Middle East And Africa Ldl Test Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.50 Billion

2025

2033

USD

1.30 Billion

USD

2.50 Billion

2025

2033

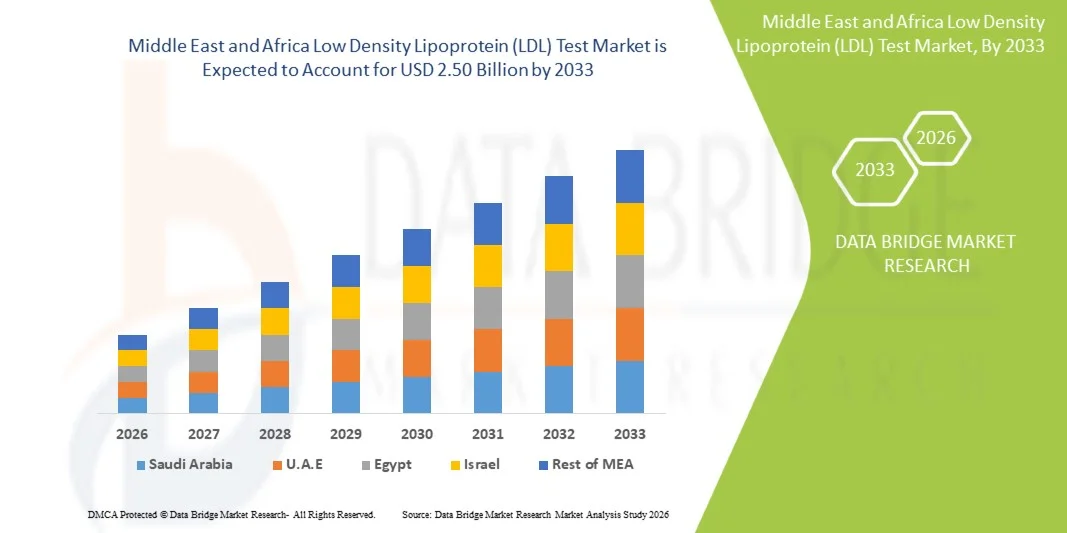

| 2026 –2033 | |

| USD 1.30 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Size

- The Middle East and Africa Low Density Lipoprotein (LDL) test market size was valued at USD 1.30 billion in 2025 and is expected to reach USD 2.50 billion by 2033, at a CAGR of 8.5% during the forecast period

- The market growth is primarily driven by the rising prevalence of cardiovascular diseases, diabetes, and obesity, coupled with increasing awareness about lipid profiling and preventive healthcare across the region

- In addition, advancements in diagnostic technologies, expanding healthcare infrastructure, and growing investments in laboratory automation are accelerating the adoption of LDL testing, thereby propelling market expansion in both hospital and clinical laboratory settings

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Analysis

- Low Density Lipoprotein (LDL) tests, critical for assessing cardiovascular health and lipid metabolism, are increasingly utilized across hospitals, clinics, and diagnostic centers in the Middle East and Africa, driven by the growing prevalence of heart disease, diabetes, and obesity-related disorders

- The demand for LDL testing is being propelled by the rising incidence of lifestyle-related diseases, expanding healthcare infrastructure, and increasing awareness of preventive diagnostics and early disease management

- South Africa dominated the Middle East and Africa LDL test market with the largest revenue share of 33.4% in 2025, supported by well-established laboratory networks, strong diagnostic capabilities, and rising adoption of lipid profiling in both public and private healthcare sectors

- Saudi Arabia is expected to be the fastest-growing country in the market during the forecast period, driven by growing healthcare investments, national health screening programs, and the introduction of advanced automated diagnostic systems

- The Kits and Reagents segment dominated the market with a share of 42.4% in 2025, attributed to their essential role in routine lipid testing, wide usage across clinical laboratories, and ongoing improvements in assay sensitivity and accuracy

