Market Analysis and Size

Marine communication systems are set of communication systems used for communication between different ships or ships to shore. There are various components of the COMMs systems, for instance, radio communication systems, VHF radio telephone, MF/HF radio telephone, dual-channel Navtex receiver, Inmarsat, marine radar, VHF data exchange system (VDES), maritime SAT phone & internet devices and other navigation related systems. Growing demand for secure communication for maritime IoT applications is making the rise in the demand for marine communication systems solutions in the market. The Middle East and Africa marine communication systems market is growing rapidly due to advent of two-way communication using VDES. The companies are even launching new products to gain a larger market share.

Data Bridge Market Research analyses that the marine communication systems market is expected to grow at a CAGR of 7.6% during the forecast period. "Ship-To-Shore Marine Communication Systems" accounts for the largest system segment in the marine communication systems market. The marine communication systems market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 |

|

Quantitative Units |

USD Thousand |

|

Segments Covered |

By Type (Ship-To-Shore Marine Communication Systems and Ship-To-Ship Marine Communication Systems), By Product (Maritime Sat Phone & Internet Devices, Marine Radio Devices, Marine Multifunction Displays (MFDS), VHF Data Exchange System (VDES), Vessel Monitoring System (VMS) Terminals, Marine Radar, Automatic Identification System (AIS) and Others), By Component (Solution and Services), By Application (Commercial, Government/Military and Recreational), By Communication Technology (Satellite, WIMAX, WLAN, LTE, IR Wi-Fi and Others) |

|

Countries Covered |

Saudi Arabia, U.A.E., Egypt, South Africa, Israel and Rest of Middle East and Africa. |

|

Market Players Covered |

Orbit Communications Systems Ltd., Leonardo S.p.A., Telemar group, Inmarsat Middle East and Africa Limited, Rohde & Schwarz, SAAB, Zenitel Group, Iridium Communications Inc., FURUNO ELECTRIC CO., LTD., Teledyne FLIR LLC, Icom Inc., Jotron., Garmin Ltd., BOCHI CORPORATION, Avatec Marine., NAVICO HOLDING AS, Cobham Satcom, Intellian Technologies, Inc., Hughes Network Systems, LLC, Thuraya Telecommunications Company, Applied Satellite Technology Ltd, Alphatron Marine B.V., NSSL Global , Marlink SAS, Norsat International Inc., Global Technology House, Thales among others |

Market Definition

Marine communication systems are set of communication systems used for communication between different ships or ships to shore. There are various components of the COMMs systems, for instance, radio communication systems, VHF radio telephone, MF/HF radio telephone, dual-channel Navtex receiver, Inmarsat, marine radar, VHF data exchange system (VDES), maritime SAT phone & internet devices and other navigation related systems. Marine communication systems are also used for visualization, catering distress calls, navigation and providing early warnings for adverse weather. It is an advanced system used for the safety and security of the vessel & life on-board.

Marine Communication Systems Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

