IVD systems dealing organizations.

- On the basis of organization size, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into small and medium enterprises (SMES) and large enterprises. In 2022, the large enterprises segment is expected to dominate as rise in strategic acquisition & partnership among organization.

- On the basis of stage, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into clinical, preclinical, and PMA (post-market authorization). In 2022, clinical segment is expected to dominate the market as emergence of various efficient technological services and standards.

- On the basis of class, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into class I, class II, and class III. In 2022, class I segment is expected to dominate the market as it involves no public health risk or low personal risk with lowest regulations. These are high in demand and 47% of medical devices fall under this category.

- On the basis of end user, the Middle East and Africa IVD regulatory affairs outsourcing market is segmented into pharmaceutical companies, medical device companies, biotechnology companies, and others. In 2022, medical device companies are expected to dominate the market the healthcare industry ranks second among all industries when it comes to the amount it spends on research and development. Rising healthcare expenditure has further resulted in better provision of research and development opportunities.

Middle East and Africa IVD Regulatory Affairs Outsourcing Market Country Level Analysis

Middle East and Africa IVD regulatory affairs outsourcing market is analysed and market size information is provided by the country, services, indication, deployment mode, organization size, stage, class and end user.

The countries covered in Middle East and Africa IVD regulatory affairs outsourcing market report are South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa.

South Africa is dominating the market in Middle East and Africa region due to developments in the healthcare sector and technological advancement in R&D activities companies across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of IVD Regulatory Affairs Outsourcing

Middle East and Africa IVD regulatory affairs outsourcing market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in IVD regulatory affairs outsourcing and changes in regulatory scenarios with their support for the IVD regulatory affairs outsourcing market. The data is available for historic period 2012 to 2020.

Competitive Landscape and Middle East and Africa IVD Regulatory Affairs Outsourcing Market Share Analysis

Middle East and Africa IVD regulatory affairs outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Middle East and Africa IVD regulatory affairs outsourcing market.

Some of the major players operating in the report are IVD regulatory affairs outsourcing market are Freyr Solutions, PPD Inc. (A Subsidiary of Thremofisher Scientific Inc.), EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife S.A., Labcorp Drug Development, WuXi AppTec, Genpact, Medpace, Dor Pharmaceutical Services, Qserve, among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of Middle East and Africa IVD regulatory affairs outsourcing market.

For instance,

- In November 2021, USA-9 Technology Magazine Listed Freyr in the “10 Best Technology Solution Providers of 2021. USA-9.com is a Technology Magazine that has listed Freyr Solutions, a leading global regulatory solution, and services provider, as the “10 Best Technology Solution Providers of 2021 as Fryer continues to design innovative software solutions and support clients in their respective compliance objectives. This has helped company to increase its popularity.

- In December 2021, Labcorp Drug Development acquired Toxikon Corporation which is a contract research organization delivering best-in-class nonclinical testing service. The addition of Toxikon to Labcorp Drug Development bolstered Labcorp’s strong nonclinical development portfolio, and created a strategic footprint for the company to partner with pharmaceutical and biotechnology clients in the Boston, Mass., area. This has helped company to expand their business.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for IVD regulatory affairs outsourcing through expanded range of size.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, REGULATORY SCENARIO

4.1.1 THE U.S.

4.1.2 REGULATIONS IN EUROPE

4.1.3 REGULATIONS IN ASIA

4.1.3.1 CHINA

4.1.3.2 SOUTH KOREA

4.1.3.3 MALAYSIA

4.1.3.4 THAILAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

5.1.2 TECHNOLOGICAL ADVANCEMENT IN DEVELOPING VARIOUS IN VITRO DIAGNOSTIC DEVICES

5.1.3 DEVELOPMENT OF PROJECT-BASED SUPPORT LEADS TO LONG TERM OUTSOURCING AGREEMENT AMONG ORGANIZATION

5.1.4 INCREASE IN PRODUCT REGISTRATION NUMBERS AND CLINICAL TRIAL APPROVALS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS REGARDING MEDICAL DEVICES IN DIFFERENT REGIONS

5.2.2 HIGHER COST RELATED TO MAINTENANCE AND OUTSOURCING OF IVD

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG ORGANIZATION

5.3.2 EMERGENCE OF VARIOUS EFFICIENT TECHNOLOGICAL SERVICES AND STANDARDS

5.3.3 INCREASE IN R&D ACTIVITIES BY COMPANIES ACROSS THE REGION

5.4 CHALLENGES

5.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

5.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING IN VITRO DIAGNOSTIC DEVICES

6 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

6.1 OVERVIEW

6.2 REGULATORY WRITING & SUBMISSIONS

6.3 LEGAL REPRESENTATION

6.4 REGULATORY CONSULTING

6.5 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

6.6 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

6.7 DATA MANAGEMENT SERVICES

6.8 OTHERS

7 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

7.1 OVERVIEW

7.2 CLINICAL CHEMISTRY AND IMMUNOASSAYS

7.3 INFECTIOUS DISEASES

7.3.1 VIROLOGY

7.3.2 MICROBIOLOGY AND MYCOLOGY

7.3.3 BACTERIOLOGY

7.3.4 SEPSIS

7.3.5 HEPATITIS B

7.3.6 HEPATITIS C

7.3.7 MALARIA

7.3.8 TUBERCULOSIS

7.3.9 SYPHILIS

7.3.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

7.3.11 OTHERS

7.4 HAEMATOLOGY

7.5 DRUG TESTING/PHARMACOGENOMICS

7.6 PRECISION MEDICINE

7.7 DIABETES

7.8 BLOOD TRANSFUSION

7.9 CARDIOLOGY

7.1 POINT OF CARE

7.10.1 WAIVED TEST

7.10.2 AT HOME TESTS

7.11 ONCOLOGY

7.12 NEUROLOGY

7.13 HIV/AIDS

7.14 GENETIC TESTING

7.15 OTHERS

8 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS I

8.3 CLASS III

8.4 CLASS II

9 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES (SMES)

