Middle East And Africa Long Chain Polyamide Market

Market Size in USD Million

CAGR :

%

USD

140.11 Million

USD

192.82 Million

2024

2032

USD

140.11 Million

USD

192.82 Million

2024

2032

| 2025 –2032 | |

| USD 140.11 Million | |

| USD 192.82 Million | |

|

|

|

Long Chain Polyamide Market Analysis

The long chain polyamide (LCPA) market is experiencing steady growth due to its widespread use in automotive, electrical, electronics, and industrial applications. These high-performance materials, characterized by superior thermal stability, chemical resistance, and mechanical properties, are increasingly replacing traditional metals and polymers. The automotive sector drives demand, with LCPA being used in fuel systems, connectors, and under-the-hood applications. In addition, growing electric vehicle production and the trend toward lightweight components further boost market prospects. Asia-Pacific leads in market share, driven by industrial expansion, while North America and Europe also contribute significantly due to technological advancements and sustainable material innovations.

Long Chain Polyamide Market Size

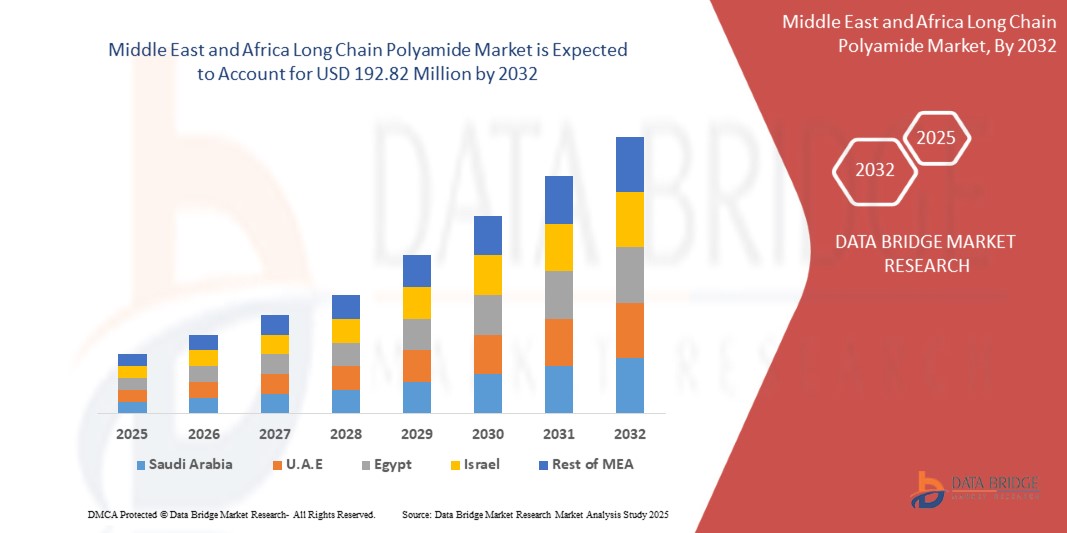

Middle East and Africa long chain polyamide market size was valued at USD 140.11 million in 2024 and is projected to reach USD 192.82 million by 2032, with a CAGR of 4.17% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Long Chain Polyamide Market

“Widespread Use in Automotive, Electrical, Electronics, And Industrial Applications”

Long Chain Polyamide (LCPA) is increasingly popular in automotive, electrical, electronics, and industrial applications due to its excellent thermal stability, mechanical strength, and chemical resistance. In the automotive industry, LCPA is used for lightweight components, fuel systems, connectors, and under-the-hood parts, contributing to improved fuel efficiency and vehicle performance. In electrical and electronics, LCPA’s insulating properties make it ideal for connectors, wires, and circuit boards. Its durability also benefits industrial applications, where LCPA is used in gears, bearings, and machinery parts. These attributes enable LCPA to replace traditional materials, driving efficiency and sustainability across diverse sectors.

Report Scope and Market Segmentation

|

Attributes |

Long Chain Polyamide Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Saudi Arabia, Egypt, U.A.E., South Africa, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

LG Chem (South Korea), BASF (Germany), Arkema (France), Evonik Industries AG (Germany), DuPont (U.S.), Asahi Kasei Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), MITSUI CHEMICALS AMERICA, INC. (Japan), KURARAY CO., LTD (Japan), Huntsman International LLC. (U.S.), Ascend Performance Materials (U.S.) Envalior (Germany) Domo Chemicals (Belgium), NYCOA (New York Chemicals) (U.S.), and Radici Partecipazioni SpA (Italy) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Long Chain Polyamide Market Definition

The Long Chain Polyamide (LCPA) market refers to the Middle East and Africa industry focused on the production, distribution, and consumption of polyamide polymers with longer molecular chains, typically containing 12 or more carbon atoms. These high-performance materials are known for their superior thermal stability, chemical resistance, mechanical strength, and durability. LCPAs are used in a wide range of applications, including automotive, electrical, electronics, industrial, and consumer goods, where their strength and resilience in harsh environments are essential. The market is driven by demand for lightweight, durable, and sustainable materials that offer better performance compared to conventional polymers and metals.