-

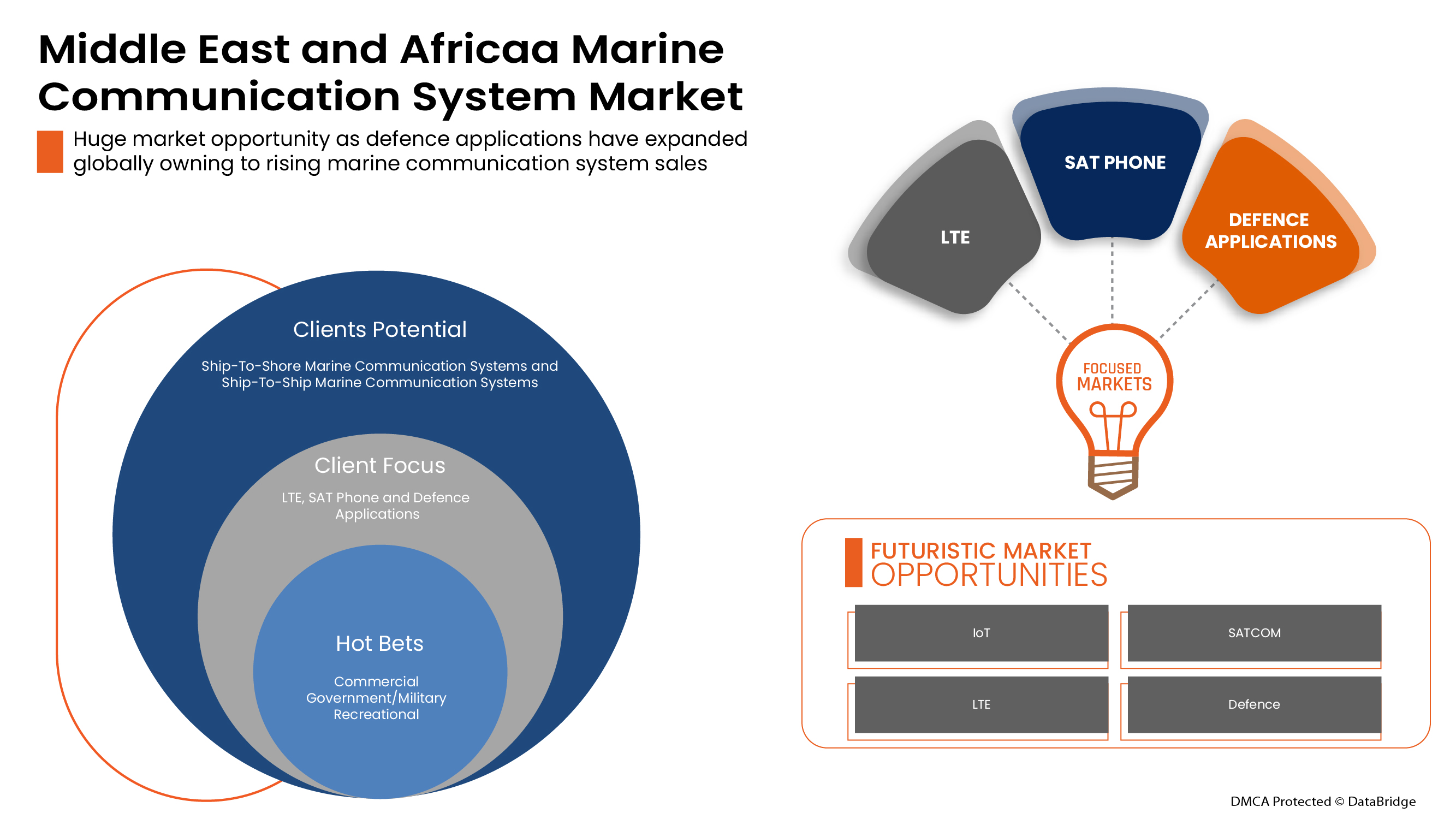

GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

There has been a progressive shift in the maritime IoT ecosphere recently. This ecosphere is served by various standard electronic parts that are the hardware integrated with multiple software. , The importance of utilizing such maritime application technologies in the IoT era is an absolute necessity that is driving the global marine communication systems market.

-

ADVENT OF TWO-WAY COMMUNICATION USING VDES

VHF Data Exchange System (VDES) is a two-way, very high frequency (VHF) ship communications system that is widely used in maritime communications in recent times. It is considered a standard automatic identification system (AIS) extension. Next-generation marine communications systems use AIS and VDES in the same box used in most commercial ships.

-

EMERGENCE OF 5G AND LTE NETWORKS

5G is the next generation of wireless cellular technology. It will provide high-speed data up to 3000 Mbps (3 Gbps) in the real world. Smartphones and other intelligent devices will hugely benefit from 5G. The internet of things (IoT), will also tremendously benefit from the speed and bandwidth of 5G. Moreover, 5G network can also enhance the maritime industry, as LTE/5G can offer much higher communications speeds at a significantly lower cost to satellites enabling the next wave of marine communications.

