Middle East And Africa Nut Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

23.59 Billion

USD

37.04 Billion

2024

2032

USD

23.59 Billion

USD

37.04 Billion

2024

2032

| 2025 –2032 | |

| USD 23.59 Billion | |

| USD 37.04 Billion | |

|

|

|

|

Nut Ingredients Market Size

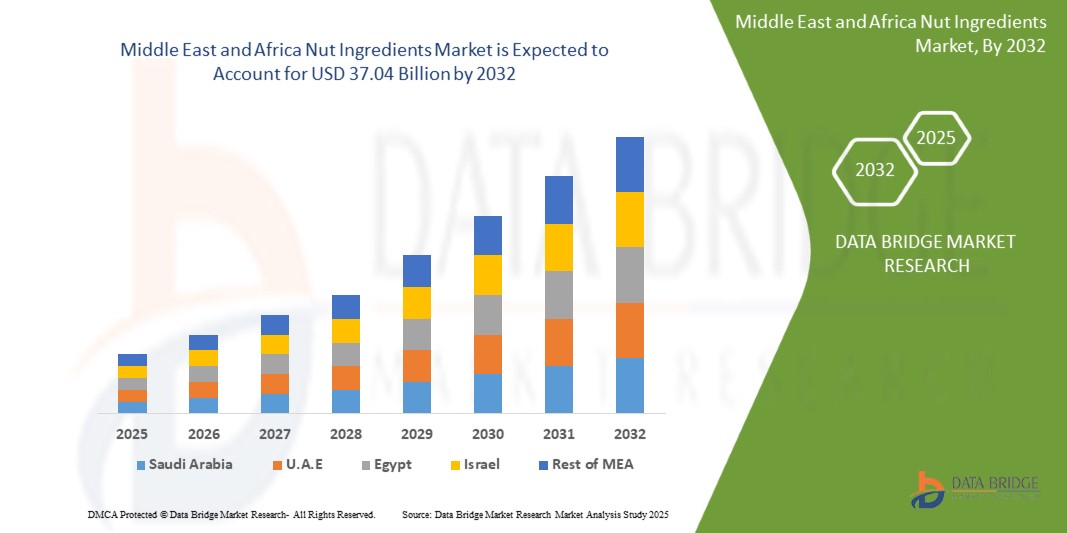

- The Middle East and Africa Nut Ingredients Market size was valued at USD 23.59 billion in 2024 and is expected to reach USD 37.04 billion by 2032, at a CAGR of 7.30% during the forecast period

- Rising health consciousness and growing adoption of plant-based diets are boosting demand for nut ingredients, especially almonds, cashews, and peanuts, across food, beverage, and snack applications in the region.

- Urbanization and expanding middle-class income levels are increasing consumer spending on functional and organic food products, driving the popularity and usage of premium nut-based ingredients in daily diets.

Nut Ingredients Market Analysis

- The market is experiencing steady expansion driven by increased application in bakery, dairy, and functional food sectors, supported by growing consumer awareness of nutrition-rich, clean-label food ingredients.

- Processed food manufacturers are increasingly incorporating nut ingredients for texture, taste, and protein enrichment, which is strengthening the region’s position in the global market and encouraging local sourcing.

- South Africa dominates the Middle East and Africa nut ingredients market with over 28% share in 2025, due to advanced food processing facilities, large urban population, and high nut consumption.

- The GCC region is the fastest growing, with a CAGR of over 8.5%, driven by a shift toward premium health foods, government nutrition initiatives, and rising demand for functional ingredients.

- The bakery segment leads in 2025 with a 34% market share, fueled by high demand for almond flour, nut toppings, and nut-based fillings in pastries, biscuits, and bread products.

Report Scope and Nut Ingredients Market Segmentation

|

Attributes |

Nut Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nut Ingredients Market Trends

“shifting toward clean-label and minimally processed products”

- The nut ingredients market in the Middle East and Africa is shifting toward clean-label and minimally processed products. Consumers are looking for transparency in sourcing and production, pushing manufacturers to adopt ethical sourcing and organic certifications.

