Middle East And Africa Menstrual Cramps Treatment Market

Market Size in USD Million

CAGR :

%

USD

341.51 Million

USD

720.96 Million

2024

2032

USD

341.51 Million

USD

720.96 Million

2024

2032

| 2025 –2032 | |

| USD 341.51 Million | |

| USD 720.96 Million | |

|

|

|

|

Middle East and Africa Menstrual Cramps Treatment Market Size

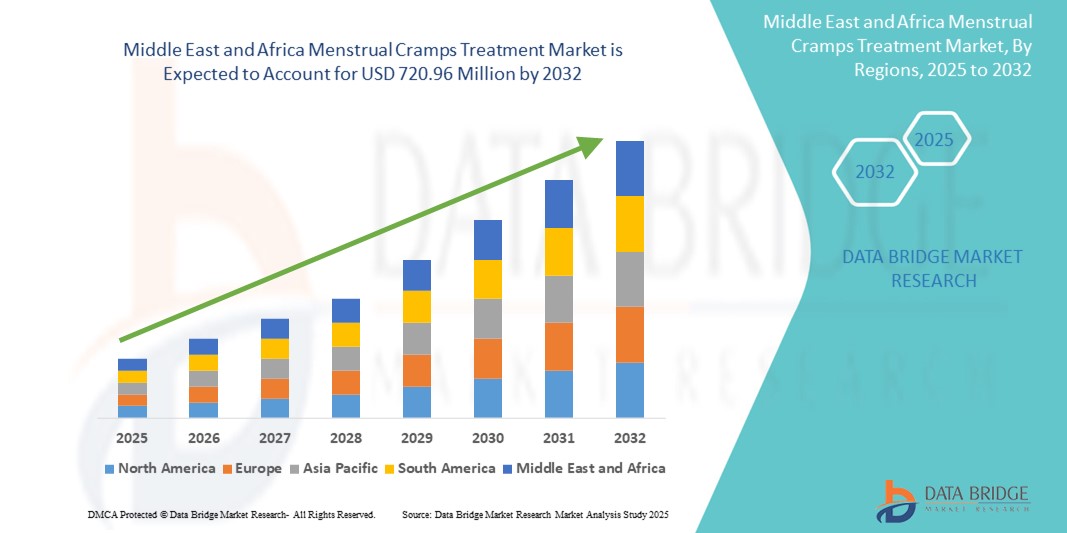

- The Middle East and Africa Menstrual Cramps Treatment Market size was valued at USD 341.51 million in 2024 and is expected to reach USD 720.96 Million by 2032, at a CAGR of 9.79% during the forecast period.

- The market growth is largely driven by the increasing prevalence of menstrual health diseases such as menstrual cramps, rising awareness about menstrual health, and increasing disposable income and healthcare spending in the region. The growing female population, coupled with government initiatives and educational campaigns focusing on women's health, are key factors contributing to the market's expansion.

- Furthermore, advancements in treatment options, including pharmacological and non-pharmacological approaches, the increasing adoption of telemedicine and e-pharmacies for accessibility, and the rapid expansion of healthcare infrastructure across Middle East and Africa countries like Saudi Arabia and South Africa, are fueling the adoption of menstrual cramps treatments. These converging factors are accelerating the uptake of various treatment modalities, thereby significantly boosting the growth of the Middle East and Africa menstrual cramps treatment market.

Middle East and Africa Menstrual Cramps Treatment Market Analysis

- Menstrual cramps, also known as dysmenorrhea, are a common gynecological condition affecting a significant portion of women in the Middle East and Africa region. Treatment options range from over-the-counter pain relievers and hormonal therapies to lifestyle modifications and alternative treatments. The increasing awareness about menstrual health and the availability of various treatment modalities are key drivers for this market.

- The growing demand for menstrual cramps treatment is primarily fueled by the rising prevalence of dysmenorrhea, increasing awareness about menstrual health, and the growing need for effective pain management solutions. Its ability to provide relief with minimal side effects is driving preference among individuals and healthcare providers.

