Middle East And Africa Metal Injection Molding Mim Powders And Feedstock Market

Market Size in USD Million

CAGR :

%

USD

107.70 Million

USD

230.73 Million

2025

2033

USD

107.70 Million

USD

230.73 Million

2025

2033

| 2026 –2033 | |

| USD 107.70 Million | |

| USD 230.73 Million | |

|

|

|

|

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Size

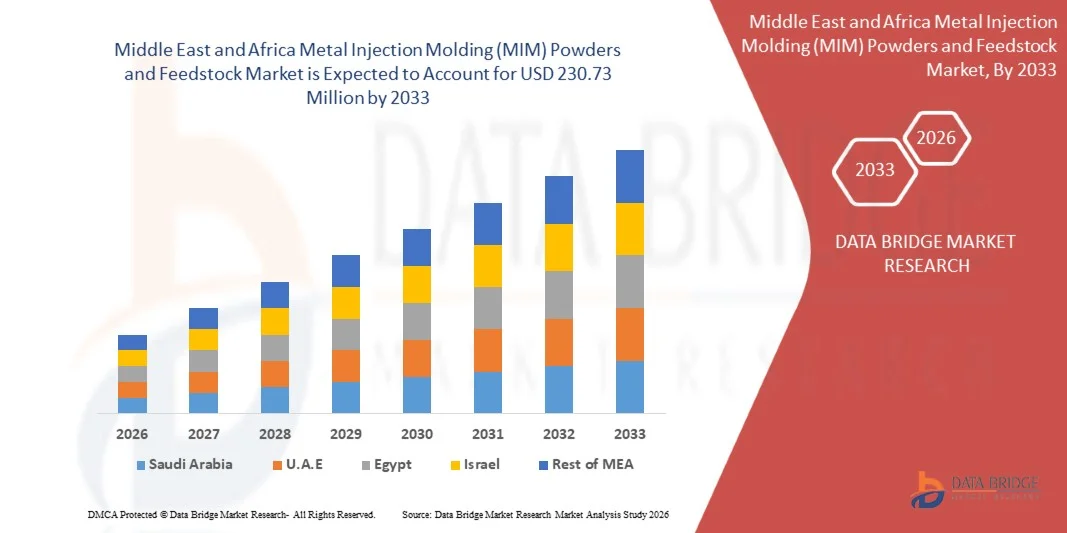

- The Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market size was valued at USD 107.70 million in 2025 and is expected to reach USD 230.73 million by 2033, at a CAGR of 10.1% during the forecast period

- MIM powders and feedstocks represent a specialized class of fine, spherical metal powders—primarily stainless steels, low-alloy steels, soft magnetic alloys, titanium, and nickel-based materials—combined with thermoplastic binders to enable near-net-shape manufacturing of complex parts. This technology bridges the gap between plastic injection molding and conventional metal forming, delivering tight tolerances, high material utilization, and cost efficiency for intricate geometries not economically feasible through machining.

- Production processes, dominated by gas atomization for powders and controlled compounding for feedstocks, ensure uniform particle size distribution, high flowability, and consistent sintering behavior. These attributes support critical end uses such as automotive transmission components, medical and dental implants, orthodontic brackets, surgical tools, electronic housings, connectors, firearm parts, and aerospace subsystems requiring dimensional accuracy and mechanical reliability.

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Analysis

- MIM powders and feedstocks, produced through gas atomization and precision binder compounding, enable high-volume manufacturing of complex, near-net-shape components. In the Middle East & Africa, demand is concentrated in automotive assembly, industrial machinery, energy equipment, medical devices, and defense applications, supported by industrial diversification initiatives but constrained by limited domestic powder production and dependence on imported specialty alloys.

- Market growth is driven by regional industrialization programs, expanding automotive and industrial manufacturing bases, and rising demand for medical devices supported by improving healthcare infrastructure. Government-led localization strategies, industrial free zones, and investments in advanced manufacturing capabilities are strengthening regional MIM supply chains, with opportunities in local powder atomization, recycled metal powder usage, and downstream component manufacturing.

- Saudi Arabia is expected to dominate the Middle East & Africa MIM powders and feedstock market in 2026, holding an estimated 32.84% share, supported by large-scale industrial investments under Vision 2030, strong defense and energy-sector demand, and growing adoption of precision metal components in automotive and industrial applications.

- The United Arab Emirates is projected to be the fastest-growing market in the region, expanding at a CAGR of approximately 10.7%, driven by rapid growth in advanced manufacturing, aerospace and defense components, medical devices, and the development of high-technology industrial clusters.

- Stainless steel powders are expected to dominate the global MIM powders and feedstock market in 2026, accounting for approximately 67.45% of total demand, due to their favorable strength-to-cost ratio, corrosion resistance, and consistent sintering performance across automotive, medical, industrial, and defense applications.

Report Scope and Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Segmentation

|

Attributes |

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia- Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, challenges and barriers, comparative analysis/benchmarking, analysis on capex & opex, for metal powder production capacity of 20,000 tonne/year, costing analysis, raw material coverage, supply chain analysis, technological advancement, value chain analysis, innovation tracker and strategic analysis, product category-wise key players, tariffs & impact on the market, regulation coverage. |

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Trends

“Growing adoption of 316l and 17-4ph mim powders in medical and surgical devices”

- The growing complexity of surgical procedures and the rapid advancement of medical technology have significantly accelerated the global demand for high-performance metal powders, specifically 316L and 17-4PH.

- The exceptional biocompatibility and corrosion resistance of 316L, paired with the high mechanical strength and wear resistance of 17-4PH, have positioned these alloys as the primary materials for next-generation medical devices.

- The upward trajectory in the production of complex medical instruments—characterized by a push for miniaturization and sterilization-compatible materials—has solidified the role of 316L and 17-4PH powders in the MIM industry.

- Stringent regulatory standards and certification requirements for implantable and surgical devices are accelerating the adoption of proven MIM-grade materials such as 316L and 17-4PH, as these alloys offer well-documented performance, repeatable sintering behavior, and established compliance with international medical material standards.

- Cost efficiency and high-volume manufacturing capability of MIM using 316L and 17-4PH powders are driving broader adoption across global healthcare systems, enabling manufacturers to produce complex, high-precision medical components at scale while maintaining consistent quality and reducing machining waste and overall production costs.

