Middle East And Africa Precision Gearbox Market

Market Size in USD Million

CAGR :

%

USD

272.40 Million

USD

503.00 Million

2024

2032

USD

272.40 Million

USD

503.00 Million

2024

2032

| 2025 –2032 | |

| USD 272.40 Million | |

| USD 503.00 Million | |

|

|

|

|

Middle East and Africa Precision Gearbox Market Size

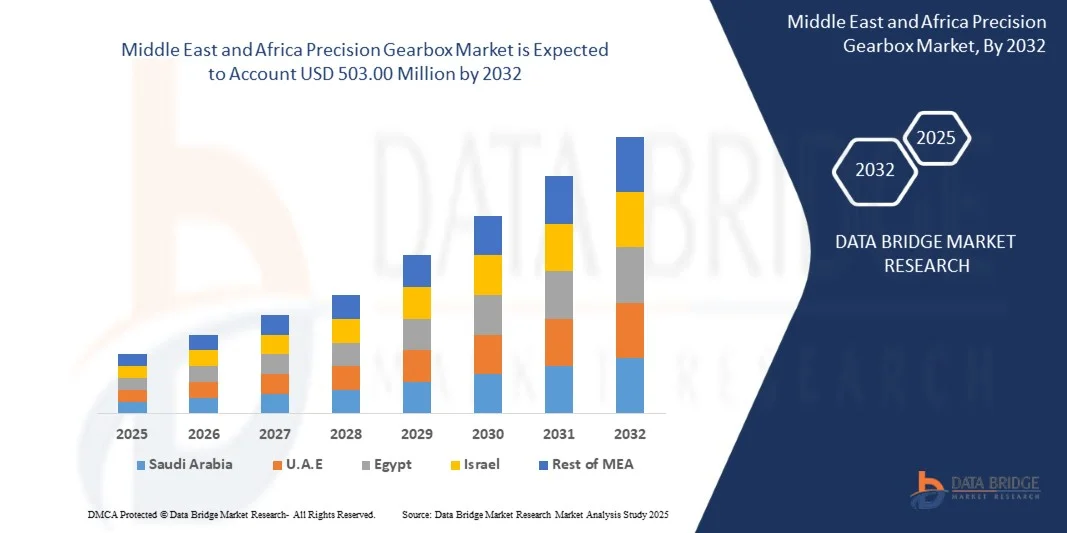

- The Middle East and Africa Precision Gearbox Market was valued at USD 272.40 Million in 2024 and is expected to reach USD 503.00 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.08%, primarily driven by rising demand in rising demand for nutrient-enriched animal-derived food products and increased focus on improving livestock health

- This growth is further fueled by increasing demand for compact, high-torque, and energy-efficient transmission systems, as well as expanding applications in electric vehicles (EVs), aerospace, renewable energy systems, and medical robotics. Ongoing technological innovations, such as smart gearboxes with IoT-enabled condition monitoring and precision planetary designs, are also expected to accelerate market expansion globally

Middle East and Africa Precision Gearbox Market Analysis

- The Middle East and Africa Precision Gearbox Market is witnessing significant growth, driven by increasing demand for high-performance, compact, and energy-efficient mechanical transmission systems across multiple industrial sectors. Precision gearboxes are essential for applications requiring accurate torque transmission, minimal backlash, high reliability, and long operational life. They are widely used in robotics, aerospace, automotive, industrial automation, packaging machinery, and renewable energy systems. However, the market faces challenges related to manufacturing complexity, material costs, and maintenance in harsh environments

- The industrial automation and robotics sectors are major growth drivers. With Industry 4.0 adoption, precision gearboxes are critical for robotics arms, CNC machines, and assembly line automation where accuracy, repeatability, and low noise operation are crucial. In the automotive sector, electric and hybrid vehicles increasingly rely on precision gearboxes for efficient power transfer and torque management in electric drivetrains. Meanwhile, renewable energy applications, such as wind turbines, utilize precision gearboxes to improve energy capture and reduce downtime, further expanding market demand

- Saudi Arabia dominates the market, led by, , due to robust industrial manufacturing growth, rising robotics adoption, and automotive electrification. Middle East and Africa follows, driven by advanced manufacturing, robotics integration, and defense applications. Europe demonstrates steady growth, fueled by automotive OEM demand, industrial automation, and renewable energy projects. Emerging markets in South America and Middle East and Africa are witnessing gradual adoption due to increasing infrastructure development and modernization of manufacturing facilities.

- The Planetary Gearboxes segment is expected to dominate the market with a market share of 46.61%.

Report Scope and Middle East and Africa Precision Gearbox Market Segmentation

|

Attributes |

Precision Gearbox Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Precision Gearbox Market Trends

“Growing Middle East and Africa Adoption Of Automation And Robotics Drives Precision Gearbox Demand”

- Rising automation and the growing adoption of industrial robotics are reshaping manufacturing architectures across advanced and emerging economies, increasing demand for compact, high-precision transmission systems that deliver repeatable torque, minimal backlash, and long service lives.

