Middle East And Africa Personal Care And Home Care Contract Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

2.29 Billion

USD

3.71 Billion

2024

2032

USD

2.29 Billion

USD

3.71 Billion

2024

2032

| 2025 –2032 | |

| USD 2.29 Billion | |

| USD 3.71 Billion | |

|

|

|

Personal Care and Home Care Contract Manufacturing Market Analysis

The personal care and home care contract manufacturing market is experiencing substantial growth, driven by rising consumer demand for high-quality, innovative products and the increasing preference for outsourced production. Brands are leveraging contract manufacturers to scale operations, reduce costs, and accelerate time-to-market. Key factors fueling market expansion include evolving consumer preferences for natural, sustainable, and cruelty-free products, prompting manufacturers to adapt formulations and packaging solutions. Technological advancements in production, coupled with the rising influence of e-commerce, enable faster, more flexible manufacturing processes.

In addition, small and medium-sized brands benefit from contract manufacturing by accessing advanced production capabilities without heavy capital investment. Geographically, North America and Asia-Pacific lead the market, with growing demand for customized, region-specific products.

However, challenges such as supply chain disruptions and regulatory complexities remain. Despite these, the market’s trajectory remains positive, as the need for agility and product innovation continues to drive demand for contract manufacturing services in the personal and home care sectors.

Personal Care and Home Care Contract Manufacturing Market Size

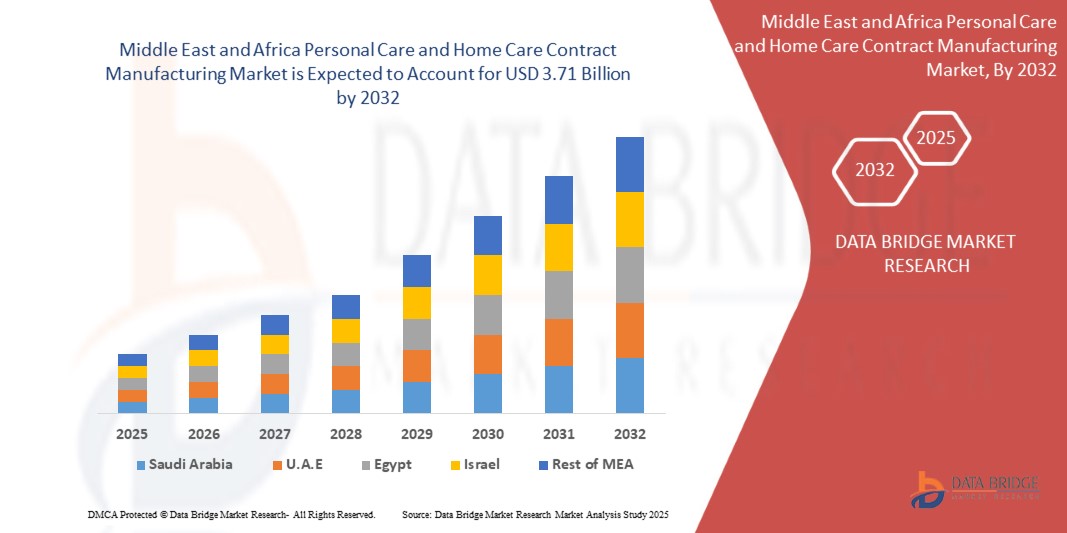

Middle East and Africa Personal care and home care contract manufacturing market is expected to reach USD 3.71 billion by 2032 from USD 2.29 billion in 2024, growing with a substantial CAGR of 6.3% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Personal Care and Home Care Contract Manufacturing Market

“Cost Efficiency and Specialization”

Cost efficiency and specialization have emerged as significant drivers of growth in the Middle East and Africa personal care and home care contract manufacturing market. As brands aim to remain competitive in a rapidly evolving industry, outsourcing production to specialized contract manufacturers allows them to achieve operational efficiency, reduce costs, and focus on core business activities.

One of the primary benefits of contract manufacturing is the reduction in production costs. Setting up and maintaining in-house manufacturing facilities involves substantial capital investment, including infrastructure, labor, raw materials, and compliance with regulatory standards. By outsourcing to contract manufacturers, brands can leverage economies of scale, as these manufacturers handle production for multiple clients and optimize resources. This cost-saving enables companies to allocate funds to marketing, research and development, and expanding their product portfolios.

Report Scope and Market Segmentation

|

Attributes |

Personal Care and Home Care Contract Manufacturing Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

VVF L.L.C. (U.S.), A.I.G. Technologies, Inc. (U.S.), Nutrix International LLC (U.S.), FormulaCorp (U.S.), PLZ Corp (U.S.), Tropical Products (U.S.), Apollo Health Care Corporation Inc. (Canada), CoValence Laboratories (U.S.), McBride (UK), RCP Ranstadt GmbH (Germany), Beautech Industries Ltd. (Canada), SKINLYS MENTIONS LÉGALES (France), Albéa Services S.A.S. (France), KIK Consumer Products Inc. (Canada), Maesa (U.S.), Fareva Group (France), Arminak Solutions LLC dba KBL Cosmetics (U.S.), Asil Middle East and Africa INC. (U.S.), STPP Group (China), Gurtler Industries, Inc. (U.S.), Steverlynck (Belgium), AMR Laboratories (U.S.), and Voyant Beauty (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Personal Care and Home Care Contract Manufacturing Market Definition

Personal care and home care contract manufacturing involves outsourcing the production of personal hygiene, cosmetic, and household cleaning products to specialized manufacturers. Companies partner with contract manufacturers to design, develop, and produce items such as skincare products, shampoos, soaps, detergents, and air fresheners. These manufacturers offer expertise in formulation, production, packaging, and regulatory compliance. This arrangement allows brands to focus on marketing, sales, and distribution while leveraging the manufacturer’s capabilities to reduce costs, improve efficiency, and ensure high-quality products. Contract manufacturing is widely used across industries to meet growing consumer demand for innovative, sustainable, and cost-effective personal and home care solutions.

