Middle East And Africa Prostate Cancer Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

4.72 Billion

2025

2033

USD

1.79 Billion

USD

4.72 Billion

2025

2033

| 2026 –2033 | |

| USD 1.79 Billion | |

| USD 4.72 Billion | |

|

|

|

|

Middle East and Africa Prostate Cancer Diagnostics Market Size

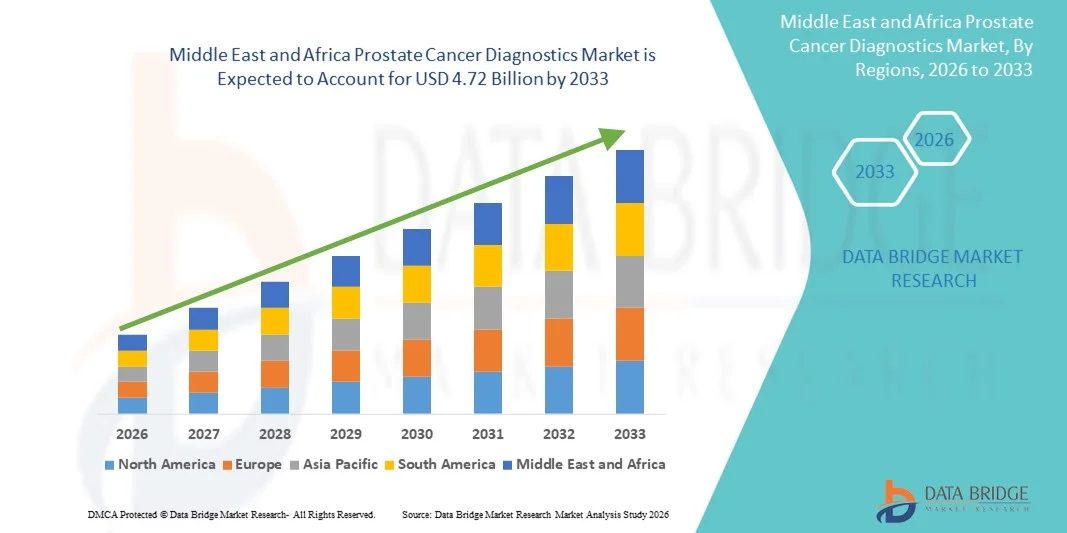

- The Middle East and Africa prostate cancer diagnostics market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 4.72 billion by 2032, at a CAGR of 12.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of prostate cancer worldwide and the growing awareness regarding early diagnosis and treatment, leading to a surge in demand for advanced diagnostic technologies such as PSA testing, MRI, and genomic testing

- Furthermore, rising healthcare expenditure, coupled with the development of non-invasive and highly accurate diagnostic tools, is establishing prostate cancer diagnostics as a crucial component in oncology care. These converging factors are accelerating the adoption of prostate cancer diagnostics solutions, thereby significantly boosting the industry's growth

Middle East and Africa Prostate Cancer Diagnostics Market Analysis

- Prostate cancer diagnostics, encompassing tools such as PSA tests, digital rectal exams (DRE), MRI, ultrasound, and genomic testing, are playing an increasingly vital role in the early detection and management of prostate cancer, particularly in men over the age of 50. The market is expanding significantly due to the growing awareness of early screening and advances in non-invasive technologies

- The escalating demand for prostate cancer diagnostics is primarily fueled by the increasing prevalence of prostate cancer globally, government initiatives promoting cancer screening, and the rising adoption of precision medicine and personalized diagnostic approaches

- Saudi Arabia dominated the anticoagulants market in the Middle East and Africa with the largest revenue share of approximately 38.2% in 2025, supported by its large patient population, high prevalence of cardiovascular and thromboembolic disorders, expanding hospital and clinic infrastructure, growing adoption of novel oral anticoagulants (NOACs), and strong presence of both domestic and multinational pharmaceutical companies.

