Middle East And Africa Pulp Moulding Machines Market

Market Size in USD Million

CAGR :

%

USD

25.46 Million

USD

35.11 Million

2024

2032

USD

25.46 Million

USD

35.11 Million

2024

2032

| 2025 –2032 | |

| USD 25.46 Million | |

| USD 35.11 Million | |

|

|

|

|

Pulp Moulding Machines Market Size

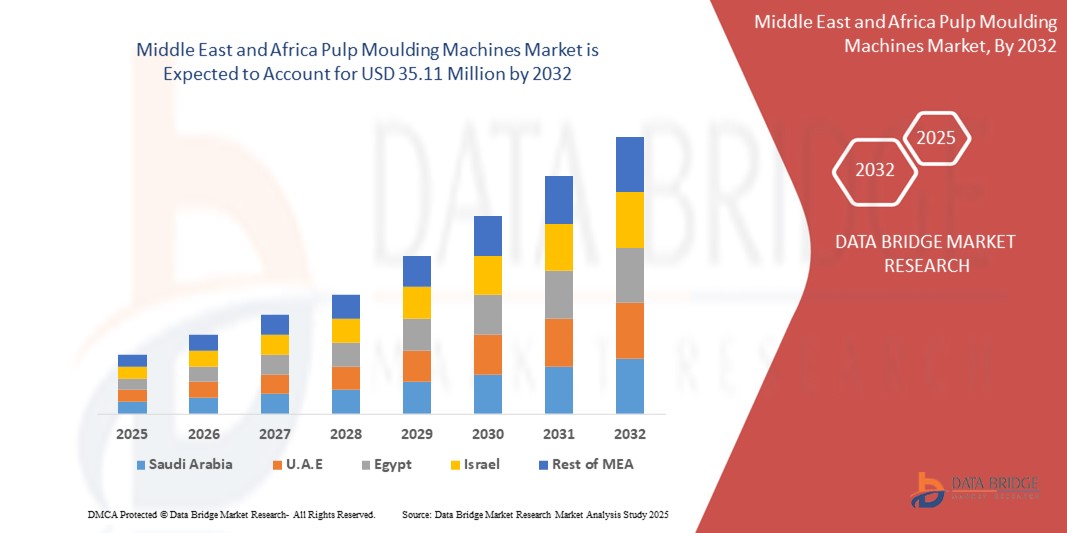

- The Middle East and Africa pulp moulding machines market size was valued at USD 25.46 million in 2024 and is expected to reach USD 35.11 million by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the increasing demand for sustainable, biodegradable, and eco-friendly packaging solutions across food, electronics, and consumer goods industries, driven by rising environmental awareness and global restrictions on single-use plastics

- Furthermore, advancements in automation, energy-efficient machinery, and mold customization are enhancing production efficiency and product quality, encouraging manufacturers to invest in pulp moulding machines as a viable alternative to conventional plastic packaging solutions, thereby accelerating market expansion

Pulp Moulding Machines Market Analysis

- Pulp moulding machines, used for manufacturing eco-friendly and biodegradable packaging products, are becoming essential across various industries such as food and beverages, electronics, healthcare, and consumer goods due to rising demand for sustainable packaging alternatives

- The accelerating adoption of pulp moulding machines is primarily driven by increasing environmental regulations against plastic use, growing consumer preference for recyclable materials, and advancements in machine automation that enhance production efficiency and customization capabilities

- U.A.E. dominated the pulp moulding machines market with a share of 27.9% in 2024, due to growing demand for sustainable packaging across hospitality, food delivery, and retail industries

- Saudi Arabia is expected to be the fastest growing region in the pulp moulding machines market during the forecast period due to manufacturers align with Vision 2030 sustainability targets and rising consumer demand for plastic alternatives

- Rotary pulp moulding machine segment dominated the market with a market share of 55.5% in 2024, due to its high-speed production capabilities and operational efficiency, making it ideal for large-scale manufacturing environments. These machines are particularly suited for continuous and high-volume production of molded fiber packaging such as trays and tableware, thereby meeting the rising demand from the food service and packaging sectors