-

SURGE IN DEMAND FOR SATELLITE COMMUNICATION SYSTEMS

Satellite communication is a type of modern telecommunications where artificial satellites provide communication links between various points on earth. It plays a vital role in multiple industries for business continuity, and emergency management in different business sectors such as marine communication, terrain communication, telecommunication, oil and gas, IoT, healthcare, government, maritime, mining and more. Moreover, satellite communications are used for various other commercials, and governmental and military applications.

Opportunity

-

INCREASING CONSTRUCTION OF MILITARY/COMMERCIAL VESSELS

Growing geopolitical pressure is forcing countries to strengthen their defence sector, including land, air, and marine. Recently, the funding for constructing a strong naval fleet has been a top priority for countries. Naval fleet construction includes a wide range of vessels such as aircraft carriers, destroyers, amphibious ships, replenishment ships, multirole and research ships, and submarines, which are prominently used in marine applications.

Restraint/Challenge

- OUTDATED MARINE COMMUNICATION SYSTEMS POSE THE THREAT OF HACKING

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security is a weaknesses which hackers exploit to perform unauthorized actions within a system.

Post COVID-19 Impact on Marine Communication Systems Market

COVID-19 created a major impact on the marine communication systems market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the marine communication systems market is rising due to the government policies to boost international trade post covid. Also the increasing construction of military/commercial vessels demand is rising the demand for marine communication systems market in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the marine communication systems market. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Development

- In May 2022, Inmarsat Middle East and Africa Limited provided modern wireless communications to maritime vessels. The service launched for Titanic expedition team aims to offer satellite communications network capabilities for the expedition. This company could offer innovative and advanced solutions for its clients

- In May 2022, SAAB received the contract from Swedish Defence Materiel Administratio for torpedo tube for lightweight torpedos with advanced control features. For this contract the company received USD 14.75 thousand. Through this company strengthened its regional presence

