Middle East And Africa Menstrual Cups Market

Market Size in USD Million

CAGR :

%

USD

20.21 Million

USD

28.52 Million

2024

2032

USD

20.21 Million

USD

28.52 Million

2024

2032

| 2025 –2032 | |

| USD 20.21 Million | |

| USD 28.52 Million | |

|

|

|

|

Middle East and Africa Menstrual Cups Market Size

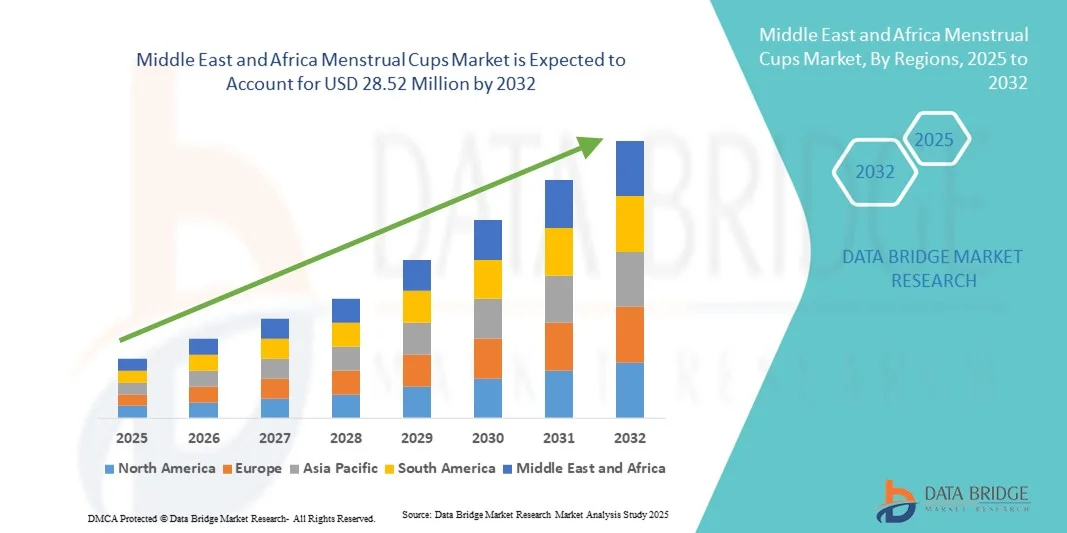

- The Middle East and Africa menstrual cups market size was valued at USD 20.21 million in 2024 and is expected to reach USD 28.52 million by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by the increasing awareness of sustainable feminine hygiene products and the rising adoption of eco-friendly alternatives to disposable sanitary products, driving demand for menstrual cups in both urban and semi-urban regions

- Furthermore, growing consumer preference for cost-effective, safe, and convenient menstrual hygiene solutions is establishing menstrual cups as a popular choice. These converging factors are accelerating the uptake of menstrual cup solutions, thereby significantly boosting the industry's growth

Middle East and Africa Menstrual Cups Market Analysis

- Menstrual cups, offering reusable and non-invasive menstrual hygiene solutions, are increasingly vital components of modern menstrual health practices in both personal and institutional settings due to their sustainability, cost-effectiveness, and convenience

- The escalating demand for menstrual cups is primarily fueled by growing environmental awareness, rising women’s health education, broader product availability through e-commerce and retail channels, and a shift toward reusable sanitary solutions

- Saudi Arabia dominated the Middle East and Africa menstrual cups market with the largest revenue share of 36.5% in 2024, driven by increasing awareness of sustainable feminine hygiene practices, expanding e-commerce penetration, and growing consumer preference for reusable and eco-friendly menstrual products

- UAE is expected to be the fastest-growing country in the Middle East and Africa menstrual cups market during the forecast period, projected to register a CAGR of 11%, fueled by rising focus on women’s health and hygiene, supportive government initiatives, and increasing integration of menstrual cups into daily personal care routines

- The Reusable segment dominated the Middle East and Africa menstrual cups market with a revenue share of 82.5% in 2024. Reusable cups offer long-term cost savings, sustainability, and environmental benefits

Report Scope and Menstrual Cups Market Segmentation

|

Attributes |

Menstrual Cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Menstrual Cups Market Trends