- U.A.E. is expected to be the fastest growing country in the anticoagulants market during the forecast period, registering a robust CAGR of around 10.1%, driven by increasing prevalence of atrial fibrillation and venous thromboembolism, rising healthcare awareness, expanding hospital networks, government initiatives to improve healthcare access, and growing penetration of affordable anticoagulant therapies

- The prostatic adenocarcinoma segment dominated the market with a share of 87.4% in 2024, as it represents the most common form of prostate cancer.

Report Scope and Prostate Cancer Diagnostics Market Segmentation

|

Attributes |

Prostate Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Prostate Cancer Diagnostics Market Trends

Integration of Advanced Technologies for Enhanced Diagnostic Precision

- A significant and accelerating trend in the Middle East and Africa prostate cancer diagnostics market is the increasing integration of advanced technologies such as genomic sequencing, machine learning algorithms, and automated pathology platforms. This fusion of innovations is enhancing the precision, efficiency, and personalization of diagnostic processes

- For instance, platforms such as Decipher Prostate and Prolaris utilize genomic testing to assess tumor aggressiveness, helping clinicians make more informed treatment decisions based on individual patient profiles. Similarly, SelectMDx evaluates mRNA biomarkers to predict the likelihood of prostate cancer, reducing unnecessary biopsies

- Machine learning algorithms are increasingly being employed to improve the accuracy of imaging-based diagnostics such as multiparametric MRI (mpMRI). These tools can help identify clinically significant cancer, reduce false positives, and streamline radiologist workflow. Furthermore, automated digital pathology systems are enhancing reproducibility and speed in histological analysis

- The seamless integration of AI-driven decision support tools with electronic health records (EHRs) is enabling oncologists and urologists to centralize patient data and apply predictive analytics for risk stratification. This results in a more unified and evidence-based diagnostic journey for patients

- This trend toward more intelligent, data-driven diagnostics is reshaping physician expectations and patient care pathways. Consequently, companies such as Myriad Genetics, MDxHealth, and OPKO Health are continuously developing molecular diagnostics and AI-powered platforms that deliver faster, more accurate prostate cancer detection

- The demand for diagnostic solutions that combine biomarker analysis, imaging technologies, and clinical decision support is growing rapidly across hospitals, specialty clinics, and diagnostic labs, as stakeholders prioritize early detection, treatment personalization, and improved outcomes

Middle East and Africa Prostate Cancer Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Cancer Incidence and Early Detection Awareness

- The increasing Middle East and Africa burden of prostate cancer, combined with rising awareness about the benefits of early detection, is a significant driver fueling the demand for advanced prostate cancer diagnostics

- For instance, in April 2024, F. Hoffmann-La Roche Ltd launched an updated diagnostic platform incorporating genomic profiling to enhance early detection and risk stratification of prostate cancer patients. Such strategic developments are expected to drive the growth of the prostate cancer diagnostics industry over the forecast period

- As men become more informed about the risks of late-stage diagnosis and treatment complications, there is a growing demand for accurate, non-invasive, and accessible diagnostic tools

- Furthermore, improvements in prostate-specific antigen (PSA) testing, combined with advancements in biomarkers, imaging techniques, and genomic diagnostics, are making early screening more efficient and reliable

- Technologies such as liquid biopsy, multiparametric MRI, and next-generation sequencing are increasingly being integrated into clinical practice, supporting more personalized diagnostic and treatment decisions. These evolving tools are also helping reduce unnecessary biopsies, improve patient experience, and enhance clinical outcomes

- The growing investments in research, public awareness campaigns, and government-led initiatives aimed at early cancer detection are also contributing significantly to the rapid adoption of prostate cancer diagnostics, particularly in developed markets

Restraint/Challenge

Limited Access and High Cost of Advanced Diagnostic Solutions

- Despite advancements in diagnostic technologies, the limited access to high-end diagnostic services in rural and underdeveloped regions remains a major challenge. The availability of cutting-edge tools such as genomic testing, mpMRI, and AI-driven pathology platforms is often restricted to urban tertiary care centers or private institutions

- Moreover, the high cost associated with these advanced prostate cancer diagnostics, including genomic and molecular tests, can be a barrier for patients without adequate insurance coverage or government reimbursement