- Middle East and Africa currently holds a significant share in the menstrual cramps treatment market, attributed to a growing female population, increasing disposable income, and rising awareness of menstrual health. Saudi Arabia leads the region’s growth, driven by increasing healthcare expenditure, rising adoption of self-care practices, and a growing market presence of pharmaceutical manufacturers.

- South Africa is expected to be a fast-growing country in the Middle East and Africa menstrual cramps treatment market during the forecast period, due to improving access to healthcare, growing awareness of women's health issues, and increased investment in research and development of novel treatments. Rising demand for natural and alternative therapies are further accelerating regional growth.

- The "Medication" treatment type segment is expected to dominate the market with a substantial share of 58% in 2025, driven by its widespread usage in managing menstrual pain, especially over-the-counter and prescription analgesics. This treatment offers rapid relief and is often the first line of defense, making it the most frequently chosen option for various severities of menstrual cramps.[AD1]

Report Scope and Middle East and Africa Menstrual Cramps Treatment Segmentation

|

Attributes |

Middle East and Africa Menstrual Cramps Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

· Pfizer Inc. · Johnson & Johnson · Bayer AG · Novartis AG · Sanofi S.A. · AbbVie Inc. · Teva Pharmaceutical Industries Ltd. · GlaxoSmithKline plc (GSK) · Merck & Co., Inc. · Organon · Acino |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Menstrual Cramps Treatment Market Trends

"Growing Adoption of Non-Invasive and Home-Based Treatments"

- A significant and rapidly growing trend in the Asia-Pacific menstrual cramps treatment market is the increased use of non-invasive and home-based solutions, owing to their convenience, cost-effectiveness, and growing preference for self-care among women.

- For instance, heat therapy products like heating pads and patches are increasingly preferred for complex conditions such as chronic dysmenorrhea and endometriosis-related pain, where continuous relief and comfort are required. Their ability to provide effective relief even in daily activities gives them a clinical advantage, especially for working women and students.

- Moreover, consumers are favoring herbal remedies and dietary supplements over traditional analgesics, particularly in East and Southeast Asia, due to a growing body of research supporting their natural origin and fewer side effects. This is especially important in high-volume urban settings and for individuals seeking holistic wellness.

- In adolescent and adult populations, wearable devices offering transcutaneous electrical nerve stimulation (TENS) are being adopted to provide age-appropriate pain relief, minimizing discomfort while ensuring daily functionality. Manufacturers are responding with discreet designs, rechargeable batteries, and smartphone connectivity, catering to the expanding base of age-diverse patients.

- The trend is also driven by technological advancements in self-care products, such as smart menstrual cups with temperature sensing and pain-relieving patches with extended release, which enhance the efficacy and user comfort when managing menstrual cramps.

Middle East and Africa Menstrual Cramps Treatment Market Dynamics

Driver

"Rising Prevalence of Menstrual Disorders and Increasing Health Awareness"

- The surge in menstrual disorders across Middle East and Africa, including dysmenorrhea, endometriosis, and PCOS, is a major driver of demand for menstrual cramps treatments. With rising awareness of women's health and increasing access to healthcare services, the need for safe, efficient, and readily available pain management solutions is higher than ever.

- According to various regional health surveys and organizations, a significant portion of the female population suffers from menstrual pain, further reinforcing the need for effective treatments during routine and advanced health interventions.

- Treatments that offer a quick onset of pain relief, effective symptom management, and minimal side effects make them a preferred choice for women globally. These attributes reduce discomfort, enable faster return to daily activities, and improve overall quality of life.

- Furthermore, the growth of wellness tourism and a focus on preventive healthcare, especially in regions like the UAE and South Africa, is fueling demand for holistic and natural remedies for menstrual cramps, which offer overall well-being and long-term benefits.

Restraint/Challenge

"Cultural Stigma and Limited Access to Specialized Care in Rural Areas"

- Despite its growing demand, the market faces challenges due to cultural stigma surrounding menstruation across various societies, which affects open discussions about pain and seeking appropriate treatment. In some developing regions, menstrual cramps are either dismissed as normal or not addressed dueed to limited access to specialized gynecological care or lack of awareness about available solutions.

