Middle East And Africa Licensed Football Merchandise Market

Market Size in USD Billion

CAGR :

%

USD

4.16 Billion

USD

6.30 Billion

2025

2033

USD

4.16 Billion

USD

6.30 Billion

2025

2033

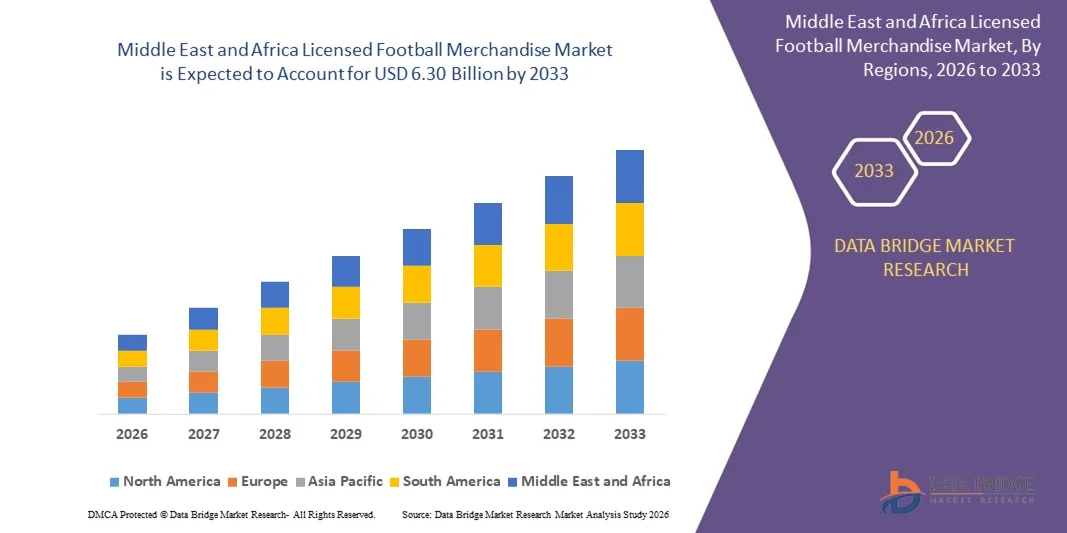

| 2026 –2033 | |

| USD 4.16 Billion | |

| USD 6.30 Billion | |

|

|

|

|

Middle East and Africa Licensed Football Merchandise Market Size

- The Middle East and Africa licensed football merchandise market size was valued at USD 4.16 billion in 2025 and is expected to reach USD 6.30 billion by 2033, at a CAGR of 5.3% during the forecast period

- The market growth is primarily driven by the increasing global popularity of football, fueled by high-profile events such as the FIFA World Cup and UEFA Champions League, which amplify fan engagement and demand for licensed merchandise

- Rising disposable incomes, growing participation in football, and the expansion of e-commerce platforms offering personalized and innovative products further contribute to the industry's robust growth

Middle East and Africa Licensed Football Merchandise Market Analysis

- Licensed football merchandise, including apparels, footwear, accessories, and toys, serves as a key expression of fan loyalty and team affiliation, driven by the global appeal of football as the world’s most popular sport

- The market is propelled by increasing fan bases, strategic partnerships between brands and football clubs, and the growing influence of social media in promoting merchandise

- U.A.E. dominated licensed football merchandise market in 2025, due to strong consumer interest in international football, rising brand awareness, and increasing purchasing power among football enthusiasts

- Saudi Arabia is expected to be the fastest growing country in the licensed football merchandise market during the forecast period due to increasing football fandom, rising disposable income, and strong demand for officially licensed merchandise

- Apparels segment dominated the market with a market share of 38.5% in 2025, due to widespread fan engagement, strong brand loyalty, and frequent seasonal releases of jerseys and training kits. Licensed apparels often serve as a primary means for fans to display team affiliation, with clubs collaborating with sportswear brands to launch limited editions and commemorative collections. The popularity of apparels is further reinforced by their versatility, ranging from casual wear to performance-oriented gear, and the increasing adoption of fan merchandise as lifestyle fashion. In addition, partnerships with international football clubs and promotional campaigns enhance the visibility and sales of apparel-based merchandise

