Middle East And Africa Organic Pigments Market

Market Size in USD Billion

CAGR :

%

USD

557.15 Billion

USD

925.54 Billion

2024

2032

USD

557.15 Billion

USD

925.54 Billion

2024

2032

| 2025 –2032 | |

| USD 557.15 Billion | |

| USD 925.54 Billion | |

|

|

|

|

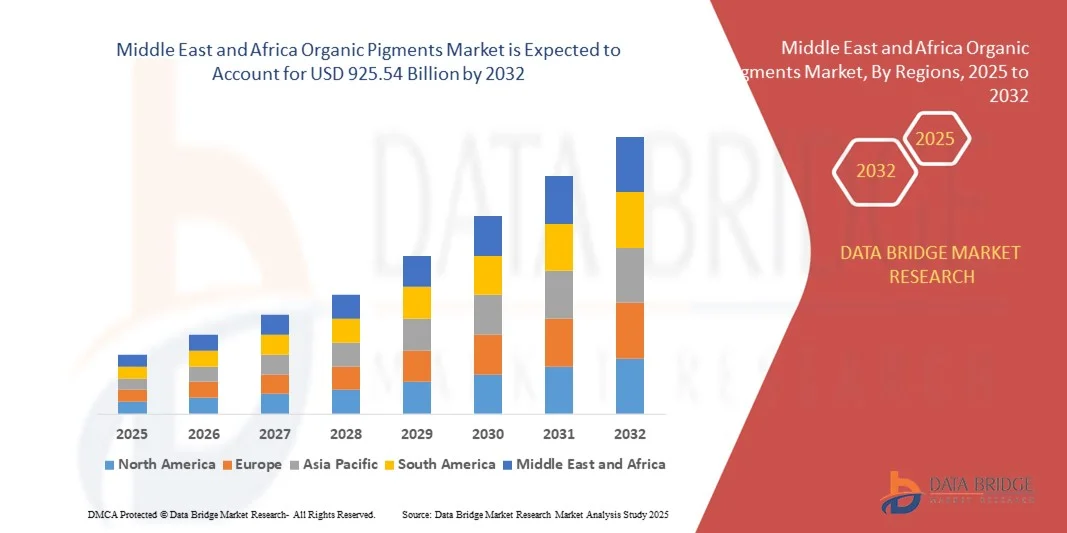

Middle East and Africa Organic Pigments Market Size

- The Middle East and Africa organic pigments market size was valued at USD 557.15 billion in 2024 and is expected to reach USD 925.54 billion by 2032, at a CAGR of 6.55% during the forecast period

- The market growth is largely fuelled by the rising demand for eco-friendly and sustainable coloring solutions, increasing adoption in coatings, plastics, and printing inks, and stringent regulations on synthetic pigments containing heavy metals

- Growing preference for organic pigments over inorganic alternatives due to their superior color strength, lightfastness, and versatility in diverse industrial applications is further propelling market expansion

Middle East and Africa Organic Pigments Market Analysis

- The organic pigments market is witnessing robust growth due to the expanding use of high-performance pigments in various industrial and consumer applications, such as packaging, automotive coatings, and textiles

- The shift toward bio-based and non-toxic pigment formulations, along with technological advancements in pigment dispersion and stability, is driving innovation across the market

- Saudi Arabia dominated the Middle East organic pigments market with the largest revenue share in 2024, driven by high demand from paints, coatings, plastics, and construction industries

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa organic pigments market due to increasing adoption of high-performance and eco-friendly pigments, rising investments in advanced manufacturing technologies, and growing demand from automotive, electronics, and high-end construction applications

- The Azo Pigments segment held the largest market revenue share in 2024, driven by their widespread use in coatings, plastics, and printing inks due to cost-effectiveness and excellent color strength. Azo pigments are highly versatile and are preferred for industrial applications requiring bright and stable colors

Report Scope and Middle East and Africa Organic Pigments Market Segmentation

|

Attributes |

Middle East and Africa Organic Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Organic Pigments Market Trends