- As factories, distribution centers and specialist manufacturers integrate more multi-axis robots, automated guided vehicles and precision motion stages, suppliers of precision gearboxes are being called upon to supply smaller, higher-torque-density, and more reliable units frequently with integrated sensing for both new builds and retrofit programs

- For Instance, In October 2023, Article Published in Reuters covered Amazon’s rollout of a new robotic system in a Houston fulfilment centre, illustrating how tier-one logistics operators are integrating diverse robotic subsystems an upstream demand signal for precision gear and transmission subsystems used in arms, drives and mobile platforms.

- As automation continues to scale, the role of advanced transmission systems will be increasingly critical in enabling performance, efficiency, and adaptability in next-generation industrial environments.

Middle East and Africa Precision Gearbox Market Dynamics

Driver

“Expansion In Renewable Energy For Optimizing Performance”

- The rapid expansion of renewable-energy infrastructure around the world is placing growing emphasis on high-performance mechanical systems including precision gearboxes within wind-turbine drivetrains, solar-tracking mechanisms and other utility-scale motion systems.

- As governments and industry accelerate the deployment of turbines, offshore platforms, and next-generation renewable equipment, manufacturers of precision gear transmissions are increasingly required to deliver units with greater durability, tighter tolerances, higher torque density and longer service intervals.

- This trend is particularly relevant for gearbox suppliers who can align their capabilities with the industrial requirements of renewables deployment signaling a significant driver of growth in the Middle East and Africa Precision Gearbox Market

- As projects scale and governments push for energy independence and sustainability, the need for high-torque, durable, and efficient drivetrain components become more urgent. Industry developments from offshore wind initiatives in the SAUDI ARABIA to European policy efforts aimed at strengthening domestic manufacturing underscore the strategic importance of precision gear technologies in the renewable energy supply chain. For gearbox manufacturers, this represents a major growth avenue, especially for those capable of meeting the exacting technical demands of the renewable sector

Restraint/Challenge

“High Production and Material Costs Of Gear Boxes”

- The Middle East and Africa Precision Gearbox Market faces significant challenges stemming from the high production and material costs associated with manufacturing these specialized components. The intricate design and stringent performance requirements of precision gearboxes necessitate the use of advanced materials and sophisticated manufacturing processes, both of which contribute to elevated production expenses.

- These high costs can limit the accessibility and affordability of precision gearboxes, particularly for small and medium-sized enterprises, thereby restraining market growth and adoption across various industries

- High production and material costs remain a critical barrier to the widespread adoption and scalability of precision gearboxes across multiple industries. The reliance on advanced materials, complex manufacturing processes, and globalized supply chains drives up expenses, making it especially difficult for small and medium-sized enterprises to compete or integrate these components cost-effectively

- These challenges highlight the need for innovation in manufacturing methods and material sourcing, as well as strategic policy support, to reduce costs and improve domestic production capabilities. Without addressing these structural cost issues, the growth potential of the Middle East and Africa Precision Gearbox Market may remain constrained despite rising demand

Middle East and Africa Precision Gearbox Market Scope

The Middle East and Africa Precision Gearbox Market is segmented into ten segments based on type, Axis Orientation, Bearing Type, Mounting Style, Torque, Material, Axle Load Capacity, Gearbox Stage, Application, and Sales Channel.

• By Type

On the basis of Type, the market is segmented into Planetary Gearboxes, Helical Gearboxes, Harmonic Gearboxes, Cycloidal Gearboxes, Bevel Gearboxes, Spur Gearboxes, Worm Gearboxes, Cylindrical Gearboxes, Others. In 2025, the Planetary Gearboxes segment is expected to dominate the market with 46.61% market share, driven by the increasing demand for high-torque, compact, and efficient motion control systems across robotics, industrial automation, and electric vehicle applications. Their ability to deliver superior load distribution, high precision, and minimal backlash makes them ideal for modern automated machinery and servo applications.

Planetary Gearboxes segment is anticipated to gain traction with the CAGR of 8.61% during the forecast period of 2025 to 2032, driven by the rapid expansion of advanced manufacturing, rising adoption of collaborative robots (cobots), and the growing need for lightweight and durable transmission systems in aerospace, medical devices, and renewable energy equipment.

• By Axis Orientation

On the basis of Axis Orientation, the market is segmented into In‑Line, Right Angle, and Parallel. In 2025, the In‑Line segment is expected to dominate the market with 59.89% market share, owing to its widespread use in precision-driven applications such as robotics, packaging, and machine tools, where compact design, high efficiency, and ease of integration are essential. The in-line configuration allows for direct power transmission with minimal energy loss, making it highly suitable for high-speed and space-constrained industrial environments.

The In‑Line segment is projected to expand steadily with a CAGR of 8.34%, as manufacturers increasingly adopt compact automation systems and servo-driven machinery that require accurate torque transfer and low-maintenance gearbox solutions. Continuous innovations in gear materials, lubrication systems, and modular in-line gearbox designs are further enhancing their performance and reliability across multiple industries.