Rising Preference for Sustainable and Eco-Friendly Menstrual Products

- A significant and accelerating trend in the Middle East and Africa menstrual cups market is the growing consumer preference for sustainable, eco-friendly, and reusable menstrual products. Women are increasingly shifting from disposable sanitary products to menstrual cups due to their environmental benefits, cost-effectiveness, and long-term usability

- For instance, in March 2022, OrganiCup launched an awareness campaign across South Africa and the UAE emphasizing the reduction in plastic waste and highlighting menstrual cups as a safe, sustainable alternative to pads and tampons

- Rising awareness regarding health, hygiene, and comfort is also driving adoption. Many consumers are seeking products that are non-toxic, made from medical-grade silicone, and suitable for long-term use without causing irritation

- The convenience of long-lasting products, combined with growing e-commerce availability and educational campaigns, further propels the adoption of menstrual cups. Subscription-based services and online tutorials have made it easier for first-time users to understand proper usage, care, and hygiene practices

- In addition, government and NGO initiatives promoting menstrual health and hygiene in schools and workplaces are raising awareness and normalizing the use of menstrual cups, further supporting this sustainability-driven trend

Middle East and Africa Menstrual Cups Market Dynamics

Driver

Growing Need Due to Rising Awareness, Health Consciousness, and Sustainable Choices

- The rising awareness of menstrual hygiene, health, and sustainability is a primary driver of the Middle East and Africa Menstrual Cups market. Consumers are increasingly seeking eco-friendly alternatives to disposable sanitary products that offer cost savings over time

- For instance, in June 2022, OrganiCup launched an awareness campaign across key markets in the Middle East and North Africa, highlighting the benefits of menstrual cups over traditional products, including reduced environmental impact, improved comfort, and long-term cost-effectiveness

- The convenience of reusable products, combined with the expansion of e-commerce platforms, subscription-based delivery, and educational campaigns, further encourages adoption

- For instance, platforms such as Mooncup Club in the region provide subscription deliveries along with guidance on proper use and hygiene, easing consumer concerns and promoting regular usage

- Government initiatives and NGO programs promoting menstrual hygiene in schools and workplaces are also increasing adoption rates. These programs raise awareness, normalize menstrual cup usage, and provide free or subsidized products to encourage trial and acceptance

- In addition, growing environmental consciousness among younger consumers is leading to preference shifts from disposable products to reusable menstrual cups, supporting sustained market growth

- Innovative product designs, improved materials such as medical-grade silicone, and ergonomic features are also contributing to market expansion by addressing comfort, hygiene, and ease-of-use concerns

Restraint/Challenge

Concerns Regarding Health Safety, Cultural Acceptance, and Affordability

- Concerns regarding health safety, hygiene, and potential discomfort remain significant challenges to market expansion. Misuse, inadequate cleaning, or allergic reactions have occasionally caused consumer hesitation in adopting menstrual cups

- The relatively higher upfront cost of premium menstrual cups compared to traditional disposable products can be a barrier for price-sensitive consumers. For example, surveys conducted in early 2023 across multiple Middle Eastern countries indicated that first-time users often delayed purchases due to cost concerns despite the long-term savings offered by reusable options

- Cultural norms and social taboos surrounding menstruation in certain regions also limit market penetration. Consumers may be reluctant to discuss menstrual hygiene openly, creating barriers for awareness campaigns

- Overcoming these challenges requires educational programs, public awareness campaigns, and accessible pricing strategies. For instance, companies like Intimina have partnered with health organizations to provide workshops and demonstrations on proper usage, hygiene practices, and comfort, helping to build trust and reduce hesitation

- Supply chain challenges, such as distribution to remote areas and limited availability in rural markets, may further restrict growth, requiring targeted strategies to expand reach

- Continuous investment in safe, high-quality materials, ergonomic designs, and hygiene education is essential to overcome concerns and support sustained market adoption

Middle East and Africa Menstrual Cups Market Scope

The market is segmented on the basis of type, material, size, usability, shape, and distribution channel.