Report Scope and Pulp Moulding Machines Market Segmentation

|

Attributes |

Pulp Moulding Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pulp Moulding Machines Market Trends

“Rising Shift Toward Sustainable and Customizable Packaging Solutions”

- A significant trend in the pulp moulding machines market is the growing shift toward sustainable and customizable packaging solutions, driven by heightened environmental regulations and the demand for biodegradable alternatives to plastic packaging across diverse industries such as food, electronics, and consumer goods

- For instance, companies such as Beston Group and HGHY are developing modular pulp moulding machines that enable the production of tailored packaging formats, including disposable tableware and molded fiber trays, meeting specific customer requirements while reducing environmental footprint

- The adoption of advanced automation technologies and energy-efficient systems is enabling manufacturers to produce high-quality, cost-effective molded fiber products at scale, supporting a circular economy model and encouraging broader use across global supply chains

- Growing consumer preference for eco-friendly packaging, especially in retail and e-commerce sectors, is encouraging brands to adopt pulp-based solutions that offer both functional and aesthetic value, thereby driving machine upgrades and new installations

- To meet this demand, manufacturers are also investing in R&D to improve mold design flexibility, drying techniques, and integration with digital control systems, enabling faster changeovers and enhanced precision in packaging production

- This evolving trend is influencing machinery design and also reshaping the competitive landscape, as companies prioritize sustainability, performance, and customization in their packaging offerings to differentiate in the market

Pulp Moulding Machines Market Dynamics

Driver

“Government Support and Environmental Regulations”

- Government regulations targeting the reduction of single-use plastics and incentives for sustainable manufacturing practices are key drivers boosting demand for pulp moulding machines, particularly in packaging and food service applications

- For instance, the Indian government’s ban on select plastic items and China’s national plastic restriction policies are accelerating the adoption of molded fiber alternatives, prompting companies to invest in pulp moulding technology to comply with new standards

- Public and private sector support for circular economy initiatives and zero-waste goals is encouraging manufacturers to adopt biodegradable packaging solutions, positioning pulp moulding machines as an essential part of green production lines

- As environmental compliance becomes critical for export-focused industries, the ability to produce compostable and recyclable packaging is becoming a competitive advantage, further motivating adoption of this machinery

- The convergence of regulatory pressure, consumer awareness, and industrial incentives is catalyzing the transformation of traditional packaging models and driving sustained investment in pulp moulding machine technologies

Restraint/Challenge

“High Initial Investment and Operational Complexity”

- The high capital investment required for purchasing and installing pulp moulding machines, especially automated or high-capacity systems, poses a challenge for small and medium-sized enterprises seeking to enter the biodegradable packaging segment

- For instance, fully automatic rotary machines equipped with drying systems and digital control features can cost significantly more than manual or semi-automatic options, making it difficult for cost-sensitive businesses to adopt the technology

- Maintenance requirements, the need for skilled operators, and integration with existing manufacturing processes further add to operational complexity, creating entry barriers for businesses with limited technical resources

- While demand for sustainable packaging is rising, the upfront financial and technical challenges often lead to delayed purchasing decisions or reliance on outsourced molded fiber packaging from third-party manufacturers

- To overcome this hurdle, suppliers are increasingly offering leasing options, modular systems, and training support, but the need for broader industry collaboration and cost-reduction innovation remains critical for mass-market penetration

Pulp Moulding Machines Market Scope

The market is segmented on the basis of type, machine type, pulp type, capacity type, application, and end-users.

- By Type

On the basis of type, the pulp moulding machines market is segmented into rotary pulp moulding machines and reciprocating pulp moulding machines. The rotary pulp moulding machine segment dominated the market revenue with a share of 55.5% in 2024, owing to its high-speed production capabilities and operational efficiency, making it ideal for large-scale manufacturing environments. These machines are particularly suited for continuous and high-volume production of molded fiber packaging such as trays and tableware, thereby meeting the rising demand from the food service and packaging sectors.