• By Bearing Type

On the basis of Bearing Type, the Middle East and Africa Precision Gearbox Market is segmented into Deep Groove Ball Bearings, Tapered Roller Bearings, Cylindrical Roller Bearings, Needle Roller Bearings, Cross Roller Bearings, and Others. In 2025, the Deep Groove Ball Bearings segment is expected to dominate the market with 41.44% market share, attributed to heir versatility, high-speed capability, and low frictional resistance, which make them ideal for a wide range of precision gearbox applications. These bearings offer excellent load-bearing capacity and smooth operation, contributing to higher efficiency and reduced noise in automation, robotics, and industrial machinery systems. Their simple design and cost-effectiveness further enhance their adoption across both standard and high-performance gear assemblies.

The Deep Groove Ball Bearings segment is likely to witness accelerated growth of 8.70% during the forecast period, supported by rising demand for compact and energy-efficient gearbox solutions, advancements in bearing materials and sealing technologies, and the growing integration of high-speed gear systems in electric vehicles, medical robotics, and aerospace equipment.

• By Mounting Style

On the basis of Mounting Style, the market is segmented into Flange Output, Hollow Shaft, Tapped Holes, Through Holes, and Others. In 2025, the Flange Output segment is expected to dominate the market with a 43.10% market share, driven by its high structural rigidity, ease of installation, and superior torque transmission capabilities, which make it highly suitable for precision-driven applications such as robotics, packaging machinery, and industrial automation. The flange mounting design ensures stable alignment and efficient load distribution, enhancing performance and reliability in high-speed and heavy-duty operations.

The Flange Output segment is gaining importance and growing with the CAGR of 8.51% due to the increasing adoption of compact servo systems, demand for easy-to-integrate gearbox solutions, and ongoing advancements in modular mounting configurations that improve design flexibility. Additionally, its compatibility with various motor types and ability to reduce assembly time are further boosting its preference in manufacturing and motion control applications.

• By Torque

On the basis of Torque, the market is segmented into UP TO 50 NM, 50-500 NM, 500-1000 NM, 1000-3000 NM, ABOVE 3000 NM. In 2025, the UP TO 50 NM segment is expected to dominate the market with a 50.46% market share, owing to its widespread application in compact machinery, robotics, light automation systems, and consumer electronics, where low to moderate torque requirements are sufficient. The segment benefits from the increasing demand for small, energy-efficient, and precise motion control solutions, making it highly suitable for high-speed, low-load operations.

The UP TO 50 NM segment is expected to grow at a CAGR of 8.31%, driven by driven by the rising adoption of compact servo motors, automation in small-scale industrial equipment, and growth in sectors like robotics, medical devices, and packaging machinery. Additionally, its cost-effectiveness, ease of integration, and compatibility with standardized modular gearboxes are further supporting market expansion

• By Material

On the basis of Material, the market is segmented into Steel, Aluminum, Plastics, Titanium, and Others. In 2025, the Steel segment is expected to dominate the market with a 61.32% market share, driven by its superior strength, durability, and ability to withstand high torque and harsh operating conditions, making it the preferred choice for industrial, automotive, and precision machinery applications. Steel gearboxes offer high wear resistance, reliability, and long service life, which are critical for applications in heavy-duty and high-performance environments.

The Steel segment is anticipated to record the fastest growth of 8.32% during 2025 to 2032, driven by rising demand for high-performance industrial equipment, automation systems, and robotics, as well as the increasing adoption of energy-efficient and durable materials in precision gearboxes. Additionally, ongoing technological advancements in steel processing and heat-treatment methods are enhancing performance, further supporting market expansion.

• By Axle Load Capacity

On the basis of Axle Load Capacity, the market is segmented into Up To 800 N, 800-1500 N, and More Than 1500 N. In 2025, the Up To 800 N segment is expected to dominate the market with a 59.59% market share, driven by the widespread use of precision gearboxes in small- and medium-sized machinery, robotics, and automotive applications where lower axle load requirements are sufficient. This segment benefits from cost-effectiveness, ease of integration, and suitability for high-speed, low-torque operations, making it the preferred choice for compact and lightweight systems

The Up To 800 N segment is anticipated to record the fastest growth of 8.33% during 2025 to 2032, driven by the rising adoption of lightweight industrial equipment, automation solutions, and electric vehicles, as well as the growing demand for precision gearboxes in consumer electronics, medical devices, and small-scale robotics, which typically require lower axle load capacities.

• By Gearbox Stage

On the basis of Gearbox Stage, the market is segmented into Multi Stage, Single, and Double. In 2025, the Multi Stage segment is expected to dominate the market with a 46.66% market share, driven by the increasing demand for high-precision applications requiring higher torque, compact design, and smooth operation across diverse industries such as automotive, robotics, and industrial automation. Multi-stage gearboxes offer the advantage of enhanced efficiency, better load distribution, and reduced wear, making them ideal for complex motion control systems.

