Middle East And Africa Low E Glass Market

Market Size in USD Billion

CAGR :

%

USD

9.43 Billion

USD

17.78 Billion

2024

2032

USD

9.43 Billion

USD

17.78 Billion

2024

2032

| 2025 –2032 | |

| USD 9.43 Billion | |

| USD 17.78 Billion | |

|

|

|

|

Low-E (Low Emissivity) Glass Market Size

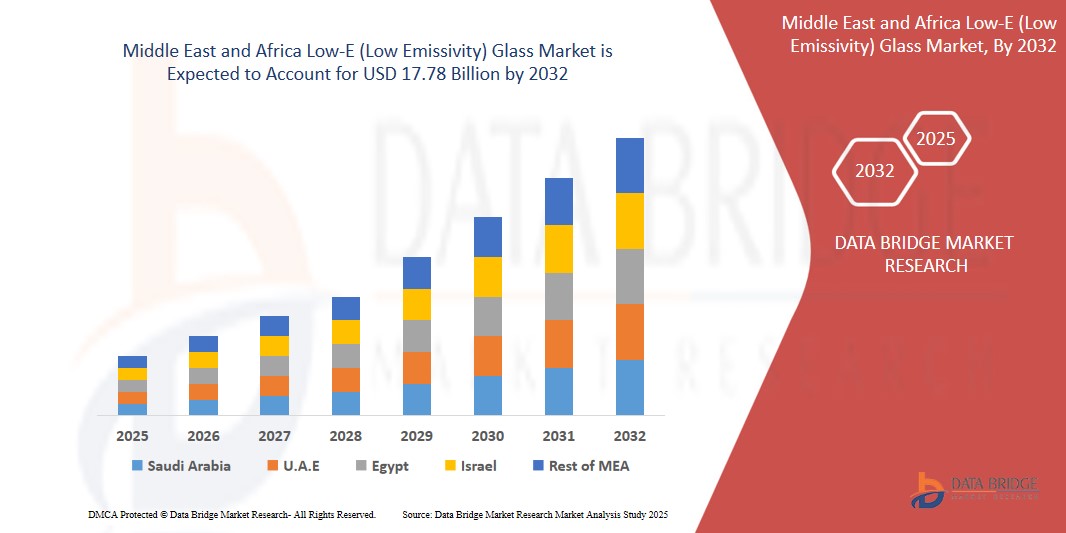

- The Middle East and Africa Low-E (Low Emissivity) Glass Market size was valued at USD 9.43 billion in 2024 and is expected to reach USD 17.78 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by the rising awareness about the beneficial features of low-e glass such as cooling expense and reduced heating in residential and commercial places

- Furthermore, rising disposable income, surge in construction activities, growing awareness about energy saving, and increasing government initiatives, thereby significantly boosting the industry's growth

Low-E (Low Emissivity) Glass Market Analysis

- Coating metal particles on the glass make Low-e glass. The most effective type is "soft coat low-e". This market finds that most of its applications are in flexible packaging of different materials. Low-e refers to low emissivity, which means that the surface hardly emits radiant heat.

- All surfaces transfer, reflect and absorb heat, thereby reducing the amount of heat transferred. Its usage not only involves the reduction of heat transfer, but also to block ultraviolet radiation waves in visible light

- Technological advancement along with innovations and emerging new markets will provide beneficial opportunities for the low-e (low emissivity) glass market growth

- North America dominates the Low-E (Low Emissivity) Glass Market with the largest revenue share of 40.01% in 2025, characterized by early smart home adoption, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in Low-E (Low Emissivity) Glass installations, particularly in new smart homes and multi-dwelling units, driven by innovations from both established tech companies and startups focusing on AI and voice-activated features.

- Asia-Pacific is expected to be the fastest growing region in the Low-E (Low Emissivity) Glass Market during the forecast period due to increasing urbanization and rising disposable incomes

- Hard coat low-e glass segment is expected to dominate the Low-E (Low Emissivity) Glass Market with a market share of 34.7% in 2025, as it is more durable and ideal for single glazing, often used in exterior applications.

Report Scope and Low-E (Low Emissivity) Glass Market Segmentation

|

Attributes |

Low-E (Low Emissivity) Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Low-E (Low Emissivity) Glass Market Trends

“Integration of Smart Glass Technologies in Sustainable Urban Development”

- A significant trend in the Middle East and Africa Low-E Glass market is the incorporation of smart glass technologies, such as electrochromic and photochromic glass, into sustainable urban development projects.

