Middle East And Africa Optical Fiber Components Market

Market Size in USD Billion

CAGR :

%

USD

28.10 Billion

USD

58.65 Billion

2024

2032

USD

28.10 Billion

USD

58.65 Billion

2024

2032

| 2025 –2032 | |

| USD 28.10 Billion | |

| USD 58.65 Billion | |

|

|

|

|

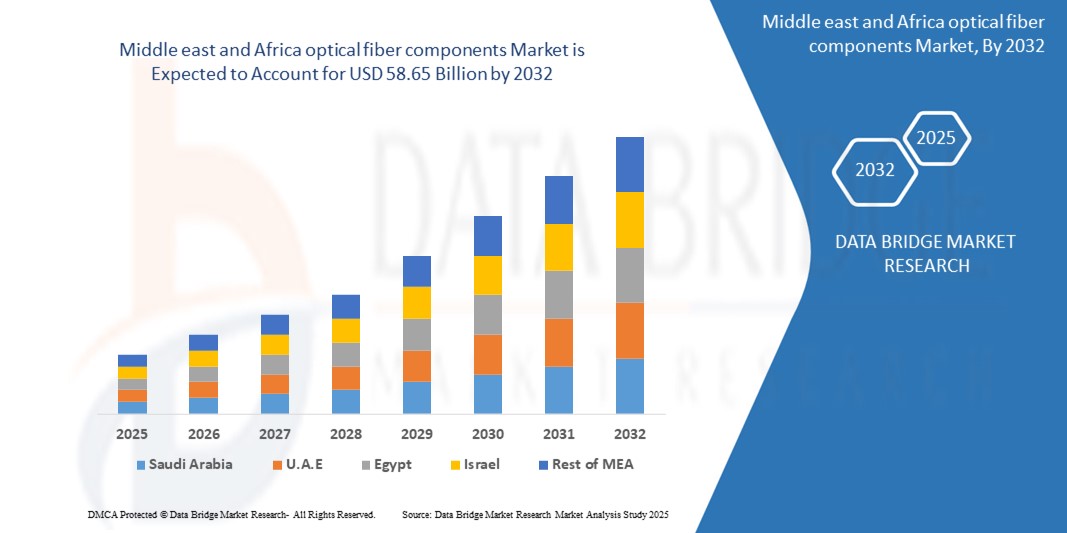

Middle east and Africa optical fiber components Market Size

- The Middle East and Africa optical fiber components market is projected to reach USD 28.1 billion in 2025 and is expected to grow to approximately USD 58.65 billion by 2032, registering a CAGR of 11.08% during the forecast period from 2025 to 2032..

- This growth is being driven by the rapid expansion of 5G networks, increased investments in FTTH infrastructure, and the region's growing emphasis on digital transformation. As countries across the Middle East and Africa prioritize smart cities, cloud adoption, and broadband connectivity, optical fiber components are playing a key role in enabling high-speed, secure, and scalable communication for both public and private sectors.

Middle East and Africa Optical Fiber Components Market Analysis

- In the Middle East and Africa, demand for optical fiber components is accelerating as governments, telecom operators, and enterprises ramp up investments in high-speed connectivity. From dense urban networks in the Gulf to expanding broadband in rural Africa, fiber-optic technologies are becoming essential for supporting everything from internet access and smart cities to cloud computing and e-governance.

- So, what’s driving this growth? A key factor is the aggressive push toward digital infrastructure. Countries like the UAE and Saudi Arabia are leading the charge with 5G deployments and nationwide fiber rollout plans. Meanwhile, across Africa, initiatives to close the digital divide are propelling demand for optical fiber in schools, healthcare facilities, and local government networks.

- The surge in mobile and data traffic is also placing pressure on networks, especially in growing urban centers. Fiber is being deployed as a backbone solution to deliver faster, more reliable internet to homes and businesses. This includes FTTH projects, enterprise-grade connectivity, and fiber backhaul for mobile towers.

- Additionally, the enterprise segment is expanding its use of fiber to support cloud migration, data centers, and remote work setups. Industries such as finance, education, oil & gas, and logistics are investing in fiber-optic infrastructure to enhance performance and reduce latency in their operations.