Personal Care and Home Care Contract Manufacturing Market Dynamics

Drivers

- Rising Consumer Awareness About Hygiene and Grooming

The Middle East and Africa personal care and home care contract manufacturing market is experiencing robust growth, driven by rising consumer awareness about hygiene and grooming. The COVID-19 pandemic significantly heightened hygiene standards, prompting consumers to prioritize personal and home care products. This behavioral shift is supported by increasing disposable income and urbanization, particularly in emerging economies, further boosting demand for diverse and innovative offerings in these categories.

As consumers become more informed about health and wellness, the demand for eco-friendly, sustainable, and organic products has surged. This has encouraged companies to innovate and partner with contract manufacturers to meet these evolving preferences. Contract manufacturers bring expertise, scalability, and cost efficiencies, allowing brands to quickly adapt to market trends and focus on core competencies such as branding and marketing.

Furthermore, the rise of e-commerce has made personal and home care products more accessible to consumers worldwide. Online platforms have not only expanded market reach but also intensified competition among brands to offer high-quality, affordable products. To meet these demands, brands are increasingly leveraging contract manufacturers with advanced technologies and flexible production capabilities.

For instance,

- According to an article by Shree Bhagwati Machtech India Private Limited, Growing consumer awareness about personal hygiene is driving market growth, as it enhances self-esteem, confidence, and overall well-being. The rising grooming trend fosters self-worth and social connection, supported by beauty influencers and celebrities. In addition, improving lifestyles in Latin America, driven by economic growth, are boosting demand for personal care products.

- In February 2022, According to an article by NCBI, the increased emphasis on hygiene due to COVID-19, driving demand for personal care products. Enhanced consumer awareness of cleanliness as a preventive health measure underscores the growing reliance on effective personal care solutions, fueling market growth for hygiene-focused products Middle East and Africaly.

- In November 2024, According to an article by pureoilsindia.com, Environmental sustainability is a key focus for brands and consumers. Indian cosmetic manufacturers are adopting eco-friendly practices, including biodegradable materials, minimal and recyclable packaging, and clean production methods. Increased awareness of plastic waste has spurred innovation in refillable packaging, reducing single-use plastic and encouraging responsible consumption.

- In September 2024, According to an article by BigCommerce Pty. Ltd., the rapid growth of eCommerce in the health and beauty sector, driven by consumer demand for convenience and product variety. Online platforms enable brands to reach Middle East and Africa audiences, while offering personalized shopping experiences, which is fueling the expansion of the health and beauty product market worldwide.

- In October 2020, According to an article by Rodman Media, The pandemic has heightened awareness of wellness and healthy lifestyles, with consumers recognizing that healthy skin is essential for beauty. This shift towards a holistic health approach drives demand for natural, multi-tasking skincare solutions. Consumers increasingly seek products that offer both skin benefits and overall wellness, influencing market trends.

In Conclusion, rising consumer awareness about hygiene and grooming has created significant opportunities in the Middle East and Africa personal care and home care contract manufacturing market. By embracing sustainability, innovation, and scalability, contract manufacturers are enabling brands to cater to dynamic consumer needs. This collaborative approach ensures that the market continues to grow while adapting to evolving trends and preferences.

- Increasing Demand for Innovative, Customized, and Sustainable Products

The Middle East and Africa personal care and home care contract manufacturing market is experiencing significant growth due to increasing demand for innovative, customized, and sustainable products. Consumers are becoming more conscious of their health and environmental impact, driving the demand for personalized solutions tailored to specific needs. Brands are investing heavily in research and development to create unique, effective formulations that address these evolving preferences.

The demand for customization is growing as consumers seek products that reflect their individual needs, from skin types to preferences for fragrance or texture. In the personal care sector, custom formulations that cater to unique skincare routines or hair types are gaining popularity. Similarly, in home care, consumers are looking for specialized products for various cleaning and disinfecting needs. This trend is pushing brands to collaborate with contract manufacturers that can offer flexibility and expertise in creating personalized products.

In addition to customization, sustainability is a key driver. Consumers are increasingly aware of the environmental consequences of their choices, prompting brands to shift towards eco-friendly formulations and packaging. This includes the use of biodegradable ingredients, recyclable packaging, and ethically sourced materials. As a result, contract manufacturers are adopting green technologies and practices, helping brands meet the growing demand for sustainable products.

Furthermore, innovation in production methods and product ingredients is fueling the growth of this market. The rise of natural and organic ingredients in personal care products is driving the creation of new formulations that are safe, effective, and environmentally friendly. As the demand for such products grows, contract manufacturers are at the forefront of developing and scaling up these innovations to meet market needs.

