Middle East And Africa Oligonucleotides Synthesis Market

Market Size in USD Billion

CAGR :

%

USD

92.50 Billion

USD

269.47 Billion

2025

2033

USD

92.50 Billion

USD

269.47 Billion

2025

2033

| 2026 –2033 | |

| USD 92.50 Billion | |

| USD 269.47 Billion | |

|

|

|

|

Middle East and Africa Oligonucleotides Synthesis Market Size

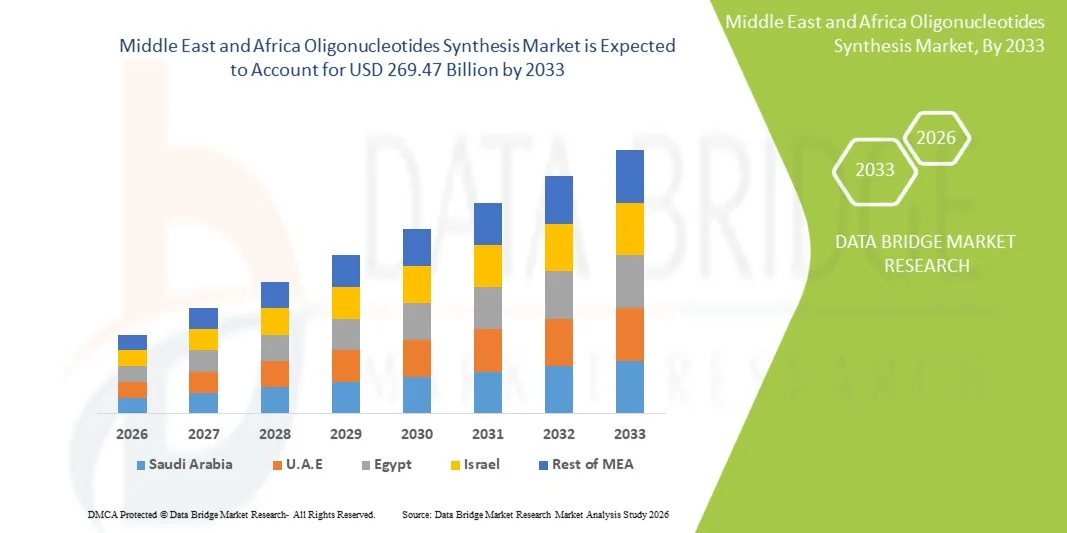

- The Middle East and Africa Oligonucleotides Synthesis Market size was valued at USD 92.50 billion in 2025 and is expected to reach USD 269.47 billion by 2033, at a CAGR of 14.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced genetic research tools and rapid technological progress in biotechnology, pharmaceuticals, and synthetic biology, leading to accelerated development in genomics, molecular diagnostics, and precision medicine across both academic and commercial settings

- Furthermore, rising demand for customized, high-purity oligonucleotides for applications such as PCR, gene synthesis, drug development, and next-generation sequencing (NGS) is establishing oligonucleotide synthesis as a critical component of modern life sciences workflows. These converging factors are accelerating the uptake of oligonucleotide synthesis solutions, thereby significantly boosting the industry's growth

Middle East and Africa Oligonucleotides Synthesis Market Analysis

- Oligonucleotides, which serve as essential tools for genetic analysis, molecular diagnostics, therapeutics, and synthetic biology, are increasingly vital components in modern biotechnology and pharmaceutical research, driven by rising applications in PCR, NGS, gene editing, antisense therapies, and personalized medicine

- The escalating demand for synthetic DNA and RNA molecules is primarily fueled by expanding genomics programs, increasing drug discovery activities, advancements in life sciences research, and a rising preference for high-purity, customized oligonucleotides to support complex biological workflows

- Saudi Arabia dominated the Middle East and Africa Oligonucleotides Synthesis Market with the largest revenue share of 36.2% in 2025, supported by substantial investments in pharmaceutical manufacturing, biotechnology infrastructure, and analytical testing capabilities, along with the presence of key regional and international market players driving innovation and adoption of high-performance oligonucleotide synthesis solutions

- U.A.E. is expected to be the fastest-growing region in the Middle East and Africa Oligonucleotides Synthesis Market during the forecast period, driven by increasing life sciences R&D initiatives, expanding pharmaceutical exports, rising laboratory modernization, and growing adoption of high-throughput analytical and synthesis technologies in both academic and industrial settings

- The Custom Oligos segment dominated the largest market revenue share of 67.4% in 2025, primarily due to the increasing need for personalized sequences in research, diagnostic assay development, gene editing, and therapeutic R&D

Report Scope and Middle East and Africa Oligonucleotides Synthesis Market Segmentation

|

Attributes |

Middle East and Africa Oligonucleotides Synthesis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Oligonucleotides Synthesis Market Trends

