Middle East And Africa Patient Handling Equipment Market

Market Size in USD Million

CAGR :

%

USD

307.65 Million

USD

664.28 Million

2024

2032

USD

307.65 Million

USD

664.28 Million

2024

2032

| 2025 –2032 | |

| USD 307.65 Million | |

| USD 664.28 Million | |

|

|

|

|

Middle East and Africa Patient Handling Equipment Market Size

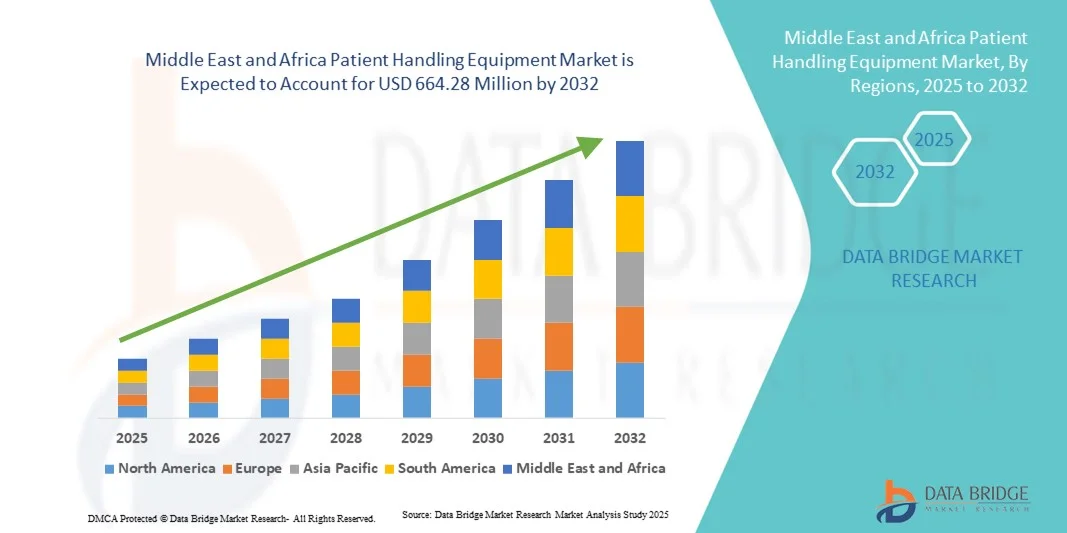

- The Middle East and Africa patient handling equipment market size was valued at USD 307.65 million in 2024 and is expected to reach USD 664.28 million by 2032, at a CAGR of 10.1% during the forecast period

- The market growth is primarily driven by the increasing geriatric population, rising prevalence of chronic diseases, and growing demand for safe and efficient patient mobility solutions in hospitals, clinics, and long-term care facilities across the region

- Additionally, healthcare infrastructure development, government initiatives to improve patient care standards, and adoption of advanced lifting and transfer devices are encouraging healthcare providers to invest in patient handling equipment, thereby propelling market expansion

Middle East and Africa Patient Handling Equipment Market Analysis

- Patient handling equipment, including hoists, transfer devices, and mobility aids, is becoming increasingly essential in hospitals, clinics, and long-term care facilities across the Middle East and Africa, ensuring safer patient handling and reducing caregiver injuries

- The rising demand for patient handling equipment is largely driven by the growing geriatric population, increasing prevalence of chronic diseases, and heightened awareness of workplace safety among healthcare providers

- Saudi Arabia dominated the Middle East and Africa market with the largest revenue share of 42.5% in 2024, supported by well-established healthcare infrastructure, high healthcare expenditure, and government initiatives to modernize hospitals and long-term care facilities

- Egypt is expected to be the fastest-growing country during the forecast period, due to expanding healthcare infrastructure, rising patient safety awareness, and increased investments in modern medical equipment

- Medical Beds dominated the patient handling equipment market with a market share of 35.9% in 2024, driven by their essential role in providing comfort, safety, and efficient patient management across acute, long-term, and critical care settings