For instance,

- In June 2024, according to an article published by Bennett, Coleman & Co. Ltd, modern consumers increasingly demand personalized and inclusive beauty solutions. Brands such as Fenty Beauty, with its extensive range of foundation shades, have set new standards. Indian companies such as Colorbar and Lakme are also expanding their shade ranges to meet diverse needs, reflecting the changing demographics and beauty preferences in the market.

- Solabia Group launched Sola Smart Fuse, which is a multifunctional ingredient that combines marine polysaccharides with soothing and moisturizing properties, making it ideal for anti-aging skincare. Its ability to restructure and enhance skin texture adds to its appeal for personalized skincare solutions.

- In November 2024, According to an article by PERSÉ BEAUTY INC, the growing trend of hyper-personalization in the beauty industry, where consumers seek highly tailored products to suit their individual needs. By leveraging data and advanced technology, companies can offer custom formulations for hair and skincare, aligning with the increasing demand for personalized, effective beauty solutions in the market.

- In November 2024, According to an article by Hale Cosmeceuticals Inc., the rising trend of customization in personal care manufacturing, driven by consumer demand for products that cater to specific needs. Brands are embracing this shift by offering personalized solutions, from skincare to hair care, allowing manufacturers to produce unique formulations that enhance customer satisfaction and brand loyalty.

- In October 2023, According to an article by John Wiley & Sons, Inc, the growing shift towards recyclable, refillable, or bio-based alternatives. While 61% of brands embrace eco-friendly options, transparency gaps persist, with 39% omitting packaging material details. The study emphasizes the need for improved regulations and industry-wide collaboration for a sustainable future.

In Conclusion, the increasing demand for innovative, customized, and sustainable products is a major driver of the Middle East and Africa personal care and home care contract manufacturing market. By leveraging advanced technologies and focusing on consumer-specific needs, contract manufacturers are enabling brands to remain competitive while meeting growing expectations for personalization and sustainability in the market.

Opportunities

- Technological Advancements In Manufacturing

Technological advancements are significantly improving the production process for personal care and home care products. Automation is helping manufacturers create items such as soaps, shampoos, detergents, and cleaning solutions with greater speed and precision. Robots and automated systems handle repetitive tasks, ensuring consistent quality while reducing human error. 3D printing is being used for packaging prototypes, allowing brands to test designs quickly and cost-effectively.

Artificial Intelligence (AI) and the Internet of Things (IoT) are transforming production lines. Machines equipped with sensors and AI can monitor production in real time, detect issues early, and ensure optimal performance. IoT allows for better connectivity between machines, improving coordination and reducing downtime.

Advanced technologies are also enabling the use of sustainable materials, catering to the growing demand for eco-friendly products. Manufacturers can experiment with new formulations and ingredients using smart tools, ensuring compliance with safety standards while reducing environmental impact. These innovations help contract manufacturers produce high-quality, efficient, and eco-conscious products for their clients.

For instance,

- In July 2024, according to an article published by Reckers Mechatronics Pvt. Ltd., integrating automation in a soap and detergent plant boosts efficiency by automating dosing, mixing, and packaging, ensuring consistent product quality and reducing human error. It enhances safety by minimizing exposure to hazards, cuts costs through optimized energy use, and offers real-time data monitoring, enabling scalability and adaptability to market demands.

- In July 2024, according to an article published by HashStudioz Technologies, Inc., in a manufacturing plant, IoT sensors monitor equipment performance in real time, while AI analyzes the data to predict failures. This AIoT integration allows for proactive maintenance, reducing downtime, improving productivity, and extending the machine's lifespan.

- In February 2024, according to a blog published by Digi International Inc., in a manufacturing facility, IoT sensors allow industrial robots to function autonomously, enhancing efficiency and productivity. Predictive maintenance tools monitor machine performance, preventing downtime by identifying potential issues early. These IoT solutions help optimize energy consumption, improve product quality, and reduce costs, resulting in smarter and more efficient operations.

- In August 2023, according to an article published by Elsevier B.V., Industry 4.0 integrates IoT and machine learning to automate manufacturing, reducing human error and improving product quality. IoT sensors monitor machinery health, while ML algorithms detect anomalies and optimize processes. This synergy enhances productivity, reduces costs, and ensures real-time monitoring, enabling smarter and more efficient manufacturing operations.

In summary, technological advancements such as AI, IoT, automation, and 3D printing are transforming personal care and home care contract manufacturing. They boost efficiency, enhance quality, and enable the use of sustainable materials, helping manufacturers meet modern consumer demands.

-

Rising Consumer Interest in Niche Product Categories

Consumers today are increasingly seeking niche product categories that cater to their specific needs and preferences. In personal care and home care, this shift is evident in the growing demand for products such as organic shampoos, eco-friendly detergents, vegan skincare, and allergen-free cleaning solutions. People are becoming more conscious about their health, the environment, and ethical practices, which drives them toward specialized products.

Manufacturers and brands are responding by offering unique, customized solutions. For example, products with natural ingredients, cruelty-free certifications, or sustainable packaging appeal to consumers looking for more than just functionality. Social media and digital platforms have amplified this trend, as consumers can easily research products, read reviews, and make informed choices.