“Increasing Adoption of Automated & High-Throughput Synthesis Platforms”

- A major global trend in the Middle East and Africa Oligonucleotides Synthesis Market is the accelerating transition toward automated and high-throughput synthesis technologies that support large-scale production, high accuracy, and shorter turnaround times for therapeutic and research applications

- For instance, in March 2025, Thermo Fisher Scientific expanded its global oligo manufacturing capacity by introducing next-generation automated synthesis platforms at its U.S. and Singapore facilities to meet rising global demand for RNA and DNA oligonucleotides

- Increasing use of oligos in mRNA vaccine development, CRISPR genome editing, antisense therapies, and qPCR-based diagnostics continues to drive heavy investment in highly automated, digitally integrated systems worldwide

- The trend is further supported by the need for precise, contamination-free, and GMP-compliant manufacturing processes as more oligonucleotide-based therapeutics enter clinical pipelines across the U.S., Europe, and Asia

- Contract manufacturing organizations (CMOs) are also adopting high-capacity and fully automated synthesizers to serve multinational pharmaceutical companies developing RNA therapeutics and gene-modifying treatment

- This global move toward scalable and automated platforms is reshaping production standards, driving innovation, and improving overall efficiency in oligonucleotide manufacturing worldwide

Middle East and Africa Oligonucleotides Synthesis Market Dynamics

Driver

“Rising Demand Driven by Growth in Genetic Research, Precision Medicine, and Nucleic Acid Therapeutics”

- The global rise in genetic disorders, infectious diseases, and chronic illness has intensified demand for oligonucleotides, which play a central role in diagnostics, gene editing, and therapeutic development

- For instance, in April 2025, Moderna expanded its global R&D investment to advance next-generation RNA-based therapies, significantly increasing the requirement for high-purity custom oligos used in mRNA vaccine optimization and antisense research

- Growing adoption of CRISPR technologies, targeted gene-silencing therapies (siRNA, antisense), and molecular diagnostic platforms continues to fuel global consumption of specialized primers, probes, and modified oligos

- Expanding genomic sequencing efforts across the U.S., India, China, and Middle East and Africa have substantially increased the need for large volumes of PCR and qPCR oligonucleotides in clinical and research laboratories

- The increasing collaboration between pharmaceutical companies, research institutions, CROs, and CMOs is creating a broader global ecosystem that depends heavily on custom and GMP-grade oligonucleotide synthesis

- Advancements in synthesis chemistry, improved customization options, and better delivery technologies are further accelerating market growth in both developed and emerging regions

Restraint/Challenge

“High Manufacturing Costs, Supply Chain Challenges, and Stringent Quality Compliance”

- High costs associated with synthesis reagents, specialty phosphoramidites, high-grade purification systems, and GMP-level production standards remain a major global restraint for manufacturers and research institutions

- For instance, in 2024, multiple global biotech companies reported delays in therapeutic oligonucleotide development due to rising prices of key raw materials and extended lead times for high-purity reagents sourced from international suppliers

- Oligonucleotide therapeutics require stringent regulatory compliance, including extensive impurity profiling, stability assessments, and precision-based analytical validation, which increases operational complexity

- The global supply chain for high-purity synthesis reagents is vulnerable to disruptions—such as shortages of phosphoramidites and chromatography-grade solvents—leading to delays in production cycles

- Skilled personnel shortages in advanced synthesis, purification, and quality-control workflows pose additional challenges, particularly in emerging markets

- Addressing these constraints will require the development of cost-efficient synthesis technologies, stronger raw-material supply networks, and enhanced quality-management systems across global manufacturing sites

Middle East and Africa Oligonucleotides Synthesis Market Scope

The market is segmented on the basis of product type, type, application, and end user.

• By Product Type

On the basis of product type, the Middle East and Africa Oligonucleotides Synthesis Market is segmented into Reagents & Consumables, Equipment, Synthesized Oligonucleotides, and Oligonucleotide-based Drugs. The Reagents & Consumables segment dominated the largest market revenue share of 42.8% in 2025, driven by the recurring need for high-quality nucleotides, phosphoramidites, enzymes, and purification kits used in both large-scale and small-scale synthesis workflows. Growing research in genomics, rising demand for custom oligos, and increased adoption of molecular diagnostic tools continue to push the consumption volume of these reagents. Their frequent re-purchasing nature ensures stable revenue generation for suppliers, unlike equipment that is purchased less frequently. The rise in therapeutic oligo development pipelines also significantly boosts the use of reagents for synthesis, modification, and scale-up. Additionally, the growing trend of outsourcing oligo synthesis by biotechnology companies strengthens demand for consumables across contract manufacturing setups, further supporting dominance. Increasing innovation in reagent purity grades, automation-ready kits, and high-efficiency synthesis chemicals contributes to consistent market leadership of this segment worldwide.