- Additionally, limited awareness among women in emerging economies regarding the comparative benefits of different treatment options, like hormonal therapies over traditional remedies, hinders broader adoption. Women may stick to traditional agents due to familiarity, cost sensitivity, or lack of access to advanced medical advice.

- Supply chain disruptions, cost-related challenges, and absence of reimbursement policies for newer treatment formulations in public healthcare systems also restrict penetration in price-sensitive markets.

- To overcome these challenges, key players are focusing on educational programs, expanding regional distribution partnerships, and offering cost-effective generic alternatives to improve accessibility. Regulatory harmonization and localized clinical trials will be essential for expanding the market footprint of menstrual cramps treatments in untapped regions.

Middle East and Africa Menstrual Cramps Treatment Market Scope

The market is segmented on the basis of type, treatment type, age group, end-users, and distribution channel.

- By Type

On the basis of type, the Middle East and Africa menstrual cramps treatment market is segmented into primary dysmenorrhea and secondary dysmenorrhea. The primary dysmenorrhea segment dominates the market with the largest revenue share of 65.2% in 2024, due to its widespread occurrence among adolescent and young adult women as a common physiological condition. Its prevalence makes it a primary focus for treatment, offering readily available and effective solutions for common discomfort.

The secondary dysmenorrhea segment is anticipated to witness the fastest CAGR from 2024 to 2032, driven by rising demand for diagnosis and treatment of underlying conditions such as endometriosis and fibroids that cause more severe and chronic pain. The growing popularity of specialized clinics and advanced diagnostic tools is also contributing to the increased focus on secondary dysmenorrhea, particularly in urban hospitals and advanced healthcare centers.

- By Treatment Type

On the basis of treatment type, the market is segmented into medication, heat therapy, lifestyle changes, and alternative therapies. The medication segment is expected to dominate the market with the largest revenue share,holding 48.9% in 2024, driven by the frequent use of over-the-counter pain relievers and prescription hormonal therapies for effective and rapid symptom relief. It is commonly used as a first-line treatment for everyday pain, balancing effectiveness with convenience.

The alternative therapies segment is projected to witness the fastest growth during the forecast period, as demand rises for natural, holistic, and non-pharmacological approaches to pain management. Its focus on overall well-being and minimal side effects is particularly beneficial for long-term management and those seeking complementary solutions.

- By Age Group

On the basis of age group, the market is segmented into adolescents and adults. The adult segment holds the largest market share of 70.5% in 2024, due to the high number of women experiencing menstrual cramps throughout their reproductive years, including those with underlying gynecological conditions.

The adolescent segment is expected to witness the fastest CAGR from 2024 to 2032, owing to increasing focus on adolescent health, growing awareness among young girls and their parents, and the availability of age-appropriate solutions for managing menstrual pain.

- By End Users

On the basis of end users, the market is segmented into hospitals, clinics, and homecare settings. The homecare settings segment accounted for the largest revenue share of 42.1% in 2024, attributed to the sheer volume of self-managed cases of menstrual cramps using readily available products and remedies. Home-based solutions are favored for their convenience, privacy, and cost-effectiveness for routine pain management.

The hospitals segment is projected to register the fastest CAGR, driven by the increasing number of women seeking diagnosis and treatment for severe or complex menstrual disorders and the use of specialized interventions for conditions like endometriosis and PCOS.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into retail pharmacies, hospital pharmacies, online pharmacies, and others. The retail pharmacies segment dominates the market with an estimate of 55.8% in 2024, due to widespread accessibility of over-the-counter pain relievers and common menstrual hygiene products, making them a primary point of purchase for consumers.

The online pharmacy segment is expected to experience the fastest growth rate during the forecast period, fueled by the digital transformation in pharmaceutical retail, increased patient preference for doorstep delivery, and the convenience of ordering menstrual pain relief products online with discretion.

