Middle East And Africa Pharmaceutical Vials Market

Market Size in USD Billion

CAGR :

%

USD

17.23 Billion

USD

29.39 Billion

2025

2033

USD

17.23 Billion

USD

29.39 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 29.39 Billion | |

|

|

|

|

Middle East and Africa Pharmaceutical Vials Market Size

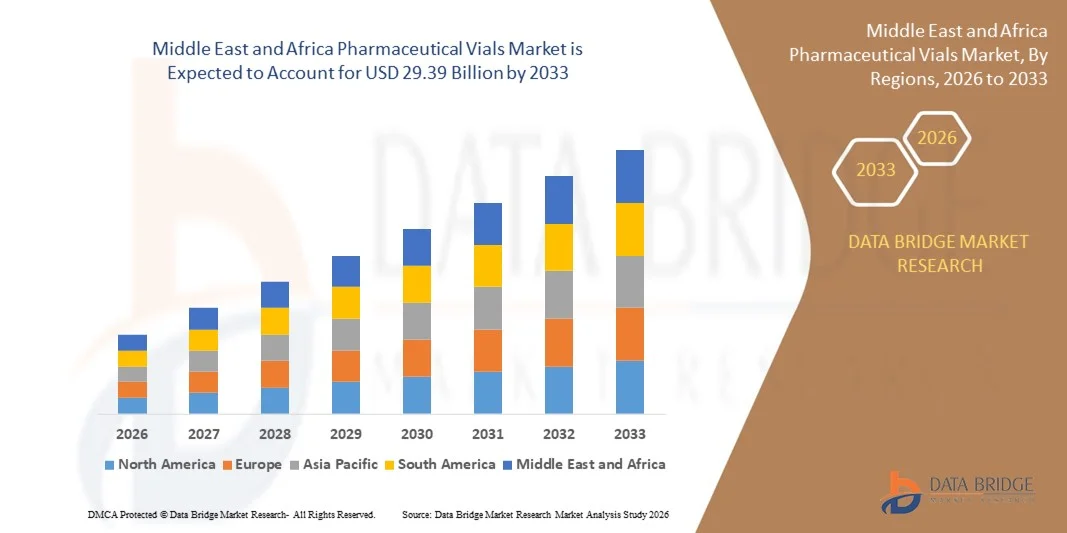

- The global Middle East and Africa Pharmaceutical Vials Market size was valued at USD 17.23 billion in 2025 and is expected to reach USD 29.39 billion by 2033, at a CAGR of 6.90% during the forecast period.

- The market growth is primarily driven by the rising demand for safe and efficient drug packaging solutions, coupled with increasing pharmaceutical production and vaccine distribution across the region.

- Additionally, technological advancements in vial manufacturing, such as automated filling and enhanced sterilization techniques, are improving product quality and operational efficiency, further propelling market expansion. These factors collectively are accelerating the adoption of pharmaceutical vials, thereby significantly boosting industry growth.

Middle East and Africa Pharmaceutical Vials Market Analysis

- Pharmaceutical vials, used for storing and transporting drugs, vaccines, and biologics, are increasingly vital components of the healthcare and pharmaceutical supply chain in both clinical and commercial settings due to their sterility, durability, and compatibility with advanced drug delivery systems.

- The escalating demand for pharmaceutical vials is primarily fueled by the growing production of vaccines and biologics, rising prevalence of chronic diseases, and increasing focus on safe and efficient drug packaging solutions.

- U.A.E. dominated the Middle East and Africa Pharmaceutical Vials Market with the largest revenue share of 32.5% in 2025, characterized by advanced pharmaceutical infrastructure, high R&D investment, and a strong presence of key industry players, with the U.S. experiencing substantial growth in vial consumption driven by vaccine production, innovative packaging solutions, and regulatory compliance standards.

- Saudi Arabia is expected to be the fastest-growing region in the Middle East and Africa Pharmaceutical Vials Market during the forecast period due to increasing pharmaceutical manufacturing, expanding healthcare infrastructure, and rising government initiatives for immunization and healthcare access.

- The glass segment dominated the market with a revenue share of 61.5% in 2025, driven by its superior chemical resistance, thermal stability, and compatibility with injectable drugs and vaccines.

Report Scope and Middle East and Africa Pharmaceutical Vials Market Segmentation

|

Attributes |

Pharmaceutical Vials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

• Gerresheimer AG (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Pharmaceutical Vials Market Trends

Enhanced Efficiency Through Advanced Automation and Digital Integration

- A significant and accelerating trend in the global Middle East and Africa Pharmaceutical Vials Market is the increasing adoption of advanced automation and digital technologies in vial production, filling, and packaging. These innovations are significantly enhancing operational efficiency, product quality, and traceability across the pharmaceutical supply chain.

