Middle East And Africa Pallet Packaging Products Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

1.87 Billion

2025

2033

USD

1.30 Billion

USD

1.87 Billion

2025

2033

| 2026 –2033 | |

| USD 1.30 Billion | |

| USD 1.87 Billion | |

|

|

|

|

Middle East and Africa Pallet Packaging Products Market Size

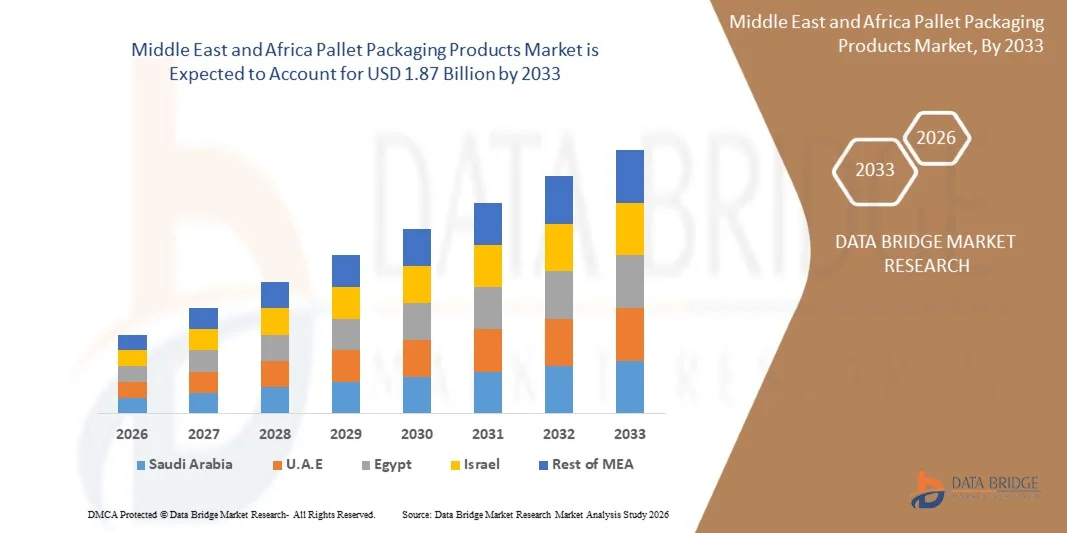

- The Middle East and Africa Pallet Packaging Products Market size was valued at USD 1.30 billion in 2025 and is expected to reach USD 1.87 billion by 2033, at a CAGR of 4.8% during the forecast period

- The expansion of Middle East & Africa manufacturing, industrial output, and organized logistics networks is a major factor driving demand, further strengthening market reach.

- Additionally, the growing adoption of unitized load handling and reusable transport packaging (RTP) supports efficiency and sustainability, boosting market growth.

Middle East and Africa Pallet Packaging Products Market Analysis

- The Middle East and Africa Pallet Packaging Products Market is experiencing steady growth driven by several key factors, including the expansion of Middle East & Africa manufacturing and industrial output, the growth of organized logistics, warehousing, and distribution networks, and an increasing preference for unitized load handling. Additionally, the rising adoption of reusable and returnable transport packaging (RTP) solutions is contributing to the market's evolution as industries seek more sustainable and cost-effective packaging options. These trends reflect a broader focus on improving supply chain efficiency, reducing product damage during transit, and optimizing space utilization across various sectors such as food and beverages, pharmaceuticals, retail, and industrial manufacturing.

- Despite these positive drivers, the market faces challenges such as volatility in raw material availability and pricing, as well as limited standardization across regions and end-use industries. Furthermore, environmental and disposal concerns for end-of-life pallets add complexity to the market’s sustainability goals. Nevertheless, emerging opportunities like the shift toward plastic and composite pallets, especially in regulated industries, and the integration of tracking and identification technologies are opening new avenues for growth. The rising demand from export-oriented sectors in emerging economies further bolsters the market’s expansion potential.

- Leading players in the market, such as Sigma Plastics Group, IPL Schoeller, Novolex, Craemer GmbH, and PalletOne, are employing diverse strategies—including product launches, capacity expansion, mergers and acquisitions, and partnerships—to strengthen their market positions. A notable example is Sigma Plastics Group’s acquisition of California-based Sun Plastics, Inc. in February 2025, marking its 43rd acquisition. This strategic move expands Sigma’s Middle East & Africa footprint to 49 locations and enhances its capabilities in producing custom, 100% recyclable LDPE bags and films for industries such as food, medical, electronics, and industrial sectors. Such acquisitions enable key players to offer advanced, sustainable packaging solutions while increasing their market reach and operational expertise.

