Middle East And Africa Renting And Leasing Test And Measurement Equipment Market

Market Size in USD Million

CAGR :

%

USD

334.44 Million

USD

443.81 Million

2024

2032

USD

334.44 Million

USD

443.81 Million

2024

2032

| 2025 –2032 | |

| USD 334.44 Million | |

| USD 443.81 Million | |

|

|

|

|

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Size

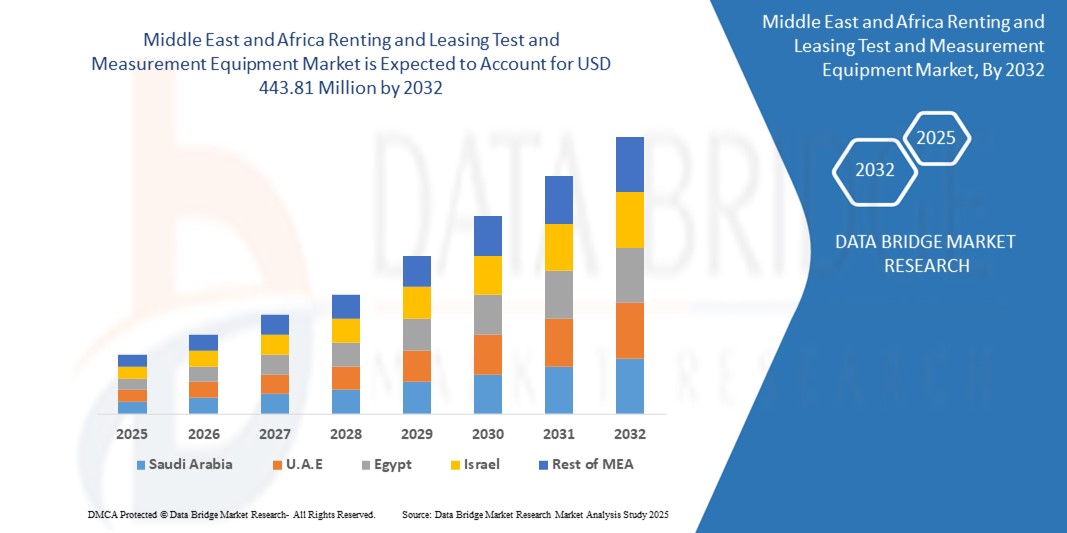

- The Middle East and Africa renting and leasing test and measurement equipment market size was valued at USD 334.44 million in 2024 and is expected to reach USD 443.81 million by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for cost-effective access to advanced testing solutions and the rising adoption of flexible business models across industries

- The growing emphasis on reducing capital expenditure while ensuring access to the latest technologies is also accelerating market adoption

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Analysis

- The market is witnessing strong growth as enterprises across electronics, telecom, automotive, and manufacturing industries opt for renting and leasing models to optimize costs and maintain operational agility

- Increasing technological complexity, shorter product life cycles, and the need for regular upgrades are compelling companies to adopt flexible access rather than outright purchases

- Saudi Arabia dominated the Middle East and Africa renting and leasing test and measurement equipment market in 2024, driven by large-scale industrial projects, growing investments in telecom and energy sectors, and government initiatives supporting technology adoption

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa renting and leasing test and measurement equipment market due to rapid technological adoption, growing emphasis on smart city initiatives, and increasing investments in telecommunications, aerospace, and renewable energy sectors

- The Services segment held the largest market revenue share in 2024, driven by the growing preference for full-service leasing solutions, including calibration, maintenance, and technical support. Service-based agreements offer operational convenience and reduce the need for in-house expertise, making them highly popular among enterprises

Report Scope and Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Segmentation

|

Attributes |

Middle East and Africa Renting and Leasing Test and Measurement Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Trends

Shift Toward Flexible Access Models

- The growing preference for renting and leasing models is reshaping the test and measurement equipment industry by enabling organizations to access advanced tools without heavy upfront investments. This approach supports cost optimization and allows companies to adapt to rapidly changing technology cycles