Report Scope and Middle East and Africa Low Density Lipoprotein (LDL) Test Market Segmentation

|

Attributes |

Middle East and Africa Low Density Lipoprotein (LDL) Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Trends

“Growing Adoption of Automated and AI-Integrated Diagnostic Solutions”

- A significant and accelerating trend in the Middle East and Africa LDL test market is the increasing adoption of automated and AI-driven diagnostic systems across hospitals, laboratories, and clinics to improve accuracy, efficiency, and turnaround time

- For instance, Abbott Laboratories and Roche Diagnostics have introduced advanced lipid testing analyzers with integrated AI capabilities, enabling faster LDL quantification and reducing manual errors in large-scale screening programs

- AI integration in LDL testing enables features such as automated data interpretation, trend analysis, and predictive insights into cardiovascular risk, allowing clinicians to provide more personalized treatment plans for patients. For instance, certain AI-enabled platforms can identify abnormal lipid patterns and issue alerts for potential cardiovascular conditions based on real-time test results

- The growing use of AI and automation facilitates seamless workflow management, integration with laboratory information systems, and improved test reliability, particularly in high-throughput diagnostic settings

- This trend toward smart, automated testing technologies is redefining the regional diagnostics landscape, driving modernization of clinical laboratories and enhancing preventive healthcare capabilities. Consequently, companies such as Siemens Healthineers are developing AI-assisted lipid testing systems tailored for emerging healthcare markets in Africa and the Middle East

- The demand for intelligent, automated diagnostic systems is rising rapidly as healthcare providers across the region seek greater accuracy, operational efficiency, and data-driven decision-making in managing cardiovascular health

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Dynamics

Driver

“Increasing Cardiovascular Disease Burden and Preventive Health Awareness”

- The escalating prevalence of cardiovascular diseases, diabetes, and obesity across the Middle East and Africa is a major driver for the growing demand for LDL testing, as early detection of lipid abnormalities becomes a key preventive measure

- For instance, in February 2025, Abbott Laboratories expanded access to its lipid testing solutions across Saudi Arabia and South Africa, supporting government-led cardiovascular screening programs aimed at improving early diagnosis and treatment outcomes

- As public health authorities and medical institutions intensify awareness campaigns around cardiovascular health, routine LDL testing is increasingly being integrated into national preventive healthcare frameworks and workplace health programs

- Furthermore, the availability of advanced diagnostic kits, expanding laboratory infrastructure, and favorable government initiatives to promote preventive diagnostics are accelerating the adoption of LDL testing across both public and private sectors

- The growing emphasis on early detection, coupled with the rising number of specialized diagnostic centers and research initiatives, is strengthening the market’s long-term growth prospects. In addition, increasing collaboration between global diagnostic firms and regional healthcare providers is improving access to accurate lipid profiling technologies

- The convenience of rapid and automated LDL testing, combined with improved healthcare accessibility and affordability, continues to drive market expansion across urban and semi-urban areas of the Middle East and Africa

Restraint/Challenge

“Limited Accessibility and Infrastructure Constraints in Remote Regions”

- Despite growing awareness, limited access to advanced diagnostic technologies in rural and underserved regions remains a significant challenge, restricting the widespread adoption of LDL testing in parts of the Middle East and Africa

- For instance, inconsistent supply chains for diagnostic reagents and the shortage of skilled laboratory professionals in countries such as Nigeria and Kenya hinder the smooth operation of lipid testing services

- Infrastructure limitations, including inadequate laboratory facilities and unreliable electricity supply in remote areas, further affect testing accuracy and timeliness, making it difficult to implement large-scale screening programs effectively. For instance, smaller clinics in sub-Saharan Africa often depend on manual or semi-automated testing systems with limited throughput capabilities

- Addressing these accessibility gaps through public-private partnerships, mobile diagnostic units, and investment in laboratory automation is critical to improving testing coverage across the region

- Moreover, high import dependency for diagnostic kits and devices results in elevated testing costs, affecting affordability for both providers and patients in price-sensitive markets. Companies such as Randox and Bio-Rad are focusing on developing cost-efficient testing solutions to overcome these economic barriers

- Enhancing diagnostic infrastructure, expanding healthcare funding, and improving local manufacturing capacity for reagents and devices will be essential to ensure equitable access and sustainable growth in the LDL testing market

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Scope

The market is segmented on the basis of type, component, disease, end user, and distribution channel.

