Middle East And Africa Medical Device Reprocessing Market

Market Size in USD Million

CAGR :

%

USD

147.92 Million

USD

433.94 Million

2025

2033

USD

147.92 Million

USD

433.94 Million

2025

2033

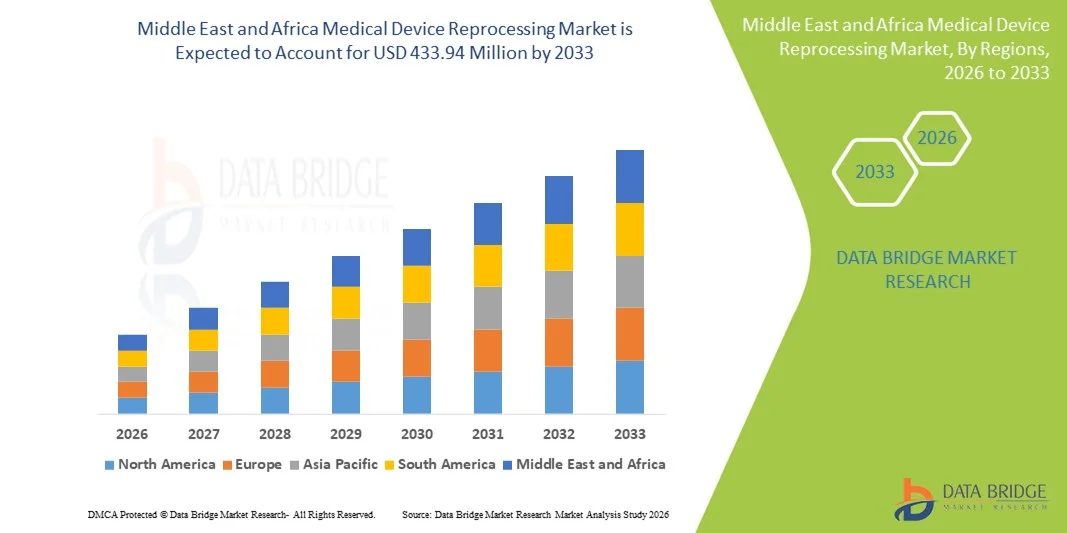

| 2026 –2033 | |

| USD 147.92 Million | |

| USD 433.94 Million | |

|

|

|

|

Middle East and Africa Medical Device Reprocessing Market Size

- The Middle East and Africa medical device reprocessing market size was valued at USD 147.92 million in 2025 and is expected to reach USD 433.94 million by 2033, at a CAGR of 14.4% during the forecast period

- The market growth is largely fueled by increasing healthcare cost pressures, rising concerns over medical waste management, and expanding adoption of reprocessing practices that enable hospitals and surgical centers to reuse selected single‑use devices at lower operational costs while reducing environmental impact

- Furthermore, growing chronic disease burden, rising surgical volumes, and supportive regulatory and waste reduction frameworks across Middle Eastern and African countries are enhancing demand for medical device reprocessing as a cost‑effective and sustainable solution in both public and private healthcare settings

Middle East and Africa Medical Device Reprocessing Market Analysis

- Medical device reprocessing, involving the cleaning, sterilization, testing, and repackaging of single-use or limited-use medical devices, is increasingly becoming a critical practice in hospitals, surgical centers, and diagnostic facilities across the Middle East and Africa due to its potential to reduce healthcare costs and minimize environmental impact

- The growing adoption of medical device reprocessing is primarily driven by rising healthcare expenditure pressures, increasing surgical volumes, and heightened awareness of sustainable medical waste management practices, enabling healthcare facilities to safely reuse devices without compromising patient safety

- Saudi Arabia dominated the market in 2025 with the largest revenue share of 38.5%, fueled by advanced healthcare infrastructure, government-led initiatives promoting cost-efficiency, and early adoption of standardized reprocessing protocols in both public and private hospitals

- South Africa is expected to be the fastest-growing country in the medical device reprocessing market during the forecast period owing to increasing investments in hospital infrastructure, expanding access to surgical care, and rising initiatives to improve healthcare affordability and reduce medical waste

- The Reprocessed medical devices segment dominated the market in 2025 with the largest share of 45.2%, driven by hospitals and diagnostic centers increasingly adopting validated reprocessed devices to reduce costs while maintaining safety and compliance standards

Report Scope and Middle East and Africa Medical Device Reprocessing Market Segmentation

|

Attributes |

Middle East and Africa Medical Device Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Medical Device Reprocessing Market Trends