Niche categories also allow brands to differentiate themselves in a competitive market. By addressing specific customer needs, they can build stronger loyalty and attract a dedicated audience. Contract manufacturers play a crucial role by helping brands create innovative products that meet these niche demands, offering flexibility in formulations, packaging, and production volumes.

For instance,

- In October 2023, according to a study published by Elsevier B.V., 60% of consumers were willing to alter their purchasing habits to reduce environmental impact, and 80% prioritized sustainability. The cosmetics industry has embraced this shift by focusing on natural ingredients, ethical sourcing, and sustainable packaging, driven by consumer demand and regulatory changes.

- In November 2022, according to a study published by Elsevier B.V., consumers are increasingly prioritizing natural and eco-friendly products, with natural claims becoming the top focus in beauty and personal care. In Europe, the market for natural products has grown by 7.2% annually. Governments and manufacturers are encouraging sustainable claims to promote responsible consumption and production practices.

- In June 2023, according to a study published by ResearchGate GmbH, the rise of vegan beauty products in the Indian market is driven by sustainability, ethical consumerism, and wellness. It explores factors such as nature-inspired formulations, the demand for cruelty-free alternatives, challenges faced by brands, and strategies employed to overcome them, offering insights into vegan beauty's impact on India's cosmetics industry.

In summary, consumers are showing increased interest in niche personal care and home care products, such as organic, vegan, and eco-friendly options. This trend reflects growing health, environmental, and ethical awareness. Brands and manufacturers are leveraging this opportunity to create specialized products that meet specific needs and build customer loyalty.

Restraints/Challenges

- Maintaining Quality Consistency

Quality consistency is crucial in the production of personal care and home care products. Consumers expect every bottle of shampoo or pack of detergent to deliver the same effectiveness and safety as the last one they purchased. For contract manufacturers, this means following strict standards during production to ensure uniformity in every batch.

Using advanced technologies such as automation, sensors, and artificial intelligence (AI), manufacturers can closely monitor each step of the production process. These tools help detect variations early, ensuring the final product meets quality requirements. Adhering to certifications such as Good Manufacturing Practices (GMP) and ISO standards also ensures consistent quality and safety.

Ingredients and raw materials are thoroughly tested before use, and formulations are carefully measured to avoid discrepancies. Regular equipment maintenance and employee training further contribute to maintaining high standards.

Consistency is not just about meeting customer expectations; it’s also about building trust and loyalty. Brands that consistently deliver high-quality products are more such asly to retain customers and grow their market share. Contract manufacturers play a vital role in this process, providing expertise and technology to maintain reliability.

For instance,

- In October 2023, according to a blog published by SkinConsult, in cosmetics manufacturing, quality management is crucial to ensure products are safe, reliable, and consistent. By adhering to strict safety standards and delivering on promises, companies can build customer trust and avoid product issues. This helps maintain brand reputation, drive success, and foster long-term customer loyalty.

- According to an article published by Rheonics, viscosity testing is crucial in the cosmetics industry to ensure product quality, consistency, and customer satisfaction. By using advanced technologies such as viscometers, automation, and IIoT, companies can improve production efficiency, reduce costs, and meet higher customer expectations. This helps manufacturers stay competitive while maintaining top-quality products and sustainable practices.

- In January 2024, according to a blog published by Hale Cosmeceuticals Inc., in the highly competitive cosmetics industry, quality management ensures product safety, consistency, and customer trust. By adhering to regulatory standards, conducting thorough testing, and implementing risk management protocols, companies can guarantee safe, effective products. This commitment to quality helps build brand reputation and ensures compliance, minimizing product issues and recalls.

In summary, maintaining quality consistency is essential for personal care and home care products. Contract manufacturers ensure this by using advanced technologies, adhering to strict standards, and performing thorough testing, helping brands build trust and meet customer expectations.

- Rapidly Changing Consumer Demands

Consumer preferences are evolving faster than ever, driven by trends such as health awareness, environmental concerns, and social responsibility. In the personal care and home care industry, customers seek innovative products such as organic soaps, biodegradable cleaners, or cruelty-free cosmetics. To meet these demands, contract manufacturers must remain agile and adapt quickly.

This agility involves staying updated on market trends, investing in new technologies, and maintaining flexible production processes. For example, manufacturers may need to quickly adjust formulations to include sustainable ingredients or redesign packaging to be eco-friendly. Advanced tools such as automation and artificial intelligence (AI) help speed up production while maintaining quality.

Collaborating closely with brands is also essential. By understanding a client’s vision and responding promptly to changes, contract manufacturers can deliver products that align with consumer expectations. Shorter product development cycles and the ability to scale production up or down are critical for staying competitive in this dynamic market.

Adaptability not only meets consumer needs but also strengthens partnerships with brands, ensuring long-term growth for both parties.

For instance,

- According to a blog published by Tecnova India Pvt. Ltd., rapidly changing consumer demands, such as the shift toward natural and organic products, personalized beauty solutions, sustainable packaging, and wellness integration, require contract manufacturers to stay agile. They must quickly adapt to these trends by leveraging technology, data analytics, and flexible production processes to meet evolving market expectations.

- In September 2024, according to a blog published by Euromonitor, the rapidly evolving consumer demands—such as the growing preference for ingredient-driven beauty, wellness-oriented sun care, and multi-functional products—require contract manufacturers to remain flexible.

