Middle East And Africa Retail Analytics Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

2.79 Billion

2025

2033

USD

1.26 Billion

USD

2.79 Billion

2025

2033

| 2026 –2033 | |

| USD 1.26 Billion | |

| USD 2.79 Billion | |

|

|

|

|

Middle East and Africa Retail Analytics Market Size

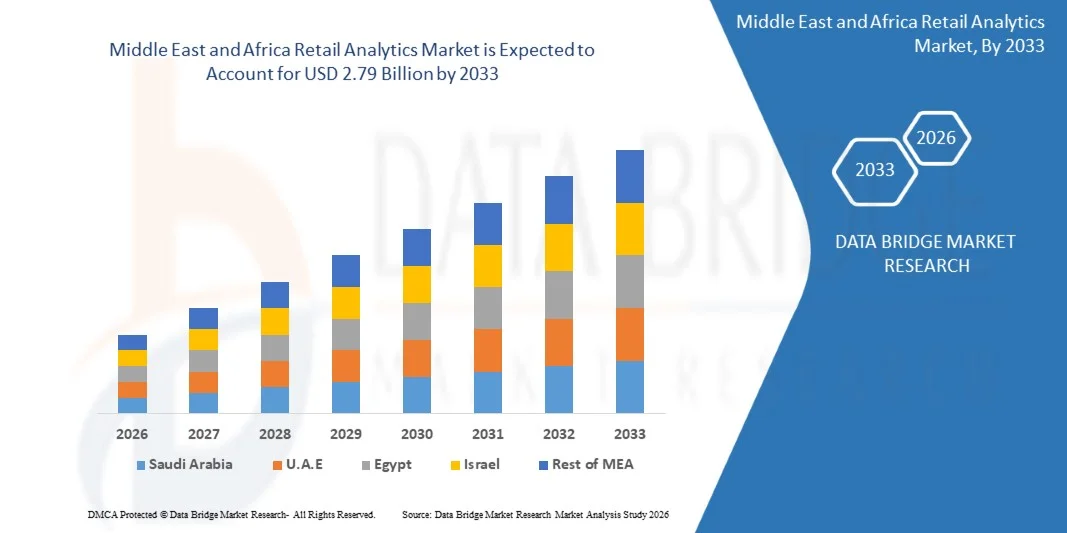

- The Middle East and Africa retail analytics market size was valued at USD 1.26 billion in 2025 and is expected to reach USD 2.79 billion by 2033, at a CAGR of 10.49% during the forecast period

- The market growth is largely fuelled by the rising adoption of data-driven decision-making by retailers to enhance operational efficiency and improve customer experience

- Increasing investment in advanced technologies such as AI, machine learning, and predictive analytics to optimize inventory management and personalize marketing strategies is further supporting market expansion

Middle East and Africa Retail Analytics Market Analysis

- The Middle East and Africa retail analytics market is witnessing strong growth as retailers increasingly leverage analytics to gain actionable insights into consumer preferences, demand trends, and pricing optimization. The growing digital transformation across retail channels, coupled with the rapid rise of e-commerce, is pushing companies to implement advanced analytics platforms for better forecasting and resource allocation

- In addition, the proliferation of omnichannel retail strategies and the need for real-time analytics to track sales and customer engagement are driving adoption. Businesses are focusing on integrating analytics into point-of-sale systems, loyalty programs, and supply chains to boost profitability and maintain competitiveness in a rapidly evolving retail environment

- U.A.E. retail analytics market dominated the Middle East and Africa region in 2025, accounting for the largest revenue share, driven by strong investments in smart retail infrastructure and advanced data analytics capabilities

- Saudi Arabia is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa retail analytics market due to rapid retail digitalization, government-backed Vision 2030 initiatives, and growing investments in data-driven retail solutions to improve decision-making and customer experience