Biochar Market Dynamics

Drivers

- Surging Demand For Lightweight And High-Performance Materials From Automotive Industry

The surging demand for lightweight and high-performance materials from the automotive industry is a significant driver of the Middle East and Africa long-chain polyamide market. As automotive manufacturers increasingly focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance, the need for materials that are both lightweight and durable has escalated. Long-chain polyamides, with their exceptional strength-to-weight ratio, are ideal for these purposes, making them a preferred choice in various automotive applications.

Long-chain polyamides are used in the production of components such as engine parts, fuel lines, connectors, and electrical components. These materials not only reduce the overall weight of the vehicle but also provide the required strength and resistance to heat, chemicals, and wear, making them essential for modern automotive manufacturing. For example, in engine compartments, where components must withstand high temperatures and stress, long-chain polyamides offer superior thermal stability and mechanical strength compared to traditional materials.

Furthermore, the automotive industry’s shift toward electric vehicles (EVs) has also boosted the demand for high-performance polymers. EVs require lightweight materials to enhance battery efficiency and range, and long-chain polyamides, with their electrical insulating properties and robustness, are increasingly being integrated into the design of battery housings, connectors, and other crucial components.

- Fast Expanding Electrical And Electronics Sector

The fast-expanding electrical and electronics sector is a key driver for the Middle East and Africa long-chain polyamide market. As technology advances and the demand for electronic devices and systems grows, there is an increasing need for materials that offer excellent thermal stability, electrical insulation, and mechanical strength. Long-chain polyamides, known for their high-performance characteristics, meet these requirements and are widely used in electrical and electronic applications.

Long-chain polyamides are particularly valued in the production of components like connectors, switches, circuit boards, insulators, and cables. These materials provide superior electrical insulation, which is critical for ensuring the safe and efficient operation of electronic devices. Their resistance to heat and chemicals makes them ideal for use in high-performance electronics, where components often operate at elevated temperatures or are exposed to harsh conditions.

The rise in consumer electronics, such as smartphones, wearables, and smart home devices, is fueling the demand for long-chain polyamides. In addition, the growth of the Internet of Things (IoT) and smart technology in industries such as healthcare, automotive, and telecommunications is further driving the need for advanced materials. Long-chain polyamides are increasingly used in the manufacturing of miniature electronic components, where space constraints and performance demands are critical.

Opportunities

- Advancements in Bio-Based Polyamides

Advancements in bio-based polyamides present a significant opportunity for the growth of the Middle East and Africa long-chain polyamide (LCPA) market. As sustainability becomes an increasingly important focus across various industries, there is a growing demand for environmentally friendly alternatives to traditional petroleum-based polymers. Bio-based polyamides, which are derived from renewable resources like plant-based sugars, oils, and other biomass sources, offer an attractive solution to reduce reliance on fossil fuels while maintaining the high-performance characteristics that LCPAs are known for.

One of the key advantages of bio-based polyamides is their ability to reduce carbon emissions and energy consumption during production. By utilizing renewable raw materials, bio-based polyamides can help lower the environmental footprint of industries such as automotive, electronics, and textiles, which are major consumers of long-chain polyamides. This aligns with Middle East and Africa efforts to transition to a circular economy and meet stricter environmental regulations, particularly in regions like Europe and North America.

Moreover, bio-based polyamides can appeal to the growing consumer preference for sustainable products. As more consumers and businesses prioritize eco-friendly solutions, the demand for bio-based alternatives to conventional plastics is on the rise. For example, bio-based polyamides are gaining traction in automotive applications, where the industry seeks lighter, more sustainable materials to improve fuel efficiency and reduce emissions. In addition, bio-based polyamides are being explored for use in electronics, where their high thermal stability and electrical insulating properties can be beneficial in green technologies.

- Rising Demand For High-Performance Textiles

The rising demand for high-performance textiles presents a significant opportunity for the growth of the Middle East and Africa long-chain polyamide (LCPA) market. High-performance textiles, known for their durability, strength, and versatility, are increasingly sought after in various industries, including automotive, sportswear, medical, and industrial applications. Long-chain polyamides, due to their unique combination of mechanical strength, wear resistance, and thermal stability, are ideal materials for these high-performance fabrics.