- For instance, multi-gene panels and precision oncology tools such as Decipher or Oncotype DX Prostate may cost hundreds to thousands of dollars per test, which can deter patients in price-sensitive markets

- In addition, there is a need for better standardization and physician training to interpret complex test results, which may hinder broader adoption in general healthcare settings

- To overcome these obstacles, stakeholders need to focus on cost-effective innovations, increasing public-private partnerships for improved diagnostics infrastructure, and expanding insurance or national health coverage for advanced screening tools. Enhanced patient and provider education will also play a critical role in improving early diagnosis and overall survival rates

Middle East and Africa Prostate Cancer Diagnostics Market Scope

The market is segmented on the basis of product type, diagnostics type, age group, type, stage, sample type, end users, and distribution channel.

- By Product Type

On the basis of product type, the prostate cancer diagnostics market is segmented into instruments, reagents & consumables, and accessories. The reagents & consumables segment dominated the market with a revenue share of 48.6% in 2024, primarily due to their repetitive and essential use in prostate cancer testing procedures. These products include assay kits, antibodies, enzymes, and biochemical reagents required for PSA testing, immunoassays, and molecular diagnostics. High testing frequency in routine screening programs significantly boosts consumption volumes. Reagents are required at every stage of diagnosis, from initial screening to disease monitoring. Rising prostate cancer awareness has increased test volumes globally. Expansion of diagnostic laboratories further supports recurring demand. Technological improvements have enhanced sensitivity and specificity, increasing adoption. Growing reliance on biomarker-based testing drives reagent usage. Hospitals and labs prioritize consistent supply chains for consumables. Regulatory approvals for advanced assays strengthen market penetration. Cost-effectiveness compared to instruments favors widespread usage. Together, these factors firmly establish segment dominance.

The instruments segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, driven by increasing adoption of automated and high-throughput diagnostic platforms. Growing demand for precise and rapid diagnostics encourages investment in advanced analyzers, imaging systems, and molecular diagnostic instruments. Rising hospital infrastructure development supports equipment upgrades. Automation reduces diagnostic errors and improves workflow efficiency. Increasing biopsy and imaging procedures accelerate instrument demand. Technological innovations such as AI-enabled diagnostics further enhance adoption. Emerging markets are expanding diagnostic capacity, fueling growth. Government healthcare investments promote modernization. Higher test accuracy requirements drive replacement of legacy systems. Clinical preference for integrated diagnostic solutions boosts sales. Strong manufacturer focus on R&D supports innovation. These drivers collectively fuel rapid segment growth.

- By Diagnostics Type

On the basis of diagnostics type, the prostate cancer diagnostics market is segmented into preliminary screening tests and confirmatory tests. The preliminary screening tests segment dominated the market with a share of 59.3% in 2024, supported by widespread adoption of PSA (prostate-specific antigen) testing. PSA tests are commonly used as first-line screening tools due to their affordability, accessibility, and non-invasive nature. Large-scale screening programs in developed regions significantly contribute to volume growth. Routine health checkups frequently include PSA testing for aging men. Increased awareness campaigns promote early detection. High physician reliance on PSA levels for risk assessment sustains demand. Integration with annual health exams strengthens utilization. Blood-based screening convenience improves patient compliance. Continuous improvements in assay sensitivity enhance accuracy. Government screening guidelines further support adoption. Cost-effectiveness compared to advanced diagnostics favors dominance. These factors collectively maintain leadership.

The confirmatory tests segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, driven by advancements in molecular diagnostics and genomic profiling. Increasing demand for precise cancer characterization supports adoption of biopsy-based and imaging-assisted confirmatory tests. Personalized medicine trends accelerate molecular validation. Rising false-positive concerns with PSA testing necessitate confirmatory diagnostics. Growing use of MRI-guided biopsy improves diagnostic confidence. Technological progress in biomarker panels enhances reliability. Expanding reimbursement for advanced diagnostics encourages uptake. Oncologists increasingly rely on confirmatory tests for treatment planning. Growing prevalence of aggressive prostate cancer fuels demand. Clinical trial evidence supports wider adoption. Diagnostic accuracy requirements strengthen usage. These drivers fuel strong growth momentum.