The Multi Stage segment is anticipated to record the fastest growth of 8.49% during 2025 to 2032, driven by the expanding adoption of automation, advanced robotics, and high-performance industrial machinery, alongside the growing need for multi-stage gearboxes in electric vehicles, renewable energy systems, and precision manufacturing equipment that require versatile and high-torque solutions.

• By Application

On the basis of Application, the market is segmented into Robotics, Machine Tools, Material Handling, Construction Equipment, Automotive, Semiconductor Equipment, Aerospace and Defense, Agricultural, Packaging, Medical, Food and Beverages, and Others. In 2025, the Robotics segment is expected to dominate the market with a 33.28% market share, driven by the rapid adoption of industrial robots across manufacturing, electronics, automotive, and logistics sectors, where precision gearboxes are essential for accurate motion control, high repeatability, and efficient load handling. The increasing integration of robots in automated production lines and smart factories further fuels the demand for reliable, high-performance gearboxes.

The Robotics segment is anticipated to record the fastest growth of 9.29% during 2025 to 2032, driven by the expansion of collaborative robots (cobots), advancements in AI-enabled robotics, and rising demand for automation in sectors such as healthcare, electronics assembly, and warehousing. The growing focus on Industry 4.0, smart factories, and precision automation solutions will continue to accelerate the adoption of precision gearboxes in robotic applications.

• By Sales Channel

On the basis of Sales Channel, the market is segmented into Direct (OEM) and Aftermarket. In 2025, the Direct (OEM) segment is expected to dominate the market with a 70.28% market share, driven by the strong preference of original equipment manufacturers for direct procurement of precision gearboxes to ensure quality, reliability, and seamless integration into new machinery and robotic systems. OEMs are increasingly prioritizing high-performance components that meet stringent specifications for industrial automation, automotive, and semiconductor applications, which further reinforces the dominance of this sales channel.

The Direct (OEM) segment is anticipated to record the fastest growth of 8.19% during 2025 to 2032, driven by driven by the rising demand for fully integrated solutions in smart manufacturing, robotics, and autonomous vehicles, as well as long-term partnerships between gearbox manufacturers and OEMs to support customized, high-precision components. The continued expansion of automated production lines and the shift toward high-tech industrial equipment will further accelerate the adoption of direct OEM procurement.

Middle East and Africa Precision Gearbox Market – Regional Analysis

Middle East and Africa Precision Gearbox Market Insight

Middle East and Africa is, driven by technological advancements in robotics, aerospace, and industrial automation. The region’s strong adoption of Industry 4.0 practices and increasing investments in renewable energy, defence, and automated manufacturing systems continue to stimulate demand for high-torque, low-backlash gearboxes. The presence of leading market players, combined with robust research and development activities in motion control and mechatronics, is enhancing the competitiveness of Middle East and African manufacturers. Additionally, the rising integration of precision gearboxes in electric vehicles, packaging equipment, and production robotics supports market expansion. Both the SAUDI ARABIA and Canada are focusing on enhancing domestic manufacturing capabilities, making the region a key contributor to Middle East and Africa precision gearbox innovation and production efficiency.

Saudi Arabia Middle East and Africa Precision Gearbox Market Insight

The Saudi Arabia is expected to dominate the Middle East and Africa market, supported by its well-established automation, robotics, and aerospace sectors. Rapid adoption of electric and autonomous vehicles, combined with the country’s strong manufacturing and R&D base, is driving demand for high-performance gearbox systems. The Saudi Arabia market benefits from continuous innovation in mechatronics, motion control technologies, and collaborative robotics, which increasingly rely on precision drive systems for accuracy and energy efficiency. Additionally, the country’s commitment to reshoring manufacturing, expanding industrial infrastructure, and investing in renewable energy projects is further accelerating market growth. With increasing adoption across aerospace, automotive, and healthcare applications, the Saudi Arabia remains one of the most technologically advanced and lucrative markets for precision gearbox manufacturers Middle East and Africa.

U.A.E. Middle East and Africa Precision Gearbox Market Insight

U.A.E remains a significant player in the Middle East and Africa Precision Gearbox Market, driven by its leadership in automotive engineering, industrial automation, and renewable energy technologies. Stringent EU regulations promoting energy efficiency, sustainability, and environmentally friendly production practices are encouraging the use of advanced gearbox solutions with enhanced torque control and reduced emissions. Major economies such as Germany, France, Italy, and Spain lead the U.A.E. market due to their well-established industrial base, continuous innovation in robotics and machinery, and increasing integration of automated systems in manufacturing. Furthermore, UAE’s strong commitment to electrification, autonomous driving, and clean energy transitions continues to drive the demand for high-precision and durable mechanical drive systems. Ongoing collaboration between research institutions, automation technology firms, and component manufacturers ensures UAE remains at the forefront of gearbox innovation and reliability.

