Middle East And Africa Lipid Poct Market

Market Size in USD Million

CAGR :

%

USD

9.19 Million

USD

11.65 Million

2025

2033

USD

9.19 Million

USD

11.65 Million

2025

2033

| 2026 –2033 | |

| USD 9.19 Million | |

| USD 11.65 Million | |

|

|

|

|

Middle East and Africa Lipid POCT Market Size

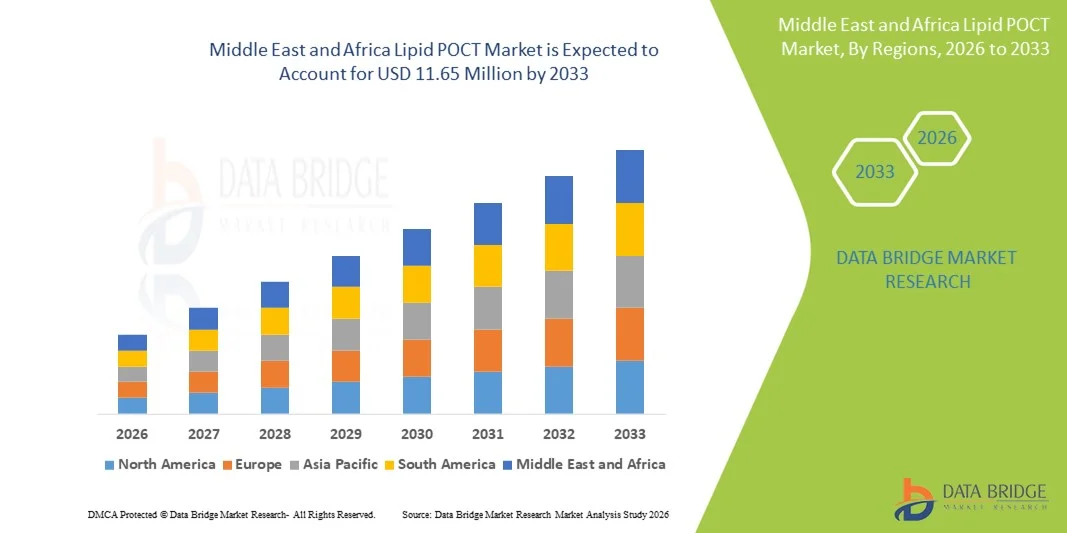

- The Middle East and Africa lipid POCT market size was valued at USD 9.19 million in 2025 and is expected to reach USD 11.65 million by 2033, at a CAGR of 3.0% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic conditions such as hyperlipidemia and cardiovascular risk factors in the region, alongside gradual expansion of decentralized diagnostic services and heightened awareness of early lipid monitoring outside traditional laboratories

- Furthermore, demand for rapid, user‑friendly point‑of‑care lipid testing solutions is rising as healthcare providers and patients seek efficient, near‑patient tools to support timely clinical decision‑making. Technological improvements in portable lipid POCT platforms and supportive healthcare infrastructure investments are also aiding adoption, establishing lipid POCT as an increasingly important component of preventive cardiometabolic care in Middle East and Africa

Middle East and Africa Lipid POCT Market Analysis

- Lipid POCT devices, providing rapid, near-patient testing for cholesterol and other lipid parameters, are becoming essential tools in preventive healthcare and cardiometabolic management across hospitals, diagnostic centers, and home care settings due to their convenience, minimal sample requirements, and timely results outside traditional laboratories

- The rising prevalence of cardiovascular diseases, diabetes, and obesity in Middle East and Africa, combined with increasing awareness of early lipid monitoring, is driving the adoption of lipid POCT, as healthcare providers and patients seek faster and more accessible testing solutions

- Saudi Arabia dominated with the largest revenue share of 30.8% in 2025, supported by advanced healthcare infrastructure, higher healthcare spending, and government initiatives promoting preventive care, with both countries seeing growth in decentralized diagnostic services and community health programs

- Nigeria is expected to be the fastest-growing country during the forecast period, driven by expanding primary care facilities, rising disposable incomes, and growing adoption of portable POCT devices in clinics, pharmacies, and home care settings

- Instruments segment dominated the market with largest share of 45.6% in 2025, fueled by the growing adoption of advanced POCT analyzers in hospitals, diagnostic centers, and home care settings