- Plant-based innovation is a strong trend. Food and beverage companies are leveraging nut-based products like almond milk, cashew cheese, and nut protein powders to meet vegan and lactose-intolerant consumer needs, particularly in urban centers.

- There is increased demand for functional snacking. Nut bars, protein mixes, and fortified granolas made with nut ingredients are trending due to rising awareness of fitness and balanced diets among young adults.

- E-commerce and online health stores are growing, allowing consumers to access niche nut ingredient products across different regions, especially in countries like the UAE and Saudi Arabia.

For instance

- In February 2024, UAE-based BAKEMART launched a new almond protein bread range to cater to rising keto and paleo diet trends in the Gulf, illustrating market responsiveness to global food trends.

Nut Ingredients Market Dynamics

Driver

“The rising popularity of paleo diets and healthy eating”

- The rising popularity of paleo diets and health-conscious lifestyles is fueling the rapid growth of the nut market in the Middle East and Africa. Nuts, being rich in protein, healthy fats, and essential nutrients, align well with paleo and clean-eating trends, making them a dietary staple for many consumers in the region.

- In addition to paleo diets, the growing adoption of vegan and plant-based food habits is driving demand for nuts. As a natural source of plant protein and energy, nuts are widely used in vegan meals, snacks, and dairy alternatives. This shift supports consistent market growth.

- Rising awareness of the health benefits of nuts—such as improved heart health and weight management—has influenced consumer buying behavior. More people are seeking nutritious, convenient snack options, contributing to increased nut sales.

- The younger generation’s preference for organic and natural products is expanding the target market. This trend encourages producers to offer cleaner, sustainable nut-based options.

For Instance

- In March 2024, Al Rifai, a leading Middle Eastern nut brand, launched a new line of organic, paleo-friendly nut mixes in the UAE. This move responded to growing consumer demand for clean-label, healthy snacks driven by paleo and vegan diet trends across the Middle East and Africa.

Restraint/Challenge

“Insufficient raw materials and price violations may cause the market to collapse”

- The nuts market in the Middle East and Africa faces significant challenges, despite the growing demand driven by healthier eating trends. One of the major threats is the shortage of raw materials, which affects the consistent supply of nuts such as almonds, cashews, and groundnuts.

- Health risks associated with nut consumption also pose a serious limitation to market growth. While nuts are nutrient-rich, they are also common allergens. Severe allergic reactions to tree nuts and peanuts are life-threatening and becoming increasingly prevalent. Additionally, overconsumption may cause negative side effects such as digestive discomfort, including diarrhea and abdominal pain, discouraging some consumers from regular intake.

- The report offers comprehensive insights into various aspects of the nuts market. It includes recent developments, shifts in trade regulations, and in-depth analysis of import-export trends and production dynamics. This helps businesses understand where opportunities lie, especially in emerging revenue pockets and regions with growing demand.

- Moreover, the report highlights innovations and strategic moves like product launches, technological advancements, and geographic expansions by key market players. It evaluates market share, product approvals, and niche applications that are gaining traction.

Nut Ingredients Market Scope

The market is segmented on the basis of Category, type, coating type, form, end user, distribution channel.

- By Category

On the basis of Category, the market is segmented into Conventional, Organic. In 2025, the Conventional segment dominates the market with a 72% share, due to its wide availability, lower cost, and strong demand across mass-market food and beverage applications in the region.

the Organic segment is the fastest growing with a CAGR of 9.2%, driven by rising health awareness, clean-label demand, and increasing preference for chemical-free, sustainably sourced products.

- By Type

On the basis of Type the market is segmented into Almonds, Brazil Nuts, Cashews, Chestnuts, Hazelnuts, Hickory Nuts, Macadamia Nuts, Pecans, Pine Nuts, Pistachios, Walnuts, Peanuts, and Others. Almonds dominate the market in 2025 due to their widespread use in bakery, snacks, and dairy alternatives, driven by high protein content, versatility, and strong consumer preference across the region.

Cashews are the fastest growing segment in 2025, fueled by rising demand in vegan and dairy-free products, especially cashew milk and cheese, and increased processing investments in African cashew-producing countries.