In the automotive sector, for instance, LCPAs are used in the production of lightweight, durable textiles for car interiors, including seat covers, upholstery, and airbags. These materials provide the required toughness and resistance to harsh conditions such as high temperatures and UV exposure, enhancing the safety and longevity of automotive components. As automotive manufacturers continue to focus on producing more fuel-efficient vehicles with advanced features, the demand for high-performance textiles made from long-chain polyamides is expected to rise.

The sportswear and activewear market is another area where the demand for high-performance textiles is growing. LCPAs offer superior strength and elasticity, making them suitable for producing clothing and gear that require both durability and comfort, such as athletic uniforms, shoes, and protective gear. As consumers become more focused on high-quality, performance-enhancing products, long-chain polyamide-based textiles provide a competitive advantage for manufacturers in the activewear industry.

Restraints/Challenges

- Complex Manufacturing Process And High Costs Of Raw Materials Like Caprolactam And Specialty Additives

The complex manufacturing process and high costs of raw materials, such as caprolactam and specialty additives, present significant restraints to the growth of the Middle East and Africa long-chain polyamide (LCPA) market. The production of LCPAs involves intricate processes that require specialized equipment and technology. These processes, including polymerization, condensation, and extrusion, demand high energy inputs and technical expertise, which can increase production costs. The complexity of manufacturing also makes scaling up production challenging, potentially limiting supply and further driving up costs.

One of the primary raw materials used in the production of long-chain polyamides is caprolactam, a key precursor in the synthesis of nylon. Caprolactam is derived from petroleum-based sources, and fluctuations in the prices of crude oil directly impact its cost. As Middle East and Africa oil prices rise, so does the price of caprolactam, which, in turn, increases the overall cost of LCPA production. This price volatility poses a challenge for manufacturers, who must balance production costs with market prices to remain competitive.

In addition, specialty additives such as plasticizers, stabilizers, and flame retardants are often used to enhance the properties of long-chain polyamides. These additives are also costly and may contribute to the overall high cost of LCPA production. The reliance on these expensive materials further strains the economics of manufacturing, especially for industries seeking to keep costs low while maintaining high-performance standards.

- Volatility in Raw Material Prices

Volatility in raw material prices is a significant challenge for the Middle East and Africa long-chain polyamide (LCPA) market. The production of LCPAs relies heavily on key raw materials such as caprolactam, a major precursor derived from petroleum-based sources, and specialty additives. The prices of these raw materials are subject to fluctuations due to various factors, including changes in Middle East and Africa oil prices, supply chain disruptions, and geopolitical instability. As a result, manufacturers face uncertainty and cost pressures, which can impact profitability and market stability.

Caprolactam, which is a critical feedstock in the production of polyamides, is highly sensitive to changes in crude oil prices. Since it is derived from petroleum, any volatility in oil markets can lead to significant increases in the cost of caprolactam, which, in turn, raises the overall production cost of LCPAs. In addition, geopolitical events or natural disasters in key oil-producing regions can disrupt the supply chain, leading to shortages and further price increases.

The prices of specialty additives used to enhance the properties of LCPAs, such as flame retardants, stabilizers, and plasticizers, are also prone to fluctuations. These additives are often derived from specific chemical processes or sourced from limited suppliers, making them vulnerable to supply chain disruptions. The increased cost of these materials can add to the financial burden on manufacturers, particularly in industries that are price-sensitive or already facing intense competition.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Middle East and Africa Long Chain Polyamide Market Scope

The Middle East and Africa long-chain polyamide market is segmented into five notable segments based on type, source, form, application, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- PA 12

- PA 11

- PA 610

- PA 612

- PA 1010

- PA 1012

- PA 410

- Others

Source

- Artificially Made

- Naturally Occurring

Form

- Chips

- Powder

- Others

Application

- Engineering Plastics

- Polyamide Fibers & Fabrics

- Polyamide Films

- Polyamide Adhesives

- Coatings

- Others

End Use

- Electrical & Electronics

- Healthcare, Industrial

- Automotive, Consumer Goods

- Packaging

- Aerospace & Defense

- Oil & Gas

- Energy

- Others

Middle East and Africa Long Chain Polyamide Market Regional Analysis

The market is analyzed and market size insights and trends are provided on the basis of country, type, source, form, application, and end-use as referenced above

The countries covered in the market are Saudi Arabia, Egypt, U.A.E., South Africa, Israel, and rest of Middle East and Africa.