- The rising need for short-term access to high-performance testing systems in sectors such as telecom, electronics, and automotive is accelerating the adoption of flexible rental agreements. These models provide companies with the agility to scale testing capacity based on project requirements

- The affordability and operational convenience of leasing contracts are making them attractive for small and mid-sized enterprises, enabling access to equipment that would otherwise be cost-prohibitive. This ensures improved testing capabilities without long-term financial commitments

- For instance, in 2023, several electronics manufacturers adopted rental models for advanced oscilloscopes and spectrum analyzers to support product development, avoiding large capital expenditures while maintaining high-quality testing standards

- While renting and leasing models are expanding access and reducing financial risk, their success depends on continued innovation in service offerings, transparent pricing, and robust customer support. Providers must focus on customized agreements and bundled services to capture rising demand

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Dynamics

Driver

Rising Demand for Cost Optimization and Access to Latest Technologies

- The increasing cost of advanced testing equipment is driving companies toward renting and leasing as a cost-efficient alternative. By avoiding large upfront expenses, organizations can redirect capital toward core operations and R&D activities. This approach also enables companies to respond quickly to fluctuating project demands without being tied to depreciating assets, ensuring operational flexibility

- Businesses are increasingly aware of the benefits of accessing the latest testing technologies without the burden of ownership. This has led to a surge in short- and medium-term contracts across industries with fast-evolving product cycles. Leasing allows firms to trial new instruments, upgrade regularly, and maintain competitive advantage without committing to long-term investments

- Market growth is further supported by service providers offering calibration, maintenance, and upgrades as part of leasing contracts, ensuring uninterrupted operations and equipment reliability. Companies also benefit from technical support, software updates, and equipment replacement guarantees, reducing downtime and operational risks

- For instance, in 2022, several telecom operators adopted leasing agreements for 5G testing instruments to accelerate deployment while minimizing financial risk, boosting demand for flexible rental solutions. This practice helped them scale testing infrastructure quickly and efficiently, supporting faster rollout of critical network services

- While cost savings and technology access are strong growth drivers, the market requires continuous innovation in service delivery, improved customization, and global availability to ensure sustained adoption. Providers investing in digital platforms for asset tracking, predictive maintenance, and remote support are likely to see accelerated growth

Restraint/Challenge

High Dependence on Equipment Availability and Service Reliability

- The limited availability of specialized test and measurement equipment in certain markets creates bottlenecks, as rental companies cannot always meet the demand for niche or high-end instruments. This restricts timely access and delays critical projects. Companies often face scheduling conflicts, which can impact product development timelines and overall operational efficiency

- In many developing regions, there is a lack of reliable rental service providers capable of maintaining equipment quality and ensuring consistent performance. This creates trust issues and limits adoption among enterprises. Maintenance gaps, calibration delays, and absence of trained personnel further exacerbate challenges in these regions

- Market penetration is also restricted by logistical challenges, including transportation, installation, and calibration delays, particularly for large or complex systems. These hurdles increase downtime and reduce operational efficiency. Companies may face additional costs for on-site setup, extended lead times, and transportation risks, which can discourage adoption in remote locations

- For instance, in 2023, multiple small-scale enterprises in region reported project delays due to unavailability of leased equipment and inadequate technical support, highlighting gaps in service quality and accessibility. These delays also affected compliance with regulatory standards and testing schedules, demonstrating the critical need for robust provider networks

- While renting and leasing models reduce upfront costs, ensuring widespread adoption depends on strengthening supply chains, enhancing after-sales service, and expanding provider networks to deliver reliable and timely solutions. Integration of digital monitoring, predictive maintenance, and scalable service contracts can mitigate risks and boost confidence among potential users

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Scope

The market is segmented on the basis of offering, component, system type, type, features, and end-user.

- By Offering

On the basis of offering, the market is segmented into Hardware and Services. The Services segment held the largest market revenue share in 2024, driven by the growing preference for full-service leasing solutions, including calibration, maintenance, and technical support. Service-based agreements offer operational convenience and reduce the need for in-house expertise, making them highly popular among enterprises.