- By Coating Type

On the basis of Coating Type the market is segmented into Coated, Uncoated. Uncoated segment dominates in 2025 due to high demand for raw and minimally processed nut ingredients in health foods, bakery, and dairy alternatives, preferred by clean-label and health-conscious consumers.

Coated segment is the fastest growing in 2025, driven by increasing popularity of flavored and seasoned nut snacks among urban consumers seeking convenient, indulgent, and protein-rich snacking options in retail channels.

- By Form

On the basis of Form the market is segmented into Whole, Diced/Cut, Roasted, Granular. Whole nuts dominate the market in 2025 due to their wide use in snacks, trail mixes, and direct consumption, supported by consumer preference for natural, unprocessed, and visually appealing products.

Roasted nuts are the fastest growing segment in 2025, driven by rising demand for ready-to-eat, flavored, and premium snacking options, particularly in urban retail and convenience food markets.

- By End user

On the basis of End user the market is segmented into Household/Retail, Food Service Sector, Café, Catering, Bakery, Others. Household/Retail segment dominates in 2025 due to increasing at-home consumption, rising health awareness, and growing demand for packaged nuts and nut-based ingredients through supermarkets and online retail platforms.

Bakery segment is the fastest growing in 2025, driven by rising demand for almond flour, nut toppings, and fillings, as consumers seek healthier, protein-rich, and artisanal baked goods across urban markets.

- By Distribution Channel

On the basis of distribution channel the market is segmented into Store Based Retailers, Non-Store Retailers. Store-Based Retailers dominate in 2025 due to their extensive presence, consumer trust, and convenience, especially supermarkets and hypermarkets offering a wide range of nut products across urban and suburban areas.

Non-Store Retailers are the fastest growing in 2025, with a strong CAGR, driven by increasing e-commerce adoption, digital health food platforms, and consumer preference for home delivery and product variety online.

Nut Ingredients Market Regional Analysis

- South Africa dominates the Middle East and Africa nut ingredients market with over 28% share in 2025, due to advanced food processing facilities, large urban population, and high nut consumption.

- The well-established food processing infrastructure, enabling efficient production and innovation in nut-based products that meet rising consumer demand across health, bakery, and functional food sectors.

- A large urban population with higher disposable income drives strong retail and household consumption of nuts. Additionally, robust distribution networks and retail chains enhance product accessibility and regional market penetration.

Saudi Arabia Is the fastest growing region in Nut Ingredients Market Insight

Saudi Arabia is the fastest-growing region in the Middle East and Africa nut ingredients market, driven by rising health awareness, growing plant-based diet adoption, and government initiatives promoting food security and healthier lifestyles, boosting demand for nut-based products.

Nut Ingredients Market Share

The Nut Ingredients industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- ADM (U.S.)

- Dupont (U.S.)

- Evonik (Germany)

- BASF SE(Germany)

- DSM (Netherlands)

- Ajinomoto Co., Inc. (Japan)

- Novozymes (Denmark)

- Chr. Hansen Holding A/S (Denmark)

- TEGASA (Spain)

- Nutreco (Netherlands)

- Kemin Industries Inc. (U.S.)

- Adisseo (France)

- Alltech (U.S.)

- Palital Feed Additives B.V. (Netherlands)

- Centafarm SRL (Italy)

- Bentoli (U.S.)

- NUQO Feed Additives (France)

- Novus International (U.S.)

Latest Developments in Middle East and Africa Nut Ingredients Market

- In 2020, Roasted almond, Brazil nut, walnut, and unsalted roasted cashew were added by Seeberger to its line of organic nut snacks.

- In 2020, Kraft-Heinz unveiled Pop & Pour nuts, enabling snackers to pop open, pour, eat, and repeat. The business wanted to build a snack shop that could handle the busy schedules of its customers.

- In 2020, Fuego, Flare, and Smokin' Lime, the three brand-new Takis Hot Nuts flavors, were released. Using double crunch technology, Takis' distinct spicy intensity is added to each bite of peanut-filled candy, providing customers with new snacking options.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Nut Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Nut Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Nut Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.