Middle East And Africa Maintenance Repair And Operations Mro Market

Market Size in USD Billion

CAGR :

%

USD

201.83 Billion

USD

310.80 Billion

2024

2032

USD

201.83 Billion

USD

310.80 Billion

2024

2032

| 2025 –2032 | |

| USD 201.83 Billion | |

| USD 310.80 Billion | |

|

|

|

Maintenance Repair and Operations (MRO) Market Analysis

The MRO market encompasses services and products used to maintain, repair, and operate machinery, infrastructure, and systems across industries such as manufacturing, aerospace, energy, and construction. Growth is driven by increased industrial automation, the rising need for equipment uptime, and the integration of advanced technologies such as IoT and predictive analytics for maintenance. Key trends include a shift toward outsourcing MRO services, adoption of digital platforms for inventory and procurement management, and a focus on sustainability in supply chains.

Maintenance Repair and Operations (MRO) Market Size

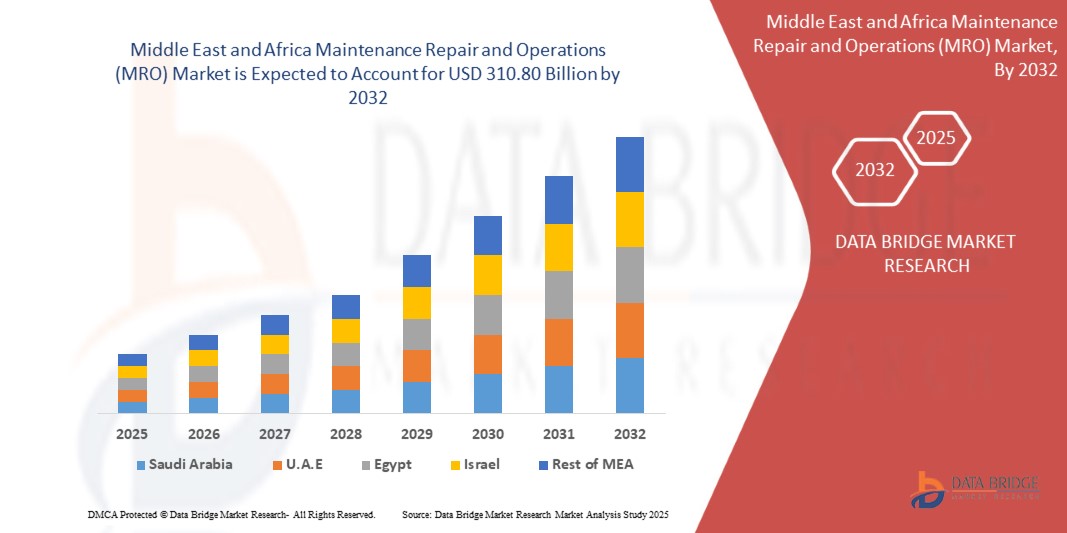

Middle East and Africa Maintenance Repair and Operations (MRO) market is expected to reach USD 310.80 billion by 2032 from USD 201.83 billion in 2024, growing with a CAGR of 5.87% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Maintenance Repair and Operations (MRO) Market Trends

“Expanding Aviation and Manufacturing Industries Worldwide”

The expanding aviation and manufacturing industries worldwide are key trend for the growth of the MRO market. As the demand for air travel and industrial production continues to rise, the need for regular maintenance, repairs, and upgrades to aircraft and manufacturing equipment becomes increasingly vital. The aviation sector, in particular, requires ongoing MRO services to ensure the safety, efficiency, and longevity of aircraft fleets. Similarly, the manufacturing industry relies on MRO solutions to maintain and optimize machinery and equipment, preventing costly downtime. As these industries expand globally, the MRO market will see significant growth, creating opportunities for businesses to provide essential services, technologies, and parts to support this demand.

Report Scope and Maintenance Repair and Operations (MRO) Market Segmentation

|

Attributes |

Maintenance Repair and Operations (MRO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa |

|

Key Market Players |

W.W. Grainger, Inc. (U.S.), Lufthansa Technik (Denmark), ST Engineering (Singapore), Airgas, Inc. (U.S.), Textron Aviation Inc. (U.S.), AAR (U.S.), SR Technics (Switzerland), and United Airlines, Inc. (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Maintenance Repair and Operations (MRO) Market Definition

A Maintenance, Repair, and Operations (MRO) refers to the activities, processes, and resources required to ensure the functionality, safety, and efficiency of equipment, machinery, and infrastructure. MRO encompasses a wide range of services, including routine maintenance, equipment repairs, replacement of spare parts, and operational support, aimed at minimizing downtime and extending the life of assets. It is widely used across various industries such as manufacturing, aviation, automotive, energy, healthcare, and facilities management. By ensuring that equipment and systems operate reliably, MRO plays a critical role in maintaining productivity, safety, and regulatory compliance.