Report Scope and Middle East and Africa Patient Handling Equipment Market Segmentation

|

Attributes |

Middle East and Africa Patient Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Patient Handling Equipment Market Trends

Growing Adoption of Ergonomic and Automated Patient Handling Solutions

- A significant and accelerating trend in the Middle East and Africa patient handling equipment market is the increasing adoption of automated and ergonomically designed devices such as hoists, transfer systems, and mobility aids, aimed at reducing caregiver injuries and enhancing patient safety

- For instance, ceiling-mounted lift systems and electric patient hoists are being integrated into modern hospitals in Saudi Arabia and the UAE to provide safe and efficient patient transfers while minimizing manual handling

- Smart patient beds with automated positioning and weight-sensing capabilities are gaining popularity, allowing healthcare staff to monitor patient movement and prevent falls or pressure ulcers

- Integration of IoT-enabled patient handling equipment with hospital management systems is facilitating real-time monitoring of device usage, maintenance schedules, and patient safety metrics

- This trend towards more advanced, automated, and ergonomically focused solutions is reshaping healthcare standards in the region, with companies such as Arjo and Hill-Rom introducing smart lift and repositioning systems to enhance care delivery

- The demand for patient handling equipment that combines safety, automation, and operational efficiency is growing rapidly across both acute care hospitals and long-term care facilities, driven by regulatory requirements and workforce safety priorities

Middle East and Africa Patient Handling Equipment Market Dynamics

Driver

Increasing Need Due to Aging Population and Rising Chronic Diseases

- The growing geriatric population and rising prevalence of chronic conditions such as obesity, arthritis, and neurological disorders are key drivers fueling demand for patient handling equipment across the Middle East and Africa

- For instance, in 2024, Saudi Arabian hospitals reported increasing adoption of mechanical and non-mechanical patient lifting devices to manage mobility-challenged patients safely and efficiently

- Healthcare providers are investing in equipment that minimizes caregiver strain, reduces workplace injuries, and improves patient comfort, thereby boosting overall adoption rates

- Government initiatives to enhance patient care infrastructure, particularly in the UAE and Egypt, are accelerating procurement of modern patient handling solutions in public and private healthcare facilities

- The rising awareness of patient safety protocols and regulatory compliance requirements for safe handling of immobile or bariatric patients further contributes to the market growth

- Growing hospital expansion projects and refurbishment of older facilities with modern handling equipment are expected to sustain demand across acute care, long-term care, and rehabilitation centers

Restraint/Challenge

High Cost and Limited Skilled Workforce for Equipment Operation

- The high initial investment costs for advanced patient handling equipment, including motorized lifts and smart repositioning beds, pose a significant challenge to market adoption, particularly in smaller healthcare facilities

- For instance, hospitals in Egypt and Nigeria often delay procurement of automated patient handling systems due to budget constraints, relying on manual equipment despite safety concerns

- A shortage of trained staff capable of safely operating complex patient handling devices further limits adoption in several countries across the region

- Maintenance requirements, limited local technical support, and dependence on imported equipment increase operational challenges and total cost of ownership for healthcare facilities

- Price sensitivity and budgetary restrictions in public hospitals, combined with the perception that manual handling is adequate for routine care, can slow market growth despite the evident safety benefits

- Addressing these challenges through affordable equipment options, local training programs, and improved technical support will be critical for sustained adoption and market expansion

Middle East and Africa Patient Handling Equipment Market Scope

The market is segmented on the basis of mode, product type, type of care, accessories, application, and end user.

- By Mode

On the basis of mode, the market is segmented into mechanical equipment and non-mechanical equipment. The mechanical equipment segment dominated the market with the largest revenue share of 56% in 2024, driven by its reliability, cost-effectiveness, and widespread availability in hospitals and care facilities. Mechanical lifts, hoists, and manual patient repositioning devices are commonly used in acute care and long-term care settings due to their low maintenance requirements and proven safety standards. Hospitals prefer mechanical solutions for routine patient handling as they reduce caregiver strain while maintaining operational efficiency. Moreover, mechanical equipment is adaptable to various patient weights and mobility levels, ensuring versatility across multiple healthcare scenarios. Its compatibility with existing hospital infrastructure without requiring significant technological upgrades further contributes to its strong adoption. The proven durability and long lifecycle of mechanical devices make them a preferred choice for budget-conscious facilities.