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Dynamics

Driver

“Automotive and EV component miniaturization increasing demand for complex MIM parts”

The global automotive industry is undergoing a structural shift driven by vehicle electrification and increasing component miniaturization. As Internal Combustion Engine (ICE) platforms are progressively replaced by Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), demand is moving away from large, mechanically intensive engine parts toward compact, high-precision, and multifunctional metal components. Metal Injection Molding (MIM) has become a key enabling technology in this transition, as it allows the cost-effective production of complex geometries using materials such as 316L and 17-4PH that would be economically impractical to manufacture through conventional machining.

At the same time, automotive lightweighting initiatives aimed at extending EV driving range, along with the rapid proliferation of miniaturized sensors for Advanced Driver-Assistance Systems (ADAS), are accelerating the adoption of MIM-manufactured components. These trends are directly increasing global demand for specialized MIM powders and feedstocks optimized for precision, strength, and dimensional stability.

- For instance- In July 2024, Sandvik Group highlighted in their industrial briefing that while EVs have fewer total moving parts than ICE vehicles, the remaining components are significantly more complex and specialized. The report specifically noted that leading EV makers are increasingly moving toward consolidated, "monolithic" designs that require high-precision tools and MIM-grade powders to achieve the necessary final form complexity and weight reduction.

- As of 2025, INDO-MIM has expanded its automotive division to focus on the high-volume production of "intelligent" components such as LiDAR sensor housings, turbocharger vanes, and electric motor connectors. By utilizing 17-4PH powder, the company produces parts that maintain high magnetic permeability and structural strength at a fraction of the weight of traditional cast parts, supporting the miniaturization of EV powertrain electronics.

- In May 2024, Sandvik’s "Meet Sandvik" publication emphasized that future electric cars will require "fewer, but more complex and expensive components." The transition to battery-electric vehicles (BEVs) is creating a surge in demand for "electrification metals" and specialized stainless steel powders used in the production of high-density battery cages and compact motor shafts that require the near-net-shape precision of the MIM process.

Restraint

“Volatile nickel, cobalt, and titanium prices impacting powder cost stability”

Price volatility in key input metals — nickel, cobalt, and titanium — poses a substantive challenge to cost stability in the global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market. These metals are foundational constituents of many MIM feedstocks, especially stainless steels (e.g., 17-4PH), superalloys, and titanium-based powders used in medical, aerospace, and high-performance applications. Their price fluctuations affect raw material procurement cost, inventory strategy, pricing mechanisms, and ultimately manufacturer margins.

Nickel — a major alloying element in corrosion-resistant stainless steels — has historically exhibited significant volatility, influenced by speculative trading and supply chain events. A notable example occurred in early 2022 when nickel prices experienced extreme short-term spikes significant enough to warrant exchange intervention, underscoring the metal’s susceptibility to sudden swings and the difficulty for sectors reliant on nickel content to forecast input costs.

- For Instance- In March 2022, according to Financial Conduct Authority (FCA), nickel prices on the London Metal Exchange (LME) nearly quadrupled within days due to extreme market stress, leading the exchange to suspend trading and cancel multiple hours of trades. The unprecedented price surge and suspension highlighted the vulnerability of nickel pricing mechanisms that underpin alloy costs relevant to MIM feedstocks containing nickel-rich alloys such as 316L and 17-4PH.

- In March 2025, according to Financial Conduct Authority (FCA), the UK regulator imposed a £9.2 million fine on the LME for its handling of the 2022 nickel market chaos, noting that price surges of more than double within short windows “undermined the orderliness of and confidence in LME’s market.” Such regulatory findings reflect how volatile base-metal pricing events can have lasting impacts on global metal commodity environments that ultimately influence feedstock costs.

- In March 2025, the USGS Titanium Mineral Commodity Summary noted fluctuations in titanium sponge production aligned with aerospace demand recovery, resulting in intermittent pricing pressure on titanium metal powders used in medical and aerospace MIM components.

- In November 2025, Outokumpu, a major stainless steel producer, reiterated in its public alloy surcharge disclosures that rapid movements in nickel prices necessitate frequent pricing adjustments, indirectly impacting powder-based value chains reliant on stainless steel melts for MIM feedstock production.

- In August 2023, the U.S. Department of Energy identified cobalt and nickel as critical minerals vulnerable to geopolitical and demand-driven disruptions, noting that price volatility in these metals poses downstream cost pressures for advanced manufacturing supply chains, including powder metallurgy and MIM feedstock producers.

Collectively, these instances underscore that volatile pricing of nickel, cobalt, and titanium represents a structural restraint on the global MIM powders and feedstock market. Sharp fluctuations in these critical metals not only elevate raw material costs but also complicate procurement planning, inventory management, and pricing strategies for feedstock producers. Despite mitigation strategies such as alloy surcharges, long-term supply agreements, and strategic stockpiling, the inherent unpredictability of these metals continues to exert pressure on cost stability. As MIM adoption grows across medical, aerospace, and high-performance applications, managing the downstream impact of base-metal volatility remains a key challenge for manufacturers seeking consistent, high-quality feedstock supply.

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Scope

The Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into five notable segments based on the material type, production method, application, end user and distribution channel.

- By Material Type

On the basis of Material type, the Global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into Stainless Steel Powders, Low Alloy Steel Powders, Nickel & Cobalt based Powders, Titanium Powders and Others. In 2026, the Stainless Steel Powders is expected to dominate the market with a 67.45% market share due to its excellent balance of mechanical strength, corrosion resistance, and cost-effectiveness, along with its wide adoption across automotive, medical, consumer electronics, and industrial machinery applications. The material’s compatibility with high-volume MIM processing and consistent sintering behavior further supports its dominant market position.

The Titanium Powders segment is growing with the highest CAGR of 11.4% due to exceptional strength-to-weight ratio and corrosion resistance are driving increased adoption of titanium powders in aerospace, medical, automotive, and defense applications, where lightweighting, durability, and long service life are critical performance requirements.

- By Production Method

On the basis of Production Method, the Global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into Gas Atomized, Water Atomized, Mechanical Alloying and Other Methods (Plasma, Ultrasonic). In 2026, Gas Atomized is expected to dominate the market with a 64.16% market share due to their superior powder sphericity, controlled particle size distribution, and enhanced flowability, which are critical for achieving high-density, defect-free MIM components. The increasing demand for precision parts with tight tolerances in automotive, medical, and aerospace applications continues to drive the adoption of gas atomized powders.