Maintenance Repair and Operations (MRO) Market Dynamics

Drivers

- Rising Government Investment in Public Infrastructure Projects

Rising government investments in public infrastructure projects significantly drive the Maintenance, Repair, and Operations (MRO) market by creating increased demand for upkeep, repair, and optimization of essential infrastructure. Investments in roads, bridges, airports, power plants, and water facilities necessitate robust MRO solutions to ensure operational efficiency, reduce downtime, and extend asset life. This trend is particularly pronounced in developing economies where infrastructure development is accelerating, alongside developed nations focusing on upgrading aging facilities. As governments prioritize sustainable and resilient infrastructure, the role of advanced MRO technologies and services becomes pivotal in meeting long-term project goals.

For instance,

In September 2023, according to a blog published by the Council on Foreign Relations, government investment in public infrastructure projects across the U.S. reached significant levels, totaling billions of dollars across key sectors. Roads and bridges led the investment at USD 110 billion, followed by USD 66 billion for rail systems, USD 65 billion each for power grid upgrades and broadband internet expansion, and USD 55 billion for improving drinking water systems. Additional allocations included USD 50 billion for resilience measures, USD 39 billion for public transit, USD 25 billion for airport enhancements, USD 21 billion for pollution reduction initiatives, USD 17 billion for ports and waterways, and USD 8 billion for electric vehicle charging infrastructure. These substantial investments are driving the Maintenance, Repair, and Operations (MRO) market, creating increased demand for specialized maintenance services and solutions to ensure the efficiency, safety, and longevity of these critical infrastructure projects.

- Rising Focus on Aftermarket Services by OEM Suppliers

The rising focus on aftermarket services by OEM suppliers is a key driver for the Maintenance Repair and Operations (MRO) Market. As OEMs increasingly recognize the long-term value of offering comprehensive aftermarket solutions, including maintenance, repairs, and spare parts, they are expanding their service offerings to ensure customers receive ongoing support throughout the product lifecycle. This shift toward aftermarket services not only strengthens customer loyalty but also creates a steady demand for MRO services, providing a continuous revenue stream for both OEMs and MRO providers, while ensuring the optimal performance and longevity of equipment and machinery.

For instance,

In November 2022, according to the blog published by Informa PLC, OEMs were recognized as crucial for supporting advanced air mobility (AAM) aftermarket services. As AAM technologies, such as eVTOLs, gain traction, OEMs will play a key role in early-stage maintenance and support. eVTOLs are expected to have lower maintenance costs compared to traditional aircraft due to advanced design and technology. OEMs will likely dominate the aftermarket due to their technical expertise and control over intellectual property, making partnerships with AAM OEMs essential for MRO providers

Opportunities

- Strategic Partnerships and Collaborations between Airlines and OEMS

Strategic partnerships and collaborations between airlines and OEMs present significant opportunities in the MRO market by fostering stronger relationships and improving operational efficiency. By working together, airlines and OEMs can optimize maintenance processes, reduce downtime, and enhance the overall lifecycle management of aircraft. These collaborations can also lead to the development of new technologies and maintenance solutions tailored to the specific needs of airlines. Furthermore, shared expertise and resources allow for cost-effective and innovative approaches to maintenance, which can improve the reliability and performance of the fleet. Airlines benefit from customized support, while OEMs gain a deeper understanding of the operational challenges faced by their clients. These synergies help strengthen the long-term sustainability of both parties. Ultimately, these collaborations contribute to the growth of a more efficient and resilient MRO ecosystem.

For instance,

In February 2024, Safran signed a three-year exclusive maintenance agreement with Malaysia Airlines Berhad (MAB) at the Singapore Air Show. The contract covers repair and maintenance for electrical harnesses on over 40 of MAB’s Boeing 737 aircraft equipped with CFM56-7B engines. This agreement will enhance MAB's operational efficiency and competitiveness by providing OEM repair services, improved turnaround times, extended warranty coverage, and exchange support. Safran's continued support through regional representatives in Singapore underscores their commitment to innovation and long-term service improvement. This partnership will contribute to better reliability and performance of MAB’s fleet, ensuring the safety and satisfaction of their passengers and crew.