- In 2025, Saudi Arabia leads the Middle East and Africa Pallet Packaging Products Market, holding a 21.43% market share, driven by its rapidly expanding industrial base, robust logistics infrastructure development, and rising demand for standardized material handling solutions.

- In 2025, the Stretch Films segment dominates the Middle East and Africa Pallet Packaging Products Market with a 24.02% share due to its cost-effectiveness, versatility in securing loads, and widespread adoption across logistics and warehousing operations.

Report Scope And Middle East and Africa Pallet Packaging Products Market Segmentation

|

Attributes |

Middle East and Africa Pallet Packaging Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Pallet Packaging Products Market Trends

“Expansion of manufacturing and industrial output”

- The expansion of Middle East & Africa manufacturing and industrial output drives demand in the pallets packaging market, as increasing production across automotive, consumer goods, pharmaceuticals, chemicals, and electronics requires reliable and standardized load-handling solutions.

- Pallets enable efficient movement of raw materials, semi-finished goods, and finished products within factories and across supply chains, supporting operational efficiency, damage prevention, and streamlined distribution in high-volume industrial environments.

- Middle East & Africa trade and industrial production growth, highlighted by Industry Today and UNIDO reports, further boost pallet demand by increasing the need for safe storage, efficient handling, and smooth transitions across domestic and international logistics networks.

- Rising industrial output positions pallets as essential infrastructure for standardized, scalable, and cost-effective logistics, making them a long-term necessity closely linked to manufacturing performance rather than a discretionary packaging component.

Middle East and Africa Pallet Packaging Products Market Dynamics

Driver

Growth of organized logistics, warehousing, and distribution networks

- The growth of organized logistics, warehousing, and distribution networks is boosting Middle East & Africa demand for pallet packaging, as supply chains move from fragmented storage to centralized warehouses, large distribution centers, and professionally managed 3PL facilities.

- Pallets serve as the backbone of these modern logistics environments, enabling efficient stacking, racking, mechanized handling, and high-throughput order fulfillment, improving turnaround times and inventory control.

- Expansion of warehousing and distribution infrastructure, driven by e-commerce and 3PL operations, has increased pallet usage for easier consolidation, movement, and storage of goods across domestic and international supply chains.

- With industries increasingly relying on standardized material handling in centralized and mechanized logistics hubs, pallets remain an essential and foundational asset, ensuring sustained and predictable demand in modern supply chains.

Restraint/Challenge

Volatility in raw material availability and pricing

- Volatility in raw material availability and pricing is a key restraint on the pallets packaging market, as production depends on timber, plastics, and recycled polymers whose costs fluctuate due to seasonal shortages, resin production changes, trade dynamics, and inflationary pressures.

- These fluctuations increase manufacturing costs and complicate procurement planning, pricing stability, and supply chain continuity, making it difficult for manufacturers and logistics providers to maintain consistent pallet quality and availability.

- Rising timber prices and limited log availability in regions like the UK and Ireland highlight the challenges of raw material supply, impacting production planning and cost control for pallet manufacturers.

- To mitigate risks, market players are adopting strategic sourcing, alternative materials, and efficient inventory management, but raw material volatility remains a significant factor limiting market growth.

Middle East and Africa Pallet Packaging Products Market Scope

The market is segmented on the basis of product type, machine type, function type, application, end use, and distribution channel.

By product type

On the basis of product type, the Middle East and Africa Pallet Packaging Products Market is segmented into stretch films, shrink hood films, euro pallet, pallet boxes, pallet lids & caps, slip sheets & tier sheets, stretch wrappers, stretch hooders, and pallet netting. In 2026, the stretch films segment is expected to dominate the market with a 24.17% market share.

By machine type

On the basis of machine type, the Middle East and Africa Pallet Packaging Products Market is segmented into fully automatic and semi‑automatic. In 2026, fully automatic is expected to dominate the market with a 66.97% market share

By function type

On the basis of function type, the Middle East and Africa Pallet Packaging Products Market is segmented into wrapping, strapping, protection & cushioning, hooding and others. In 2026, wrapping is expected to dominate the market with a 48.76% market share.