- For instance, fully automated vial filling and sealing systems can handle high-volume production with minimal human intervention, ensuring consistent sterilization and reducing the risk of contamination. Similarly, vision inspection systems integrated with robotics improve quality control by detecting defects in glass vials or improper seals in real time.

- Digital integration in vial manufacturing enables features such as real-time monitoring of production parameters, predictive maintenance of equipment, and batch-level tracking for regulatory compliance. For example, some systems utilize IoT sensors and AI-driven analytics to optimize filling accuracy and detect anomalies before they impact output.

- The seamless integration of automated production lines with enterprise resource planning (ERP) and warehouse management systems allows manufacturers to coordinate production, inventory, and distribution from a single interface. This creates a highly streamlined and traceable workflow that enhances supply chain efficiency and minimizes waste.

- This trend towards more intelligent, automated, and digitally connected manufacturing processes is fundamentally reshaping industry expectations for pharmaceutical vial production. Consequently, companies such as Schott, Gerresheimer, and Stevanato Group are developing fully automated, AI-assisted vial production solutions with real-time monitoring, defect detection, and digital traceability features.

- The demand for pharmaceutical vials produced using automated and digitally integrated systems is growing rapidly across both vaccine and biologics sectors, as manufacturers increasingly prioritize efficiency, product safety, and regulatory compliance.

Middle East and Africa Pharmaceutical Vials Market Dynamics

Driver

Growing Need Due to Rising Pharmaceutical Demand and Vaccine Distribution

- The increasing prevalence of chronic diseases, coupled with the accelerated production and distribution of vaccines and biologics, is a significant driver for the heightened demand for pharmaceutical vials.

- For instance, in early 2025, Gerresheimer AG announced an expansion of its automated vial production lines to support growing vaccine manufacturing needs in the Middle East and Africa. Such strategic moves by key companies are expected to drive market growth during the forecast period.

- As healthcare providers and pharmaceutical manufacturers prioritize safe and sterile packaging, vials offer advanced features such as tamper-evident seals, high chemical resistance, and compatibility with advanced drug delivery systems, providing a critical upgrade over traditional containers.

- Furthermore, the growing focus on immunization programs, biologics, and injectable therapeutics is making pharmaceutical vials an indispensable component of healthcare supply chains, ensuring safe and efficient storage and distribution of sensitive drugs.

- The need for standardized, high-quality vials, rapid filling and sealing solutions, and traceable packaging systems are key factors propelling adoption in both large-scale pharmaceutical manufacturing and smaller clinical settings. The trend toward automated filling lines and user-friendly packaging solutions further contributes to market growth.

Restraint/Challenge

Regulatory Compliance and High Production Costs

- Strict regulatory standards and compliance requirements for pharmaceutical packaging pose a significant challenge to broader market expansion. Vials must meet rigorous quality, sterility, and safety regulations, which can increase manufacturing complexity and costs.

- For instance, failure to comply with FDA, EMA, or local regulatory standards can result in recalls or delayed product launches, creating hesitancy among manufacturers to scale production rapidly.

- Addressing these regulatory challenges through robust quality assurance systems, validated sterilization methods, and adherence to Good Manufacturing Practices (GMP) is crucial for building trust with clients. Companies such as Schott AG and Stevanato Group emphasize their compliance capabilities and certifications in their marketing and client communications to reassure buyers.

- Additionally, the relatively high cost of producing specialized vials, such as glass vials with precision sterilization or coated surfaces, can be a barrier to adoption, particularly for smaller pharmaceutical manufacturers in developing regions. While some standard vials have become more cost-effective, premium vials with advanced features often come at a higher price point.

- Overcoming these challenges through process optimization, innovation in cost-efficient production methods, and continued regulatory support will be vital for sustained market growth in the Middle East and Africa pharmaceutical vials sector.

Middle East and Africa Pharmaceutical Vials Market Scope

The pharmaceutical vials market is segmented on the basis of the material, neck type, cap size, distribution channel, capacity, drug type, application, end-user and market.

- By Material

On the basis of material, the Middle East and Africa Pharmaceutical Vials Market is segmented into glass, plastic, and others. The glass segment dominated the market with a revenue share of 61.5% in 2025, driven by its superior chemical resistance, thermal stability, and compatibility with injectable drugs and vaccines. Glass vials are widely preferred for sterile formulations, ensuring long-term drug stability and adherence to stringent regulatory standards. They are particularly favored in high-value biologics and parenteral applications where contamination prevention is critical.