- With ongoing regional transformation programs, increased public-private partnerships, and favorable regulatory support, the Middle East and Africa optical fiber components market is poised for strong, long-term growth across both developed and emerging markets

Report Scope and Middle East and Africa Optical Inspection Segmentation

|

Attributes |

Middle East and Africa Optical Inspection Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

|

Middle East and Africa Optical Fiber Components Market Trends

“Fiber Connectivity Fueling Digital Growth Across the Middle East and Africa”

- One of the key trends shaping the optical fiber components market in the Middle East and Africa is the region’s increasing demand for high-speed, low-latency connectivity to support digital transformation. From smart cities and 5G networks to remote education and e-health, fiber is becoming the foundation for seamless, future-ready communication infrastructure.

- In urban areas, governments and telecom providers are rapidly expanding fiber-to-the-home (FTTH) and fiber-to-the-business (FTTB) networks. Cities like Dubai, Riyadh, and Cape Town are investing in fiber as a core element of smart infrastructure—connecting everything from traffic systems to surveillance and public Wi-Fi..

- Across the enterprise landscape, industries like finance, education, and healthcare are upgrading their internal networks with optical components such as transceivers, connectors, and amplifiers. These upgrades enable faster data transfer, stronger security, and better integration with cloud-based platforms.

- Rural connectivity is also seeing renewed focus. In underserved areas, countries are partnering with infrastructure firms to deploy long-distance fiber backbones, bridging the digital divide and bringing broadband services to remote schools, clinics, and households.

- Another emerging trend is the rise of regional data centers. With growing cloud adoption and the need for localized data storage, optical fiber components are in high demand for linking server farms, ensuring ultra-fast processing, and supporting edge computing.

- Altogether, these trends highlight the region’s transition toward a fiber-powered digital economy. Whether supporting next-gen mobile networks or driving education and innovation, optical fiber components are at the heart of creating faster, smarter, and more inclusive connectivity across the Middle East and Africa

Middle East and Africa Optical Fiber Components Market Dynamics

Driver

“Accelerating Demand for Digital Infrastructure in a Connected Economy”

- Across the Middle East and Africa, there’s a clear and growing shift toward digitalization. Governments and businesses alike are pushing to enhance digital connectivity, and that’s placing fiber optic technology at the heart of this transformation. With more people working remotely, relying on streaming services, and using cloud-based tools, the demand for fast, reliable internet has skyrocketed. Optical fiber components—like transceivers, splitters, and amplifiers—are critical to supporting this surge, especially as they enable high-speed, low-latency networks across both urban and rural areas.

- National development plans in countries such as the UAE, Saudi Arabia, South Africa, and Egypt increasingly highlight the importance of fiber in building smart cities, expanding 5G coverage, and powering tech-driven economies. As telecom operators expand their fiber networks and tech hubs multiply, there’s a strong need for quality components that ensure scalability, speed, and resilience.

- At the same time, sectors like healthcare, education, and finance are digitizing at a rapid pace—driving demand for data centers, cloud infrastructure, and high-speed connectivity. All of this is supported by optical fiber technology, which is being widely deployed to future-proof networks and reduce bandwidth limitations..

Restraint/Challenge

“High Deployment Costs and Regional Infrastructure Gaps”

- Despite the market’s strong growth potential, one of the most pressing challenges in the region is the high cost of deploying and maintaining fiber optic networks. From trenching and laying fiber in vast rural areas to managing international imports of high-quality components, the upfront capital investment can be significant—especially for developing countries with tight budgets.

- Additionally, the availability of skilled technicians, specialized installation tools, and standardized regulatory frameworks is inconsistent across the region. In countries with weaker infrastructure ecosystems, these gaps can lead to longer rollout timelines, network inefficiencies, and increased operational risks.

- Many parts of Sub-Saharan Africa also face power reliability issues and limited access to backhaul networks—further complicating efforts to scale fiber deployments beyond urban centers. While donor support and public-private partnerships are stepping in to address some of these hurdles, the pace of progress varies significantly between countries.