Report Scope and Middle East and Africa Lipid POCT Market Segmentation

|

Attributes |

Middle East and Africa Lipid POCT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Lipid POCT Market Trends

Growing Adoption of Portable and Connected POCT Devices

- A key and accelerating trend in the Middle East and Africa lipid POCT market is the rising adoption of portable and connected point-of-care devices that allow near-patient lipid testing with rapid results, improving accessibility and convenience for both clinicians and patients

- For instance, Roche Cobas B 101 enables healthcare providers to perform cholesterol testing at the bedside or in outpatient clinics, delivering results within minutes and reducing dependency on central laboratories

- Integration with mobile apps and cloud-based platforms allows real-time data sharing with healthcare professionals, enabling remote patient monitoring and better management of chronic conditions such as hyperlipidemia and diabetes

- The seamless connectivity of POCT devices with hospital information systems and electronic medical records (EMRs) facilitates centralized tracking of patient lipid profiles and enhances workflow efficiency

- This trend towards portable, connected, and easy-to-use lipid testing devices is reshaping preventive healthcare approaches in the region, as companies such as Alere and PTS Cardiochek develop solutions combining mobility, connectivity, and accuracy

- The demand for lipid POCT devices that provide rapid, reliable, and digitally connected testing is rising rapidly across hospitals, diagnostic centers, and home care settings, driven by the need for timely intervention and chronic disease management

- Healthcare providers are adopting user-friendly and compact devices that reduce the need for specialized training, supporting broader deployment in remote and resource-limited areas

Middle East and Africa Lipid POCT Market Dynamics

Driver

Increasing Prevalence of Cardiometabolic Disorders and Preventive Healthcare Awareness

- The rising prevalence of cardiovascular diseases, obesity, and diabetes, coupled with growing awareness of preventive healthcare, is a major driver for the adoption of lipid POCT devices in the Middle East and Africa

- For instance, in March 2025, Roche announced the expansion of its lipid POCT services in GCC countries to support early detection and management of hyperlipidemia, targeting both hospital and community-based healthcare facilities

- Lipid POCT devices provide rapid, actionable results, enabling healthcare professionals to initiate timely interventions and monitor treatment efficacy without the delays associated with central laboratories

- Furthermore, increasing government initiatives and health programs promoting early screening and preventive care are encouraging hospitals, diagnostic centers, and clinics to adopt point-of-care lipid testing solutions

- Convenience, accuracy, and the ability to integrate results into patient health records are additional factors driving adoption among healthcare providers and patients across both urban and semi-urban areas

- The growing penetration of health insurance and reimbursement schemes for preventive diagnostics is motivating healthcare providers to adopt lipid POCT for cost-effective patient management

- Increasing collaboration between POCT manufacturers and local distributors is enabling faster product rollout and training, further boosting market adoption in the region

Restraint/Challenge

High Device Cost and Regulatory Compliance Barriers

- The relatively high initial cost of advanced lipid POCT devices and consumables can limit adoption, particularly in price-sensitive healthcare facilities and emerging markets within the region

- For instance, some hospitals and clinics in Sub-Saharan Africa have delayed POCT implementation due to budget constraints, despite the potential clinical benefits

- Clearing regulatory approvals and maintaining compliance with local health authorities can be complex, slowing product launch and distribution timelines

- Addressing affordability through tiered device offerings and ensuring adherence to regulatory standards is critical to increasing market penetration across Middle East and Africa

- Overcoming these challenges through cost-effective device solutions, clinician education, and streamlined regulatory processes will be key to sustaining market growth and expanding access to lipid POCT in the region

- Limited awareness and training among healthcare staff on proper POCT usage and interpretation of results can reduce adoption and effective utilization

- Challenges related to supply chain logistics, including availability of consumables and timely maintenance of instruments, may hinder widespread deployment in remote and rural areas

Middle East and Africa Lipid POCT Market Scope

The market is segmented on the basis of type, application, mode, brand, platform, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into instruments and consumables & kits. The Instruments segment dominated the market with the largest share of 45.6% in 2025, fueled by increasing adoption of advanced analyzers in hospitals, professional diagnostic centers, and home care settings. Instruments offer high accuracy, rapid testing, and integration with hospital information systems, supporting near-patient testing and multi-analyte capabilities. Hospitals and diagnostic centers invest in these instruments to improve workflow efficiency and provide timely results. Their ability to integrate with mobile and cloud-based platforms enhances data management and remote monitoring. The segment benefits from recurring usage in preventive healthcare programs and chronic disease management initiatives.