The Major Market Leaders Operating in the Market Are:

- Siemens AG (Germany)

- Nabtesco Corporation (U.A.E.)

- Sumitomo Electric Industries (U.A.E.)

- ABB Ltd (Switzerland)

- Bonfiglioli (Italy)

- Emerson Electric Co. (U.S.)

- Parker Hannifin Corporation (U.S.)

- Regal Rexnord Corporation (U.S.)

- Hiwin Corporation (Taiwan)

- STOBER Drives Inc. (U.S.)

- David Brown Santasalo (U.K.)

- Neugart GmbH (Germany)

- Dana Incorporated (U.S.)

- Apex Dynamics, Inc. (Taiwan)

- SEW-EURODRIVE GmbH & Co KG (Germany)

- Cone Drive (U.S.)

- Spinea s.r.o. (Slovakia)

- WITTENSTEIN SE (Germany)

- Horsburgh & Scott (U.S.)

- GAM Enterprises, Inc. (U.S.)

- Nidec Drive Technology America Corporation (U.S.)

- Curtis Machine Company (U.S.)

- Newstart Planetary Gear Boxes Co., Ltd (Saudi Arabia)

- Onvio LLC (U.S.)

- Harmonic Drive LLC (U.S.)

- Riley Gear Corp (U.S.)

- Prime Transmission (India)

- ATLANTA Drive Systems, Inc. (U.S.)

- SMD Gearbox (India)

Latest Developments in Middle East and Africa Precision Gearbox Market

- In September 2022, Gabriel-Chemie introduced a new series of halogen-free flame retardant masterbatches for the electrical conduits and tubes market, emphasizing the company's commitment to sustainability. These masterbatches comply with flame retardant standard EN 61386, halogen-free standard EN 50642, and low smoke standard IEC 61304-2. Benefits include reduced toxic gas emissions during fires, enhanced recyclability, and minimized corrosion of electronic equipment and machinery.

- In October 2023, Clariant inaugurated a new CHF 60 million Exolit™ OP flame retardant plant in Daya Bay, Saudi Arabia. Aimed at meeting Asia’s demand for sustainable fire protection, the facility enhances local supply capabilities. A second production line is under construction, set to launch in 2024

- In May, BASF expanded its Polyphthalamide (PPA) portfolio with various flame-retardant grades offering high thermal stability, excellent electrical insulation, and low water uptake. These halogen-free materials featured RTI values above 140°C, improved color stability, and enabled safer, more reliable applications across e-mobility, electronics, appliances, and power connectors.

- In July, BASF and THOR GmbH combined their expertise in non-halogenated flame retardant additives to offer a comprehensive solution that improved sustainability and performance in select plastic compounds while meeting strict fire safety standards.

- In January, BASF's advanced flame-retardant grade of Ultramid T6000 polyphthalamide (PPA) was adopted for terminal block applications, replacing non-FR materials to improve safety in inverter and motor systems of Electric Vehicles (EVs). It supports electrical safety enhancement in electric vehicles, making it a functional upgrade with direct implications for thermal protection, reliability, and compliance in automotive electrical systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES IN THE MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET

4.2 REGULATORY STANDARDS IN THE PRECISION GEARBOX MARKET

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.5 NEW BUSINESS AND EMERGING BUSINESSES' REVENUE OPPORTUNITIES

4.6 PENETRATION AND GROWTH POSPECT MAPPING

4.7 EVOLUTION OF GEAR DESIGN AND MATERIAL ADVANCEMENTS

5 TARIFFS & IMPACT ON THE MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET

5.1 OVERVIEW

5.2 TARIFF STRUCTURES

5.2.1 MIDDLE EAST AND AFRICA VS. REGIONAL TARIFF STRUCTURES

5.2.1.1 United States: Automotive Tariff Policies

5.2.2 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS AND REIMBURSEMENT POLICIES

5.2.2.1 Asia-Pacific: Government-Imposed Tariffs on Automotive Components

5.3 IMPACT ON AUTOMAKERS

5.3.1 INCREASED PRODUCTION COSTS

5.3.1.1 Supply Chain Disruptions

5.3.1.2 Shift in Manufacturing Footprint

5.3.1.3 Competitive Disadvantage

5.3.1.4 Increased Investment in Domestic Production

5.4 IMPACT ON SUPPLIERS

5.4.1 COST PRESSURES

5.4.1.1 Reduced Demand

5.4.1.2 Supply Chain Vulnerability

5.5 IMPACT ON CONSUMERS

5.5.1 HIGHER VEHICLE PRICES

5.5.2 REDUCED AVAILABILITY OF OPTIONS

5.5.2.1 Increased Maintenance Costs

5.6 THE FUTURE OF AUTOMOTIVE TRADE

5.6.1 ONGOING TRADE NEGOTIATIONS

5.6.2 TECHNOLOGICAL ADVANCEMENTS

5.6.3 GEOPOLITICAL FACTORS

5.6.4 FOCUS ON DOMESTIC PRODUCTION

5.6.4.1 Conclusion

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING MIDDLE EAST AND AFRICA ADOPTION OF AUTOMATION AND ROBOTICS DRIVES PRECISION GEARBOX DEMAND

