Middle East And Africa Newborn Screening Market

Market Size in USD Million

CAGR :

%

USD

42.86 Million

USD

122.18 Million

2025

2033

USD

42.86 Million

USD

122.18 Million

2025

2033

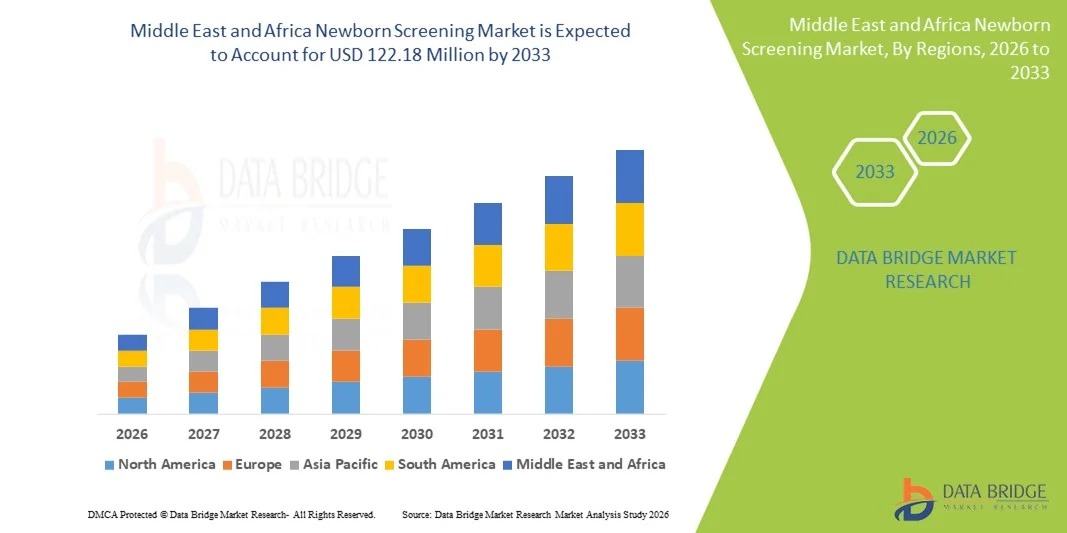

| 2026 –2033 | |

| USD 42.86 Million | |

| USD 122.18 Million | |

|

|

|

|

Middle East and Africa Newborn Screening Market Size

- The Middle East and Africa newborn screening market size was valued at USD 42.86 million in 2025 and is expected to reach USD 122.18 million by 2033, at a CAGR of 13.99% during the forecast period

- The market growth is largely fueled by increasing government initiatives, investments in healthcare infrastructure, and rising awareness of the importance of early disease detection in infants, leading to broader adoption of newborn screening programs across both Middle Eastern and African countries

- Furthermore, rising demand for reliable screening solutions including tandem mass spectrometry, pulse oximetry, and dry blood spot tests is driving the uptake of advanced newborn screening technologies in hospitals and diagnostic centers, contributing to market expansion

Middle East and Africa Newborn Screening Market Analysis

- Newborn screening, offering early detection of congenital and metabolic disorders in infants, is increasingly vital for improving neonatal health outcomes and reducing infant morbidity and mortality in both public and private healthcare settings due to its potential for timely intervention, cost savings, and integration into broader maternal and child health programs

- The escalating demand for newborn screening is primarily fueled by increasing government initiatives, growing awareness of neonatal health, rising prevalence of congenital disorders, and expanding adoption of advanced screening technologies such as tandem mass spectrometry and pulse oximetry

- Saudi Arabia dominated the MEA newborn screening market with the largest revenue share of 45.1% in 2025, characterized by well-established national screening programs, strong government funding, and a robust healthcare infrastructure, with significant adoption in both public hospitals and private clinics driven by early disease detection initiatives

- South Africa is expected to be the fastest growing country in the MEA newborn screening market during the forecast period due to expanding healthcare facilities, increasing urbanization, rising awareness about neonatal health, and growing adoption of advanced diagnostic technologies

- Dried blood spot testing segment dominated the newborn screening market with a market share of 52.4% in 2025, driven by its reliability, cost-effectiveness, and ease of use in detecting multiple disorders early, allowing for timely treatment interventions

Report Scope and Middle East and Africa Newborn Screening Market Segmentation

|

Attributes |

Middle East and Africa Newborn Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Newborn Screening Market Trends

Growing Use of Advanced AI and Machine Learning in Screening

- A significant and accelerating trend in the MEA newborn screening market is the increasing integration of artificial intelligence (AI) and machine learning algorithms into screening workflows to enhance detection accuracy and reduce false positives by analyzing complex clinical and genetic data