Middle East and Africa Menstrual Cramps Treatment Market Regional Analysis

- Middle East and Africa dominates the menstrual cramps treatment market with a significant revenue share of 38.5% in 2024, driven by the increasing prevalence of dysmenorrhea, growing awareness about women's health, and expanding healthcare infrastructure in the region.

- Consumers and patients in the region highly value effective pain management, especially for common menstrual discomfort. The adoption of various treatments is supported by improving access to healthcare, a growing network of pharmacies and clinics, and increasing acceptance of modern as well as traditional remedies.

- This widespread usage is further bolstered by favorable government initiatives, increasing investments in women's health and wellness, and a growing preference for both pharmacological and non-pharmacological solutions. These factors collectively reinforce Middle East and Africa's leadership in the menstrual cramps’ treatment market across both homecare and clinical settings.

Saudi Arabia Menstrual Cramps Treatment Market Insight

The Saudi Arabia menstrual cramps treatment market captured a significant revenue share of 25.3% within the Middle East and Africa in 2024, owing to rapid urbanization, increasing disposable income, and high awareness of women's health. Treatment options are becoming more popular in Saudi Arabian healthcare settings due to their effectiveness in managing both basic and severe menstrual pain. With a growing middle-class population and expansion of private healthcare providers, demand for quality treatment solutions is on the rise. Additionally, local production capabilities and the government’s push for healthcare modernization are contributing to broader availability and cost-effectiveness of menstrual cramps treatment products.

South Africa Menstrual Cramps Treatment Market Insight

The South Africa menstrual cramps treatment market is gaining traction, supported by the country’s improving healthcare access and rising demand for effective pain management. South Africa's healthcare providers are increasingly adopting various therapies for their rapid relief and improved patient comfort outcomes. The strengthening regulatory environment, combined with technological innovations in digital health and wearable devices, is encouraging the use of high-efficacy and convenient treatments. Moreover, the cultural preference for modern healthcare and safety in healthcare makes a wide range of treatment options favorable among South African women.

UAE Menstrual Cramps Treatment Market Insight

The UAE menstrual cramps treatment market is projected to grow at a substantial CAGR of 12.5%, as the country serves as a major hub for healthcare development and a growing patient population in the Middle East. The UAE’s growing awareness of menstrual health is supported by public health campaigns and increasing access to advanced primary healthcare. The increasing demand for accessible and affordable pain relief, along with a growing female population requiring various menstrual health solutions, continues to fuel the need for effective treatments. Furthermore, the country’s emphasis on telemedicine and digital health platforms ensures sustained market expansion.

Middle East and Africa Menstrual Cramps Treatment Market Share

The Middle East and Africa Menstrual Cramps Treatment industry is primarily led by well-established companies, including:

- Pfizer Inc.

- Johnson & Johnson

- Bayer AG

- Novartis AG

- Sanofi S.A.

- AbbVie Inc.

- Teva Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc (GSK)

- Merck & Co., Inc.

- Organon

- Acino

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PIPELINE ANALYSIS

4.1 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, PIPELINE ANALYSIS

5 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: REGULATIONS

6 PREMIUM INSIGHTS

6.1 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: ADOPTION RATE

6.1.1 DRIVERS AND BARRIERS FOR THE ADOPTIONS

6.2 MARKETING EXPENSES

6.3 PAYERS:

6.4 PHARMACIES COLD/HOT PADS MARKET SHARE:

7 EPIDEMIOLOGY

8 COVID-19 IMPACT ON MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC INITIATIVES BY MARKET PLAYERS DURING COVID-19

8.5 CONCLUSION

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 GROWING PREVALENCE OF DYSMENORRHEA