Saudi Arabia is expected to dominate the long chain polyamide market due to advanced technological innovation, strong automotive and electronics industries, a focus on sustainability, and high demand for high-performance materials in various applications.

Egypt is expected to be fastest growing region in the long chain polyamide market due to its focus on automotive innovation, sustainable manufacturing practices, increasing demand for high-performance materials, and strong presence in industrial and electronic sectors.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Long Chain Polyamide Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Long Chain Polyamide Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- BASF (Germany)

- Arkema (France)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- TORAY INDUSTRIES INC. (Japan)

- MITSUI CHEMICALS AMERICA INC. (Japan)

- KURARAY CO. LTD (Japan)

- Huntsman International LLC. (U.S.)

- Ascend Performance Materials (U.S.)

- Envalior (Germany)

- Domo Chemicals (Belgium)

- NYCOA (New York Chemicals) (U.S.)

- Radici Partecipazioni SpA (Italy)

Latest Developments in Middle East and Africa Long Chain Polyamide Market

- In November 2024, BASF’s Polyamide 6 (PA6) plant in Shanghai received the ISCC PLUS certification, enabling it to produce biomass-balanced and Ccycled PA6. This certification supports BASF’s commitment to sustainability, offering lower carbon footprint and circular product alternatives in the PA6 value chain

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business, a leading global producer. This move expanded Arkema's portfolio in flexible packaging, positioning the company as a key player in the market

- In November 2024, Asahi Kasei has announced its decision to absorb its wholly owned subsidiary, Asahi Kasei NS Energy, through a simplified absorption-type merger, effective April 1, 2025. This move aims to streamline operations after Asahi Kasei NS Energy became a fully owned subsidiary in April 2023

- In April 2024, Domo Chemicals has inaugurated a new factory in China with a USD 15.12 million investment, enhancing production capacity. The facility, located south of Shanghai, will double output in the short term and potentially triple it in the future.

- In September 2022, NYCOA announced the launch of NXTamid-L, a new family of specialty performance nylons designed as alternatives to Nylon 12 and 11. NXTamid-L offers comparable or superior properties, including flexibility, lower moisture absorption, higher glass transition temperatures, and enhanced chemical resistance. This innovative nylon family can also be customized to meet specific performance requirements, reinforcing NYCOA’s position as a leader in the nylon industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OVERVIEW: MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

4.7 VALUE CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT (MONOMERS & CHEMICALS)

4.7.2 POLYMERIZATION PROCESS (SYNTHESIS OF POLYAMIDE)

4.7.3 COMPOUNDING AND ADDITIVES

4.7.4 FABRICATION (PROCESSING INTO FINAL SHAPES)

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USE APPLICATIONS (FINAL PRODUCTS)

4.7.7 CONCLUSION

4.8 VENDOR SELECTION CRITERIA

4.9 CLIMATE CHANGE SCENARIO

4.9.1 ENVIRONMENTAL CONCERNS

4.9.2 INDUSTRY RESPONSE

4.9.3 GOVERNMENT’S ROLE

4.9.4 ANALYST RECOMMENDATIONS

4.1 MARKET SITUATION

4.10.1 PA 1010

4.10.2 PA 1012

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 DEVELOPMENT OF BIO-BASED POLYAMIDES

4.12.2 ADVANCED POLYMERIZATION TECHNIQUES

4.12.3 INTEGRATION OF RECYCLING TECHNOLOGIES

4.12.4 ADOPTION OF SMART MANUFACTURING

4.13 RAW MATERIAL COVERAGE

4.13.1 DICARBOXYLIC ACIDS

4.13.2 DIAMINES

4.13.3 LONG-CHAIN FATTY ACIDS

4.13.4 PETROCHEMICAL FEEDSTOCKS

4.13.5 EMERGING BIO-BASED ALTERNATIVES

4.13.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY

6.1.2 FAST EXPANDING ELECTRICAL AND ELECTRONICS SECTOR

6.1.3 ADVANCEMENTS AND INNOVATIONS IN SUSTAINABLE PRODUCTION TECHNOLOGIES FOR LONG CHAIN POLYAMIDE

6.2 RESTRAINTS

6.2.1 COMPLEX MANUFACTURING PROCESS AND HIGH COSTS OF RAW MATERIALS

6.2.2 COMPETITION FROM OTHER HIGH-PERFORMANCE POLYMERS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIO-BASED POLYAMIDES