6.1.2 EXPANSION IN RENEWABLE ENERGY FOR OPTIMIZING PERFORMANCE

6.1.3 FOCUS ON FUEL EFFICIENCY AND PERFORMANCE OPTIMIZATION IN AEROSPACE INDUSTRY

6.1.4 GROWING ADOPTION OF ELECTRIC VEHICLES IS FUELING DEMAND FOR PRECISION GEARBOXES

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND MATERIAL COSTS OF GEAR BOXES

6.2.2 SUPPLY CHAIN VOLATILITY FOR RAW MATERIALS AND PRECISION COMPONENTS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC PARTNERSHIPS WITH OEMS AND SYSTEM INTEGRATORS

6.3.2 GEOGRAPHIC EXPANSION ACROSS ASIA-PACIFIC AND EMERGING MARKETS

6.3.3 RISING ADOPTION OF 4.0 INDUSTRIAL REVOLUTION USING SMART MANUFACTURING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 MAINTAINING HIGH PERFORMANCE WHILE MANAGING COST PRESSURES REMAINS A CHALLENGE

6.4.2 COMPETITION FROM ALTERNATE TECHNOLOGIES

7 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TYPE

7.1 OVERVIEW

7.2 PLANETARY GEARBOXES

7.3 HELICAL GEARBOXES

7.4 HARMONIC GEARBOXES

7.5 CYCLOIDAL GEARBOXES

7.6 BEVEL GEARBOXES

7.7 SPUR GEARBOXES

7.8 WORM GEARBOXES

7.9 CYLINDRICAL GEARBOXES

7.1 OTHERS

8 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXIS ORIENTATION

8.1 OVERVIEW

8.2 IN‑LINE

8.3 RIGHT ANGLE

8.4 PARALLEL

9 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY BEARING TYPE

9.1 OVERVIEW

9.2 DEEP GROOVE BALL BEARINGS

9.3 TAPERED ROLLER BEARINGS

9.4 CYLINDRICAL ROLLER BEARINGS

9.5 NEEDLE ROLLER BEARINGS

9.6 CROSS ROLLER BEARINGS

9.7 OTHERS

10 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MOUNTING STYLE

10.1 OVERVIEW

10.2 FLANGE OUTPUT

10.3 HOLLOW SHAFT

10.4 TAPPED HOLES

10.5 THROUGH HOLES

10.6 OTHERS

11 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TORQUE

11.1 OVERVIEW

11.2 UP TO 50 NM

11.3 50-500 NM

11.4 500-1000 NM

11.5 1000-3000 NM

11.6 ABOVE 3000 NM

12 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 STEEL

12.3 ALUMINUM

12.4 PLASTICS

12.5 TITANIUM

12.6 OTHERS

13 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 ROBOTICS

13.3 MACHINE TOOLS

13.4 MATERIAL HANDLING

13.5 CONSTRUCTION EQUIPMENT

13.6 AUTOMOTIVE

13.7 SEMICONDUCTOR

13.8 AEROSPACE AND DEFENSE

13.9 AGRICULTURAL

13.1 PACKAGING

13.11 MEDICAL

13.12 FOOD AND BEVERAGES

13.13 OTHERS

14 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY

14.1 OVERVIEW

14.2 UP TO 800 N

14.3 800–1500 N

14.4 MORE THAN 1500 N

15 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY GEARBOX STAGE

15.1 OVERVIEW

15.2 MULTI STAGE

15.3 SINGLE STAGE

15.4 DOUBLE STAGE

16 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY SALES CHANNEL

16.1 OVERVIEW

16.2 DIRECT (OEM)

16.3 AFTERMARKET

17 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY REGION

17.1 MIDDLE EAST AND AFRICA

17.1.1 SAUDI ARABIA

17.1.2 UNITED ARAB EMIRATES

17.1.3 SOUTH AFRICA

17.1.4 EGYPT

17.1.5 QATAR

17.1.6 KUWAIT

17.1.7 OMAN

17.1.8 BAHRAIN

17.1.9 REST OF MIDDLE EAST AND AFRICA

18 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 SIEMENS

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 NABTESCO CORPORATION

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 SUMITOMO HEAVY INDUSTRIES, LTD

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 ABB

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.5 BONFIGLIOLI

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 APEX DYNAMICS, INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 ATLANTA DRIVE SYSTEMS, INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 CONE DRIVE OPERATIONS, INC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CURTIS MACHINE COMPANY.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 DANA LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 DBSANTASALO.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 EMERSON ELECTRIC CO.

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 COMPANY SHARE ANALYSIS

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENT

20.13 GAM ENTERPRISES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 HARMONIC DRIVE LLC

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 HIWIN TECHNOLOGIES(CHINA) CORP.