The plastic segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing demand for lightweight, break-resistant, and cost-effective alternatives in prefilled and disposable drug delivery systems. Plastic vials are gaining traction in emerging markets due to easier transportation, reduced breakage risk, and adaptability for large-scale production. Increasing innovation in polymer formulations with high chemical resistance is further driving adoption.

- By Neck Type

On the basis of neck type, the Middle East and Africa Pharmaceutical Vials Market is segmented into screw neck, crimp neck, double chamber, flip cap, and others. The screw neck segment dominated the market with a revenue share of 45.3% in 2025, owing to its ease of sealing, compatibility with automated filling lines, and suitability for both injectable and oral drug formulations. Screw neck vials are widely adopted in hospitals, pharmacies, and research labs for their standardized closure systems and cost-effectiveness.

The crimp neck segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its enhanced sealing capabilities, suitability for lyophilized products, and preference in high-volume vaccine production. The crimp neck design ensures minimal contamination risk, reliable stopper placement, and compliance with strict GMP standards, making it a preferred choice for critical injectable drug formulations.

- By Cap Size

On the basis of cap size, the Middle East and Africa Pharmaceutical Vials Market is segmented into 13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm, and others. The 13-425 mm segment dominated the market with a revenue share of 38.7% in 2025, driven by its widespread use for injectable formulations and standardization across pharmaceutical manufacturing lines. This cap size is favored due to compatibility with automated filling and sealing machinery and its prevalence in both hospital and retail applications.

The 18-400 mm segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing adoption in vaccine packaging and high-volume biologics manufacturing. The segment’s growth is supported by innovations in sealing technology, improved compatibility with rubber stoppers, and the growing trend of multi-dose vials for mass immunization campaigns.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa Pharmaceutical Vials Market is segmented into direct sales, medical stores/pharmacies, e-commerce, and others. The direct sales segment dominated the market with a revenue share of 52.1% in 2025, driven by direct procurement by pharmaceutical and biopharmaceutical companies from manufacturers, ensuring bulk supply, customized orders, and strict quality assurance.

The e-commerce segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising digitalization in healthcare procurement, the convenience of online ordering, and growing acceptance among small pharmacies and research labs. E-commerce platforms facilitate quick access to standardized vial sizes, materials, and cap types, particularly for urgent or niche requirements, thereby supporting the rapid adoption of online channels in the pharmaceutical supply chain.

- By Capacity

On the basis of capacity, the Middle East and Africa Pharmaceutical Vials Market is segmented into 1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml, and others. The 10 ml segment dominated the market with a revenue share of 35.9% in 2025, owing to its versatility for vaccines, biologics, and injectable drugs commonly used in hospitals and clinics. The 10 ml vial size is compatible with automated filling, inspection, and labeling systems, offering efficiency and consistency in large-scale pharmaceutical production.

The 2 ml segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the rising demand for prefilled syringes, pediatric formulations, and laboratory-scale applications. Smaller-capacity vials provide precision dosing and reduce drug wastage, meeting the needs of personalized medicine and small-volume injectable therapies.

Middle East and Africa Pharmaceutical Vials Market Regional Analysis

- U.A.E. dominated the Middle East and Africa Pharmaceutical Vials Market with the largest revenue share of 32.5% in 2025, driven by the growing demand for vaccines, biologics, and safe injectable drug packaging, as well as advanced pharmaceutical manufacturing infrastructure.

- Manufacturers and healthcare providers in the region highly value the reliability, sterility, and compliance with regulatory standards offered by high-quality pharmaceutical vials, ensuring safe storage and transportation of sensitive drugs and vaccines.

- This widespread adoption is further supported by robust pharmaceutical R&D, high investment in production facilities, and increasing focus on automation and quality assurance, establishing pharmaceutical vials as an indispensable solution for both clinical and commercial healthcare applications.

Saudi Arabia Pharmaceutical Vials Market Insight

The Saudi Arabia pharmaceutical vials market captured a significant revenue share in 2025, driven by the country’s expanding healthcare infrastructure, growing pharmaceutical manufacturing, and increasing demand for vaccines and biologics. Government initiatives supporting local drug production and vaccination programs are fueling market growth. The adoption of automated vial filling and advanced sterilization technologies is further enhancing production efficiency and product quality across both clinical and commercial sectors.

U.A.E. Pharmaceutical Vials Market Insight

The U.A.E. pharmaceutical vials market is projected to grow at a substantial CAGR during the forecast period, primarily fueled by the increasing presence of pharmaceutical manufacturing facilities and the rising need for sterile injectable packaging. The region’s investment in healthcare innovation, along with a growing focus on vaccine distribution and biologics, is driving adoption. Both local and international manufacturers are expanding production capacities to meet demand in hospitals, clinics, and export markets.