The Oligonucleotide-based Drugs segment is expected to witness the fastest CAGR of 18.6% from 2026 to 2033, driven by the expanding clinical pipeline of antisense oligonucleotides, siRNA therapies, aptamers, and mRNA-stabilizing oligos. An increasing number of regulatory approvals for oligo therapeutics addressing genetic disorders, cancers, rare diseases, and metabolic disorders is accelerating global adoption. The success of nucleic-acid-based drugs such as RNA therapies has boosted investment into next-generation oligo drugs. Pharma companies are rapidly shifting toward precision-medicine approaches, driving high-value demand for therapeutic oligos with complex chemical modifications. Advances in delivery technologies, including lipid nanoparticles (LNPs) and conjugation chemistries, further support growth. Expanded R&D budgets, favorable regulatory pathways, and rising venture capital funding are strengthening this segment’s position as the fastest-growing category over the forecast period.

• By Type

On the basis of type, the Middle East and Africa Oligonucleotides Synthesis Market is segmented into Custom Oligos and Predesigned Oligos. The Custom Oligos segment dominated the largest market revenue share of 67.4% in 2025, primarily due to the increasing need for personalized sequences in research, diagnostic assay development, gene editing, and therapeutic R&D. Scientists require highly specific sequences for PCR, sequencing, molecular cloning, gene silencing, and CRISPR applications, driving strong reliance on custom synthesis providers. The capability to modify length, purity level, labeling, backbone chemistry, and functional groups significantly enhances utility across applications. Growing demand from universities, biotech firms, CROs, and pharmaceutical companies boosts this segment. Advancements in automated synthesis platforms and improved turnaround times further strengthen dominance. Increased use of custom oligos in next-generation sequencing (NGS), synthetic biology, and COVID-era diagnostic assay development continues to reinforce market leadership.

The Predesigned Oligos segment is expected to witness the fastest CAGR of 14.9% from 2026 to 2033, driven by rising use in standardized qPCR assays, genetic testing kits, pathogen detection panels, and off-the-shelf research workflows. Their availability in ready-to-use formats significantly reduces design time for researchers and diagnostic labs. Growing use in oncology testing, infectious disease diagnostics, and bioinformatics-based genomics panels ensures rapid adoption. Increasing preference for validated sequences with proven assay performance also accelerates demand. Growth in personalized medicine and companion diagnostics is boosting use of catalog-based primers and probes. As more diagnostics companies launch targeted gene testing kits, predesigned oligos continue to gain traction as a convenient and reliable solution.

• By Application

On the basis of application, the Middle East and Africa Oligonucleotides Synthesis Market is segmented into Research, Therapeutic, Diagnostic, and Others. The Research segment held the largest market revenue share of 49.6% in 2025, driven by extensive use of synthesized oligos in PCR, qPCR, sequencing, mutagenesis, cloning, and gene-editing experiments. Continuous growth in genomics, transcriptomics, and synthetic biology fields boosts demand. Academic and industry research institutions rely heavily on oligos for molecular assays, functional gene studies, pathway analysis, and CRISPR applications. Availability of high-purity and modified oligos accelerates adoption across basic and applied research. Rising funding from governments and private entities for life science R&D ensures sustained demand. Increasing use of custom DNA/RNA oligos in drug-discovery programs and laboratory automation also supports segment dominance globally.

The Therapeutic segment is expected to witness the fastest CAGR of 19.4% from 2026 to 2033, driven by rapid advancements in RNA-based treatments, antisense oligo therapies, and gene-silencing drugs. Multiple pharmaceutical companies are expanding clinical trials involving siRNA, miRNA modulators, aptamers, and ASOs. Increasing approvals for nucleic-acid-based therapeutics addressing diseases such as spinal muscular atrophy, Duchenne muscular dystrophy, and rare genetic disorders continue to fuel market growth. Advances in delivery platforms, such as LNPs and ligand conjugation, make therapeutic oligos more effective and safer. Strong corporate investments, partnerships, and licensing agreements are rapidly accelerating pipeline expansion, positioning this segment as the fastest-growing category.

• By End-User

On the basis of end-user, the Middle East and Africa Oligonucleotides Synthesis Market is segmented into Biotechnology & Pharmaceutical Companies, Research Institutes, Diagnostic Laboratories, and Others. The Biotechnology & Pharmaceutical Companies segment dominated the largest market revenue share of 46.3% in 2025, driven by growing use of oligos in drug discovery, preclinical testing, gene modulation studies, and therapeutic development. These companies rely heavily on oligo synthesis for antisense technologies, siRNA platforms, targeted gene regulation, and vaccine research. Expansion of biologics and RNA therapeutic pipelines further accelerates demand. The need for highly purified, modified, and GMP-grade oligos for clinical applications strengthens their leading position. Increasing collaboration with CROs and CDMOs for large-scale manufacturing also contributes to dominance. Investments in precision medicine and molecular-targeted therapies continue to fuel demand across global biopharma organizations.