The non-mechanical equipment segment is expected to witness the fastest growth, with a CAGR of 18.5% from 2025 to 2032, fueled by rising demand for automated patient lifts, smart beds, and IoT-enabled repositioning devices. Non-mechanical solutions reduce physical workload, enhance patient safety, and offer integration with hospital management systems for real-time monitoring. Increasing government initiatives to modernize healthcare facilities in Saudi Arabia, UAE, and Egypt are further accelerating the adoption of non-mechanical devices. The growing focus on ergonomics and caregiver safety is driving investments in motorized and automated handling solutions. Facilities are increasingly incorporating smart technology to improve patient outcomes and optimize staff efficiency.

- By Product Type

On the basis of product type, the market is segmented into medical beds, patient repositioning equipment, mobility aids, bathroom safety, and ambulatory aids. The medical beds segment dominated the market with a revenue share of 35.9% in 2024, owing to their critical role in patient care and recovery. Adjustable beds with automated positioning, weight monitoring, and fall-prevention features are widely adopted in hospitals and long-term care facilities. Medical beds improve patient comfort, enhance caregiver efficiency, and reduce the risk of pressure ulcers and other complications. The compatibility of these beds with accessories such as lifting aids and monitoring systems further drives their adoption. Hospitals and specialized care centers consider medical beds a core component of patient handling infrastructure. Continuous innovations in smart bed technology, such as IoT integration and automated repositioning, further strengthen this segment.

The mobility aids segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing aging population and rising incidence of mobility-related disorders. Wheelchairs, walkers, and patient transport devices are gaining traction in home care and rehabilitation settings. Rising awareness about patient independence and quality of life is contributing to the expansion of this segment. Demand is also rising for lightweight, foldable, and portable designs suitable for both hospitals and home care. Technological enhancements such as adjustable seating, motorized assistance, and smart tracking systems are further accelerating adoption.

- By Type of Care

On the basis of type of care, the market is segmented into long-term care, bariatric care, acute and critical care, wound care, fall prevention, and others. The acute and critical care segment dominated with a market share of 38% in 2024, due to the high prevalence of hospital admissions requiring intensive patient handling. ICU and emergency departments rely heavily on lifting devices, adjustable beds, and patient repositioning systems to provide safe and efficient care. Acute care facilities prioritize equipment that minimizes caregiver injuries while ensuring patient safety and comfort. Technological advancements such as smart beds and IoT-enabled monitoring systems are increasingly incorporated in acute care settings. The demand is further bolstered by regulatory mandates ensuring patient safety in hospitals. Hospitals in Saudi Arabia and UAE are particularly investing in state-of-the-art handling solutions to meet growing patient volumes.

The long-term care segment is expected to witness the fastest growth from 2025 to 2032, as the increasing geriatric population in countries such as Saudi Arabia and Egypt requires ongoing support for mobility and daily care activities. Nursing homes and rehabilitation centers are increasingly adopting mechanical and non-mechanical aids to enhance patient quality of life. Demand is fueled by chronic disease prevalence and extended hospital stays. Technological adoption, such as automated lifts and repositioning systems, is rising in long-term care facilities. Caregiver safety and reduction of manual handling stress are key motivators for adoption.

- By Accessories

On the basis of accessories, the market is segmented into hospital bed accessories, medical bed accessories, lifting accessories, transfer accessories, stretcher accessories, and others. The lifting accessories segment dominated with a revenue share of 32% in 2024, due to its critical role in enhancing the efficiency and safety of patient transfers. Slings, harnesses, and motorized lift attachments allow caregivers to lift patients safely while reducing physical strain. Hospitals and long-term care facilities rely on lifting accessories for bariatric and immobile patients. Adoption is further driven by training programs emphasizing ergonomic handling practices. The market for lifting accessories also benefits from increasing awareness about caregiver injury prevention and compliance with workplace safety regulations. Increasing investment in high-quality lifting aids with adjustable features enhances operational efficiency in healthcare facilities.