Growing Adoption of Sustainable and High-Performance Pigments

- The global shift toward environmentally friendly and sustainable solutions is driving a strong preference for organic pigments over conventional synthetic options. Manufacturers are increasingly focusing on developing eco-compliant products that meet regulatory standards while maintaining superior color quality and performance. This trend is further reinforced by stringent government policies limiting hazardous substances and growing corporate sustainability initiatives across industries

- Rising consumer awareness and brand commitments to sustainability are encouraging the use of non-toxic and bio-based pigments in packaging, textiles, and coatings. This transition supports reduced carbon emissions and aligns with global initiatives promoting green manufacturing. Companies are also investing in marketing and education campaigns to highlight the benefits of organic pigments, boosting adoption across end-user segments

- The demand for high-performance pigments with enhanced durability, heat stability, and weather resistance is steadily increasing across industrial applications. These pigments are being adopted in automotive, construction, and plastic industries due to their long-lasting color retention. Manufacturers are continuously innovating to develop pigments that meet rigorous technical standards while remaining environmentally safe

- For instance, in 2023, several global pigment producers introduced bio-based pigment lines made from renewable feedstocks to meet sustainability targets and comply with international environmental norms. These initiatives not only address regulatory requirements but also cater to growing customer demand for green and premium-quality products. Early adopters have reported enhanced brand image and increased market share as a result

- While sustainability and innovation are transforming the pigment landscape, success depends on continuous R&D, cost optimization, and scalability to meet growing industrial demand and consumer expectations. Strategic collaborations between raw material suppliers, pigment manufacturers, and end-users are also helping accelerate the transition toward eco-friendly solutions

Middle East and Africa Organic Pigments Market Dynamics

Driver

Increasing Demand for Eco-Friendly and Non-Toxic Pigments

• The tightening of environmental regulations and restrictions on heavy metal-based pigments have accelerated the demand for organic pigments, which offer safer and cleaner alternatives for industrial use. Manufacturers are investing heavily in research to ensure products are compliant with evolving global environmental standards while maintaining performance and aesthetics

• Industries such as coatings, plastics, and printing inks are rapidly transitioning toward eco-friendly pigment formulations to ensure compliance with sustainability standards and reduce environmental impact. This adoption is also driven by rising consumer expectations for safe, non-toxic products that do not compromise quality or durability, creating a strong market pull

• Growing consumer preference for non-toxic and biodegradable materials in decorative and packaging applications is supporting market expansion. This is further reinforced by corporate sustainability goals across end-user industries. Companies are increasingly seeking certification and eco-labeling to demonstrate compliance, which boosts trust and adoption among environmentally conscious consumers

• For instance, in 2023, leading packaging manufacturers adopted organic pigments to replace lead chromates and cadmium-based colorants, enhancing both safety and environmental compatibility. The shift not only mitigated regulatory risk but also opened opportunities for entering international markets with strict environmental standards. These initiatives highlight the tangible benefits of adopting organic pigments

• While awareness and regulation-driven adoption are key growth factors, continuous technological improvements and cost efficiency are crucial for sustaining the momentum in the organic pigments market. Manufacturers are exploring innovative production processes, renewable feedstocks, and strategic partnerships to enhance competitiveness and ensure long-term growth

Restraint/Challenge

High Production Costs and Limited Availability of Raw Materials

• The complex synthesis process of organic pigments and the high cost of natural raw materials significantly increase overall production expenses compared to inorganic alternatives. This limits price competitiveness, particularly in emerging markets where cost sensitivity is high, and slows large-scale adoption across price-conscious end-users

• Manufacturers often face raw material shortages due to dependence on specific plant-based or petrochemical feedstocks, leading to inconsistent supply and fluctuating pricing in the market. These disruptions can affect production schedules, lead times, and customer satisfaction, creating operational and commercial challenges for pigment producers

• Limited scalability of bio-based pigment production remains a key barrier to meeting global demand, particularly in cost-sensitive industries such as textiles and printing. The need for specialized extraction and purification techniques adds complexity, while small-scale operations struggle to achieve economies of scale, keeping prices elevated and supply inconsistent