9.1.2 RISING TECHNOLOGICAL ADVANCEMENTS

9.1.3 INCREASING RESEARCH AND DEVELOPMENT FOR DEVELOPING INNOVATIVE DRUGS AND THERAPIES

9.1.4 GOVERNMENT INITIATIVES WITH RESPECT TO WOMEN HEALTHCARE

9.1.5 INCREASING NUMBER OF TREATMENT OPTIONS

9.2 RESTRAINTS

9.2.1 PRODUCT RECALLS

9.2.2 LACK OF AWARENESS ABOUT REPRODUCTIVE HEALTH IN WOMEN

9.2.3 HIGH COST OF ENDOMETRIAL ABLATION AND HYSTERECTOMY

9.3 OPPORTUNITIES

9.3.1 RISE IN AWARENESS ABOUT DYSMENORRHEA

9.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

9.3.3 RISING DISPOSABLE INCOME

9.4 CHALLENGES

9.4.1 TRADITIONAL FAMILY VALUE LEADING TO NO TREATMENT

9.4.2 SIDE EFFECTS AND COMPLICATIONS ASSOCIATED WITH LONG TERM TREATMENT

9.4.3 EFFECTIVENESS OF COMPLEMENTARY AND ALTERNATIVE THERAPIES

10 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE

10.1 OVERVIEW

10.2 PRIMARY DYSMENORRHEA

10.3 SECONDARY DYSMENORRHEA

11 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE

11.1 OVERVIEW

11.2 MEDICATION

11.2.1 FIRST LINE TREATMENT

11.2.1.1 Nonhormonal Therapy

11.2.1.1.1 Nonsteroidal Anti-Inflammatory Drugs

11.2.1.1.1.1 Ibuprofen

11.2.1.1.1.2 Naproxen

11.2.1.1.1.3 Celecoxib

11.2.1.1.1.4 Mefenamic Acid

11.2.1.1.1.5 Meclofenamate

11.2.1.1.2 Acetaminophen

11.2.1.2 Hormonal Replacement Therapy y

11.2.1.2.1 Combined Oral Contraceptives (Monophasic or Multiphasic)

11.2.1.2.1.1 Norethindrone/Ethinyl Estradiol

11.2.1.2.1.2 Extended-Cycle Oral Contraceptives

11.2.1.2.2 Extended-Cycle Oral Contraceptives

11.2.1.2.2.1 Levonorgestrel/Ethinyl Estradiol

11.2.1.2.2.2 Others

11.2.1.2.3 Other

11.2.1.2.3.1 Etonogestrel/Ethinyl Estradiol

11.2.1.2.3.2 Etonogestrel Implant

11.2.1.2.3.3 Levonorgestrel-Releasing Intrauterine System

11.2.1.2.3.4 Medroxyprogesterone Shot

11.2.1.3 Diuretic

11.2.1.3.1 Spironolactone

11.2.1.3.2 Ammonium Chloride

11.2.1.4 Antidepressants

11.2.2 SECOND LINE TREATMENT

11.2.2.1 Empiric GNRH Analogue or Antagonist Therapy

11.2.2.2 Ammonium Chloride

11.3 THERAPY

11.3.1 HEAT THERAPY

11.3.1.1 Patch

11.3.1.2 Wrap

11.3.1.3 Ceramic Belt Emitting Far-Infrared Radiation (FIR)

11.3.2 BEHAVIORAL COUNSELING

11.3.2.1 Desensitization-Based Procedures

11.3.2.2 Coping Strategies

11.3.2.3 Imagery

11.3.2.4 Hypnotherapy

11.3.2.5 Others

11.3.3 DIET AND VITAMINS

11.3.3.1 Vitamin E

11.3.3.2 Vitamin B

11.3.3.3 Vitamin D

11.3.3.4 Others

11.4 SURGERY

11.4.1 ENDOMETRIAL ABLATION

11.4.2 HYSTERECTOMY

11.5 OTHERS

12 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION

12.1 OVERVIEW

12.2 OVER THE COUNTER

12.3 PRESCRIPTION

13 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 ORAL

13.2.1 TABLETS

13.2.2 PILLS

13.2.3 CAPSULE

13.2.4 OTHERS

13.3 PARENTERAL

13.3.1 INTRAVENOUS

13.3.2 SUBCUTANEOUS

13.3.3 OTHERS

13.4 IMPLANTS

13.5 OTHERS

14 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 SPECIALTY CENTERS

14.4 AMBULATORY SURGICAL CENTERS

14.5 OTHERS

15 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 PHARMACIES

15.2.1 HOSPITAL

15.2.2 RETAIL

15.3 DIRECT TENDER

15.4 RETAIL SALES

15.5 OTHERS

16 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY GEOGRAPHY

16.1 MIDDLE EAST & AFRICA

16.1.1 SAUDI ARABIA

16.1.2 SOUTH AFRICA

16.1.3 UAE

16.1.4 ISRAEL

16.1.5 KUWAIT

16.1.6 EGYPT

16.1.7 REST OF MIDDLE EAST & AFRICA

17 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GLAXOSMITHKLINE PLC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 JANSSEN PHARMACEUTICALS, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 TEVA PHARMACEUTICALS USA, INC. (A SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANLYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 ABBVIE INC.

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MYLAN N. V. (A PART OF VIATRIS INC.).

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ALVOGEN

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 BAYER AG

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 BEURER GMBH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 BIOELECTRONICS CORPORATION

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 COLOR SEVEN CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 CUMBERLAND PHARMACEUTICALS INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 LIVIA

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 LUPIN PHARMACEUTICALS, INC. (A SUBSIDIARY OF LUPIN)

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 MYOVANT SCIENCES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 NOBELPHARMA CO., LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 OBSEVA

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 PFIZER INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 PMS4PMS, LLC

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

19.2 SANOFI

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENT

19.21 SUN PHARMACEUTICAL INDUSTRIES LTD.

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 MARKETING EXPENSES OF THE MARKET PLAYERS

TABLE 2 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA PRIMARY DYSMENORRHEA IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SECONDARY DYSMENORRHEA IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 7 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 8 MIDDLE EAST & AFRICA MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OVER THE COUNTER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA PRESCRIPTION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA IMPLANTS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2020-2028 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA HOSPITALS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SPECIALTY CENTERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA OTHERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIRECT TENDER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA RETAIL SALES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA OTHERS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 52 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 53 MIDDLE EAST & AFRICA MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 75 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 77 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 78 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 79 SAUDI ARABIA MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 80 SAUDI ARABIA FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 81 SAUDI ARABIA NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 82 SAUDI ARABIA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 83 SAUDI ARABIA HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 84 SAUDI ARABIA COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 85 SAUDI ARABIA EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 86 SAUDI ARABIA OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 87 SAUDI ARABIA DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 88 SAUDI ARABIA SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 89 SAUDI ARABIA THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 90 SAUDI ARABIA HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 91 SAUDI ARABIA BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 92 SAUDI ARABIA DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 93 SAUDI ARABIA SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 