- For instance, Saudi Arabia's NEOM project plans to install 7.5 million square meters of smart glass by 2030, aiming to enhance energy efficiency and indoor comfort.

- Similarly, the UAE's Sustainable City utilizes photovoltaic glass to achieve 100% renewable energy for residential units, reducing air conditioning demand by 40% in desert conditions.

- These integrations not only contribute to energy conservation but also align with the region's sustainability goals, driving the demand for advanced Low-E glass solutions.

- The demand for Low-E (Low Emissivity) Glass that offer seamless AI and voice control integration is growing rapidly across both residential and commercial sectors, as consumers increasingly prioritize convenience and comprehensive smart home functionality.

Low-E (Low Emissivity) Glass Market Dynamics

Driver

“Government Initiatives and Visionary Projects Fueling Demand”

- Government-led initiatives, such as Saudi Arabia's Vision 2030 and the UAE's Green Building Regulations, are major drivers for the Low-E Glass market in the region.

- These programs mandate the use of energy-efficient materials in new constructions, promoting the adoption of Low-E glass to reduce energy consumption and enhance building performance.

- Large-scale projects like the Jeddah Central Project and Masar Makkah redevelopment are incorporating smart technologies, including Low-E glass, to optimize energy usage and indoor environments.

- Such initiatives are creating a robust demand for Low-E glass products, positioning them as essential components in modern construction practices.

Restraint/Challenge

“High Costs and Technical Limitations in Harsh Environments”

- The adoption of Low-E glass in the Middle East and Africa faces challenges due to high production and installation costs, which can be a barrier for budget-conscious developers.

- Additionally, technical limitations in extreme weather conditions may affect the durability and effectiveness of certain energy-efficient glass types.

- Retrofitting existing structures with Low-E glass can also be complex and costly, requiring structural modifications that may not be feasible for all buildings.

- Addressing these challenges through technological advancements and cost-effective solutions is crucial for wider adoption in the region

Low-E (Low Emissivity) Glass Market Scope

The market is segmented on the basis of type, coating type, coating material, glazing, technology, and end-user.

- By Type

On the basis of type, the Low-E (Low Emissivity) Glass Market is segmented into hard coat low-e glass and soft coat low-e glass. The hard coat low-e glass segment dominates the largest market revenue share of 34.7% in 2025, as it is more durable and ideal for single glazing, often used in exterior applications. It’s less expensive and easier to handle but provides moderate energy efficiency compared to soft coat variants, making it popular in lower-budget or mild climate projects.

The soft coat low-e glass segment is anticipated to witness the fastest growth rate of 6.3% from 2025 to 2032, fueled by higher infrared reflectivity. It’s used mainly in double or triple glazing applications but is less durable and requires protective glazing. Preferred in modern energy-efficient buildings where insulation and performance are top priorities.

- By Coating Type

On the basis of communication protocol, the Low-E (Low Emissivity) Glass Market is segmented into passive low-e coating, solar control low-e coating. The passive low-e coating the largest market revenue share in 2025 of, as it allows maximum solar heat gain while minimizing heat loss, suitable for colder climates or seasonal regions within MEA. These coatings help reduce heating costs while maintaining natural light and comfort inside buildings, although less commonly used in hotter areas of the region.

The solar control low-e coating segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its reduced solar heat gain while allowing visible light transmission, making them ideal for hot climates across MEA. Solar control coatings enhance energy efficiency by lowering cooling demand, which is crucial for buildings exposed to intense sunlight in places like the Gulf states.

- By Coating Material

On the basis of coating material, the Low-E (Low Emissivity) Glass Market is segmented into metallic and semi-conductive coating. The metallic coatings held the largest market revenue share in 2025, driven by the high performance in reducing energy transfer, supporting advanced thermal insulation in modern buildings, and are commonly used in double or triple glazed glass configurations. Made of thin metal layers like silver, metallic coatings reflect infrared heat effectively while allowing light transmission.

The semi-conductive coatings are expected to witness the fastest CAGR from 2025 to 2032, favored for its semi-conductive materials like tin oxide to create a balance between transparency and thermal performance. They are less expensive than metallic coatings and more durable, often used in commercial glazing applications where budget constraints or durability are important considerations.

- By Glazing

On the basis of glazing, the Low-E (Low Emissivity) Glass Market is segmented into single low-e glazing, double low-e glazing, and triple low-e glazing. The double low-e glazing segment accounted for the largest market revenue share in 2024, driven by its balanced cost and performance, offering good insulation and energy savings. This type is widely used in residential and commercial buildings to enhance comfort and reduce dependency on air conditioning.