The Consumables & Kits segment is expected to witness the fastest growth from 2026 to 2033, driven by recurring demand for test strips, reagent cassettes, and cartridges in hospitals, clinics, and home care settings. Their affordability and ease of replacement encourage adoption across clinical and consumer markets. Multi-analyte kits capable of measuring cholesterol, triglycerides, and other biomarkers are increasing in demand. Rising awareness of preventive healthcare and self-monitoring boosts consumption. Pharmacies and home care providers are contributing to rapid growth in this segment. Manufacturers benefit from repeat usage and recurring revenue streams, supporting market expansion.

- By Application

On the basis of application, the market is segmented into hyperlipidemia, hypertriglyceridemia, hyperlipoproteinemia, familial hypercholesterolemia, tangier disease, and others. The Hyperlipidemia segment dominated the market in 2025, driven by high prevalence and critical need for early detection to prevent cardiovascular diseases. Testing for hyperlipidemia is routinely conducted in preventive check-ups and chronic disease management programs. Hospitals and diagnostic centers prefer lipid POCT for rapid and actionable results. Government screening initiatives in GCC countries further support the segment’s dominance. Multi-analyte POCT platforms enhance workflow efficiency and patient care. The demand is reinforced by increased clinician and patient awareness for cardiovascular risk management.

The Hypertriglyceridemia segment is expected to witness the fastest growth from 2026 to 2033, driven by rising obesity, diabetes, and lifestyle-related disorders. Multi-analyte POCT devices capable of measuring triglycerides alongside cholesterol are gaining adoption in urban and semi-urban centers. Increased awareness among healthcare professionals and patients regarding triglyceride management supports growth. Hospitals, clinics, and home care users are integrating testing into preventive healthcare routines. The segment benefits from technological advancements in compact and portable analyzers. Consumer interest in self-monitoring and chronic disease prevention is further accelerating adoption.

- By Mode

On the basis of mode, the market is segmented into prescription-based testing and otc-based testing. The Prescription-Based Testing segment dominated the market in 2025, driven by hospitals and diagnostic centers preferring controlled and accurate assessments for clinical diagnosis. Clinicians favor prescription-based devices for reliability, quality compliance, and integration with patient health records. Hospitals benefit from structured workflows and standardized preventive healthcare programs. The segment supports multi-analyte testing and chronic disease management initiatives. Prescription-based testing ensures regulatory compliance and consistent usage. Data integration into EMRs enhances patient management and reporting efficiency.

The OTC-Based Testing segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing trend of home testing and self-monitoring among patients with chronic conditions. Affordable, user-friendly POCT devices encourage consumer adoption. Mobile connectivity and app integration allow remote monitoring and record keeping. Rising preventive healthcare awareness is driving adoption among urban and semi-urban consumers. Retail availability of OTC devices enhances accessibility across the region. The segment benefits from growing interest in convenient, near-patient lipid testing solutions and repeat usage.

- By Brand

On the basis of brand, the market includes Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek, and Others. The Roche Cobas B 101 segment dominated the market in 2025, driven by its high accuracy, rapid testing capabilities, and seamless integration with hospital IT systems. Hospitals and professional diagnostic centers in GCC countries prefer this device for its reliability and clinical workflow efficiency. The brand’s strong regional presence ensures robust supply and after-sales support. Multi-analyte testing and connectivity to electronic medical records enhance patient monitoring. Its adoption in preventive healthcare programs reinforces its leadership. Clinicians rely on Roche Cobas B 101 for timely and actionable lipid testing results.

The PTS Cardiochek segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for portable, home-based, and connected POCT devices. Its user-friendly design supports self-monitoring and remote patient management. Increasing awareness of preventive healthcare and chronic disease monitoring drives adoption among consumers. Mobile app integration enables real-time tracking and record sharing with clinicians. The device’s affordability and ease of use make it attractive for home care and smaller clinics. Rising consumer interest in multi-analyte POCT platforms further supports growth in this segment.