- By Type

On the basis of type, the Middle East & Africa menstrual cups market is segmented into vaginal cup and cervical cup. The Vaginal Cup segment dominated the market with the largest revenue share of 66% in 2024. Vaginal cups are widely preferred due to their ease of use, comfort, and suitability for different body types. They offer a flexible design that adapts to various anatomical needs while providing effective menstrual protection. The segment benefits from strong awareness campaigns, educational programs, and growing acceptance in both urban and semi-urban regions. Social media and online platforms have also helped in educating consumers about their advantages. Reusability and long-term cost-effectiveness make them highly attractive. Increased product availability through pharmacies and e-commerce channels further strengthens adoption. The eco-friendly aspect aligns with rising environmental consciousness among consumers. Healthcare providers recommend them for sustainable menstrual hygiene practices. The segment has maintained stability due to repeat purchases and strong consumer trust. Marketing by both startups and established brands continues to fuel demand.

The Cervical Cup segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032. This growth is driven by rising awareness of specialized menstrual products, increasing focus on women’s health, and innovative designs offering higher comfort and capacity. Cervical cups are particularly appealing to experienced users seeking longer wear times and better leakage protection. Emerging regions are witnessing growing adoption as educational campaigns highlight their benefits. Targeted marketing and availability through online channels are expanding reach. Continuous product innovation, including softer materials and ergonomic designs, enhances user experience. Rising disposable incomes in key markets further support affordability. Healthcare endorsements promote usage for optimal menstrual health. Cultural acceptance is gradually increasing in regions where menstrual hygiene awareness is rising. Consumer preference for hygienic, non-invasive solutions is strengthening the segment. E-commerce platforms allow discreet purchasing, encouraging first-time users. Brand collaborations and influencer campaigns amplify product visibility and credibility.

- By Material

On the basis of material, the Middle East & Africa menstrual cups market is segmented into silicone, thermoplastic isomer, rubber, and latex. The Silicone segment dominated with a revenue share of 72% in 2024. Silicone cups are hypoallergenic, flexible, and durable, ensuring safe and comfortable use over extended periods. They are easy to clean and maintain, enhancing user satisfaction. The material is widely accepted for its non-reactive properties and long-term sustainability. Awareness programs and healthcare recommendations strengthen trust in silicone cups. Social influence and positive user reviews drive adoption among first-time and repeat buyers. Silicone’s versatility allows multiple shapes and sizes, catering to diverse preferences. The segment benefits from widespread availability in retail and online channels. Eco-conscious consumers favor silicone due to its reusability and reduced waste. The material’s durability supports repeat use for several years. Leading brands focus on silicone-based innovations to maintain market dominance. High consumer satisfaction ensures consistent demand. Promotional campaigns highlight safety, comfort, and environmental benefits.

The Thermoplastic Isomer segment is expected to witness the fastest CAGR of 11% from 2025 to 2032. This growth is fueled by advancements in softer, skin-friendly materials that enhance comfort and usability. Innovative designs make cups more adaptable to various anatomies. Marketing campaigns emphasize improved hygiene and better user experience. Rising awareness about alternative materials contributes to adoption. New product launches in online and retail channels are expanding consumer choice. Research and development focus on non-toxic, flexible, and durable formulations. The segment appeals to younger consumers and first-time users. E-commerce accessibility allows discreet purchasing, encouraging experimentation. Promotional collaborations with influencers boost visibility. Increasing acceptance in emerging markets is a key driver. Sustainability messaging strengthens consumer trust. Improved affordability compared to premium silicone products also fuels growth.

- By Size

On the basis of size, the Middle East & Africa menstrual cups market is segmented into small and large. The Small segment dominated with a revenue share of 58% in 2024. Small cups are ideal for first-time users, younger women, and individuals with lighter menstrual flow. They are easier to insert, remove, and clean, providing a comfortable experience. The segment benefits from strong educational initiatives and online tutorials that simplify usage. Small cups are widely promoted through e-commerce and retail channels. They are reusable and cost-effective, appealing to eco-conscious consumers. Marketing emphasizes convenience, portability, and discretion. Healthcare professionals recommend smaller sizes for safety and comfort. User reviews and positive feedback reinforce confidence in the product. Social campaigns highlight suitability for active lifestyles and travel. The segment has consistent repeat purchases due to durability. Packaging and design improvements increase aesthetic appeal. Availability across multiple price ranges enhances accessibility.

The Large segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032. Large cups cater to women with heavier menstrual flow, experienced users, and those seeking longer wear times. Rising awareness of menstrual health and hygiene in emerging markets contributes to growth. Product innovation focuses on improved comfort, fit, and leak protection. Marketing targets established users familiar with reusable products. Affordability and accessibility through online stores accelerate adoption. Educational campaigns emphasize suitability for high-flow days. Healthcare endorsements support usage. Expanding product portfolios increase choice and customization. Growing e-commerce penetration ensures wider reach. Social influence promotes confidence in using larger sizes. Reusable, durable materials strengthen long-term adoption. Consumer trust and repeat purchase behavior drive market expansion.