- For instance, emerging AI models are being explored to improve early identification of conditions such as retinopathy of prematurity by detecting subtle patterns in large newborn datasets that traditional methods may miss

- These intelligent systems help healthcare providers improve decision-making by enabling faster, more accurate screening outcomes and supporting personalized intervention strategies

- The adoption of AI‑enhanced tools complements existing technologies such as tandem mass spectrometry and pulse oximetry, making screening more efficient even in high‑birth‑rate settings across MEA

- This trend is reshaping expectations around newborn health diagnostics and encouraging investment in digital diagnostic infrastructure across the region

- The demand for smarter and more precise newborn screening technologies continues to grow as healthcare systems in MEA evolve and prioritize early detection of congenital and metabolic disorders

- Increasing mobile and cloud-based diagnostic platforms are allowing remote hospitals and clinics to access centralized screening analysis, expanding coverage even in rural areas

- Collaboration between academic institutions and healthcare providers for AI-based screening research is driving innovations in early detection and treatment planning

Middle East and Africa Newborn Screening Market Dynamics

Driver

Growing Need Due to Rising Infant Health Concerns and Government Support

- The increasing prevalence of congenital and inherited disorders, combined with rising infant mortality concerns, is a major driver for newborn screening programs across MEA

- For instance, Saudi Arabia, the UAE, and other regional governments are expanding newborn screening mandates and funding to enhance early detection and reduce long‑term healthcare burdens

- As awareness grows among health professionals and families about the benefits of early diagnosis, demand for comprehensive screening panels continues to rise

- Government initiatives aimed at improving maternal and child health infrastructure are further fueling the adoption of newborn screening services

- Enhanced funding for screening programs encourages the deployment of advanced technologies such as mass spectrometry and molecular assays in clinical settings

- This combination of healthcare investment and infant health priorities is propelling sustained market growth in MEA

- Rising public awareness campaigns and educational programs are improving parental participation and compliance with newborn screening guidelines

- Expansion of insurance coverage and reimbursement policies for newborn screening in several MEA countries is increasing accessibility and affordability

Restraint/Challenge

Limited Infrastructure and High Implementation Costs

- The newborn screening market in MEA faces significant challenges due to limited laboratory infrastructure and the high cost of establishing comprehensive screening programs in many countries

- For instance, advanced screening technologies such as tandem mass spectrometry and related automation systems require substantial capital investment and skilled personnel, which can be scarce in lower‑resource settings

- Many clinics and diagnostic centers lack the necessary facilities or stable power and transport logistics to reliably process and manage screening tests

- Variations in regulatory frameworks and screening protocols across different MEA countries further complicate standardization and program scale‑up

- Persistent infrastructure gaps can delay turnaround times and reduce the overall coverage and effectiveness of screening initiatives

- Addressing these structural constraints remains crucial to unlocking broader adoption of newborn screening across the region

- Limited trained workforce and technical expertise in neonatal diagnostics is slowing the adoption of advanced screening methods in some countries

- Logistical challenges in sample transportation and timely reporting of results can impact the effectiveness of early intervention programs

Middle East and Africa Newborn Screening Market Scope

The market is segmented on the basis of test type, product type, technology, disease type, and end user.

- By Test Type

On the basis of test type, the MEA newborn screening market is segmented into dried blood spot test, hearing screen test, and critical congenital heart diseases (CCHD) test. The Dried Blood Spot Test segment dominated the market with the largest market revenue share of 52.4% in 2025, driven by its reliability, cost-effectiveness, and ability to detect multiple metabolic and genetic disorders from a single sample. Hospitals and clinics widely adopt this method for its ease of collection and storage, allowing timely processing in centralized laboratories. In addition, its integration into national screening programs in countries such as Saudi Arabia and the UAE has further reinforced its dominance. The simplicity, low sample volume requirement, and established regulatory acceptance make it the preferred method for large-scale newborn screening across the region.

The Hearing Screen Test segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of neonatal hearing loss and rising initiatives for early intervention. Portable and automated hearing screening devices allow paediatric clinics and hospitals to conduct quick, non-invasive screenings at birth. Government-backed programs and NGO-supported awareness campaigns are driving adoption in both urban and semi-urban areas. In addition, the growing focus on improving developmental outcomes through early detection contributes to the strong uptake of hearing screening tests.

- By Product Type

On the basis of product type, the market is segmented into Instruments and reagents/assay kits. The Instruments segment dominated the market with the largest revenue share in 2025, driven by the requirement for sophisticated equipment such as mass spectrometers, automated analyzers, and pulse oximeters for reliable testing. Hospitals and large diagnostic centers invest heavily in instruments to maintain high throughput and accuracy. Advanced instruments also support multiple testing panels simultaneously, improving efficiency and reducing turnaround time. Their adoption is bolstered by government funding and inclusion in national screening programs, particularly in GCC countries. The presence of established vendors providing service, maintenance, and training also reinforces the segment’s leadership.