By application

On the basis of application, the Middle East and Africa Pallet Packaging Products Market is segmented food & beverages, retail & e-commerce, consumer packaged goods (CPG), pharmaceuticals, chemicals, agriculture & horticulture, industrial manufacturing, automotive, electronics & appliances and others. In 2026, food & beverages are expected to dominate the market with a 25.51% market share.

By end use

On the basis of end use, the Middle East and Africa Pallet Packaging Products Market is segmented into logistics & 3pl providers, manufacturing plants, retail distribution centers, cold chain operators and others. In 2026, logistics & 3pl providers are expected to dominate the market with a 42.70% market.

By distribution channel

On the basis of distribution channel, the Middle East and Africa Pallet Packaging Products Market is segmented into direct and indirect. In 2026, direct segment is expected to dominate the market with a 59.95% market share.

Middle East and Africa Pallet Packaging Products Market Regional Analysis

- Saudi Arabia dominates the Middle East and Africa Pallet Packaging Products Market, holding 21.43% of the total share in 2025, primarily due to its strong industrial base, advanced logistics infrastructure, and strategic position as a trade hub. The country’s growing manufacturing, construction, and export sectors drive high demand for efficient pallet packaging solutions. Additionally, government investments in industrial diversification and modern supply chain systems enhance the adoption of high-quality packaging products, giving Saudi Arabia a clear edge in the regional market.

- U.A.E. accounts for 17.37% of the Middle East and Africa Pallet Packaging Products Market in 2025, driven by its status as a major logistics and trade hub, robust e-commerce growth, and a rapidly expanding manufacturing and construction sector. The country’s focus on modern supply chain solutions, infrastructure development, and adoption of sustainable packaging practices further fuels the demand for efficient pallet packaging products.

Saudi Arabia Market Insight

Saudi Arabia is expected to lead the Middle East and Africa Pallet Packaging Products Market with a 21.61% share in 2026 and is projected to grow at a CAGR of 5.6% from 2026 to 2033, driven by expanding industrial and construction activities. Additionally, robust logistics infrastructure and government initiatives supporting modern supply chains are set to further accelerate market growth.

U.A.E. Market Insight

The U.A.E. is expected to hold a 17.42% share of the Middle East and Africa Pallet Packaging Products Market in 2026 and is projected to grow at a CAGR of 5.1% from 2026 to 2033, driven by the growth of e-commerce, advanced logistics infrastructure, and increasing demand for efficient and sustainable packaging solutions.

South Africa Market Insight

South Africa is expected to hold a 15.31% share of the Middle East and Africa Pallet Packaging Products Market and is projected to grow at a CAGR of 4.9% from 2026 to 2033, driven by the expansion of its manufacturing and retail sectors, increasing export activities, and growing adoption of modern logistics and packaging solutions.

The Major Market Leaders Operating in the Market Are:

- Aetna Group SPA (Italy)

- bekuplast sp. z o. o. (Poland)

- BENOPLAST (Turkey)

- IPL Schoeller (Austria)

- Middle East & Africa Pallets and Containers (U.S.)

- Craemer GmbH (Germany)

- Mosca GmbH (Germany)

- Novolex (U.S.)

- TranPak Inc. (U.S.)

- Orion Packaging Systems LLC (U.S.)

- Paragon Films (U.S.)

- MAILLIS GROUP (Greece)

- M Stretch S.p.A. (Italy)

- Conwed (U.S.)

- POLYFAVO (Italy)

- Polyreflex Hi‑Tech Co., Ltd (China)

- Rokson Packaging Industry (India)

- Matere Packaging (India)

- Sigma Plastics Group (U.S.)

- Transoplast (U.K.)

- Trioworld (Sweden)

- UCMPL (India)

- Greendot Biopak Pvt. Ltd. (India)

- Wulftec International Inc. (Canada)

- FROMM Packaging (Switzerland)

- Hexa Pak (U.S.)

- HIVIC PLASTIC MANUFACTURE CO., LTD. (China)

- IPG (Canada)

- Lantech (U.S.)

Latest Developments in Middle East and Africa Pallet Packaging Products Market

- In February 2025, Sigma Plastics Group, along with its affiliate Mercury Plastics, acquired the assets of California-based Sun Plastics, Inc., marking Sigma’s 43rd acquisition and expanding its Middle East & Africa operations to 49 locations. Sun Plastics, founded in 1979, specializes in high-quality, custom, 100% recyclable LDPE bags and films for diverse sectors including food, medical, electronics, and industrial markets. The acquisition strengthens Sigma’s presence in North America and enhances its capabilities in value-added, sustainable packaging solutions. This strategic move will provide Sigma with expanded market reach, advanced production expertise, and new growth opportunities.