Advancements Through Automation and Process Standardization

- A significant and accelerating trend in the Middle East and Africa medical device reprocessing market is the increasing adoption of automated cleaning and sterilization systems, alongside standardized protocols, enhancing consistency, efficiency, and safety in reprocessing operations

- For instance, automated washer-disinfectors and sterilizers implemented in hospitals in Saudi Arabia allow simultaneous cleaning and disinfection of multiple instruments, reducing manual errors and labor requirements

- Integration of digital tracking and barcoding systems in reprocessing workflows enables better monitoring of device usage, reprocessing cycles, and maintenance schedules, improving regulatory compliance and operational efficiency

- These advancements facilitate centralized management of surgical and diagnostic devices across hospitals and clinics, allowing staff to track the status of each device in real time and reduce delays in procedure readiness

- This trend towards automation and standardization is reshaping expectations in hospital and clinic operations, prompting service providers to develop process-optimized reprocessing solutions with traceability, compliance, and efficiency as core features

- The demand for automated and standardized reprocessing solutions is growing rapidly across both large hospitals and diagnostic centers, as healthcare providers increasingly prioritize patient safety, regulatory compliance, and operational efficiency

- There is also a growing trend of outsourcing reprocessing services to specialized third-party providers in countries such as Egypt and Kenya, enabling smaller healthcare facilities to access high-quality reprocessing without heavy capital investment

Middle East and Africa Medical Device Reprocessing Market Dynamics

Driver

Rising Need Due to Healthcare Cost Pressures and Surgical Volumes

- The increasing healthcare expenditure pressures and rising surgical volumes in the Middle East and Africa are significant drivers for the adoption of medical device reprocessing

- For instance, in April 2025, a leading hospital in South Africa implemented a full-scale reprocessing program to reduce costs on single-use surgical instruments while maintaining compliance with sterilization standards

- As hospitals and clinics seek to optimize budgets and reduce medical waste, reprocessed devices provide a cost-effective alternative to new single-use items without compromising patient safety

- Furthermore, expanding access to surgical care and diagnostic procedures is creating growing demand for reliable, efficient reprocessing systems in both urban and semi-urban healthcare facilities

- The operational efficiency, resource optimization, and sustainable waste reduction offered by medical device reprocessing are key factors driving adoption in hospitals, diagnostic centers, and ambulatory surgical centers across the region

- Supportive regulatory frameworks and increasing awareness of reprocessing benefits among healthcare administrators further contribute to the market growth across the Middle East and Africa

- For instance, hospitals in Qatar have reported that reprocessing critical devices has reduced annual expenditure on single-use instruments by up to 20%, highlighting tangible financial benefits

- The increasing focus on environmental sustainability and reduction of medical waste in countries such as UAE and Saudi Arabia is also encouraging hospitals to adopt reprocessing practices, aligning with national green healthcare initiatives

Restraint/Challenge

Regulatory Compliance and Infection Control Concerns

- Concerns surrounding regulatory compliance and infection control risks pose a significant challenge to broader adoption of medical device reprocessing in the region

- For instance, inconsistencies in sterilization protocols or insufficient validation of reprocessing cycles in some clinics can lead to infection risks, making administrators cautious about adoption

- Addressing these concerns requires strict adherence to international standards, regular staff training, and investment in validated reprocessing equipment to ensure patient safety and legal compliance

- In addition, initial setup costs for automated and high-standard reprocessing systems can be relatively high, which may limit adoption in smaller clinics or resource-constrained hospitals

- While the long-term cost benefits are recognized, the perceived complexity and capital investment of reprocessing systems can still hinder uptake among healthcare facilities with limited budgets

- Overcoming these challenges through government guidance, training programs, and affordable compliance-ready solutions will be essential for sustained market growth across the Middle East and Africa

- For instance, a survey in Nigeria highlighted that 30% of clinics delayed adoption of reprocessing due to uncertainty over local regulatory enforcement and infection control monitoring

- Challenges in maintaining trained personnel for reprocessing, especially in rural or underserved areas, also limit the consistent implementation of high-quality reprocessing protocols across the region

Middle East and Africa Medical Device Reprocessing Market Scope

The market is segmented on the basis of type, product & service, process, device type, application, and end user.

