Middle East And Africa Multifocal Iols Market

Market Size in USD Million

CAGR :

%

USD

133.32 Million

USD

195.49 Million

2024

2032

USD

133.32 Million

USD

195.49 Million

2024

2032

| 2025 –2032 | |

| USD 133.32 Million | |

| USD 195.49 Million | |

|

|

|

|

Middle East and Africa Multifocal IOLs Market Size

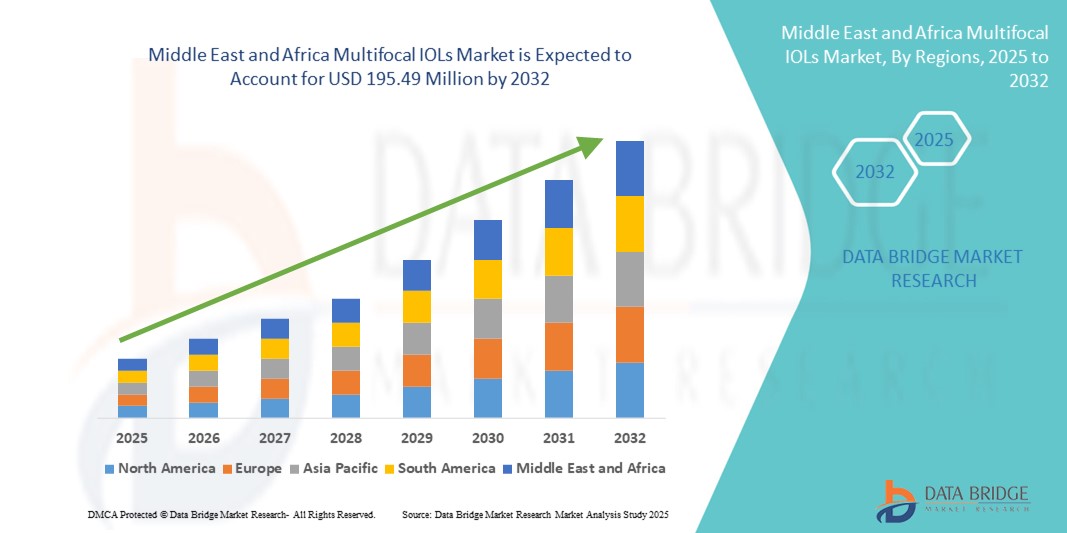

- The Middle East and Africa Multifocal IOLs market size was valued at USD 133.32 million in 2024 and is expected to reach USD 195.49 million by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by rising incidences of cataracts and presbyopia, coupled with increasing access to ophthalmic care across the Middle East and Africa. Improved healthcare infrastructure, expanding health insurance coverage, and government-led initiatives are enabling early diagnosis and intervention for age-related vision disorders. As a result, there is a growing number of patients undergoing cataract surgeries and opting for advanced vision correction solutions such as multifocal IOLs, supporting robust market growth in the region

- Furthermore, the increasing availability of specialized eye care services and the introduction of advanced ophthalmic technologies in countries such as Saudi Arabia, the UAE, South Africa, and Egypt are accelerating the adoption of multifocal IOLs. Private sector investment in eye clinics and ambulatory surgical centers is helping to meet rising demand, especially among the aging population. In addition, public awareness campaigns and training programs for ophthalmologists are contributing to the rising use of premium IOLs, thereby boosting the overall market expansion in the Middle East and Africa

Middle East and Africa Multifocal IOLs Market Analysis

- Multifocal intraocular lenses (IOLs), designed to correct presbyopia and cataracts by offering clear vision at multiple distances, are gaining rapid traction across the Middle East and Africa, driven by rising awareness of advanced vision correction options and growing demand for improved quality of life among aging populations

- The increasing preference for premium IOLs over traditional monofocal lenses is being fueled by expanding access to specialized ophthalmic care, a rise in elective cataract surgeries, and the growing presence of advanced technologies such as diffractive and extended depth-of-focus (EDOF) lenses. In addition, the proliferation of private eye clinics and greater affordability in urban centers are accelerating adoption across both affluent and emerging healthcare markets in the region

- Saudi Arabia dominated the Middle East and Africa Multifocal IOLs market, accounting for the largest revenue share of 33.8% in 2024. This is attributed to its rapidly advancing healthcare infrastructure, increased public and private investment in ophthalmic care, and early adoption of premium intraocular lens technologies. National initiatives such as Saudi Vision 2030 have accelerated the development of specialized eye care centers and encouraged the use of advanced vision correction surgeries, particularly among the aging population