The transfer accessories segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for slide sheets, transfer boards, and portable lifting solutions that facilitate patient movement between beds, chairs, and toilets. These accessories are particularly relevant in rehabilitation and home care settings. Demand is increasing due to enhanced patient comfort, reduced injury risk, and compliance with safety standards. Technological innovations, such as lightweight and foldable transfer devices, are further boosting adoption. Rising awareness among caregivers about safe patient handling is also driving market expansion.

- By Application

On the basis of application, the market is segmented into acute and critical care, long-term care, mobility assistance, fall prevention, and others. The mobility assistance segment dominated the market with a revenue share of 37% in 2024, driven by the growing need to support patient independence and reduce caregiver workload. Devices such as wheelchairs, walking aids, and patient transfer systems play a crucial role in mobility assistance across hospitals, home care, and elderly care facilities. The adoption of mobility aids ensures enhanced patient safety and facilitates smoother rehabilitation processes. Increasing awareness among healthcare providers about the benefits of patient mobility in recovery has further fueled this segment. Hospitals and rehabilitation centers are investing in ergonomic mobility solutions to enhance patient outcomes. The integration of mobility devices with digital monitoring systems is further accelerating adoption.

The fall prevention segment is expected to witness the fastest growth from 2025 to 2032, as hospitals and elderly care facilities increasingly focus on reducing fall-related injuries. Bed rails, anti-slip mats, and alert systems are being widely adopted in Saudi Arabia, UAE, and Egypt to ensure patient safety and compliance with care standards. Growth is driven by regulatory requirements and caregiver safety programs. The adoption of smart fall prevention devices integrated with monitoring systems is increasing rapidly. Rising patient awareness and demand for safe care environments further propel this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, home care settings, elderly care facilities, and others. The hospital segment dominated with a revenue share of 55% in 2024, due to high patient volumes and stringent safety protocols requiring advanced handling equipment. Acute care, ICU, and rehabilitation departments are primary adopters of mechanical and non-mechanical patient handling devices. Hospitals prefer integrated solutions that improve workflow, reduce caregiver injuries, and enhance patient outcomes. Government-funded hospital modernization programs across the Middle East and Africa further support adoption. The presence of trained staff and infrastructure to support complex equipment also reinforces hospital dominance. Hospitals continue to invest in technologically advanced patient handling solutions to meet growing care demands.

The home care settings segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing preference for in-home care, aging populations, and the need for independent living support. Portable lifts, adjustable beds, and mobility aids are increasingly purchased for private residences and assisted living homes. Rising awareness about patient safety and caregiver support is accelerating this trend. Affordable and compact designs suitable for home environments are boosting adoption. Integration with telehealth monitoring systems is also contributing to market expansion. Growing government and private initiatives to support home-based care further drive this segment.

Middle East and Africa Patient Handling Equipment Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa market with the largest revenue share of 42.5% in 2024, supported by well-established healthcare infrastructure, high healthcare expenditure, and government initiatives to modernize hospitals and long-term care facilities

- Healthcare providers in the region prioritize the adoption of advanced lifting, transfer, and mobility devices to enhance patient safety, reduce caregiver injuries, and improve operational efficiency. The presence of well-established private and public hospitals further supports market growth

- High government spending on healthcare modernization, regulatory mandates for patient safety, and increasing awareness of occupational health standards are contributing to the widespread adoption of patient handling equipment in Saudi Arabia and the UAE

U.A.E. Patient Handling Equipment Market Insight

The U.A.E. patient handling equipment market is expected to grow at a substantial CAGR during the forecast period, driven by government-led initiatives to enhance healthcare quality and patient safety standards. The country is witnessing increased adoption of mechanical and non-mechanical patient handling devices in hospitals, elderly care facilities, and rehabilitation centers. Rising awareness about caregiver safety, occupational health regulations, and advanced healthcare infrastructure are facilitating market growth. Private and public hospitals are integrating smart lifting systems and automated beds for improved patient care. The demand for ergonomic equipment that reduces manual handling strain is also a key growth driver. Additionally, the presence of multinational suppliers ensures availability of advanced solutions in the region.