The Reagents and Assay Kits segment is expected to witness the fastest growth from 2026 to 2033, owing to the rising need for standardized testing materials compatible with both large laboratories and smaller clinics. Kits allow rapid deployment of screening panels and are crucial for regions with limited laboratory infrastructure. The flexibility to test specific disorders and the growing availability of ready-to-use kits make this segment increasingly attractive. Expansion of outreach programs and mobile testing units further supports the growth of reagent and kit usage across the MEA region.

- By Technology

On the basis of technology, the market is segmented into tandem mass spectrometry, hearing screen technology, pulse oximetry screening technology, immunoassays and enzymatic assays, electrophoresis, DNA-Based Assays. The Tandem Mass Spectrometry segment dominated the market in 2025 due to its capability to detect a wide range of metabolic and genetic disorders from a single sample, offering high sensitivity and specificity. Hospitals and central laboratories prefer this technology for large-scale national programs, and its proven clinical accuracy ensures regulatory compliance. The technology supports multiplex testing, reducing cost per test and improving early diagnosis. Continuous innovations and software enhancements also make tandem mass spectrometry increasingly efficient and reliable.

The Pulse Oximetry Screening Technology segment is expected to witness the fastest growth from 2026 to 2033, driven by rising awareness of critical congenital heart diseases (CCHDs) and the push for early detection of cardiac anomalies. Non-invasive and easy-to-administer pulse oximetry devices allow rapid bedside screening in hospitals and clinics. Their growing adoption is supported by governmental mandates and professional healthcare associations recommending routine neonatal cardiac screening. Integration with digital record systems and low-cost devices further contributes to adoption in both urban and semi-urban hospitals.

- By Disease Type

On the basis of disease type, the market is segmented into critical congenital heart diseases, newborn hearing loss, sickle cell disease, phenylketonuria (PKU), cystic fibrosis (CF), maple syrup urine disease, and others. The Phenylketonuria (PKU) segment dominated the market in 2025, owing to its inclusion in early screening panels across MEA countries and the severe impact of untreated PKU on infant development. The test’s reliability and cost-effectiveness make it widely adopted in national programs. Hospitals and clinics prioritize PKU screening due to established treatment protocols, early dietary interventions, and improved long-term outcomes. Government initiatives ensuring universal screening coverage have further strengthened the segment’s dominance.

The Sickle Cell Disease segment is expected to witness the fastest growth from 2026 to 2033, driven by the high prevalence of hemoglobinopathies in parts of Africa and growing government and NGO initiatives to reduce morbidity and mortality. Awareness campaigns and newborn-focused hematology programs are increasing early detection rates. Adoption of simple yet accurate screening kits suitable for both urban hospitals and rural clinics accelerates growth. Expansion of treatment and counseling services alongside screening programs further reinforces adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, paediatric clinics, and clinics. The Hospital segment dominated the market in 2025 with the largest revenue share, driven by the centralized infrastructure, availability of advanced technologies, and large patient volume allowing comprehensive newborn screening. Hospitals are integral to national screening programs and often act as referral centers for specialized testing. Their ability to manage multiple test types simultaneously and employ trained staff ensures reliability and accuracy. Collaboration with governmental programs and continuous investment in neonatal diagnostic infrastructure further strengthens hospitals’ market leadership.

The Paediatric Clinics segment is expected to witness the fastest growth from 2026 to 2033, owing to increasing outpatient screening initiatives, early detection programs, and the growing number of private paediatric practices. Clinics provide flexible, localized access to newborn screening, particularly in urban and semi-urban regions. Mobile testing units and portable equipment facilitate early screening even in areas without large hospital facilities. Rising parental awareness and demand for convenience drive rapid adoption in this segment.

Middle East and Africa Newborn Screening Market Regional Analysis

- Saudi Arabia dominated the MEA newborn screening market with the largest revenue share of 45.1% in 2025, characterized by well-established national screening programs, strong government funding, and a robust healthcare infrastructure, with significant adoption in both public hospitals and private clinics driven by early disease detection initiatives

- Hospitals and clinics in the country have widely adopted newborn screening due to its proven effectiveness in early detection of congenital and metabolic disorders, ensuring timely intervention and improved neonatal health outcomes

- The widespread adoption is further supported by increasing public awareness campaigns, government mandates for universal newborn screening, and a growing focus on reducing infant morbidity and mortality, establishing Saudi Arabia as the leading market for screening services in the region

The Saudi Arabia Newborn Screening Market Insight

The Saudi Arabia newborn screening market captured the largest revenue share of 45.1% in 2025 within MEA, fueled by well-established national programs and strong government support for maternal and child health. Hospitals and clinics widely adopt comprehensive screening panels to detect metabolic and genetic disorders early, ensuring timely intervention. The growing public awareness of neonatal health, coupled with mandatory screening policies, further drives adoption. Investments in advanced technologies, such as tandem mass spectrometry and pulse oximetry, enhance screening efficiency. In addition, partnerships with private diagnostic providers and NGOs are expanding program reach. The country’s healthcare infrastructure and high regulatory compliance make it the leading market in MEA.