- U.A.E. is projected to register the fastest CAGR of 11.7% in the Middle East and Africa Multifocal IOLs market during the forecast period, supported by a growing number of private ophthalmology clinics, high per capita healthcare expenditure, and a thriving medical tourism sector. The country’s strategic efforts to position itself as a hub for advanced eye care technologies, along with strong demand for spectacle-free postoperative outcomes, are significantly boosting the adoption of multifocal intraocular lenses

- Non Reduction lenses dominated the Middle East and Africa Multifocal IOLs market with a market share at 66.4% in 2024, driven by their widespread clinical preference, simplicity in design, and cost-effectiveness, making them a standard choice in multifocal IOL procedures across Middle East and Africa Multifocal IOLs market

Report Scope and Middle East and Africa Multifocal IOLs Market Segmentation

|

Attributes |

Middle East and Africa Multifocal IOLs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Multifocal IOLs Market Trends

Growing Therapeutic Advancements and Increasing Clinical Research

- A significant and accelerating trend in the Middle East and Africa Multifocal IOLs market is the increasing focus on therapeutic innovations and clinical research—particularly addressing complex visual impairments through improved IOL designs and neurosensory integration

- For instance, various medical device companies and research institutes across Middle East and Africa are investing in next-generation multifocal intraocular lenses that incorporate enhanced diffractive optics, extended depth-of-focus (EDOF) mechanisms, and light-adjustable technologies. These developments aim to deliver sharper vision with reduced side effects such as halos or glare, which are commonly associated with older multifocal lenses

- The increasing adoption of personalized eye care models across specialty clinics and surgical centers is enabling better visual outcomes. These models use advanced preoperative diagnostics such as wavefront aberrometry and ocular biometry to optimize lens selection based on individual ocular anatomy and lifestyle needs

- Partnerships between medical technology firms, university hospitals, and government-backed programs are also helping to expand access to premium intraocular lenses by improving reimbursement structures, streamlining import regulations, and boosting physician training

- As Middle East and Africa continues to prioritize precision eye care and value-based health outcomes, the Multifocal IOLs market is poised for sustained growth—driven by innovation, improved surgical precision, and a rising demand for spectacle-free vision among aging populations

Middle East and Africa Multifocal IOLs Market Dynamics

Driver

Growing Need Due to Rising Diagnosis Rates and Advancements in Genetic Research

- The increasing prevalence of cataract and presbyopia-related vision impairments across the Middle East and Africa, combined with rising awareness and improved diagnostic capabilities, is significantly driving the adoption of Multifocal Intraocular Lens (IOL) procedures. Countries such as the UAE, Saudi Arabia, and South Africa are investing in ophthalmic care infrastructure, enabling earlier diagnosis and broader access to advanced vision correction solutions

- For instance, in April 2024, Anavex Life Sciences reported positive progress in its Phase III clinical trial for Anavex 2-73 (blarcamesine), a small molecule therapy aimed at addressing visual impairments through sigma-1 receptor activation. Such pipeline advancements in ophthalmology are expected to support the growth of multifocal IOL adoption in the region during the forecast period

- There is growing interest in next-generation IOL technologies across the region, including light-adjustable lenses and extended-depth-of-focus (EDOF) lenses, as patients and healthcare providers increasingly seek personalized, long-term solutions over conventional vision correction methods

- Supportive government policies and public-private partnerships are helping to accelerate investment in ophthalmic care and surgical innovations across major markets in the region. These efforts are aimed at expanding the availability of advanced surgical interventions and ensuring broader population access to premium IOL solutions

- Collaborations between healthcare providers, international vision care organizations, and regional academic institutions are creating a favorable ecosystem for clinical research and training programs, which are vital to scaling the use of multifocal IOLs and improving long-term patient outcomes across the Middle East and Africa

Restraint/Challenge

Limited Infrastructure and Variability in Clinical Adoption

- The high treatment cost associated with advanced Multifocal IOLs—including premium lens implants, gene therapies, and customized diagnostics—poses a substantial barrier to widespread adoption, especially in Eastern Middle East and Africa and rural areas with limited healthcare funding

- Even when granted orphan drug status, these therapies typically involve lengthy and expensive development cycles with sophisticated manufacturing requirements, making them less affordable for national health systems with constrained budgets

- Moreover, specialized multidisciplinary care, which includes ophthalmologists, optometrists, genetic counselors, and rehabilitation therapists, is often concentrated in urban centers. This geographic disparity forces patients and families to travel long distances or endure long wait times for specialized services