- By Type

On the basis of type, the market is segmented into enzymatic and non-enzymatic detergents. The enzymatic detergent segment dominated the market in 2025 with the largest revenue share of 41.6%, driven by its effectiveness in removing organic soils such as blood and tissue residues from medical devices. Hospitals and diagnostic centers often prefer enzymatic detergents for critical devices due to their proven compatibility with automated cleaning systems and minimal risk of damaging sensitive instruments. The segment also benefits from increasing awareness of infection control protocols, ensuring high cleaning efficiency and regulatory compliance across healthcare facilities. Enzymatic detergents are widely used in countries such as Saudi Arabia and UAE where advanced reprocessing infrastructure exists, making them the preferred choice in high-volume surgical centers. Moreover, their integration with presoak and automatic cleaning processes enhances workflow efficiency and reduces manual labor. The market for enzymatic detergents continues to grow steadily as healthcare providers focus on patient safety and sterilization reliability.

The non-enzymatic detergent segment is anticipated to witness the fastest growth rate of 15.8% from 2026 to 2033, fueled by its increasing adoption in smaller hospitals, clinics, and home healthcare settings. Non-enzymatic detergents are generally more cost-effective and simpler to use, making them suitable for facilities with limited resources or lower surgical volumes. Their mild formulation reduces the risk of corrosion on reusable instruments, appealing to regions where equipment longevity is prioritized. In addition, awareness campaigns and training programs in countries such as South Africa and Kenya are promoting their safe usage in manual cleaning processes. The flexibility to use non-enzymatic detergents across multiple device types further contributes to their growing popularity.

- By Product & Service

On the basis of product & service, the market is segmented into reprocessing support & services and reprocessed medical devices. The reprocessed medical devices segment dominated the market in 2025 with a share of 45.2%, driven by the high demand from hospitals and diagnostic centers seeking cost-effective alternatives to single-use devices. Reprocessed devices allow healthcare facilities to maintain high-quality standards while reducing procurement costs, particularly for critical and semi-critical devices. The segment also benefits from stringent regulatory guidelines in countries such as Saudi Arabia and UAE, which ensure safety and compliance, encouraging adoption. Hospitals increasingly prefer outsourcing validated reprocessed devices to improve operational efficiency and reduce waste. The growing focus on sustainability and medical waste reduction further accelerates this segment’s demand. In addition, reprocessed medical devices align with initiatives for green healthcare and resource optimization, reinforcing their dominance.

The reprocessing support & services segment is expected to witness the fastest growth at a CAGR of 14.9% from 2026 to 2033, supported by rising outsourcing trends in smaller hospitals, clinics, and ambulatory surgical centers. Countries such as Egypt and Kenya are seeing rapid adoption of third-party reprocessing service providers that offer validated cleaning, sterilization, and monitoring services. The availability of these services reduces the need for hospitals to invest in costly infrastructure and trained personnel while ensuring compliance with sterilization standards. Increasing partnerships between hospitals and specialized service providers further enhance adoption. The convenience, scalability, and risk mitigation offered by reprocessing services are major growth drivers for this segment.

- By Process

On the basis of process, the market is segmented into presoak, manual cleaning, automatic cleaning, and disinfection. The automatic cleaning segment dominated the market in 2025 with a share of 39.7%, driven by its efficiency in processing large volumes of devices while ensuring consistent sterilization quality. Automated washer-disinfectors reduce manual labor, minimize human error, and provide traceability of cleaning cycles, which is critical for regulatory compliance. Hospitals in Saudi Arabia and UAE widely adopt automatic cleaning for critical and semi-critical devices due to its compatibility with enzymatic detergents and digital tracking systems. The segment also benefits from increasing hospital infrastructure investments, where advanced reprocessing workflows are implemented to meet high surgical volumes. Furthermore, automation reduces infection risks and accelerates turnaround time for device availability. The rising focus on standardized, reproducible cleaning processes makes this segment dominant.

The manual cleaning segment is expected to witness the fastest growth at a CAGR of 16.2% from 2026 to 2033, especially in smaller hospitals, clinics, and remote healthcare facilities in countries such as South Africa and Nigeria. Manual cleaning remains essential for devices that cannot be processed automatically or for facilities with limited automation infrastructure. Awareness campaigns and training programs are increasing its adoption in resource-constrained areas. Manual cleaning also allows greater control over delicate instruments and is often the first step before automated processes. The affordability, flexibility, and adaptability of manual cleaning contribute to its accelerated growth in the region.