The reciprocating pulp moulding machine segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its suitability for small to mid-scale operations and cost-effectiveness. These machines are often preferred by SMEs for producing customized, lower-volume items with flexibility in mould design. Their relatively lower investment and maintenance costs also make them an attractive choice for emerging markets and local manufacturers.

- By Machine Type

On the basis of machine type, the market is segmented into automatic, semi-automatic, and manual. The automatic pulp moulding machines segment held the largest revenue share in 2024, primarily due to increasing demand for fast, precise, and labor-efficient production systems in industrial manufacturing. These machines reduce manual intervention and allow for seamless integration with drying and stacking units, significantly enhancing productivity and quality consistency.

The manual segment is expected to record the fastest CAGR during the forecast period, especially in developing regions where labor is more cost-effective and initial capital investments are limited. Manual machines are preferred for their simplicity and adaptability in customized, small-batch manufacturing applications, particularly for niche packaging solutions and artisanal biodegradable products.

- By Pulp Type

On the basis of pulp type, the market is segmented into thick wall, transfer, thermoformed, and processed. The transfer pulp segment held the largest market share in 2024, attributed to its wide application in packaging electronics, food containers, and industrial parts due to its balanced strength, lightweight design, and cost-efficiency. Its versatile nature and capacity for detailed mold formation make it suitable for both protective and presentational packaging.

The thermoformed pulp segment is anticipated to grow at the fastest pace from 2025 to 2032, owing to the increasing demand for high-precision, smooth-surfaced, and visually appealing products. Thermoformed pulp is gaining traction in premium packaging, cosmetics, and consumer electronics due to its sharp detailing and superior aesthetics that rival traditional plastic packaging.

- By Capacity Type (in Units Per Hour)

On the basis of capacity, the market is categorized into less than 1500, 1501 to 3500, 3501 to 5500, and above 5500 units per hour. The 1501 to 3500 units segment led the market in 2024, favored for its optimal balance between cost and output, catering to mid-sized enterprises aiming to scale production without over-investment. This range is ideal for companies targeting a diverse product mix across moderate to large volumes.

The above 5500 units per hour segment is projected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand from large-scale producers and export-oriented operations that require high throughput and consistent product quality. The segment benefits from increasing automation in the packaging industry and the growing shift toward sustainable mass production.

- By Application

Based on application, the market is segmented into trays, boxes & containers, disposable pulp tableware, finery pack, cardboard lids, drink carrier, and others. The trays segment accounted for the largest revenue share in 2024 due to the widespread use of molded fiber trays across food, healthcare, and electronics industries for safe and efficient transportation and storage. Their shock-absorbent and biodegradable properties make them a preferred alternative to plastic.

The disposable pulp tableware segment is expected to exhibit the highest growth from 2025 to 2032, propelled by growing environmental awareness and government bans on single-use plastics. Increasing consumer preference for sustainable, compostable products in the food service industry continues to boost demand for eco-friendly tableware made from molded pulp.

- By End-Users

On the basis of end-users, the market is segmented into food and beverages, electrical & electronics, automotive, healthcare, consumer goods, cosmetics & personal care, and others. The food and beverages segment held the highest market share in 2024, driven by surging demand for sustainable packaging solutions for food delivery, takeaway, and retail packaging. Molded pulp packaging offers hygienic, durable, and eco-friendly alternatives suited for direct food contact.

The healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032, due to the increasing adoption of molded fiber products for medical packaging, such as kidney trays, disposable bedpans, and packaging for surgical instruments. As sustainability standards tighten across the healthcare industry, fiber-based packaging is becoming an increasingly favored option.