94 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 95 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 96 SAUDI ARABIA ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 97 SAUDI ARABIA PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 98 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 99 SAUDI ARABIA MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 100 SAUDI ARABIA PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 101 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 102 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 103 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 104 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 105 SOUTH AFRICA MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 106 SOUTH AFRICA FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 107 SOUTH AFRICA NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 108 SOUTH AFRICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 109 SOUTH AFRICA HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 110 SOUTH AFRICA COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 111 SOUTH AFRICA EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 112 SOUTH AFRICA OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 113 SOUTH AFRICA DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 114 SOUTH AFRICA SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 115 SOUTH AFRICA THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 116 SOUTH AFRICA HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 117 SOUTH AFRICA BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 118 SOUTH AFRICA DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 119 SOUTH AFRICA SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 120 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 121 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 122 SOUTH AFRICA ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 123 SOUTH AFRICA PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 124 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 125 SOUTH AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 126 SOUTH AFRICA PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 127 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 129 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 130 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 131 UAE MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 132 UAE FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 133 UAE NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 134 UAE NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 135 UAE HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 136 UAE COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 137 UAE EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 138 UAE OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 139 UAE DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 140 UAE SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 141 UAE THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 142 UAE HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 143 UAE BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 144 UAE DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 145 UAE SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 146 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 147 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 148 UAE ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 149 UAE PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 150 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 151 UAE MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 152 UAE PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 153 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 154 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 155 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 156 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 157 ISRAEL MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 158 ISRAEL FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 159 ISRAEL NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 160 ISRAEL NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 161 ISRAEL HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 162 ISRAEL COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 163 ISRAEL EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 164 ISRAEL OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 165 ISRAEL DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 166 ISRAEL SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 167 ISRAEL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 168 ISRAEL HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 169 ISRAEL BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 170 ISRAEL DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 171 ISRAEL SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 172 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 173 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 174 ISRAEL ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 175 ISRAEL PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 176 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 177 ISRAEL MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 178 ISRAEL PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 179 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 180 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 181 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 182 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 183 KUWAIT MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 184 KUWAIT FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 185 KUWAIT NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 186 KUWAIT NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 187 KUWAIT HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 188 KUWAIT COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 189 KUWAIT EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 190 KUWAIT OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 191 KUWAIT DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 192 KUWAIT SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 193 KUWAIT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 194 KUWAIT HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 195 KUWAIT BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 196 KUWAIT DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 197 KUWAIT SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 198 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 199 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 200 KUWAIT ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 201 KUWAIT PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 202 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 203 KUWAIT MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 204 KUWAIT PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 205 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 206 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 207 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (UNITS)

