Middle East And Africa Pharmaceutical Glass Packaging Market

Market Size in USD Million

CAGR :

%

USD

345.93 Million

USD

598.84 Million

2024

2032

USD

345.93 Million

USD

598.84 Million

2024

2032

| 2025 –2032 | |

| USD 345.93 Million | |

| USD 598.84 Million | |

|

|

|

|

What is the Middle East and Africa Pharmaceutical Glass Packaging Market Size and Growth Rate?

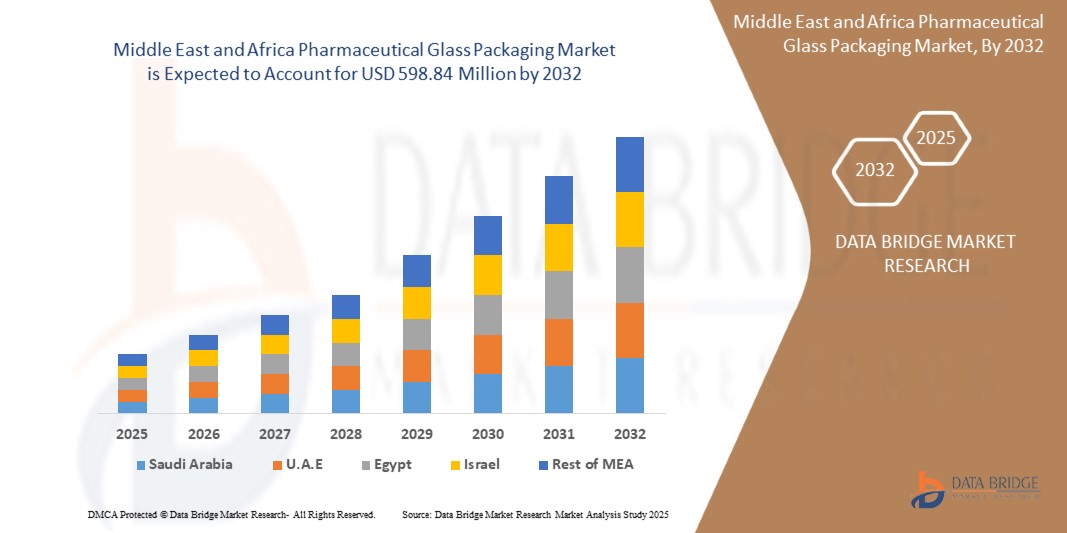

- The Middle East and Africa pharmaceutical glass packaging market size was valued at USD 345.93 million in 2024 and is expected to reach USD 598.84 million by 2032, at a CAGR of 7.10% during the forecast period

- Medicinal products encompass a wide range of pharmaceutical formulations, including tablets, capsules, liquids, and injectables, all of which require reliable packaging to maintain their efficacy and safety

- Pharmaceutical glass packaging companies serves a preferred choice for storing and dispensing these products due to its inert nature, which prevents chemical interactions and maintains product integrity

- Glass containers from pharmaceutical glass packaging market offer excellent barrier properties, protecting medicines from moisture, light, and oxygen, thereby extending their shelf life

What are the Major Takeaways of Pharmaceutical Glass Packaging Market?

- Regulatory bodies worldwide impose strict guidelines on packaging materials to ensure the protection of medicinal products from contamination, degradation, and tampering. Glass packaging is favored for pharmaceuticals due to its inert nature, which minimizes the risk of chemical interactions and maintains product stability

- Regulations also govern aspects such as sterility and barrier properties, further emphasizing the suitability of glass containers

- Compliance with these regulations necessitates pharmaceutical companies to invest in reliable packaging solutions, driving the demand for pharmaceutical glass packaging and propelling the market growth

- U.A.E. is expected to dominate the market with the market share of 45.87%, propelled by rapid urbanization and heightened consumer awareness regarding diverse pharmaceutical glass packaging solutions

- Saudi Arabia is expected to experience fastest growth rate of 7.12% in the market due to rising demand within the pharmaceutical sector. Factors such as population growth, expanding healthcare infrastructure, and increasing pharmaceutical production contribute to this surge

- The Type I segment dominated the market with the largest revenue share of 48.6% in 2024, owing to its high chemical resistance and suitability for storing sensitive and injectable drugs

Report Scope and Pharmaceutical Glass Packaging Market Segmentation

|

Attributes |

Pharmaceutical Glass Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pharmaceutical Glass Packaging Market?