Middle East and Africa Marine Communication Systems Market Scope

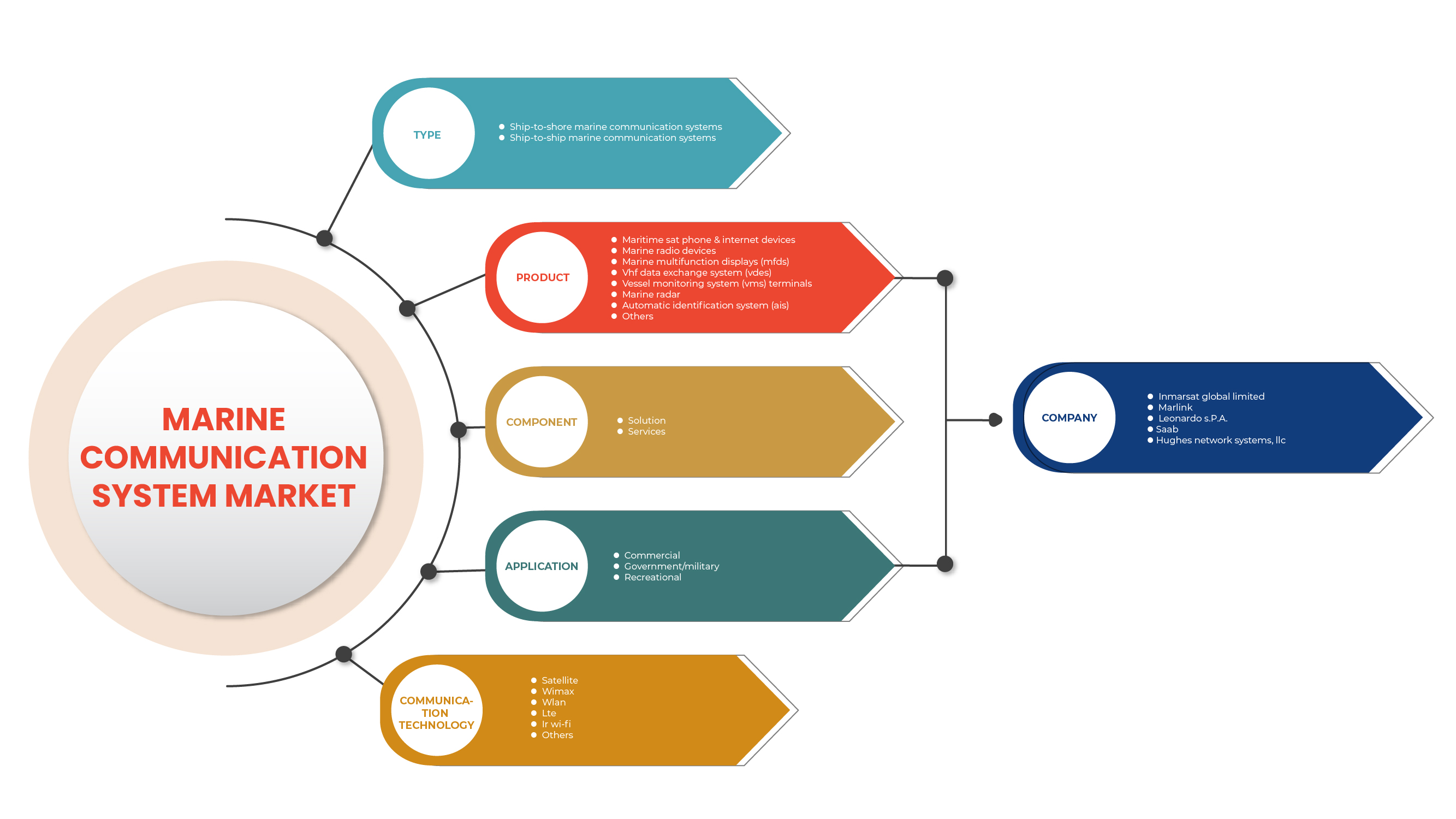

The marine communication systems market is segmented on the basis of by type, product, component, application and communication technology. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- Ship-To-Shore Marine Communication Systems

- Ship-To-Ship Marine Communication Systems

On the basis of type, the Middle East and Africa marine communication systems market is segmented into ship-to-shore marine communication systems and ship-to-ship marine communication systems.

By Product

- Maritime Sat Phone & Internet Devices

- Marine Radio Devices

- Marine Multifunction Displays (MFDS)

- VHF Data Exchange System (VDES)

- Vessel Monitoring System (VMS) Terminals

- Marine Radar

- Automatic Identification System (AIS)

- Others

On the basis of by product, the Middle East and Africa marine communication systems market has been segmented into maritime sat phone & internet devices, marine radio devices, Marine Multifunction Displays (MFDS), VHF Data Exchange System (VDES), Vessel Monitoring System (VMS) Terminals, Marine Radar, Automatic Identification System (AIS), and others.

By Component

- Solution

- Services

On the basis of component, the Middle East and Africa marine communication systems market has been segmented into solution and services.

By Application

- Commercial

- Government/Military

- Recreational

On the basis of application, the Middle East and Africa marine communication systems market has been segmented into commercial, government/military and recreational.

By Communication Technology

- Satellite

- WIMAX

- WLAN

- LTE

- IR Wi-Fi

- Others

On the basis of communication technology, the Middle East and Africa marine communication systems market has been segmented into Satellite, WIMAX, WLAN, LTE, IR Wi-Fi, and others.