- In August 2022, according to a report published by Nielsen Consumer LLC, rapidly changing consumer demands—such as the growing focus on wellness, eco-friendly ingredients, and authenticity in marketing—require contract manufacturers to remain agile. Manufacturers must adapt quickly to shifting trends, ensuring that products meet evolving consumer expectations for health, sustainability, and social impact, while maintaining quality and efficacy.

In summary, contract manufacturers in personal care and home care must stay agile to meet rapidly changing consumer demands. by using advanced technologies, maintaining flexibility, and collaborating closely with brands, they can adapt to trends such as eco-friendly products and deliver high-quality solutions efficiently.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Middle East and Africa Personal Care and Home Care Contract Manufacturing Market Scope

The Middle East and Africa personal care and home care contract manufacturing market is segmented into based on service, packaging, packaging filling technology, packaging nature, formulation, category, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service [Personal Care]

- Manufacturing

- Manufacturing, By Products

- Skin Care Products

- Skin Care Products, By Products Type

- Face Washes and Cleansers

- Toners

- Moisturizers

- Moisturizers, By Products Type

- Creams

- Creams, By Type

- Sun Creams

- Anti-Aging Creams

- Lotions

- Gels

- Creams, By Type

- Serums

- Face Masks

- Face Masks, By Products Type

- Clay Masks

- Sheet Masks

- Face Masks, By Products Type

- Makeup Removers

- Makeup Removers, By Products Type

- Balms

- Wipes

- Cleansing Oils

- Others

- Makeup Removers, By Products Type

- Skin Care Products, By Products Type

- Skin Care Products

- Hair Care Products

- Hair Care Products, By Products Type

- Shampoos

- Shampoos, By Type

- Wet

- Dry

- Shampoos, By Type

- Conditioners

- Hair Masks

- Gels

- Oils

- Serum

- Hair Sprays

- Colors And Dyes

- Others

- Shampoos

- Hair Care Products, By Products Type

- Cosmetics And Makeup Products

- Cosmetics And Makeup Products, By Type

- Foundation, Concealers, And Bb/Cc Creams

- Blushes, Highlighters, And Bronzers

- Eye Makeup (Mascara, Eyeliner, Eyeshadow)

- Lipsticks, Glosses, and Liners

- Makeup Removers and Cleansing Wipes

- Primers And Setting Sprays

- Cosmetics And Makeup Products, By Type

- Bath Products

- Bath Products, By Products Type

- Bar Soaps

- Bar Soaps, By Type

- Moisturizing Soap

- Antibacterial Soap

- Herbal/Organic Soap

- Exfoliating Soap

- Bar Soaps, By Type

- Bar Soaps

- Bath Products, By Products Type

- Liquid Soaps and Body Washes

- Liquid Soaps and Body Washes, By Type

- Shower Gel

- Cream-Based Body Wash

- Foaming Body Wash

- Ph-Balanced Wash

- Fragrance-Free Wash (For Sensitive Skin)

- Liquid Soaps and Body Washes, By Type

- Bath Oils and Cleansers

- Bath Oils and Cleansers, By Type

- Moisturizing Bath Oils

- Aromatherapy Bath Oils

- Bath Oils and Cleansers, By Type

- Oral Care Products

- Oral Care Products, By Products Type

- Toothpaste

- Toothpaste, By Type

- Whitening

- Sensitive

- Herbal

- Toothpaste, By Type

- Mouthwashes

- Mouthwashes, By Type

- Antibacterial Mouthwash

- Fluoride Mouthwash

- Whitening Mouthwash

- Herbal Mouthwash

- Alcohol-Free Mouthwash

- Mouthwashes, By Type

- Toothbrushes

- Toothbrushes, By Type

- Manual

- Electric

- Toothbrushes, By Type

- Tongue Cleaners

- Toothpaste

- Oral Care Products, By Products Type

- Grooming And Hygiene

- Grooming And Hygiene, By Products

- Razors And Blades

- Razors And Blades, By Type

- Electric

- Disposable

- Razors And Blades, By Type

- Shaving Products

- Shaving Products, By Type

- Creams

- Foams

- Gels

- Shaving Products, By Type

- Razors And Blades

- Grooming And Hygiene, By Products

- Aftershave Lotions

- Hair Removal Creams and Waxes

- Feminine Hygiene Products

- Feminine Hygiene Products, By Type

- Sanitary Pads

- Tampons

- Menstrual Cups

- Feminine Hygiene Products, By Type

- Fragrances And Perfumes

- Fragrances And Perfumes, By Type

- Perfumes

- Perfumes, By Products

- Parfum (Pure Perfume/Extrait De Parfum)

- Eau De Parfum (Edp)

- Eau De Toilette (Edt)

- Eau De Cologne (Edc)

- Solid Perfumes

- Perfume Oils

- Rollerball Perfumes

- Pocket Or Travel-Sized Perfumes

- Perfumes, By Products

- Perfumes

- Fragrances And Perfumes, By Type

- Body Sprays and Mists

- Body Sprays and Mists, By Products

- Body Sprays (Men/Women/Unisex)