The Mechanical Alloying segment is growing with the highest CAGR of 10.6% due to Rising demand for advanced and non-equilibrium alloy systems is driving adoption of mechanical alloying, as the process enables the production of ultra-fine, nanostructured, and dispersion-strengthened powders that cannot be achieved through conventional melting or gas atomization routes.

- By Application

On the basis of Application, the Global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into Automotive, Medical & Dental, Industrial Machinery, Consumer Electronics, Aerospace, Firearms & Defense and Others. In 2026, Automotive is expected to dominate the market with a 38.34% market due to increasing use of MIM for lightweight, high-strength, and complex-shaped components that support fuel efficiency, emission reduction, and performance optimization. The growing adoption of electric and hybrid vehicles further accelerates demand for precision metal components manufactured through MIM processes.

The Medical & Dental segment is growing with the highest CAGR of 10.8% due to Rapidly aging global populations and rising healthcare expenditure are increasing the volume of surgical procedures, orthopedic interventions, and dental treatments, directly driving demand for high-precision metal components produced through Metal Injection Molding (MIM).

- By End user

On the basis of End user, the Global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into Electronics & Electrical, Automotive OEMs, Medical Devices, Industrial Equipment, Defense & Aerospace and Others. In 2026, Electronics & Electrical is expected to dominate the market with a 44.05% market share due to rising demand for miniaturized, high-precision metal components used in connectors, housings, sensors, and structural parts. The need for high-volume production with consistent quality and tight dimensional tolerances strongly supports the adoption of MIM powders and feedstock within this end-user segment.

The Industrial Equipment segment is growing with the highest CAGR of 10.6% due to accelerated industrial automation and smart manufacturing adoption are increasing demand for high-precision, durable metal components used in robotics, actuators, sensors, valves, and motion-control systems, where MIM enables complex geometries and tight tolerances at scale.

- By Distribution channel

On the basis of Distribution channel, the Global Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is segmented into Direct Sales and Distributors. In 2026, Direct Sales are expected to dominate the market due large OEMs and Tier-1 suppliers increasingly prefer direct engagement with powder and feedstock manufacturers to ensure material customization, consistent quality, technical support, and long-term supply agreements for high-volume production programs.

The Direct Sales segment is growing with the highest CAGR of 10.2% due to Rising demand for advanced and non-equilibrium alloy systems is driving adoption of mechanical alloying, as the process enables the production of ultra-fine, nanostructured, and dispersion-strengthened powders that cannot be achieved through conventional melting or gas atomization routes.

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Insight

Middle East & Africa accounts for an estimated ~3.94% share of the global MIM powders and feedstock market and is growing at a CAGR of approximately 10.1% during the forecast period. Growth is led primarily by Saudi Arabia and the United Arab Emirates, supported by large-scale industrial diversification programs, defense and aerospace localization initiatives, and rising investments in advanced metal component manufacturing. The region is witnessing gradual development of domestic metal powder processing and precision manufacturing capabilities, alongside increasing demand for high-accuracy components used in oil & gas equipment, medical devices, defense platforms, and industrial machinery. Government-led initiatives across GCC countries—focused on strengthening local manufacturing ecosystems, technology transfer, and reducing dependence on imported components—are further accelerating adoption of MIM powders and feedstocks across the MEA region.

Saudi Arabia Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Insight

Saudi Arabia dominates the Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market, accounting for approximately 32.91% share in 2026 and registering a CAGR of around 10.3% during 2026–2033. Market growth is driven by increasing investments under Vision 2030 in advanced manufacturing, defense localization, industrial automation, and downstream metal component production. Rising demand for precision metal parts from aerospace, oil & gas equipment, medical devices, and defense applications is supporting the adoption of MIM technology. In addition, government-backed industrial clusters, expanding metal processing capabilities, and efforts to reduce import dependency are strengthening domestic consumption of MIM powders and feedstocks, reinforcing Saudi Arabia’s leadership position within the MEA region.

United Arab Emirates Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Insight

The United Arab Emirates is expected to witness the fastest growth in the MEA MIM powders and feedstock market, with a projected CAGR of approximately 10.7% during 2026–2033, driven by rapid industrial diversification, expanding aerospace and defense manufacturing, and increasing adoption of advanced precision engineering technologies. Strong demand from aviation components, medical devices, electronics assemblies, and industrial machinery—combined with the UAE’s role as a regional manufacturing and logistics hub—is accelerating MIM material consumption. Government-led initiatives focused on advanced manufacturing, innovation, and foreign direct investment, along with growing local capabilities in tooling, sintering, and component production, are steadily increasing demand for high-quality MIM powders and feedstocks across the country.

Israel Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Insight

Israel represents an emerging market within the Middle East & Africa MIM powders and feedstock landscape, supported by its established automotive assembly base, industrial machinery manufacturing, and growing medical device production. Market growth is driven by demand for cost-efficient, high-precision metal components used in automotive systems, mining and industrial equipment, and healthcare applications. Increasing adoption of advanced manufacturing technologies, gradual development of local powder metallurgy capabilities, and integration into global automotive and industrial supply chains are supporting steady growth in MIM powder and feedstock consumption. Government initiatives aimed at strengthening local manufacturing, skills development, and industrial modernization are further contributing to the expansion of MIM adoption in Israel.

Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market Share

The Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market is primarily led by well-established companies, including:

- Linde PLC (U.K.)

- BASF (Germany)

- Epson Atmix Corporation (Japan)

- Sandvik AB (Sweden)

- CRS Holdings, LLC (Carpenter Technology) (U.S.)

- Advanced Technology & Materials Co., Ltd. (China)

- AMETEK Inc. (U.S.)

- CNPC POWDER (Canada)

- Hoganas AB (Sweden)

- Tronox Holdings Plc (U.S.)

- OC Oerlikon Management AG (Switzerland)

- Pometon S.P.A. (Italy)

- GKN Powder Metallurgy (U.K.)

- MITSUBISHI STEEL MFG. CO., LTD. (Japan)

- Rio Tinto (U.K.)

Latest Developments in Middle East and Africa Metal Injection Molding (MIM) Powders and Feedstock Market

- In April 2024, Linde Advanced Material Technologies (AMT) announced a licensing agreement with NASA for the revolutionary GRX-810 alloy metal powder, enabling commercialization for additive manufacturing and MIM applications in aerospace.