- Another challenge is the lack of standardized protocols for fitting and managing advanced Multifocal IOLs. Due to limited clinical data and physician familiarity—especially in low-volume centers—the adoption of innovative solutions remains inconsistent

- To overcome these challenges, policy reforms, enhanced government funding, cross-border research collaboration, and the establishment of dedicated ophthalmology hubs across Middle East and Africa will be essential in expanding access and achieving sustainable growth in the Middle East and Africa Multifocal IOLs Market

Middle East and Africa Multifocal IOLs Market Scope

The Middle East and Africa Multifocal Intraocular Lens (IOLs) market is segmented on the basis of type, design, packaging, product type, brand, incision size, pupil dependence, power, material, adjustability, price range, flexibility, age group, gender, application, end user, and distribution channel.

- By Type

On the basis of type, the multifocal IOLs market is segmented into soft lens and rigid gas permeable (RGP or Hard) Lens. The soft lens segment dominated the market with the largest revenue share of 68.3% in 2024, owing to their high comfort, wide adoption, and ease of use.

The rigid gas permeable lens segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2032, due to increasing demand for sharper vision correction and long-lasting lens material.

- By Design

On the basis of design, the multifocal IOLs market is segmented into simultaneous vision lenses and segmented multifocal lenses. Simultaneous Vision Lenses led the segment with 61.9% share in 2024, favored for their ability to provide vision at multiple distances simultaneously.

The Segmented Multifocal Lenses segment is expected to witness the highest CAGR of 6.9% during 2025–2032, due to increased customization and suitability for post-cataract patients.

- By Packaging

On the basis of packaging, the multifocal IOLs market is segmented into packaging into Pack of 6, Pack of 30, and Others. The Pack of 6 segment held the largest market share at 47.6% in 2024, due to affordability and common use for short-term needs.

The Pack of 30 segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2032, as it supports long-term usage and bulk purchases by clinics.

- By Product Type

On the basis of product type, the multifocal IOLs market is segmented into Diffractive Multifocal IOLs, Hybrid Multifocal IOLs, and Refractive Multifocal IOLs. The Diffractive Multifocal IOLs segment led the market with 42.8% share in 2024, owing to consistent visual outcomes and wide clinical usage.

Hybrid Multifocal IOLs are expected to grow at the fastest CAGR of 9.3% from 2025 to 2032, driven by innovation and combining benefits of both diffractive and refractive technologies.

- By Brand

On the basis of brand, the multifocal IOLs market is segmented into Technis Symphony, Zeiss Trifocal, and Others. Zeiss Trifocal held the largest share at 35.1% in 2024, supported by strong brand trust, innovative lens design, and wide availability.

The Technis Symphony segment is forecasted to grow at the highest CAGR of 7.8% from 2025 to 2032, due to increasing preference in premium lens surgeries.

- By Incision Size

On the basis of incision size, the multifocal IOLs market is segmented into 1.8 MM, 2.2 MM, and Others. 2.2 MM held the dominant market share of 54.6% in 2024, as it balances ease of insertion and surgical control.

The 1.8 MM segment is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, due to a rising shift toward micro-incision cataract surgeries.

- By Pupil Dependence

On the basis of pupil dependence, the multifocal IOLs market is segmented into dependent and independent. Independent pupil lenses dominated the market with 63.2% share in 2024, valued for their effectiveness across variable light conditions.

The Dependent pupil segment is projected to grow at a CAGR of 6.7% from 2025 to 2032, as product refinements reduce their light condition limitations.

- By Power

On the basis of power, the multifocal IOLs market is segmented into low power and high power. Low Power lenses accounted for the largest share at 58.9% in 2024, suitable for patients with minimal refractive correction needs.

High Power lenses are expected to grow at the fastest CAGR of 7.6% from 2025 to 2032, due to rising demand in post-surgical and high-prescription use cases.

- By Material

On the basis of material, the multifocal IOLs market is segmented into Hydrophobic Acrylic, Silicon & Collamer, Lehfilcon-A, Somofilcon A, and Others. The Hydrophobic Acrylic segment held the largest market share of 49.5% in 2024, driven by its superior biocompatibility, high optical clarity, and a reduced risk of posterior capsule opacification (PCO), making it a preferred choice for long-term implantation.

The Somofilcon A segment is projected to witness the fastest CAGR of 8.8% from 2025 to 2032, supported by its enhanced oxygen permeability and comfort, particularly suitable for soft contact lens-based intraocular applications.