- The software segment held the largest market revenue share in 2025, driven by the increasing adoption of analytics platforms that enable real-time data visualization, predictive modeling, and business intelligence reporting. Retailers are increasingly relying on advanced software tools to track sales performance, optimize product assortments, and enhance customer engagement

Report Scope and Middle East and Africa Retail Analytics Market Segmentation

|

Attributes |

Middle East and Africa Retail Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa Retail Analytics Market Trends

“Rise Of AI-Driven Predictive Insights In Retail Operations”

- The growing integration of artificial intelligence (AI) and machine learning (ML) into retail analytics is transforming how businesses understand consumer behavior, manage inventory, and optimize pricing. Retailers are leveraging predictive models to anticipate demand shifts, reduce overstocking, and personalize customer experiences across channels, resulting in improved profitability and operational agility. The ability to forecast accurately based on real-time insights is enabling retailers to adapt faster to changing market conditions and consumer trends

- The widespread digital transformation among regional retailers, coupled with the adoption of cloud-based analytics platforms, is accelerating data-driven decision-making. Businesses are focusing on automation and predictive insights to streamline operations, enhance supply chain transparency, and respond quickly to changing consumer preferences across diverse markets. This trend is strengthening retailers’ ability to manage multi-location operations efficiently while minimizing operational bottlenecks and cost inefficiencies

- AI-powered recommendation engines and sentiment analysis tools are gaining traction, allowing retailers to tailor marketing campaigns and promotions in real time. These technologies are not only improving customer engagement but also helping retailers enhance conversion rates and customer retention through intelligent insights. By analyzing customer behavior and purchase intent, these systems allow personalized targeting that strengthens brand loyalty and drives higher lifetime value

- For instance, in 2024, several retail chains in the UAE and Saudi Arabia implemented AI-enabled analytics dashboards that provided real-time sales and inventory insights, reducing stockouts by over 20% and optimizing promotional planning. These advancements highlight the growing importance of intelligent automation in retail decision-making. The success of such implementations underscores how AI adoption is becoming central to enhancing operational excellence in competitive retail environments

- While AI and predictive analytics are transforming the retail landscape, their success depends on the availability of high-quality data, skilled workforce, and secure digital infrastructure. Retailers must invest in robust data governance and talent development to maximize the potential of these technologies. In addition, collaboration between analytics providers and local retail firms will be essential to create customized solutions suited to regional consumer dynamics

Middle East and Africa Retail Analytics Market Dynamics

Driver

“Increasing Digitalization And Data-Driven Retail Strategies”

- The accelerating digital transformation across the retail sector is driving the adoption of advanced analytics tools to gain actionable insights into customer preferences, purchasing patterns, and supply chain performance. Retailers are using analytics to optimize inventory management, pricing, and promotions, leading to improved efficiency and profitability. As e-commerce and digital payments continue to grow, data-driven models are enabling more precise decision-making and demand forecasting

- Growing competition in the retail landscape has prompted businesses to rely on real-time data to support strategic decisions and enhance customer engagement. Retailers are utilizing analytics to create personalized shopping experiences and strengthen brand loyalty through targeted marketing and seamless omnichannel experiences. The integration of analytics with CRM systems allows businesses to identify high-value customers and deliver tailored offerings that boost long-term retention

- Governments and private enterprises are investing in smart retail technologies and cloud infrastructure, enabling the integration of big data analytics into day-to-day retail operations. Such initiatives are supporting digital readiness and driving analytics adoption across modern and traditional retail formats. The region’s focus on digital innovation is helping retailers enhance efficiency, sustainability, and scalability, particularly in high-growth urban markets

- For instance, in 2023, Saudi Arabia’s Vision 2030 initiative encouraged the modernization of retail infrastructure by integrating analytics platforms across major retail chains, leading to improved sales forecasting and operational efficiency in the region. This initiative also promoted local partnerships between analytics firms and retailers to boost regional capabilities in data utilization. Such collaborations are laying the groundwork for a technology-driven retail ecosystem