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 HORSBURGH & SCOTT.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 NEUGART GMBH

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 NEWSTART PLANETARY GEAR BOXES CO., LTD

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 NIDEC DRIVE TECHNOLOGY AMERICA CORPORATION

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENT

20.2 ONVIO LLC

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 PARKER HANNIFIN CORP

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 PRIME TRANSMISSION

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 REGAL REXNORD CORPORATION

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENT

20.24 RILEY GEAR CORP

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 SEW-EURODRIVE

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

20.26 SMD GEARBOX

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 SPINEA, S.R.O

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

20.28 STOBER DRIVES, INC.

20.28.1 COMPANY SNAPSHOT

20.28.2 PRODUCT PORTFOLIO

20.28.3 RECENT DEVELOPMENT

20.29 WITTENSTEIN SE

20.29.1 COMPANY SNAPSHOT

20.29.2 PRODUCT PORTFOLIO

20.29.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA PLANETARY GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA HELICAL GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HARMONIC GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA CYCLOIDAL GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA BEVEL GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA SPUR GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA WORM GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA CYLINDRICAL GEARBOXES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA OTHERS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA IN‑LINE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RIGHT ANGLE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PARALLEL IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA DEEP GROOVE BALL BEARINGS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA TAPERED ROLLER BEARINGS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CYLINDERICAL ROLLER BEARING IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA NEEDLE ROLLER BEARINGS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA CROSS ROLLER BEARINGS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA OTHERS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA FLANGE OUTPUT IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA HOLLOW SHAFT IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TAPPED HOLES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA THROUGH HOLES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA UP TO 50 NM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA 50-500 NM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA 500-1000 NM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA 1000-3000 NM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ABOVE 3000 NM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA STEEL IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ALUMINUM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA PLASTICS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA TITANIUM IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA OTHERS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA ROBOTICS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AGRICULTURAL IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA PACKAGING IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA MEDICAL IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA OTHERS IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA 800–1500 N IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA MORE THAN 1500 N IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA MULTI STAGE IN PRECISION GEARBOX MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA SINGLE STAGE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA DOUBLE STAGE IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DIRECT (OEM) IN PRECISION GEARBOX MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA AFTERMARKET IN PRECISION GEARBOX MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA

TABLE 85 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA

TABLE 87 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 152 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 153 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 154 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 155 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 UNITED ARAB EMIRATES ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 UNITED ARAB EMIRATES MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 UNITED ARAB EMIRATES MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 UNITED ARAB EMIRATES CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 UNITED ARAB EMIRATES AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 UNITED ARAB EMIRATES PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 UNITED ARAB EMIRATES COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 UNITED ARAB EMIRATES TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 UNITED ARAB EMIRATES BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 UNITED ARAB EMIRATES THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 UNITED ARAB EMIRATES AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 UNITED ARAB EMIRATES SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 UNITED ARAB EMIRATES AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 UNITED ARAB EMIRATES AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 UNITED ARAB EMIRATES PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 UNITED ARAB EMIRATES MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 UNITED ARAB EMIRATES PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 176 UNITED ARAB EMIRATES AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SOUTH AFRICA PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SOUTH AFRICA PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 179 SOUTH AFRICA PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SOUTH AFRICA PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 181 SOUTH AFRICA PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 182 SOUTH AFRICA PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 183 SOUTH AFRICA PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 184 SOUTH AFRICA PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 185 SOUTH AFRICA PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 SOUTH AFRICA ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SOUTH AFRICA MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SOUTH AFRICA CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SOUTH AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SOUTH AFRICA PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SOUTH AFRICA COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SOUTH AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SOUTH AFRICA TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SOUTH AFRICA BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SOUTH AFRICA THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SOUTH AFRICA AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SOUTH AFRICA SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SOUTH AFRICA PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SOUTH AFRICA MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SOUTH AFRICA FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SOUTH AFRICA PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 206 SOUTH AFRICA AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 EGYPT PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 EGYPT PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 209 EGYPT PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 EGYPT PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 211 EGYPT PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 212 EGYPT PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 213 EGYPT PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 214 EGYPT PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 215 EGYPT PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 216 EGYPT ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 EGYPT MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 EGYPT MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 EGYPT CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 EGYPT AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 EGYPT PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 EGYPT COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 EGYPT LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 EGYPT HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 EGYPT TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 EGYPT BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 EGYPT THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 EGYPT AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 EGYPT SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 EGYPT AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 EGYPT AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 EGYPT PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 EGYPT MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 EGYPT FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 EGYPT PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 EGYPT AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ISRAEL