- By Type

On the basis of type, the Middle East and Africa LDL Test Market is segmented into LDL-C, LDL-B, LDL-P, and Others. The LDL-C (Low-Density Lipoprotein Cholesterol) segment dominated the market with the largest revenue share of 46.3% in 2025, driven by its widespread use in routine lipid profiling and cardiovascular risk evaluation. LDL-C testing is a key component of standard lipid panels due to its reliability and strong clinical relevance in diagnosing and monitoring heart disease. It is widely adopted across hospitals, clinics, and diagnostic centers for early detection and management of atherosclerosis and coronary artery disease. The availability of automated analyzers and high-precision assay kits has further enhanced testing accuracy and throughput. Growing government-led preventive health initiatives emphasizing regular lipid screening continues to reinforce LDL-C’s dominance in the region.

The LDL-P (Low-Density Lipoprotein Particle) segment is anticipated to witness the fastest growth rate of 9.2% from 2026 to 2033, driven by the increasing recognition that LDL particle number provides more accurate cardiovascular risk prediction than LDL-C concentration alone. LDL-P testing offers clinicians deeper insights into lipid metabolism, particularly for patients with metabolic syndrome or normal LDL-C levels but elevated risk. Growing adoption of advanced diagnostic techniques such as NMR spectroscopy and the introduction of cost-efficient assays are expanding its accessibility. Rising clinical awareness and the shift toward precision diagnostics in cardiovascular care are expected to drive strong growth in the LDL-P segment during the forecast period.

- By Component

On the basis of component, the market is segmented into kits and reagents, devices, and services. The Kits and Reagents segment dominated the market with the largest revenue share of 42.4% in 2025, attributed to their frequent use in both routine and specialized LDL testing procedures. Laboratories across the Middle East and Africa rely heavily on high-quality reagents for accurate lipid quantification, ensuring test precision and reproducibility. Increasing procurement through hospital tenders and diagnostic laboratory networks further supports market demand. Continuous innovation in reagent formulations—such as ready-to-use and liquid-stable reagents—has improved workflow efficiency and reduced turnaround times. Expanding partnerships between reagent manufacturers and regional distributors are also enhancing supply chain accessibility.

The Services segment is expected to witness the fastest growth rate of 8.7% from 2026 to 2033, driven by the expanding trend of diagnostic outsourcing and preventive health screening. Growing adoption of LDL testing services within private diagnostic chains and telehealth-based laboratories is improving access to lipid testing across urban and semi-urban regions. Increasing public awareness of cardiovascular health and the convenience of home sample collection offered by service providers are accelerating segment expansion. The rise of value-based healthcare and digital reporting platforms further strengthens the services segment, positioning it as a major growth driver in the coming years.

- By Disease

On the basis of disease, the market is categorized into diabetes, stroke, atherosclerosis, obesity, dyslipidaemia, carotid artery disease, peripheral arterial disease, angina, and others. The Atherosclerosis segment dominated the market with the largest revenue share of 27.4% in 2025, as LDL levels play a central role in assessing arterial plaque buildup and cardiovascular risk. Increasing prevalence of coronary artery disease and expanding access to lipid testing in hospitals and specialized cardiac centers support its strong market position. National health programs emphasizing early detection of cardiovascular conditions are further boosting demand for LDL testing among at-risk populations. Continuous advancements in automated lipid analyzers and integration with hospital information systems are improving testing reliability and speed. The rising burden of lifestyle-related diseases across the region reinforces consistent demand for LDL-based diagnostics.