- In September 2025, Linde AMT partnered with Velo3D to supply domestically produced CuNi (70-30 Copper-Nickel) powder from its Indiana facility, supporting U.S. Navy shipbuilding via MIM and additive processes for corrosion-resistant components.

- In February 2025, BASF launched Catamold motion 8620, a new low-alloy feedstock using pre-alloyed gas-atomized powders for enhanced MIM performance in structural applications.

- In June 2025, Epson Atmix launched operations at its new $38 million metal recycling plant at Kita-Inter Plant No. 2. This facility refines Epson Group metal scraps and out-of-spec powders into high-quality MIM feedstock, supporting sustainable production for energy-efficient devices.

- In April 2025, Epson Atmix partnered with Epson Europe Electronics GmbH to expand MIM powder distribution in Europe for IT, automotive, and medical applications. The collaboration targets growing demand in 5G and self-driving tech.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 CHALLENGES AND BARRIERS

4.2.1 TECHNICAL CHALLENGES: POWDER PRODUCTION AND FEEDSTOCK MANUFACTURING

4.2.2 CONSTRAINTS

4.2.3 SUPPLY-CHAIN CHALLENGES

4.2.3.1 CERTIFICATION REQUIREMENTS

4.2.3.2 QUALITY EXPECTATIONS

4.2.4 CUSTOMER QUALIFICATION CYCLE AND VALIDATION CHALLENGES

4.3 COMPARATIVE ANALYSIS/ BENCHMARKING

4.3.1 INTRODUCTION

4.3.2 OVERVIEW ON MIM VS. AM POWDERS

4.3.3 MIDDLE EAST AND AFRICA SUPPLIERS ANALYSIS AND PRICING COMPARISON

4.3.3.1 MIM POWDERS

4.3.3.1.1 COMPANY NAMES

4.3.3.1.2 PRODUCT PORTFOLIO

4.3.3.2 FEEDSTOCK

4.3.3.2.1 COMPANY NAMES

4.3.3.2.2 PRODUCT PORTFOLIO

4.3.4 SUPPLIER PRICING BENCHMARKING

4.3.4.1 DOMESTIC VS INTERNATIONAL

4.3.4.2 REASONS FOR PRICE DIFFERENCES BETWEEN SUPPLIERS

4.4 ANALYSIS ON CAPEX & OPEX, FOR METAL POWDER PRODUCTION CAPACITY OF 20,000 TONNE/YEAR

4.4.1 INTRODUCTION

4.4.2 CAPEX ANALYSIS FOR POWDER MANUFACTURING & FEEDSTOCK COMPOUNDING

4.4.2.1 Land & Infrastructure

4.4.2.2 Process Equipment

4.4.2.3 Utilities & Ancillaries

4.4.2.4 Indirect & Soft Costs

4.4.3 OPEX ANALYSIS FOR YEARLY OPERATIONS

4.4.3.1 Raw Materials

4.4.3.2 Utilities & Energy

4.4.3.3 Labor & Administration

4.4.3.4 Maintenance

4.4.3.5 Consumables & Packaging

4.4.3.6 Overheads & Miscellaneous

4.4.3.7 Profitability Indicators

4.4.3.7.1 Break-Even Analysis

4.4.3.8 Return on Investment (ROI)

4.4.3.9 Payback Analysis

4.5 COSTING ANALYSIS

4.5.1 POWDER COST BREAKDOWN

4.5.1.1 RAW MATERIALS (~40-60% of Powder Cost)

4.5.1.2 ATOMIZATION (~15-25% OF POWDER COST)

4.5.1.3 CLASSIFICATION (~10-20% of Powder Cost)

4.5.1.4 ALLOYING (~5-15% of Powder Cost)

4.5.1.5 QUALITY ASSURANCE AND QUALITY CONTROL (QA/QC) (~5-10% of Powder Cost)

4.5.1.6 BINDER INGREDIENTS (~15-25% of Feedstock Cost)

4.5.1.7 COMPOUNDING (~20-30% of Feedstock Cost)

4.5.1.8 PELLETIZING (~8-15% of Feedstock Cost)

4.5.1.9 PACKAGING (~5-15% of Feedstock Cost)

4.5.2 NUMERIC COST RANGES BY ALLOY (USD/KG)

4.6 RAW MATERIAL COVERAGE

4.6.1 INTRODUCTION

4.6.2 POWDER

4.6.2.1 POWDER CHARACTERISTICS

4.6.2.2 GRADES USED IN MIM

4.6.2.3 ANNUAL CONSUMPTION TRENDS

4.6.3 FEEDSTOCK FORMULATION TRENDS

4.6.3.1 BINDER SYSTEMS

4.6.3.2 POWDER LOADING

4.6.3.3 COMPOUNDING METHODS

4.6.4 DEMAND FORECAST ANALYSIS

4.6.4.1 MIM POWDERS

4.6.4.2 FEEDSTOCK

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENT

4.8.1 INTRODUCTION

4.8.2 INTEGRATION OF DIGITAL TWINS AND REAL-TIME MONITORING IN MIM POWDER & FEEDSTOCK PROCESSING

4.8.3 ADVANCED BINDER SYSTEMS FOR MIM POWDERS & FEEDSTOCK

4.8.4 MICRO-MIM FOR MINIATURIZATION ADVANCEMENT

4.8.5 INTEGRATION OF ADDITIVE MANUFACTURING (AM)

4.8.6 3D PRINTING ADVANCEMENTS DRIVING INNOVATION IN MIM POWDERS

4.8.7 CONCLUSION

4.9 VALUE CHAIN ANALYSIS

4.9.1 RAW MATERIAL EXTRACTION

4.9.1.1 VOLATILITY AND PRICING DYNAMICS

4.9.2 METAL POWDER PRODUCTION

4.9.3 FEEDSTOCK FORMULATION AND COMPOUNDING

4.9.4 PACKAGING, STORAGE, AND LOGISTICS

4.9.5 DISTRIBUTION AND SALES CHANNELS

4.9.6 TECHNICAL SUPPORT AND APPLICATION DEVELOPMENT

4.9.7 END-USE INDUSTRIES AND FEEDBACK LOOP

4.9.8 CONCLUSION

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND PARTNERSHIP

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 KEY MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS MANUFACTURERS, BY TOP COUNTRIES:

5 PRODUCT CATEGORY-WISE KEY PLAYERS

5.1 SANDVIK AB

5.1.1 COMPANY OVERVIEW

5.1.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.1.2.1 SUPPLY CHAIN MANAGEMENT

5.1.2.2 RAW MATERIALS

5.1.2.3 PRODUCTION PROCESS

5.1.2.4 VALUE AND VOLUME ANALYSIS

5.1.2.5 COSTING ANALYSIS

5.1.3 STRATEGIC DEVELOPMENTS

5.2 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

5.2.1 COMPANY OVERVIEW

5.2.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDER)

5.2.2.1 SUPPLY CHAIN MANAGEMENT

5.2.2.2 RAW MATERIALS

5.2.2.3 PRODUCTION PROCESS

5.2.2.4 VALUE AND VOLUME ANALYSIS

5.2.2.5 COSTING ANALYSIS

5.2.3 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL POWDER)

5.2.3.1 SUPPLY CHAIN MANAGEMENT

5.2.3.2 RAW MATERIALS

5.2.4 PRODUCTION PROCESS

5.2.4.1 VALUE AND VOLUME ANALYSIS

5.2.4.2 COSTING ANALYSIS

5.2.5 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.2.5.1 SUPPLY CHAIN MANAGEMENT

5.2.5.2 RAW MATERIALS

5.2.5.3 PRODUCTION PROCESS

5.2.5.4 VALUE AND VOLUME ANALYSIS

5.2.5.5 COSTING ANALYSIS

5.2.6 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY)

5.2.6.1 SUPPLY CHAIN MANAGEMENT

5.2.6.2 RAW MATERIALS

5.2.6.3 PRODUCTION PROCESS

5.2.7 VALUE AND VOLUME ANALYSIS

5.2.7.1 COSTING ANALYSIS

5.2.8 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.2.8.1 SUPPLY CHAIN MANAGEMENT

5.2.8.2 RAW MATERIALS

5.2.8.3 PRODUCTION PROCESS

5.2.8.4 VALUE AND VOLUME ANALYSIS

5.2.8.5 COSTING ANALYSIS

5.2.9 STRATEGIC DEVELOPMENTS

5.3 EPSON ATMIX CORPORATION

5.3.1 COMPANY OVERVIEW

5.3.2 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.3.3 SUPPLY CHAIN MANAGEMENT

5.3.4 RAW MATERIALS

5.3.5 PRODUCTION PROCESS

5.3.6 VALUE AND VOLUME ANALYSIS

5.3.7 COSTING ANALYSIS

5.3.8 STRATEGIC DEVELOPMENTS

5.4 HOGANAS AB

5.4.1 COMPANY OVERVIEW

5.4.2 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY)

5.4.2.1 SUPPLY CHAIN MANAGEMENT

5.4.2.2 RAW MATERIALS

5.4.2.3 PRODUCTION PROCESS

5.4.2.4 VALUE AND VOLUME ANALYSIS

5.4.2.5 COSTING ANALYSIS

5.4.3 STRATEGIC DEVELOPMENTS

5.5 POMETON S.P.A.

5.5.1 COMPANY OVERVIEW

5.5.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDER)

5.5.2.1 SUPPLY CHAIN MANAGEMENT

5.5.2.2 RAW MATERIALS

5.5.2.3 PRODUCTION PROCESS

5.5.2.4 VALUE AND VOLUME ANALYSIS

5.5.2.5 COSTING ANALYSIS

5.5.3 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL POWDER)

5.5.3.1 SUPPLY CHAIN MANAGEMENT

5.5.3.2 RAW MATERIALS

5.5.3.3 PRODUCTION PROCESS

5.5.3.4 VALUE AND VOLUME ANALYSIS

5.5.3.5 COSTING ANALYSIS

5.5.4 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWER)

5.5.4.1 SUPPLY CHAIN MANAGEMENT

5.5.4.2 RAW MATERIALS

5.5.4.3 PRODUCTION PROCESS

5.5.4.4 VALUE AND VOLUME ANALYSIS

5.5.4.5 COSTING ANALYSIS

5.5.5 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHERS)

5.5.5.1 SUPPLY CHAIN MANAGEMENT

5.5.5.2 RAW MATERIALS

5.5.5.3 PRODUCTION PROCESS

5.5.5.4 VALUE AND VOLUME ANALYSIS

5.5.5.5 COSTING ANALYSIS

5.5.6 STRATEGIC DEVELOPMENTS

5.6 BASF

5.6.1 COMPANY OVERVIEW

5.6.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.6.3 SUPPLY CHAIN MANAGEMENT

5.6.4 RAW MATERIALS

5.6.5 PRODUCTION PROCESS

5.6.6 VALUE AND VOLUME ANALYSIS

5.6.7 COSTING ANALYSIS

5.6.8 STRATEGIC DEVELOPMENTS

5.7 CNPC POWDER

5.7.1 COMPANY OVERVIEW

5.7.2 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.7.3 SUPPLY CHAIN MANAGEMENT

5.7.4 RAW MATERIALS

5.7.5 PRODUCTION PROCESS

5.7.6 VALUE AND VOLUME ANALYSIS

5.7.7 COSTING ANALYSIS

5.7.8 STRATEGIC DEVELOPMENTS

5.8 GKN POWDER METALLURGY

5.8.1 COMPANY OVERVIEW

5.8.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.8.3 SUPPLY CHAIN MANAGEMENT

5.8.4 RAW MATERIALS

5.8.5 PRODUCTION PROCESS

5.8.6 VALUE AND VOLUME ANALYSIS

5.8.7 COSTING ANALYSIS

5.8.8 STRATEGIC DEVELOPMENTS

5.9 MITSUBISHI STEEL MFG. CO., LTD.

5.9.1 COMPANY OVERVIEW

5.9.2 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL - COBALT POWDER)

5.9.2.1 SUPPLY CHAIN MANAGEMENT

5.9.3 RAW MATERIALS

5.9.3.1 PRODUCTION PROCESS

5.9.3.2 VALUE AND VOLUME ANALYSIS

5.9.3.3 COSTING ANALYSIS

5.9.4 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.9.4.1 SUPPLY CHAIN MANAGEMENT

5.9.4.2 RAW MATERIALS

5.9.4.3 PRODUCTION PROCESS

5.9.4.4 VALUE AND VOLUME ANALYSIS

5.9.4.5 COSTING ANALYSIS

5.9.5 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDER)