Report Scope and Licensed Football Merchandise Market Segmentation

|

Attributes |

Licensed Football Merchandise Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Licensed Football Merchandise Market Trends

Increasing Integration of Smart Technologies and Personalization

- The licensed football merchandise market is witnessing a significant trend towards integrating smart technologies and advanced personalization options, allowing fans to customize products such as jerseys, footwear, and accessories with names, numbers, or interactive features that enhance engagement and loyalty while creating a sense of exclusivity and identity

- For instance, Nike’s customization platform allows fans to personalize club jerseys and football boots with player names or custom designs, providing a unique fan experience and boosting online sales, while the platform also offers regional editions and limited releases to cater to local fan bases

- Smart technologies embedded in merchandise, such as NFC-enabled apparel, connected footballs, or augmented reality-enabled collectibles, are creating interactive experiences by linking products to apps for stats tracking, AR features, and exclusive content, encouraging deeper digital and physical engagement with clubs and players

- The availability of limited-edition and collectible merchandise with smart personalization features is encouraging repeat purchases and strengthening brand loyalty, as fans seek rare items representing their favorite clubs or milestone achievements in tournaments

- Retailers and football clubs are increasingly leveraging data-driven personalization tools to suggest merchandise based on fan preferences, purchase history, and match attendance, increasing relevance and conversion rates while providing a highly tailored fan experience that strengthens emotional connections

- This shift towards smart, personalized football merchandise is transforming the market by merging traditional fan culture with technology-enabled engagement, setting new standards for consumer interaction, loyalty, and overall market growth as more brands and clubs invest in such offerings

Middle East and Africa Licensed Football Merchandise Market Dynamics

Driver

Rising Popularity of Football and Fan Engagement

- The growing global popularity of football, combined with enhanced fan engagement through social media, digital campaigns, and live event coverage, is a primary driver of demand for licensed merchandise across multiple product categories

- For instance, Adidas’ collaborations with top European clubs such as Real Madrid and Bayern Munich to launch exclusive merchandise collections have significantly boosted sales and fan participation, reinforcing brand loyalty and international market reach

- Increased viewership of domestic leagues, international tournaments, and interactive fan content is fostering stronger emotional connections between fans and clubs, which translates into higher merchandise consumption and active participation in club-related activities

- Expansion of football academies, youth programs, and community initiatives is cultivating early brand loyalty, encouraging younger audiences to purchase player-inspired and club-branded merchandise as a part of fan identity development

- Fans increasingly seek tangible ways to demonstrate allegiance to their favorite teams through products such as jerseys, footwear, and accessories, driving sustained growth in licensed merchandise sales and reinforcing the long-term profitability of official club partnerships

Restraint/Challenge

High Costs of Licensed Products and Counterfeit Issues

- High pricing of officially licensed football merchandise can limit purchases among price-sensitive consumers, creating a barrier to wider adoption, particularly in emerging markets where disposable income for premium products is lower

- For instance, counterfeit products produced by unauthorized manufacturers often mimic club branding, creating competition, diluting brand value, and reducing consumer trust in official merchandise

- Ensuring product authenticity and maintaining consistent quality standards remain ongoing challenges for manufacturers and retailers, especially in regions with high counterfeit activity and limited regulatory enforcement

- Reliance on premium materials, branding collaborations, and exclusive limited releases contributes to elevated costs, which may deter some potential buyers and restrict adoption of officially licensed merchandise despite high fan interest

- Addressing the dual challenges of high product costs and counterfeit threats is critical for preserving brand value, safeguarding fan trust, and ensuring the sustainable long-term expansion of the licensed football merchandise market across all global regions

Middle East and Africa Licensed Football Merchandise Market Scope

The market is segmented on the basis of product type, distribution channel, and end-user.

- By Product Type

On the basis of product type, the licensed football merchandise market is segmented into footwear, apparels, accessories, and others. The apparels segment dominated the market with the largest revenue share of 38.5% in 2025, driven by widespread fan engagement, strong brand loyalty, and frequent seasonal releases of jerseys and training kits. Licensed apparels often serve as a primary means for fans to display team affiliation, with clubs collaborating with sportswear brands to launch limited editions and commemorative collections. The popularity of apparels is further reinforced by their versatility, ranging from casual wear to performance-oriented gear, and the increasing adoption of fan merchandise as lifestyle fashion. In addition, partnerships with international football clubs and promotional campaigns enhance the visibility and sales of apparel-based merchandise.