- By Age Group

On the basis of age group, the prostate cancer diagnostics market is segmented into adult, pediatric, and geriatric populations. The geriatric segment dominated the market with a share of 66.7% in 2024, due to the high incidence of prostate cancer among men aged 65 and above. Aging populations globally significantly contribute to diagnostic demand. Risk of prostate cancer increases sharply with age, driving routine screening. Healthcare systems prioritize elderly screening programs. Higher comorbidity rates necessitate frequent monitoring. Increased life expectancy leads to prolonged diagnostic surveillance. Government initiatives promote early detection in older populations. Access to Medicare-type insurance boosts testing rates. Rising awareness among aging men improves compliance. Physicians recommend frequent testing for elderly patients. Advanced diagnostics improve disease management in this group. These factors ensure segment dominance.

The adult segment is expected to grow at a CAGR of 7.1% from 2025 to 2032, driven by increasing early-onset prostate cancer awareness. Lifestyle changes and genetic risk identification encourage earlier screening. Improved diagnostic accessibility supports adoption among younger adults. Employer-based health screenings contribute to growth. Rising family history-based testing increases demand. Advancements in non-invasive testing improve acceptance. Increased emphasis on preventive healthcare fuels screening. Growing urban populations with healthcare access support growth. Education campaigns promote proactive diagnosis. Technological ease of testing enhances uptake. Expanding private insurance coverage encourages testing. These factors collectively drive growth.

- By Type

On the basis of type, the prostate cancer diagnostics market is segmented into prostatic adenocarcinoma, small cell carcinoma, and others. The prostatic adenocarcinoma segment dominated the market with a share of 87.4% in 2024, as it represents the most common form of prostate cancer. The majority of diagnostic procedures focus on identifying adenocarcinoma due to its high prevalence. PSA testing is particularly effective for detecting this type. Clinical guidelines prioritize early adenocarcinoma diagnosis. High patient volume ensures sustained testing demand. Screening programs mainly target this cancer type. Pathology workflows are optimized for adenocarcinoma detection. Research funding supports improved diagnostics. Treatment success rates increase screening emphasis. Hospital diagnostic protocols center on adenocarcinoma identification. Awareness campaigns highlight its risks. These factors secure overwhelming dominance.

The small cell carcinoma segment is expected to grow at a CAGR of 8.9% from 2025 to 2032, driven by increased awareness of aggressive prostate cancer variants. Although rare, its poor prognosis necessitates precise diagnostics. Advancements in molecular testing improve detection accuracy. Rising oncologist focus on aggressive cancers drives diagnostic demand. Improved pathology techniques support identification. Increased research into neuroendocrine tumors boosts testing. Adoption of specialized biomarker panels supports growth. Clinical trial activity increases detection efforts. Precision oncology trends encourage differentiation. Expanding referral centers enhance diagnosis rates. Growing healthcare investment supports specialized testing. These factors fuel rapid growth.

- By Stage

On the basis of stage, the prostate cancer diagnostics market is segmented into localized prostate cancer, recurrent/advanced prostate cancer, and castration-resistant prostate cancer (CRPC). The localized prostate cancer segment held the largest market share of 54.9% in 2024, driven by widespread early screening initiatives. Increased PSA testing enables detection at early stages. Early diagnosis improves treatment outcomes, encouraging testing. Government-supported screening programs strengthen demand. Patient awareness promotes proactive testing. Imaging and biopsy advancements improve early detection. Healthcare providers emphasize localized diagnosis. High survivability encourages screening compliance. Lower treatment complexity supports early testing adoption. Insurance coverage supports early diagnostics. Technological ease enhances detection rates. These factors maintain dominance.

