Middle East And Africa Lysosomal Storage Disorder Drugs Market

Market Size in USD Million

CAGR :

%

USD

510.05 Million

USD

928.67 Million

2024

2032

USD

510.05 Million

USD

928.67 Million

2024

2032

| 2025 –2032 | |

| USD 510.05 Million | |

| USD 928.67 Million | |

|

|

|

Middle East and Africa Lysosomal Storage Disorder Drugs Market Analysis

The Middle East and Africa lysosomal storage disorder drugs market encompasses the commercial sector for pharmaceuticals developed to diagnose, treat, and manage various lysosomal storage disorders, which are rare genetic conditions typically characterized by the accumulation of undigested substances within lysosomes due to enzyme deficiencies. This market includes a range of therapeutic products, such as enzyme replacement therapies, substrate reduction therapies, and gene therapies, aimed at addressing the diverse clinical manifestations of LSDs, such as Gaucher disease, Fabry disease, and Pompe disease. With increasing awareness, advancements in research and technology, and a growing number of pipeline therapies, this market is poised for significant expansion. In addition, rising healthcare expenditure and initiatives to improve access to rare disease treatments further drive market growth, presenting both opportunities and challenges for pharmaceutical companies and healthcare providers.

Lysosomal Storage Disorder Drugs Market Size

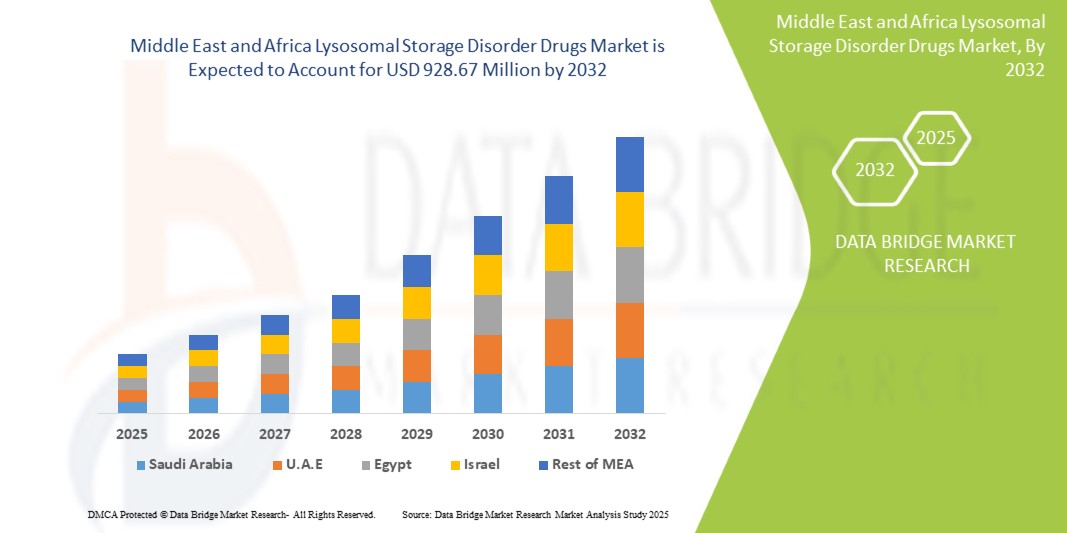

Middle East and Africa lysosomal storage disorder drugs market size was valued at USD 510.05 million in 2024 and is projected to reach USD 928.67 million by 2032, growing with a CAGR of 7.8% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Lysosomal Storage Disorder Drugs Market Trends

“Biotechnology Advancements for Lysosomal Storage Disorders Treatments”

Advancements in biotechnology have played a pivotal role in transforming the treatment landscape for Lysosomal Storage Disorders (LSDs), providing patients with more effective and tailored treatment options. Enzyme Replacement Therapy (ERT) has revolutionized the treatment of Lysosomal Storage Disorders (LSDs) by directly addressing the enzyme deficiencies that cause these conditions. In LSD patients, the lack of specific enzymes leads to the accumulation of toxic substances in cells, damaging organs and tissues. ERT works by administering synthetic enzymes to compensate for the missing ones, improving metabolic functions and alleviating symptoms. Over the years, ERT has advanced significantly, with new, more effective formulations and delivery methods that improve enzyme absorption and reduce side effects. These innovations have resulted in better clinical outcomes, this trend slowed disease progression, reduced organ damage, and enhanced patient quality of life.