- Integrating Advanced Technologies Namely AI and IoT to Enhance Overall Efficiency

Integrating advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) presents a significant opportunity for the Maintenance Repair and Operations (MRO) market. By leveraging AI for predictive analytics and IoT for real-time monitoring, MRO providers can enhance operational efficiency, reduce downtime, and optimize maintenance schedules. These technologies enable smarter decision-making, improve asset management, and streamline maintenance processes, leading to cost reductions and increased performance reliability. As industries adopt these innovations, the MRO market is poised to benefit from increased demand for technologically advanced maintenance solutions.

For instance,

In May 2024, according to an article published by NDTV, HCL Technologies introduced generative AI capabilities into its iMRO/4 solution to enhance enterprise asset utilization. The integration of AI aims to optimize maintenance processes and improve overall efficiency. By leveraging AI, HCL Tech provides a smarter approach to asset management, enabling predictive maintenance, reducing downtime, and boosting operational performance. This move creates significant opportunities for the Maintenance Repair and Operations (MRO) market, as companies increasingly seek AI-driven solutions to improve efficiency and asset utilization.

Restraints/Challenges

- Disruption in Supply Chain & Equipment Complexity

The disruption in the supply chain and increasing equipment complexity pose significant challenges to the MRO market. Supply chain interruptions, such as delays in parts procurement and logistics, can lead to extended downtime and higher operational costs. In addition, as equipment becomes more technologically advanced, the need for specialized skills and tools for maintenance grows, further complicating the maintenance and repair processes. These factors create strain on MRO service providers, who must adapt quickly to maintain efficiency while managing higher costs and the complexity of newer systems.

For instance,

In May 2024, the Center for Strategic & International Studies reported how global economic trends, including fluctuating inflation rates, slowing growth in the U.S., and China's uneven recovery, highlighted persistent supply chain challenges. China's increased imports of high-tech equipment to bolster AI and manufacturing indicated pressure on supply chains, while slow recovery in consumer spending showed fragile economic conditions. These disruptions and economic complexities presented challenges for the Maintenance Repair and Operations (MRO) Market, complicating procurement and increasing the difficulty of managing advanced equipment maintenance efficiently.

- Training Workforce for New Digital MRO Systems

Training the workforce for new digital MRO systems presents a significant challenge for the market as it requires a shift in skill sets and adaptability to advanced technologies. Many employees need extensive upskilling to operate AI-driven tools, IoT-based systems, and predictive maintenance platforms effectively. The transition demands substantial investment in training programs, time, and resources, which can strain organizations, especially small and mid-sized enterprises. Resistance to change among the workforce and a lack of familiarity with digital systems can slow the adoption process. Furthermore, bridging the gap between traditional practices and modern digital solutions requires robust change management strategies. Ensuring consistent and comprehensive training is crucial to fully leveraging the potential of digital MRO systems. Organizations must prioritize workforce development to overcome this challenge and remain competitive.

For instance,

In March 2024, according to the article published by WorldRef Pte Ltd, the ongoing challenge of a skilled labor shortage in heavy industries, exacerbated by an aging workforce and rapid technological advancements. Many experienced workers are nearing retirement, leaving a gap in the availability of skilled workers needed for modern MRO tasks. With the rise of digital MRO systems, industries face the challenge of training workers to handle new technologies effectively. The shortage of skilled labor creates difficulties in finding and retaining employees capable of handling complex maintenance and repair tasks. Companies can benefit from focusing on workforce training to bridge this gap and ensure smoother transitions to advanced digital MRO systems.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Maintenance Repair and Operations (MRO) Market Scope

The market is segmented on the basis of product type, type, applications, technology, provider, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Automation

- Hand Tools

- Power Transmission

- Hydraulics

- Electrics

- Pneumatics

- Pipes, Valves & Fitting

- Chemicals

- Abrasives

- Power Tools

- Welding Equipment & Gas

- Fasteners

- Cutting Tools

- Rubber Products

- Seal

- Others

Type

- Production Equipment Repair and Maintenance

- Tooling and Consumables

- Powered Hand Tools (Drills, Drivers, Circular Saws, Jigsaws)

- Manual Hand Tools (Wrenches, Socket Sets, Screwdrivers, Hammers, Pliers)