- In July 2025, Sigma Stretch Film of Georgia announced a $39 million investment in Columbus, Georgia, to expand its operations and create 100 new jobs. The project includes a 75,000 sq. ft. expansion of an existing facility and the construction of a new 75,000 sq. ft. warehouse to produce stretch film for pallet wrap, addressing regional demand. This marks Sigma’s first stretch film facility in Columbus, complementing its existing Forest Park location. The investment strengthens the company’s manufacturing capacity, reduces service costs, and supports local economic growth.

- In March, Novolex completed its combination with Pactiv Evergreen Inc., creating a leading manufacturer in food, beverage, and specialty packaging, enhancing its product offering, innovation capabilities, and manufacturing footprint to better serve Middle East & Africa packaging markets.

- In March, Novolex earned the 2025 Gold Award for Sustainability and BPI commercial compostable certification for its new compostable butter wrap, reflecting its commitment to sustainable packaging solutions.

- In April, Novolex brand Eco-Products received the Bronze Stevie Award in the Reuse and Recycle category for its new Veda reusable foodservice container line, highlighting innovation in sustainable reusable packaging.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 VENDOR SHARE ANALYSIS

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET VERTICAL COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 INTENSITY OF COMPETITIVE RIVALRY

4.1.2 BARGAINING POWER OF BUYERS / CONSUMERS

4.1.3 THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 BARGAINING POWER OF SUPPLIERS

4.1.6 CONCLUSION

4.2 PRICING ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL AND FEEDSTOCK SUPPLY

4.3.2 MANUFACTURING AND PROCESSING

4.3.3 DISTRIBUTION AND LOGISTICS INTEGRATION

4.3.4 END-USE INDUSTRIES AND SALES CHANNELS

4.3.5 CONCLUSION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL SOURCING & PROCUREMENT

4.4.2 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.4.3 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.4.4 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.4.5 CONCLUSION

4.5 VENDOR SELECTION CRITERIA

4.5.1 PRODUCT QUALITY & COMPLIANCE

4.5.2 PRODUCT RANGE & CUSTOMIZATION

4.5.3 PRICING & TOTAL COST OF OWNERSHIP

4.5.4 SUPPLY CHAIN RELIABILITY

4.5.5 TECHNICAL SUPPORT & SERVICE

4.5.6 SUSTAINABILITY & ENVIRONMENTAL PRACTICES

4.5.7 VENDOR REPUTATION & FINANCIAL STABILITY

4.5.8 INNOVATION & TECHNOLOGY INTEGRATION

4.5.9 RISK & COMPLIANCE ASSESSMENT

4.5.10 PARTNERSHIP & STRATEGIC FIT

4.6 TECHNOLOGICAL ADVANCEMENTS

4.6.1 SUSTAINABLE MATERIAL INNOVATION

4.6.2 AUTOMATION & ROBOTICS IN PALLET PACKAGING

4.6.2.1 Integration with Robotics and Automated Lines:

4.6.2.2 Advanced Machine Controls & Interfaces:

4.6.3 SMART PACKAGING & IOT INTEGRATION

4.6.4 EFFICIENCY & WASTE REDUCTION TECHNOLOGIES

4.6.5 SUPPORTING SUSTAINABILITY THROUGH INNOVATION

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.2 ACTIVE DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.8 CLIMATE CHANGE SCENARIO

4.8.1 TRANSFORMATION OF RAW MATERIAL SOURCING

4.8.2 CARBON FOOTPRINT ACCOUNTABILITY ACROSS THE PALLET LIFECYCLE

4.8.3 INFLUENCE OF CLIMATE VOLATILITY ON PALLET PERFORMANCE AND DESIGN

4.8.4 REGULATORY AND POLICY ALIGNMENT WITH CLIMATE COMMITMENTS

4.8.5 CLIMATE CHANGE AS A CATALYST FOR INNOVATION AND STRATEGIC REPOSITIONING

4.9 INDUSTRY ECOSYSTEM ANALYSIS

4.9.1 PROMINENT COMPANIES

4.9.2 SMALL AND MEDIUM SIZE COMPANIES

4.9.3 END USERS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.1.1 UNITED STATES (MAJOR IMPORTER OF PALLET PACKAGING):

5.1.2 CHINA (MAJOR PRODUCER & EXPORTER)

5.1.3 INDIA

5.1.4 EUROPEAN UNION

5.1.5 BRAZIL

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT:

5.4.2 MANUFACTURING AND PRODUCTION:

5.4.3 LOGISTICS AND DISTRIBUTION:

5.4.4 PRICE PITCHING AND POSITION IN MARKET:

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXPANSION OF MIDDLE EAST AND AFRICA MANUFACTURING AND INDUSTRIAL OUTPUT.