11 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

11.1 OVERVIEW

11.2 CLINICAL

11.3 PRECLINICAL

11.4 PMA (POST MARKET AUTHORIZATION)

12 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDICAL DEVICE COMPANIES

12.2.1 BY ORGANIZATION SIZE

12.2.1.1 LARGE ENTERPRISES

12.2.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.2 BY SERVICE

12.2.2.1 REGULATORY WRITING & SUBMISSIONS

12.2.2.2 LEGAL REPRESENTATION

12.2.2.3 REGULATORY CONSULTING

12.2.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.2.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.2.2.6 DATA MANAGEMENT SERVICES

12.2.2.7 OTHERS

12.3 PHARMACEUTICAL COMPANIES

12.3.1 BY ORGANIZATION SIZE

12.3.1.1 LARGE ENTERPRISES

12.3.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.3.2 BY SERVICE

12.3.2.1 REGULATORY WRITING & SUBMISSIONS

12.3.2.2 LEGAL REPRESENTATION

12.3.2.3 REGULATORY CONSULTING

12.3.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.3.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.3.2.6 DATA MANAGEMENT SERVICES

12.3.2.7 OTHERS

12.4 BIOTECHNOLOGY COMPANIES

12.4.1 BY ORGANIZATION SIZE

12.4.1.1 LARGE ENTERPRISES

12.4.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.4.2 BY SERVICE

12.4.2.1 REGULATORY WRITING & SUBMISSIONS

12.4.2.2 LEGAL REPRESENTATION

12.4.2.3 REGULATORY CONSULTING

12.4.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.4.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.4.2.6 DATA MANAGEMENT SERVICES

12.4.2.7 OTHERS

12.5 OTHERS

13 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ICON PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MEDPACE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PAREXEL INTERNATIONAL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LABCORP DRUG DEVELOPMENT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PPD INC. (A SUBSIDIARY OF THERMOFISHER SCIENTIFIC INC.)

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHARLES RIVER LABORATORIES

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 FREYR

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASSENT COMPLIANCE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ANDAMAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ASIA ACTUAL

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 AXSOURCE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRITERIUM, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DOR PHARMACEUTICAL SERVICES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 EMERGO BY UL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 GENPACT

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GROUPE PRODUCTLIFE S.A.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LORENZ LIFE SCIENCES GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MAKROCARE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MARACA INTERNATIONAL BVBA

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MDICONSULTANTS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 PBC BIOMED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PROPHARMA GROUP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QSERVE

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 REGULATORY COMPLIANCE ASSOCIATES INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 RMQ+

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SARACA SOLUTIONS PRIVATE LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VCLS

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 WUXI APPTEC

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA REGULATORY WRITING & SUBMISSIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA LEGAL REPRESENTATION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA REGULATORY CONSULTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA DATA MANAGEMENT SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA CLINICAL CHEMISTRY AND IMMUNOASSAYS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION,2020-2029 (THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA HAEMATOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA DRUG TESTING/PHARMACOGENOMICS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA PRECISION MEDICINE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA DIABETES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA BLOOD TRANSFUSION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CARDIOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA ONCOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA NEUROLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA HIV/AIDS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA GENETIC TESTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA CLASS I IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA CLASS III IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CLASS II IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA CLOUD IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA ON-PREMISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA LARGE ENTERPRISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SMALL & MEDIUM ENTERPRISES (SMES) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PRECLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA PMA (POST MARKET AUTHORIZATION) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 82 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 83 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 84 SAUDI ARABIA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SAUDI ARABIA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 86 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 87 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 89 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 90 SAUDI ARABIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 SAUDI ARABIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 SAUDI ARABIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 SAUDI ARABIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 SAUDI ARABIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 97 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 98 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 99 U.A.E INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 U.A.E POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 101 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 102 U.A.E. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 104 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 105 U.A.E IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 U.A.E MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 U.A.E MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 108 U.A.E PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 U.A.E PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 110 U.A.E BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 111 U.A.E BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 112 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 113 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 114 EGYPT INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 EGYPT POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 116 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 117 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 118 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 119 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 120 EGYPT IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 121 EGYPT MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 122 EGYPT MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 123 EGYPT PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 124 EGYPT PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 125 EGYPT BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 126 EGYPT BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BYTYPE, 2020-2029 (USD THOUSAND)

TABLE 131 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 132 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 133 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 134 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 135 ISRAEL IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 136 ISRAEL MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 137 ISRAEL MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 138 ISRAEL PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 139 ISRAEL PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 140 ISRAEL BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 141 ISRAEL BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 142 REST OF MIDDLE EAST AND AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISE IN THE PREVALENCE OF CHRONIC DISEASES ACROSS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

FIGURE 15 MULTIPLE CHRONIC CONDITIONS AMONG PEOPLE AGED 65 AND ABOVE IN EUROPEAN REGION (2017)

FIGURE 16 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE, 2021

FIGURE 17 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY INDICATION, 2021

FIGURE 18 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY CLASS, 2021

FIGURE 19 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 21 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY STAGE, 2021

FIGURE 22 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY END USER, 2021

FIGURE 23 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.