- By Adjustability

On the basis of adjustability, the multifocal IOLs market is segmented into light reduction and non reduction. The Non Reduction lenses segment dominated the market with a share of 66.4% in 2024, owing to their widespread adoption, consistent light transmission, and ease of manufacturing, which cater to standard post-cataract correction needs.

The Light Reduction lenses segment is expected to grow at the fastest CAGR of 9.1% from 2025 to 2032, fueled by innovations in photoadaptive materials that provide dynamic visual adjustments under different lighting conditions, improving patient comfort and outcomes.

- By Price Range

On the basis of price range, the multifocal IOLs market is segmented into Premium Lens and Standard Lens. The Premium Lens segment captured the largest revenue share of 59.7% in 2024, driven by increasing demand from aging populations seeking advanced visual outcomes and a rise in disposable incomes enabling patients to opt for premium surgical interventions.

The Standard Lens segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, due to growing access in public healthcare systems and greater affordability, particularly in emerging economies.

- By Flexibility

On the basis of flexibility, the market is segmented into Foldable IOLs and Rigid IOLs. The Foldable IOLs segment led with a market share of 73.5% in 2024, owing to their dominance in micro-incision cataract surgeries, which enable faster recovery and reduced postoperative complications.

The Rigid IOLs segment is anticipated to grow at a CAGR of 5.9% from 2025 to 2032, sustained by their limited use in specific ophthalmic procedures where higher structural rigidity is required.

- By Age Group

On the basis of age group, the market is segmented into Above 51 Years, 41–50 Years, and Below 40 Years. The Above 51 Years segment held the highest share of 67.2% in 2024, driven by a higher prevalence of age-related visual conditions such as cataract and presbyopia in the aging population.

The 41–50 Years segment is expected to grow at the fastest CAGR of 7.2% from 2025 to 2032, attributed to increasing early intervention through elective vision correction procedures and rising adoption of premium lens technologies in this age group.

- By Gender

On the basis of gender, the multifocal IOLs market is segmented into female and male. The female segment dominated the market with a share of 53.8% in 2024, due to higher life expectancy and increased healthcare engagement for routine eye exams and vision care.

The male segment is expected to grow at the fastest CAGR of 6.9% during the forecast period, supported by rising awareness and increased participation in elective vision correction among aging male demographics.

- By Application

On the basis of application, the market is segmented into Vision disorder, cataract, corneal disorder, and others. The cataract segment held the largest market share of 64.9% in 2024, as multifocal IOLs are predominantly used post-cataract surgery to restore vision across multiple distances, eliminating the need for glasses.

The corneal disorder segment is projected to grow at the fastest CAGR of 8.7% from 2025 to 2032, driven by a growing number of corrective corneal procedures and lens innovations tailored for corneal irregularities.

- By End User

On the basis of end user, the market is segmented into hospitals, ophthalmology clinics, eye research institutes, ambulatory surgery centers, and others. The Hospitals segment dominated the market with a share of 45.6% in 2024, supported by comprehensive surgical infrastructure and a higher volume of IOL implant procedures.

The ophthalmology clinics segment is expected to grow at the fastest CAGR of 9.2% from 2025 to 2032, due to increasing preference for specialized outpatient care and rising investments in clinic-based surgical suites.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment held the largest share of 48.1% in 2024, driven by centralized procurement of IOLs through public hospitals and government-funded institutions.

The retail sales segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2032, driven by the emergence of online optical retailers, increased patient awareness, and growing access to lens prescriptions and customization options.

Middle East and Africa Multifocal IOLs Market Regional Analysis

- The Middle East and Africa global multifocal intraocular lenses (IOLs) market has a revenue share of 30.7% in 2024, driven by the region's rapidly evolving ophthalmic care infrastructure, increasing prevalence of presbyopia and cataracts, and accelerated adoption of premium IOL technologies

- Supportive government initiatives, expanding private healthcare networks, and growing patient awareness are fostering robust demand for advanced vision correction procedures

- In addition, increased investments in eye care programs, partnerships with international manufacturers, and public-private collaborations to reduce surgical backlogs are contributing to the steady growth of multifocal IOL adoption in both urban and emerging healthcare zones

Saudi Arabia Middle East and Africa Multifocal IOLs Market Insight

The Saudi Arabia multifocal IOLs market led the Middle East and Africa multifocal intraocular lenses market with the largest revenue share of 33.8% in 2024. The market is fueled by the government’s Vision 2030 agenda, which prioritizes healthcare expansion, modernization of surgical services, and increased access to premium ophthalmic devices. The rising elderly population, growth in refractive surgeries, and the presence of leading eye hospitals and vision centers have made Saudi Arabia a key market for advanced IOL adoption. Continuous training for ophthalmic surgeons and collaborations with international device manufacturers are also propelling growth.