- While digitalization and analytics adoption are reshaping retail operations, continuous innovation, employee upskilling, and cybersecurity measures remain essential to sustain growth and ensure data integrity. Retailers must also address data silos and interoperability challenges to ensure seamless analytics integration. The ability to turn raw data into actionable insights will define the competitiveness of retailers in this evolving market

Restraint/Challenge

“Data Privacy Concerns And Lack Of Skilled Analytics Professionals”

- Growing concerns around consumer data privacy and security are posing significant challenges to the adoption of retail analytics in the Middle East and Africa. Retailers face regulatory pressures to comply with data protection laws and ensure transparent data management, which can limit the scope of analytics implementation. A lack of standardized compliance frameworks across countries adds complexity for multinational retailers operating in multiple jurisdictions

- The shortage of skilled professionals with expertise in data science, machine learning, and retail analytics hinders the effective use of advanced tools. Many retailers struggle to interpret complex datasets or deploy AI-driven insights, leading to suboptimal decision-making and slower technology integration. This talent gap is widening as demand for analytics professionals grows faster than supply, especially in developing markets within the region

- Infrastructure gaps in emerging markets further restrict seamless analytics adoption, as some regions lack reliable connectivity or cloud infrastructure necessary for large-scale data processing. This creates disparities in analytics adoption between developed and developing retail markets. Limited access to digital infrastructure also slows down innovation and affects the consistency of analytics-based operations

- For instance, in 2024, several small and mid-sized retailers in Africa reported delays in implementing data analytics solutions due to a lack of technical expertise and cybersecurity concerns, limiting their ability to compete with global retail players. Such limitations have hindered digital transformation efforts, especially in rural and semi-urban areas where retail modernization is still in early stages. As a result, these retailers rely on traditional methods that limit scalability and responsiveness

- While retail analytics adoption continues to rise, addressing privacy, talent, and infrastructure challenges will be critical to realizing its full potential. Collaborative efforts among governments, technology providers, and retailers can help bridge these gaps and foster a secure, skilled, and data-driven retail ecosystem in the region. Strategic investments in education, data security frameworks, and cloud accessibility will further strengthen regional competitiveness and enable sustainable analytics-driven growth

Middle East and Africa Retail Analytics Market Scope

The market is segmented on the basis of offering, deployment model, organization size, business functionality, application, and end user.

• By Offering

On the basis of offering, the Middle East and Africa retail analytics market is segmented into software and services. The software segment held the largest market revenue share in 2025, driven by the increasing adoption of analytics platforms that enable real-time data visualization, predictive modeling, and business intelligence reporting. Retailers are increasingly relying on advanced software tools to track sales performance, optimize product assortments, and enhance customer engagement.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the growing need for consulting, integration, and maintenance services. As more retailers implement data-driven strategies, demand for professional support in system customization, data migration, and technical training is expected to rise significantly.

• By Deployment Model

On the basis of deployment model, the market is segmented into cloud and on-premises. The cloud segment accounted for the largest share in 2025 due to its scalability, cost efficiency, and accessibility across distributed retail operations. Cloud-based solutions allow businesses to centralize analytics, enabling seamless collaboration and remote decision-making across multiple store locations.

The on-premises segment is projected to grow steadily during the forecast period, driven by retailers prioritizing data security, regulatory compliance, and greater control over internal infrastructure. This deployment model remains favored among enterprises with sensitive customer data and stringent data governance policies.

• By Organization Size

Based on organization size, the market is segmented into large enterprises and small and medium enterprises (SMEs). Large enterprises dominated the market in 2025 owing to their significant investment capacity and adoption of advanced analytics platforms to enhance business intelligence and customer experience. These organizations leverage data analytics for strategic planning and performance optimization across multiple business units.

The SME segment is anticipated to record the fastest growth between 2026 and 2033, driven by the increasing availability of affordable cloud-based analytics tools. Growing digital adoption among smaller retailers seeking to improve operational efficiency and compete effectively with larger players is further supporting this growth.