Report Scope and Lysosomal Storage Disorder Drugs Market Segmentation

|

Attributes |

Lysosomal Storage Disorder Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South Africa, Egypt, Bahrain, United Arab Emirates, Kuwait, Oman, Qatar, Saudi Arabia, and rest of Middle East and Africa |

|

Key Market Players |

Sanofi (France), BioMarin (U.S.), Pfizer Inc. (U.S.), Amicus Therapeutics, Inc. (U.S.), Takeda Pharmaceutical Company Limited (Japan), Protalix BioTherapeutics Inc. (Israel), and REGENXBIO INC. (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lysosomal Storage Disorder Drugs Market Definition

Lysosomal storage disorder drugs refer to a category of pharmaceuticals specifically developed to treat Lysosomal Storage Disorders (LSDs), which are a group of rare genetic conditions caused by deficiencies in specific enzymes responsible for breaking down complex molecules within lysosomes. These drugs aim to address the underlying metabolic abnormalities associated with LSDs by either replacing the missing enzymes (enzyme replacement therapy), by enhancing the body's ability to produce the enzymes, or by modifying the substrates that accumulate due to enzyme deficiency (substrate reduction therapy). By improving enzymatic function or reducing the toxic build-up of substrates, these treatments can alleviate symptoms, slow disease progression, and ultimately improve the quality of life for individuals affected by these challenging conditions.

Lysosomal Storage Disorder Drugs Market Dynamics

Drivers

- Emerging Personalized Medicine for Lysosomal Storage Disorders

Emerging personalized medicine is transforming the landscape of treatment for Lysosomal Storage Disorders (LSDs) by offering therapies specifically tailored to the individual genetic profiles of patients. LSDs are caused by genetic mutations that affect enzyme function, and these mutations can vary widely between patients. Personalized treatments involve analyzing a patient’s unique genetic makeup to develop a more targeted approach, optimizing the efficacy of therapies such as enzyme replacement or gene therapy. This precision allows for better matching of treatments with the patient's specific needs, minimizing side effects and enhancing therapeutic outcomes. As advancements in genetic testing and technology progress, healthcare providers are able to identify the most suitable interventions, potentially improving response rates and overall treatment success. The shift toward personalized medicine is accelerating the development of customized LSD treatments, which promise to revolutionize disease management. With these innovations, the global lysosomal storage disorders drug market is witnessing increased demand for more effective, individualized treatment options. Personalized medicine is thus a key driver of market growth, as it boosts treatment effectiveness and enhances patient outcomes, fostering greater confidence in therapeutic options.

For instance,

In February 2023, according to the article published by NCBI, Emerging personalized medicine uses an individual’s genetic profile to guide decisions related to the prevention, diagnosis, and treatment of diseases. This approach enables more precise and effective therapies for Lysosomal Storage Disorders (LSDs), tailoring treatments to specific genetic mutations. As personalized medicine becomes more prevalent, it drives the demand for targeted LSD therapies, fueling growth in the global lysosomal storage disorders drug market.

- Increased Government Funding for Research into Rare Disease Treatments

Government funding and grants for research into rare disease treatments are crucial for advancing the development of therapies for conditions such as Lysosomal Storage Disorders (LSDs). Rare diseases, often lacking commercial viability due to small patient populations, pose significant challenges in drug development. To address this, governments worldwide are increasingly allocating funds to incentivize research in these underserved areas. Financial support in the form of grants, subsidies, and tax credits helps pharmaceutical companies and research institutions overcome the high costs and risks associated with developing treatments for rare diseases. Furthermore, governments often fast-track regulatory processes for these treatments, recognizing the urgent need for solutions. By reducing the financial burden on researchers and companies, these funding mechanisms enable the exploration of innovative therapies, such as enzyme replacement and gene therapies that would otherwise face significant barriers to development.

For instance,

In August 2023, according to the article published by National Organization for Rare Diseases, The National Organization for Rare Disorders announced over USD 100,000 in grant funding for rare disease research, highlighting increased government support for advancing treatments. These funds enable researchers to explore innovative therapies for rare diseases like Lysosomal Storage Disorders (LSDs). Such financial backing accelerates drug development, driving growth in the global LSD drug market by fostering new treatment options.