The Hardware segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing availability of advanced testing instruments for rent or lease. Hardware rentals allow businesses to access the latest equipment without heavy capital expenditure, supporting short-term projects and rapid technological upgrades.

- By Component

On the basis of component, the market is segmented into Cable Assemblies, Connectors, Value Added Accessories, and Others. The Value Added Accessories segment held the largest revenue share in 2024, fueled by demand for comprehensive rental packages that include adapters, probes, and calibration kits, ensuring seamless operation with leased equipment.

The Connectors segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for compatible and high-performance connectors that enhance the usability of rented or leased testing devices across multiple applications.

- By System Type

On the basis of system type, the market is segmented into Sensing System, Connectivity System, Safety & Security System, Human Machine Interface (HMI), Power & Energy Management System, Motor Control System, and Lighting System. The Connectivity System segment held the largest market revenue share in 2024, driven by increased adoption in IT, telecom, and electronics sectors that require reliable testing of communication networks and devices.

The Sensing System segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing demand for precision measurement and real-time data acquisition tools offered through flexible leasing models.

- By Type

On the basis of type, the market is segmented into Rent and Lease. The Rent segment held the largest revenue share in 2024, as businesses increasingly prefer short-term rentals for project-specific testing and prototyping, which reduces upfront costs and minimizes equipment obsolescence.

The Lease segment is expected to witness the fastest growth rate from 2025 to 2032, driven by long-term contracts that provide continuous access to high-end test and measurement devices along with value-added services, ensuring operational efficiency and cost optimization.

- By Features

On the basis of features, the market is segmented into Diagnostic Equipment, Electrical Sensing, Metering ICS, and Others. The Diagnostic Equipment segment held the largest market revenue share in 2024, supported by high demand across industrial, automotive, and telecommunication sectors for precision testing and troubleshooting.

The Electrical Sensing segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing adoption of rented and leased electrical testing instruments for energy monitoring, compliance, and safety applications.

- By End-User

On the basis of end-user, the market is segmented into IT & Telecommunication, Automotive, Aerospace & Defense, Industrial, Consumer Electronics, Energy & Utilities, Medical Equipment, and Others. The IT & Telecommunication segment held the largest revenue share in 2024, driven by rapid deployment of network infrastructure and increasing adoption of rental and leasing solutions for testing high-speed communication systems.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing reliance on advanced testing and diagnostic equipment in vehicle R&D and manufacturing processes offered through flexible rental and leasing models.

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa renting and leasing test and measurement equipment market in 2024, driven by large-scale industrial projects, growing investments in telecom and energy sectors, and government initiatives supporting technology adoption

- Companies are increasingly utilizing renting and leasing models to access high-end testing instruments for industrial, energy, and infrastructure projects without heavy capital expenditure

- This widespread adoption is further supported by the need for operational efficiency, project flexibility, and reliable equipment maintenance services, making rental and leasing solutions the preferred choice for enterprises

U.A.E. Renting and Leasing Test and Measurement Equipment Market

U.A.E. renting and leasing test and measurement equipment market is expected to witness the fastest growth rate from 2025 to 2032 due to increasing adoption of flexible equipment access models in IT, telecom, and industrial sectors. Enterprises are favoring rental and leasing solutions to reduce upfront costs, maintain access to advanced testing technologies, and support rapid project execution. Growing investments in smart city initiatives, industrial automation, and advanced infrastructure projects are significantly contributing to the market’s accelerated growth in the region

Middle East and Africa Renting and Leasing Test and Measurement Equipment Market Share

The Middle East and Africa renting and leasing test and measurement equipment industry is primarily led by well-established companies, including:

- Zamil Air Conditioners (Saudi Arabia)

- SKM Air Conditioning LLC (U.A.E.)

- Cool Tech (Saudi Arabia)

- Al Salem Johnson Controls (Saudi Arabia)

- Qatar Cool (Qatar)

- Emirates Advanced Refrigeration (U.A.E.)

- Bahri & Mazroei Group (U.A.E.)

- National Air Conditioning Company (Saudi Arabia)

- Frigoglass Industries (South Africa)

- AFCON Cooling Solutions (Egypt)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.