- For the optical fiber components market to truly flourish in the Middle East and Africa, greater regional cooperation, investment in local manufacturing, and streamlined regulatory policies will be needed to lower costs and expand accessibility.

By Type

- The optical fiber components market across the Middle East and Africa includes a wide range of core technologies that are fundamental to enabling high-speed, high-capacity communication. Optical Transceivers are among the most critical components, serving as the interface between electronic equipment and optical networks. These devices are used extensively in telecom networks and data centers for rapid signal conversion and transmission.

- Optical Amplifiers, such as EDFA (Erbium-Doped Fiber Amplifiers), are crucial for boosting signal strength over long distances without the need for electrical conversion. They’re commonly deployed in national fiber backbones and submarine cable systems.

- Optical Cables, the physical medium of transmission, are seeing growing demand due to network expansions and fiber-to-the-home (FTTH) deployments. Demand is strong in both urban connectivity projects and cross-border broadband corridors.

- Connectors and Splitters help maintain signal continuity and split data across different network branches. These components are essential in structured cabling, FTTH installations, and passive optical networks (PONs).

- Circulators and WDM (Wavelength Division Multiplexing) Components are gaining traction in advanced setups, helping increase bandwidth by allowing multiple signals to travel on a single fiber strand, a vital need in high-density data networks and regional backbones..

By Data Rate:

- Optical fiber components in MEA are categorized based on the speeds they support. Up to 10 Gbps components are still widely used in traditional telecom and enterprise setups, especially in countries where digital infrastructure is still maturing.

- 10 Gbps to 40 Gbps and 40 Gbps to 100 Gbps segments are witnessing strong growth, particularly in Gulf countries and South Africa, where digital transformation and demand for cloud-based services are accelerating.

- The Above 100 Gbps segment, while still niche, is growing steadily, driven by investments in hyperscale data centers and international internet exchanges (IXPs). These ultra-high-speed components are essential for emerging AI workloads, real-time streaming, and fintech platforms.

By Application:

- The market supports a wide range of applications. Data Communication leads in demand, driven by the rise of cloud services, data center interconnects, and enterprise-level communication networks.

- Telecommunication remains a dominant segment, with regional operators deploying fiber deeper into networks to support 5G and future-ready infrastructure.

- Enterprise applications include the use of optical fiber components in large-scale business campuses, IT parks, and commercial complexes for faster, secure internal networks.

- In Industrial sectors like mining, oil & gas, and utilities, fiber is preferred for its immunity to electromagnetic interference and ability to perform in harsh environments.

- Military & Aerospace sectors are using optical fiber for secure, mission-critical communication and sensor integration due to its lightweight, secure, and high-bandwidth nature.

- Retail: AV devices are used to attract and engage shoppers through tools like video walls, interactive displays, and in-store audio systems. Retailers are using these technologies to create modern, immersive shopping environments and convey brand messages effectively.

By End User:

- Telecom Operators are the biggest adopters, investing in large-scale deployments to meet bandwidth demand, particularly in urban corridors and smart city initiatives across the UAE, Saudi Arabia, and South Africa.

- Data Centers, especially those emerging in UAE, Nigeria, and Kenya, are driving high-volume demand for fiber components that support redundancy and high-speed data throughput.

- Government & Defense institutions use fiber for secure networks, border surveillance, and internal e-governance systems.

- IT & ITeS sectors in countries like Egypt and South Africa rely on optical networks to support offshore services, data outsourcing, and global connectivity.

- Healthcare, BFSI, and Education sectors are increasingly integrating fiber-based systems for telemedicine, secure banking infrastructure, and digital classrooms, respectively

Regional Analysis:

United Arab Emirates (UAE)

The UAE is leading fiber optic adoption in the region, supported by its strong commitment to digital infrastructure and smart city transformation. With major initiatives like Smart Dubai and widespread 5G deployment, the country has significantly upgraded its fiber backbone. Operators like Etisalat and du are investing in next-gen optical components to support data-intensive applications such as AI, IoT, and cloud computing. High-speed fiber connectivity is now a standard across most urban and commercial zones

Saudi Arabia

Driven by its Vision 2030 blueprint, Saudi Arabia is making large-scale investments in broadband and 5G, which heavily depend on advanced optical fiber components. The expansion of NEOM and other giga-projects is spurring demand for high-performance fiber optics in smart buildings, industrial zones, and public infrastructure. Local telecoms like STC and Mobily are ramping up fiber deployments in both urban and underserved rural areas to ensure universal access to high-speed internet...