The footwear segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for branded football boots, casual sneakers, and replica footwear among youth and sports enthusiasts. For instance, Adidas’ collaboration with major football clubs to release exclusive club-themed shoes has significantly contributed to market growth. Footwear products provide both functional and aspirational value to consumers, combining performance technology with team branding, which attracts both professional players and casual fans. The growing trend of personalized and limited-edition football shoes further boosts adoption, while social media campaigns amplify consumer engagement and brand visibility.

- By Distribution Channel

On the basis of distribution channel, the licensed football merchandise market is segmented into e-commerce, department stores, specialty stores, supermarket & hypermarket, and others. The e-commerce segment held the largest revenue share in 2025, driven by convenience, wider product availability, and the ability to access international club merchandise. E-commerce platforms provide detailed product information, reviews, and secure payment options, which enhance consumer confidence and facilitate repeat purchases. The growth of mobile shopping apps and the increasing adoption of omnichannel retail strategies further reinforce the dominance of online sales.

The specialty stores segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by dedicated fan stores and sports outlets offering exclusive licensed merchandise. For instance, Nike’s flagship football stores showcase club-specific collections that attract loyal fans and collectors. Specialty stores provide an immersive shopping experience, allowing consumers to explore a wide range of products, receive personalized assistance, and participate in promotional events. The ability to curate limited editions, pre-orders, and exclusive launches gives specialty stores a competitive edge. In addition, regional expansion of specialty stores in emerging football markets contributes to higher sales growth and brand engagement.

- By End-User

On the basis of end-user, the licensed football merchandise market is segmented into children, men, and women. The men’s segment dominated the market with the largest revenue share in 2025, driven by strong fandom, disposable income, and a high affinity for collecting club apparel, footwear, and accessories. Men often constitute the primary consumer base for match-day merchandise and player-inspired products, which drives consistent demand. Collaborations between football clubs and leading sports brands enhance product appeal, while fan loyalty and club membership programs strengthen repeat purchases. Social media influence and football-related content consumption further amplify engagement with men’s merchandise, consolidating its market leadership.

The children’s segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing participation of youth in football and parental inclination to encourage fandom from a young age. For instance, Puma’s launch of junior kits and youth-focused footwear collections for top clubs has accelerated market expansion in this segment. Children’s merchandise combines functional aspects, such as sports performance gear, with aspirational value, fostering brand attachment early on. Schools, youth clubs, and football academies adopting branded merchandise also contribute to growth, while marketing campaigns targeting young fans and their parents strengthen visibility. The rising popularity of family-oriented football experiences ensures continued growth and engagement in the children’s segment.

Middle East and Africa Licensed Football Merchandise Market Regional Analysis

- U.A.E. dominated the licensed football merchandise market with the largest revenue share in 2025, driven by strong consumer interest in international football, rising brand awareness, and increasing purchasing power among football enthusiasts

- High availability of official club merchandise, premium product offerings, and expanding retail and e-commerce networks further reinforce the country’s dominance in the regional market. Collaborations between international football clubs and local sportswear distributors, along with fan engagement initiatives, continue to strengthen accessibility and product variety

- The growing popularity of football leagues, tournaments, and fan-centric events aligns with evolving consumer preferences, helping U.A.E. maintain its leading position. Strategic marketing campaigns, exclusive merchandise launches, and loyalty programs enhance repeat purchases, creating a strong and sustainable market presence. Overall, U.A.E.’s combination of consumer enthusiasm, brand collaborations, and retail penetration ensures its leadership in the regional licensed football merchandise market

Saudi Arabia Licensed Football Merchandise Market Insight

Saudi Arabia is projected to register the fastest CAGR in the Middle East and Africa licensed football merchandise market from 2026 to 2033, fueled by increasing football fandom, rising disposable income, and strong demand for officially licensed merchandise. For instance, Puma’s exclusive club collections for teams such as Manchester City and FC Barcelona have significantly boosted sales and local fan engagement. Expanding retail and e-commerce channels, along with targeted marketing campaigns, are making official merchandise more accessible across urban and semi-urban regions. The growing participation of youth in football academies and community tournaments is accelerating demand for jerseys, footwear, and accessories. Saudi Arabia’s combination of fan engagement, rising consumer spending, and enhanced accessibility positions it as the fastest-growing market in the region.