5.9.5.1 SUPPLY CHAIN MANAGEMENT

5.9.5.2 RAW MATERIALS

5.9.5.3 PRODUCTION PROCESS

5.9.5.4 VALUE AND VOLUME ANALYSIS

5.9.5.5 COSTING ANALYSIS

5.9.6 COMPONENT-WISE OPERATIONAL ANALYSIS (LOW ALLOY STEEL POWDER)

5.9.6.1 SUPPLY CHAIN MANAGEMENT

5.9.6.2 RAW MATERIALS

5.9.6.3 PRODUCTION PROCESS

5.9.6.4 VALUE AND VOLUME ANALYSIS

5.9.6.5 COSTING ANALYSIS

5.9.7 STRATEGIC DEVELOPMENTS

5.1 OC OERLIKON MANAGEMENT AG

5.10.1 COMPANY OVERVIEW

5.10.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.10.2.1 SUPPLY CHAIN MANAGEMENT

5.10.3 RAW MATERIALS

5.10.4 PRODUCTION PROCESS

5.10.5 VALUE AND VOLUME ANALYSIS

5.10.6 COSTING ANALYSIS

5.10.7 COMPONENT-WISE OPERATIONAL ANALYSIS (NICKEL COBALT POWDERS)

5.10.7.1 SUPPLY CHAIN MANAGEMENT

5.10.7.2 RAW MATERIALS

5.10.7.3 PRODUCTION PROCESS

5.10.7.4 VALUE AND VOLUME ANALYSIS

5.10.8 COSTING ANALYSIS

5.10.9 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL POWDERS)

5.10.9.1 SUPPLY CHAIN MANAGEMENT

5.10.9.2 RAW MATERIALS

5.10.9.3 PRODUCTION PROCESS

5.10.9.4 VALUE AND VOLUME ANALYSIS

5.10.10 COSTING ANALYSIS

5.10.11 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.10.11.1 SUPPLY CHAIN MANAGEMENT

5.10.11.2 RAW MATERIALS

5.10.11.3 PRODUCTION PROCESS

5.10.11.4 VALUE AND VOLUME ANALYSIS

5.10.12 COSTING ANALYSIS

5.10.13 STRATEGIC DEVELOPMENTS

5.11 RIO TINTO

5.11.1 COMPANY OVERVIEW

5.11.2 COMPONENT-WISE OPERATIONAL ANALYSIS (STAINLESS STEEL)

5.11.2.1 SUPPLY CHAIN MANAGEMENT

5.11.2.2 RAW MATERIALS

5.11.2.3 PRODUCTION PROCESS

5.11.2.4 VALUE AND VOLUME ANALYSIS

5.11.2.5 COSTING ANALYSIS

5.11.3 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.11.3.1 SUPPLY CHAIN MANAGEMENT

5.11.3.2 RAW MATERIALS

5.11.3.3 PRODUCTION PROCESS

5.11.3.4 VALUE AND VOLUME ANALYSIS

5.11.3.5 COSTING ANALYSIS

5.11.4 STRATEGIC DEVELOPMENTS

5.12 TRONOX HOLDINGS PLC

5.12.1 COMPANY OVERVIEW

5.12.2 COMPONENT-WISE OPERATIONAL ANALYSIS (TITANIUM POWDERS)

5.12.2.1 SUPPLY CHAIN MANAGEMENT

5.12.2.2 RAW MATERIALS

5.12.2.3 PRODUCTION PROCESS

5.12.2.4 VALUE AND VOLUME ANALYSIS

5.12.2.5 COSTING ANALYSIS

5.12.3 COMPONENT-WISE OPERATIONAL ANALYSIS (OTHER METAL POWDERS)

5.12.3.1 SUPPLY CHAIN MANAGEMENT

5.12.3.2 RAW MATERIALS

5.12.3.3 PRODUCTION PROCESS

5.12.3.4 VALUE AND VOLUME ANALYSIS

5.12.4 COSTING ANALYSIS

5.12.5 STRATEGIC DEVELOPMENTS

6 TARIFFS & IMPACT ON THE MARKET

6.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

6.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

6.3 VENDOR SELECTION CRITERIA DYNAMICS

6.4 IMPACT ON SUPPLY CHAIN

6.4.1 RAW MATERIAL PROCUREMENT

6.4.2 MANUFACTURING AND PRODUCTION

6.4.3 LOGISTICS AND DISTRIBUTION

6.4.4 PRICE PITCHING AND POSITION OF MARKET

6.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

6.5.1 SUPPLY CHAIN OPTIMIZATION

6.5.2 JOINT VENTURE ESTABLISHMENTS

6.6 IMPACT ON PRICES

6.7 REGULATORY INCLINATION

6.7.1 GEOPOLITICAL SITUATION

6.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

6.7.2.1 FREE TRADE AGREEMENTS

6.7.2.2 ALLIANCE ESTABLISHMENTS

6.7.3 STATUS ACCREDITATION (INCLUDING MFN)

6.7.4 DOMESTIC COURSE OF CORRECTION

6.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

6.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

7 REGULATION COVERAGE

7.1 INTRODUCTION

7.2 PRODUCT CODES

7.3 CERTIFIED STANDARDS

7.4 SAFETY STANDARDS

7.4.1 MATERIAL HANDLING & STORAGE

7.4.2 TRANSPORT & PRECAUTIONS

7.4.3 HAZARD IDENTIFICATION

7.5 CONCLUSION

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 GROWING ADOPTION OF 316L AND 17-4PH MIM POWDERS IN MEDICAL AND SURGICAL DEVICES