Opportunities

- Increasing Number of Pipeline Drugs

The increasing number of drugs in the pipeline for Lysosomal Storage Disorders (LSDs) represents a significant opportunity for the global lysosomal storage disorders drugs market, potentially leading to improved treatment options and enhanced patient outcomes. As researchers and pharmaceutical companies enhance their understanding of these disorders, they are developing a diverse array of novel therapies, including gene therapies, substrate reduction therapies, and small molecule drugs. This expanded pipeline reflects a growing recognition of the unmet medical needs within the LSD community and promises to offer patients a wider variety of treatment modalities tailored to their specific conditions. The introduction of innovative therapies can enhance patient adherence to treatment, reduce disease burden, and ultimately improve the quality of life for individuals living with these disorders.

For instance,

In June 2024, Ultragenyx announced the Planning to file for accelerated approval of UX111 for the treatment of Sanfilippo Syndrome Type A (MPS IIIA). UX111 is a novel in vivo gene therapy in Phase 1/2/3 development for Sanfilippo syndrome type A (MPS IIIA), a rare fatal lysosomal storage disease with no approved treatment that primarily affects the central nervous system.

- Growing Emphasis on Early Diagnosis

The growing emphasis on early diagnosis of Lysosomal Storage Disorders (LSDs) presents a significant opportunity for the global lysosomal storage disorders drugs market by facilitating timely interventions that can greatly enhance patient outcomes. As healthcare systems place greater emphasis on early detection through improved screening programs, genetic testing, and advancements in diagnostic technologies, more patients are likely to be diagnosed at an earlier stage of their diseases. This early intervention allows for better management of symptoms but increases the potential efficacy of existing and emerging therapies. The result of this shift is a broader patient base that requires and can benefit from treatment options, ultimately driving demand within the lysosomal storage disorders drug market.

For instance,

In February 2023, according to an article, ‘Lysosomal storage disorders: from biology to the clinic with reference to India’, early diagnosis is the most critical part of the management of LSDs as it provides the opportunity for therapeutic intervention, precise genetic counselling, prenatal diagnosis and a better outcome for the patient.

Restraints/Challenges

- Lack of Awareness Among Healthcare Professionals and Patients

The lack of awareness among healthcare professionals and patients about Lysosomal Storage Disorders (LSDs) presents a significant barrier to early diagnosis, treatment, and effective management. Many healthcare providers, especially in regions with limited exposure to rare diseases, often fail to recognize the symptoms of LSDs, which are diverse and overlap with other more common conditions. This lack of knowledge leads to delayed diagnoses, misdiagnosis, and ineffective treatment, exacerbating the severity of the disease. For patients, especially those in resource-poor or underserved areas, the lack of awareness prevents early intervention, leaving them unaware of potential therapies. The complexity and rarity of LSDs further complicate the situation, as patients and healthcare professionals may not fully understand the importance of early treatment or the availability of specialized care options. Fewer patients are diagnosed and treated in time, leading to suboptimal clinical outcomes. This lack of awareness limits the demand for LSD-specific treatments and hinders the overall growth of the global lysosomal storage disorders drugs market.

For instance,

In January 2024, according to the article published by Wiley, there’s a significant diagnostic delay of around 15 years from symptom onset to diagnosis is common in adult LSD cases due to overlapping clinical phenotypes and varying severity. This delay highlights the lack of awareness among healthcare professionals, particularly those treating adult patients. Such restraints hinder early detection and timely treatment, restricting the growth of the global lysosomal storage disorders drugs market.

- Prolonged Drug Approval Procedures

Lengthy drug approval processes present a significant restraint for the lysosomal storage disorder drugs market, slowing the introduction of much-needed therapies. The process for obtaining regulatory approval for new drugs, particularly for rare diseases like LSDs, involves numerous clinical trials, extensive documentation, and rigorous assessments by regulatory bodies such as the FDA and EMA. These approval timelines are often extended due to the need for a thorough evaluation of safety, efficacy, and potential long-term effects. In the case of LSDs, the rarity and complexity of these diseases add another layer of challenge, as there is a limited patient population for clinical trials, making it difficult to generate robust data. The need for specialized treatments and the lack of established standards for these rare diseases complicates the approval process. Consequently, drug developers face prolonged waiting periods, delays in bringing new treatments to market, and additional costs, which can be discouraging for pharmaceutical companies. As a result, the lengthy approval processes slow the availability of innovative therapies for patients, reducing market growth and hindering the accessibility of effective treatments for LSDs. This regulatory delay ultimately acts as a major restraint for the global lysosomal storage disorders drugs market.