7.1.2 GROWTH OF ORGANIZED LOGISTICS, WAREHOUSING, AND DISTRIBUTION NETWORKS.

7.1.3 INCREASING PREFERENCE FOR UNITIZED LOAD HANDLING.

7.1.4 RISING ADOPTION OF REUSABLE AND RETURNABLE TRANSPORT PACKAGING (RTP).

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL AVAILABILITY AND PRICING

7.2.2 LIMITED STANDARDIZATION ACROSS REGIONS AND END-USE INDUSTRIES .

7.3 OPPORTUNITY

7.3.1 SHIFT TOWARD PLASTIC AND COMPOSITE PALLETS IN REGULATED INDUSTRIES

7.3.2 INTEGRATION OF TRACKING AND IDENTIFICATION TECHNOLOGIES .

7.3.3 RISING DEMAND FROM EMERGING ECONOMIES’ EXPORT-ORIENTED SECTORS

7.4 CHALLENGES

7.4.1 HIGH REPAIR, REVERSE LOGISTICS, AND ASSET RECOVERY COSTS

7.4.2 ENVIRONMENTAL AND DISPOSAL CONCERNS FOR END-OF-LIFE PALLETS

8 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 STRETCH FILMS

8.2.2 SHRINK HOOD FILMS

8.2.3 EURO PALLET

8.2.4 PALLET BOXES

8.2.5 PALLET LIDS & CAPS

8.2.6 SLIP SHEETS & TIER SHEETS

8.2.7 STRETCH WRAPPERS

8.2.8 STRETCH HOODERS

8.2.9 PALLET NETTING

8.3 MIDDLE EAST AND AFRICA STRETCH FILMS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.3.1 ASIA-PACIFIC

8.3.2 NORTH AMERICA

8.3.3 EUROPE

8.3.4 MIDDLE EAST AND AFRICA

8.3.5 SOUTH AMERICA

8.4 MIDDLE EAST AND AFRICA SHRINK HOOD FILMS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 MIDDLE EAST AND AFRICA

8.4.5 SOUTH AMERICA

8.5 MIDDLE EAST AND AFRICA EURO PALLET IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 MIDDLE EAST AND AFRICA

8.5.5 SOUTH AMERICA

8.6 MIDDLE EAST AND AFRICA PALLET BOXES IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.6.1 ASIA-PACIFIC

8.6.2 NORTH AMERICA

8.6.3 EUROPE

8.6.4 MIDDLE EAST AND AFRICA

8.6.5 SOUTH AMERICA

8.7 MIDDLE EAST AND AFRICA PALLET LIDS & CAPS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.7.1 ASIA-PACIFIC

8.7.2 NORTH AMERICA

8.7.3 EUROPE

8.7.4 MIDDLE EAST AND AFRICA

8.7.5 SOUTH AMERICA

8.8 MIDDLE EAST AND AFRICA SLIP SHEETS & TIER SHEETS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 MIDDLE EAST AND AFRICA

8.8.5 SOUTH AMERICA

8.9 MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

8.9.1 FULLY AUTOMATIC

8.9.2 SEMI AUTOMATIC

8.1 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 INLINE WRAPPING SYSTEMS

8.10.2 MONOBLOC WRAPPING SYSTEMS

8.11 MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 MIDDLE EAST AND AFRICA

8.11.5 SOUTH AMERICA

8.12 MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

8.12.1 FULLY AUTOMATIC

8.12.2 SEMI AUTOMATIC

8.13 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 INLINE HOODING SYSTEMS