“Rise of Sustainable and Lightweight Packaging Solutions”

- A prominent and accelerating trend in the Middle East and Africa pharmaceutical glass packaging market is the growing shift towards eco-friendly, lightweight, and sustainable packaging options. Pharmaceutical companies are increasingly prioritizing environmentally responsible solutions to meet regulatory guidelines and reduce carbon footprints

- For instance, Bormioli Pharma has launched lightweight glass bottles using eco-design principles, achieving a 16% weight reduction and a significant drop in CO₂ emissions per unit. Similarly, Schott AG offers Type I FIOLAX® glass tubing that is both durable and sustainable, helping customers meet strict pharma safety and environmental standards

- Advances in glass forming technology and recycling processes have enabled the production of high-purity glass containers that are lighter, reduce energy consumption, and retain protective qualities for sensitive drug formulations. Leading manufacturers are developing multi-dose and unit-dose formats tailored for injectable drugs, vaccines, and biologics

- Sustainable innovations such as returnable glass systems, recycled content incorporation, and lightweighting are aligning with global and regional sustainability goals. In addition, sustainability-focused packaging also enhances brand value among pharmaceutical companies under increasing pressure to comply with ESG regulations

- Companies such as Gerresheimer, SGD Pharma, and Bormioli Pharma are investing heavily in green glass manufacturing, including low-carbon furnaces and closed-loop recycling systems to create circular packaging models for the pharmaceutical industry

- This trend is reshaping material choices and influencing the supply chain and product design, as eco-conscious packaging becomes a competitive differentiator across injectables, oral liquids, and ophthalmic formulations in the pharmaceutical sector

What are the Key Drivers of Pharmaceutical Glass Packaging Market?

- The rising demand for parenteral and biologic drugs, along with a sharp increase in vaccine distribution, is driving the need for high-quality, chemically inert glass containers. Glass offers superior barrier properties and compatibility with sensitive formulations, making it the preferred material for injectable drug packaging

- For instance, in June 2023, Schott Pharma announced an expansion in its global production capacity for pre-fillable glass syringes in response to growing biologics demand. This move aims to support pharmaceutical companies in securing reliable delivery systems for critical therapies

- The growing prevalence of chronic diseases and expanding elderly population are increasing the consumption of pharmaceuticals that require safe and long-term storage, boosting demand for high-performance glass packaging

- In addition, stringent regulatory standards set by organizations such as the U.S. FDA, EMA, and WHO mandate the use of packaging materials that prevent drug interaction and ensure patient safety, further reinforcing the market for pharmaceutical-grade glass

- The market is also benefiting from technological advancements in manufacturing, such as precision forming, automated inspection systems, and innovations such as low-friction coatings and break-resistant vials, which enhance handling and reduce product loss during transportation and storage

Which Factor is challenging the Growth of the Pharmaceutical Glass Packaging Market?

- A key challenge hindering market growth is the fragility and breakability of glass packaging, particularly in high-speed production lines and during international distribution. This raises concerns about product safety, especially for injectable formats, which must maintain sterility and integrity

- For instance, incidents of glass delamination—where thin flakes separate from the inner surface of vials—have led to recalls and increased scrutiny from regulatory bodies, making some manufacturers cautious about glass usage for critical drugs

- In response, companies are exploring coated or strengthened glass technologies, such as Corning’s Valor® Glass, which enhances durability and reduces breakage. However, these advanced materials can significantly increase packaging costs

- Furthermore, supply chain disruptions, particularly during global crises such as COVID-19, exposed the limited availability of medical-grade glass tubing, creating bottlenecks in vaccine production and slowing market expansion

- Price volatility of raw materials, energy-intensive manufacturing processes, and dependency on a few key players for specialized borosilicate glass also pose risks to scalability and profitability

- Overcoming these challenges requires collaborative innovation, investments in R&D, and strategic partnerships between pharmaceutical companies and packaging providers to develop next-gen solutions that are both robust and cost-effective

How is the Pharmaceutical Glass Packaging Market Segmented?

The market is segmented on the basis of material, product, drug type, application, and end-use.

• By Material

On the basis of material, the pharmaceutical glass packaging market is segmented into Type I, Type II, and Type III. The Type I segment dominated the market with the largest revenue share of 48.6% in 2024, owing to its high chemical resistance and suitability for storing sensitive and injectable drugs. Type I borosilicate glass is the industry standard for critical pharmaceutical packaging due to its low alkali content and high thermal shock resistance.

The Type II segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for packaging less reactive formulations such as aqueous solutions. Its cost-effectiveness and compatibility with acidic and neutral parenteral preparations support its adoption, especially in emerging markets.

• By Product

On the basis of product, the market is segmented into Bottles, Ampoules, Cartridges and Syringes, Vials, and Others. The Vials segment accounted for the largest revenue share of 34.9% in 2024, due to their extensive use in storing vaccines, injectable drugs, and biologicals. Their compatibility with lyophilization and ease of transport make them essential in pharmaceutical logistics.