- Cutting Bits

- Clamps and Joining Tools

- Others

- Infrastructure Repair and Maintenance

- Roof

- Doors

- Windows

- Loading Dock Bays

- Others

- Material Handling Equipment Maintenance

- Landscaping the Grounds Around the Building

- Parking Lots and Garages

- Snow Removal

- Others

Applications

- Part Replacement

- Mobility & Functionality

- Predictive Analysis

- Performance Monitoring

- Inspection

- Others

Technology

- Predictive Maintenance

- AR/VR

- 3D Printing

- Blockchain

- Artificial Intelligence

- Robotics

- Big Data Analytics

- Digital Twin

- IoT

- Others

Provider

- Original Equipment Manufacturer (OEM)

- Aftermarket

End Use

- Machinery

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Mining, Oil & Gas

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Transportation

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Aircraft

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Chemicals

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Metal Processing & Foundry

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Pharmaceuticals

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Food, Beverage & Tobacco

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Electrical

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Construction

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Rubber Plastic & Non – Metallic

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Textile

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Wood & Paper

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

- Others

- Artificial Intelligence

- IoT

- Big Data Analytics

- Robotics

- Predictive Maintenance

- Digital Twin

- AR/VR

- Blockchain

- 3D Printing

- Others

Maintenance Repair and Operations (MRO) Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product type, type, application, technology, and end use as referenced above.

The countries covered in the market are U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia is currently dominating the Middle East and Africa Maintenance Repair and Operations (MRO) market, driven by its robust industrial base, advanced manufacturing technologies, and early adoption of digital solutions like predictive analytics and IoT in maintenance processes. The region's focus on preventive maintenance and sustainability, along with significant investments in infrastructure and industrial automation, further solidifies its leadership position in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Maintenance Repair and Operations (MRO) Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Maintenance Repair and Operations (MRO) Market Leaders Operating in the Market Are:

- W.W. Grainger, Inc. (U.S.)

- Lufthansa Technik (Denmark)

- ST Engineering (Singapore)

- Airgas, Inc. (U.S.)

- Textron Aviation Inc. (U.S.)

- AAR (U.S.)

- SR Technics (Switzerland)

- United Airlines, Inc. (U.S.)

Latest Developments in Maintenance Repair and Operations (MRO) Market

- In October 2024, Wesco International announced its acquisition of Ascent, a provider of data center facility management services, with USD 115 million in sales. The acquisition expanded Wesco's data center solutions portfolio, including advanced cooling systems and lifecycle support, enhancing services across the data center market

- In April 2024, Wesco International announced the completion of its sale of the Wesco Integrated Supply (WIS) business to Vallen Distribution for USD 350 million. The divestment included Wesco’s industrial maintenance, repair, and operations (MRO) supply business in North America and Europe, with 2023 net sales of USD 784 million. Wesco planned to use the proceeds to reduce debt and repurchase shares

- In January 2025, Avianca has partnered with Lufthansa Technik to implement its Digital Tech Ops Ecosystem, becoming the first airline in the Americas to use the suite. The collaboration aims to optimize fleet management, reduce costs, and enhance operational efficiency through digital solutions like AMOS, AVIATAR, and flydocs

- In September 2024, Lufthansa Group has extended its wet lease agreement with airBaltic for three more years, beginning in the summer of 2025. This partnership will provide up to 21 Airbus A220-300 aircraft in summer and five in winter, enhancing network flexibility and supporting seasonal demand peaks

- In August 2024, NBA legend Dirk Nowitzki partners with Lufthansa for the launch of its Allegris campaign, representing the airline’s new long-haul flight experience. Nowitzki features in an ad showcasing the luxurious Allegris Business Class with its innovative seat options, including temperature-controlled features

