Middle East And Africa Mea Sludge Treatment Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

0.23 Billion

USD

0.32 Billion

2024

2032

USD

0.23 Billion

USD

0.32 Billion

2024

2032

| 2025 –2032 | |

| USD 0.23 Billion | |

| USD 0.32 Billion | |

|

|

|

|

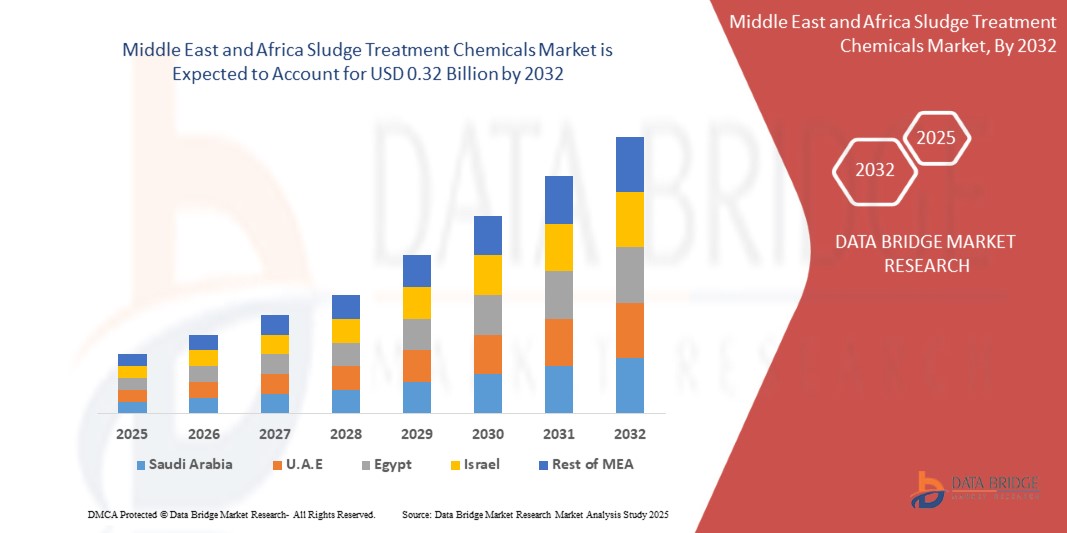

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Size

- The Middle East and Africa (MEA) Sludge Treatment Chemicals Market size was valued at USD 0.23 Billion in 2024 and is expected to reach USD 0.32 Billion by 2032, at a CAGR of 4.4% during the forecast period

- This growth is driven by factors such as rising industrialization, urbanization, stringent environmental regulations, and increased wastewater generation are key drivers for sludge treatment chemicals demand

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Analysis

- Sludge Treatment Chemicals are essential components used to treat and manage sludge generated from industrial and municipal wastewater to meet regulatory standards

- The demand for Sludge Treatment Chemicals is significantly driven by increasing urbanization, growing industrial activities, and stringent environmental regulations on wastewater discharge

- The United Arab Emirates (UAE) dominates the market due to the region's large installed plant capacities of sludge treatment chemicals and its export-based sludge treatment chemicals market

- Saudi Arabia is expected to be the fastest-growing region in the MEA Sludge Treatment Chemicals market during the forecast period due to rising awareness of water sanitation, rapid urban growth, and government initiatives

- Primary Sludge segment is expected to dominate with a market share of 58.7% due to its high solid content and the urgent need for effective initial treatment processes

Report Scope and Middle East and Africa (MEA) Sludge Treatment Chemicals Market Segmentation

|

Attributes |

Middle East and Africa (MEA) Sludge Treatment Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Trends

Sustainable Solutions and Advanced Chemical Blends in Sludge Treatment

- One prominent trend in the MEA Sludge Treatment Chemicals market is the growing demand for sustainable and eco-friendly chemical solutions due to rising environmental awareness and stricter discharge regulations

- Companies are increasingly developing advanced chemical blends—such as biodegradable flocculants and low-toxicity coagulants—that enhance treatment efficiency while minimizing ecological impact

- For instance, plant-based coagulants and green polymers are being adopted as alternatives to conventional inorganic chemicals, especially in regions focused on sustainable water reuse.

- The push for zero-liquid discharge (ZLD) systems and circular economy practices in water management is also driving the adoption of high-performance sludge conditioners and dewatering aids tailored for resource recovery

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Dynamics

Driver

Rising Focus on Wastewater Reuse and Environmental Sustainability

- The increasing need for sustainable water management solutions is significantly contributing to the rising demand for sludge treatment chemicals in the Middle East and Africa

- Water scarcity across the region, coupled with rapid urbanization and industrial growth, has led governments and industries to prioritize wastewater treatment and reuse

- Sludge treatment chemicals such as coagulants, flocculants, and disinfectants are critical in optimizing sludge volume reduction, improving effluent quality, and supporting circular water use

For instance

- According to the International Water Association (2023), over 60% of countries in the MENA region are investing in water reuse initiatives, driving growth in the wastewater treatment chemical sector.

- As a result, the increasing emphasis on environmental compliance and water resource sustainability is expected to propel the demand for advanced sludge treatment chemicals in both municipal and industrial applications

Opportunity

Expansion of Industrial and Municipal Wastewater Projects

- Rapid industrialization and population growth in the Middle East and Africa are fueling demand for new and upgraded wastewater treatment infrastructure

- Governments and private sector players are launching large-scale projects, especially in water-stressed nations, to address wastewater management and reuse challenges

- These initiatives create strong opportunities for sludge treatment chemical providers to supply advanced formulations tailored to diverse sludge compositions

For instance

- In 2024, the UAE announced over USD 2 billion in investments for expanding wastewater treatment capacity under its water security strategy, opening new markets for chemical suppliers.