The Diabetes segment is projected to grow at the fastest CAGR of 9.8% from 2026 to 2033, driven by the increasing prevalence of type 2 diabetes and associated cardiovascular complications. Diabetic patients frequently undergo LDL testing to monitor lipid abnormalities and prevent long-term vascular damage. For instance, diabetes care programs in Saudi Arabia and Egypt are integrating lipid profiling as part of standard management protocols. Growing clinical awareness of diabetic dyslipidemia and the availability of advanced lipid analyzers in both public and private healthcare settings are accelerating adoption. Expansion of diabetes screening campaigns and collaborations between diagnostic companies and national health ministries will continue to support strong growth in this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory care, and research laboratory. The Hospitals segment dominated the market with the largest revenue share of 38.5% in 2025, supported by high patient inflow, strong diagnostic infrastructure, and the inclusion of lipid profiling in preventive health packages. Hospitals serve as key centers for cardiovascular diagnosis and monitoring, leveraging high-throughput analyzers and automated systems for LDL testing. Increasing government investments in public hospital networks and partnerships with diagnostic equipment manufacturers further reinforce this dominance. The integration of digital reporting systems and electronic health records enhances data accuracy and efficiency in hospital laboratories.

The Ambulatory Care segment is expected to register the fastest growth rate of 8.9% from 2026 to 2033, driven by the shift toward outpatient and decentralized diagnostic testing. Ambulatory centers provide cost-effective and quick testing options for routine lipid monitoring, appealing to patients seeking convenience and faster turnaround times. Rising investments in point-of-care diagnostic devices and mobile health units are expanding accessibility, particularly in urban and peri-urban areas. The growing focus on preventive care and early detection of cardiovascular conditions supports strong adoption of LDL testing within ambulatory care networks across the Middle East and Africa.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and retail. The Direct Tenders segment dominated the market with the largest revenue share of 57.2% in 2025, driven by large-scale procurement of diagnostic kits and reagents by hospitals, research laboratories, and government health agencies. This procurement model ensures standardized quality, cost efficiency, and steady supply across healthcare institutions. Public healthcare systems in countries such as Saudi Arabia, South Africa, and the UAE frequently adopt tender-based supply models to streamline diagnostic product distribution. Increasing preference for long-term supply contracts between manufacturers and government buyers supports stable revenue generation.

The Retail segment is projected to witness the fastest growth rate of 9.1% from 2026 to 2033, fueled by the rise of e-commerce platforms and growing accessibility of diagnostic supplies through private distributors. Independent laboratories, clinics, and smaller healthcare providers are increasingly purchasing kits and reagents directly from retail channels due to flexible order quantities and faster delivery timelines. Expanding online healthcare marketplaces and competitive pricing strategies are making diagnostic consumables more accessible to regional buyers. The increasing digitalization of procurement and growing participation of local distributors are expected to further boost this segment’s growth over the forecast period.

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Regional Analysis

- South Africa dominated the Middle East and Africa LDL test market with the largest revenue share of 33.4% in 2025, supported by well-established laboratory networks, strong diagnostic capabilities, and rising adoption of lipid profiling in both public and private healthcare sectors

- Consumers and patients in the country are becoming more aware of the importance of regular cholesterol and lipid testing for early detection and management of heart-related conditions, supported by strong diagnostic accessibility through both public and private laboratories

- This widespread adoption is further reinforced by national health initiatives promoting cardiovascular risk assessment, growing investments in laboratory automation, and expanding insurance coverage for diagnostic services, positioning South Africa as the leading hub for LDL testing across the region

The Saudi Arabia Low Density Lipoprotein (LDL) Test Market Insight

The Saudi Arabia LDL test market captured the largest revenue share of 33.4% in 2025 within the Middle East, driven by high cholesterol incidence rates and the country's growing emphasis on preventive healthcare. The government’s Vision 2030 initiative is fostering healthcare modernization, with strong investments in diagnostic facilities and clinical laboratory automation. Rising public awareness about lifestyle diseases and regular cholesterol screening is boosting the demand for LDL testing. Moreover, collaborations between public health institutions and private laboratories are expanding testing accessibility, particularly in urban regions such as Riyadh and Jeddah.