The Cartridges and Syringes segment is expected to grow at the fastest rate during the forecast period, supported by the rising adoption of prefilled syringes for chronic disease management and increasing preference for self-administration in home care settings.

• By Drug Type

Based on drug type, the market is segmented into Generic, Branded, and Biologic. The Generic segment held the highest market revenue share of 42.7% in 2024, attributed to the high volume production and increasing demand for cost-effective drug alternatives globally. The expiration of key drug patents and growth in aging populations drive this demand.

The Biologic segment is projected to register the fastest CAGR from 2025 to 2032, due to the expanding biologics pipeline and growing focus on complex diseases such as cancer and autoimmune disorders, which require high-integrity glass packaging solutions.

• By Application

On the basis of application, the market is segmented into Oral, Injectable, Nasal, and Others. The Injectable segment dominated the market with a revenue share of 59.1% in 2024, as parenteral drugs require sterile, non-reactive, and highly protective packaging, making glass the material of choice. The rise of biologics and vaccine administration continues to propel this segment forward.

The Nasal segment is expected to witness the fastest growth, driven by the increasing development of intranasal drug delivery therapies for pain relief, psychiatric disorders, and vaccination.

• By End-Use

On the basis of end-use, the pharmaceutical glass packaging market is segmented into Pharmaceutical Companies, Biopharmaceutical Companies, Contract Development and Manufacturing Companies (CDMOs), Compound Pharmacy, and Others. Pharmaceutical Companies led the market with the largest revenue share of 37.5% in 2024, due to their extensive manufacturing capacity and in-house drug formulation capabilities. Their reliance on safe, standardized packaging for regulatory compliance sustains this dominance.

The Contract Development and Manufacturing Companies (CDMOs) segment is projected to grow at the fastest CAGR from 2025 to 2032, propelled by the rising trend of outsourcing drug manufacturing to specialized firms that require scalable and quality-assured packaging solutions.

Which Region Holds the Largest Share of the Pharmaceutical Glass Packaging Market?

- U.A.E. is expected to dominate the market with the market share of 45.87%, propelled by rapid urbanization and heightened consumer awareness regarding diverse pharmaceutical glass packaging solutions

- This trend reflects a burgeoning demand for advanced packaging options that ensure product safety, quality, and longevity in the rapidly expanding urban landscape of the U.A.E

- With a proactive approach to meet evolving consumer needs and industry standards, the U.A.E. solidifies its position as a key player in shaping the future of pharmaceutical packaging solutions regionally and globally

Which Region is the Fastest Growing Region in the Pharmaceutical Glass Packaging Market?

Saudi Arabia is expected to experience fastest growth rate of 7.12% in the market due to rising demand within the pharmaceutical sector. Factors such as population growth, expanding healthcare infrastructure, and increasing pharmaceutical production contribute to this surge. In addition, stringent regulations promoting the use of high-quality packaging for medicines further drive the market. As the pharmaceutical industry expands and innovates, Saudi Arabia emerges as a key market for pharmaceutical glass packaging manufacturers, presenting lucrative opportunities for growth and investment.

Which are the Top Companies in Pharmaceutical Glass Packaging Market?

The pharmaceutical glass packaging industry is primarily led by well-established companies, including:

- RAK Ghani Glass LLC (U.A.E.)

- Asia Pulp & Paper Group (APG) (Indonesia)

- Middle East Glass – MEG (Egypt)

- Bormioli Pharma S.p.a (Italy)

- FRIGOGLASS AG (Switzerland)

- Medicinal Glass CO., Ltd. (China)

What are the Recent Developments in Middle East and Africa Pharmaceutical Glass Packaging Market?

- In May 2023, Nipro PharmaPackaging International NV, a subsidiary of Nipro Corporation, acquired Piramida, a prominent Croatian glass pharmaceutical packaging producer. The acquisition, following Piramida's impressive growth under Blue Sea Capital's ownership, underscores Nipro's dedication to expanding its footprint in European and global pharmaceutical packaging markets

- In September 2022, Gerresheimer AG and StevanatoGroup SpA collaborated to develop a high-end ready-to-use (RTU) solution platform, focusing initially on vials using StevanatoGroup's EZ-fill technology. This partnership promises customers increased productivity, higher quality standards, faster time to market, lower total cost of ownership (TCO), and reduced supply chain risks

- In July 2022, Nipro Corporation Japan invested HRK 100 million in a new glass packaging plant in Croatia. The facility, located in Zagreb's suburb Sesvete, specializes in producing glass ampoules and vials for pharmaceuticals, aiming to meet the demand for life-saving drugs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Pharmaceutical Glass Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Pharmaceutical Glass Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Pharmaceutical Glass Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.