8.13.2 MONOBLOC HOODING SYSTEMS

8.14 MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 NORTH AMERICA

8.14.3 EUROPE

8.14.4 MIDDLE EAST AND AFRICA

8.14.5 SOUTH AMERICA

8.15 MIDDLE EAST AND AFRICA PALLET NETTING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 NORTH AMERICA

8.15.3 EUROPE

8.15.4 MIDDLE EAST AND AFRICA

8.15.5 SOUTH AMERICA

9 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY MACHINE TYPE

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

9.2.1 FULLY AUTOMATIC

9.2.2 SEMI AUTOMATIC

9.3 MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 INLINE HOODING SYSTEMS

9.3.2 MONOBLOC HOODING SYSTEMS

9.4 MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 NORTH AMERICA

9.4.3 EUROPE

9.4.4 MIDDLE EAST AND AFRICA

9.4.5 SOUTH AMERICA

9.5 MIDDLE EAST AND AFRICA SEMI AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 MIDDLE EAST AND AFRICA

9.5.5 SOUTH AMERICA

10 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY FUNCTION TYPE

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

10.2.1 WRAPPING

10.2.2 STRAPPING

10.2.3 PROTECTION & CUSHIONING

10.2.4 HOODING

10.2.5 OTHERS

10.3 MIDDLE EAST AND AFRICA WRAPPING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 NORTH AMERICA

10.3.3 EUROPE

10.3.4 MIDDLE EAST AND AFRICA

10.3.5 SOUTH AMERICA

10.4 MIDDLE EAST AND AFRICA STRAPPING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 NORTH AMERICA

10.4.3 EUROPE

10.4.4 MIDDLE EAST AND AFRICA

10.4.5 SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA PROTECTION & CUSHIONING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 MIDDLE EAST AND AFRICA

10.5.5 SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA HOODING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 NORTH AMERICA

10.6.3 EUROPE

10.6.4 MIDDLE EAST AND AFRICA

10.6.5 SOUTH AMERICA

10.7 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 MIDDLE EAST AND AFRICA

10.7.5 SOUTH AMERICA

11 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 FOOD & BEVERAGES (1000)

11.2.2 RETAIL & E-COMMERCE

11.2.3 CONSUMER PACKAGED GOODS (CPG)

11.2.4 PHARMACEUTICALS (2100)

11.2.5 CHEMICALS (2000)

11.2.6 AGRICULTURE & HORTICULTURE (0100)

11.2.7 INDUSTRIAL MANUFACTURING (0001)

11.2.8 AUTOMOTIVE (2900)

11.2.9 ELECTRONICS & APPLIANCES (2500)

11.2.10 OTHERS

11.3 MIDDLE EAST AND AFRICA FOOD & BEVERAGES (1000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 NORTH AMERICA

11.3.3 EUROPE

11.3.4 MIDDLE EAST AND AFRICA

11.3.5 SOUTH AMERICA

11.4 MIDDLE EAST AND AFRICA RETAIL & E-COMMERCE IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 NORTH AMERICA

11.4.3 EUROPE

11.4.4 MIDDLE EAST AND AFRICA

11.4.5 SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA CONSUMER PACKAGED GOODS (CPG) (1000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 MIDDLE EAST AND AFRICA

11.5.5 SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA PHARMACEUTICALS (2100) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 MIDDLE EAST AND AFRICA

11.6.5 SOUTH AMERICA

11.7 MIDDLE EAST AND AFRICA CHEMICALS (2000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 NORTH AMERICA

11.7.3 EUROPE

11.7.4 MIDDLE EAST AND AFRICA

11.7.5 SOUTH AMERICA

11.8 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE (0100) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 MIDDLE EAST AND AFRICA

11.8.5 SOUTH AMERICA

11.9 MIDDLE EAST AND AFRICA INDUSTRIAL MANUFACTURING (0001) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.9.1 ASIA-PACIFIC

11.9.2 NORTH AMERICA

11.9.3 EUROPE

11.9.4 MIDDLE EAST AND AFRICA

11.9.5 SOUTH AMERICA

11.1 MIDDLE EAST AND AFRICA AUTOMOTIVE (2900) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 MIDDLE EAST AND AFRICA

11.10.5 SOUTH AMERICA

11.11 MIDDLE EAST AND AFRICA ELECTRONICS & APPLIANCES (2500) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 MIDDLE EAST AND AFRICA

11.11.5 SOUTH AMERICA

11.12 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 MIDDLE EAST AND AFRICA

11.12.5 SOUTH AMERICA

12 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY END USE

12.1 OVERVIEW

12.2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 LOGISTICS & 3PL PROVIDERS