- Body Mists

- Refreshing Body Splash

- Refreshing Body Splash, By Products

- Deodorants And Antiperspirants

- Deodorants And Antiperspirants, By Product

- Stick Deodorants

- Roll-On Deodorants

- Spray Deodorants

- Gel Or Cream Deodorants

- Alcohol-Free Deodorants

- Deodorants And Antiperspirants, By Product

- Others

- Deodorants And Antiperspirants

- Body Sprays and Mists, By Products

- Manufacturing, By Products

- Packaging

- Logistics And Distribution

- Private Labeling

- Marketing And Sales Support

- Product Development and Formulation

- Regulatory Compliance

- R&D

Packaging [Personal Care]

- Primary Packaging

- Primary Packaging, By Type

- Standard Bottles

- Spray Bottles

- Spray Bottles, By Type

- Body Spray

- Hair Spray

- Trigger Spray Bottles

- Fine Mist Spray Bottles

- Spray Bottles, By Type

- Fragrance Bottles

- Jars

- Airless Containers

- Pouches

- Tubes

- Applicators & Droppers

- Closuress/ Valve Actuators

- Closuress/ Valve Actuators, By Type

- Disc Tops

- Snap Tops

- Pour Spouts

- Tube Tops

- Wide Mouth Snap Top

- Others

- Closuress/ Valve Actuators, By Type

- Primary Packaging, By Type

- Dispensing Pumps

- Dispensing Pumps, By Type

- Lotion

- Foam

- Fine Mist/Spray

- Others

- Dispensing Pumps, By Type

- Valves

- Packaging Filled Format

- Packaging Filled Format, By Type

- Lip Stick

- Pencils

- Paletter

- Mascara

- Lip Gloss

- Compact

- Pen

- Others

- Others

- Packaging Filled Format, By Type

- Secondary Packaging

- Secondary Packaging, By Type

- Labeling

- Cartoning

- Blister Packaging

- Shrink Wrapping

- Secondary Packaging, By Type

- Tertiary Packaging

- Tertiary Packaging, By Type

- Outer Cartons

- Palletizing

- Protective Packaging

- Tertiary Packaging, By Type

Packaging Filling Technology [Personal Care]

- Hot Pour Technology

- Cold Pour Technology

- Powder Filling

- Emulsion Filling

- Others

Packaging Nature [Personal Care]

- Natural

- Synthetic

Formulation [Personal Care]

- Solutions

- Gels

- Lotions

- Creams/Emulsions

- Powders

- Sticks

- Suspensions

- Ointments/Pastes

- Tablets & Capsules

- Aerosols

- Others

Category [Personal Care]

- Mass Product

- Premium Product

- Professional Products

End Use [Personal Care]

- Global Label

- Private/Individual Label

- Local Label

Service [Home Care]

- Manufacturing

- Manufacturing, By Products

- Cleaning Products

- Cleaning Products, By Products

- Surface Cleaners

- Floor Cleaners

- Glass Cleaners

- Carpet And Upholstery Cleaners

- Cleaning Products, By Products

- Cleaning Products

- Manufacturing, By Products

- Laundry Products

- Laundry Products, By Products

- Detergents

- Fabric Softeners

- Stain Removers

- Laundry Pods

- Laundry Products, By Products

- Dishwashing Products

- Dishwashing Products, By Products

- Dishwashing Liquids

- Dishwasher Pods/Tablets

- Air Care Products

- Others

- Dishwashing Products, By Products

- Packaging

- Logistics And Distribution

- Marketing And Sales Support

- Product Development and Formulation

- Private Labeling

- R&D

- Regulatory Compliance

Packaging [Home Care]

- Primary Packaging

- Primary Packaging, By Type

- Bottles

- Bottles, By Type

- Glass Bottles

- Plastic Bottles

- Bottles, By Type

- Jars And Containers

- Jars And Containers, By Type

- Glass Jars and Containers

- Plastic Jars and Containers

- Jars And Containers, By Type

- Bottles

- Aluminum Cans and Bottles

- Stand-Up Pouches

- Sachets

- Others

- Primary Packaging, By Type

- Secondary Packaging

- Secondary Packaging Services, By Type

- Labeling

- Cartoning

- Blister Packaging

- Shrink Wrapping

- Secondary Packaging Services, By Type

- Tertiary Packaging

- Tertiary Packaging Services, By Type

- Outer Cartons

- Palletizing

- Protective Packaging

- Tertiary Packaging Services, By Type

Middle East and Africa Care and Home Care Contract Manufacturing Market Regional Analysis

The market is analyzed and market size insights and trends are based on country, service, packaging, packaging filling technology, packaging nature, formulation, category, and end use.

The countries covered in the market are South Africa, Saudi Arabia, U.A.E., Egypt, Israel, and Rest of Middle East and Africa.

South Africa is expected to dominate the personal care and home care contract manufacturing market due to rising consumer demand for high-quality, innovative products and the increasing preference for outsourced production. Brands are leveraging contract manufacturers to scale operations, reduce costs, and accelerate time-to-market.

Saudi Arabia is expected to witness the highest CAGR in the personal care and home care contract manufacturing market due evolving consumer preferences for natural, sustainable, and cruelty-free products, prompting manufacturers to adapt formulations and packaging solutions. Technological advancements in production, coupled with the rising influence of e-commerce, enable faster, more flexible manufacturing processes.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Care and Home Care Contract Manufacturing Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Care and Home Care Contract Manufacturing Market Leaders Operating in the Market Are:

- VVF L.L.C. (U.S.)