For instance,

In August 2024, according to the article published by Drugs.com, The research, development, and approval process for drugs typically takes 12 to 15 years. This extended timeline delays the introduction of new therapies and increases costs for pharmaceutical companies. As a result, the lengthy drug approval process restrains the growth of the global LSD drug market by limiting the speed of treatment availability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Lysosomal Storage Disorder Drugs Market Scope

The market is segmented on the basis of by type of disorder, type, drugs, route of administration, age group, gender, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type of Disorder

- Gaucher Disease

- Type 1

- Type 3

- Type 2

- Fabry Disease

- Pompe Disease

- Infantile-Onset Pompe

- Late-Onset Pompe

- Mucopolysaccharidosis (MPS)

- MPS I

- MPS II

- MPS IV

- MPS VI

- MPS III

- Niemann-Pick Disease

- Type C

- Type B

- Type A

- Krabbe Disease

- Others

Type

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Chaperone Therapy

- Others

Drugs

- Imiglucerase

- Agalsidase Beta

- Idursulfase

- Alglucosidase Alpha

- Velaglucerase

- Taliglucerase Alfa

- Laronidase

- Agalsidase Alpha

- Galsulfase

- Avalglucosidase Alfa

- Others

Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Oral

- Others

Age Group

- Pediatric

- Adults

- Geriatric

Gender

- Male

- Female

Distribution Channel

- Hospital Pharmacies

- Drugs Stores and Retail Pharmacies

- Online Pharmacies

Lysosomal Storage Disorder Drugs Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type of disorder, type, drugs, route of administration, age group, gender, and distribution channel as referenced above.

The countries covered in the market are South Africa, Egypt, Bahrain, United Arab Emirates, Kuwait, Oman, Qatar, Saudi Arabia, and rest of Middle East and Africa.

Saudi Arabia is expected to dominate and the highest growing country in Middle East and Africa lysosomal storage disorder drugs market due to its advanced healthcare infrastructure, high adoption of drugs, significant research and development investments, and a large patient population.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lysosomal Storage Disorder Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Lysosomal Storage Disorder Drugs Market Leaders Operating in the Market Are:

- Sanofi (France)

- BioMarin (U.S.)

- Pfizer Inc. (U.S.)

- Amicus Therapeutics, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Protalix BioTherapeutics Inc. (Israel)

- REGENXBIO INC. (U.S.)

Latest Developments in Lysosomal Storage Disorder Drugs Market

- In October 2024, Amicus Therapeutics announced a settlement regarding its drug Galafold (migalastat), which treats Fabry disease. The settlement resolves ongoing patent disputes and confirms the continuation of the drug’s marketing without litigation interference. This agreement with multiple parties aims to provide stability for Galafold’s availability and development while protecting intellectual property rights

- In June 2024, Amicus Therapeutics was honored with the Prix Galien UK Award for its innovative treatment, Pombiliti (miglustat), for the management of Fabry disease. The award recognizes excellence in pharmaceutical innovation and emphasizes the impact of Pombiliti in improving the lives of patients with rare genetic conditions. This accolade highlights Amicus’ leadership in rare disease therapies

- In April 2024, Forge Biologics announced it would present nine times at the ASGCT 27th Annual Meeting in May 2024, including a late-breaking oral presentation and three technical sessions. Presentations will cover process development, molecular advancements, and clinical updates, including a significant clinical result for FBX-101 in Krabbe disease

- In November 2023, Chiesi Group has been reaccredited as a Great Place to Work-Certified organization across multiple regions, including Italy, Australia, the US, and others. With an 85% response rate from employees, Chiesi achieved an 83% overall satisfaction rate, reflecting its commitment to fostering a positive, inclusive, and collaborative work environment focused on employee well-being and growth

- In January 2024, Denali Therapeutics Inc., a biopharmaceutical company developing therapies to cross the blood-brain barrier for treating neurodegenerative and lysosomal storage diseases, announced progress and milestones for 2024. CEO Ryan Watts, Ph.D., highlighted these developments during a corporate presentation at the 42nd Annual J.P. Morgan Healthcare Conference on January 9th

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PIPELINE ANALYSIS

5 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE MIDDLE EAST AND AFRICA.