12.2.2 MANUFACTURING PLANTS

12.2.3 RETAIL DISTRIBUTION CENTERS

12.2.4 COLD CHAIN OPERATORS

12.2.5 OTHERS

12.3 MIDDLE EAST AND AFRICA LOGISTICS & 3PL PROVIDERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 NORTH AMERICA

12.3.3 EUROPE

12.3.4 MIDDLE EAST AND AFRICA

12.3.5 SOUTH AMERICA

12.4 MIDDLE EAST AND AFRICA MANUFACTURING PLANTS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 NORTH AMERICA

12.4.3 EUROPE

12.4.4 MIDDLE EAST AND AFRICA

12.4.5 SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA RETAIL DISTRIBUTION CENTERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 NORTH AMERICA

12.5.3 EUROPE

12.5.4 MIDDLE EAST AND AFRICA

12.5.5 SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA COLD CHAIN OPERATORS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 NORTH AMERICA

12.6.3 EUROPE

12.6.4 MIDDLE EAST AND AFRICA

12.6.5 SOUTH AMERICA

12.7 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 NORTH AMERICA

12.7.3 EUROPE

12.7.4 MIDDLE EAST AND AFRICA

12.7.5 SOUTH AMERICA

13 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.1.1 DIRECT

13.1.2 INDIRECT

13.2 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.2.1 COMPANY'S SALES TEAMS

13.2.2 DIRECT OEM CONTRACTS

13.2.3 COMPANY-OWNED WEBSITES

13.3 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.3.1 ASIA-PACIFIC

13.3.2 NORTH AMERICA

13.3.3 EUROPE

13.3.4 MIDDLE EAST AND AFRICA

13.3.5 SOUTH AMERICA

13.4 MIDDLE EAST AND AFRICA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.4.1 WHOLESALERS / DISTRIBUTORS

13.4.2 INDUSTRIAL SUPPLY STORES

13.4.3 THIRD-PARTY E-COMMERCE

13.5 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 MIDDLE EAST AND AFRICA

13.5.5 SOUTH AMERICA

14 MIDDLE EAST AND AFRICA PALLET PACKAGING MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 U.A.E.

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 QATAR

14.1.7 KUWAIT

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA PALLET PACKAGING MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 DISTRIBUTOR COMPANY PROFILE

17.1 BUNZL AUSTRALIA & NEW ZEALAND

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 SOURCE: COMPANY WEBSITE, ANNUAL REPORT, SEC FILING

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 FASTENAL COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 ULINE

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT/SERVICE PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 VERITIV OPERATING COMPANY

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT/SERVICE PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 W.W. GRAINGER, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

18 MANUFACTURER COMPANY PROFILE

18.1 SIGMA PLASTICS ASIA

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 IPL SCHOELLER.

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 NOVOLEX

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 CRAEMER GMBH.

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 PALLETONE

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 AETNA GROUP SPA

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BEKUPLAST SP. Z O. O.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 BENOPLAST.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CONWED

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FROMM PACKAGING SYSTEMS

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT/SERVICE PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 MIDDLE EAST AND AFRICA PALLETS AND CONTAINERS.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GREENDOT BIOPAK PVT. LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 HEXAPAK

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT/SERVICE PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 HIVIC PLASTIC MANUFACTURE CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT/SERVICE PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 INTERTAPE POLYMER GROUP (IPG)

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT/SERVICE PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LANTECH

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT/SERVICE PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 M STRETCH S.P.A.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MAILLIS GROUP

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT/SERVICE PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 MATERE PACKAGING

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 MOSCA GMBH

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ORION PACKAGING SYSTEMS LLC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 PARAGON FILMS.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 POLYFAVO..

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 POLYREFLEX HI-TECH CO., LTD .

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 ROKSON PACKAGING INDUSTRY

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 TRANPAK INC.