- A.I.G. Technologies, Inc. (U.S.)

- Nutrix International LLC (U.S.)

- FormulaCorp (U.S.)

- PLZ Corp (U.S.)

- Tropical Products (U.S.)

- Apollo Health Care Corporation Inc. (Canada)

- CoValence Laboratories (U.S.)

- McBride (UK)

- RCP Ranstadt GmbH (Germany)

- Beautech Industries Ltd. (Canada)

- SKINLYS MENTIONS LÉGALES (France)

- Albéa Services S.A.S. (France)

- KIK Consumer Products Inc. (Canada)

- Maesa (U.S.)

- Fareva Group (France)

- Arminak Solutions LLC dba KBL Cosmetics (U.S.)

- Asil Middle East and Africa INC. (U.S.)

- STPP Group (China)

- Gurtler Industries, Inc. (U.S.)

- Steverlynck (Belgium)

- AMR Laboratories (U.S.)

- Voyant Beauty (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 SECONDARY SOURCES

2.9 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 VENDOR SELECTION CRITERIA

4.4.1 EXPERIENCE AND EXPERTISE

4.4.2 REGULATORY COMPLIANCE

4.4.3 QUALITY ASSURANCE

4.4.4 CAPACITY AND SCALABILITY

4.4.5 COST AND PRICING STRUCTURE

4.4.6 TECHNOLOGY AND EQUIPMENT

4.4.7 COMMUNICATION AND TRANSPARENCY

4.4.8 SUSTAINABILITY AND ETHICAL PRACTICES

4.4.9 REFERENCES AND REVIEWS

4.4.10 LOCATION

4.4.11 CONCLUSION

4.5 CLIMATE CHANGE SCENARIO

4.5.1 SUPPLY CHAIN DISRUPTIONS

4.5.2 WATER SCARCITY

4.5.3 ENERGY CONSUMPTION AND GREENHOUSE GAS EMISSIONS

4.5.4 REGULATORY CHANGES

4.5.5 SUSTAINABLE PACKAGING

4.5.6 CONSUMER DEMAND FOR ECO-FRIENDLY PRODUCTS

4.5.7 ADAPTATION AND RESILIENCE STRATEGIES

4.5.8 CONCLUSION

4.6 RAW MATERIAL COVERAGE

4.6.1 SURFACTANTS

4.6.2 EMOLLIENTS AND MOISTURIZERS

4.6.3 ACTIVE INGREDIENTS

4.6.4 FRAGRANCES AND FLAVORS

4.6.5 PRESERVATIVES

4.6.6 CONCLUSION

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT AND SOURCING

4.7.2 MANUFACTURING AND PRODUCTION

4.7.3 PACKAGING AND LABELING

4.7.4 DISTRIBUTION AND LOGISTICS

4.7.5 LOGISTICS COST SCENARIO

4.7.5.1 TRANSPORTATION COSTS

4.7.5.2 WAREHOUSING AND INVENTORY MANAGEMENT

4.7.5.3 PACKAGING AND HANDLING

4.7.5.4 REGULATORY COMPLIANCE

4.7.6 THE IMPORTANCE OF LOGISTICS SERVICE PROVIDERS (LSPS)

4.7.6.1 MIDDLE EAST AND AFRICA NETWORK AND LOCAL EXPERTISE

4.7.6.2 COST-EFFECTIVENESS

4.7.6.3 RISK MANAGEMENT AND SUPPLY CHAIN RESILIENCE

4.7.6.4 TECHNOLOGICAL INTEGRATION AND TRANSPARENCY

4.7.6.5 SUSTAINABILITY AND GREEN LOGISTICS

4.7.6.6 COMPLIANCE AND DOCUMENTATION MANAGEMENT

4.7.7 CHALLENGES IN THE SUPPLY CHAIN:

4.7.8 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.8.1 AUTOMATION AND ROBOTICS

4.8.2 BIOTECHNOLOGY INNOVATIONS

4.8.3 ARTIFICIAL INTELLIGENCE (AI) INTEGRATION

4.8.4 ADVANCED FORMULATION TECHNOLOGIES

4.8.5 ENHANCED SUPPLY CHAIN MANAGEMENT

4.8.6 SUSTAINABLE MANUFACTURING PRACTICES

4.8.7 CONCLUSION

4.9 PRODUCTION CAPACITY OVERVIEW

4.1 PRICE INDEX

4.11 PRODUCTION CONSUMPTION ANALYSIS

4.11.1 PRODUCTION ANALYSIS

4.11.2 CONSUMPTION ANALYSIS

4.11.3 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CONSUMER AWARENESS ABOUT HYGIENE AND GROOMING FUELING THE DEMAND FOR PERSONAL AND HOME CARE PRODUCTS

6.1.2 INCREASING DEMAND FOR INNOVATIVE, CUSTOMIZED, AND SUSTAINABLE PRODUCTS

6.1.3 FOCUS ON CORE COMPETENCIES SUCH AS MARKETING, BRANDING, AND PRODUCT DEVELOPMENT BY BRANDS

6.1.4 COST EFFICIENCY AND SPECIALIZATION

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES AND SUPPLY CHAIN DISRUPTIONS