- By Platform

On the basis of platform, the market is segmented into lateral flow assays (immunochromatography tests), molecular diagnostics, immunoassays, dipsticks, and microfluidics. The Lateral Flow Assays segment dominated the market in 2025, due to simplicity, rapid results, and widespread adoption in hospitals, diagnostic centers, and home care. Lateral flow devices require minimal training and provide reliable near-patient results. Their portability supports deployment in remote or resource-limited areas. Hospitals and clinics value the quick turnaround for lipid profile results. Multi-analyte capabilities in some lateral flow assays enhance clinical utility. Rising preventive healthcare awareness reinforces their adoption.

The Microfluidics segment is expected to witness the fastest growth from 2026 to 2033, driven by technological advancements that enable miniaturized, multi-analyte testing with higher accuracy. Research laboratories and diagnostic centers adopt microfluidics for high-throughput and compact testing solutions. Portable microfluidic platforms support point-of-care diagnostics in urban and semi-urban areas. Integration with digital platforms allows data sharing and remote monitoring. Growing interest in advanced POCT technologies among hospitals and clinics accelerates adoption. The segment benefits from increasing investments in innovative testing platforms.

- By End User

On the basis of end user, the market is segmented into hospitals, professional diagnostic centers, home care, research laboratories, and other end users. The Hospitals segment dominated the market in 2025, driven by high patient volumes, structured diagnostic workflows, and strong purchasing power for instruments and consumables. Hospitals prefer advanced lipid POCT devices to support preventive healthcare and chronic disease management programs. Integration with electronic medical records enhances clinical decision-making. Multi-analyte and connected devices improve efficiency and patient care. The segment benefits from long-term adoption due to recurring use of consumables. Government and private healthcare programs also reinforce hospital demand.

The Home Care segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing consumer awareness of preventive health and rising self-monitoring practices among patients with chronic conditions. Affordable, user-friendly devices support widespread adoption. Connectivity to mobile apps allows remote monitoring and record sharing with clinicians. Retail availability and improved access to OTC devices further support growth. Home care adoption is driven by convenience, portability, and time-saving benefits. Multi-analyte devices for home use accelerate consumer acceptance and repeat usage.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market in 2025, as hospitals, diagnostic centers, and government health programs prefer procuring devices and consumables directly from manufacturers for bulk supply, service support, and warranty coverage. Direct tender agreements ensure timely delivery and technical support for instruments. Hospitals benefit from negotiated pricing and after-sales training. Multi-analyte instruments are commonly procured through this channel. Large-scale preventive healthcare initiatives favor direct tenders for consistent supply. The segment supports long-term adoption of lipid POCT solutions.

The Retail Sales segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing availability of OTC POCT devices for home testing. Rising consumer awareness of preventive healthcare and self-monitoring supports retail adoption. Pharmacies and online channels enhance accessibility in urban and semi-urban areas. Retail sales encourage repeat purchases of consumables such as strips and cartridges. Home care users increasingly prefer retail devices for convenience and portability. Multi-analyte devices with connectivity further drive retail growth across the region.

Middle East and Africa Lipid POCT Market Regional Analysis

- Saudi Arabia dominated with the largest revenue share of 30.8% in 2025, supported by advanced healthcare infrastructure, higher healthcare spending, and government initiatives promoting preventive care, with both countries seeing growth in decentralized diagnostic services and community health programs

- Healthcare providers in these countries prioritize rapid, near-patient lipid testing to support early detection of cardiovascular diseases, diabetes, and obesity, ensuring timely intervention and improved patient outcomes

- Widespread adoption is further supported by the presence of well-established hospitals and diagnostic centers, investments in connected and multi-analyte POCT devices, and growing awareness among clinicians and patients about the benefits of decentralized testing

The Saudi Arabia Lipid POCT Market Insight

The Saudi Arabia lipid POCT market captured the largest revenue share of 30.8% in 2025, driven by advanced healthcare infrastructure, government initiatives promoting preventive care, and the high prevalence of cardiovascular diseases and diabetes. Healthcare providers increasingly rely on near-patient lipid testing for timely diagnosis and monitoring of hyperlipidemia. The adoption of connected and multi-analyte POCT devices in hospitals and diagnostic centers supports rapid and accurate testing. Rising awareness among clinicians and patients about early detection and management of lipid disorders is further propelling market growth. Moreover, investments in healthcare technology and preventive health programs are strengthening the overall market demand.