The CRPC segment is projected to grow at the fastest CAGR of 9.6% from 2025 to 2032, driven by increasing incidence of treatment-resistant prostate cancer. Improved patient survival increases progression cases. Advanced diagnostics are required to monitor resistance. Precision medicine approaches boost testing demand. Rising use of genomic profiling supports growth. Clinical focus on advanced disease management increases diagnostics. Specialized imaging techniques enhance detection. Pharmaceutical R&D drives companion diagnostics. Growing oncology specialization supports adoption. Increased clinical trials accelerate testing. Higher healthcare expenditure fuels growth. These drivers ensure rapid expansion.

- By Sample Type

On the basis of sample type, the prostate cancer diagnostics market is segmented into blood, tissue, urine, and others. The blood segment dominated the market with a revenue share of 46.2% in 2024, owing to widespread PSA-based blood testing. Blood sampling is minimally invasive and cost-effective. High patient compliance supports frequent testing. Routine screening heavily relies on blood diagnostics. Easy sample collection enables large-scale programs. Laboratory workflows are optimized for blood tests. PSA assays are globally standardized. Rapid turnaround time enhances adoption. Continuous monitoring requires repeated blood tests. Insurance coverage supports blood-based diagnostics. Technological improvements increase accuracy. These factors ensure leadership.

The tissue segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, driven by growing reliance on biopsy-based molecular diagnostics. Precision medicine trends demand tissue analysis. Advanced staging requires histopathological confirmation. Rising MRI-guided biopsy procedures fuel demand. Genomic profiling requires tissue samples. Treatment personalization accelerates tissue testing. Technological advancements improve biopsy accuracy. Increased use of companion diagnostics supports growth. Oncology specialists emphasize tissue-based validation. Research funding boosts molecular diagnostics. Clinical guideline evolution encourages biopsy confirmation. These factors drive rapid growth.

- By End Users

On the basis of end users, the prostate cancer diagnostics market is segmented into hospitals, independent diagnostic laboratories, cancer research institutes and clinics, ambulatory surgical centers, and others. The hospital segment dominated the market with a share of 38.7% in 2024, due to integrated diagnostic and treatment services. Hospitals offer comprehensive testing infrastructure. High patient inflow supports testing volumes. Availability of imaging and biopsy services enhances utilization. Multidisciplinary oncology teams drive diagnostics. Government funding supports hospital diagnostics. Advanced equipment availability strengthens dominance. Emergency and inpatient diagnostics contribute significantly. Skilled professionals ensure accuracy. Referral networks funnel patients to hospitals. Reimbursement systems favor hospital diagnostics. These factors secure leadership.

The independent diagnostic laboratories segment is projected to grow at the fastest CAGR of 9.3% from 2025 to 2032, driven by increasing demand for specialized testing. Outsourcing trends boost lab services. Faster turnaround times improve preference. Expansion of outpatient diagnostics supports growth. Cost-effective services attract patients. Technological investments enhance capabilities. Home sample collection boosts access. Growing urbanization supports lab networks. Insurance acceptance strengthens adoption. Specialized molecular testing expands offerings. Retail diagnostic chains drive penetration. These factors accelerate growth.

- By Distribution Channel

On the basis of distribution channel, the prostate cancer diagnostics market is segmented into direct tender and retail sales. The direct tender segment dominated the market with a share of 64.3% in 2024, driven by bulk procurement by hospitals and laboratories. Government and institutional contracts ensure stable demand. Cost advantages favor tender-based purchasing. Long-term supply agreements enhance reliability. Large-scale screening programs rely on tenders. Centralized procurement supports efficiency. Hospitals prefer direct sourcing for critical diagnostics. Regulatory compliance is streamlined. Predictable demand sustains volumes. Supplier partnerships strengthen continuity. These factors ensure dominance.

The retail sales segment is expected to register the fastest CAGR of 9.1% from 2025 to 2032, fueled by rising demand for home-based and OTC diagnostic solutions. Consumer awareness encourages self-testing. Technological ease supports retail adoption. Pharmacy networks expand availability. Digital health platforms boost accessibility. Growing preference for convenience drives growth. Private diagnostics support retail expansion. E-commerce penetration enhances reach. Rapid urbanization supports retail diagnostics. Affordability improvements increase uptake. Preventive healthcare trends fuel demand. These drivers ensure rapid expansion.