6.2.2 INTENSE COMPETITION AMONG CONTRACT MANUFACTURERS LEADING TO PRICE WARS AND REDUCED PROFIT MARGINS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN MANUFACTURING

6.3.2 RISING CONSUMER INTEREST IN NICHE PRODUCT CATEGORIES

6.3.3 RISING POPULARITY OF PRIVATE-LABEL BRANDS ENCOURAGES PARTNERSHIPS WSITH CONTRACT MANUFACTURERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN MAINTAINING QUALITY CONSISTENCY

6.4.2 RAPIDLY CHANGING CONSUMER DEMANDS REQUIRE CONTRACT MANUFACTURERS TO STAY AGILE AND ADAPT QUICKLY

7 MIDDLE EAST AND AFRICA PERSONAL CARE CONTRACT MANUFACTURING MARKET

7.1 MIDDLE EAST AND AFRICA

8 MIDDLE EAST AND AFRICA HOME CARE CONTRACT MANUFACTURING MARKET

8.1 MIDDLE EAST AND AFRICA

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 APOLLO HEALTH CARE CORPORATION INC.

10.1.1 COMPANY SNAPSHOT

10.1.2 PRODUCT PORTFOLIO

10.1.3 RECENT DEVELOPMENT

10.2 COVALENCE LABORATORIES

10.2.1 COMPANY SNAPSHOT

10.2.2 PRODUCT PORTFOLIO

10.2.3 RECENT DEVELOPMENT

10.3 RCP RANSTADT GMBH

10.3.1 COMPANY SNAPSHOT

10.3.2 SERVICE PORTFOLIO

10.3.3 RECENT DEVELOPMENT

10.4 MCBRIDE

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 ARMINAK SOLUTIONS LLC DBA KBL COSMETICS

10.5.1 COMPANY SNAPSHOT

10.5.2 SERVICE PORTFOLIO

10.5.3 RECENT DEVELOPMENT

10.6 ASIL MIDDLE EAST AND AFRICA INC.

10.6.1 COMPANY SNAPSHOT

10.6.2 SERVICE PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 STPP GROUP

10.7.1 COMPANY SNAPSHOT

10.7.2 SERVICE PORTFOLIO

10.7.3 RECENT DEVELOPMENT

10.8 GURTLER INDUSTRIES, INC.

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENT

10.9 STEVERLYNCK

10.9.1 COMPANY SNAPSHOT

10.9.2 SERVICE PORTFOLIO

10.9.3 RECENT DEVELOPMENT

10.1 AMR LABORATORIES

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICE PORTFOLIO

10.10.3 RECENT DEVELOPMENT

10.11 VOYANT BEAUTY

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENT

10.12 BEAUTECH INDUSTRIES LTD

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENT

10.13 SKINLYS MENTIONS LÉGALES

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENT

10.14 ALBÉA SERVICES S.A.S.

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENT

10.15 KIK CONSUMER PRODUCTS INC.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENT

10.16 MAESA

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENT

10.17 FAREVA

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENT

10.18 TROPICAL PRODUCTS

10.18.1 COMPANY SNAPSHOT

10.18.2 SERVICE PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 VVF L.L.C.

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENT

10.2 A.I.G. TECHNOLOGIES, INC.

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCT PORTFOLIO

10.20.3 RECENT DEVELOPMENT

10.21 NUTRIX INTERNATIONAL LLC

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCT PORTFOLIO

10.21.3 RECENT DEVELOPMENT

10.22 FORMULACORP

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCT PORTFOLIO

10.22.3 RECENT DEVELOPMENT

10.23 PLZ CORP

10.23.1 COMPANY SNAPSHOT

10.23.2 PRODUCT PORTFOLIO

10.23.3 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET

FIGURE 2 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA PERSONAL CARE CONTRACT MANUFACTURING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA HOME CARE CONTRACT MANUFACTURING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 10 MIDDLE EAST AND AFRICA PERSONAL CARE CONTRACT MANUFACTURING MARKET EXECUTIVE SUMMARY

FIGURE 11 MIDDLE EAST AND AFRICA HOME CARE CONTRACT MANUFACTURING MARKET EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET, BY OFFERING

FIGURE 13 INCREASING DEMAND FOR INNOVATIVE, CUSTOMIZED, AND SUSTAINABLE PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 THE MANUFACTURING IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA PERSONAL CARE CONTRACT MANUFACTURING MARKET IN 2025 AND 2032

FIGURE 15 THE MANUFACTURING IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA HOME CARE CONTRACT MANUFACTURING MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 MIDDLE EAST AND AFRICA PERSONAL CARE AND HOME CARE CONTRACT MANUFACTURING MARKET, 2025-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 DROC ANALYSIS

FIGURE 23 MIDDLE EAST AND AFRICA PERSONAL CARE CONTRACT MANUFACTURING MARKET: SNAPSHOT (2024)

FIGURE 24 MIDDLE EAST AND AFRICA HOME CARE CONTRACT MANUFACTURING MARKET: SNAPSHOT (2024)

Middle East And Africa Personal Care And Home Care Contract Manufacturing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Personal Care And Home Care Contract Manufacturing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Personal Care And Home Care Contract Manufacturing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.