Marine Communication Systems Market Regional Analysis/Insights

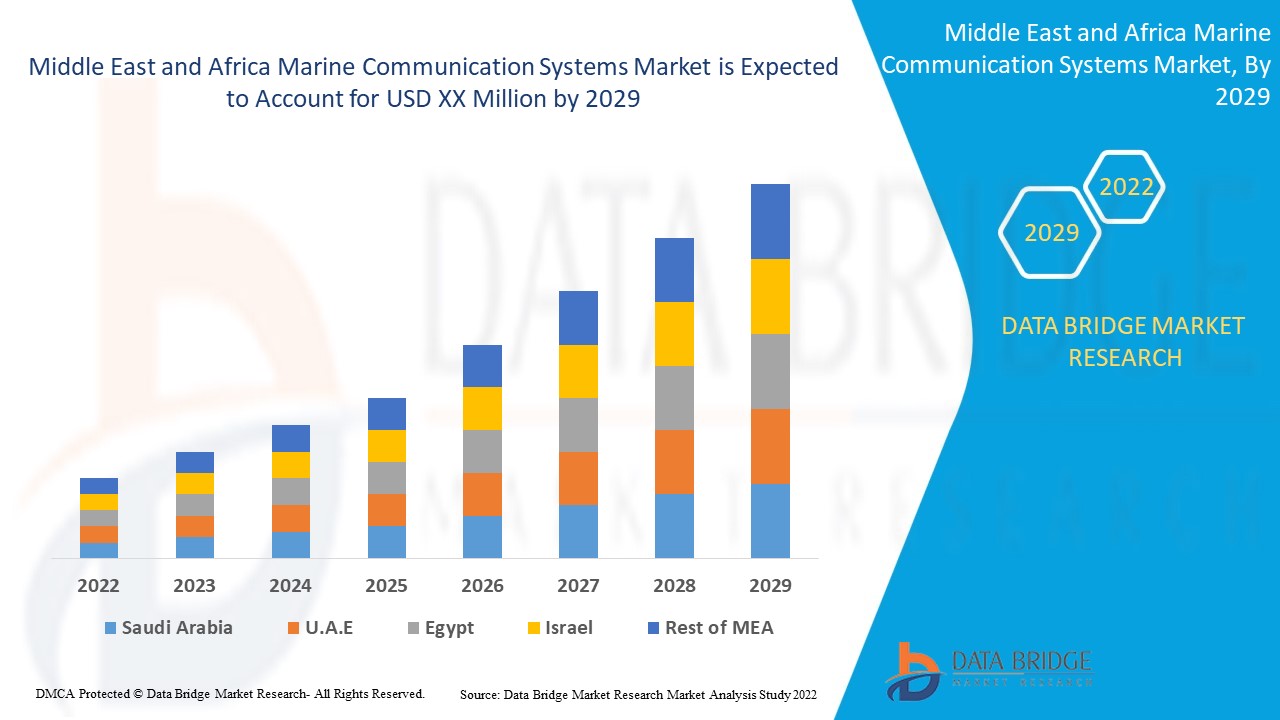

The marine communication systems market is analysed and market size insights and trends are provided by country, type, product, component, application and communication technology as referenced above.

The countries covered in the marine communication systems market report are Saudi Arabia, U.A.E., Egypt, South Africa, Israel and Rest of Middle East and Africa.

Saudi Arabia dominates the marine communication systems market. The Saudi Arabia Marine communication systems Market is expected to be the fastest-growing in the world. Saudi Arabia has the major trade routes flowing from its territories which makes it an important market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Marine Communication Systems Market Share Analysis

The marine communication systems market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to marine communication systems market.

Some of the major players operating in the marine communication systems market are:

Orbit Communications Systems Ltd., Leonardo S.p.A., Telemar group, Inmarsat Middle East and Africa Limited, Rohde & Schwarz, SAAB, Zenitel Group, Iridium Communications Inc., FURUNO ELECTRIC CO., LTD., Teledyne FLIR LLC, Icom Inc., Jotron., Garmin Ltd., BOCHI CORPORATION, Avatec Marine., NAVICO HOLDING AS, Cobham Satcom, Intellian Technologies, Inc., Hughes Network Systems, LLC, Thuraya Telecommunications Company, Applied Satellite Technology Ltd, Alphatron Marine B.V., NSSL Global , Marlink SAS, Norsat International Inc., Global Technology House, Thales among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 REGULATORY STANDARDS