The triple low-e glazing segment is expected to witness the fastest CAGR from 2025 to 2032, as it offers superior energy efficiency and is ideal for buildings with extreme temperature exposure or stringent green certifications. Though more expensive, it provides the best insulation and is typically used in high-performance buildings or specialty projects within the region.

- By Technology

On the basis of technology, the Low-E (Low Emissivity) Glass Market is segmented into pyrolytic process (on-line), and sputtered process (off-line). The pyrolytic process (on-line) segment accounted for the largest market revenue share in 2024, as it isdurable and suitable for single-glazed products. Pyrolytic Low-E glass resists handling damage and is cost-effective, making it suitable for widespread applications, particularly in less complex or exterior-facing designs.

The sputtered process (off-line) segment is expected to witness the fastest CAGR from 2025 to 2032, as it allows for greater control and higher energy performance. However, it requires sealing between panes due to lower durability. This method is preferred in high-performance applications needing precise thermal and light control.

- By End-User

On the basis of end-user, the Low-E (Low Emissivity) Glass Market is segmented into construction and transportation. The construction segment accounted for the largest market revenue share in 2024, driven by urban development and demand for sustainable buildings. Low-E glass is increasingly used in homes, offices, and commercial buildings to reduce energy consumption, enhance comfort, and comply with evolving building regulations focused on energy conservation.

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, as it improves passenger comfort by reducing solar heat gain and protects interiors from UV damage. With rising vehicle sales and production in MEA, this segment presents strong growth opportunities for glass manufacturers.

Low-E (Low Emissivity) Glass Market Country Analysis

- Saudi Arabia dominates the Low-E (Low Emissivity) Glass Market with the largest revenue share of 37.13% in 2024, propelled by its Vision 2030 agenda. This initiative has spurred over USD 1 trillion in infrastructure and real estate projects, including NEOM, Qiddiya, and the Red Sea Project, all emphasizing sustainability and energy efficiency

- Saudi Arabia's ambition to become a regional automotive manufacturing center is further boosting the Low-E glass market.

- Efforts to attract original equipment manufacturers (OEMs) and establish vehicle production plants are increasing the demand for Low-E glass in automotive applications, enhancing energy efficiency and passenger comfort.

U.A.E. Low-E (Low Emissivity) Glass Market Insight

The U.A.E. Low-E (Low Emissivity) Glass Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by Strong Urban Infrastructure Growth. The UAE is undertaking large-scale smart city and commercial development projects (e.g., Dubai South, Abu Dhabi’s Masdar City), driving high demand for energy-efficient construction materials such as Low-E glass. The U.A.E. has introduced green building codes like Estidama and the Dubai Green Building Regulations, which promote the use of Low-E glass for energy savings and thermal comfort.

South Africa Low-E (Low Emissivity) Glass Market Insight

South Africa Low-E (Low Emissivity) Glass Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rapid urbanization and a growing demand for residential and commercial buildings. This drives the adoption of energy-efficient materials like Low-E glass to support modern infrastructure. South Africa’s National Building Regulations (SANS 10400-XA) mandate energy-efficient design. These guidelines encourage the use of Low-E glazing to reduce energy usage in buildings, especially in climate-sensitive zones.

Low-E (Low Emissivity) Glass Market Share

The Low-E (Low Emissivity) Glass industry is primarily led by well-established companies, including:

- CSG HOLDING CO., LTD. (China)

- Saint-Gobain S.A. (France)

- AGC Inc. (Japan)

- Nippon Sheet Glass Co., Ltd. (Japan)

- arcon Flachglas-Veredlung GmbH & Co. KG (Germany)

- Metro Performance Glass (New Zealand)

- Qingdao Migo Glass Co., Ltd. (China)

- Taiwan Glass Industry Corporation (Taiwan)

- Central Glass Co., Ltd. (Japan)

Latest Developments in Middle East and Africa Low-E (Low Emissivity) Glass Market

- In December 2023, Saint-Gobain completed the acquisition of a leading provider of insulation solutions to strengthen its low-emissivity (low-e) glass production and boost its portfolio of energy-efficient offerings

- In January 2023, Guardian Glass introduced an advanced low-e coating technology designed to improve solar control and thermal insulation in residential windows, offering enhanced UV protection

- In February 2023, AGC Inc. entered into a collaboration with a prominent architectural firm to develop integrated smart window solutions that leverage low-e glass for improved energy efficiency

- In March 2023, Pilkington launched its new Optiwhite low-e glass, known for superior clarity and high energy performance, targeting upscale architectural projects and skyscrapers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Low E Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Low E Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Low E Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.