- As public and private investments in environmental infrastructure rise, the region presents significant untapped potential for innovative sludge treatment solutions

Restraint/Challenge

Volatile Raw Material Costs and Limited Technical Expertise

- The MEA sludge treatment chemicals market is sensitive to fluctuations in the prices of raw materials such as polymers, metal salts, and specialty coagulants, which can impact overall production and procurement costs

- Furthermore, many countries in the region face a shortage of skilled professionals and technical know-how in advanced wastewater treatment, limiting the effective deployment of chemical solutions

- These challenges can delay project implementation, increase dependency on imports, and hinder adoption of innovative treatment methods

For instance

- According to the World Bank (2023), over 40% of wastewater treatment facilities in Sub-Saharan Africa operate below capacity due to technical skill gaps and poor maintenance practices.

- Such cost pressures and operational limitations may restrain market growth, particularly in developing economies with limited infrastructure and funding

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Scope

The market is segmented on the basis of source, source type, processes, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Source Type |

|

|

By Processes |

|

|

By End-User |

|

In 2025, the Primary Sludge is projected to dominate the market with a largest share in source type segment

The primary sludge segment is expected to dominate the Sludge Treatment Chemicals market with the largest share of 58.7% in 2025, due to its crucial role in the initial stages of wastewater treatment. Primary sludge is generated during the physical treatment of wastewater, containing high concentrations of solid waste, making it a key focus for effective chemical treatment solutions that improve dewatering and disposal efficiency.

The Thickening is expected to account for the largest share during the forecast period in processes market

The thickening segment is expected to dominate the Sludge Treatment Chemicals market with the largest share of 49.17% in 2025, driven by the essential role of thickening agents in enhancing the efficiency of solid-liquid separation during the wastewater treatment process.

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Regional Analysis

U.A.E Holds the Largest Share in the Sludge Treatment Chemicals Market

- The U.A.E. holds a significant share of around 36.78% of the Sludge Treatment Chemicals market, driven by the country’s rapid industrialization, urban growth, and stringent environmental regulations on wastewater management

- Dubai and Abu Dhabi account for the largest share due to extensive infrastructure development, including large-scale wastewater treatment facilities, which increases demand for effective sludge treatment chemicals

- The growing emphasis on water reuse and sustainability in the U.A.E., supported by initiatives like the UAE Water Security Strategy 2036, is accelerating the adoption of advanced chemical solutions for sludge management

- Additionally, the presence of key environmental companies and a focus on green technologies are driving market growth, particularly in sludge stabilization and dewatering applications

Saudi Arabia is Projected to Register the Highest CAGR in the Sludge Treatment Chemicals Market

- Saudi Arabia is expected to experience steady growth in the Sludge Treatment Chemicals market, driven by industrialization, rapid urbanization, and government focus on environmental sustainability

- The country is investing heavily in wastewater treatment and recycling infrastructure, particularly in cities like Riyadh and Jeddah, increasing the demand for advanced chemical solutions for sludge management

- Saudi Arabia’s Vision 2030 emphasizes sustainable water management and energy efficiency, further driving the adoption of chemical treatments for sludge stabilization, dewatering, and disposal

- The oil & gas and manufacturing industries in Saudi Arabia are significant contributors to sludge production, boosting the need for efficient and effective sludge treatment chemicals

Middle East and Africa (MEA) Sludge Treatment Chemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SUEZ (France)

- AES Arabia Ltd. (Saudi Arabia)

- BESIX Sanotec (Belgium)

- Huber SE (Germany)

- Tanqia (United Arab Emirates)

- Gulf Eco Friendly Services (United Arab Emirates)

- VEOLIA (France)

- Ramboll Group A/S (Denmark)

- Econet Ltd. (Kenya)

- Bauer Resources GmbH (Germany)

- Arkoil Technologies (Russia)

- Ovivo (Canada)

- WABAG (India)

- Saudi Environmental Works Ltd. (Saudi Arabia)

- Doosan Heavy Industries & Construction (South Korea)

- Parkson Corporation (United States)

- SSI Aeration Inc. (United States)

- NIFAM Engineering Co. (Nigeria)

- Mekorot (Israel)

- Concorde-Corodex Group (United Arab Emirates)

Latest Developments in Middle East and Africa (MEA) Sludge Treatment Chemicals Market

- In 2020, BASF and Solenis have successfully concluded the merger of BASF's wet-end Paper and Water Chemicals business with Solenis. The unified entity, operating under the Solenis name, emerges as a global specialty chemical company with a strategic focus on paper and industrial water technologies

- In 2019, in Europe, Kemira Oyj entered into a collaboration arrangement for water and sludge treatment processes. The goal of this collaboration is to bring together Kemira's great chemistry and intelligent performance optimization knowledge in industrial and municipal water treatment with Valmet's analyzer and measurement technology capabilities, as well as its on-site service network

- In 2019, the acquisition of BASF's wet-end Paper and Water Chemicals division by Solenis was completed. It will be a global specialty chemical corporation concentrated on paper and industrial water solutions

- In 2019, GN Separation has secured substantial orders from African clients for its Disc Centrifuge, designed for efficient chemical separation in both solid and liquid waste. The cost-effective solution ensures continuous production, contributing to increased company revenue and an enhanced market share due to its smooth and reliable operation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Mea Sludge Treatment Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Mea Sludge Treatment Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Mea Sludge Treatment Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.