Pulp Moulding Machines Market Regional Analysis

- U.A.E. dominated the pulp moulding machines market with the largest revenue share of 27.9% in 2024, driven by growing demand for sustainable packaging across hospitality, food delivery, and retail industries

- The country benefits from strong government initiatives supporting circular economy goals, advanced logistics infrastructure, and increasing import substitution of eco-friendly packaging products

- Surging investments in green manufacturing, along with rising consumer awareness and tourism-driven consumption, are accelerating the deployment of pulp moulding machines across domestic production facilities

Saudi Arabia Pulp Moulding Machines Market Insight

Saudi Arabia is projected to post robust growth in the pulp moulding machines market from 2025 to 2032 as manufacturers align with Vision 2030 sustainability targets and rising consumer demand for plastic alternatives. Growing capital outlays on automated moulding equipment for food-service ware, agricultural trays, and electronics cushioning, supported by regulations that prioritise recycled materials, are expanding domestic capacity. Government-backed expos, fiscal incentives, and partnerships with global technology suppliers are reinforcing the kingdom’s transition to circular-economy packaging, underpinning long-term market momentum.

Israel Pulp Moulding Machines Market Insight

Israel is set to register steady adoption of pulp moulding machines during 2025 to 2032, fuelled by escalating demand for biodegradable packaging in food, electronics, and produce-export channels. Local converters and tech start-ups are investing in precision moulding lines to satisfy stringent environmental benchmarks and benefit from state incentives that encourage circular-economy solutions. Collaboration between recyclers, brand owners, and equipment vendors, along with tax credits for sustainable manufacturing, is strengthening the scalability and competitiveness of pulp-based packaging in the country.

Pulp Moulding Machines Market Share

The pulp moulding machines industry is primarily led by well-established companies, including:

- Qingdao Perfect Equipment (China)

- SODALTECH (India)

- BeSure Technology Co., Ltd (China)

- Henan Qinyang Shunfu Paper Machinery Co., LTD (China)

- Beston Machinery (China)

- Shuanghuan Fiber Molding Machinery Co., Ltd (China)

- Quanzhou Far East Environmental Protection Equipment Co., Ltd (China)

- Anyang General International Co., Ltd (China)

- HGHY PULP MOLDING PACK CO., LTD (China)

- Inmaco Solutions BV (Netherlands)

- Southern Pulp Machinery (Pty) Ltd (South Africa)

- DKM Machine Manufacturing Inc (Turkey)

- Xiangtan ZH Pulp Moulded Co., Ltd (China)

- Jinan Wanyou Packaging Machinery Factory (China)

- Longkou Hongrun Packing Machinery Co., Ltd (China)

- Eurasia Light Industry Equipment Manufacture Co., Ltd (China)

- Jinde Long Paper Machine Factory (China)

- Longkou FuChang Packing Machinery Co., Ltd (China)

- Longkou YIHAO Machinery Equipment Co., Ltd (China)

- Taiwan Pulp Molding Co., Ltd (Taiwan)

Latest Developments in Middle East and Africa Pulp Moulding Machines Market

- In July 2024, Ecosure Pulpmolding Technologies Ltd significantly strengthened its market position by acquiring Thermo9, launching the industry-first fiber pulp molding machine “FiberFormer,” and introducing the T9 Tableware brand. These strategic moves are expected to accelerate innovation in fiber-based packaging and expand Ecosure’s footprint in premium molded fiber solutions, reinforcing its leadership in the pulp molding machinery market

- In September 2023, PulPac unveiled the PulPac Scala, a next-generation machine platform integrating its Mill-to-Web fiber unit with injection molding technology. This launch is poised to enhance global accessibility and scalability of Dry Molded Fiber, promoting faster adoption of sustainable alternatives to single-use plastics across industries

- In July 2022, Ecosure Pulpmolding announced the expansion of its production capabilities by establishing a second unit dedicated to fully automated pulp molding machines. This development is aimed at meeting growing demand for high-efficiency, sustainable packaging machinery and is expected to improve supply capacity and market responsiveness globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Pulp Moulding Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Pulp Moulding Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Pulp Moulding Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.