Egypt Patient Handling Equipment Market Insight

The Egypt patient handling equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing healthcare infrastructure development and the rising elderly population. Hospitals and long-term care facilities are adopting modern patient handling solutions such as mobility aids, hoists, and transfer boards to enhance safety and efficiency. Government support for healthcare modernization and private investments are driving adoption in both urban and semi-urban areas. Training programs for hospital staff on proper patient handling techniques further promote equipment usage. The growing awareness of workplace safety for caregivers also contributes to the market expansion. The introduction of cost-effective and compact devices suitable for home care is expected to boost future demand.

South Africa Patient Handling Equipment Market Insight

The South Africa patient handling equipment market is poised to grow at a considerable CAGR during the forecast period, driven by increasing hospital modernization programs and rehabilitation care facilities. The adoption of medical beds, lifting devices, and mobility aids is rising to address patient safety and reduce caregiver injuries. The presence of private hospitals and international suppliers supports availability of advanced solutions. Rising awareness of ergonomics and occupational health is encouraging investments in mechanical and automated patient handling equipment. Long-term care and home care facilities are increasingly incorporating innovative solutions for mobility and fall prevention. Furthermore, government initiatives promoting improved healthcare standards are contributing to market growth.

Middle East and Africa Patient Handling Equipment Market Share

The Middle East and Africa Patient Handling Equipment industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Hill-Rom Services Inc. (U.S.)

- Arjo (Sweden)

- Invacare International Holdings Corp (U.S.)

- Etac AB (Sweden)

- Guldmann Inc. (Denmark)

- Medline Industries, Inc (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- Joerns Healthcare LLC (U.S.)

- Handicare Group AB (Sweden)

- Stiegelmeyer GmbH & Co. KG (Germany)

- DJO Global, Inc. (U.S.)

- Sunrise Medical (U.S.)

- LINET (Czech Republic)

- Permobil Holding AB (Sweden)

- Baxter. (U.S.)

- GF Health Products, Inc. (U.S.)

- Savaria Corporation (Canada)

What are the Recent Developments in Middle East and Africa Patient Handling Equipment Market?

- In April 2025, Stryker initiated Project C, a collaboration aimed at distributing medical equipment to regions in need. This initiative helps increase healthcare capacity and improve the quality of care in underserved areas, including parts of the Middle East and Africa. The project underscores Stryker's commitment to enhancing healthcare access

- In September 2023, Hill-Rom released an updated software for its automated patient handling system. This update aims to enhance the efficiency and safety of patient handling processes in healthcare settings, supporting the growing adoption of automated solutions in the Middle East and Africa region

- In June 2023, Philips launched two new health innovations at Africa Health Excon 2023, aiming to address Africa's growing healthcare demands. These innovations were designed to enable caregivers to provide the right care at the right time and place, improving health outcomes across the continent. While specific details about patient handling equipment were not disclosed, Philips' commitment to enhancing healthcare access is evident

- In February 2023, United Imaging announced multiple partnerships at Arab Health 2023, including collaborations with I-ONE, My Doctor Medical Center, Health Garden Clinic, Cigalah, and Tengri LLC. These partnerships aimed to expand United Imaging's presence in the Middle East and Africa, particularly in countries such as Qatar, Morocco, Saudi Arabia, and Kazakhstan. The company showcased its advanced medical imaging and radiotherapy equipment, such as the uMR 680 and uCT 960+, to enhance patient care in the region

- In January 2023, Arjo introduced a new line of lightweight patient lifts. These lifts are designed to improve patient mobility and reduce the physical strain on caregivers, aligning with the growing demand for safe patient handling solutions in the Middle East and Africa region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.