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 BIOTECHNOLOGY ADVANCEMENTS FOR LYSOSOMAL STORAGE DISORDERS TREATMENTS

6.1.2 EMERGING PERSONALIZED MEDICINE FOR LYSOSOMAL STORAGE DISORDERS

6.1.3 INCREASED GOVERNMENT FUNDING FOR RESEARCH INTO RARE DISEASE TREATMENTS

6.1.4 COLLABORATIONS AND PARTNERSHIPS BETWEEN PHARMACEUTICAL COMPANIES AND RESEARCH INSTITUTIONS

6.2 RESTRAINTS

6.2.1 LACK OF AWARENESS AMONG HEALTHCARE PROFESSIONALS AND PATIENTS

6.2.2 PROLONGED DRUG APPROVAL PROCEDURES

6.3 OPPORTUNITIES

6.3.1 INCREASING NUMBER OF PIPELINE DRUGS

6.3.2 GROWING EMPHASIS ON EARLY DIAGNOSIS

6.3.3 ADVANCEMENTS IN GENE THERAPY FOR THE TREATMENT OF LYSOSOMAL STORAGE DISORDERS

6.4 CHALLENGES

6.4.1 SIGNIFICANT EXPENSES RELATED TO THE TREATMENT OF THE DISEASE

6.4.2 NARROW PATIENT BASE SUFFERING FROM LYSOSOMAL STORAGE DISORDERS

7 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER

7.1 OVERVIEW

7.2 GAUCHER DISEASE

7.2.1 TYPE 1

7.2.2 TYPE 3

7.2.3 TYPE 2

7.3 FABRY DISEASE

7.4 POMPE DISEASE

7.4.1 INFANTILE-ONSET POMPE

7.4.2 LATE-ONSET POMPE

7.5 MUCOPOLYSACCHARIDOSIS (MPS)

7.5.1 MPS I

7.5.2 MPS II

7.5.3 MPS IV

7.5.4 MPS VI

7.5.5 MPS III

7.6 NIEMANN-PICK DISEASE

7.6.1 TYPE C

7.6.2 TYPE B

7.6.3 TYPE A

7.7 KRABBE DISEASE

7.8 OTHERS

8 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS

8.1 OVERVIEW

8.2 IMIGLUCERASE

8.3 AGALSIDASE BETA

8.4 IDURSULFASE

8.5 ALGLUCOSIDASE ALPHA

8.6 VELAGLUCERASE

8.7 TALIGLUCERASE ALFA

8.8 LARONIDASE

8.9 AGALSIDASE ALPHA

8.1 GALSULFASE

8.11 AVALGLUCOSIDASE ALFA

8.12 OTHERS

9 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE

9.1 OVERVIEW

9.2 ENZYME REPLACEMENT THERAPY (ERT)

9.3 SUBSTRATE REDUCTION THERAPY (SRT)

9.4 CHAPERONE THERAPY

9.5 OTHERS

10 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER

10.1 OVERVIEW

10.2 MALE

10.3 FEMALE

11 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 PEDIATRIC

11.3 ADULT

11.4 GERIATRIC

12 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 HOSPITAL PHARMACIES

12.3 DRUGS STORES AND RETAIL PHARMACIES

12.4 ONLINE PHARMACIES

13 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 INTRAVENOUS (IV)

13.3 SUBCUTANEOUS (SC)

13.4 ORAL

13.5 OTHERS

14 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES (UAE)

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 QATAR

14.1.6 KUWAIT

14.1.7 OMAN

14.1.8 BAHRAIN

14.1.9 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 SANOFI

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BIOMARIN

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 PFIZER INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TAKEDA PHARMACEUTICAL COMPANY LIMITED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 AMICUS THERAPEUTIC, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 CHIESI FARMACEUTICI S.P.A.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 DENALI THERAPEUTICS

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PIPELINE PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 FORGE BIOLOGICS

17.8.1 COMPANY SNAPSHOT

17.8.2 PIPELINE PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 JCR PHARMACEUTICALS CO., LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PINELINE PRODUCT PORTFOLIO