U.A.E. Middle East and Africa Multifocal IOLs Market Insight

The U.A.E. multifocal IOLs market is projected to witness the fastest CAGR of 11.7% from 2025 to 2032, supported by the country’s premium healthcare delivery model, high per capita spending on medical procedures, and a growing medical tourism industry. Cities such as Dubai and Abu Dhabi are becoming hubs for advanced eye surgeries, including multifocal IOL implants. The introduction of advanced trifocal and toric IOLs, along with strong regulatory support and increasing public awareness, is driving demand across both public and private eye care institutions.

South Africa Middle East and Africa Multifocal IOLs Market Insight

The South Africa multifocal IOLs market is among the most mature healthcare markets in sub-Saharan Africa, with a dual-tiered healthcare system that supports adoption of advanced ophthalmic devices. Multifocal IOLs in South Africa accounted for 17.2% of the MEA market share in 2024, backed by a growing number of private ophthalmology clinics and access to international product lines. Increasing cataract procedures among aging populations, especially in urban areas such as Johannesburg and Cape Town, and NGO-led outreach programs are supporting market expansion.

Egypt Middle East and Africa Multifocal IOLs Market Insight

The Egypt multifocal IOLs market multifocal intraocular lenses market is experiencing steady growth, driven by government initiatives to improve eye care services in public hospitals and clinics. With a rising elderly population and increasing cataract burden, Egypt’s demand for multifocal IOLs—particularly cost-effective and foldable options—is expanding. Partnerships with multinational companies and awareness campaigns run by ophthalmic associations are playing a key role in boosting surgical volumes and product availability in major cities such as Cairo and Alexandria.

Middle East and Africa Multifocal IOLs Market Share

The Middle East and Africa multifocal IOLs industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- Hoya Medical Singapore Pte. Ltd. (Singapore)

- Zeiss Group (Germany)

- Alcon Inc. (Switzerland)

- Rayner Group (U.K.)

- Lenstec, Inc. (U.S.)

- Aurolab (India)

- Excellent Hi-Care Pvt Ltd (India)

- Sav-Iol SA (Switzerland)

- Vsy Biotechnology GmbH (Germany)

- Hanita Lenses Ltd. (Israel)

- Care Group (India)

- Iolart (India)

- Omni Lens Pvt. Ltd. (India)

- Ophtec BV (Netherlands)

Latest Developments in Middle East and Africa Multifocal IOLs market

- In February 2025, Taysha Gene Therapies announced positive interim results from Part A of its Phase I/II clinical trial evaluating TSHA-102, an investigational gene therapy for Rett syndrome. The results showed no serious adverse events and dose-dependent clinical improvements, paving the way for a pivotal Part B study. The company is now working with global regulators to initiate expansion trials in pediatric populations and further validate its one-time gene therapy approach to address MECP2 mutations

- In June 2024, the ZEISS Group actively promotes eye health during Cataract Awareness Month by conducting educational campaigns and free eye screenings. Their initiatives aim to raise awareness about cataract prevention and treatment, emphasizing the importance of early detection and modern surgical solutions. ZEISS's efforts include partnerships with local healthcare providers to improve access to quality eye care and support communities in managing and preventing vision impairment

- In December 2024, Pfizer Inc. announced the successful completion of its acquisition of Seagen Inc., a Middle East and Africa biotechnology company known for discovering, developing, and commercializing transformative cancer medicines. Pfizer acquired all outstanding common stock of Seagen for USD 229 per share in cash, totalling In March 2023, The ZEISS Group design and innovate IOL and OVD Portfolio to address both patient needs and surgeon preferences. Combining innovation and precision, it offers a comprehensive selection of cataract consumables and implants, tailored for monofocal, toric, and refractive cataract surgeries

- In April 2024, Alcon, a leader in eye care dedicated to helping people see brilliantly, showcased approximately 100 company-supported and investigator-led data presentations demonstrating its latest innovative efforts aimed at optimizing patient outcomes at the 2024 American Society of Cataract and Refractive Surgery (ASCRS) Annual Meeting, April 5-8 in Boston. In addition, the company hosts multiple peer-to-peer symposia and in-booth demonstrations of its industry-leading implantable and devices, including the Clareon intraocular lens (IOL) portfolio, cloud-based SMARTCataract surgical planner, Hydrus Microstent and more

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.