South Africa Pharmaceutical Vials Market Insight

The South Africa pharmaceutical vials market is expected to expand at a noteworthy CAGR, driven by rising healthcare expenditure, increased vaccination programs, and growing awareness of safe drug storage practices. The market growth is supported by improvements in supply chain infrastructure and the adoption of advanced packaging solutions to ensure the integrity of sensitive drugs and biologics in both urban and rural healthcare settings.

Egypt Pharmaceutical Vials Market Insight

The Egypt pharmaceutical vials market is poised to grow steadily during the forecast period, fueled by the country’s expanding pharmaceutical manufacturing sector, growing demand for vaccines, and government-led healthcare initiatives. Increasing investment in sterile drug packaging technologies and quality control measures is enhancing the production of high-quality vials for local and regional distribution. The adoption of automated filling and inspection systems is also gaining traction, improving efficiency and product safety.

Israel Pharmaceutical Vials Market Insight

The Israel pharmaceutical vials market is gaining momentum due to the country’s strong pharmaceutical R&D ecosystem, growing biologics and vaccine production, and advanced manufacturing capabilities. The integration of digital and automated vial production systems, along with stringent regulatory compliance, is driving efficiency and ensuring high product quality. Israel’s focus on innovation and export-oriented pharmaceutical manufacturing is further supporting market growth across clinical and commercial sectors.

Middle East and Africa Pharmaceutical Vials Market Share

The Pharmaceutical Vials industry is primarily led by well-established companies, including:

• Gerresheimer AG (Germany)

• SCHOTT AG (Germany)

• Stevanato Group (Italy)

• Vetter Pharma-Fertigung GmbH & Co. KG (Germany)

• BD (Becton, Dickinson and Company) (U.S.)

• Nipro Corporation (Japan)

• Catalent, Inc. (U.S.)

• AptarGroup, Inc. (U.S.)

• Pfizer Packaging Solutions (U.S.)

• Sartorius AG (Germany)

• Ompi (SGD Pharma) (France)

• Rexam (now part of Ball Corporation) (U.K.)

• Aseptic Technologies (France)

• Alpha Pro Tech (Canada)

• Rommelag Group (Germany)

• Gerresheimer Regensburg GmbH (Germany)

• Thermo Fisher Scientific (U.S.)

• SCHOTT Kaisha Ltd. (Japan)

• Pfizer Glass & Vial Solutions (U.S.)

• Spartek Group (U.K.)

What are the Recent Developments in Middle East and Africa Pharmaceutical Vials Market?

- In April 2024, Schott AG, a global leader in specialty glass and pharmaceutical packaging, expanded its production capacity in the United Arab Emirates to support growing demand for sterile pharmaceutical vials. This initiative underscores the company’s commitment to delivering high-quality, reliable packaging solutions tailored to the region’s expanding pharmaceutical and vaccine markets. By leveraging its global expertise and advanced manufacturing technologies, Schott is addressing regional healthcare needs while strengthening its presence in the Middle East and Africa Pharmaceutical Vials Market.

- In March 2024, Gerresheimer AG, a Germany-based pharmaceutical packaging company, launched a new automated vial filling line in Saudi Arabia designed for biologics and injectable drugs. The advanced system enhances production efficiency, ensures sterility, and supports rapid scaling of vaccine and drug manufacturing. This development highlights Gerresheimer’s dedication to innovation in pharmaceutical packaging and its role in strengthening regional healthcare infrastructure.

- In March 2024, Stevanato Group successfully implemented a state-of-the-art inspection and serialization system at its Egyptian facility, aimed at improving quality control and regulatory compliance for pharmaceutical vials. This initiative utilizes advanced automation and digital traceability solutions to ensure product safety and integrity, reflecting Stevanato Group’s commitment to delivering high-quality packaging solutions in the Middle East and Africa region.

- In February 2024, Catalent, Inc., a leading global provider of drug development and manufacturing solutions, partnered with local pharmaceutical companies in South Africa to expand vial production for vaccines and injectable therapies. The collaboration is designed to enhance local manufacturing capabilities, improve supply chain resilience, and provide reliable access to critical medicines, underscoring Catalent’s focus on innovation and operational efficiency in the regional pharmaceutical market.

- In January 2024, Vetter Pharma International GmbH launched a fully automated vial filling and sealing line in Israel, capable of handling high-volume production of sterile injectable drugs. The system integrates advanced quality control, real-time monitoring, and regulatory-compliant processes, demonstrating Vetter Pharma’s commitment to combining technological innovation with operational excellence to meet the growing demands of the Middle East and Africa Pharmaceutical Vials Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Pharmaceutical Vials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Pharmaceutical Vials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Pharmaceutical Vials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.