- By Usability

On the basis of usability, the Middle East & Africa menstrual cups market is segmented into reusable and disposable. The reusable segment dominated with a revenue share of 82.5% in 2024. Reusable cups offer long-term cost savings, sustainability, and environmental benefits. They appeal to eco-conscious consumers, reducing plastic waste. Reusability encourages repeat usage over several years, ensuring market stability. Educational campaigns and influencer promotions highlight hygiene and ease of use. Healthcare recommendations reinforce safety and efficacy. Reusable cups are available in diverse materials, sizes, and shapes. Online platforms facilitate discreet purchasing and global distribution. Growing awareness of menstrual health and sustainable living drives adoption. Repeat purchases contribute to market retention. Consumer satisfaction and comfort maintain loyalty. Brand innovations improve flexibility and design. Awareness in emerging regions is gradually expanding.

The Disposable segment is expected to witness the fastest CAGR of 12% from 2025 to 2032. Disposable cups cater to first-time users and travel convenience. Rising awareness in emerging markets fuels adoption. Marketing campaigns emphasize hygiene and single-use benefits. Availability in pharmacies, online stores, and retail outlets increases accessibility. Trial adoption by new consumers encourages market penetration. Disposable cups provide lower upfront costs, appealing to budget-conscious buyers. Packaging innovations enhance convenience and appeal. Integration of lightweight, flexible materials improves comfort. Awareness campaigns highlight ease of disposal and reduced cleaning effort. Social influence and product reviews promote acceptance. Expansion of retail networks strengthens reach. Emerging economies see rapid growth due to increasing menstrual health education.

- By Shape

On the basis of shape, the Middle East & Africa menstrual cups market is segmented into Round, Hollow, Pointy, and Flat. The Round segment dominated with a revenue share of 47% in 2024, widely preferred for comfort, ergonomic design, and ease of insertion. Round cups accommodate various body types and menstrual flow levels. Educational campaigns and online tutorials promote usage confidence. Reusability and durability enhance adoption. Strong online and retail presence ensures accessibility. Marketing emphasizes convenience, hygiene, and environmental benefits. Positive word-of-mouth and social media influence further adoption. Healthcare endorsements reinforce safety and suitability. Variety in sizes complements round shapes for better fit. Repeat purchases strengthen segment stability. Brand innovations maintain consumer interest. Consumer preference for simple, reliable designs drives growth.

The Pointy segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032. Pointy cups provide improved anatomical fit, targeted comfort, and enhanced leak protection. Rising product awareness in urban and semi-urban regions supports adoption. Marketing highlights ergonomic benefits and user customization. Online and retail distribution channels facilitate trial and purchase. Product innovation focuses on softer materials and adaptable designs. Healthcare endorsements encourage usage for enhanced comfort. Growing consumer preference for specialized solutions drives uptake. E-commerce platforms enable discreet and convenient purchase. Positive social media campaigns enhance trust. Educational content guides proper usage. Repeat purchases sustain market growth. Expansion in emerging economies contributes to higher CAGR.

- By Distribution Channel

On the basis of distribution channel, the Middle East & Africa menstrual cups market is segmented into online stores, retail pharmacies, department stores, supermarkets, and others. The online stores segment dominated with a revenue share of 51% in 2024, driven by convenience, discreet delivery, and product variety. Online availability allows consumers to explore different brands and sizes safely. E-commerce platforms enable promotions, reviews, and educational content. Subscription models encourage repeat purchases. Targeted digital marketing campaigns enhance consumer awareness. Delivery reliability and easy returns boost confidence. Social media campaigns promote brand visibility. Emerging economies are witnessing increased online adoption. Repeat purchases maintain segment stability. Wide reach across regions supports growth. Convenience for younger demographics strengthens preference. Price comparisons and discounts attract first-time buyers.

