Middle East And Africa Network Packet Broker Market

Market Size in USD Million

CAGR :

%

USD

36.64 Million

USD

60.63 Million

2024

2032

USD

36.64 Million

USD

60.63 Million

2024

2032

| 2025 –2032 | |

| USD 36.64 Million | |

| USD 60.63 Million | |

|

|

|

|

Middle East and Africa Network Packet Broker Market Size

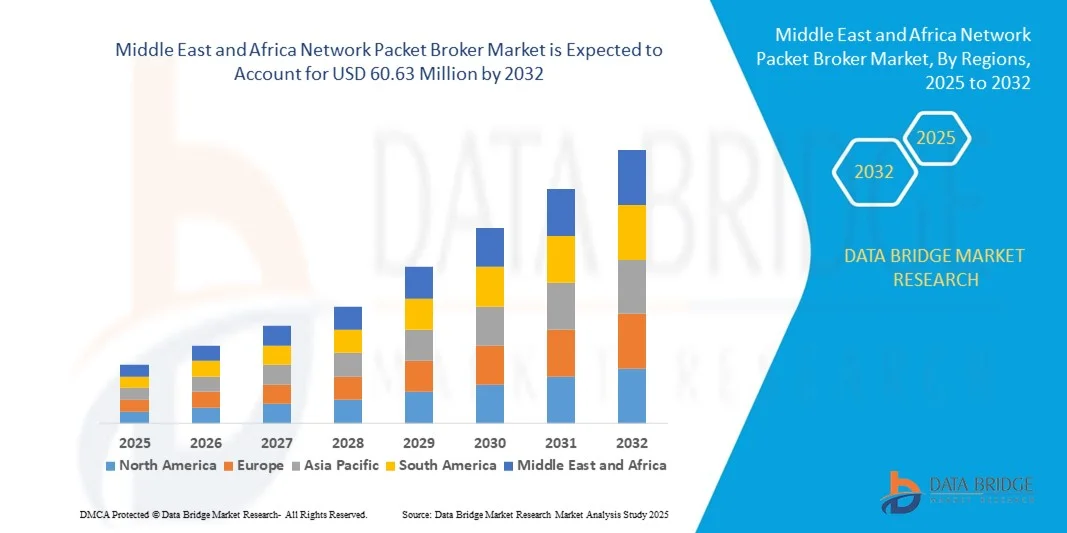

- The Middle East and Africa network packet broker market size was valued at USD 36.64 million in 2024 and is expected to reach USD 60.63 million by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for network visibility, rising adoption of cloud services, growing cyber threats, and the need for efficient data traffic management across enterprises and service providers

- The adoption of packet brokers is also supported by the expansion of cloud computing, virtualization, and heightened concerns around cybersecurity and compliance requirements

Middle East and Africa Network Packet Broker Market Analysis

- Increasing network complexity across hybrid and multi-cloud environments is driving demand for network packet brokers

- Rising cybersecurity threats and strict compliance requirements are boosting the adoption of packet brokers for enhanced monitoring and threat detection

- South Africa dominated the Middle East and Africa network packet broker market with the largest revenue share in 2024, driven by rapid digital infrastructure expansion, increasing enterprise IT adoption, and growing demand for network visibility and optimization

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa network packet broker market due to rapid digital transformation, increasing investments in smart city projects, and growing demand for network visibility and security solutions across enterprises and government organizations

- The 1 Gbps and 10 Gbps segment held the largest market revenue share in 2024, driven by the growing deployment of enterprise and SME networks requiring efficient traffic monitoring at moderate data rates. These packet brokers provide reliable performance for typical corporate and data center environments, enabling real-time analytics and traffic optimization

Report Scope and Middle East and Africa Network Packet Broker Market Segmentation

|

Attributes |

Middle East and Africa Network Packet Broker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Middle East and Africa Network Packet Broker Market Trends