South Africa Licensed Football Merchandise Market Insight

South Africa is expected to experience steady growth between 2026 and 2033, driven by increasing awareness and consumption of official football club merchandise among fans. The growing popularity of international football leagues, regional tournaments, and fan communities is enhancing engagement with licensed jerseys, footwear, and accessories. Expanding e-commerce platforms, retail partnerships, and local sports promotions are improving product availability and convenience for consumers. Collaborations between regional distributors and global sports brands targeting localized fan preferences are strengthening market development. South Africa’s rising interest in authentic, officially licensed football merchandise supports consistent market expansion and a stronger regional presence.

Middle East and Africa Licensed Football Merchandise Market Share

The licensed football merchandise industry is primarily led by well-established companies, including:

- givsport.sk (Italy)

- JOMA SPORT S.A. (Spain)

- PUMA SE (Germany)

- Mitre International (U.K.)

- ADIDAS AG (Germany)

- Castore (U.K.)

- Erreà Sport Spa (Italy)

- New Balance (U.S.)

- Score Draw (U.K.)

- DRH Sports (U.K.)

- Fanatics, Inc. (U.S.)

- Nike, Inc. (U.S.)

- MACRON S.P.A. (Italy)

- New Era Cap (U.S.)

- Under Armour, Inc. (U.S.)

Latest Developments in Middle East and Africa Licensed Football Merchandise Market

- In August 2024, Fanatics, a global leader in licensed sports merchandise, announced a strategic partnership with Belk, a prominent U.S. department store chain. This collaboration aims to expand Belk’s inventory by integrating Fanatics’ extensive catalog of licensed sports apparel, jerseys, headwear, and collectibles into Belk’s digital platforms. Customers can now shop a wide range of fan gear—initially focused on NCAA teams, with more leagues to follow—directly on Belk.com and the Belk app. While Belk manages the shopping interface, Fanatics handles fulfillment and shipping, enhancing product availability and streamlining the customer experience

- In September 2023, Adidas launched the X Crazyfast Messi 'Las Estrellas' boots, a striking tribute to Lionel Messi’s 2022 World Cup victory with Argentina. Released shortly after his 'Infinito' boots, this signature edition features a design inspired by the Argentinian flag, with a white, blue, and gold colorway, and includes three stars on the heel to represent Argentina’s World Cup titles. The boots also showcase Messi’s logo, his iconic number 10, and a G.O.A.T. symbol. This release underscores the enduring power of player endorsements and commemorative merchandise in driving fan engagement and product demand

- In August 2023, Academy Sports + Outdoors extended its partnership with Fanatics, a global leader in licensed sports merchandise, to significantly broaden its assortment of officially licensed products. This expanded collaboration allows Academy customers—both in-store and online—to access a wider range of fan gear, including apparel, jerseys, headwear, and novelty items from top brands such as Nike, adidas, Mitchell & Ness, New Era, and more. The initiative underscores both companies’ commitment to enhancing product variety and accessibility, beginning with NCAA merchandise and expanding to other leagues as seasons progress

- In June 2023, Adidas officially unveiled the new Team India cricket jerseys for all three formats—Tests, ODIs, and T20Is—marking the brand’s debut as the official kit sponsor for the Indian national cricket team. The launch coincided with the World Test Championship Final, where the team debuted the new kits. Designed with Adidas’ signature performance technologies such as AEROREADY and made from 100% recycled materials, the jerseys reflect a blend of innovation, sustainability, and national pride. This release also underscores the growing influence of licensed sports apparel across global markets, including football and other team sports

- In May 2023, PUMA announced a landmark multi-year partnership with Formula 1, becoming the official licensing partner and exclusive trackside retailer for the sport. This agreement grants PUMA the rights to produce F1-branded apparel, footwear, and accessories, and to sell official fanwear for all ten F1 teams at race circuits starting in 2024. PUMA will also supply uniforms for F1 staff and launch lifestyle collections that blend motorsport culture with streetwear fashion. This move reflects a broader trend among major sportswear brands to expand their licensing portfolios across global sports, including football

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.