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VENDOR SELECTION CRITERIA

4.2.1 QUALITY OF PRODUCTS AND SERVICES

4.2.2 COST COMPETITIVENESS

4.2.3 DELIVERY AND LEAD TIMES

4.2.4 TECHNICAL EXPERTISE AND INNOVATION

4.2.5 COMPLIANCE AND REGULATORY ADHERENCE

4.2.6 CUSTOMER SUPPORT AND SERVICE

4.2.7 FLEXIBILITY AND SCALABILITY

4.2.8 VENDOR STABILITY AND REPUTATION

4.2.9 GEOGRAPHICAL COVERAGE

4.2.10 1SUSTAINABILITY AND ENVIRONMENTAL CONSIDERATIONS

4.3 CASE STUDIES

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4.1 INDUSTRY ANALYSIS

4.4.2 FUTURISTIC SCENARIO

4.5 END USER SEGMENT DEFINITIONS

4.5.1 MACHINERY

4.5.2 MINING, OIL & GAS

4.5.3 TRANSPORTATION

4.5.4 AIRCRAFT

4.5.5 CHEMICALS

4.5.6 METAL PROCESSING & FOUNDRY

4.5.7 PHARMACEUTICALS

4.5.8 FOOD, BEVERAGE & TOBACCO:

4.5.9 ELECTRICAL

4.5.10 CONSTRUCTION:

4.5.11 RUBBER, PLASTIC & NON-METALLIC

4.5.12 TEXTILE

4.5.13 WOOD & PAPER

4.5.14 OTHERS

4.6 TECHNOLOGICAL TRENDS

4.6.1 PREDICTIVE MAINTENANCE AND IOT INTEGRATION:

4.6.2 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML):

4.6.3 DRONES AND ROBOTICS:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING GOVERNMENT INVESTMENT IN PUBLIC INFRASTRUCTURE PROJECTS

5.1.2 EXPANDING AVIATION AND MANUFACTURING INDUSTRIES WORLDWIDE

5.1.3 REGULATORY REQUIREMENTS INCREASE THE DEMAND FOR MRO SERVICES

5.1.4 RISING FOCUS ON AFTERMARKET SERVICES BY OEM SUPPLIERS

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF ADVANCED MRO TOOLS AND SYSTEMS

5.2.2 FLUCTUATING RAW MATERIAL PRICES AFFECTING COSTS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC PARTNERSHIPS AND COLLABORATIONS BETWEEN AIRLINES AND OEMS

5.3.2 INTEGRATING ADVANCED TECHNOLOGIES NAMELY AI AND IOT TO ENHANCE OVERALL EFFICIENCY

5.4 CHALLENGES

5.4.1 DISRUPTION IN SUPPLY CHAIN & EQUIPMENT COMPLEXITY

5.4.2 TRAINING WORKFORCE FOR NEW DIGITAL MRO SYSTEMS

6 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AUTOMATION

6.3 HAND TOOLS

6.4 POWER TRANSMISSION

6.5 PIPES, VALVES & FITTING

6.6 CHEMICALS

6.7 ABRASIVES

6.8 POWER TOOLS

6.9 WELDING EQUIPMENT & GAS

6.1 FASTNERS

6.11 CUTTING TOOLS

6.12 RUBBER PRODUCTS

6.13 SEAL

6.14 OTHERS

7 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE

7.1 OVERVIEW

7.2 PRODUCTION EQUIPMENT REPAIR AND MAINTENANCE

7.3 TOOLING AND CONSUMABLES

7.4 INFRASTRUCTURE REPAIR AND MAINTENANCE

7.5 MATERIAL HANDLING EQUIPMENT MAINTENANCE

7.6 LANDSCAPING THE GROUNDS AROUND THE BUILDING

8 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PART REPLACEMENT

8.3 MOBILITY & FUNCTIONALITY

8.4 PREDICTIVE ANALYSIS

8.5 PERFORMANCE MONITORING

8.6 INSPECTION

8.7 OTHERS

9 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PREDICTIVE MAINTENANCE

9.3 AR/VR

9.4 3D PRINTING

9.5 BLOCKCHAIN

9.6 ARTIFICIAL INTELLIGENCE

9.7 ROBOTICS

9.8 BIG DATA ANALYTICS

9.9 DIGITAL TWIN

9.1 IOT

9.11 OTHERS

10 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE

10.1 OVERVIEW

10.2 MACHINERY

10.3 MINING, OIL & GAS

10.4 TRANSPORTATION

10.5 AIRCRAFT

10.6 CHEMICALS

10.7 METAL PROCESSING & FOUNDRY

10.8 PHARMACEUTICALS

10.9 FOOD, BEVERAGE & TOBACCO

10.1 ELECTRICAL

10.11 CONSTRUCTION

10.12 RUBBER, PLASTIC & NON – METALLIC

10.13 TEXTILE

10.14 WOOD & PAPER

10.15 OTHERS

11 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER

11.1 OVERVIEW

11.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

11.3 AFTERMARKET

12 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET BY REGIONS

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THE HOME DEPOT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 W.W. GRAINGER, IN.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 FCX PERFORMANCE, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WESCO

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 LUFTHANSA TECHNIK

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 AAR

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AIRGAS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 FOKKER TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HISCO

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IBERIA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MJETS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 SEPANG AIRCRAFT ENGINEERING SDN BHD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SONEPAR

15.13.1 BRAND SNAPSHOT

15.13.2 BRAND PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 SR TECHNICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 ST ENGINEERING