TABLE 208 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (ASP)

TABLE 209 EGYPT MEDICATION IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 210 EGYPT FIRST LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 211 EGYPT NONHORMONAL THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 212 EGYPT NONSTEROIDAL ANTI-INFLAMMATORY DRUGS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 213 EGYPT HORMONAL REPLACEMENT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 214 EGYPT COMBINED ORAL CONTRACEPTIVES (MONOPHASIC OR MULTIPHASIC) IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 215 EGYPT EXTENDED-CYCLE ORAL CONTRACEPTIVES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 216 EGYPT OTHER IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 217 EGYPT DIURETIC IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 218 EGYPT SECOND LINE TREATMENT IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 219 EGYPT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 220 EGYPT HEAT THERAPY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 221 EGYPT BEHAVIORAL COUNSELING IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 222 EGYPT DIET AND VITAMINS IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 223 EGYPT SURGERY IN MENSTRUAL CRAMPS TREATMENT MARKET, BY TREATMENT TYPE, 2019-2028 (USD MILLION)

TABLE 224 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 225 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 226 EGYPT ORAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 227 EGYPT PARENTERAL IN MENSTRUAL CRAMPS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2019-2028 (USD MILLION)

TABLE 228 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 229 EGYPT MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 230 EGYPT PHARMACIES IN MENSTRUAL CRAMPS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: SEGMENTATION

FIGURE 10 INCREASING PREVALENCE OF DYSMENORRHEA IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 PRIMARY DYSMENORRHEA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET IN 2021 & 2028

FIGURE 12 PHARMACIES COLD/HOT PADS MARKET SHARE: 2020 (%)

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET

FIGURE 14 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TYPE, 2020

FIGURE 15 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 17 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TREATMENT TYPE, 2020

FIGURE 19 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TREATMENT TYPE, 2020-2028 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2021-2028)

FIGURE 21 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY MODE OF PRESCRIPTION, 2020

FIGURE 23 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY MODE OF PRESCRIPTION 2020-2028 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY MODE OF PRESCRIPTION, CAGR (2021-2028)

FIGURE 25 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY MODE OF PRESCRIPTION, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2020

FIGURE 27 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2020-2028 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2021-2028)

FIGURE 29 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY END USER, 2020

FIGURE 31 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY END USER, CAGR (2021-2028)

FIGURE 33 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 35 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 37 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: SNAPSHOT (2020)

FIGURE 39 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY COUNTRY (2020)

FIGURE 40 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 41 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 42 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: BY TYPE (2021-2028)

FIGURE 43 MIDDLE EAST & AFRICA MENSTRUAL CRAMPS TREATMENT MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.