- By Device Type

On the basis of device type, the market is segmented into critical devices, semi-critical devices, and non-critical devices. The critical devices segment dominated the market in 2025 with the largest share of 47.8%, driven by the high reprocessing requirements for surgical instruments, endoscopes, and other devices that come into contact with sterile body areas. Hospitals prioritize reprocessing critical devices to prevent infections, reduce procurement costs, and maintain compliance with international sterilization standards. Countries such as Saudi Arabia and UAE have advanced protocols ensuring safe and validated reprocessing of critical devices. The segment also benefits from the growing number of surgical procedures and diagnostic interventions requiring high-quality sterilized instruments. Increasing awareness of patient safety and hospital accreditation standards reinforces this segment’s dominance.

The non-critical devices segment is expected to witness the fastest growth at a CAGR of 15.5% from 2026 to 2033, driven by rising adoption in clinics, home healthcare, and diagnostic centers in countries such as Egypt, Kenya, and South Africa. Non-critical devices, which contact intact skin, can be reprocessed more easily and with lower costs. Healthcare facilities are increasingly implementing standardized reprocessing protocols for these devices to minimize infection risks and reduce waste. The segment’s growth is supported by cost-conscious healthcare administrators and government initiatives promoting sustainable practices.

- By Application

On the basis of application, the market is segmented into devices and accessories. The devices segment dominated the market in 2025 with a share of 51.3%, owing to the high reprocessing demand for surgical and diagnostic equipment. Hospitals and surgical centers prioritize devices over accessories for reprocessing due to their critical role in patient safety and operational efficiency. Countries such as Saudi Arabia and UAE, with high surgical volumes, heavily invest in device reprocessing systems. The availability of automated cleaning systems compatible with multiple device types also drives this segment. In addition, devices are more expensive to replace, making reprocessing economically attractive.

The accessories segment is expected to witness the fastest growth at a CAGR of 14.8% from 2026 to 2033, driven by increased adoption in smaller clinics, diagnostic centers, and home healthcare facilities. Accessories, such as tubing, connectors, and reusable instrument parts, can be reprocessed safely and cost-effectively. Countries such as South Africa and Egypt are witnessing rising demand for accessory reprocessing due to lower capital investment requirements and simpler process protocols. Growing awareness about waste reduction and sustainability further accelerates this segment’s growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, diagnostic centers, manufacturers, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2025 with a share of 54.7%, driven by high surgical volumes, stringent regulatory requirements, and large-scale reprocessing infrastructure. Hospitals in Saudi Arabia and UAE are leading adopters due to advanced sterilization protocols, high patient throughput, and investment in automated reprocessing systems. The dominance is also reinforced by cost-saving initiatives and sustainable waste management policies in large healthcare facilities.

The clinics segment is expected to witness the fastest growth at a CAGR of 16.1% from 2026 to 2033, fueled by increasing awareness of infection control, growing adoption of small-scale reprocessing systems, and government initiatives to support cost-effective healthcare in countries such as South Africa, Kenya, and Egypt. Smaller clinics are investing in compact automated washers and validated manual cleaning processes to maintain patient safety while controlling operational costs. Growing training programs and service outsourcing are also boosting adoption in this segment.

Middle East and Africa Medical Device Reprocessing Market Regional Analysis

- Saudi Arabia dominated the market in 2025 with the largest revenue share of 38.5%, fueled by advanced healthcare infrastructure, government-led initiatives promoting cost-efficiency, and early adoption of standardized reprocessing protocols in both public and private hospitals

- Healthcare facilities in the country highly prioritize patient safety, regulatory compliance, and operational efficiency, adopting automated and standardized reprocessing systems for critical and semi-critical devices to ensure high-quality sterilization and traceability

- This widespread adoption is further supported by strong investments in hospital infrastructure, a technologically skilled workforce, and growing awareness of sustainable medical waste management, establishing medical device reprocessing as a standard practice in both public and private healthcare institutions

The Saudi Arabia Medical Device Reprocessing Market Insight

The Saudi Arabia medical device reprocessing market captured the largest revenue share of 38.5% in 2025, driven by the country’s advanced healthcare infrastructure, high surgical volumes, and strong government initiatives promoting cost-efficient and sustainable reprocessing practices. Hospitals and diagnostic centers are increasingly adopting automated cleaning and sterilization systems, alongside digital tracking and barcoding for compliance and efficiency. The growing focus on patient safety, infection control, and regulatory adherence is further encouraging adoption. Moreover, the presence of multinational suppliers and service providers offering validated reprocessed medical devices enhances market penetration. The market expansion is also supported by training programs for healthcare personnel and integration of reprocessing systems into large-scale hospital workflows.