The Diagnostic Laboratories segment is expected to witness the fastest CAGR of 15.8% from 2026 to 2033, driven by widespread adoption of qPCR assays, molecular panels, infectious disease diagnostics, genotyping tests, and oncology biomarker testing. Diagnostic labs require large volumes of reliable primers, probes, and labeled oligos for routine testing. The rise of personalized medicine and increased use of liquid biopsies further supports this demand. Growing focus on early disease detection, especially for cancer and genetic disorders, accelerates the use of diagnostic oligos. The expansion of decentralized testing, point-of-care diagnostics, and multiplex molecular assays positions diagnostic laboratories as the fastest-growing end-user segment.

Middle East and Africa Oligonucleotides Synthesis Market Regional Analysis

- Middle East and Africa dominated the Middle East and Africa Oligonucleotides Synthesis Market with the largest revenue share in 2025

- Primarily driven by strong advancements in biotechnology, robust genomic research capabilities, and expanding applications of synthetic oligos in diagnostics and therapeutics

- The region benefits from substantial public and private investments in molecular biology, personalized medicine, and drug discovery programs, further fueling market growth and adoption of high-throughput oligonucleotide synthesis technologies

Saudi Arabia Middle East and Africa Oligonucleotides Synthesis Market Insight

Saudi Arabia Middle East and Africa Oligonucleotides Synthesis Market dominated the Middle East and Africa Oligonucleotides Synthesis Market with the largest revenue share of 36.2% in 2025, supported by substantial investments in pharmaceutical manufacturing, biotechnology infrastructure, and analytical testing capabilities, along with the presence of key regional and international market players driving innovation and adoption of high-performance oligonucleotide synthesis solutions. Government-backed genomics initiatives, research funding in gene therapy and molecular diagnostics, and the expansion of local biotech companies are further strengthening the country’s leading position in the MEA region.

U.A.E. Middle East and Africa Oligonucleotides Synthesis Market Insight

U.A.E. Middle East and Africa Oligonucleotides Synthesis Market is expected to be the fastest-growing region in the Middle East and Africa Oligonucleotides Synthesis Market during the forecast period, driven by increasing life sciences R&D initiatives, expanding pharmaceutical exports, rising laboratory modernization, and growing adoption of high-throughput analytical and synthesis technologies in both academic and industrial settings. The country’s strategic investments in precision medicine, genomics research, and public-private partnerships in biotech are accelerating demand for synthetic oligos across therapeutics, diagnostics, and molecular biology research.

Middle East and Africa Oligonucleotides Synthesis Market Share

The Oligonucleotides Synthesis industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Integrated DNA Technologies (U.S.)

- Merck KGaA (Germany)

- Agilent Technologies (U.S.)

- Eurofins Genomics (Luxembourg )

- LGC Biosearch Technologies (U.K.)

- GenScript Biotech Corporation (China)

- TriLink BioTechnologies (U.S.)

- Bio‑Synthesis, Inc. (U.S.)

- Twist Bioscience (U.S.)

- GE Healthcare (U.S.)

- Azenta Life Sciences (U.S.)

- ATDBio Ltd. (U.K.)

- Microsynth AG (Switzerland)

- Macrogen Inc. (South Korea)

- Ajinomoto Bio‑Pharma Services (Japan)

- Bio‑Rad Laboratories, Inc. (U.S.)

Latest Developments in Middle East and Africa Oligonucleotides Synthesis Market

- In May 2024, Molecular Assemblies introduced its licensing program for Fully Enzymatic Synthesis (FES ) technology, enabling onsite synthesis of long, high-purity DNA chains. This development provides scalable and more efficient oligonucleotide production solutions for therapeutic and diagnostic applications

- In November 2023, Twist Bioscience launched its new “Express Genes” service, offering rapid turnaround for synthetic genes and oligonucleotides within 5–7 business days. This launch strengthens the company’s portfolio in high-throughput gene synthesis and accelerates research and therapeutic development globally

- In May 2023, GenScript Biotech Corporation expanded its main manufacturing facility in Zhenjiang, China, enhancing its global capacity to supply high-quality oligonucleotides and peptides for research, preclinical, and therapeutic applications, addressing the surging demand worldwide

- In January 2022, Integrated DNA Technologies (IDT) opened a new production site in Coralville, Iowa, U.S., increasing its ability to manufacture high-purity oligonucleotides for global research and clinical applications

- In August 2021, LGC Biosearch Technologies launched a new automated oligonucleotide synthesis platform, designed to improve throughput and accuracy for custom oligos, supporting growing demand from biotech and pharmaceutical companies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.