Middle East and Africa Prostate Cancer Diagnostics Market Regional Analysis

- The Middle East and Africa prostate cancer diagnostics market is projected to grow at a strong CAGR of around 11.2% during 2025–2032

- Driven by rising awareness of prostate cancer, increasing healthcare expenditure, and rapid modernization of diagnostic infrastructure across emerging economies

- The region is witnessing higher adoption of PSA testing, advanced imaging modalities, and molecular diagnostics, supported by government-led screening initiatives, private healthcare expansion, and growing investments in oncology-focused biotechnology and diagnostics

Saudi Arabia Prostate Cancer Diagnostics Market Insight

Saudi Arabia prostate cancer diagnostics market dominated the prostate cancer diagnostics market in the Middle East and Africa with the largest revenue share of approximately 36.5% in 2025, supported by its well-established healthcare infrastructure, increasing awareness of prostate cancer, growing adoption of PSA testing and advanced imaging modalities, and strong presence of both domestic and multinational diagnostic companies. Government-led screening initiatives, private healthcare expansion, and investments in oncology-focused biotechnology are further strengthening Saudi Arabia’s market position.

U.A.E. Prostate Cancer Diagnostics Market Insight

U.A.E. prostate cancer diagnostics market is expected to be the fastest growing country in the prostate cancer diagnostics market during the forecast period, registering a robust CAGR of around 11.8%, driven by increasing prostate cancer prevalence, rising awareness campaigns, expanding diagnostic networks, modernization of laboratory infrastructure, and growing adoption of molecular and imaging-based diagnostic technologies. The focus on early detection and public–private partnerships in healthcare is accelerating market growth in the U.A.E.

Middle East and Africa Prostate Cancer Diagnostics Market Share

The prostate cancer diagnostics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- ACON Laboratories, Inc. (U.S.)

- HUMASIS (South Korea)

- Teco Diagnostics (U.S.)

- Hologic Inc. (U.S.)

- Accuquik Test Kits (U.S.)

- mdxhealth (Belgium)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- OPKO Health Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- DiaSorin S.p.A (Italy)

- Beckman Coulter, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Prostatype Genomics AB (Switzerland)

- Fujirebio (Japan)

- Proteomedix (Switzerland)

- Eurolyser Diagnostica GmbH (Austria)

Latest Developments in Middle East and Africa Prostate Cancer Diagnostics Market

- In April 2024, Roche Diagnostics launched an advanced prostate-specific antigen (PSA) blood test with enhanced sensitivity and specificity to detect early-stage prostate cancer. This next-generation diagnostic solution is designed to reduce false positives and improve early intervention outcomes, reinforcing Roche’s leadership in precision oncology diagnostics within the Asia-Pacific prostate cancer diagnostics market

- In March 2024, Exact Sciences Corporation announced the expansion of its prostate cancer diagnostic portfolio with a novel genomic testing platform aimed at predicting disease aggressiveness. This development leverages artificial intelligence and genomic sequencing to aid in personalized treatment planning, supporting the trend toward precision medicine

- In February 2024, Siemens Healthineers unveiled an integrated imaging and diagnostic platform that combines MRI and AI-driven analytics to detect and monitor prostate cancer progression with greater accuracy. The system, now being deployed in major hospitals across Europe and North America, marks a significant advancement in non-invasive diagnostic capabilities

- In January 2024, Bio-Techne Corporation, through its Exosome Diagnostics division, introduced a urine-based liquid biopsy test for prostate cancer detection that eliminates the need for invasive procedures. The test is gaining adoption across U.S. urology clinics and specialty centers, highlighting the shift toward non-invasive, patient-friendly diagnostic approaches

- In December 2023, OPKO Health Inc. partnered with a leading academic medical center to conduct large-scale clinical trials for its 4Kscore Test, a blood-based biomarker assay used to assess the risk of aggressive prostate cancer. This strategic collaboration aims to expand the test’s clinical utility and regulatory approvals across additional Asia-Pacific markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.