UAE Medical Device Reprocessing Market Insight

The UAE medical device reprocessing market is anticipated to grow at a significant CAGR during the forecast period, driven by government-led initiatives for sustainable healthcare, rising surgical procedures, and the expansion of private healthcare facilities. Clinics and hospitals are increasingly implementing automated and standardized reprocessing systems to improve efficiency, reduce device turnaround times, and maintain compliance with international sterilization standards. The country’s well-developed healthcare infrastructure and high awareness of infection control protocols further support market growth. In addition, public-private partnerships and adoption of outsourcing models for reprocessing services are enabling smaller facilities to access high-quality solutions.

South Africa Medical Device Reprocessing Market Insight

The South Africa market is experiencing rapid growth due to increasing healthcare expenditure, rising surgical volumes, and expanding private hospital networks adopting validated reprocessing workflows. Hospitals are focusing on reducing costs associated with single-use devices while ensuring compliance with strict sterilization standards. The market is further supported by increasing awareness of environmental sustainability and medical waste reduction practices. The adoption of both automated and manual reprocessing systems across urban and semi-urban healthcare facilities is accelerating growth. Government incentives and training programs also encourage smaller clinics to adopt standardized reprocessing practices.

Egypt Medical Device Reprocessing Market Insight

The Egypt medical device reprocessing market is expected to expand at a considerable CAGR during the forecast period, fueled by growing investments in hospital infrastructure, increasing surgical procedures, and rising adoption of automated sterilization systems. Clinics and ambulatory surgical centers are gradually embracing reprocessed medical devices and support services to optimize costs and improve operational efficiency. Awareness campaigns on infection control and compliance with regulatory guidelines are further driving adoption. In addition, partnerships with third-party reprocessing service providers are enabling smaller healthcare facilities to implement safe and standardized practices.

Middle East and Africa Medical Device Reprocessing Market Share

The Middle East and Africa Medical Device Reprocessing industry is primarily led by well-established companies, including:

- STERIS (U.S.)

- Stryker (U.S.)

- Medline Industries, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Arjo Group (Sweden)

- Getinge AB (Sweden)

- NEScientific, Inc. (U.S.)

- Innovative Health, Inc. (U.S.)

- Medisafe International (U.K.)

- Vanguard AG (Germany)

- SteriPro Canada, Inc. (Canada)

- HYGIA Health Services, Inc. (U.S.)

- SureTek Medical (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- B. Braun SE (Germany)

- Smith & Nephew plc (U.K.)

- Teleflex Incorporated (U.S.)

- 3M (U.S.)

- Afri Medical (Egypt)

What are the Recent Developments in Middle East and Africa Medical Device Reprocessing Market?

- In August 2025, the South African Health Products Regulatory Authority (SAHPRA) published an updated communication outlining its official position on the reprocessing of single‑use medical devices to industry stakeholders, clarifying regulatory expectations and compliance requirements for reprocessing practices in South Africa’s regulated healthcare market. This guidance helps hospitals and reprocessing service providers understand how single‑use devices may be handled, supporting safer device reuse frameworks

- In July 2025, Egypt’s Minister of Health and Population and the UNDP discussed expanded cooperation on medical waste management and human development, reinforcing joint efforts to upgrade healthcare waste infrastructure and improve handling systems a foundation for medical device reprocessing protocols. This underscores government prioritization of medical waste systems that support safe reprocessing frameworks

- In January 2025, SGS received approval to extend the scope of its EU Medical Device Regulation (MDR) sterilization services in the UAE, enabling the company to assess additional sterilization processes and enhance medical device sterilization service offerings for healthcare providers in the region. This development supports broader reprocessing activities by improving sterilization capabilities essential for safe reuse of medical devices

- In December 2024, Egypt’s Ministry of Health and Population and the United Nations Development Programme (UNDP) signed an agreement to build a state‑of‑the‑art hazardous medical waste treatment facility in the Suez Governorate, aimed at strengthening medical waste infrastructure and safer handling of hazardous healthcare materials

- In September 2023, Egypt adopted Ethylene Oxide (EtO) sterilization technology to improve the sterilization of medical devices, particularly for heat‑sensitive instruments, enhancing safety and treatment outcomes across healthcare facilities. EtO sterilization is widely recognized for its effectiveness in ensuring sterility for complex and delicate medical products, supporting safer reuse protocols and strengthening the overall medical device handling and reprocessing environment in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.