8.1.2 AUTOMOTIVE AND EV COMPONENT MINIATURIZATION INCREASING DEMAND FOR COMPLEX MIM PARTS

8.1.3 ADVANCEMENTS IN BINDER AND DEBINDING TECHNOLOGIES IMPROVING PRODUCTION EFFICIENCY

8.1.4 COST-EFFECTIVE MASS PRODUCTION CAPABILITY OF MIM FOR TIGHT-TOLERANCE COMPONENTS

8.2 RESTRAINTS

8.2.1 VOLATILE NICKEL, COBALT, AND TITANIUM PRICES IMPACTING POWDER COST STABILITY.

8.2.2 EXTENDED QUALIFICATION TIMELINES IN REGULATED END-USE INDUSTRIES

8.3 OPPORTUNITY

8.3.1 INCREASING DEMAND FOR TITANIUM AND SPECIALTY ALLOY FEEDSTOCKS IN HIGH VALUE APPLICATIONS

8.3.2 LOCALIZATION OF POWDER AND FEEDSTOCK MANUFACTURING TO STRENGTHEN SUPPLY CHAINS

8.3.3 EXPANSION OF VALUE-ADDED SERVICES SUCH AS POWDER CHARACTERIZATION AND PROCESS SUPPORT

8.4 CHALLENGES

8.4.1 MAINTAINING CONSISTENT PARTICLE SIZE DISTRIBUTION AND POWDER QUALITY AT SCALE

8.4.2 STRICT CONTAMINATION CONTROL REQUIREMENTS IN MEDICAL AND AEROSPACE APPLICATIONS

9 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE

9.1 OVERVIEW

9.2 STAINLESS STEEL POWDERS

9.3 LOW ALLOY STEEL POWDERS

9.4 NICKEL & COBALT BASED POWDERS

9.5 TITANIUM POWDERS

9.6 OTHERS

9.7 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (TONS)

9.7.1 STAINLESS STEEL POWDERS

9.7.2 LOW ALLOY STEEL POWDERS

9.7.3 NICKEL & COBALT BASED POWDERS

9.7.4 TITANIUM POWDERS

9.7.5 OTHERS

9.8 MIDDLE EAST AND AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 316L

9.8.2 17-4 PH

9.8.3 304 / 304L

9.8.4 440C

9.8.5 OTHER

9.9 MIDDLE EAST AND AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 MIDDLE EAST AND AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 4140

9.10.2 4340

9.10.3 8620

9.10.4 4605

9.10.5 OTHERS

9.11 MIDDLE EAST AND AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 MIDDLE EAST AND AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 INCONEL 718

9.12.2 INCONEL 625

9.12.3 CO–CR ALLOY

9.12.4 OTHERS

9.13 MIDDLE EAST AND AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 NORTH AMERICA

9.13.3 EUROPE

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 MIDDLE EAST AND AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.14.1 GRADE 5

9.14.2 GRADE 1

9.14.3 GRADE 2

9.14.4 GRADE 3

9.14.5 OTHERS

9.15 MIDDLE EAST AND AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.15.1 ASIA-PACIFIC

9.15.2 NORTH AMERICA

9.15.3 EUROPE

9.15.4 SOUTH AMERICA

9.15.5 MIDDLE EAST & AFRICA

9.16 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

10 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD

10.1 OVERVIEW

10.2 GAS ATOMIZED

10.3 WATER ATOMIZED

10.4 MECHANICAL ALLOYING

10.5 OTHER METHODS (PLASMA, ULTRASONIC)

10.6 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

10.6.1 GAS ATOMIZED

10.6.2 WATER ATOMIZED

10.6.3 MECHANICAL ALLOYING

10.6.4 OTHER METHODS (PLASMA, ULTRASONIC)

10.7 MIDDLE EAST AND AFRICA GAS ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 MIDDLE EAST AND AFRICA WATER ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 MIDDLE EAST AND AFRICA MECHANICAL ALLOYING IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 MIDDLE EAST AND AFRICA OTHER METHODS (PLASMA, ULTRASONIC) IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 AUTOMOTIVE

11.1.2 MEDICAL & DENTAL

11.1.3 INDUSTRIAL MACHINERY

11.1.4 CONSUMER ELECTRONICS

11.1.5 AEROSPACE

11.1.6 FIREARMS & DEFENSE

11.1.7 OTHERS

11.2 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

11.2.1 AUTOMOTIVE

11.2.2 MEDICAL & DENTAL

11.2.3 INDUSTRIAL MACHINERY

11.2.4 CONSUMER ELECTRONICS

11.2.5 AEROSPACE

11.2.6 FIREARMS & DEFENSE

11.2.7 OTHERS

11.3 MIDDLE EAST AND AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 ENGINE COMPONENTS

11.3.2 TRANSMISSION COMPONENTS

11.4 MIDDLE EAST AND AFRICA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 TURBOCHARGER PARTS

11.4.2 FUEL INJECTORS

11.4.3 SENSORS & ACTUATORS

11.5 MIDDLE EAST AND AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 MIDDLE EAST AND AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SURGICAL INSTRUMENTS

11.6.2 ORTHOPEDIC IMPLANTS

11.7 MIDDLE EAST AND AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 NORTH AMERICA

11.7.3 EUROPE

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 MIDDLE EAST AND AFRICA INDUSTRIAL MACHINERY IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 SOUTH AMERICA

11.8.5 MIDDLE EAST & AFRICA

11.9 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

11.9.1 SMARTPHONE PARTS

11.9.2 CONNECTORS & HOUSINGS

11.1 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 MIDDLE EAST AND AFRICA AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 MIDDLE EAST AND AFRICA FIREARMS & DEFENSE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 NORTH AMERICA

11.13.3 EUROPE

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

12 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER

12.1 OVERVIEW

12.2 ELECTRONICS & ELECTRICAL

12.3 AUTOMOTIVE OEMS

12.4 MEDICAL DEVICES

12.5 INDUSTRIAL EQUIPMENT

12.6 DEFENSE & AEROSPACE

12.7 OTHERS

12.8 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

12.8.1 ELECTRONICS & ELECTRICAL

12.8.2 AUTOMOTIVE OEMS

12.8.3 MEDICAL DEVICES

12.8.4 INDUSTRIAL EQUIPMENT

12.8.5 DEFENSE & AEROSPACE

12.8.6 OTHERS

12.9 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 NORTH AMERICA

12.9.3 EUROPE

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 MIDDLE EAST AND AFRICA AUTOMOTIVE OEMS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 NORTH AMERICA

12.11.3 EUROPE

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 MIDDLE EAST AND AFRICA INDUSTRIAL EQUIPMENT IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 MIDDLE EAST AND AFRICA DEFENSE & AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.13.1 ASIA-PACIFIC

12.13.2 NORTH AMERICA

12.13.3 EUROPE

12.13.4 SOUTH AMERICA

12.13.5 MIDDLE EAST & AFRICA

12.14 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.15.1 DIRECT SALES

12.15.2 DISTRIBUTORS

12.16 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

13 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 DISTRIBUTORS

13.4 MIDDLE EAST AND AFRICA DIRECT SALES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 MIDDLE EAST AND AFRICA DISTRIBUTORS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES

14.1.3 ISRAEL

14.1.4 SOUTH AFRICA

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMAPANY PROFILES

17.1 LINDE PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVEOPMENT

17.2 BASF

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVEOPMENT

17.3 EPSON ATMIX CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVEOPMENT

17.4 SANDVIK AB

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVEOPMENT

17.5 CRS HOLDINGS, LLC (CARPENTER TECHNOLOGY)

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVEOPMENT

17.6 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 AMETEK INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 COMPANY SHARE ANALYSIS

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENT

17.8 CNPC POWDER

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVEOPMENT

17.9 HOGANAS AB

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVEOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 KEY TECHNICAL AND COMMERCIAL PARAMETERS: MIM VS. AM POWDERS

TABLE 2 THE FOLLOWING TABLE ILLUSTRATES HOW MAJOR SUPPLIERS ALIGN WITH KEY MIM MATERIAL CATEGORIES WITHIN THE SCOPE OF THIS STUDY.

TABLE 3 INDICATIVE PRICING RANGE (2025)

TABLE 4 KEY SUPPLIERS IN THE MIM INDUSTRY:

TABLE 5 CAPITAL EXPENDITURE BREAKDOWN – LAND & INFRASTRUCTURE

TABLE 6 CAPITAL EXPENDITURE ALLOCATION – CORE PROCESS EQUIPMENT

TABLE 7 CAPITAL EXPENDITURE DISTRIBUTION – UTILITIES & ANCILLARY SYSTEMS

TABLE 8 CAPITAL EXPENDITURE ALLOCATION – INDIRECT & SOFT COSTS

TABLE 9 OPERATING COST STRUCTURE – RAW MATERIALS

TABLE 10 OPERATING COST STRUCTURE – UTILITIES & ENERGY CONSUMPTION

TABLE 11 OPERATING COST STRUCTURE – LABOR & ADMINISTRATION

TABLE 12 OPERATING COST STRUCTURE – MAINTENANCE

TABLE 13 OPERATING COST STRUCTURE – CONSUMABLES & PACKAGING

TABLE 14 OPERATING COST STRUCTURE – OVERHEADS & MISCELLANEOUS

TABLE 15 FINANCIAL PERFORMANCE BENCHMARKS – PAYBACK ANALYSIS

TABLE 16 INDICATIVE POWDER AND FEEDSTOCK PRICING RANGES (RELATIVE INDEX)

TABLE 17 MIM POWDER COST RANGES

TABLE 18 POWDER TYPE OVERVIEW

TABLE 19 PRODUCT CATEGORY-WISE KEY PLAYERS

TABLE 20 ESTIMATED COST STRUCTURE FOR LOW ALLOY STEEL POWDERS

TABLE 21 COST STRUCTURE

TABLE 22 COST STRUCTURE OF IRON POWDER AND COPPER POWDER

TABLE 23 COMPLIANCE OVERVIEW OF MIM POWDERS AND FEEDSTOCK – STANDARDS, SAFETY CODES, AND APPLICATIONS

TABLE 24 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 37 MIDDLE EAST AND AFRICA GAS ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA WATER ATOMIZED IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA MECHANICAL ALLOYING IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OTHER METHODS (PLASMA, ULTRASONIC) IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 43 MIDDLE EAST AND AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA INDUSTRIAL MACHINERY IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 50 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FIREARMS & DEFENSE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 56 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA AUTOMOTIVE OEMS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INDUSTRIAL EQUIPMENT IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA DEFENSE & AEROSPACE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 64 MIDDLE EAST AND AFRICA DIRECT SALES IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA DISTRIBUTORS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 68 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 70 MIDDLE EAST AND AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 78 MIDDLE EAST AND AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 82 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 84 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 86 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 88 SAUDI ARABIA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 94 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 95 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 96 SAUDI ARABIA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 SAUDI ARABIA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 SAUDI ARABIA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 100 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 101 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 102 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 103 SAUDI ARABIA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 104 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 106 UNITED ARAB EMIRATES STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 UNITED ARAB EMIRATES LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 UNITED ARAB EMIRATES NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 UNITED ARAB EMIRATES TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 111 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 112 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 113 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 114 UNITED ARAB EMIRATES AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 UNITED ARAB EMIRATES ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATES CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 118 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 119 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 120 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATES METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 122 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 124 ISRAEL STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 ISRAEL LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 ISRAEL NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 ISRAEL TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 129 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 130 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 132 ISRAEL AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 ISRAEL ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 ISRAEL MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 ISRAEL CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 136 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 137 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 138 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 139 ISRAEL METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 140 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 142 SOUTH AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 SOUTH AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 SOUTH AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 148 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 149 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 150 SOUTH AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH AFRICA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SOUTH AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SOUTH AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 154 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 156 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 158 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 160 EGYPT STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 EGYPT LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 EGYPT NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 EGYPT TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 165 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 166 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 167 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 168 EGYPT AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 EGYPT ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 EGYPT MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 EGYPT CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 172 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 173 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 174 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 175 EGYPT METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

TABLE 176 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY MATERIAL TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY VEHICLE TYPE, 2018-2033 (TONS)

TABLE 178 REST OF MIDDLE EAST & AFRICA STAINLESS STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 REST OF MIDDLE EAST & AFRICA LOW ALLOY STEEL POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 REST OF MIDDLE EAST & AFRICA NICKEL & COBALT BASED POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 REST OF MIDDLE EAST & AFRICA TITANIUM POWDERS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (USD THOUSAND)

TABLE 183 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY PRODUCTION METHOD, 2018-2033 (TONS)

TABLE 184 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 185 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 186 REST OF MIDDLE EAST & AFRICA AUTOMOTIVE IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 REST OF MIDDLE EAST & AFRICA ENGINE COMPONENTS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 REST OF MIDDLE EAST & AFRICA MEDICAL & DENTAL IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 REST OF MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 190 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 191 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY END USER, 2018-2033 (TONS)

TABLE 192 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 193 REST OF MIDDLE EAST & AFRICA METAL INJECTION MOLDING (MIM) POWDERS AND FEEDSTOCK MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (TONS)

List of Figure