Rise of Cloud-Integrated and AI-Driven Packet Brokers

- The increasing integration of AI and cloud-based capabilities in network packet brokers is transforming the Middle East and Africa market by enabling intelligent traffic management and real-time analytics. These advancements allow organizations to detect anomalies quickly, optimize network performance, and reduce downtime. This is particularly important for large enterprises and telecom providers managing complex networks across multiple sites

- The growing adoption of hybrid IT environments and remote network monitoring is accelerating the deployment of cloud-integrated packet brokers. These solutions are highly effective in regions where centralized IT teams need visibility over dispersed networks, ensuring proactive threat detection and efficient traffic routing. The trend is further supported by government initiatives promoting digital infrastructure development across the region

- The affordability and scalability of modern packet brokers are making them increasingly attractive for organizations of all sizes. Enterprises benefit from enhanced network visibility and simplified traffic management without significant capital investment or complex deployment requirements. This is driving wider adoption across sectors such as finance, telecommunications, and government services

- For instance, in 2023, several telecom operators in South Africa implemented AI-driven packet brokers to manage growing data traffic and improve service reliability. These deployments helped detect network congestion in real time, optimize bandwidth allocation, and reduce operational costs while enhancing end-user experience

- While cloud-integrated and AI-driven packet brokers are accelerating real-time network optimization, their impact depends on continued innovation, cybersecurity measures, and workforce training. Vendors must focus on localized solutions and deployment strategies to fully capture the growing demand in Middle East and Africa

Middle East and Africa Network Packet Broker Market Dynamics

Driver

Rising Demand for Real-Time Network Visibility and Enhanced Security

- Organizations in the Middle East and Africa are increasingly prioritizing network visibility to ensure uninterrupted operations and safeguard critical data. Growing cyber threats, regulatory compliance requirements, and increasing network complexity are accelerating the adoption of advanced packet brokers

- Enterprises and service providers recognize the operational and financial risks associated with undetected network issues, including downtime, data loss, and degraded customer experience. This awareness is prompting investment in real-time monitoring and traffic management solutions

- Regional governments and industry bodies are actively supporting network modernization programs. Initiatives promoting digital infrastructure, smart city projects, and enhanced IT governance are driving demand for packet brokers that provide granular visibility and intelligent traffic routing

- For instance, in 2022, several UAE-based banks and telecom providers upgraded their network infrastructures with AI-powered packet brokers to improve data monitoring, ensure compliance, and prevent cyber incidents, boosting market demand for advanced solutions across the region

- While growing awareness and institutional support are key drivers, challenges remain in integrating packet brokers into existing legacy networks and ensuring that organizations have the technical expertise to fully leverage these solutions

Restraint/Challenge

High Cost of Advanced Packet Brokers and Limited Skilled Workforce

- The high investment required for advanced network packet brokers, especially those with AI and cloud capabilities, limits adoption among small and mid-sized enterprises. These systems are often adopted only by large organizations with sufficient IT budgets, making cost a major barrier to widespread usage

- In many parts of the region, there is a shortage of trained network engineers capable of deploying, managing, and maintaining complex packet broker systems. This lack of technical expertise reduces operational efficiency and delays adoption

- Supply chain and infrastructure challenges further restrict market penetration in remote areas, where reliable connectivity and consistent hardware availability are not guaranteed. Organizations in these regions often rely on basic network monitoring, which is less effective for managing high-volume or complex traffic flows

- For instance, in 2023, network service providers in Sub-Saharan Africa reported that over 65% of smaller enterprises were unable to deploy modern packet brokers due to high costs and lack of trained personnel

- While technology continues to advance, addressing affordability, workforce training, and infrastructure limitations is critical. Vendors must focus on scalable, cost-effective solutions and skill-building initiatives to bridge the gap and unlock long-term market growth in the Middle East and Africa

Middle East and Africa Network Packet Broker Market Scope

The market is segmented on the basis of bandwidth, network set-up, security tools, and end user.