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 TAP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TEXTRON AVIATION INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 UNITED TECHNOLOGIES CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 WAJAX LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 HIGH PRICE OF MRO (MAINTENANCE REPAIR OPERATIONS) PRODUCTS

TABLE 2 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA AUTOMATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HAND TOOLS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA PIPES, VALVES & FITTING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ABRASIVES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA POWER TOOLS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA WELDING EQUIPMENT & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA FASTNERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CUTTING TOOLS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA RUBBER PRODUCTS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA SEAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA PRODUCTION EQUIPMENT REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA MATERIAL HANDLING EQUIPMENT MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA PART REPLACEMENT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MOBILITY & FUNCTIONALITY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PREDICTIVE ANALYSIS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PERFORMANCE MONITORING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA INSPECTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PREDICTIVE MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA AR/VR IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA 3D PRINTING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BLOCKCHAIN IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA ROBOTICS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BIG DATA ANALYTICS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA DIGITAL TWIN IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA IOT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY END USE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA ORIGINAL EQUIPMENT MANUFACTURER (OEM) IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA AFTERMARKET IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 101 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SAUDI ARABIA POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SAUDI ARABIA TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SAUDI ARABIA INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 112 SAUDI ARABIA MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 125 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.A.E POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.A.E TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.A.E INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.A.E LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 133 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 134 U.A.E MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 135 U.A.E MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 136 U.A.E MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 137 U.A.E TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 138 U.A.E AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 139 U.A.E CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 140 U.A.E METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 141 U.A.E PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 142 U.A.E FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 143 U.A.E ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 144 U.A.E CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 145 U.A.E RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 146 U.A.E TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 147 U.A.E WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 148 U.A.E OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH AFRICA POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH AFRICA TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH AFRICA INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH AFRICA LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 157 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 158 SOUTH AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH AFRICA MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH AFRICA MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 161 SOUTH AFRICA TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 162 SOUTH AFRICA AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 163 SOUTH AFRICA CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 164 SOUTH AFRICA METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 165 SOUTH AFRICA PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 166 SOUTH AFRICA FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 167 SOUTH AFRICA ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 168 SOUTH AFRICA CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 169 SOUTH AFRICA RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 170 SOUTH AFRICA TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 171 SOUTH AFRICA WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 172 SOUTH AFRICA OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 EGYPT LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 193 EGYPT RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 194 EGYPT TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 195 EGYPT WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 196 EGYPT OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 197 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 ISRAEL POWER TRANSMISSION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 ISRAEL TOOLING AND CONSUMABLES IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 ISRAEL INFRASTRUCTURE REPAIR AND MAINTENANCE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 ISRAEL LANDSCAPING THE GROUNDS AROUND THE BUILDING IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 205 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PROVIDER, 2018-2032 (USD THOUSAND)

TABLE 206 ISRAEL MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 207 ISRAEL MACHINERY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 208 ISRAEL MINING, OIL & GAS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 209 ISRAEL TRANSPORTATION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 210 ISRAEL AIRCRAFT IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 211 ISRAEL CHEMICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 212 ISRAEL METAL PROCESSING & FOUNDRY IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 213 ISRAEL PHARMACEUTICALS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 214 ISRAEL FOOD, BEVERAGE & TOBACCO IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 215 ISRAEL ELECTRICAL IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 216 ISRAEL CONSTRUCTION IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 217 ISRAEL RUBBER, PLASTIC & NON – METALLIC IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 218 ISRAEL TEXTILE IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 219 ISRAEL WOOD & PAPER IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 220 ISRAEL OTHERS IN MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 221 REST OF MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: PRODUCT TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA CHILD SAFETY SEATS MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RISING GOVERNMENT INVESTMENT IN PUBLIC INFRASTRUCTURE PROJECTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 AUTOMATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET

FIGURE 19 U.S. GOVERNMENT INVESTMENT IN INFRASTRUCTURE(IN BILLION)

FIGURE 20 INDIA AIRPORTS SINCE LAST 10 YEARS

FIGURE 21 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY PRODUCT TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY TYPE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY APPLICATION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY TECHNOLOGY, 2024

FIGURE 25 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY END USE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: BY PROVIDER, 2024

FIGURE 27 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA MAINTENANCE REPAIR AND OPERATIONS (MRO) MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Maintenance Repair And Operations Mro Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Maintenance Repair And Operations Mro Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Maintenance Repair And Operations Mro Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.