United Arab Emirates (UAE) Low Density Lipoprotein (LDL) Test Market Insight

The UAE LDL test market is anticipated to grow at a significant CAGR during the forecast period, supported by a rapidly expanding healthcare infrastructure and the country’s focus on early disease detection. High rates of obesity and diabetes among the population are driving increased demand for lipid profile testing. The market also benefits from the integration of advanced diagnostic systems within hospitals and private labs, alongside a surge in medical tourism. The adoption of digital health solutions and remote diagnostic services further enhances the convenience and frequency of LDL testing across the UAE.

South Africa Low Density Lipoprotein (LDL) Test Market Insight

The South Africa LDL test market accounted for the largest revenue share of 32.8% in 2025 within the African region, fueled by a strong network of pathology laboratories and heightened health awareness. Cardiovascular diseases and obesity are leading causes of morbidity, spurring regular cholesterol screening and preventive health checkups. The availability of advanced diagnostic technologies, coupled with government-led health programs addressing non-communicable diseases, is accelerating market expansion. In addition, partnerships between private labs and public hospitals are improving affordability and access to LDL testing services.

Egypt Low Density Lipoprotein (LDL) Test Market Insight

The Egypt LDL test market is expected to expand at a considerable CAGR during the forecast period, driven by increasing healthcare investments and growing public awareness about lipid management. The government’s focus on preventive health through initiatives such as “100 Million Health” has significantly increased screening rates for cardiovascular and metabolic disorders. The expansion of diagnostic laboratory chains, coupled with the adoption of cost-effective LDL testing kits and reagents, supports wider accessibility. Furthermore, the rising urban population and improving diagnostic infrastructure in cities such as Cairo and Alexandria are bolstering market growth.

Middle East and Africa Low Density Lipoprotein (LDL) Test Market Share

The Middle East and Africa Low Density Lipoprotein (LDL) Test industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

- Randox Laboratories Ltd. (U.K.)

- Bio-Rad Laboratories, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Sysmex Corporation (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Werfen (Spain)

- Arkray, Inc. (Japan)

- Sekisui Medical Co., Ltd. (Japan)

- Tosoh Corporation (Japan)

- FUJIFILM Wako Pure Chemical Corporation (Japan)

- Shenzhen New Industry Biomedical Engineering Co., Ltd. (China)

- Kehua Bio-Engineering Co., Ltd. (China)

- Spinreact. (Spain)

- Acon Laboratories, Inc. (U.S.)

What are the Recent Developments in Middle East and Africa Low Density Lipoprotein (LDL) Test Market?

- In October 2025, the Saudi laboratory group Advanced Cell Labs launched a comprehensive blood-cholesterol testing service in Saudi Arabia that includes LDL measurement, with detailed guidance for patients and a focus on preventive cardiovascular health

- In June 2024, researchers in Saudi Arabia published a study deriving and validating a novel equation for estimating LDL-C (low-density lipoprotein cholesterol) specifically for the Saudi population, which showed significantly lower bias compared to the traditional Friedewald equation and other commonly used formulas

- In April 2024, the event Medlab West Africa 2024 kicked off in Lagos, Nigeria, focusing on diagnostics and laboratory testing access & quality across West Africa including sessions on lipid tests and cardiovascular screening. The conference underscores the growing importance of advanced diagnostics (including LDL testing) in African labs

- In November 2024, the World Health Organization (WHO) pledged support and collaboration with Nigeria’s regulatory body for in-vitro diagnostics (IVDs) to improve quality and local manufacturing of diagnostic tests an initiative that would include lipid-panel tests encompassing LDL measurement

- In August 2023, the Ministry of Health (Saudi Arabia) published educational content on “Blood Lipid Disorders” emphasizing the role of LDL (“bad” cholesterol) in heart-disease risk, thereby increasing public awareness of LDL testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.