South Africa Newborn Screening Market Insight

The South Africa newborn screening market is expected to grow at the fastest CAGR during the forecast period, driven by expanding healthcare infrastructure and rising awareness of congenital and metabolic disorders. Government-led initiatives and NGO-supported programs are increasing accessibility to screening services across both urban and semi-urban regions. Portable and cost-effective screening technologies allow early detection in hospitals, paediatric clinics, and community health centers. Public health campaigns educating parents on the importance of early diagnosis are further fueling adoption. The growing integration of digital health records facilitates tracking and follow-up for positive cases. Consequently, South Africa presents significant growth opportunities within MEA.

UAE Newborn Screening Market Insight

The UAE newborn screening market is gaining momentum due to robust investments in healthcare infrastructure and advanced diagnostic laboratories. Public-private partnerships and national health strategies are accelerating the adoption of comprehensive screening panels. Hospitals and specialized clinics are increasingly implementing automated screening technologies for improved accuracy. Awareness campaigns and government incentives promote widespread parental participation. The UAE’s focus on healthcare innovation and adoption of AI-assisted diagnostics is supporting market expansion. Strong regulatory frameworks ensure high-quality screening, making the UAE a key contributor to MEA market growth.

Egypt Newborn Screening Market Insight

The Egypt newborn screening market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising infant health concerns and the increasing prevalence of genetic disorders. Expansion of hospital-based screening services, along with the establishment of regional diagnostic centers, is supporting market development. Public health initiatives to improve early detection of conditions such as PKU, sickle cell disease, and congenital hypothyroidism are boosting adoption. Government policies to subsidize screening costs are increasing accessibility. Collaboration with international healthcare organizations ensures knowledge transfer and technology adoption. Egypt is emerging as a critical growth market in North Africa within MEA.

Middle East and Africa Newborn Screening Market Share

The Middle East and Africa Newborn Screening industry is primarily led by well-established companies, including:

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Waters Corporation (U.S.)

- Natus Medical Incorporated (U.S.)

- Trivitron Healthcare Pvt Ltd. (India)

- Thermo Fisher Scientific, Inc. (U.S.)

- PerkinElmer (U.S.)

- Medtronic (Ireland)

- Baebies, Inc. (U.S.)

- ZenTech s.a. (Belgium)

- F. Hoffmann-La Roche AG (Switzerland)

- Masimo Corporation (U.S.)

- GE Lifesciences (U.S.)

- AB SCIEX (U.S.)

- Demant A/S (Denmark)

- Chromsystems Instruments & Chemicals GmbH (Germany)

- Recipe Chemicals+Instruments (Germany)

- CENTOGENE AG (Germany)

- Luminex Corporation (U.S.)

- Revvity (U.S.)

What are the Recent Developments in Middle East and Africa Newborn Screening Market?

- In October 2025, King Faisal Specialist Hospital & Research Centre in Saudi Arabia joined the BeginNGS® Consortium to implement an advanced genome‑based newborn screening platform in the region, expanding access to early identification and intervention for genetic disorders

- In August 2025, the Department of Health Abu Dhabi launched one of the most comprehensive newborn genetic screening programmes, using whole‑genome sequencing to screen newborns for more than 815 treatable childhood genetic conditions, aiming to improve early detection and personalised care through genomics and AI

- In August 2025, Sidra Medicine in Qatar partnered with the BeginNGS® Consortium to launch a genome‑based newborn screening research program (NOOR‑QATAR), advancing detection of hundreds of treatable genetic diseases and setting a regional benchmark in precision newborn healthcare

- In July 2024, the UAE Ministry of Health and Prevention (MoHAP) launched National Newborn Screening Guidelines to standardize and enhance newborn screening procedures nationwide, improving early diagnosis of genetic, metabolic, hearing, and congenital conditions across public and private hospitals

- In December 2023, Qatar’s national newborn screening program celebrated 20 years of screening service success, having screened over 428,000 babies for metabolic and endocrine diseases with an expanded panel of conditions to improve early treatment outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.