TABLE 238 ISRAEL PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ISRAEL PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 240 ISRAEL PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 ISRAEL PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 242 ISRAEL PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 243 ISRAEL PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 244 ISRAEL PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 245 ISRAEL PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 246 ISRAEL PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 247 ISRAEL ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 ISRAEL MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 ISRAEL MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 ISRAEL CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 ISRAEL AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 ISRAEL PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 ISRAEL COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 ISRAEL LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 ISRAEL HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 ISRAEL TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 ISRAEL BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 ISRAEL THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 ISRAEL AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 ISRAEL SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 ISRAEL AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 ISRAEL AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 ISRAEL PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 ISRAEL MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 ISRAEL FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 ISRAEL PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 267 ISRAEL AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 QATAR PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 QATAR PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 270 QATAR PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 QATAR PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 272 QATAR PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 273 QATAR PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 274 QATAR PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 275 QATAR PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 276 QATAR PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 277 QATAR ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 QATAR MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 QATAR MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 QATAR CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 QATAR AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 QATAR PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 QATAR COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 QATAR LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 QATAR HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 QATAR TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 QATAR BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 QATAR THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 QATAR AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 QATAR SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 QATAR AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 QATAR AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 QATAR PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 QATAR MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 QATAR FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 QATAR PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 297 QATAR AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 KUWAIT PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 KUWAIT PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 300 KUWAIT PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 KUWAIT PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 302 KUWAIT PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 303 KUWAIT PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 304 KUWAIT PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 305 KUWAIT PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 306 KUWAIT PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 307 KUWAIT ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 KUWAIT MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 KUWAIT MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 KUWAIT CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 KUWAIT AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 KUWAIT PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 KUWAIT COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 KUWAIT LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 KUWAIT HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 KUWAIT TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 KUWAIT BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 KUWAIT THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 KUWAIT AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 KUWAIT SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 KUWAIT AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 KUWAIT AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 KUWAIT PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 KUWAIT MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 KUWAIT FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 KUWAIT PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 327 KUWAIT AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 OMAN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 OMAN PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 330 OMAN PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 OMAN PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 332 OMAN PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 333 OMAN PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 334 OMAN PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 335 OMAN PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 336 OMAN PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 337 OMAN ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 OMAN MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 OMAN MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 OMAN CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 OMAN AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 OMAN PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 OMAN COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 OMAN LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 OMAN HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 OMAN TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 OMAN BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 OMAN THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 OMAN AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 OMAN SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 OMAN AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 OMAN AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 OMAN PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 OMAN MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 OMAN FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 OMAN PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 357 OMAN AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 BAHRAIN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 BAHRAIN PRECISION GEARBOX MARKET, BY AXIS ORIENTATION, 2018-2032 (USD THOUSAND)

TABLE 360 BAHRAIN PRECISION GEARBOX MARKET, BY BEARING TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 BAHRAIN PRECISION GEARBOX MARKET, BY MOUNTING STYLE, 2018-2032 (USD THOUSAND)

TABLE 362 BAHRAIN PRECISION GEARBOX MARKET, BY TORQUE, 2018-2032 (USD THOUSAND)

TABLE 363 BAHRAIN PRECISION GEARBOX MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 364 BAHRAIN PRECISION GEARBOX MARKET, BY AXLE LOAD CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 365 BAHRAIN PRECISION GEARBOX MARKET, BY GEARBOX STAGE, 2018-2032 (USD THOUSAND)

TABLE 366 BAHRAIN PRECISION GEARBOX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 367 BAHRAIN ROBOTICS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 BAHRAIN MACHINE TOOLS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 BAHRAIN MATERIAL HANDLING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 BAHRAIN CONSTRUCTION EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 BAHRAIN AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 BAHRAIN PASSENGER CARS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 BAHRAIN COMMERCIAL VEHICLES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 BAHRAIN LIGHT COMMERCIAL VEHICLES (LCV) PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 BAHRAIN HEAVY COMMERCIAL VEHICLES (HCV) IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 BAHRAIN TWO WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 BAHRAIN BIKES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 BAHRAIN THREE-WHEELERS IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 BAHRAIN AUTOMOTIVE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 BAHRAIN SEMICONDUCTOR EQUIPMENT IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 BAHRAIN AEROSPACE AND DEFENSE IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 BAHRAIN AGRICULTURAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 BAHRAIN PACKAGING IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 BAHRAIN MEDICAL IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 BAHRAIN FOOD AND BEVERAGES IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 BAHRAIN PRECISION GEARBOX MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 387 BAHRAIN AFTERMARKET IN PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 REST OF MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET

FIGURE 2 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 NINE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY TYPE

FIGURE 14 EXPANSION IN RENEWABLE ENERGY FOR OPTIMIZING PERFORMANCE IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE PLANETARY GEARBOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY TYPE, 2024

FIGURE 18 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY AXIS ORIENTATION, 2024

FIGURE 19 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY BEARING TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY MOUNTING STYLE, 2024

FIGURE 21 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY TORQUE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY MATERIAL, 2024

FIGURE 23 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET, BY APPLICATION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY AXLE LOAD CAPACITY, 2024

FIGURE 25 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY GEARBOX STAGE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: BY SALES CHANNEL, 2024

FIGURE 27 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA PRECISION GEARBOX MARKET: COMPANY SHARE 2024 (%)

Research Methodology