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 TRANSOPLAST

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 TRIOWORLD

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

18.29 UCMPL

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 WULFTEC INTERNATIONAL INC

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT/SERVICE PORTFOLIO

18.30.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA STRETCH FILMS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SHRINK HOOD FILMS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA EURO PALLET IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA PALLET BOXES IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA PALLET LIDS & CAPS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA SLIP SHEETS & TIER SHEETS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PALLET NETTING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SEMI AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA WRAPPING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA STRAPPING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PROTECTION & CUSHIONING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HOODING IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FOOD & BEVERAGES (1000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA RETAIL & E-COMMERCE IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA CONSUMER PACKAGED GOODS (CPG) (1000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PHARMACEUTICALS (2100) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CHEMICALS (2000) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE (0100) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA INDUSTRIAL MANUFACTURING (0001) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AUTOMOTIVE (2900) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA ELECTRONICS & APPLIANCES (2500) IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA LOGISTICS & 3PL PROVIDERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA MANUFACTURING PLANTS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA RETAIL DISTRIBUTION CENTERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA COLD CHAIN OPERATORS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA OTHERS IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 SAUDI ARABIA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 SAUDI ARABIA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SAUDI ARABIA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SAUDI ARABIA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 SAUDI ARABIA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 73 SAUDI ARABIA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 SAUDI ARABIA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 U.A.E STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 U.A.E FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 U.A.E STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 U.A.E FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 U.A.E FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 84 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 85 U.A.E PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 86 U.A.E DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 U.A.E INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 SOUTH AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SOUTH AFRICA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 SOUTH AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 SOUTH AFRICA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 SOUTH AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 97 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 98 SOUTH AFRICA PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 99 SOUTH AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 SOUTH AFRICA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 EGYPT STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 EGYPT FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 EGYPT STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 EGYPT FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 EGYPT FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 110 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 111 EGYPT PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 112 EGYPT DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 EGYPT INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 ISRAEL STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 ISRAEL FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 ISRAEL STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 ISRAEL FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 ISRAEL FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 123 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 124 ISRAEL PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 125 ISRAEL DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 ISRAEL INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 QATAR PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 QATAR STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 QATAR FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 QATAR STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 QATAR FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 QATAR PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 QATAR FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 QATAR PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 QATAR PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 136 QATAR PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 137 QATAR PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 138 QATAR DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 QATAR INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 KUWAIT STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 KUWAIT FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 KUWAIT STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 KUWAIT FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 KUWAIT FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 149 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 150 KUWAIT PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 151 KUWAIT DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 KUWAIT INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 OMAN PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 OMAN STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 OMAN FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 OMAN STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 OMAN FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 OMAN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 OMAN FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 OMAN PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 OMAN PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 162 OMAN PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 163 OMAN PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 164 OMAN DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 OMAN INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 BAHRAIN STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 BAHRAIN FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 BAHRAIN STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 BAHRAIN FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 BAHRAIN FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 175 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 176 BAHRAIN PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 BAHRAIN DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 BAHRAIN INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 REST OF MIDDLE EAST AND AFRICA

TABLE 180 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 REST OF MIDDLE EAST AND AFRICA STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 REST OF MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH WRAPPERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 REST OF MIDDLE EAST AND AFRICA STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 REST OF MIDDLE EAST AND AFRICA FULLY AUTOMATIC STRETCH HOODERS IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY MACHINE TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 REST OF MIDDLE EAST AND AFRICA FULLY AUTOMATIC IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY FUNCTION TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 189 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 190 REST OF MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 191 REST OF MIDDLE EAST AND AFRICA DIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 REST OF MIDDLE EAST AND AFRICA INDIRECT IN PALLET PACKAGING PRODUCTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: MULTIVARIVATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: VERTICAL COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: SEGMENTATION

FIGURE 13 SEVEN SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET, BY PRODUCT TYPE (2025)

FIGURE 14 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 EXPANSION OF MIDDLE EAST AND AFRICA MANUFACTURING, GROWTH OF ORGANIZED LOGISTICS, UNITIZED LOAD HANDLING, AND ADOPTION OF REUSABLE TRANSPORT PACKAGING ARE EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 STRETCH FILMS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKET IN 2026 & 2033

FIGURE 18 MIDDLE EAST AND AFRICA PALLET PACKAGING PRODUCTS MARKETSS, 2025-2033, AVERAGE SELLING PRICE (USD/PER ROLL)

FIGURE 19 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET

FIGURE 20 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY PRODUCT TYPE, 2025

FIGURE 21 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY MACHINE TYPE, 2025

FIGURE 22 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY FUNCTION TYPE, 2025

FIGURE 23 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY APPLICATION, 2025

FIGURE 24 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY END USE, 2025

FIGURE 25 MIDDLE EAST AND AFRICA PALLETS PACKAGING MARKET: BY DISTRIBUTION CHANNEL , 2025

FIGURE 26 MIDDLE EAST AND AFRICA PALLET PACKAGING MARKET: SNAPSHOT (2026)

FIGURE 27 MIDDLE EAST AND AFRICA PALLET PACKAGING MARKET: COMPANY SHARE 2025 (%)

Middle East And Africa Pallet Packaging Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Pallet Packaging Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Pallet Packaging Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.