UAE Lipid POCT Market Insight

The UAE lipid POCT market accounted for largest share in 2025, fueled by high healthcare spending, modern medical facilities, and growing interest in chronic disease management. Hospitals and diagnostic centers are increasingly integrating POCT devices into routine screenings for hyperlipidemia and hypertriglyceridemia. The convenience of near-patient testing, rapid results, and compatibility with hospital IT systems is driving adoption. Government-led health initiatives and preventive care programs encourage regular lipid monitoring across both urban and semi-urban areas. The availability of multi-analyte and portable devices further supports growth in clinical and home care settings.

Egypt Lipid POCT Market Insight

The Egypt lipid POCT market is witnessing rapid adoption due to rising prevalence of obesity, diabetes, and cardiovascular diseases. The market is supported by growing awareness of preventive healthcare and early diagnosis. Hospitals and diagnostic centers are increasingly deploying portable lipid analyzers to improve workflow efficiency and provide timely results. Integration with electronic medical records and mobile platforms enhances patient management and remote monitoring capabilities. Affordability and accessibility of POCT devices are driving adoption in private clinics and home care. In addition, the expansion of government health programs and insurance coverage encourages routine lipid testing.

Nigeria Lipid POCT Market Insight

The Nigeria lipid POCT market is expected to grow at the fastest CAGR during the forecast period, driven by increasing prevalence of lifestyle-related disorders and rising awareness of preventive healthcare. Hospitals, clinics, and diagnostic centers are adopting portable and connected POCT devices for rapid lipid profiling. Home care adoption is also increasing as affordable devices become widely available. Multi-analyte platforms capable of monitoring cholesterol, triglycerides, and other biomarkers are gaining traction. Mobile connectivity and cloud-based monitoring further support market expansion. Consumer interest in self-monitoring and preventive health interventions is accelerating growth across urban and semi-urban areas.

Middle East and Africa Lipid POCT Market Share

The Middle East and Africa Lipid POCT industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- PTS Diagnostics (U.S.)

- Trinity Biotech (Ireland)

- Siemens Healthineers AG (Germany)

- ACON Laboratories, Inc. (U.S.)

- Nova Biomedical (U.S.)

- SD Biosensor (South Korea)

- A. Menarini Diagnostics (Italy)

- Callegari Srl (Italy)

- EuroMedix International NV (Netherlands)

- Quest Diagnostics Incorporated (U.S.)

- TASCOM (Japan)

- General Life Biotechnology Co., Ltd. (Taiwan)

- MICO BIOMED (South Korea)

- Jant Pharmacal Corporation (U.S.)

- PRIMA Lab SA (Poland)

- VivaChek Biotech (China)

- Sinocare Inc. (China)

- MiCo BioMed Co., Ltd. (South Korea)

What are the Recent Developments in Middle East and Africa Lipid POCT Market?

- In September 2025, UAE doctors reported a significant rise in heart disease among younger residents, highlighting the increasing need for preventive diagnostics including AI‑assisted blood tests that can help identify cardiovascular risk factors early. The Ministry of Health emphasised that cardiovascular disease remains a leading cause of mortality and urged adoption of early detection strategies. This trend underscores the importance of lipid and other biomarker testing in routine clinical practice to curb rising CVD risk

- In September 2025, Medcare Hospital Al Safa in the UAE launched a groundbreaking AI‑powered blood test called “Cardio Explorer” that can predict coronary artery disease with 95% accuracy before clinical symptoms appear, enhancing early preventive cardiology screening across the region. The test analyzes a combination of blood biomarkers and clinical parameters to deliver personalized heart risk scores rapidly, offering a non‑invasive alternative to traditional stress tests or imaging

- In June 2025, the Middle East & Africa point‑of‑care diagnostics market was highlighted for its rapid expansion driven by demand for decentralized rapid testing solutions that include cardiovascular and chronic disease markers. Growing investments in portable diagnostic devices and digital connectivity are enhancing access to timely clinical decisions across hospitals, clinics, and remote areas

- In March 2025, Roche Diagnostics expanded its point‑of‑care diagnostic portfolio with advancements in POC testing solutions designed to deliver reliable, rapid results for cardiometabolic panels including lipid profiles at or near the site of care, supporting broader deployment of decentralized diagnostics

- In August 2024, a clinical study in South Africa demonstrated the efficacy of the Fujifilm™ NX700 POCT system in accurately measuring serum lipid levels compared to standard lab methods, highlighting the clinical performance and potential for rapid screening in primary health care settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.