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENT

17.1 ORCHARD THERAPEUTICS PLC

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 PROTALIX BIOTHERAPEUTICS

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PIPELINE PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 REGENXBIO INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PINELINE PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 SANGAMO THERAPEUTICS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 SPUR THERAPEUTICS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ULTRAGENYX PHARMACEUTICAL INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA FABRY DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA KRABBE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA OTHERS IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA IMIGLUCERASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA AGALSIDASE BETA IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA IDURSULFASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ALGLUCOSIDASE ALPHA IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA VELAGLUCERASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA TALIGLUCERASE ALFA IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA LARONIDASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA AGALSIDASE ALPHA IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA GALSULFASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA AVALGLUCOSIDASE ALFA IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA OTHERS IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA ENZYME REPLACEMENT THERAPY (ERT) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA SUBSTRATE REDUCTION THERAPY (SRT) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA CHAPERONE THERAPY IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA OTHERS IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA MALE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA FEMALE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA PEDIATRIC IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA ADULT IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA GERIATRIC IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HOSPITAL PHARMACIES IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA DRUGS STORES AND RETAIL PHARMACIES IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA ONLINE PHARMACIES IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA INTRAVENOUS (IV) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA SUBCUTANEOUS (SC) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA ORAL IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 58 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 59 SAUDI ARABIA GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 60 SAUDI ARABIA POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 SAUDI ARABIA MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 SAUDI ARABIA NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 65 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 66 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 67 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 68 SAUDI ARABIA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 69 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 70 UNITED ARAB EMIRATES (UAE) GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 UNITED ARAB EMIRATES (UAE) POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 UNITED ARAB EMIRATES (UAE) MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 UNITED ARAB EMIRATES (UAE) NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 76 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 77 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 78 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 79 UNITED ARAB EMIRATES (UAE) LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 80 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 81 SOUTH AFRICA GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 82 SOUTH AFRICA POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 SOUTH AFRICA MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 SOUTH AFRICA NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 87 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 88 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 89 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 90 SOUTH AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 91 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 92 EGYPT GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 EGYPT POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 94 EGYPT MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 EGYPT NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 98 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 99 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 100 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 101 EGYPT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 102 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 103 QATAR GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 QATAR POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 QATAR MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 QATAR NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 107 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 109 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 110 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 111 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 112 QATAR LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 113 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 114 KUWAIT GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 KUWAIT POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 KUWAIT MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 KUWAIT NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 119 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 120 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 121 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 122 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 123 KUWAIT LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 124 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 125 OMAN GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 OMAN POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 127 OMAN MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 128 OMAN NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 129 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 131 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 132 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 133 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 134 OMAN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 135 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

TABLE 136 BAHRAIN GAUCHER DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 BAHRAIN POMPE DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 BAHRAIN MUCOPOLYSACCHARIDOSIS (MPS) IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 139 BAHRAIN NIEMANN-PICK DISEASE IN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 140 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DRUGS, 2018-2032 (USD MILLION)

TABLE 142 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 143 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 144 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY GENDER, 2018-2032 (USD MILLION)

TABLE 145 BAHRAIN LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SEVEN SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET, BY TYPE OF DISORDER

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 BIOTECHNOLOGY ADVANCEMENTS FOR LYSOSOMAL STORAGE DISORDER TREATMENTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET IN THE FORECAST PERIOD

FIGURE 14 GAUCHER DISEASE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET IN 2025 & 2032

FIGURE 15 PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET

FIGURE 17 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE OF DISORDER, 2024

FIGURE 18 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE OF DISORDER, 2025-2032 (USD MILLION)

FIGURE 19 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE OF DISORDER, CAGR (2025-2032)

FIGURE 20 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE OF DISORDER, LIFELINE CURVE

FIGURE 21 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DRUGS, 2024

FIGURE 22 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DRUGS, 2025-2032 (USD MILLION)

FIGURE 23 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DRUGS, CAGR (2025-2032)

FIGURE 24 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DRUGS, LIFELINE CURVE

FIGURE 25 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 27 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 28 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY GENDER, 2024

FIGURE 30 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY GENDER, 2025-2032 (USD MILLION)

FIGURE 31 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 32 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY AGE GROUP, 2024

FIGURE 34 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY AGE GROUP, 2025-2032 (USD MILLION)

FIGURE 35 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 36 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 37 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 38 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 39 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 42 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD MILLION)

FIGURE 43 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 44 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 45 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: SNAPSHOT 2024

FIGURE 46 MIDDLE EAST AND AFRICA LYSOSOMAL STORAGE DISORDER DRUGS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.