• For instance, in 2023, several small-scale pigment producers reported operational disruptions caused by shortages of key intermediates used in organic pigment manufacturing, affecting supply consistency. These shortages led to delayed shipments and increased procurement costs for end-users, highlighting vulnerabilities in the supply chain

• While technological innovations aim to reduce costs, addressing supply chain constraints and developing sustainable raw material sources remain critical for the long-term growth of the organic pigments market. Strategic collaborations, investment in renewable feedstock cultivation, and advanced manufacturing techniques are essential to overcome these challenges and ensure reliable, cost-effective production

Middle East and Africa Organic Pigments Market Scope

The market is segmented on the basis of type, color, and application

- By Type

On the basis of type, the Middle East and Africa organic pigments market is segmented into azo pigments, phthalocyanine pigments, carbazole violet, high performance pigments, and others. The Azo Pigments segment held the largest market revenue share in 2024, driven by their widespread use in coatings, plastics, and printing inks due to cost-effectiveness and excellent color strength. Azo pigments are highly versatile and are preferred for industrial applications requiring bright and stable colors.

The High Performance Pigments segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by their superior durability, heat stability, and resistance to weathering. These pigments are increasingly adopted in automotive, construction, and high-end industrial applications where long-lasting color retention and high performance are critical.

- By Color

On the basis of color, the market is segmented into yellow, red, blue, green, violet, and others. The Red segment held the largest market revenue share in 2024, owing to its extensive use across printing inks, paints, and coatings applications. Red pigments are favored for their vibrant hue, opacity, and compatibility with various substrates.

The Blue segment is projected to witness the fastest growth during the forecast period, driven by increasing demand in automotive coatings, plastics, and textiles. Blue pigments are valued for their stability, lightfastness, and ability to meet high-performance standards in industrial applications.

- By Application

On the basis of application, the market is segmented into printing inks, paints and coatings, plastics, ceramics, glass, minerals, leather and textile, cosmetics, electronics, and others. The Paints and Coatings segment held the largest market share in 2024, fueled by rising construction activity and demand for decorative and protective coatings. Organic pigments in this segment provide eco-friendly alternatives and vibrant color options for architectural and industrial applications.

The Plastics segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption of colored plastic products in packaging, consumer goods, and automotive industries. The demand is further supported by the growing preference for non-toxic, sustainable pigment formulations in plastic applications.

Middle East and Africa Organic Pigments Market Regional Analysis

- Saudi Arabia dominated the Middle East organic pigments market with the largest revenue share in 2024, driven by high demand from paints, coatings, plastics, and construction industries

- The country’s ongoing infrastructure projects and industrial diversification initiatives are boosting the use of high-performance organic pigments

- This widespread adoption is further supported by government support for industrial growth, increasing investments in sustainable manufacturing practices, and rising awareness of eco-friendly solutions

U.A.E. Organic Pigments Market Insight

The U.A.E. organic pigments market is witnessing the fastest growth in the Middle East, fueled by rapid urbanization, expanding infrastructure projects, and increasing demand for eco-friendly and non-toxic pigments across industrial and consumer applications. Growing emphasis on sustainability, coupled with government initiatives promoting green manufacturing and smart city developments, is driving adoption. In addition, rising investments in advanced pigment production technologies and innovations in high-performance pigment formulations are significantly contributing to market expansion.

Middle East and Africa Organic Pigments Market Share

The Middle East and Africa organic pigments industry is primarily led by well-established companies, including:

- Al Qawasim Trading Est. (Saudi Arabia)

- Noor Arabia Trading Co. Ltd. (Saudi Arabia)

- Maar Group (Saudi Arabia)

- Haris Al Afaq (Saudi Arabia)

- S D International (U.A.E.)

- Poliya Composite Resins and Polymers Inc. (U.A.E.)

- Omni Color (South Africa)

- MICC (Muhammad Iqbal Color Company) (South Africa)

- Gulf Pigments & Chemicals (U.A.E.)

- Emirates Pigments Co. (U.A.E.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Organic Pigments Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Organic Pigments Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Organic Pigments Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.