The Retail Pharmacies segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032. In-store availability provides product trial opportunities, personal consultation, and awareness for new consumers. Marketing campaigns educate users about sustainable menstrual hygiene. Retail expansion in urban and semi-urban regions increases reach. Collaboration with healthcare professionals strengthens credibility. Packaging innovations attract attention and encourage trial purchases. Repeat purchases are driven by trust and convenience. Consumer’s value immediate access without waiting for delivery. Retail presence complements online channels to maximize coverage. Promotions and discounts increase affordability. Local awareness campaigns highlight hygiene and health benefits. Continuous product introduction ensures variety. Emerging markets drive rapid adoption and market penetration.

Middle East and Africa Menstrual Cups Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa menstrual cups market with the largest revenue share of 36.5% in 2024, driven by increasing awareness of sustainable feminine hygiene practices, expanding e-commerce penetration, and growing consumer preference for reusable and eco-friendly menstrual products

- UAE is expected to be the fastest-growing country in the Middle East and Africa menstrual cups market during the forecast period, projected to register a CAGR of 11%, fueled by rising focus on women’s health and hygiene, supportive government initiatives, and increasing integration of menstrual cups into daily personal care routines

- The adoption of menstrual cups is also supported by educational campaigns, NGO initiatives, and government programs aimed at improving menstrual hygiene and women’s health. Furthermore, urbanization and the modernization of retail and healthcare infrastructure are facilitating access to high-quality menstrual cup products across key markets in the region

Saudi Arabia Menstrual Cups Market Insight

The Saudi Arabia menstrual cups market dominated the Middle East region in 2024 with the largest revenue share of 36.5%, driven by increasing awareness of sustainable feminine hygiene practices, expanding e-commerce penetration, and growing consumer preference for reusable and eco-friendly menstrual products. Urbanization, higher disposable incomes, and education initiatives around menstrual health have further contributed to the widespread adoption of menstrual cups. Both retail and online channels are making high-quality products more accessible, while campaigns emphasizing health, hygiene, and environmental benefits continue to support market growth.

UAE Menstrual Cups Market Insight

The UAE menstrual cups market is expected to be the fastest-growing country in the Middle East menstrual cups market during the forecast period, projected to register a CAGR of 11%. This growth is fueled by a rising focus on women’s health and hygiene, supportive government initiatives, and increasing integration of menstrual cups into daily personal care routines. Awareness campaigns highlighting sustainability, convenience, and long-term cost savings, combined with growing availability through retail and e-commerce channels, are driving adoption among young and health-conscious consumers.

Middle East and Africa Menstrual Cups Market Share

The menstrual cups industry is primarily led by well-established companies, including:

- Mooncup (U.K.)

- Lunette (Finland)

- Me Luna CUP (Germany)

- Fleurcup (France)

- Intimina (Sweden)

- AllMatters (Denmark)

- Diva International Inc. (Canada)

- Saalt (U.S.)

- Ruby Cup (U.K.)

- YUUKI Company s.r.o. (Czech republic)

- Blossom Cup (U.S.)

Latest Developments in Middle East and Africa Menstrual Cups Market

- In March 2024, Spain's Catalonia region initiated a program to provide free reusable menstrual cups, period underwear, and cloth pads at pharmacies. This initiative aimed to combat "period poverty" after a survey revealed that 44% of women in Catalonia couldn't afford their preferred menstruation products, and 23% had to reuse products intended for single use. The program is expected to benefit about 2.5 million individuals, including non-binary and transgender people who menstruate. Authorities noted that reusable products could significantly reduce the lifetime cost of menstrual products from 2,500 euros to around 145

- In November 2024, HLL Lifecare Ltd's 'Thinkal' project, aimed at promoting menstrual cups as a sustainable alternative, helped reduce an estimated 10,000 tons of napkin waste and 13,250 tons of carbon emissions. The project has benefited over 7.5 lakh women across the country, with nearly four lakh consumers in Kerala alone. The initiative, which began in response to sanitary napkin disposal challenges faced during the 2018 floods, has been included in the state government's 14th five-year plan

- In May 2025, the Kerala government in India, in collaboration with HLL Lifecare Ltd and other public sector companies, expanded the Thinkal project to promote the use of menstrual cups among underprivileged women. For the 2025-26 financial year, three lakh menstrual cups were distributed free of cost across all local bodies in Kerala. The initiative aims to increase acceptance, particularly in rural areas, and build on previous successful efforts where villages such as Kumbalangi and Kallikkad were declared napkin-free after the distribution of around 5,000 cups and raising awareness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.