- By Bandwidth

On the basis of bandwidth, the market is segmented into 1 Gbps and 10 Gbps, 40 Gbps and 100 Gbps. The 1 Gbps and 10 Gbps segment held the largest market revenue share in 2024, driven by the growing deployment of enterprise and SME networks requiring efficient traffic monitoring at moderate data rates. These packet brokers provide reliable performance for typical corporate and data center environments, enabling real-time analytics and traffic optimization.

The 40 Gbps and 100 Gbps segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing data traffic in large enterprises, telecom operators, and data centers. High-bandwidth packet brokers are critical for managing heavy workloads, ensuring low latency, and supporting cloud migration and 5G-enabled network infrastructures.

- By Network Set-Up

Based on network set-up, the market is classified into On-Premise, Cloud, and Virtual. The On-Premise segment dominated the market in 2024 due to enterprise preference for direct control over network monitoring and security, particularly in government organizations and large service providers. On-premise deployment ensures data sovereignty, reduces dependency on third-party platforms, and facilitates integration with existing IT infrastructure.

The Cloud and Virtual segments is expected to witness the fastest growth from 2025 to 2032, fueled by the rising adoption of hybrid and distributed networks. Cloud-based packet brokers provide scalable, centralized management, while virtual deployments offer cost-effective, flexible solutions for organizations with dynamic network requirements.

- By Security Tools

The market is segmented into Passive and Active security tools. The Passive segment held the largest share in 2024, as it enables real-time traffic monitoring without interrupting network flows, making it ideal for routine network analysis and troubleshooting.

The Active segment is expected to witness the fastest growth from 2025 to 2032, driven by the need for advanced threat mitigation, deep packet inspection, and automated traffic management in high-performance networks. Active packet brokers are increasingly adopted in data centers, telecom networks, and cloud environments for proactive security and network optimization.

- By End User

On the basis of end user, the market is categorized into Enterprise, Service Providers, and Government Organizations. The Enterprise segment held the largest market revenue share in 2024, driven by the increasing need for network visibility, traffic optimization, and security compliance across corporate IT infrastructures.

The Service Providers and Government Organizations segments is expected to witness the fastest growth from 2025 to 2032, supported by large-scale network expansion, smart city initiatives, and digital transformation projects across the Middle East and Africa.

Middle East and Africa Network Packet Broker Market Regional Analysis

- South Africa dominated the Middle East and Africa network packet broker market with the largest revenue share in 2024, driven by rapid digital infrastructure expansion, increasing enterprise IT adoption, and growing demand for network visibility and optimization

- Organizations in the country are increasingly investing in advanced packet brokers to manage high-volume data traffic, ensure cybersecurity compliance, and support hybrid IT environment

- This widespread adoption is further supported by government initiatives promoting digital transformation, telecom modernization projects, and the rising need for intelligent network traffic monitoring across commercial, enterprise, and service provider networks

U.A.E. Network Packet Broker Market Insight

U.A.E. is expected to witness the fastest growth from 2025 to 2032. The growth is fueled by rapid adoption of AI-driven and cloud-integrated network packet brokers to enhance network performance and optimize traffic flow. Enterprises and service providers in the UAE are increasingly leveraging intelligent packet brokers for real-time analytics, proactive threat detection, and seamless integration with existing IT infrastructure. The expansion of smart city initiatives, 5G network rollouts, and government-led digitalization programs are key factors contributing to the accelerated deployment of packet brokers in the country.

Middle East and Africa Network Packet Broker Market Share

The Middle East and Africa network packet broker industry is primarily led by well-established companies, including:

- SCOPE Middle East (U.A.E.)

- NEOX Networks (U.A.E.)

- AmiViz (U.A.E.)

- CMC Networks (South Africa)

- WireFilter (U.A.E.)

- Al Bawaba (Jordan)

- Tarek Nour Communications (Egypt)

- IHS Towers (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Network Packet Broker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Network Packet Broker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Network Packet Broker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.