4.4 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 ADVENT OF TWO-WAY COMMUNICATION USING VDES

5.1.3 EMERGENCE OF 5G AND LTE NETWORKS

5.1.4 SURGE IN DEMAND FOR SATELLITE COMMUNICATION SYSTEMS

5.1.5 INCREASING CONSTRUCTION OF MILITARY/COMMERCIAL VESSELS

5.2 RESTRAINT

5.2.1 OUTDATED MARINE COMMUNICATION SYSTEMS POSE THE THREAT OF HACKING

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR MIDDLE EAST & AFRICA MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING NEED FOR MARINE COMMUNICATION FOR AUTONOMOUS SHIPS

5.3.3 GROWING NEED FOR E-NAVIGATION/ ADVANCED NAVIGATION SYSTEMS

5.3.4 STRATEGIC SOLUTION LAUNCHES PARTNERSHIPS & MERGERS TAKEN BY MAJOR PLAYERS

5.4 CHALLENGES

5.4.1 SATURATION PROBLEMS IN AREAS WITH A HIGH CONCENTRATION OF USERS

5.4.2 FACTORS HINDERING RELIABILITY OF MARINE COMMUNICATION

6 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE

6.1 OVERVIEW

6.2 SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS

6.3 SHIP-TO-SHIP MARINE COMMUNICATION SYSTEMS

7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 MARITIME SAT PHONE & INTERNET DEVICES

7.2.1 INMARSAT

7.2.2 COSPAS-SARSAT SYSTEM

7.2.2.1 LEOSAR

7.2.2.2 MEOSAR

7.2.2.3 GEOSAR

7.2.3 IRIDIUM/HIBLEO 2

7.2.4 MIDDLE EAST & AFRICASTAR

7.2.5 OTHERS

7.3 MARINE RADIO DEVICES

7.3.1 FIXED-MOUNT VHF MARINE RADIOS

7.3.2 HANDHELD MARINE VHF RADIOS

7.3.3 MF/HF RADIOS

7.4 MARINE MULTIFUNCTION DISPLAYS (MFDS)

7.5 VHF DATA EXCHANGE SYSTEM (VDES)

7.6 VESSEL MONITORING SYSTEM (VMS) TERMINALS

7.7 MARINE RADAR

7.8 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

7.8.1 AIS TRANSPONDERS

7.8.2 AIS RECEIVERS

7.9 OTHERS

8 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 SOLUTION

8.2.1 DATA

8.2.2 VOICE

8.2.3 TRACKING AND MONITORING

8.2.4 VIDEO

8.2.5 OTHERS

8.3 SERVICES

8.3.1 INSTALLATION AND INTEGRATION

8.3.2 AFTER-SALES SUPPORT & MAINTENANCE

8.3.3 CONSULTING

9 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 BY TYPE

9.2.1.1 MERCHANT NAVY

9.2.1.2 OIL AND GAS

9.2.1.3 FISHING

9.2.1.4 OTHERS

9.2.2 BY PRODUCT

9.2.2.1 MARITIME SAT PHONE & INTERNET DEVICES

9.2.2.2 MARINE RADIO DEVICES

9.2.2.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.2.2.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.2.2.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.2.2.6 MARINE RADAR

9.2.2.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.2.2.8 OTHERS

9.3 GOVERNMENT/MILITARY

9.3.1 BY PRODUCT

9.3.1.1 MARITIME SAT PHONE & INTERNET DEVICES

9.3.1.2 MARINE RADIO DEVICES

9.3.1.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.3.1.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.3.1.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.3.1.6 MARINE RADAR

9.3.1.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.3.1.8 OTHERS

9.4 RECREATIONAL

9.4.1 BY PRODUCT

9.4.1.1 MARITIME SAT PHONE & INTERNET DEVICES

9.4.1.2 MARINE RADIO DEVICES

9.4.1.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.4.1.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.4.1.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.4.1.6 MARINE RADAR