South Africa

South Africa has emerged as a key player in Africa’s fiber optics space, especially in urban corridors like Johannesburg, Cape Town, and Durban. With a growing number of data centers and increasing mobile traffic, demand for optical transceivers, cables, and WDM components is rising. However, challenges remain in rural fiber access, prompting government and private collaboration to bridge the digital divide through affordable fiber rollouts..

Egypt

Egypt is modernizing its telecom infrastructure under the Digital Egypt strategy. The expansion of the national fiber network and partnerships with global vendors are helping bring faster internet to homes, businesses, and government facilities. Cairo and Alexandria are leading in terms of fiber deployment, with ongoing projects targeting educational institutions and healthcare facilities that require high-bandwidth, low-latency connections.

Nigeria

As Africa’s most populous country, Nigeria holds massive growth potential for optical fiber components. Urbanization, data center development, and mobile broadband expansion are fueling demand for scalable and cost-effective fiber solutions. The National Broadband Plan aims to increase fiber reach significantly by 2025, especially in underserved regions. However, infrastructure challenges and high deployment costs continue to impact rollout speed.

Rest of MEA

Other countries like Oman, Qatar, Kenya, and Morocco are witnessing steady growth as they digitize public services, boost enterprise connectivity, and strengthen national broadband plans. While infrastructure gaps persist in parts of Sub-Saharan Africa, regional telecoms and governments are investing in cross-border fiber routes, submarine cables, and terrestrial backbone networks to enable long-term connectivity and economic integration.

Middle East and Africa Optical Fiber Components Market Share

The MEA optical fiber components market is led by a mix of global technology providers and strong regional telecom players. Companies like Corning, Prysmian, CommScope, and Fujikura dominate with reliable fiber cables, transceivers, and WDM systems. In the Middle East, major telecom operators like Etisalat (UAE) and STC (Saudi Arabia) are working closely with these brands to support 5G and smart city projects. In Africa, providers such as Liquid Intelligent Technologies and Telecom Egypt are expanding fiber networks using components from global vendors. Local distributors and system integrators help tailor solutions with installation, maintenance, and financing support to meet regional demands

- Etisalat Group (United Arab Emirates)

- STC (Saudi Telecom Company) (Saudi Arabia)

- MTN Group (South Africa)

- Liquid Intelligent Technologies (formerly Liquid Telecom (South Africa )

- Zain Group (Kuwait)

- Telecom Egypt (Egypt)

- Batelco (Bahrain Telecommunications Company) (Bahrain.)

- Dark Fibre Africa (DFA) South Africa)

Latest Developments Middle East and Africa Optical Fiber Components Market

- In March 2025, the Africa-1 submarine cable system officially launched, linking key MEA regions like Egypt, UAE, Saudi Arabia, and Kenya, significantly boosting regional internet bandwidth and cross-border data connectivity..

- In February 2025, the UAE’s du Telecom collaborated with Huawei to enhance fiber optic backbone infrastructure, enabling higher-speed broadband and 5G-ready networks across Abu Dhabi and Duba.

- In January 2025, Liquid Intelligent Technologies expanded its fiber network in South Africa by an additional 4,000 kilometers, aiming to bridge connectivity gaps in underserved rural provinces.

- In November 2024, Saudi Arabia’s STC completed a national fiber expansion phase, deploying over 10,000 km of optical fiber as part of Vision 2030’s smart infrastructure goals

- In October 2024, Telecom Egypt signed a strategic agreement to host landing points for the 2Africa submarine cable, enhancing Egypt’s role as a digital hub for Africa, Asia, and Europe..

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.