6.3.2 RISING DEMAND FOR HIGH-PERFORMANCE TEXTILES

6.3.3 GROWING APPLICATIONS OF LONG CHAIN POLYAMIDE IN MEDICAL DEVICES

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL PRICES

6.4.2 STRINGENT REGULATIONS ON PLASTIC USE, RECYCLING AND DISPOSAL

7 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE

7.1 OVERVIEW

7.2 PA 11

7.3 PA 12

7.4 PA 610

7.5 PA 612

7.6 PA 410

7.7 PA 1010

7.8 PA 1012

7.9 OTHERS

8 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ARTIFICIALLY MADE

8.3 NATURALLY OCCURRING

9 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM

9.1 OVERVIEW

9.2 CHIPS

9.3 POWDER

9.4 OTHERS

10 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ENGINEERING PLASTICS

10.3 POLYAMIDE FIBERS & FABRICS

10.4 POLYAMIDE FILMS

10.5 POLYAMIDE ADHESIVES

10.6 COATINGS

10.7 OTHERS

11 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE

11.1 OVERVIEW

11.2 ELECTRICAL & ELECTRONICS

11.3 HEALTHCARE

11.4 INDUSTRIAL

11.5 AUTOMOTIVE

11.6 CONSUMER GOODS

11.7 PACKAGING

11.8 AEROSPACE & DEFENSE

11.9 OIL & GAS

11.1 ENERGY

11.11 OTHERS

12 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 EGYPT

12.1.3 UNITED ARAB EMIRATES

12.1.4 SOUTH AFRICA

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EVONIK INDUSTRIES AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ARKEMA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASAHI KASEI CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASCEND PERFORMANCE MATERIALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DOMO CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENVALIOR

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUNTSMAN INTERNATIONAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 KURARAY CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 LG CHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MITSUI CHEMICALS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NYCOA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 RADICI PARTECIPAZIONI SPA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TORAY INDUSTRIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF TOP COMPANIES: MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 5 MIDDLE EAST AND AFRICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 9 MIDDLE EAST AND AFRICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 11 MIDDLE EAST AND AFRICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 15 MIDDLE EAST AND AFRICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 21 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (TONS)

TABLE 23 MIDDLE EAST AND AFRICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 27 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 MIDDLE EAST AND AFRICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 37 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 MIDDLE EAST AND AFRICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 MIDDLE EAST AND AFRICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 MIDDLE EAST AND AFRICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 49 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 61 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 69 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 73 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 79 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 82 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 85 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (TON)

TABLE 88 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 90 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 92 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 96 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 98 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 115 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 117 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 119 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 121 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 123 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 EGYPT LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 EGYPT LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 140 EGYPT LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 141 EGYPT LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 142 EGYPT LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 143 EGYPT LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 144 EGYPT LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 EGYPT LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 146 EGYPT LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 147 EGYPT LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 148 EGYPT ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 EGYPT ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 EGYPT HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 EGYPT HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 EGYPT AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 EGYPT CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 EGYPT PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 EGYPT OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 EGYPT OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 165 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 166 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 167 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 168 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 169 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 173 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 174 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 UNITED ARAB EMIRATES HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 UNITED ARAB EMIRATES HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 UNITED ARAB EMIRATES INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 UNITED ARAB EMIRATES INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 UNITED ARAB EMIRATES AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 180 UNITED ARAB EMIRATES AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 UNITED ARAB EMIRATES CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 UNITED ARAB EMIRATES CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 UNITED ARAB EMIRATES PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 UNITED ARAB EMIRATES OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 UNITED ARAB EMIRATES ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 UNITED ARAB EMIRATES OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 190 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 191 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 192 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 194 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 196 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 197 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 198 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SOUTH AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 SOUTH AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SOUTH AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 SOUTH AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SOUTH AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 SOUTH AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SOUTH AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SOUTH AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SOUTH AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SOUTH AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SOUTH AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 215 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 216 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 217 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 218 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 219 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 221 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 222 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 223 ISRAEL ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 ISRAEL ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ISRAEL HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 ISRAEL HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ISRAEL INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 ISRAEL INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 ISRAEL AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 ISRAEL AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ISRAEL CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 232 ISRAEL CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 ISRAEL PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ISRAEL AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 ISRAEL OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ISRAEL ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ISRAEL OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 REST OF MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 REST OF MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PA 11 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 VALUE CHAIN ANALYSIS FOR MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 24 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY TYPE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2024

FIGURE 27 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2024

FIGURE 28 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2024

FIGURE 29 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: SNAPSHOT (2024)

FIGURE 30 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Long Chain Polyamide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Long Chain Polyamide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Long Chain Polyamide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.