• By Business Functionality

On the basis of business functionality, the market is segmented into sales and marketing, supply chain, finance, operations, procurement, and human resource. The sales and marketing segment held the largest share in 2025, fuelled by the use of analytics to understand consumer behavior, personalize promotions, and improve conversion rates. Retailers are increasingly adopting marketing analytics to optimize campaigns and enhance brand engagement.

The supply chain segment is expected to witness significant growth during the forecast period, driven by the need for end-to-end visibility, predictive demand forecasting, and logistics optimization. Analytics-driven insights are enabling retailers to minimize stockouts, control costs, and improve delivery timelines.

• By Application

On the basis of application, the market is segmented into customer management, merchandising analysis, inventory analysis, performance analysis, pricing analysis, yield analysis, order and fulfilment management, cluster planning and transportation management, and others. The customer management segment dominated the market in 2025 due to the growing emphasis on personalized shopping experiences and loyalty program optimization. Retailers are utilizing analytics to identify buying patterns and improve customer retention.

The inventory analysis segment is expected to witness the highest growth rate from 2026 to 2033, supported by the increasing need for accurate stock tracking and demand forecasting. Retailers are integrating analytics solutions to optimize replenishment cycles, reduce carrying costs, and ensure product availability across multiple sales channels.

• By End User

On the basis of end user, the Middle East and Africa retail analytics market is segmented into offline and online (e-commerce). The offline segment accounted for the largest share in 2025, driven by the growing adoption of in-store analytics solutions to enhance layout planning, staffing efficiency, and customer engagement within physical stores. Retailers are leveraging real-time data to monitor foot traffic and improve conversion rates at the store level.

The online (e-commerce) segment is expected to grow at the fastest pace during the forecast period, propelled by the rapid expansion of digital retail channels across the region. The increasing use of analytics for personalized recommendations, pricing optimization, and website performance tracking is enhancing customer satisfaction and driving revenue growth for online retailers.

Middle East and Africa Retail Analytics Market Regional Analysis

- U.A.E. retail analytics market dominated the Middle East and Africa region in 2025, accounting for the largest revenue share, driven by strong investments in smart retail infrastructure and advanced data analytics capabilities

- The country’s commitment to digital transformation, under initiatives such as Smart Dubai and U.A.E. Vision 2031, has accelerated the integration of analytics across retail channels

- Major retailers are increasingly adopting AI-powered analytics solutions for demand forecasting, inventory optimization, and customer engagement enhancement

Saudi Arabia Retail Analytics Market Insight

The Saudi Arabia retail analytics market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the rapid evolution of the retail landscape under Vision 2030 and the government’s push toward digital transformation. The growing adoption of omnichannel retail strategies and the expansion of e-commerce platforms are driving demand for advanced analytics tools that support real-time decision-making and performance optimization.

Middle East and Africa Retail Analytics Market Share

The Middle East and Africa retail analytics industry is primarily led by well-established companies, including:

- Majid Al Futtaim Retail (U.A.E.)

- Noon.com (Saudi Arabia)

- Al Tayer Retail (U.A.E.)

- LuLu Group International (U.A.E.)

- Al Shaya Group (Kuwait)

- BFL Group (U.A.E.)

- Landmark Group (U.A.E.)

- Chalhoub Group (U.A.E.)

- Panda Retail Company (Saudi Arabia)

- Foodics (Saudi Arabia)

Latest Developments in Middle East and Africa Retail Analytics Market

- In May 2020, RetailNext, Inc. entered into partnership with YOOBIC and sensalytics for optimizing shopper experiences at retail stores. The company’s partnership with YOOBIC will help retail stores to maximize safety efforts and improve customer experience. Whereas, the company’s partnership with sensalytics will allow retailers to communicate in-store occupancy analytics with employees and customers. This has helped the company to better meet customers need and to grow in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.