9.4.1.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.4.1.8 OTHERS

10 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY

10.1 OVERVIEW

10.2 SATELLITE

10.3 WIMAX

10.4 WLAN

10.5 LTE

10.6 IR WI-FI

10.7 OTHERS

11 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST & AFRICA

11.1.1 SAUDI ARABIA

11.1.2 U.A.E.

11.1.3 EGYPT

11.1.4 SOUTH AFRICA

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 INMARSAT MIDDLE EAST & AFRICA LIMITED

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCTS PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 MARLINK SAS

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 LEONARDO S.P.A.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCTS PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SAAB

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCTS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 HUGHES NETWORK SYSTEMS, LLC

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 THALES

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 RODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 FURUNO ELECTRIC CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ROHDE & SCHWARZ

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 GARMIN LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCTS PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 APPLIED SATELLITE TECHNOLOGY LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 ALPHATRON MARINE B.V.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 AVATEC MARINE.

14.12.1 COMPANY SNAPSHOT

14.12.2 SOLUTION PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 BOCHI CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 COBHAM SATCOM

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MIDDLE EAST & AFRICA TECHNOLOGY HOUSE

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 ICOM INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCTS PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 INTELLIAN TECHNOLOGIES, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCTS PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 IRIDIUM COMMUNICATIONS INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCTS PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 JOTRON.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCTS PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 NAVICO HOLDING AS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCTS PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 NORSAT INTERNATIONAL INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 NSSL MIDDLE EAST & AFRICA

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 ORBIT COMMUNICATIONS SYSTEMS LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCTS PORTFOLIO

14.23.4 RECENT DEVELOPMENTS

14.24 TELEDYNE FLIR LLC

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCTS PORTFOLIO

14.24.4 RECENT DEVELOPMENT

14.25 TELEMAR GROUP

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCTS PORTFOLIO

14.25.3 RECENT DEVELOPMENT

14.26 THURAYA TELECOMMUNICATIONS COMPANY

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 ZENITEL GROUP

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCTS PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 VARIOUS MARINE COMMUNICATION SYSTEMS REGULATORY STANDARDS.

TABLE 2 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 3 POSSIBILITY OF ATTACKS ON COMMUNICATION SYSTEMS

TABLE 4 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA SHIP-TO-SHIP MARINE COMMUNICATION SYSTEMS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA MARINE MULTIFUNCTION DISPLAYS (MFDS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA VHF DATA EXCHANGE SYSTEM (VDES) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA VESSEL MONITORING SYSTEM (VMS) TERMINALS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA MARINE RADAR IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEMS (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA SATELLITE IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA WIMAX IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA WLAN IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA LTE IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA IR WI-FI IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA OTHERS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 56 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 58 SAUDI ARABIA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 SAUDI ARABIA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.A.E. MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 EGYPT COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 EGYPT COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 98 EGYPT GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 EGYPT RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 100 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 101 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 SOUTH AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 SOUTH AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SOUTH AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 SOUTH AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 SOUTH AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 116 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 ISRAEL MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 ISRAEL COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 ISRAEL MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 ISRAEL AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 123 ISRAEL SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 ISRAEL COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 131 REST OF MIDDLE EAST AND AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA TO DOMINATING AND THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGICAL TRENDS IN MARINE COMMUNICATION SYSTEMS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET

FIGURE 15 TOP 7 COUNTRIES WITH LARGEST NAVAL FLEET

FIGURE 16 MIDDLE EAST & AFRICA SHIPPING LOSSES BY NUMBER OF VESSELS, 2011-2020

FIGURE 17 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2021

FIGURE 19 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2021

FIGURE 20 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2021

FIGURE 21 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2021

FIGURE 22 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY TYPE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Marine Communication Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Marine Communication Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Marine Communication Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.